UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission file number: 001-34936

Noah

Holdings Limited

1226 South Shenbin Road

Shanghai 201107

People’s Republic of China

+86 (21) 8035-8292

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Noah Holdings Limited |

| |

|

| |

By: |

/s/ Qing Pan |

| |

|

Name: |

Qing Pan |

| |

|

Title: |

Chief Financial Officer |

Date: August 29, 2023

Exhibit 99.2

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility

for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability

whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

Noah

Holdings

Noah

Holdings Private Wealth and Asset Management Limited

諾亞控股私人財富資產管理有限公司

(Incorporated

in the Cayman Islands with limited liability under the name Noah Holdings Limited and

carrying on business in Hong Kong as Noah Holdings Private Wealth and Asset Management Limited)

(Stock

Code: 6686)

PROPOSED

SHARE SUBDIVISION;

CHANGE IN BOARD LOT SIZE; AND

RECORD DATE FOR THE EGM

PROPOSED

SHARE SUBDIVISION

The

Board proposes that each issued and unissued Shares with a par value of US$0.0005 each be subdivided into 10 Subdivided Shares with a

par value of US$0.00005 each. The Share Subdivision will become effective upon the fulfilment of the conditions set out in the sub-section

headed “Conditions of the Share Subdivision” in this announcement.

In

connection with the Share Subdivision, the Board has approved the ADS Ratio Change from two ADSs representing one Share to a new ratio

of one ADS representing five Subdivided Shares. The ADS Ratio Change is subject to and conditional upon the Share Subdivision becoming

effective. The ADS Ratio Change and the Share Subdivision, if approved, will take effect on the same date. No action is required by the

Company’s ADS holders to effect the ADS Ratio Change (other than to vote to approve the Share Subdivision proposal at the EGM).

CHANGE

IN BOARD LOT SIZE

The

Shares are currently traded on the Hong Kong Stock Exchange in board lot size of 20 Shares each. The Board proposes that, subject to

and conditional upon the Share Subdivision becoming effective, the board lot size will be changed from 20 Shares to 100 Subdivided

Shares. The Change in Board Lot Size will not affect any of the relative rights of the Shareholders. There will be a temporary counter

open for trading in temporary board lot of 200 Subdivided Shares (in the form of Existing Share Certificates) between 9:00 a.m. on

Monday, October 30, 2023 and 4:10 p.m. on Friday, December 1, 2023.

GENERAL

The Company will convene

the EGM on or around October 26, 2023 for the purpose of considering, and if thought fit, approving the Share Subdivision.

A circular containing

the information regarding, among other things, details of (i) the Share Subdivision and the Change in Board Lot Size; (ii) the

trading arrangements in respect of the Subdivided Shares; and (iii) a notice convening the EGM, will be issued by the Company on

or before September 19, 2023.

PROPOSED SHARE SUBDIVISION

As of the date of this announcement,

the authorized share capital of the Company is US$50,000 divided into 100,000,000 Shares of par value of US$0.0005 each. The Board proposes

that each issued and unissued Shares with a par value of US$0.0005 each be subdivided into 10 Subdivided Shares with a par value of US$0.00005

each.

Immediately following the Share

Subdivision being effective, the authorized share capital of the Company will be US$50,000 divided into 1,000,000,000 Subdivided Shares,

of which 319,455,750 Subdivided Shares will be in issue and fully paid or credited as fully paid, assuming that no further Shares will

be issued or repurchased after the date of this announcement and prior to the Share Subdivision becoming effective.

Upon

the Share Subdivision becoming effective, the Subdivided Shares shall rank pari passu in all respects with each other in

accordance with the articles of association of the Company and shall have the same rights and privileges and be subject to the same restriction

as the Shares in issue prior to the Share Subdivision, and the Share Subdivision will not result in any change in the relevant rights

of the Shareholders.

Simultaneous ADS Ratio Change

In connection with the Share Subdivision,

the Board has approved the ADS Ratio Change from two ADSs representing one Share to a new ratio of one ADS representing five Subdivided

Shares. The ADS Ratio Change is subject to and conditional upon the Share Subdivision becoming effective. The ADS Ratio Change and the

Share Subdivision, if approved, will take effect on the same date. No action is required by the Company’s ADS holders to effect

the ADS Ratio Change (other than to vote to approve the Share Subdivision proposal at the EGM).

Conditions of the Share Subdivision

The Share Subdivision is conditional on:

| (i) | the passing by the Shareholders at the EGM of an ordinary resolution approving the Share Subdivision; |

| (ii) | the Hong Kong Stock Exchange granting the listing of, and permission to deal in (i) the Subdivided

Shares; and (ii) any Subdivided Shares which may be issued upon (A) exercise of the share options and share awards granted and

to be granted under the Share Incentive Plans and (B) vesting of the RSUs granted and to be granted under the RSU Plan; and |

| (iii) | the compliance with all relevant procedures and requirements under the laws of the Cayman Islands (where

applicable), the requirements from New York Stock Exchange and the Hong Kong Stock Exchange to effect the Share Subdivision. |

CHANGE IN BOARD LOT SIZE

The Shares are currently traded

on Hong Kong Stock Exchange in board lot size of 20 Shares each. The Board proposes that, subject to and conditional upon the Share Subdivision

becoming effective, the board lot size will be changed from 20 Shares to 100 Subdivided Shares. The Change in Board Lot Size will not

affect any of the relative rights of the Shareholders. There will be a temporary counter open for trading in temporary board lot of 200

Subdivided Shares (in the form of Existing Share Certificates) between 9:00 a.m. on Monday, October 30, 2023 and 4:10 p.m. on

Friday, December 1, 2023.

LISTING APPLICATION

An application will be made by

the Company to the Hong Kong Stock Exchange for the listing of, and the permission to deal in (i) the Subdivided Shares; and (ii) any

Subdivided Shares which may be issued upon (A) exercise of the share options and share awards granted and to be granted under the

Share Incentive Plans and (B) the vesting of the RSUs granted and to be granted under the RSU Plan. All necessary arrangements will

be made for the Subdivided Shares to be admitted into CCASS established and operated by HKSCC.

Subject to the granting of the

listing approval for the listing of, and permission to deal in, the Subdivided Shares on the Hong Kong Stock Exchange, the Subdivided

Shares will be accepted as eligible securities by HKSCC for deposit, clearance and settlement in CCASS with effect from the commencement

date of dealings in the Subdivided Shares on the Hong Kong Stock Exchange or such other date as determined by HKSCC. Settlement of transactions

between participants of the Hong Kong Stock Exchange on any trading day is required to take place in CCASS on the second settlement day

thereafter. All activities under CCASS are subject to the General Rules of CCASS and CCASS Operational Procedures in effect from

time to time.

EXCHANGE OF SHARE CERTIFICATES

Holders of Shares listed in Hong

Kong may submit their Existing Share Certificates (colored blue) to the address and between the times set out below in exchange for Subdivided

Share Certificates (colored dark green). The Existing Share Certificates for the Shares will only be valid for delivery, trading and settlement

purposes for the period up to 4:10 p.m. on Friday, December 1, 2023 and thereafter will not be accepted for delivery, trading

and settlement purposes. However, the Existing Share Certificates will continue to be good evidence of legal title and may be exchanged

for Subdivided Share Certificates for the Subdivided Shares at any time.

| Period to exchange for Subdivided Share Certificates at no extra cost |

|

Monday, October 30, 2023 until Tuesday, December 5, 2023 (Hong Kong Time) (both days inclusive) |

| |

|

|

| Exchange for Subdivided Share Certificates for HK$2.50

(or as otherwise specified by the Hong Kong Stock Exchange)(1) |

|

Wednesday, December 6, 2023 (Hong Kong Time) onwards |

| |

|

|

| Address |

|

Computershare Hong Kong Investor Services Limited |

| |

|

|

| |

|

Shops 1712-1716, 17th Floor, Hopewell Centre, 183 Queen’s Road East, Wan Chai, Hong Kong |

Note:

| (1) | The total fee for exchange of Subdivided Share Certificates will be the higher of HK$2.50 multiplied by the number of certificates

issued or HK$2.50 multiplied by the number of certificates cancelled. |

REASON FOR THE SHARE SUBDIVISION AND CHANGE IN BOARD

LOT SIZE

The Share Subdivision will increase

the number of shares issued by the Company, and reduce the nominal value and trading price of each Share. The Board believes that this

will lower the investment barrier and increase the trading liquidity of the Share. The increase in trading liquidity would attract more

investors to trade in the Shares, and give the Company more flexibility to explore future fundraising activities.

Based on the closing price of

HK$209.8 per Share as of the date of this announcement, the market value per board lot of 20 Shares is approximately HK$4,196. The expected

value per new board lot of 100 Subdivided Shares would be approximately HK$2,098 immediately upon the Share Subdivision and the Change

in Board Lot Size becoming effective. Upon the Change in Board Lot Size, the Company is expected to be in compliance with the board lot

value being more than HK$2,000 as set out in the Guide on Trading Arrangements for Selected Types of Corporate Actions issued by the Hong

Kong Stock Exchange on November 28, 2008 and updated on October 1, 2020. Although the Share Subdivision will result in downward

adjustment to the trading price of the Shares, the Share Subdivision would, together with the Change in Board Lot Size, enhance the liquidity

in trading of Subdivided Shares and thereby would enable the Company to attract more investors and broaden its Shareholder base. Both

the Share Subdivision and the Change in Board Lot Size will not result in odd lots or fractional shares.

As of the date of this announcement,

the Company has no intention to carry out other corporate actions in the next 12 months which may have an effect of undermining or negating

the intended purpose of the Share Subdivision and the Change in Board Lot Size.

Save for the expenses to be incurred

by the Company in relation to the Share Subdivision and the Change in Board Lot Size, the implementation of the Share Subdivision will

not, by itself, alter the underlying assets, business operations, management or the financial position of the Company or the proportionate

interest of the Shareholders.

Based on the above, the Board

considers that the proposed Share Subdivision and Change in Board Lot Size are fair and reasonable, as well as in the best interests of

the Company, its Shareholders and investors overall.

EXPECTED

TIMETABLE(1)

The following timetable sets out

the key days for the Share Subdivision and Change in Board Lot Size:

| |

|

Hong Kong Time |

|

U.S. Eastern Time |

| |

|

|

|

|

| Expected date of publishing notice for the record date of the EGM and the latest time for lodging transfer documents to qualify for attending and voting at the EGM |

|

On Tuesday, August 29, 2023 |

|

— |

| |

|

|

|

|

| Record date for the EGM, for holders of Shares listed in Hong

Kong (the “Shares Record Date”)(2) |

|

4:30 p.m., Tuesday, September 12, 2023 |

|

— |

| |

|

|

|

|

| Record date for the EGM, for holders of ADSs listed in the U.S. (the

“ADS Record Date”, together with the “Shares Record Date”, the “Record Dates”)(3) |

|

— |

|

Close of business, Tuesday, September 12, 2023 |

| |

|

|

|

|

| Latest time for lodging transfer documents to qualify for attending and

voting at the EGM, for holders of Shares listed in Hong Kong |

|

Not later than 4:30 p.m., Tuesday, September 12, 2023 |

|

— |

| |

|

|

|

|

| Expected date of dispatch of the circular (including the notice of the EGM) and the related form of proxy to the Shareholders |

|

On or before Tuesday, September 19, 2023 |

|

— |

| |

|

|

|

|

| Latest time for lodging votes to depositary bank, for holders of ADSs

listed in the U.S.(4) |

|

— |

|

10:00 a.m., Tuesday, October 17, 2023 |

| |

|

Hong Kong Time |

|

U.S. Eastern Time |

| |

|

|

|

|

| Latest time for lodging forms of proxy for the EGM, for holders of Shares

listed in Hong Kong(5) |

|

9:00 a.m., Tuesday, October 24, 2023 |

|

— |

| |

|

|

|

|

| Date and time of the EGM |

|

9:00 a.m., Thursday, October 26, 2023 |

|

9:00 p.m., Wednesday, October 25, 2023 |

| |

|

|

|

|

| Announcement of poll results of the EGM |

|

Before 8:00 p.m., Thursday, October 26, 2023 |

|

Before 8:00 a.m., Thursday, October 26, 2023 |

| |

|

|

|

|

The following tables sets out the events following the approval at the EGM and upon the fulfillment of the conditions

for the Share Subdivision:

| |

|

Hong Kong Time |

|

U.S. Eastern Time |

| |

|

|

|

|

| Effective date for the Share Subdivision |

|

Monday, October 30, 2023 |

|

|

| |

|

|

|

|

| Commencement of dealings in the Subdivided Shares, for holders of Shares

listed in Hong Kong |

|

9:00 a.m., Monday, October 30, 2023 |

|

— |

| |

|

|

|

|

| Original counter for trading the Shares in board lots of 20 Shares (being

the “existing board lot”) temporarily closes on the Hong Kong Stock Exchange, for holders of Shares listed

in Hong Kong |

|

9:00 a.m., Monday, October 30, 2023 |

|

— |

| |

|

|

|

|

| Temporary counter for trading in the Subdivided Shares (in the form of Existing

Share Certificates) and in board lots of 200 Subdivided Shares (being the “temporary board lot”) opens on the

Hong Kong Stock Exchange, for holders of Shares listed in Hong Kong |

|

9:00 a.m., Monday, October 30, 2023 |

|

— |

| |

|

|

|

|

| First day of free exchange of Existing Share Certificates for the Subdivided

Share Certificates for the Subdivided Shares, for holders of the Shares listed in Hong Kong |

|

Monday, October 30, 2023 |

|

— |

| |

|

Hong Kong Time |

|

U.S. Eastern Time |

| |

|

|

|

|

| Original counter for trading in the Subdivided Shares (in the

form of new Subdivided Share Certificates) and in new board lot of 100 Subdivided Shares (being the “new board lot”)

re-opens on the Hong Kong Stock Exchange, for holders of Shares listed in Hong Kong |

|

9:00 a.m., Monday, November 13, 2023 |

|

— |

| |

|

|

|

|

| Parallel trading in the Subdivided Shares (in the form of Existing Share

Certificates and Subdivided Share Certificates) starts on the Hong Kong Stock Exchange, for holders of Shares listed in Hong Kong |

|

9:00 a.m., Monday, November 13, 2023 |

|

— |

| |

|

|

|

|

| Temporary counter for trading in the Subdivided Shares (in the form of Existing

Share Certificates) and in temporary board lot closes on the Hong Kong Stock Exchange, for holders of Shares listed in Hong Kong |

|

4:10 p.m., Friday, December 1, 2023 |

|

— |

| |

|

|

|

|

| Parallel trading in the Subdivided Shares (in the form of Existing Share

Certificates and Subdivided Share Certificates) closes on the Hong Kong Stock Exchange, for holders of Shares listed in Hong Kong |

|

4:10 p.m., Friday, December 1, 2023 |

|

— |

| |

|

|

|

|

| Last day of free exchange of Existing Share Certificates for Subdivided

Share Certificates, for holders of Shares listed in Hong Kong |

|

4:30 p.m., Tuesday, December 5, 2023 |

|

— |

Notes:

| (1) | Dates and times above are indicative only and may be varied by the Company. Any consequential changes

to the expected timetable will be notified to the Shareholders (including ADS(s) holders) as and when appropriate in accordance with

relevant Hong Kong and U.S. regulations. |

| (2) | New holders of Shares registered after the Shares Record Date will not be entitled to attend and vote

at the EGM. |

| (3) | Holders of the ADS(s) will not be entitled to attend and vote at the EGM and cannot vote the Shares

represented by their ADSs directly. New holders of the ADS(s) registered after the ADS Record Date will not be entitled to exercise

their voting rights for the underlying Shares through Citibank, N.A., as the depositary of the ADSs. |

| (4) | Holders of the ADS(s) will not be entitled to attend and vote at the EGM. Holders of the ADS(s) as

of the ADS Record Date who wish to exercise their voting rights for the underlying Shares must act through Citibank, N.A., as the depositary

of the ADSs. |

| (5) | The latest time to lodge the form of proxy prior to the date of the EGM is consistent with the current

articles of associations of the Company. All the persons who are registered holders of the Shares as of the close of business on Tuesday,

September 12, 2023, Hong Kong time will be entitled to attend and vote at the EGM. Completion and return of a form of proxy will

not preclude a holder of Shares of the Company from attending in person and voting at the EGM or any adjournment thereof, should he or

she so wish, but his/her proxy’s authority to vote on a resolution is to be regarded as revoked if he/she attend the EGM in person

and vote on that particular resolution. |

GENERAL

The Company will convene the EGM

on or around October 26, 2023 for the purpose of considering, and if thought fit, approving the Share Subdivision. The voting in

respect at the EGM will be conducted by way of poll. To the best of the Directors’ knowledge, information and belief, having made

all reasonable enquiries, none of the Shareholders and their respective close associates has any material interest in the relevant resolutions,

and no Shareholder will be required to abstain from voting on the relevant resolutions at the EGM.

A circular containing the information

regarding, among other things, details of (i) the Share Subdivision and the Change in Board Lot Size; (ii) the trading arrangements

in respect of the Subdivided Shares; and (iii) a notice convening the EGM, will be issued by the Company on or before September 19,

2023.

RECORD DATE FOR EGM

The record date for the purpose

of determining the eligibility of the holders of the Shares of the Company with a par value of US$0.0005 each to attend and vote at the

EGM will be as of close of business on Tuesday, September 12, 2023, Hong Kong time. In order to be eligible to attend and vote at

the EGM, all valid documents for the transfers of the shares accompanied by the relevant share certificates must be lodged with the Company’s

Hong Kong share registrar, Computershare Hong Kong Investor Services Limited, Shops 1712-1716, 17th Floor, Hopewell Centre, 183 Queen’s

Road East, Wan Chai, Hong Kong, not later than 4:30 p.m., Tuesday, September 12, 2023, Hong Kong time. All persons who are registered

holders of the Shares on the Shares Record Date will be entitled to attend and vote at the EGM.

Holders of ADSs issued by Citibank,

N.A., as depositary of the ADSs, and representing the right to receive the Shares are not entitled to attend or vote at the EGM. Holders

of record of ADSs as of close of business on Tuesday, September 12, 2023, New York time will be able to instruct Citibank, N.A.,

the holder of record of Shares (through a nominee) represented by the ADSs, as to how to vote the Shares represented by such ADSs. Such

voting instructions may be given only in respect of a number of ADSs representing an integral number of Shares. Citibank, N.A. will endeavor,

to the extent practicable and legally permissible, to vote or cause to be voted at the EGM the amount of Shares it holds represented by

the ADSs in accordance with the instructions that it has properly received from ADS holders who hold ADSs as of the ADSs Record Date.

If no timely instructions are

received by Citibank, N.A. from a holder of ADSs by close of business on Monday, September 11, 2023, New York time under the terms

of the Deposit Agreement, Citibank, N.A. will deem such holder of ADSs to have instructed it to give a discretionary proxy to a person

designated by the Company to vote the Shares represented by such holder’s ADSs, unless voting at the meeting is by show of hands

and unless the Company has informed Citibank, N.A. that (a) the Company does not wish such proxy to be given, (b) substantial

opposition exists, or (c) the rights of holders of Shares may be materially adversely affected, in each case in accordance with the

terms of the Deposit Agreement.

If a holder of ADSs wishes to

attend and vote at the EGM or vote directly, such holder must cancel their ADSs in exchange for Shares and will need to make arrangements

to deliver their ADSs to Citibank, N.A., as depositary of the ADSs, for cancellation with sufficient time to allow for the delivery and

exchange of them for the underlying Shares before the Share Record Date. Any such holder of ADSs who presents ADSs for cancellation on

the ADS Record Date will not be able to instruct Citibank, N.A., as depositary of the ADSs, as to how to vote the Shares represented by

the cancelled ADSs as described above, and will also not be a holder of those Shares as of the Shares Record Date for the purpose of determining

the eligibility to attend and vote at the EGM.

Details including the date and

location of the EGM will be set out in the Company’s notice of EGM to be issued and provided to holders of the Shares and ADSs as

of the respective Record Dates together with the proxy materials in due course.

Completion of the Share Subdivision

is subject to the fulfillment of certain conditions. Accordingly, the Share Subdivision may or may not proceed. Shareholders and potential

investors are advised to exercise caution when dealing in the Shares of the Company.

DEFINITIONS

Unless otherwise

defined, the following expressions in this announcement have the following meanings:

| “ADS(s)” |

American Depositary Share(s), being two ADSs representing one Share prior to the ADS Ratio Change, and one ADS representing five Subdivided Shares after the ADS Ratio Change |

| |

|

| “ADS Ratio Change” |

a change in the Company’s ratio of ADSs from two ADSs representing one Share to a new ratio of one ADS representing five Subdivided Shares, subject to and conditional upon the Share Subdivision becoming effective |

| |

|

| “Affected Clients” |

the 818 affected clients of the Camsing Incident, all of whom were independent third parties of the Company |

| |

|

| “Board” |

the board of Directors |

| |

|

| “Camsing Incident” |

details of the Camsing Incident are set out in the section headed “Business – Legal and Administrative Proceedings – The Camsing Incident” from pages 224 to 232 of the Company’s prospectus published on June 30, 2022 in connection to its secondary listing on the Hong Kong Stock Exchange |

| |

|

| “CCASS” |

the Central Clearing and Settlement System established and operated by HKSCC |

| |

|

| “Change in Board Lot Size” |

the change in the board lot size of the Company from 20 Shares to 100 Subdivided Shares, subject to the Share Subdivision becoming effective |

| |

|

| “Company” |

Noah Holdings Limited, an exempted company with limited liability incorporated in the Cayman Islands on June 29, 2007, carrying on business in Hong Kong as “Noah Holdings Private Wealth and Asset Management Limited (諾亞控股私人財富資產管理有限公司)” |

| |

|

| “Deposit Agreement” |

the depositary agreement by and among the Company and Citibank, N.A., among others, dated as of November 9, 2010, and its amendments dated as of March 28, 2016 and as of December 22, 2022 |

| |

|

| “Director(s)” |

the director(s) of the Company |

| |

|

| “EGM” |

the extraordinary general meeting of the Company to be held on or around October 26, 2023 |

| |

|

| “Existing Share Certificate(s)” |

share certificates for the Shares |

| |

|

| “Group” |

the Company, its subsidiaries and its consolidated affiliated entities from time to time |

| |

|

| “HKSCC” |

Hong Kong Securities Clearing Company Limited, a wholly- owned subsidiary of Hong Kong Exchanges and Clearing Limited |

| |

|

| “HK$” |

Hong Kong dollars, the lawful currency of Hong Kong |

| |

|

| “Hong Kong Listing Rules” |

the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited, as amended, supplemented or otherwise modified from time to time |

| |

|

| “Hong

Kong Stock Exchange” |

The Stock Exchange of Hong Kong Limited |

| |

|

| “RSU(s)” |

restricted

share unit(s) |

| |

|

| “RSU Plan” |

the ex gratia settlement offer to the Affected Clients, pursuant to which any Affected Clients who agreed to settle with the Company on the Camsing Incident shall receive RSUs, the vesting of which shall be subject to the vesting schedule pursuant to the terms of the RSU Plan |

| |

|

| “SEC” |

the United States Securities and Exchange Commission |

| |

|

| “Share(s)” |

existing ordinary share(s) of par value of US$0.0005 each in the share capital of the Company prior to the Share Subdivision becoming effective |

| |

|

| “Shareholder(s)” |

the holder(s) of the Company’s issued shares |

| |

|

| “Share Incentive Plans” |

refer to (i) the 2010 share incentive plan as amended and initially filed with the SEC on October 27, 2010, (ii) the 2017 share incentive plan adopted on December 29, 2017 and filed with the SEC on December 29, 2017, and (iii) the 2022 share incentive plan adopted on the annual general meeting held on December 16, 2022 with effect from December 23, 2022 and filed with the SEC on December 23, 2022 |

| |

|

| “Share Subdivision” |

the proposed subdivision of each issued and unissued Share into 10 Subdivided Shares |

| |

|

| “Subdivided Shares” |

subdivided ordinary share(s) of par value of US$0.00005 each in the share capital of the Company upon the Share Subdivision becoming effective |

| |

|

| “Subdivided Share Certificate(s)” |

share certificate for the Subdivided Shares |

| |

|

| “%” |

per cent. |

| |

By order of the Board |

| |

Noah Holdings Private Wealth and Asset Management Limited

Ms. Jingbo Wang |

| |

Chairwoman of the Board |

Hong Kong, August 29, 2023

As

of the date of this announcement, the Board comprises Ms. Jingbo Wang, the chairwoman, and Mr. Zhe Yin as Directors; Ms. Chia-Yue Chang,

Mr. Kai Wang and Mr. Boquan He as non- executive Directors; and Dr. Zhiwu Chen, Ms. Cynthia Jinhong Meng, Ms. May Yihong Wu and Mr. Jinbo

Yao as independent Directors.

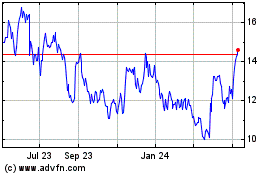

Noah (NYSE:NOAH)

Historical Stock Chart

From Apr 2024 to May 2024

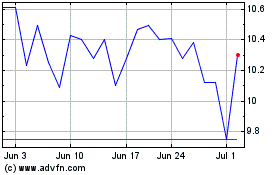

Noah (NYSE:NOAH)

Historical Stock Chart

From May 2023 to May 2024