UPDATE: Icahn Reports Higher Stake In Motorola

February 14 2011 - 8:32PM

Dow Jones News

Billionaire investor Carl Icahn raised his wager on Motorola in

the fourth quarter, ahead of the company's split in January.

Icahn had been steadily increasing his investment in Motorola

Inc., which split into two companies--Motorola Mobility Holdings

Inc. (MMI), which sells cellphones and home set-top boxes, and

Motorola Solutions Inc. (MSI), which builds public-safety radios

and enterprise computing devices.

The billionaire activist investor bought 17.6 million shares of

Motorola, bringing his total holding to roughly 268 million shares,

according to a filing with the Securities and Exchange

Commission.

Icahn reported the assets in his funds were worth $11.52 billion

as of the end of the fourth quarter. The assets were valued at

$10.55 billion at the end of the third quarter.

Many investors who manage more than $100 million are required to

disclose most securities holdings within a month and a half of the

end of a quarter. The filings give the public a relatively fresh

look at the portfolios of well-known investors.

While a large portion of his assets remained unchanged, Icahn

made some adjustments. He slashed his stake in Cadence Design

Systems Inc. (CDNS), which supplies electronic design automation

products, to 355,686 shares from 2.8 million in the third

quarter.

Always active in the medical field, Icahn added to his position

in Enzon Pharmaceuticals Inc. (ENZN), scooping up 3.6 million

shares and more than doubling its total holding to 7.1 million

shares. His stake in Genzyme Corp. (GENZ) remained unchanged, while

he slightly lowered his position in Regeneron Pharmaceuticals Inc.

(REGN).

Icahn cut his stake in Masco Corp. (MAS) by 844,084 shares to

4.2 million shares.

He also added a significant position in Chesapeake Energy Corp.

(CHK), which was disclosed in a previously filing.

Icahn has been busy recently, having recently sough to acquire

Dynergy Inc. (DYN). Earlier Monday, he made what he said was the

final extension of his tender offer for the merchant power

producer. On Friday, Icahn disclosed a 9.08% stake in Clorox Co.

(CLX).

-By Roger Cheng, Dow Jones Newswires; 212-416-2153;

roger.cheng@dowjones.com

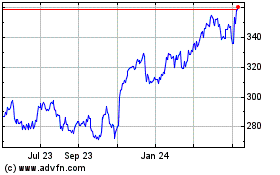

Motorola Solutions (NYSE:MSI)

Historical Stock Chart

From Oct 2024 to Nov 2024

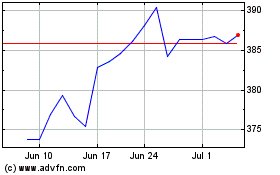

Motorola Solutions (NYSE:MSI)

Historical Stock Chart

From Nov 2023 to Nov 2024