-- Net sales decreased 13.1 percent over first quarter 2004 -- Net

losses of EUR 3.5 million versus net earnings of EUR 9.4 million

reported in first quarter 2004 -- Cash flow from operations at EUR

8.7 million The Board of Directors of Natuzzi S.p.A. (NYSE: NTZ)

('Natuzzi' or 'the Company'), the world's leading manufacturer of

leather-upholstered furniture, today announces the approval of the

financial results for the first quarter ended March 31, 2005. -0-

*T NET SALES Natuzzi's first-quarter 2005 net sales decreased 13.1

percent to EUR 166.6 million, or $ 218.4 million, as compared to

EUR 191.8 million, or $ 240.0 million, reported in the first

quarter 2004. Over the same comparable period, seats sold decreased

13.1 percent. In the first quarter of 2005, net upholstery sales

were EUR 146.4 million, or $ 192.0 million, 13.6 percent down from

EUR 169.5 reported in last year's first quarter. Other sales

(principally living-room accessories and raw materials produced by

the Company and sold to third parties) decreased 9.4 percent to EUR

20.2 million, or $ 26.5 million. In the first three months of 2005,

upholstery sales in the Americas decreased by 24.7 percent on a

quarter-on-quarter- basis to EUR 59.9 million, or $ 78.5 million.

In Europe upholstery sales were EUR 76.7 million, or $ 100.6

million, down 4.5 percent from EUR 80.3 million, or $ 100.5 million

reported in the first quarter of 2004. In the Rest of the World

upholstery net sales were up 1.0 percent to EUR 9.8, or $ 12.8

million. In the first quarter 2005, total net sales to Divani &

Divani by Natuzzi, Natuzzi and Kingdom of Leather Stores increased

7.9 percent to EUR 30.0 million, or $ 39.3 million, compared to the

last year's first quarter. During the same quarter four new stores

were opened: one in Italy, one in France and two in Spain, thus

bringing the total number of stores to 271, of which 139 in Italy

and 132 in the rest of the world. As of March 31, 2004 there were

253 stores worldwide. In the first quarter of 2005,

leather-upholstered furniture sales decreased 12.8 percent to EUR

120.4 million, or $ 157.9 million, and fabric-upholstered sales by

17.5 percent over last year's quarter to EUR 26.0 million, or $

34.1 million. First quarter 2005 net sales of Natuzzi-branded

upholstery were EUR 105.6 million, or $ 138.5 million, representing

a 17.9 percent decrease from EUR 128.6 million reported in last

year's first quarter. Net sales of Italsofa upholstery were

substantially flat at EUR 40.8 million, or $ 53.5 million. Pasquale

Natuzzi, Chairman and Chief Executive Officer, commented: "The

overall scenario in which the Company is operating is still

characterized by the same mix of unfavorable factors that have

negatively impacted our sales and order flow over the past months:

furniture demand softening in all major markets and aggressive

price competition deriving from low-cost countries located in

Eastern Europe and from China that is even more competitive

compared to the Italian production thanks to the fixed currency

rate with the US Dollar". GROSS PROFIT & OPERATING INCOME In

the first quarter of 2005, Gross profit decreased by 19.0 percent

to EUR 55.1 million, or $ 72.2 million, from EUR 68.0 million, or $

85.1 million, reported in the prior year first quarter. Gross

profit margin decreased to 33.1 percent from 35.5 percent achieved

in first quarter 2004. In the first quarter 2005 the Group reported

a net operating loss of EUR 1.1, or $ 1.4 million loss, whereas in

the same period last year the Company recorded a net operating

income of EUR 13.8 million, or $ 17.3 million. FOREX & TAXES In

the first quarter of 2005 Natuzzi reported a foreign exchange loss

of EUR 1.5 million, or $ 2.0 million loss, increasing from a net

foreign exchange loss of EUR 0.4 million reported in the previous

year's first quarter. Income taxes for the first quarter 2005 were

EUR 1.0 million, or $ 1.3 million. During the same period last year

income taxes were EUR 4.0 million, or $ 5.0 million. NET INCOME

& EARNINGS PER SHARE In the first-quarter 2005 the Company

reported net losses of EUR 3.5 million, or $ 4.6 million net

losses, decreasing from net earnings of EUR 9.4 million, or $ 11.8

million, reported in the same period last year. Losses per share

(ADR) were EUR 0.06, or $ 0.08, from EUR 0.17 or $ 0.21 earnings

per share reported in the first quarter 2004. Pasquale Natuzzi

said, "In the first quarter 2005 the Company reported net losses

because of the adverse market and economic conditions restraining

the effectiveness of our marketing investments and the limited

impact of the price increases made in US to offset the devaluation

against the Euro". CASH FLOW In the first quarter of 2005 the

Company generated EUR 8.7 million of cash flow from operations, or

$11.4 million, a 24.3 percent decrease from EUR 11.5 million, or $

14.4 million, generated in the first three months of 2004 On a per

ADR basis, net operating cash flow was EUR 0.16, or $ 0.21.

--------------------------------------------------------------------

OUTLOOK

--------------------------------------------------------------------

Concluded Mr. Natuzzi: "In the past months, the furniture demand

has been weakening together with a progressive shift of the

consumers' preference towards the promotional products. As a

consequence, year-to-date order flow of the Natuzzi products

manufactured in Italy has decreased by a double digit percentage

versus the same period of 2004, while, over the same periods,

orders for our promotional brand Italsofa manufactured abroad have

grown at a single digit rate. In light of this, we expect unit

sales in 2005 to decrease between 10 and 15 percent versus 2004,

while net results should break even in 2005 and achieve in 2006 a

net profit margin in the region of 3 percent as a result of the

reorganization plan approved recently by the Board". CONVERSION

RATES

--------------------------------------------------------------------

The first quarter 2005 and 2004 dollar figures presented in this

announcement were converted at an average noon buying rate of $

1.3112 per EUR and $ 1.2513 per EUR, respectively. *T ABOUT NATUZZI

S.P.A. Founded in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. designs

and manufactures a broad collection of leather-upholstered

residential furniture. Italy's largest furniture manufacturer,

Natuzzi is the global leader in the leather segment, exporting its

innovative, high-quality sofas and armchairs to 135 markets on 5

continents. Cutting-edge design, superior Italian craftsmanship,

and advanced, vertically-integrated manufacturing operations

underpin the Company's market leadership. Since 1990, Natuzzi has

sold its furnishings in Italy through the popular Divani &

Divani by Natuzzi chain of 137 stores, which it licenses to

qualified furniture dealers. Outside Italy, the Company sells to

various furniture retailers, as well as through 135 licensed Divani

& Divani by Natuzzi, Natuzzi Stores and Kingdom of Leather

Stores. Natuzzi S.p.A. was listed on the New York Stock Exchange on

May 13, 1993. The Company is ISO 9001 and 14001 certified.

Forward-Looking Statements Statements in this press release other

than statements of historical fact are "forward-looking

statements". Forward-looking statements are based on management's

current expectations and beliefs and therefore you should not place

undue reliance on them. These statements are subject to a number of

risks and uncertainties, including risks that may not be subject to

the Company's control, that could cause actual results to differ

materially from those contained in any forward-looking statement.

These risks include, but are not limited to, fluctuations in

exchange rates, economic and weather factors affecting consumer

spending, competitive and regulatory environment, as well as other

political, economical and technological factors, and other risks

identified from time to time in the Company's filings with the

Securities and Exchange Commission, particularly in the Company's

annual report on Form 20-F. Forward looking statements speak as of

the date they were made, and the Company undertakes no obligation

to update publicly any of them in light of new information or

future events. -0- *T NATUZZI S.p.A. AND SUBSIDIARIES Unaudited

Consolidated Statement of Earnings for the first quarter ended

March 31, 2005 and 2004 on the basis of Italian GAAP (Expressed in

millions of EUR except per share data) 1st Quarter % 1st Quarter %

% ----------- ----- ----------- ------------ 2005 Sales 2004 Sales

Change ----------- ----- ----------- ------------ Upholstery net

sales 146.4 169.5 -13.6% Other sales 20.2 22.3 -9.4% Net Sales

166.6 100% 191.8 100% -13.1% ---------------------------

----------------- ------------------------ Purchases (79.0) (86.0)

-8.1% Labor (28.2) (27.7) 1.8% Third-party Manufacturers (6.6)

(8.5) -22.4% Manufacturing Costs (8.1) (7.5) 8.0% Inventories, net

10.4 5.9 76.3% Cost of Sales (111.5) (123.8) -9.9%

--------------------------- -----------------

------------------------ Gross Profit 55.1 33.1% 68.0 35.5% -19.0%

--------------------------- -----------------

------------------------ Selling Expenses (46.0) (44.7) 3.0%

General and Administrative Expenses (10.2) (9.5) 6.9% Operating

Income (Loss) (1.1) -0.7% 13.8 7.2%-108.0%

--------------------------- -----------------

------------------------ Interest Income, net 0.1 0.0 Foreign

Exchange, net (1.5) (0.4) Other Income, net 0.0 0.1 Earnings

(Losses) before taxes and minority interest (2.5) 13.5 -118.5%

--------------------------------------- ----------- ------- Income

taxes (1.0) (4.0) -75.0% Earnings (Losses) before minority interest

(3.5) 9.5 -136.8% ---------------------------------------

----------- ------- Minority Interest 0.0 0.1 Net Earnings (Losses)

(3.5) -2.1% 9.4 4.9%-137.2% ===========================

================= ======================== Earnings (Losses) per

Share (0.06) 0.17 -137.2% --------------------------- -----------

----------- ------- Average Number of Shares Outstanding 54,681,628

54,681,628

----------------------------------------------------------------------

*T -0- *T KEY FIGURES IN U.S. DOLLARS (millions) 1st 1st Quarter

Quarter 2005 2004 -------- -------- Net Sales 218.4 240.0 Gross

Profit 72.2 85.1 Operating Income (Loss) (1.4) 17.3 Net Earnings

(Losses) (4.6) 11.8 Earnings (Losses) per Share in U.S. dollars

(0.08) 0.21 Average exchange rate (U.S. dollar per Euro) 1.3112

1.2513 *T -0- *T GEOGRAPHIC BREAKDOWN Sales Seat Units (Expressed

in millions of EUR) 1st 1st 1st 1st Quarter Quarter % Quarter

Quarter % ----------------- ------ -------- -------- ------ 2005

2004 Change 2005 2004 Change ----------------- ------ --------

-------- ------ Americas 59.9 79.5 -24.7% 348,355 450,283 -22.6% %

of total 40.9% 46.9% 49.5% 55.6% Europe 76.7 80.3 -4.5% 314,272

316,488 -0.7% % of total 52.4% 47.4% 44.6% 39.1% Rest of world 9.8

9.7 1.0% 41,447 43,352 -4.4% % of total 6.7% 5.7% 5.9% 5.4% TOTAL

146.4 169.5 -13.6% 704,074 810,123 -13.1% --------------------

----------------- ------ -------- -------- ------ *T -0- *T

BREAKDOWN BY COVERING Sales Seat Units (Expressed in millions of

EUR) 1st 1st 1st 1st Quarter Quarter % Quarter Quarter % --------

-------- ------ -------- -------- ------ 2005 2004 Change 2005 2004

Change -------- -------- ------ -------- -------- ------ Leather

120.4 138.0 -12.8% 539,511 613,075 -12.0% % of total 82.2% 81.4%

76.6% 75.7% Fabric 26.0 31.5 -17.5% 164,563 197,048 -16.5% % of

total 17.8% 18.6% 23.4% 24.3% TOTAL 146.4 169.5 -13.6% 704,074

810,123 -13.1% -------------------- -------- -------- ------

-------- -------- ------ *T -0- *T BREAKDOWN BY BRAND Sales Seat

Units (Expressed in millions of EUR) 1st 1st 1st 1st Quarter

Quarter % Quarter Quarter % -------- -------- ------ --------

-------- ------ 2005 2004 Change 2005 2004 Change -------- --------

------ -------- -------- ------ Natuzzi 105.6 128.6 -17.9% 418,676

529,634 -20.9% % of total 72.1% 75.9% 59.5% 65.4% Italsofa 40.8

40.9 -0.2% 285,398 280,489 1.8% % of total 27.9% 24.1% 40.5% 34.6%

TOTAL 146.4 169.5 -13.6% 704,074 810,123 -13.1%

-------------------- -------- -------- ------ -------- --------

------ *T -0- *T NATUZZI S.p.A. AND SUBSIDIARIES Unaudited

Consolidated Balance Sheet as of March 31, 2005 and December 31,

2004 (Expressed in millions of EUR) March December 31, 31, 2005

2004 Current Assets: Cash and cash equivalents 88.9 87.3 Marketable

debt securities 0.0 0.0 Trade receivables, net 136.7 137.6 Other

receivables 37.7 41.2 Inventories 123.0 112.6 Unrealized foreign

exchange gain 0.7 7.1 Prepaid expenses and accrued income 4.2 2.4

Deferred income taxes 0.9 1.2 Total current assets 392.1 389.4

------ -------- Non-Current Assets: Net property, plant and

equipment 274.1 272.0 Treasury shares 0.0 0.0 Other assets 10.8

11.2 Deferred income taxes 0.6 0.6 Total Assets 677.6 673.2 ======

======== LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities:

Short-term borrowings 6.3 5.6 Current portion of long-term debt 0.1

0.6 Accounts payable-trade 88.2 83.7 Accounts payable-shareholders

for dividends 0.6 0.6 Accounts payable-other 21.8 19.7 Allowance

for unrealized foreign exchange losses 0.0 0.0 Income taxes 2.1 2.5

Salaries, wages and related liabilities 18.9 18.7 Total current

liabilities 138.0 131.4 ------ -------- Long-Term Liabilities:

Employees' termination indemnity 30.3 29.6 Long-term debt 5.1 5.0

Deferred income taxes 0.4 0.4 Deferred income for capital grants

12.3 12.5 Other liabilities 6.1 5.4 Minority Interest 0.9 0.9

Shareholders' Equity: Share capital 54.7 54.7 Reserves 42.3 42.3

Additional paid-in capital 8.3 8.3 Retained earnings 379.2 382.7

Total shareholders' equity 484.5 488.0 ------ -------- Total

Liabilities and Shareholders' Equity 677.6 673.2 ====== ======== *T

-0- *T NATUZZI S.p.A. AND SUBSIDIARIES Unaudited Consolidated

Statements of Cash Flows as of March 31, 2005 and 2004 (Expressed

in millions of EUR) March March 31 31 2005 2004 ------------ Cash

flows from operating activities: Net earnings (3.5) 9.4 Adjustments

to reconcile net income to net cash provided by operating

activities: Depreciation 6.9 6.7 Employees' leaving entitlement 0.7

0.3 Deferred income taxes 0.3 (2.3) Minority interest 0.0 0.1

(Gain) loss on disposal of assets 0.1 0.0 Change in provision for

unrealized foreign exchange (losses) / gain 6.4 5.9 Gain on

disposal of business 0.0 0.0 Impairment losses 0.0 0.0 Change in

assets and liabilities: Receivables, net 0.9 (9.6) Inventories

(10.4) (5.9) Prepaid expenses and accrued income (1.8) (1.8) Other

assets 3.4 7.1 Accounts payable 4.5 2.3 Income taxes (0.5) (1.5)

Salaries, wages and related liabilities 0.2 (0.6) Other liabilities

1.5 1.4 ------ ----- Total adjustments 12.2 2.1 ------ ----- Net

cash provided by operating activities 8.7 11.5 ------ ----- Cash

flows from investing activities: Property, plant and equipment:

Additions (8.4) (8.7) Disposals 0.0 6.6 Government grants received

0.0 0.0 Marketable debt securities: Purchases 0.0 0.0 Proceeds from

maturities 0.0 0.0 Proceeds from sales 0.0 0.0 Purchase of

business, net of cash acquired 0.0 (0.1) Purchase of minority

interest 0.0 (0.0) Disposal of business 0.0 ------ ----- Net cash

used in investing activities (8.4) (2.2) Cash flows from financing

activities: Long term debt: Proceeds 0.0 0.0 Repayments (0.3) (0.5)

Short-term borrowings 0.8 1.8 Exercise of stock options 0.0 0.0

Treasury shares 0.0 0.0 Dividends paid 0.0 0.0 Dividends paid to

minority shareholders (0.1) 0.0 ------ ----- Net cash used in

financing activities 0.4 1.3 ------ ----- Effect of translation

adjustments on cash 0.9 0.3 ------ ----- Increase (decrease) in

cash and cash equivalents 1.6 10.9 Cash and cash equivalents,

beginning of the year 87.3 63.6 Cash and cash equivalents, end of

the period 88.9 74.5 *T -0- *T Natuzzi S.p.A. FIRST QUARTER 2005

FINANCIAL RESULTS TELECONFERENCE Senior management will review

first-quarter 2005 financial results. The review will be followed

by a question and answer session. Pasquale Natuzzi Chairman of the

Board and Chief Executive Officer Nicola Dell'Edera Finance

Director and Fred Starr President and Chief Executive Officer of

Natuzzi Americas Inc. Wednesday, June 1, 2001 10:00 a.m. (New York

time) 3:00 p.m. (London time) 4:00 p.m. (Italian time) Replay of

this event will be available on our web-site www.natuzzi.com

starting from 15:00 Italian time on June 13, 2005. *T

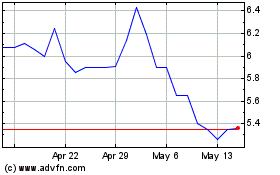

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Jul 2024 to Aug 2024

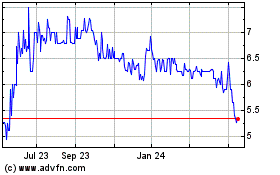

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Aug 2023 to Aug 2024