0001713863

false

0001713863

2023-10-30

2023-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 30, 2023

RAFAEL HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-38411 |

|

82-2296593 |

|

(State or other jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

520 Broad Street

Newark, New Jersey |

|

07102 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 212 658-1450

Not Applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section 12(b)-2 of the Exchange Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on

which registered |

| Class B common stock, par value $0.01 per share |

|

RFL |

|

New York Stock Exchange |

Item 2.02. Results of Operations and Financial

Condition.

On October 30, 2023, Rafael Holdings, Inc. (the “Company”) distributed over a wire service and posted

an earnings release to the investors page of its website (www.rafaelholdings.com) announcing its results of operations for the fiscal

quarter and fiscal year ended July 31, 2023. A copy of the earnings release concerning the foregoing results is furnished herewith as

Exhibit 99.1 and is incorporated herein by reference.

The Company is furnishing the information contained in this Report, including

Exhibit 99.1, pursuant to Item 2.02 of Form 8-K promulgated by the Securities and Exchange Commission (the “SEC”). This information

shall not be deemed to be “filed” with the SEC or incorporated by reference into any other filing with the SEC unless otherwise

expressly stated in such filing. In addition, this Report and the press release contain statements intended as “forward-looking

statements” that are subject to the cautionary statements about forward-looking statements set forth in the press release.

Item 9.01 Financial Statements and

Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RAFAEL HOLDINGS, INC. |

| |

|

| |

By: |

/s/ William Conkling |

| |

|

Name: |

William Conkling |

| |

|

Title: |

Chief Executive Officer |

Dated: October 30, 2023

EXHIBIT INDEX

3

Exhibit 99.1

Rafael Holdings Reports Fourth Quarter and Full

Year Fiscal 2023 Financial Results

Company positions itself to generate value

for its stockholders by curtailing expenses while increasing investment in strategic opportunities

NEWARK, NJ – October 30, 2023 (GLOBE NEWSWIRE) - Rafael

Holdings, Inc. (NYSE: RFL), today reported its financial results for the fourth quarter and full year of fiscal 2023 - the three and twelve

months ended July 31, 2023.

“During fiscal 2023, we made meaningful

progress toward expanding our portfolio through strategic investments in companies which have the potential to generate value for our

stockholders. We greatly curtailed our expenses with the suspension of activities at Barer Institute while increasing our liquidity by

selling our principal real estate holding for $33 million in net proceeds,” said Bill Conkling, CEO of Rafael Holdings. “We

continue to believe that the current dislocation in the capital markets and in particular the biotech industry makes this a particularly

opportune time for us. Notably, during this period we invested in Cyclo Therapeutics (Nasdaq: CYTH) in support of its Phase 3 registrational

clinical trial for patients with Niemann-Pick Disease Type C and in in Day Three Laboratories, a company which reimagines existing cannabis

offerings with pharmaceutical-grade technology and innovation.”

Rafael Holdings, Inc. Fourth Quarter Fiscal Year 2023 Financial

Results

As of July 31, 2023, we had cash, cash equivalents

and marketable securities of $79.2 million.

For the three months ended July 31, 2023, we incurred net income from

continuing operations of $1.3 million, or $0.06 per share. For the same period in the prior year, we incurred a net loss from continuing

operations of $4.6 million, or $0.24 per share.

Research and development expenses were $1.3 million for the quarter

compared to $1.8 million in the year ago period. The year over year reduction in spending is due to the winding down of early-stage programs,

including at Barer Institute.

Our general and administrative expenses from continuing

operations were $1.4 million for the three months ended July 31, 2023, which includes $0.5 million in non-cash stock-based compensation

expense. For the same period in the prior year, general and administrative expenses were $3.0 million which included $1.0 million in non-cash

stock-based compensation expense.

Rafael Holdings, Inc. Full Year Fiscal Year 2023 Financial Results

For the twelve months ended July 31, 2023, we incurred a net loss from

continuing operations of $8.7 million, or $0.36 per share. For the same period in the prior year, we incurred a net loss from continuing

operations of $140.5 million, or $6.22 per share, which included a $25 million loss on the write-off of a receivable pursuant to a line

of credit, a loss of $10.1 million on the write-off of a related party receivable and a $79.1 million charge for the impairment of our

investment in Cornerstone Pharmaceuticals, Inc.

Research and development expenses were $6.3 million for the twelve

months ended July 31, 2023, which includes $0.5 million in severance costs. For the same period in the prior year, research and development

expenses were $8.7 million.

Our general and administrative expenses were $8.9 million for the twelve

months ended July 31, 2023, which includes $0.4 million in severance costs as well as $2.1 million net of non-cash stock-based compensation

expense. For the same period in the prior year, general and administrative expenses were $17.0 million which included $5.9 million in

severance costs as well as a net, non-cash credit of $1.5 million of stock-based compensation expense.

About Rafael Holdings, Inc.

Rafael Holdings is a holding company with interests

in clinical and early-stage pharmaceutical companies, including an investment in Cornerstone Pharmaceuticals, Inc., formerly known as

Rafael Pharmaceuticals Inc., a cancer metabolism-based therapeutics company, a majority equity interest in LipoMedix Pharmaceuticals Ltd.,

a clinical stage pharmaceutical company, the Barer Institute Inc., a wholly-owned preclinical cancer metabolism research operation, an

investment in Cyclo Therapeutics Inc. (Nasdaq: CYTH), a clinical-stage biotechnology company dedicated to developing life-changing medicines

for patients and families living with challenging diseases through its lead therapeutic asset, Trappsol® Cyclo™,

an investment in Day Three Labs, Inc., a company which reimagines existing cannabis offerings with pharmaceutical-grade technology and

innovation like Unlokt™ to bring to market better, cleaner, more precise and predictable products in the cannabis industry, and

a majority interest in Rafael Medical Devices, LLC, an orthopedic-focused medical device company developing instruments to advance minimally

invasive surgeries. The Company’s primary focus is to expand our investment portfolio through opportunistic and strategic investments

including therapeutics which address high unmet medical needs.

Forward Looking Statements

This press release contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters

of historical fact should be considered forward-looking statements, including without limitation statements regarding our expectations

surrounding the potential, safety, efficacy, and regulatory and clinical progress of our product candidates; plans regarding the further

evaluation of clinical data; and the potential of our pipeline, including our internal cancer metabolism research programs. These statements

are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our

actual results, performance or achievements to be materially different from any future results, performance or achievements expressed

or implied by the forward-looking statements, including, but not limited to, the following: the impact of public health threats, including

COVID-19, on our business and operations; clinical trials of product candidates may not be successful; our pharmaceutical companies may

not be able to develop any medicines of commercial value; our pharmaceutical companies may not be successful in their efforts to identify

or discover potential product candidates; the manufacturing and manufacturing development of our products and product candidates present

technological, logistical and regulatory risks, each of which may adversely affect our potential revenue; potential unforeseen events

during clinical trials could cause delays or other adverse consequences; risks relating to the regulatory approval process; interim, topline

and preliminary data may change as more patient data become available, and are subject to audit and verification procedures that could

result in material changes in the final data; our product candidates may cause serious adverse side effects; ongoing regulatory obligations;

effects of significant competition; unfavorable pricing regulations, third-party reimbursement practices or healthcare reform initiatives;

product liability lawsuits; failure to attract, retain and motivate qualified personnel; the possibility of system failures or security

breaches; risks relating to intellectual property and significant costs as a result of operating as a public company. These and other

important factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended July 31,

2023, and our other filings with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements

made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release.

While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if

subsequent events cause our views to change.

Contact:

Barbara Ryan

Barbara.ryan@rafaelholdings.com

(203) 274-2825

# # #

RAFAEL HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS

(audited, in thousands, except share and per

share data)

| | |

July 31,

2023 | | |

July 31,

2022 | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| CURRENT ASSETS | |

| | |

| |

| Cash and cash equivalents | |

$ | 21,498 | | |

$ | 26,537 | |

| Available-for-sale securities | |

| 57,714 | | |

| 36,698 | |

| Interest receivable | |

| 387 | | |

| 140 | |

| Convertible note receivable, related party | |

| 1,921 | | |

| - | |

| Trade accounts receivable, net of allowance for doubtful accounts of $245 and $197 at July 31, 2023 and July 31, 2022, respectively | |

| 213 | | |

| 157 | |

| Prepaid expenses and other current assets | |

| 914 | | |

| 4,621 | |

| Assets held for sale | |

| - | | |

| 40,194 | |

| Investment in equity securities | |

| 294 | | |

| 40,194 | |

| Total current assets | |

| 82,941 | | |

| 148,541 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 1,695 | | |

| 1,770 | |

| Investments – Other Pharmaceuticals | |

| 65 | | |

| 477 | |

| Investments – Hedge Funds | |

| 4,984 | | |

| 4,764 | |

| Investments – Day Three Labs Inc. | |

| 2,797 | | |

| - | |

| Investments – Cyclo Therapeutics Inc. | |

| 4,763 | | |

| - | |

| In-process research and development and patents | |

| 1,575 | | |

| 1,575 | |

| Other assets | |

| 9 | | |

| 1,387 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 98,829 | | |

$ | 158,514 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Trade accounts payable | |

$ | 333 | | |

$ | 564 | |

| Accrued expenses | |

| 763 | | |

| 1,875 | |

| Other current liabilities | |

| 1,023 | | |

| 3,518 | |

| Due to related parties | |

| 26 | | |

| 69 | |

| Note payable, net of debt issuance costs | |

| - | | |

| 15,000 | |

| Total current liabilities | |

| 2,145 | | |

| 21,026 | |

| | |

| | | |

| | |

| Other liabilities | |

| 55 | | |

| 88 | |

| TOTAL LIABILITIES | |

$ | 2,200 | | |

$ | 21,114 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | |

| | |

| | | |

| | |

| EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Class A common stock, $0.01 par value; 35,000,000 shares authorized, 787,163 shares issued and outstanding as of July 31, 2023 and July 31, 2022, respectively | |

| 8 | | |

| 8 | |

| Class B common stock, $0.01 par value; 200,000,000 shares authorized, 23,635,709 issued and 23,490,527 outstanding as of July 31, 2022, and 23,712,449 issued and 23,687,964 outstanding as of July 31, 2022 | |

| 236 | | |

| 237 | |

| Additional paid-in capital | |

| 264,010 | | |

| 262,023 | |

| Accumulated deficit | |

| (167,333 | ) | |

| (165,457 | ) |

| Accumulated other comprehensive loss related to unrealized loss on available-for-sale securities | |

| (353 | ) | |

| (63 | ) |

| Accumulated other comprehensive income related to foreign currency translation adjustment | |

| 3,725 | | |

| 3,767 | |

| Total equity attributable to Rafael Holdings, Inc. | |

| 100,293 | | |

| 100,515 | |

| Noncontrolling interests | |

| (3,664 | ) | |

| (3,309 | ) |

| TOTAL EQUITY | |

$ | 96,629 | | |

$ | 97,206 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND EQUITY | |

$ | 98,829 | | |

$ | 118,320 | |

RAFAEL HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS

(in thousands, except share and per share data)

| | |

(unaudited) | | |

(audited) | |

| | |

For the three months ended | | |

For the the twelve months ended | |

| | |

7/31/2023 | | |

7/31/2022 | | |

7/31/2023 | | |

7/31/2022 | |

| Revenues | |

$ | 68 | | |

$ | 69 | | |

$ | 279 | | |

$ | 410 | |

| | |

| | | |

| | | |

| | | |

| | |

| SG&A Expenses | |

| 1,395 | | |

| 3,048 | | |

| 8,932 | | |

| 16,978 | |

| R&D Expenses | |

| 1,266 | | |

| 1,841 | | |

| 6,312 | | |

| 8,742 | |

| Depreciation and amortization | |

| 18 | | |

| 18 | | |

| 78 | | |

| 72 | |

| Provision for loss on receivable pursuant to line of credit | |

| - | | |

| - | | |

| - | | |

| 25,000 | |

| Provision for losses on related party receivables | |

| - | | |

| - | | |

| - | | |

| 10,095 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Loss | |

| (2,611 | ) | |

| (4,838 | ) | |

| (15,043 | ) | |

| (60,477 | ) |

| Impairment of cost method investment - Cornerstone Pharmaceuticals | |

| - | | |

| - | | |

| - | | |

| (79,141 | ) |

| Unrealized (loss) gain on investments - Hedge Funds | |

| 100 | | |

| 80 | | |

| 220 | | |

| (504 | ) |

| Impairment of investments - Other Pharmaceuticals | |

| 17 | | |

| - | | |

| (334 | ) | |

| - | |

| Unrealized gain on investments - Cyclo Therapeutics Inc. | |

| 2,663 | | |

| - | | |

| 2,663 | | |

| - | |

| Other, net | |

| 1,294 | | |

| 113 | | |

| 3,749 | | |

| 150 | |

| Loss before Incomes Taxes | |

| 1,463 | | |

| (4,645 | ) | |

| (8,745 | ) | |

| (139,972 | ) |

| Taxes | |

| (4 | ) | |

| 6 | | |

| 255 | | |

| - | |

| Equity in loss of Day Three Labs Inc. | |

| (203 | ) | |

| - | | |

| (203 | ) | |

| - | |

| Equity loss in equity of RP Finance | |

| - | | |

| - | | |

| - | | |

| (575 | ) |

| Consolidated net income (loss) from continuing operations | |

| 1,256 | | |

| (4,639 | ) | |

| (8,693 | ) | |

| (140,547 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Discontinued Operations | |

| | | |

| | | |

| | | |

| | |

| Loss from operations related to 520 Broad Street, net of tax | |

| (65 | ) | |

| (214 | ) | |

| (306 | ) | |

| (1,830 | ) |

| Gain on disposal of 520 Property | |

| - | | |

| - | | |

| 6,784 | | |

| - | |

| Income (loss) on discontinued operations | |

| (65 | ) | |

| (214 | ) | |

| 6,478 | | |

| (1,830 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (income) loss | |

| 1,191 | | |

| (4,853 | ) | |

| (2,215 | ) | |

| (142,377 | ) |

| Net (loss) attributable to noncontrolling interests | |

| (28 | ) | |

| (69 | ) | |

| (339 | ) | |

| (17,719 | ) |

| Net income (loss) attributable to Rafael Holdings, Inc. | |

$ | 1,163 | | |

$ | (4,784 | ) | |

$ | (1,876 | ) | |

$ | (124,658 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Continuing operations loss per share | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) from continuing operations | |

| 1,256 | | |

| (4,639 | ) | |

| (8,693 | ) | |

| (140,547 | ) |

| Net loss attributable to noncontrolling interests | |

| (28 | ) | |

| (69 | ) | |

| (339 | ) | |

| (17,719 | ) |

| Numerator for loss per share from continuing operations | |

$ | 1,284 | | |

$ | (4,570 | ) | |

$ | (8,354 | ) | |

$ | (122,828 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Discontinued operations loss per share | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) from discontinued operations | |

$ | (65 | ) | |

$ | (214 | ) | |

$ | 6,478 | | |

$ | (1,830 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) per share | |

| | | |

| | | |

| | | |

| | |

| Continuing operations - basic and diluted | |

| 0.06 | | |

| (0.24 | ) | |

| (0.36 | ) | |

| (6.22 | ) |

| Discontinued operations - basic and diluted | |

| (0.00 | ) | |

| (0.01 | ) | |

| 0.28 | | |

| (0.09 | ) |

| Income (loss) per basic common share | |

$ | 0.06 | | |

$ | (0.24 | ) | |

$ | (0.08 | ) | |

$ | (6.31 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares in calculation | |

| 22,263,211 | | |

| 19,767,342 | | |

| 22,263,211 | | |

| 19,767,342 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

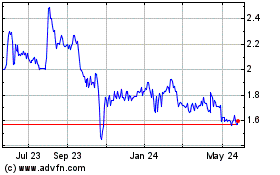

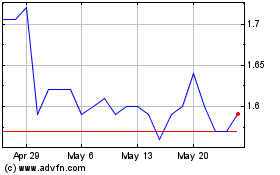

Rafael (NYSE:RFL)

Historical Stock Chart

From Apr 2024 to May 2024

Rafael (NYSE:RFL)

Historical Stock Chart

From May 2023 to May 2024