UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by

the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐

Definitive Proxy Statement

☒ Definitive Additional Materials

☐

Soliciting Material under § 240.14a-12

Magellan Midstream Partners, L.P.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐

Fee paid previously with preliminary materials.

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11

On September 1, 2023, Magellan Midstream Partners, L.P. (NYSE:

MMP) (“Magellan”) and ONEOK, Inc. (NYSE: OKE) (“ONEOK”) shared a joint video message from and Aaron Milford,

President and CEO of Magellan, and Pierce Norton, President and CEO of ONEOK. A transcript of the video message is set forth below. While

effort has been made to provide an accurate transcription, there may be typographical mistakes, inaudible statements, errors, omissions

or inaccuracies in the transcript. Magellan believes that none of these are material.

Pierce Norton: Thank you for taking your time to watch this

message. My name is Pierce Norton, CEO of ONEOK.

Aaron Milford: And my name is Aaron Milford, and I’m the

CEO of Magellan. Thanks for joining us today.

Pierce Norton: We are coming to you today from The Gathering

Place in Tulsa, Oklahoma.

Aaron Milford: The Gathering Place is a public park designed

to bring our community together. It was created through a public-private partnership and both of our companies proudly contributed to

the building of this unique place.

Pierce Norton: This space where we are sitting today

is symbolic of how central both companies’ commitments are to the communities where we live and work. It’s a great place to

bring a message of how two companies can become one.

Aaron Milford: I agree, gathering and planning for a future

together has been evident since the announcement of the merger. I want to thank everyone for their efforts to get us to where we are today,

and also especially thank you for keeping day-to-day operations running with a consistent focus on safety and customer service.

Pierce Norton: Aaron, I echo your comments to both employee

groups and particularly for operating our businesses safely and responsibly. Our message today is going to center on a simple, but a powerful

word – A..N..D.. AND – and how it can support the foundation of bringing our two companies together.

We introduced a concept called “The Power of AND” at ONEOK

earlier this year to share with employees the value in strengthening our core business and looking for new opportunities. But thinking

about it from an integration lens, it became a strong way to capture the potential of bringing ONEOK and Magellan together.

The result of this combination will be a more diversified and a stronger

company with an even greater potential to make an impact in the industry and the communities we serve. Together, we are a more complete

company than we are apart. If you’ve heard the definition of synergy, which is greater than the sum of its parts, it captures exactly

the potential we see in the combination of ONEOK and Magellan.

Aaron Milford: Pierce, similarly, we’ve used “AND”

in an equally powerful way at Magellan. Over the last few years, we have discussed our goal to optimize how we run our business and continue

creating value for our customers and unitholders. We often talk about not limiting our potential by thinking about “this idea”

or “that idea,” but instead challenging ourselves to think differently and find ways to accomplish both “this idea”

and “that idea.” The results have been that synergy you are talking about.

Pierce Norton: So, we’ve both experienced “AND”

to help in our pursuit of value for all of our stakeholders, our employees, our customers, shareholders and unitholders. In addition,

we also unlocked the Power of AND by turning it into an acronym to establish a way to think about decisions and maximizing our opportunities:

A is for “Ask,” N is for “Navigate” and D is for “Develop.” These three focus concepts will help us

achieve the full potential of the combined company.

First, you must “Ask” the right questions. Ask to understand

before making decisions.

Second, both companies must “Navigate” through all phases

of this combination – through stabilizing, integration and eventually, transformation through innovation.

And finally, we must "Develop” the new organization.

Our goal is to be the best we can become together! The new senior leadership

organizational structure is Aaron’s and my primary focus. It will answer a lot of questions and create some new ones. Ask, Navigate

and Develop will become increasingly more valuable as this process unfolds.

Aaron Milford: Pierce and I know that bringing two companies

together can be exciting and unsettling at the same time. It requires a substantial amount of change, and while change is an opportunity,

it also brings uncertainty. Over the years, I have learned that even in positive change, it is the transition between where we are today

to where we are going that brings various levels of uncertainty. By embracing The Power of AND, we can unite in a mindset that is forward-focused

and solutions-oriented.

Pierce Norton: So in summary, we hope you can see the value

in The Power of AND. This common thread can help guide our thoughts and actions as we continue the exciting and challenging work to bring

our two companies together. You’ll hear more about this concept and integration updates from the Integration Management Office in

future communications.

So thank you again for taking your time today with Aaron and I, and

thank you for your continued commitment to operate ONEOK and Magellan safely and responsibly.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This transcript contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. All statements, other than statements of historical fact, included in this transcript that address activities,

events or developments that ONEOK, Inc. (NYSE: OKE) (“ONEOK”) or Magellan expects, believes or anticipates will or may occur

in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,”

“expect,” “anticipate,” “potential,” “create,” “intend,” “could,”

“would,” “may,” “plan,” “will,” “guidance,” “look,” “goal,”

“future,” “build,” “focus,” “continue,” “strive,” “allow” or the

negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of

future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements

are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the proposed transaction

between ONEOK and Magellan (the “Proposed Transaction”), the expected closing of the Proposed Transaction and the timing thereof

and as adjusted descriptions of the post-transaction company and its operations, strategies and plans, integration, debt levels and leverage

ratio, capital expenditures, cash flows and anticipated uses thereof, synergies, opportunities and anticipated future performance, including

maintaining current ONEOK management, enhancements to investment-grade credit profile, an expected accretion to earnings and free cash

flow, dividend payments and potential share repurchases, increase in value of tax attributes and expected impact on EBITDA. Information

adjusted for the Proposed Transaction should not be considered a forecast of future results. There are a number of risks and uncertainties

that could cause actual results to differ materially from the forward-looking statements included in this transcript. These include the

risk that ONEOK’s and Magellan’s businesses will not be integrated successfully; the risk that cost savings, synergies and

growth from the Proposed Transaction may not be fully realized or may take longer to realize than expected; the risk that the credit ratings

of the combined company or its subsidiaries may be different from what the companies expect; the possibility that shareholders of ONEOK

may not approve the issuance of new shares of ONEOK common stock in the Proposed Transaction or that unitholders of Magellan may not approve

the Proposed Transaction; the risk that a condition to closing of the Proposed Transaction may not be satisfied, that either party may

terminate the merger agreement or that the closing of the Proposed Transaction might be delayed or not occur at all; potential adverse

reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the Proposed

Transaction; the occurrence of any other event, change or other circumstances that could give rise to the termination of the merger agreement

relating to the Proposed Transaction; the risk that changes in ONEOK’s capital structure and governance could have adverse effects

on the market value of its securities; the ability of ONEOK and Magellan to retain customers and retain and hire key personnel and maintain

relationships with their suppliers and customers and on ONEOK’s and Magellan’s operating results and business generally; the

risk the Proposed Transaction could distract management from ongoing business operations or cause ONEOK and/or Magellan to incur substantial

costs; the risk of any litigation relating to the Proposed Transaction; the risk that ONEOK may be unable to reduce expenses or access

financing or liquidity; the impact of a pandemic, any related economic downturn and any related substantial decline in commodity prices;

the risk of changes in governmental regulations or enforcement practices, especially with respect to environmental, health and safety

matters; and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult

to predict and are beyond ONEOK’s or Magellan’s control, including those detailed in the joint proxy statement/prospectus

(as defined below). All forward-looking statements are based on assumptions that ONEOK and Magellan believe to be reasonable but that

may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and neither ONEOK

nor Magellan undertakes any obligation to correct or update any forward-looking statement, whether as a result of new information, future

events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the Proposed

Transaction, on July 25, 2023, ONEOK and Magellan each filed with the Securities and Exchange Commission (the “SEC”) a definitive

joint proxy statement/prospectus (the “joint proxy statement/prospectus”), and each party has and will file other documents

regarding the Proposed Transaction with the SEC. Each of ONEOK and Magellan commenced mailing copies of the joint proxy statement/prospectus

to shareholders of ONEOK and unitholders of Magellan, respectively, on or about July 25, 2023. This transcript is not a substitute for

the joint proxy statement/prospectus or for any other document that ONEOK or Magellan has filed or may file in the future with the SEC

in connection with the Proposed Transaction. INVESTORS AND SECURITY HOLDERS OF ONEOK AND MAGELLAN ARE URGED TO CAREFULLY AND THOROUGHLY

READ THE JOINT PROXY STATEMENT/PROSPECTUS, INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO, AND OTHER RELEVANT DOCUMENTS FILED OR THAT

WILL BE FILED BY ONEOK AND MAGELLAN WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ONEOK AND MAGELLAN, THE PROPOSED

TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS.

Investors can obtain free copies

of the joint proxy statement/prospectus and other relevant documents filed by ONEOK and Magellan with the SEC through the website maintained

by the SEC at www.sec.gov. Copies of documents filed with the SEC by ONEOK, including the joint proxy statement/prospectus, are available

free of charge from ONEOK’s website at www.oneok.com under the “Investors” tab. Copies of documents filed with the SEC

by Magellan, including the joint proxy statement/prospectus, are available free of charge from Magellan’s website at www.magellanlp.com

under the “Investors” tab.

3

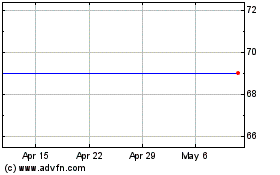

Magellan Midstream Partn... (NYSE:MMP)

Historical Stock Chart

From Apr 2024 to May 2024

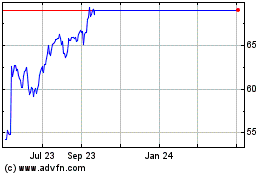

Magellan Midstream Partn... (NYSE:MMP)

Historical Stock Chart

From May 2023 to May 2024