LTC Properties, Inc. (NYSE: LTC) released results of operations

for the three and nine months ended September 30, 2011 and

announced that net income available to common stockholders for the

third quarter was $11.5 million or $0.38 per diluted share.

For the same period in 2010, net income available to common

stockholders was $5.6 million or $0.22 per diluted share. The

Company reported total revenues for the three months ended

September 30, 2011, were $21.4 million versus

$18.4 million for the same period last year.

For the nine months ended September 30, 2011, net income

available to common stockholders was $28.2 million or $0.97

per diluted share which included a $3.6 million charge related

to the Company’s redemption of all remaining shares of its 8.0%

Series F Cumulative Preferred Stock (“Series F preferred stock”).

For the same period in 2010, net income available to common

stockholders was $20.0 million or $0.83 per diluted share

which included a $2.4 million charge related to the Company’s

redemption of all of its Series E Preferred Stock and 40% of

its Series F Preferred Stock and $0.9 million provision for

doubtful accounts related to a mortgage loan secured by a school

property. Revenues for the nine months ended September 30, 2011,

were $62.9 million versus $53.9 million for the same period

last year.

The Company will conduct a conference call on Thursday, November

3, 2011, at 10:00 a.m. Pacific Time, in order to comment on the

Company’s performance and operating results for the quarter ended

September 30, 2011. The conference call is accessible by dialing

877-317-6789. The international number is 412-317-6789. An audio

replay of the conference call will be available from November 3,

2011 through November 25, 2011. Callers can access the replay by

dialing 877-344-7529 or 412-317-0088 and entering conference number

10005732. The earnings release will be available on our website.

The Company’s supplemental information package for the current

period will also be available on the Company’s website at

www.LTCProperties.com in the “Presentations” section of the

“Investor Information” tab.

At September 30, 2011, LTC had investments in 89 skilled nursing

properties, 102 assisted living properties, 14 other senior

housing properties and two schools. These properties are located in

30 states. Other senior housing properties consist of independent

living properties and properties providing any combination of

skilled nursing, assisted living and/or independent living

services. The Company is a self-administered real estate investment

trust that primarily invests in senior housing and long-term care

facilities through mortgage loans, facility lease transactions and

other investments. For more information on LTC Properties, Inc.,

visit the Company’s website at www.LTCProperties.com.

This press release includes statements that are not purely

historical and are “forward looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding the Company’s expectations, beliefs,

intentions or strategies regarding the future. All statements other

than historical facts contained in this press release are forward

looking statements. These forward looking statements involve a

number of risks and uncertainties. Please see our most recent

Annual Report on Form 10-K, our subsequent Quarterly Reports on

Form 10-Q, and in our other publicly available filings with the

Securities and Exchange Commission for a discussion of these and

other risks and uncertainties. All forward looking statements

included in this press release are based on information available

to the Company on the date hereof, and the Company assumes no

obligation to update such forward looking statements. Although the

Company’s management believes that the assumptions and expectations

reflected in such forward looking statements are reasonable, no

assurance can be given that such expectations will prove to have

been correct. The actual results achieved by the Company may differ

materially from any forward looking statements due to the risks and

uncertainties of such statements.

LTC PROPERTIES, INC. CONSOLIDATED STATEMENTS OF

INCOME

(Amounts in thousands, except per share

amounts)

(Unaudited)

Three Months EndedSeptember 30, Nine Months EndedSeptember

30, 2011 2010 2011 2010

Revenues: Rental income $19,620 $16,227 $57,139 $47,355 Interest

income from mortgage loans 1,582 1,868 4,851 5,683 Interest and

other income 227 264 872 838 Total

revenues 21,429 18,359 62,862 53,876

Expenses: Interest expense 1,794 852 4,441 1,672

Depreciation and amortization 4,974 4,010 14,374 11,618 (Recovery)

provisions for doubtful accounts (1 ) 60 (15 ) 1,029 Acquisition

costs 60 4 225 117 Operating and other expenses 2,149 1,896

6,800 5,615 Total expenses 8,976 6,822

25,825 20,051 Income from continuing

operations 12,453 11,537 37,037 33,825 Discontinued

operations: (Loss) income from discontinued operations (30 ) 25

(198 ) (63 ) Net (loss) income from discontinued operations

(30 ) 25 (198 ) (63 ) Net income 12,423 11,562 36,839 33,762

Income allocated to non-controlling interests (48 ) (48 ) (144 )

(144 ) Net income attributable to LTC Properties, Inc. 12,375

11,514 36,695 33,618 Income

allocated to participating securities (85 ) (54 ) (259 ) (155 )

Income allocated to preferred stockholders (818 ) (5,889 ) (8,260 )

(13,459 ) Net income available to common stockholders $11,472

$ 5,571 $28,176 $20,004

Basic

earnings per common share: Continuing operations $0.38 $0.22

$0.98 $0.84 Discontinued operations ($0.00 ) $0.00 ($0.01 )

($0.00 ) Net income available to common stockholders $0.38

$0.22 $0.98 $0.83

Diluted earnings

per common share: Continuing operations $0.38 $0.22 $0.98 $0.84

Discontinued operations ($0.00 ) $0.00 ($0.01 ) ($0.00 ) Net

income available to common stockholders $0.38 $0.22

$0.97 $0.83

Weighted average shares used to

calculate earnings per common share: Basic 30,137 24,930

28,874 23,959 Diluted 30,156 24,945

28,902 24,055

NOTE: Computations of per share amounts from continuing

operations, discontinued operations and net income are made

independently. Therefore, the sum of per share amounts from

continuing operations and discontinued operations may not agree

with the per share amounts from net income allocable to common

stockholders. Quarterly and year-to-date computations of per share

amounts are made independently. Therefore, the sum of per share

amounts for the quarters may not agree with the per share amounts

for the year.

Reconciliation of Funds From Operations (“FFO”)

FFO is a supplemental measure of a real estate investment

trust’s (“REIT”) financial performance that is not defined by U.S.

generally accepted accounting principles (“GAAP”). The Company uses

FFO as a supplemental measure of our operating performance and we

believe FFO is helpful in evaluating the operating performance of a

REIT. Real estate values historically rise and fall with market

conditions, but cost accounting for real estate assets in

accordance with U.S. GAAP assumes that the value of real estate

assets diminishes predictably over time. We believe that by

excluding the effect of historical cost depreciation, which may be

of limited relevance in evaluating current performance, FFO and

modified FFO facilitate comparisons of operating performance

between periods.

FFO is defined as net income available to common stockholders

(computed in accordance with U.S. GAAP) excluding gains or losses

on the sale of assets plus real estate depreciation and

amortization, with adjustments for unconsolidated partnerships and

joint ventures. Adjustments for unconsolidated partnerships and

joint ventures will be calculated to reflect FFO on the same basis.

Modified FFO represents FFO adjusted for certain items detailed in

the reconciliations. The Company’s computation of FFO may not be

comparable to FFO reported by other REITs that do not define the

term in accordance with the current National Association of Real

Estate Investment Trusts’ (“NAREIT”) definition or that have a

different interpretation of the current NAREIT definition from the

Company; therefore, caution should be exercised when comparing our

company’s FFO to that of other REITs.

The Company uses FFO, modified FFO, modified FFO excluding

non-cash rental income and modified FFO excluding non-cash rental

income and non-cash compensation charges as supplemental

performance measures of our cash flow generated by operations and

cash available for distribution to stockholders. FFO, modified FFO,

modified FFO excluding non-cash rental income and modified FFO

excluding non-cash rental income and non-cash compensation charges

do not represent cash generated from operating activities in

accordance with U.S. GAAP, and are not necessarily indicative of

cash available to fund cash needs and should not be considered an

alternative to net income available to common stockholders.

The following table reconciles net income available to common

stockholders to FFO available to common stockholders, modified FFO

available to common stockholders, modified FFO available to common

stockholders excluding non-cash rental income and modified FFO

available to common stockholders excluding non-cash rental income

and non-cash compensation charges (unaudited, amounts in thousands,

except per share amounts):

Three Months EndedSeptember 30, Nine Months EndedSeptember

30, 2011 2010 2011 2010 Net

income available to common stockholders $11,472 $ 5,571 $28,176

$20,004 Add: Depreciation and amortization (continuing and

discontinued operations) 4,974 4,073 14,482

11,947 FFO available to common stockholders 16,446 9,644

42,658 31,951 Add: Preferred stock redemption charge — 2,383 3,566

(1)

2,383

(3)

Add: Preferred stock redemption dividend — — 472

(2)

— Add: Non-cash interest related to earn-out liabilities 177 — 354

— Add: Non-recurring one-time items — — — 852

(4)

Modified FFO available to common stockholders 16,623 12,027 47,050

35,186 Less: Non-cash rental income (912 ) (788 ) (2,268 ) (2,315 )

Modified FFO excluding non-cash rental income 15,711 11,239 44,782

32,871 Add: Non-cash compensation charges 374 261

1,095 982 Modified FFO excluding non-cash rental

income and non-cash compensation charges $16,085 $11,500

$45,877 $33,853

(1) Represents the original issue costs

related to the redemption of the remaining Series F preferred

stock.

(2) Represents the dividends on the Series

F preferred stock up to the redemption date.

(3) Represents the original issue costs

related to the redemption of all of the Series E and 40% of the

Series F preferred stock.

(4) Includes a $0.9 million provision for

doubtful accounts charge related to a mortgage loan secured by a

school property located in Minnesota.

Basic FFO

available to common stockholders per share $0.55 $0.39

$1.48 $1.33 Diluted FFO available to common

stockholders per share $0.54 $0.39 $1.46 $1.32

Diluted FFO $17,397 $9,698 $45,515

$34,744 Weighted average shares used to calculate diluted

FFO per share available to common stockholders 32,473 25,090

31,221 26,304

Basic modified FFO available to common

stockholders per share $0.55 $0.48 $1.63 $1.47

Diluted modified FFO available to common stockholders per

share $0.54 $0.48 $1.60 $1.44 Diluted

modified FFO $17,574 $12,947 $49,907 $37,979

Weighted average shares used to calculate diluted modified

FFO per share available to common stockholders 32,473 27,203

31,221 26,304

Basic modified FFO excluding non-cash

rental income per share $0.52 $0.45 $1.55

$1.37 Diluted modified FFO excluding non-cash rental income

per share $0.51 $0.45 $1.53 $1.36

Diluted modified FFO excluding non-cash rental income $16,662

$12,159 $47,639 $35,664 Weighted

average shares used to calculate diluted modified FFO excluding

non-cash rental income per share available to common stockholders

32,473 27,203 31,221 26,304

Basic modified FFO

excluding non-cash rental income and non-cash compensation charges

per share $0.53 $0.46 $1.59 $1.41

Diluted modified FFO excluding non-cash rental income and non-cash

compensation charges per share $0.52 $0.46 $1.56

$1.39 Diluted modified FFO excluding non-cash rental

income and non-cash compensation charges $17,036 $12,420

$48,734 $36,646 Weighted average shares

used to calculate diluted modified FFO excluding non-cash rental

income and non-cash compensation charges per share available to

common stockholders 32,473 27,204 31,221

26,304

LTC PROPERTIES, INC. CONSOLIDATED BALANCE

SHEETS (Amounts in thousands) September 30, 2011

December 31, 2010

ASSETS (unaudited) (audited) Real estate

investments: Land $ 50,409 $ 43,031 Buildings and improvements

634,418 567,017 Accumulated depreciation and amortization (172,480

) (158,204 ) Net operating real estate property 512,347 451,844

Properties held-for-sale, net of accumulated depreciation and

amortization: 2011 — $613; 2010 — $505 5,018 5,113

Net real estate property 517,365 456,957 Mortgage loans receivable,

net of allowance for doubtfulaccounts: 2011 — $931; 2010 — $981

54,056 59,026 Real estate investments, net 571,421

515,983 Other assets: Cash and cash equivalents 5,214 6,903 Debt

issue costs, net 2,377 743 Interest receivable 1,339 1,571

Straight-line rent receivable, net of allowance for

doubtfulaccounts: 2011 — $668; 2010 — $634 22,822 20,090 Prepaid

expenses and other assets 8,541 8,162 Other assets related to

properties held-for-sale, net of allowance for doubtfulaccounts:

2011 — $839; 2010 — $839 51 51 Notes receivable 768 1,283

Marketable securities 6,483 6,478 Total assets

$619,016 $561,264

LIABILITIES Bank

borrowings $ 28,400 $ 37,700 Senior unsecured notes 100,000 50,000

Bonds payable 3,200 3,730 Accrued interest 1,014 675 Earn-out

liabilities 6,195 — Accrued expenses and other liabilities 10,872

9,737 Accrued expenses and other liabilities related to properties

held-for-sale 93 132 Distributions payable — 1,768

Total Liabilities 149,774 103,742

EQUITY

Stockholders' equity: Preferred stock $0.01 par value; 15,000

shares authorized; shares issued and outstanding: 2011 — 2,000;

2010 — 5,536 38,500 126,913 Common stock: $0.01 par value; 45,000

shares authorized;shares issued and outstanding: 2011 — 30,341;

2010 — 26,345 303 263 Capital in excess of par value 506,851

398,599 Cumulative net income 660,186 623,491 Other 219 264

Cumulative distributions (738,779 ) (693,970 ) Total LTC

Properties, Inc. stockholders' equity 467,280 455,560

Non-controlling interests 1,962 1,962 Total equity

469,242 457,522 Total liabilities and equity $619,016

$561,264

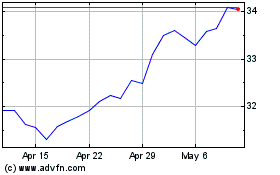

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Jul 2024 to Aug 2024

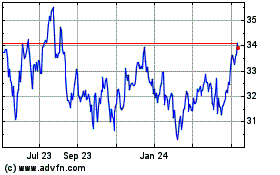

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Aug 2023 to Aug 2024