0000716643FALSE00007166432023-08-232023-08-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 23, 2023

REGIS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Minnesota | | 1-12725 | | 41-0749934 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No) |

3701 Wayzata Boulevard

Minneapolis, MN 55416

(Address of principal executive offices and zip code)

(952) 947-7777

(Registrant’s telephone number, including area code)

(Former name or former address, if changed from last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.05 per share | | RGS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Regis Corporation

Current Report on Form 8-K

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On August 23, 2023, Regis Corporation announced the financial results for its fiscal year ended June 30, 2023. A copy of the Press Release issued by Regis Corporation in connection with this Item 2.02 is attached as Exhibit No. 99.1 and incorporated by reference herein.

The information in this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, regardless of any general incorporation language in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

Exhibit

Number

| | | | | | | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

|

| | | |

| | | REGIS CORPORATION |

| | | |

| | | |

| Dated: August 23, 2023 | | By: | /s/ Kersten D. Zupfer |

| | | Kersten D. Zupfer |

| | | | Executive Vice President and Chief Financial Officer |

Regis Corporation Reports Continued Profitability for the Fourth Fiscal Quarter and Full Fiscal Year 2023

MINNEAPOLIS, August 23, 2023 -- Regis Corporation (NYSE: RGS), a leader in the haircare industry, today announced financial results for the fourth fiscal quarter and full year ended June 30, 2023.

Matthew Doctor, Regis Corporation's President and Chief Executive Officer, commented: "At the end of fiscal 2022, I mentioned that we were poised to deliver stronger results in fiscal 2023 – and we did exactly that. We finished the year strong, delivering our fourth consecutive quarter of positive operating income, leading to our highest-level of operating income since 2017. We demonstrated growth across key financial metrics including same-store sales, operating income and adjusted EBITDA, reflecting the successful execution of the strategies we have been implementing. We have largely stabilized the business in a relatively short period of time, and during what remains to be a challenging operating environment for our industry – having gone from an adjusted EBITDA loss of $76.9 million in fiscal 2021, an adjusted EBITDA loss $1.8 million in fiscal 2022, to positive adjusted EBITDA of $21.0 million in fiscal 2023. We continued to reduce costs and generated efficiencies while focusing on our talent, technology, stylist community, and customer marketing to optimize our platform for sustained profitable growth. I am proud of our team and franchisees for their valuable contributions to the year and am excited to make continued progress in fiscal 2024."

Financial Highlights:

Fourth quarter fiscal 2023 compared to fourth quarter fiscal 2022:

•System-wide revenue of $311.8 million decreased $5.0 million from $316.8 million and system-wide same-store sales increased 2.5%;

•Operating income improved $4.9 million to $3.6 million, from an operating loss of $1.3 million in the 2022 fourth quarter;

•Franchise adjusted EBITDA of $5.5 million increased $3.0 million from $2.5 million in the 2022 fourth quarter;

•Net loss of $4.8 million improved $37.8 million from a loss of $42.6 million in the 2022 fourth quarter; and

•Adjusted EBITDA of $5.2 million increased $4.2 million from $1.0 million in the 2022 fourth quarter.

Full fiscal year 2023 compared to full fiscal year 2022:

•System-wide revenue of $1,230.5 million increased $2.0 million from $1,228.5 million and system-wide same-store sales increased 4.4%;

•Operating income improved $37.7 million to $8.8 million, from an operating loss of $28.9 million in the 2022 fiscal year;

•Franchise adjusted EBITDA of $22.8 million increased $15.1 million from $7.7 million in the 2022 fiscal year;

•Net loss of $7.4 million improved $78.5 million from a loss of $85.9 million in the 2022 fiscal year; and

•Adjusted EBITDA of $21.0 million increased $22.8 million from a loss of $1.8 million in the 2022 fiscal year.

Fourth Quarter Fiscal Year 2023 Consolidated Results

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Twelve Months Ended June 30, |

| (Dollars in millions, except per share data) | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Consolidated revenue | | $ | 55.7 | | | $ | 66.1 | | | $ | 233.3 | | | $ | 276.0 | |

| System-wide revenue (1) | | 311.8 | | | 316.8 | | | 1,230.5 | | | 1,228.5 | |

| | | | | | | | |

| System-wide same-store sales comps | | 2.5 | % | | 7.1 | % | | 4.4 | % | | 14.8 | % |

| | | | | | | | |

| Operating income (loss) | | $ | 3.6 | | | $ | (1.3) | | | $ | 8.8 | | | $ | (28.9) | |

| Loss from continuing operations | | (4.8) | | | (8.6) | | | (11.3) | | | (46.5) | |

| Diluted loss per share from continuing operations | | (0.10) | | | (0.19) | | | (0.25) | | | (1.07) | |

| (Loss) income from discontinued operations | | — | | | (34.1) | | | 4.0 | | | (39.4) | |

| Net loss | | (4.8) | | | (42.6) | | | (7.4) | | | (85.9) | |

| Diluted net loss per share | | (0.10) | | | (0.93) | | | (0.16) | | | (1.97) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted EBITDA (2) | | 5.2 | | | 1.0 | | | 21.0 | | | (1.8) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

_______________________________________________________________________________(1)Represents total sales within the system.

(2)See GAAP to non-GAAP reconciliations within the attached section titled "Non-GAAP Reconciliations."

Revenue

Total revenue in the fourth quarter 2023 of $55.7 million decreased $10.4 million and total revenue in fiscal year 2023 of $233.3 million decreased $42.7 million. The decreases were driven primarily by a reduction in salon count and exiting the product distribution business.

Operating Income

Regis reported fourth quarter 2023 income from operations of $3.6 million compared to a loss from operations of $1.3 million in the fourth quarter 2022. Regis reported fiscal year 2023 income from operations of $8.8 million, compared to a loss from operations of $28.9 million in 2022. The year-over-year improvement in operations was driven primarily by our lower general and administrative expense structure and the wind down of loss-generating company-owned salons during the last twelve months.

Net Loss from Continuing Operations

Regis reported fourth quarter 2023 net loss from continuing operations of $4.8 million, or $0.10 loss per diluted share, compared to a net loss from continuing operations of $8.6 million, or $0.19 loss per diluted share, in the fourth quarter 2022. Regis reported fiscal year 2023 net loss from continuing operations of $11.3 million, or $0.25 loss per diluted share, compared to a net loss from continuing operations of $46.5 million, or $1.07 loss per diluted share, in 2022. The year-over-year improvement in net loss from continuing operations in both periods was driven primarily by an increase in operating income partially offset by an increase in interest expense.

Net Loss

The Company reported a fourth quarter 2023 net loss of $4.8 million, or $0.10 loss per diluted share, compared to a net loss of $42.6 million, or $0.93 loss per diluted share for the same period last year. The Company reported fiscal year 2023 net loss of $7.4 million, or $0.16 loss per diluted share, compared to a net loss of $85.9 million, or $1.97 loss per diluted share, in 2022. The year-over-year improvement in net loss in both periods was driven by the loss on the sale of our point-of-sale system in the prior year.

Adjusted EBITDA

Fourth quarter adjusted EBITDA of $5.2 million improved $4.2 million versus adjusted EBITDA of $1.0 million in the same period last year. Fiscal year adjusted EBITDA of $21.0 million improved $22.8 million, versus an adjusted EBITDA loss of $1.8 million in the same period last year. The improvements were driven by lower general and administrative expense and the wind down of loss-generating company-owned salons during the last twelve months. Fiscal year 2023 adjusted EBITDA also benefited from a $1.1 million grant from the state of North Carolina related to COVID-19 relief.

Fourth Quarter Fiscal Year 2023 Segment Results

Franchise | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Increase (Decrease) | | Twelve Months Ended June 30, | | Increase (Decrease) |

| (Dollars in millions) (1) | | 2023 | | 2022 | | | 2023 | | 2022 | |

| | | | | | | | | | | | |

| Royalties | | $ | 16.6 | | | $ | 17.2 | | | $ | (0.6) | | | $ | 66.0 | | | $ | 65.8 | | | $ | 0.2 | |

| Fees | | 3.0 | | | 3.0 | | | — | | | 11.3 | | | 11.6 | | | (0.3) | |

| Product sales to franchisees | | 0.6 | | | 3.3 | | | (2.7) | | | 2.8 | | | 15.1 | | | (12.3) | |

| Advertising fund contributions | | 7.7 | | | 8.4 | | | (0.7) | | | 31.7 | | | 32.6 | | | (0.9) | |

| Franchise rental income | | 25.6 | | | 30.6 | | | (5.0) | | | 111.4 | | | 130.8 | | | (19.4) | |

| Total Franchise revenue | | $ | 53.5 | | | $ | 62.5 | | | $ | (9.0) | | | $ | 223.2 | | | $ | 255.8 | | | $ | (32.6) | |

| | | | | | | | | | | | |

| Franchise same-store sales comps | | 2.4 | % | | 7.2 | % | | | | 4.4 | % | | 15.0 | % | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Franchise adjusted EBITDA | | $ | 5.5 | | | $ | 2.5 | | | $ | 3.0 | | | $ | 22.8 | | | $ | 7.7 | | | $ | 15.1 | |

| as a percent of revenue | | 10.2 | % | | 4.1 | % | | | | 10.2 | % | | 3.0 | % | | |

| as a percent of adjusted revenue (2) | | 27.1 | % | | 10.8 | % | | | | 28.5 | % | | 8.4 | % | | |

| | | | | | | | | | | | |

| Total Franchise salons | | 4,795 | | | 5,395 | | | (600) | | | | | | | |

| as a percent of total Franchise and Company-owned salons | | 98.6 | % | | 98.1 | % | | | | | | | | |

_______________________________________________________________________________ (1)Variances calculated on amounts shown in millions may result in rounding differences.

(2)Adjusted revenue excludes non-margin revenue. See GAAP to non-GAAP reconciliations within the attached section titled "Non-GAAP Reconciliations."

Franchise Revenue

Fourth quarter franchise revenue was $53.5 million, a $9.0 million, or 14.4%, decrease compared to the prior year quarter. Non-margin franchise rental income decreased $5.0 million due to fewer salons in the current year. Royalties were $16.6 million, a $0.6 million, or 3.5% decrease, versus the same period last year due to the decline in salon count. Product sales to franchisees of $0.6 million decreased $2.7 million, or 81.8%, as a result of the transition out of the wholesale product business.

Fiscal year 2023 franchise revenue was $223.2 million, a $32.6 million, or 12.7%, decrease compared to the prior year primarily due to a decline in non-margin franchise rental income as a result of a lower franchise salon count.

Franchise Adjusted EBITDA

Fourth quarter franchise adjusted EBITDA of $5.5 million improved $3.0 million year-over-year primarily due to a decrease in general and administrative expense.

Fiscal year 2023 franchise adjusted EBITDA of $22.8 million improved $15.1 million year-over-year primarily due to a decrease in general and administrative expense.

Company-Owned Salons | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Increase (Decrease) | | Twelve Months Ended June 30, | | Increase (Decrease) |

| (Dollars in millions) (1) | | 2023 | | 2022 | | | 2023 | | 2022 | |

| | | | | | | | | | | | |

| Total Company-owned salon revenue | | $ | 2.2 | | | $ | 3.6 | | | $ | (1.4) | | | $ | 10.1 | | | $ | 20.2 | | | $ | (10.1) | |

| Company-owned same-store sales comps | | 8.7 | % | | (0.8) | % | | | | 4.9 | % | | 3.4 | % | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Company-owned salon adjusted EBITDA | | $ | (0.3) | | | $ | (1.6) | | | $ | 1.3 | | | $ | (1.8) | | | $ | (9.5) | | | $ | 7.7 | |

| as a percent of revenue | | (13.6) | % | | (44.4) | % | | | | (17.8) | % | | (47.0) | % | | |

| | | | | | | | | | | | |

| Total Company-owned salons | | 68 | | | 105 | | | (37) | | | | | | | |

| as a percent of total Franchise and Company-owned salons | | 1.4 | % | | 1.9 | % | | | | | | | | |

_______________________________________________________________________________

(1)Variances calculated on amounts shown in millions may result in rounding differences.

Company-Owned Salon Revenue

Fourth quarter revenue for the Company-owned salon segment decreased $1.4 million versus the prior year to $2.2 million. The year-over-year decline in revenue was expected and driven by the closure of 37 unprofitable salons over the past twelve months.

Fiscal year 2023 revenue for the Company-owned salon segment decreased $10.1 million versus the prior year to $10.1 million due to company-owned salons closures.

Company-Owned Salon Adjusted EBITDA

Fourth quarter Company-owned salon adjusted EBITDA loss improved $1.3 million year-over-year driven primarily by the closure of unprofitable salons.

Fiscal year 2023 Company-owned salon adjusted EBITDA loss improved $7.7 million year-over-year driven primarily by the closure of unprofitable salons and includes a $1.1 million grant from the state of North Carolina related to COVID-19 relief in fiscal year 2023.

Balance Sheet and Cash Flow

The Company ended fiscal year 2023 with $9.5 million in cash and cash equivalents, $183.3 million in outstanding borrowings and total liquidity of $42.8 million. Net cash used in operating activities for the fiscal year totaled $7.9 million, an improvement of $30.7 million from the prior year. Cash use improved due primarily to lower general and administrative expense.

Non-GAAP reconciliations

For GAAP to non-GAAP reconciliations, please refer to the attached section titled "Non-GAAP Reconciliations." A complete reconciliation of reported earnings to adjusted earnings is included in this press release and is available on the Company’s website at www.regiscorp.com.

Earnings Webcast

Regis Corporation will host a conference call via webcast discussing fourth quarter and fiscal year 2023 results today, August 23, 2023 at 7:30 a.m., Central time. Interested parties are invited to participate in the live webcast by registering for the event at www.regiscorp.com/investor-relations.html. The webcast will include a slide presentation. A replay of the presentation will be available on our website at the same web address.

About Regis Corporation

Regis Corporation (NYSE:RGS) is a leader in the haircare industry. As of June 30, 2023, the Company franchised or owned 4,863 locations. Regis' franchised and corporate locations operate under concepts such as Supercuts®, SmartStyle®, Cost Cutters®, Roosters® and First Choice Haircutters®. For additional information about the Company, including a reconciliation of certain non-GAAP financial information and certain supplemental financial information, please visit the Investor Information section of the corporate website at www.regiscorp.com.

CONTACT: REGIS CORPORATION:

Kersten Zupfer

investorrelations@regiscorp.com

This press release contains or may contain "forward-looking statements" within the meaning of the federal securities laws, including statements concerning anticipated future events and expectations that are not historical facts. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements in this document reflect management’s best judgment at the time they are made, but all such statements are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those expressed in or implied by the statements herein. Such forward-looking statements are often identified herein by use of words including, but not limited to, "may," "believe," "project," "forecast," "expect," "estimate," "anticipate," and "plan." In addition, the following factors could affect the Company's actual results and cause such results to differ materially from those expressed in forward-looking statements. These uncertainties include a potential material adverse impact on our business and results of operations as a result of changes in consumer shopping trends and changes in manufacturer distribution channels; laws and regulations could require us to modify current business practices and incur increased costs including increases in minimum wages; our potential responsibility for Empire Education Group, Inc.'s liabilities; changes in general economic environment; changes in consumer tastes, hair product innovation, fashion trends and consumer spending patterns; compliance with New York Stock Exchange listing requirements; reliance on franchise royalties and overall success of our franchisees’ salons; our salons' dependence on a third-party supplier agreement for merchandise; our franchisees' ability to attract, train and retain talented stylists and salon leaders; the success of our franchisees, which operate independently; data security and privacy compliance and our ability to manage cyber threats and protect the security of potentially sensitive information about our guests, franchisees, employees, vendors or Company information; the ability of the Company to maintain a satisfactory relationship with Walmart; marketing efforts to drive traffic to our franchisees' salons; the successful migration of our franchisees to the Zenoti salon technology platform; our ability to maintain and enhance the value of our brands; reliance on information technology systems; reliance on external vendors; the use of social media; the effectiveness of our enterprise risk management program; ability to generate sufficient cash flow to satisfy our debt service obligations; compliance with covenants in our financing arrangement, access to the existing revolving credit facility, and acceleration of our obligation to repay our indebtedness; limited resources to invest in our business; premature termination of agreements with our franchisees; financial performance of Empire Education Group, Inc.; the continued ability of the Company to implement cost reduction initiatives and achieve expected cost savings; continued ability to compete in our business markets; reliance on our management team and other key personnel; the continued ability to maintain an effective system of internal control over financial reporting; changes in tax exposure; the ability to use U.S. net operating loss carryforwards; potential litigation and other legal or regulatory proceedings; or other factors not listed above. Additional information concerning potential factors that could affect future financial results is set forth under Item 1A of Form 10-K. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made in our subsequent annual and periodic reports filed or furnished with the SEC on Forms 10-K, 10-Q and 8-K and Proxy Statements on Schedule 14A.

REGIS CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except per share data) | | | | | | | | | | | | | | |

| | June 30, |

| | 2023 | | 2022 |

| | | | |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 9,508 | | | $ | 17,041 | |

| Receivables, net | | 10,885 | | | 14,531 | |

| Inventories | | 1,681 | | | 3,109 | |

| Other current assets | | 15,164 | | | 13,984 | |

| | | | |

| Total current assets | | 37,238 | | | 48,665 | |

| | | | |

| Property and equipment, net | | 6,422 | | | 12,835 | |

| Goodwill | | 173,791 | | | 174,360 | |

| Other intangibles, net | | 2,783 | | | 3,226 | |

| Right of use asset | | 360,836 | | | 493,749 | |

| Other assets | | 26,307 | | | 36,465 | |

| | | | |

| Total assets | | $ | 607,377 | | | $ | 769,300 | |

| | | | |

| LIABILITIES AND SHAREHOLDERS' DEFICIT | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 14,309 | | | $ | 15,860 | |

| Accrued expenses | | 30,109 | | | 33,784 | |

| | | | |

| Short-term lease liability | | 81,917 | | | 103,196 | |

| | | | |

| Total current liabilities | | 126,335 | | | 152,840 | |

| | | | |

| Long-term debt, net | | 176,830 | | | 179,994 | |

| Long-term lease liability | | 291,901 | | | 408,445 | |

| | | | |

| Other non-current liabilities | | 49,041 | | | 58,974 | |

| | | | |

| Total liabilities | | 644,107 | | | 800,253 | |

| Commitments and contingencies | | | | |

| Shareholders' deficit: | | | | |

Common stock, $0.05 par value; issued and outstanding, 45,566,228 and 45,510,245 common shares as of June 30, 2023 and 2022, respectively | | 2,278 | | | 2,276 | |

| Additional paid-in capital | | 64,600 | | | 62,562 | |

| Accumulated other comprehensive income | | 9,023 | | | 9,455 | |

| Accumulated deficit | | (112,631) | | | (105,246) | |

| | | | |

| Total shareholders' deficit | | (36,730) | | | (30,953) | |

| | | | |

| Total liabilities and shareholders' deficit | | $ | 607,377 | | | $ | 769,300 | |

– more –

REGIS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars and shares in thousands, except per share data) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Twelve Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Revenues: | | | | | | | | |

| Royalties | | $ | 16,607 | | | $ | 17,227 | | | $ | 65,981 | | | $ | 65,753 | |

| Fees | | 2,965 | | | 2,954 | | | 11,266 | | | 11,587 | |

| Product sales to franchisees | | 608 | | | 3,343 | | | 2,802 | | | 15,072 | |

| Advertising fund contributions | | 7,744 | | | 8,360 | | | 31,747 | | | 32,573 | |

| Franchise rental income | | 25,596 | | | 30,577 | | | 111,441 | | | 130,777 | |

| Company-owned salon revenue | | 2,195 | | | 3,608 | | | 10,089 | | | 20,205 | |

| Total revenue | | 55,715 | | | 66,069 | | | 233,326 | | | 275,967 | |

| Operating expenses: | | | | | | | | |

| Cost of product sales to franchisees | | 715 | | | 4,172 | | | 3,540 | | | 17,391 | |

| Inventory reserve | | — | | | 1,235 | | | 1,228 | | | 7,655 | |

| General and administrative | | 11,544 | | | 14,566 | | | 50,751 | | | 65,274 | |

| Rent | | 3,276 | | | 3,368 | | | 9,196 | | | 9,357 | |

| Advertising fund expense | | 7,744 | | | 8,360 | | | 31,747 | | | 32,573 | |

| Franchise rent expense | | 25,596 | | | 30,577 | | | 111,441 | | | 130,777 | |

| Company-owned salon expense (1) | | 1,536 | | | 3,648 | | | 8,827 | | | 21,952 | |

| Depreciation and amortization | | 1,664 | | | 1,458 | | | 7,716 | | | 6,224 | |

| Long-lived asset impairment | | 65 | | | — | | | 101 | | | 542 | |

| | | | | | | | |

| Goodwill impairment | | — | | | — | | | — | | | 13,120 | |

| Total operating expenses | | 52,140 | | | 67,384 | | | 224,547 | | | 304,865 | |

| | | | | | | | |

| Operating income (loss) | | 3,575 | | | (1,315) | | | 8,779 | | | (28,898) | |

| | | | | | | | |

| Other (expense) income: | | | | | | | | |

| Interest expense | | (9,018) | | | (3,292) | | | (22,141) | | | (12,914) | |

| Loss from sale of salon assets to franchisees, net | | — | | | (145) | | | — | | | (2,334) | |

| Other, net | | 198 | | | (309) | | | 1,364 | | | (296) | |

| | | | | | | | |

| Loss from operations before income taxes | | (5,245) | | | (5,061) | | | (11,998) | | | (44,442) | |

| | | | | | | | |

| Income tax benefit (expense) | | 442 | | | (3,499) | | | 655 | | | (2,017) | |

| | | | | | | | |

| Loss from continuing operations | | (4,803) | | | (8,560) | | | (11,343) | | | (46,459) | |

| | | | | | | | |

| (Loss) income from discontinued operations, net of income taxes | | — | | | (34,073) | | | 3,958 | | | (39,398) | |

| | | | | | | | |

| Net loss | | $ | (4,803) | | | $ | (42,633) | | | $ | (7,385) | | | $ | (85,857) | |

| | | | | | | | |

| Net loss per share: | | | | | | | | |

Basic and diluted: | | | | | | | | |

| Loss from continuing operations | | $ | (0.10) | | | $ | (0.19) | | | $ | (0.25) | | | $ | (1.07) | |

| (Loss) income from discontinued operations | | 0.00 | | | (0.74) | | | 0.09 | | | (0.90) | |

| Net loss per share, basic and diluted (2) | | $ | (0.10) | | | $ | (0.93) | | | $ | (0.16) | | | $ | (1.97) | |

| | | | | | | | |

| Weighted average common and common equivalent shares outstanding: | | | | | | | | |

| Basic and diluted | | 46,461 | | | 45,969 | | | 46,235 | | | 43,582 | |

_______________________________________________________________________________

(1)Includes cost of service and product sold to guests in our Company-owned salons. Excludes general and administrative expense, rent and depreciation and amortization related to Company-owned salons.

(2)Total is a recalculation; line items calculated individually may not sum to total due to rounding.

– more –

REGIS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in thousands) | | | | | | | | | | | | | | |

| | Twelve Months Ended June 30, |

| | 2023 | | 2022 |

| | | | |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (7,385) | | | $ | (85,857) | |

| Adjustments to reconcile net loss to net cash used in operating activities | | | | |

| (Gain) loss from sale of OSP | | (4,562) | | | 36,143 | |

| Depreciation and amortization | | 7,189 | | | 6,504 | |

| | | | |

| | | | |

| | | | |

| Long-lived asset impairment | | 101 | | | 542 | |

| Deferred income taxes | | (8) | | | 391 | |

| | | | |

| Inventory reserve | | 1,228 | | | 10,478 | |

| Non-cash interest | | 3,790 | | | — | |

| | | | |

| Loss from sale of salon assets to franchisees, net | | — | | | 2,334 | |

| | | | |

| | | | |

| Goodwill impairment | | — | | | 16,000 | |

| | | | |

| Stock-based compensation | | 2,316 | | | 1,334 | |

| Amortization of debt discount and financing costs | | 2,891 | | | 1,839 | |

| Other non-cash items affecting earnings | | 155 | | | 709 | |

Changes in operating assets and liabilities (1): | | | | |

| Receivables | | 943 | | | 11,896 | |

| Inventories | | (182) | | | 7,886 | |

| Income tax receivable | | (577) | | | 1,118 | |

| Other current assets | | 850 | | | 2,118 | |

| Other assets | | 6,818 | | | 2,703 | |

| Accounts payable | | (497) | | | (10,966) | |

| Accrued expenses | | (6,151) | | | (21,983) | |

| Net lease liabilities | | (4,991) | | | (5,960) | |

| Other non-current liabilities | | (9,817) | | | (15,867) | |

| Net cash used in operating activities: | | (7,889) | | | (38,638) | |

| Cash flows from investing activities: | | | | |

| Capital expenditures | | (481) | | | (5,316) | |

| | | | |

| | | | |

| Net proceeds from sale of OSP | | 4,500 | | | 13,000 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Net cash provided by investing activities: | | 4,019 | | | 7,684 | |

| Cash flows from financing activities: | | | | |

| Borrowings on credit facility | | 13,357 | | | 10,000 | |

| Repayments of long-term debt | | (11,083) | | | (16,916) | |

| Debt refinancing fees | | (4,383) | | | — | |

| Proceeds from issuance of common stock, net of offering costs | | — | | | 37,185 | |

| | | | |

| Taxes paid for shares withheld | | (36) | | | (845) | |

| | | | |

| | | | |

| | | | |

| Net cash (used in) provided by financing activities: | | (2,145) | | | 29,424 | |

| Effect of exchange rate changes on cash and cash equivalents | | (53) | | | (158) | |

| Decrease in cash, cash equivalents and restricted cash | | (6,068) | | | (1,688) | |

| Cash, cash equivalents and restricted cash: | | | | |

| Beginning of year | | 27,464 | | | 29,152 | |

| | | | |

| | | | |

| End of year | | $ | 21,396 | | | $ | 27,464 | |

_______________________________________________________________________________

(1)Changes in operating assets and liabilities exclude assets and liabilities sold or acquired.

– more –

SYSTEM-WIDE SAME-STORE SALES (1): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | June 30, 2023 | | June 30, 2022 |

| | Service | | Retail | | Total | | Service | | Retail | | Total |

| | | | | | | | | | | | |

Supercuts | | 4.5 | % | | (2.4) | % | | 4.2 | % | | 14.4 | % | | (11.8) | % | | 13.0 | % |

SmartStyle | | (1.9) | | | (9.7) | | | (3.4) | | | 1.5 | | | (17.9) | | | (2.7) | |

Portfolio Brands | | 4.2 | | | (0.4) | | | 3.8 | | | 6.5 | | | (5.5) | | | 5.3 | |

| Total | | 3.2 | % | | (5.3) | % | | 2.5 | % | | 9.6 | % | | (13.4) | % | | 7.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended |

| | June 30, 2023 | | June 30, 2022 |

| | Service | | Retail | | Total | | Service | | Retail | | Total |

| | | | | | | | | | | | |

Supercuts | | 7.5 | % | | (5.2) | % | | 6.9 | % | | 23.8 | % | | (5.6) | % | | 22.1 | % |

SmartStyle | | 0.1 | | | (12.8) | | | (2.5) | | | 10.7 | | | (10.5) | | | 5.7 | |

Portfolio Brands | | 6.4 | | | (3.7) | | | 5.5 | | | 13.0 | | | (3.4) | | | 11.2 | |

| Total | | 5.7 | % | | (8.5) | % | | 4.4 | % | | 17.8 | % | | (7.5) | % | | 14.8 | % |

_______________________________________________________________________________

(1)System-wide same-store sales are calculated as the total change in sales for system-wide franchise and company-owned locations that were open on a specific day of the week during the current period and the corresponding prior period. Quarterly and year-to-date system-wide same-store sales are the sum of the system-wide same-store sales computed on a daily basis. Franchise salons that do not report daily sales are excluded from same-store sales. System-wide same-store sales are calculated in local currencies to remove foreign currency fluctuations from the calculation.

– more –

REGIS CORPORATION

System-Wide Location Counts | | | | | | | | | | | | | | |

| | June 30, |

| | 2023 | | 2022 |

| | | | |

FRANCHISE SALONS: | | | | |

| | | | |

Supercuts | | 2,082 | | | 2,264 | |

SmartStyle/Cost Cutters in Walmart stores | | 1,388 | | | 1,646 | |

Portfolio Brands | | 1,223 | | | 1,344 | |

Total North American salons | | 4,693 | | | 5,254 | |

Total International salons (1) | | 102 | | | 141 | |

Total Franchise salons | | 4,795 | | | 5,395 | |

as a percent of total Franchise and Company-owned salons | | 98.6 | % | | 98.1 | % |

| | | | |

COMPANY-OWNED SALONS: | | | | |

| | | | |

Supercuts | | 7 | | | 18 | |

SmartStyle/Cost Cutters in Walmart stores | | 48 | | | 49 | |

Portfolio Brands | | 13 | | | 38 | |

Total Company-owned salons | | 68 | | | 105 | |

as a percent of total Franchise and Company-owned salons | | 1.4 | % | | 1.9 | % |

| | | | |

| Total Franchise and Company-owned salons | | 4,863 | | | 5,500 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

_______________________________________________________________________________

(1)Canadian and Puerto Rican salons are included in the North American salon totals.

– more –

Non-GAAP Reconciliations:

This press release includes a presentation of operating income excluding certain non-cash charges, adjusted EBITDA and adjusted Franchise revenue, which are non-GAAP measures. The non-GAAP measures are financial measures that do not reflect United States Generally Accepted Accounting Principles (GAAP). We believe our presentation of the non-GAAP measures provides meaningful insight into our ongoing operating performance and a supplemental perspective of our results of operations. Presentation of the non-GAAP measures allows investors to review our core ongoing operating performance from the same perspective as management and the Board of Directors. These non-GAAP financial measures provide investors an enhanced understanding of our operations, facilitate investors' analyses and comparisons of our current and past results of operations and provide insight into the prospects of our future performance. We also believe the non-GAAP measures are useful to investors because they provide supplemental information that research analysts frequently use to analyze financial performance.

Items impacting comparability are not defined terms within U.S. GAAP. Therefore, our non-GAAP financial information may not be comparable to similarly titled measures reported by other companies. We determine the items to consider as "items impacting comparability" based on how management views our business, makes financial, operating and planning decisions and evaluates the Company's ongoing performance.

The reconciliation of U.S. GAAP operating income to non-GAAP operating income excluding certain non-cash charges is included in the release.

The following items have been excluded from our non-GAAP adjusted EBITDA results: discontinued operations, non-recurring non-operating income, distribution center wind down fees, CEO transition costs, inventory reserve, goodwill impairment, one-time professional fees and settlements, severance expense, the benefit from lease liability decreases in excess of previously impaired right of use asset, lease termination fees and asset retirement obligation costs.

We present adjusted revenue to provide a meaningful Franchise adjusted EBITDA margin, which removes non-margin revenue from total revenue to arrive at an adjusted margin. Margin is a common metric used by investors, however, the majority of our revenue is offset by equal expense, so it does not contribute to our margin. We remove the non-margin revenue from this metric in order to show a meaningful margin rate.

The method we use to produce non-GAAP results is not in accordance with U.S. GAAP and may differ from methods used by other companies. These non-GAAP results should not be regarded as a substitute for corresponding U.S. GAAP measures, but instead should be utilized as a supplemental measure of operating performance in evaluating our business. Non-GAAP measures do have limitations as they do not reflect certain items that may have a material impact upon our reported financial results. As such, these non-GAAP measures should be viewed in conjunction with our financial statements prepared in accordance with U.S. GAAP.

– more –

REGIS CORPORATION

Reconciliation of U.S. GAAP Net Loss to Adjusted EBITDA

(Dollars in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Twelve Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Consolidated reported net loss, as reported (U.S. GAAP) | | $ | (4,803) | | | $ | (42,633) | | | $ | (7,385) | | | $ | (85,857) | |

| Interest expense, as reported | | 9,018 | | | 3,292 | | | 22,141 | | | 12,914 | |

| Income taxes, as reported | | (442) | | | 3,499 | | | (655) | | | 2,017 | |

| Depreciation and amortization, as reported | | 1,664 | | | 1,458 | | | 7,716 | | | 6,224 | |

| Long-lived asset impairment, as reported | | 65 | | | — | | | 101 | | | 542 | |

| EBITDA | | $ | 5,502 | | | $ | (34,384) | | | $ | 21,918 | | | $ | (64,160) | |

| | | | | | | | |

| Inventory reserve | | — | | | 1,235 | | | 1,228 | | | 7,655 | |

| CEO transition | | — | | | — | | | — | | | (466) | |

| Distribution center fees | | — | | | — | | | — | | | 285 | |

| Professional fees and legal settlements | | — | | | 280 | | | 1,248 | | | 2,140 | |

| Severance | | (132) | | | 59 | | | 720 | | | 2,074 | |

| Lease liability benefit | | (258) | | | (336) | | | (1,773) | | | (3,620) | |

| Lease termination fees | | 56 | | | 32 | | | 1,627 | | | 1,835 | |

| Real estate fees | | — | | | — | | | — | | | 40 | |

| Goodwill impairment | | — | | | — | | | — | | | 13,120 | |

| Non-recurring, non-operating income | | — | | | — | | | — | | | (100) | |

| Discontinued operations | | — | | | 34,073 | | | (3,958) | | | 39,398 | |

| Adjusted EBITDA, non-GAAP financial measure | | $ | 5,168 | | | $ | 959 | | | $ | 21,010 | | | $ | (1,799) | |

– more –

REGIS CORPORATION

Reconciliation of Reported Franchise Adjusted EBITDA as a Percent of GAAP Franchise Revenue

to Franchise Adjusted EBITDA as a Percent of Adjusted Franchise Revenue

(Dollars in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Twelve Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Franchise adjusted EBITDA | | $ | 5,460 | | | $ | 2,538 | | | $ | 22,799 | | | $ | 7,730 | |

| GAAP Franchise revenue | | 53,520 | | | 62,461 | | | 223,237 | | | 255,762 | |

| Franchise adjusted EBITDA as a percent of GAAP Franchise revenue | | 10.2 | % | | 4.1 | % | | 10.2 | % | | 3.0 | % |

| Non-margin revenue adjustments: | | | | | | | | |

| Franchise rental income | | $ | (25,596) | | | $ | (30,577) | | | $ | (111,441) | | | $ | (130,777) | |

| Advertising fund contributions | | (7,744) | | | (8,360) | | | (31,747) | | | (32,573) | |

| Adjusted Franchise revenue | | $ | 20,180 | | | $ | 23,524 | | | $ | 80,049 | | | $ | 92,412 | |

| Franchise adjusted EBITDA as a percent of adjusted Franchise revenue | | 27.1 | % | | 10.8 | % | | 28.5 | % | | 8.4 | % |

– end –

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

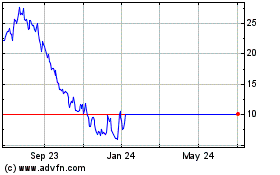

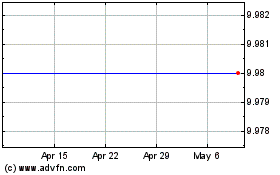

Regis (NYSE:RGS)

Historical Stock Chart

From Apr 2024 to May 2024

Regis (NYSE:RGS)

Historical Stock Chart

From May 2023 to May 2024