0001444380false00014443802024-01-062024-01-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 06, 2024 |

NEVRO CORP.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36715 |

56-2568057 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1800 Bridge Parkway |

|

Redwood City, California |

|

94065 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 251-0005 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value per share |

|

NVRO |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 9, 2024, Nevro Corp. (“Nevro” or the “Company”) issued a press release announcing its preliminary unaudited revenue for the fourth quarter and full year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information furnished pursuant to this Item 2.02 of this Current Report on Form 8-K and the Exhibit 99.1 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the press release attached as Exhibit 99.1 to this Current Report on Form 8-K shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 2.05 Costs Associated with Exit or Disposal Activities.

On January 6, 2024, the Company approved a restructuring plan that includes laying off 63 employees, which represented approximately 5% of the Company’s total number of employees (the “Restructuring”). The Restructuring affects employees in corporate, sales and marketing, and operations positions but is largely focused on internally facing roles within the Company. This action was taken to support the Company’s strategy and allow it to focus its investments to further position the Company for long-term growth and profitability.

The Company expects the Restructuring to have a $14 million to $15 million positive impact on its full-year 2024 adjusted EBITDA, which will be largely offset by normal operating expense increases, including inflation, merit increases and other acquisition-related expenses. In addition, GAAP operating expenses in the first quarter of 2024 will reflect a $5 million to $6 million restructuring charge, consisting of one-time severance and other termination benefit costs. The Company expects that the Restructuring, including related cash payments, will be substantially complete by the end of the first quarter of 2024. The timing and cost estimates related to the Restructuring are subject to a number of assumptions and actual results may differ materially from those expected and disclosed above.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on management’s beliefs and assumptions and on information currently available to management. Forward-looking statements include, but are not limited to, statements regarding the number of employees impacted by the layoffs; the Company’s expectations regarding the adjusted EBITDA impact to be realized in connection with the Restructuring as well as 2024 estimated operating expenses; the Company’s expectations regarding the amount and timing of such costs being incurred in connection with the Restructuring; and the timing of completion of the Restructuring. Undue reliance should not be placed on these forward-looking statements because they involve known and unknown risks, uncertainties and other factors that are, in some cases, beyond the Company’s control and that could materially affect actual results. Information about factors that could materially affect actual results can be found in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on February 21, 2023, including under the caption “Risk Factors,” and in the Company’s other periodic reports filed with the SEC. The Company expressly disclaims any intent or obligation to update these forward-looking statements, except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

NEVRO CORP. |

|

|

|

|

Date: |

January 9, 2024 |

By: |

/s/ Roderick H. MacLeod |

|

|

|

Roderick H. MacLeod

Chief Financial Officer |

Exhibit 99.1

Nevro Announces Preliminary Fourth-Quarter

and Full-Year 2023 Revenue Results

Fourth-Quarter 2023 Worldwide Revenue Exceeds Company’s Expectations

Announces Restructuring to Support Company’s Long-Term Growth and Profitability

REDWOOD CITY, Calif. — January 9, 2024 — Nevro Corp. (NYSE: NVRO), a global medical device company that is delivering comprehensive, life-changing solutions for the treatment of chronic pain, today announced its preliminary, unaudited fourth-quarter and full-year 2023 revenue results. The company also announced a restructuring, including laying off 5% of its workforce, that will be substantially complete by the end of the first quarter of 2024. The vast majority of layoffs affected internally focused employees and not customer-facing personnel in the field.

Financial Highlights

•Fourth-quarter 2023 worldwide revenue of approximately $116.0 million grew 2% as reported and 1% constant currency compared with fourth-quarter 2022

•Full-year 2023 worldwide revenue of approximately $425.0 million, representing 5% growth reported and 4.5% on a constant currency basis

•Painful Diabetic Neuropathy indication (PDN) Q4 sales of approximately $22.4 million grew 29% over 2022, bringing full-year 2023 PDN sales to $77.9 million and 63% growth over full-year 2022

Preliminary, Unaudited Fourth-Quarter 2023 Revenue Results

Preliminary, unaudited fourth-quarter 2023 worldwide revenue is expected to be approximately $116.0 million, an increase of 2% as reported and 1% on a constant currency basis, compared with $113.8 million in the fourth quarter of 2022. PDN represented approximately $22.4 million in revenue and 20% of worldwide permanent implant procedures in the fourth quarter of 2023.

Preliminary, unaudited fourth-quarter 2023 U.S. revenue is expected to be approximately $101.5 million, reflecting growth of 2% compared with $99.8 million in the fourth quarter of 2022. Fourth-quarter 2023 U.S. trial procedures were down approximately 1% versus the prior-year quarter and in line with the company’s expectations. Fourth-quarter 2023 U.S. PDN trial procedures represented approximately 24% of total U.S. trial volume.

Preliminary, unaudited fourth-quarter 2023 international revenue is expected to be approximately $14.5 million, an increase of 3% as reported and a decrease of 1% on a constant currency basis, compared with $14.1 million in the fourth quarter of 2022.

Preliminary, Unaudited Full-Year 2023 Revenue Results

Nevro's preliminary, unaudited full-year 2023 worldwide revenue is expected to be approximately $425.0 million, an increase of 5% as reported, or an increase of 4.5% on a constant currency basis, compared with $406.4 million for full-year 2022. Worldwide revenue for 2023 includes approximately $77.9 million of revenue for PDN, compared with $48.0 million for full-year 2022. Preliminary, unaudited full-year 2023 U.S. revenue is expected to be approximately $366.5 million, reflecting growth of 5% over $348.2 million in 2022. Preliminary, unaudited full-year 2023 international revenue is expected to be approximately $58.5 million, an increase of 0.5% as reported, or flat on a constant currency basis, compared with $58.2 million in 2022.

“We are pleased with our preliminary fourth-quarter 2023 revenue which exceeded our expectations and demonstrates that our commercial realignment and execution is delivering stronger and more consistent growth,” said Kevin Thornal, Nevro’s CEO. “Also, we are excited to enter the fast-growing sacroiliac joint space through our recent acquisition of Vyrsa Technologies, which allows us to leverage one of our greatest assets – our commercial team. As we look ahead, we remain focused on delivering on our three key pillars of commercial execution, market penetration and profit progress.”

Nevro expects to report its complete fourth-quarter and full-year 2023 financial results and provide 2024 financial guidance in February 2024.

Restructuring

The Company also announced a restructuring, including laying off 63 employees, or 5% of its total number of employees, that will be substantially complete by the end of the first quarter of 2024. The layoffs affect employees in corporate, sales and marketing, and operations positions but are largely focused on internally facing roles within the organization.

“This restructuring supports our strategy and allows us to focus our investments to further position Nevro for long-term growth and profitability. This was a difficult decision that impacts some of our team members who have been committed to our mission. We appreciate their dedication and contributions to Nevro,” Thornal said. “As we look ahead, we remain focused on bringing innovative products to market, working closely with physicians treating patients living with chronic pain and creating value for all our stakeholders.”

Nevro expects the restructuring to have a $14 million to $15 million positive impact on its full-year 2024 adjusted EBITDA, which will be largely offset by normal operating expense increases, including inflation, merit increases and other acquisition-related expenses. Excluding acquisition-related operating expenses, the company expects 2024 operating expenses to be approximately flat compared with 2023 operating expenses. In addition, GAAP operating expenses in the first quarter of 2024 will reflect a $5 million to $6 million restructuring charge. The company will provide more details on the restructuring during its fourth-quarter 2023 earnings call in February.

Nevro to Participate in J.P. Morgan 42nd Annual Healthcare Conference

As previously announced, members of Nevro’s management team will participate in the J.P. Morgan 42nd Annual Healthcare Conference on Thursday, January 11, 2024. The company’s formal presentation will begin at 8:15 am PST (11:15 am EST).

A live webcast of the formal presentation and Q&A session, as well as an archived recording, will be available on the Events and Presentations page in the Investors section of the company’s website at www.nevro.com.

About Nevro

Headquartered in Redwood City, California, Nevro is a global medical device company focused on delivering comprehensive, life-changing solutions that continue to set the standard for enduring patient outcomes in chronic pain treatment. The company started with a simple mission to help more patients suffering from debilitating pain and developed its proprietary 10 kHz Therapy™, an evidence-based, non-pharmacologic innovation that has impacted the lives of more than 115,000 patients globally. Nevro's comprehensive HFX™ spinal cord stimulation (SCS) platform includes a Senza™ SCS system and support services for the treatment of chronic pain of the trunk and limb and painful diabetic neuropathy. Nevro recently added a minimally invasive treatment option for patients suffering from chronic sacroiliac joint ("SI

2

joint") pain and now provides the most comprehensive portfolio of products in the SI joint fusion space, designed to meet the preferences of physicians and varying patient needs in order to improve outcomes and quality of life for patients.

Senza®, Senza II®, Senza Omnia™, and HFX iQ™ are the only SCS systems that deliver Nevro's proprietary 10 kHz Therapy. Nevro's unique support services provide every patient with an HFX Coach™ throughout their pain relief journey and every physician with HFX Cloud™ insights for enhanced patient and practice management.

SENZA, SENZA II, SENZA OMNIA, OMNIA, HF10, the HF10 logo, 10 kHz Therapy, HFX, the HFX logo, HFX iQ, the HFX iQ logo, HFX Algorithm, HFX CONNECT, the HFX Connect logo, HFX ACCESS, the HFX Access logo, HFX COACH, the HFX Coach logo, HFX CLOUD, the HFX Cloud logo, RELIEF MULTIPLIED, the X logo, NEVRO, and the NEVRO logo are trademarks or registered trademarks of Nevro Corp. Patents covering Senza HFX iQ and other Nevro products are listed at Nevro.com/patents.

To learn more about Nevro, connect with us on LinkedIn, Twitter, Facebook, and Instagram.

Forward-Looking Statements

In addition to historical information, this press release contains forward-looking statements reflecting the company's current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including: our preliminary, unaudited estimated fourth-quarter and full-year 2023 revenue results; the prospects of Vyrsa, its products and the U.S. SI joint market; the expected timing, cost savings, costs to incurred and long-term benefits of our restructuring and layoffs; and our expected operating expense in 2024. These forward-looking statements are based upon information that is currently available to us or our current expectations, speak only as of the date hereof, and are subject to numerous risks and uncertainties, including our ability to successfully integrate Vyrsa with Nevro’s existing business, our ability to successfully continue to develop and commercialize our products; our ability to manufacture our products to meet demand; the level and availability of third-party payor reimbursement for our products; our ability to effectively manage our anticipated growth and the costs and expenses of operating our business; our ability to protect our intellectual property rights and proprietary technologies; our ability to operate our business without infringing the intellectual property rights and proprietary technology of third parties; competition in our industry; additional capital and credit availability; our ability to attract and retain qualified personnel; our ability to accurately forecast financial and operating results, including in connection with the restructuring and layoffs; and product liability claims, in each case, including with respect to Vyrsa. These factors, together with those that are described in greater detail in our Annual Report on Form 10-K filed on February 21, 2023, as well as any subsequent reports filed with the Securities and Exchange Commission, may cause our actual results, performance or achievements to differ materially and adversely from those anticipated or implied by our forward-looking statements. We expressly disclaim any obligation, except as required by law, or undertaking to update or revise any such forward-looking statements.

Investors and Media:

Angie McCabe

Vice President, Investor Relations &

Corporate Communications

angeline.mccabe@nevro.com

3

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

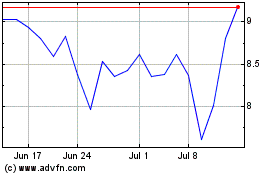

Nevro (NYSE:NVRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nevro (NYSE:NVRO)

Historical Stock Chart

From Apr 2023 to Apr 2024