SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13E-3

TRANSACTION STATEMENT

UNDER SECTION 13(e) OF THE

SECURITIES EXCHANGE ACT OF 1934 AND

RULE 13e-3 THEREUNDER

Rule 13e-3 Transaction Statement

Under Section 13(e) of the Securities Exchange Act of 1934

(Amendment No. 3)

KAYNE

ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC.

(Name of Issuer)

Kayne Anderson Energy

Infrastructure Fund, Inc.

(Names of Person(s) Filing Statement)

Common Stock, $0.001

par value per share

(Title of Class of Securities)

48661E108

(CUSIP Number of Class of Securities)

Michael J. O’Neil

KA Fund Advisors, LLC

2121 Avenue of the Stars, 9th Floor

Los Angeles, California 90067

(713) 493-2020

(Name, Address, and Telephone Numbers of Person

Authorized to Receive Notices and Communications on Behalf of the Persons Filing Statement)

With copies to

R. William Burns

Paul Hastings LLP

600 Travis Street, 58th Floor

Houston, Texas 77002

(713) 860-7300 |

David A. Hearth

Paul Hastings LLP

101 California Street, 48th

Floor

San Francisco, California 94111

(415) 856-7000 |

This statement is filed in connection with (check the appropriate

box):

| a. | ☐ The filing of solicitation materials or an information

statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities

Exchange Act of 1934. |

| b. | ☒ The filing of a registration statement under the Securities

Act of 1933. |

Check the following box if the soliciting materials or information

statement referred to in checking box (a) are preliminary copies: ☒

Check the following box if the filing is a final amendment reporting

the results of the transaction: ☐

INTRODUCTION

This Amendment No. 3 to the

Rule 13e-3 Transaction Statement on Schedule 13E-3 (this “Transaction Statement”), together with the exhibits hereto, is

being filed with the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), by Kayne Anderson Energy Infrastructure Fund, Inc., a Maryland corporation

(“KYN”).

This Transaction Statement

relates to the Amended and Restated Agreement and Plan of Merger, dated as of April 24, 2023 (as may be amended from time to time, the

“Merger Agreement”), by and between KYN and Kayne Anderson NextGen Energy & Infrastructure, Inc., a Maryland corporation

(“KMF”). Pursuant to the Merger Agreement, KMF will be merged with and into a wholly owned subsidiary (“Merger Sub”)

of KYN (the “Merger”). KMF stockholders will be entitled to receive in exchange for each of their outstanding shares of KMF

common stock either (i) shares of KYN common stock equal to 100% of the net asset value (“NAV”) per share of the KMF common

stock (“Stock Consideration”) or (ii) an amount of cash equal to 95% of the NAV per share of the KMF common stock (“Cash

Consideration”). KMF stockholders’ right to elect to receive Cash Consideration is subject to the adjustment and proration

procedures set forth in the Merger Agreement to ensure that the total number of shares of KMF common stock converted into the right to

receive Cash Consideration will not exceed 7,079,620 shares (representing 15% of the outstanding shares of KMF common stock prior to

the closing of the Merger). KMF will then cease its separate existence under Maryland law and terminate its registration under the Investment

Company Act of 1940, as amended (the “1940 Act”). Immediately following the Merger, it is expected that Merger Sub will be

merged with and into KYN.

The Board of Directors of

KMF, including the directors who are not “interested persons” of KMF (as defined in Section 2(a)(19) of the 1940 Act, has

unanimously approved the Merger Agreement, determined the Merger to be in the bests interests of each of KMF and KYN and directed that

the Merger proposal be submitted to the KMF stockholders for consideration.

Stockholder approval of the

Merger requires the affirmative vote of the holders of a majority of the outstanding KMF common and preferred stock (voting as a class).

In addition, the rules of the New York Stock Exchange require that the stockholders of KYN approve the issuance of additional shares

of KYN common stock in connection with the Merger. KYN stockholder approval of the issuance of additional KYN common shares in connection

with the Merger requires the affirmative vote of the holders of a majority of votes cast by the holders of the issued and outstanding

KYN common and preferred stock (voting as a class).

Concurrently with the filing

of this Transaction Statement, KYN is filing an amendment to its Registration Statement on Form N-14 (File No. 333-270879) (the “Registration

Statement”) relating to the Merger Agreement and the transactions contemplated thereby under the Securities Act of 1933, as amended.

The Registration Statement includes a joint proxy statement/prospectus (the “Proxy Statement”) for the solicitation of the

required approvals by each of the KYN and KMF stockholders. A copy of the Proxy Statement is attached hereto as Exhibit (a)(1). A copy

of the Merger Agreement is attached as Appendix A to the Proxy Statement. All references in this Transaction Statement to Items numbered

1001 to 1016 are references to Items contained in Regulation M-A under the Securities Exchange Act of 1934, as amended.

Pursuant to General Instruction

F to Schedule 13E-3, the information contained in the Proxy Statement, including all appendices thereto, is incorporated herein by reference

in its entirety and responses to each item herein are qualified in their entirety by the information contained in the Proxy Statement

and the appendices thereto. The cross-references below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show

the location in the Proxy Statement of the information required to be included in response to the items of Schedule 13E-3. As of the

date hereof, the Registration Statement is not yet effective and it and the Proxy Statement are subject to completion. Terms used but

not defined in this Transaction Statement have the meanings given to them in the Proxy Statement.

ITEM 1. SUMMARY TERM SHEET

Regulation M-A Item 1001

The information set forth in the Proxy

Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers”

ITEM 2. SUBJECT COMPANY INFORMATION

Regulation M-A Item 1002

| (a) | Name and Address. The information

set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“Summary Term Sheet—Parties

to the Merger Agreement”

| (b) | Securities. Common

stock, par value $0.001 per share of KMF. As of August 31, 2023, there were 47,197,462 shares

of KMF common stock outstanding. |

| (c) | Trading Market and Price. The

information set forth in the Proxy Statement under the following caption is incorporated

herein by reference: |

“Proposal One: Merger —

Market and Net Asset Value Information”

| (d) | Dividends. The information

set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“Proposal One: Merger —

Market and Net Asset Value Information — Distributions”

| (e) | Prior Public Offerings. Not

applicable. |

| (f) | Prior Stock Purchases. Not

applicable. |

ITEM 3. IDENTITY AND BACKGROUND OF FILING

PERSON

Regulation M-A Item 1003

| (a) | through (b) Name and Address; Business

and Background of Entities. The information set forth in the Proxy Statement under the

following captions is incorporated herein by reference: |

“Summary Term Sheet—Parties

to the Merger Agreement”

“Statement of Additional

Information Relating to the Merger of Kayne Anderson Energy Infrastructure Fund, Inc. and Kayne Anderson NextGen Energy & Infrastructure,

Inc.—Management”

| (c) | Business and Background of Natural

Persons. Not applicable. |

ITEM 4. TERMS OF THE TRANSACTION

Regulation M-A Item 1004

| (a) | Material Terms. The information

set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors —

Reasons for the Merger and Board Considerations”

“Special Factors —

Background of the Merger”

“Special Factors —

Position of KYN as to the Fairness of the Merger”

“Special Factors —

Interests of the Directors and Officers of KYN and KMF in the Merger”

“Special Factors —

Financing of the Cash Consideration”

“Special Factors —

Costs of the Merger”

“Special Factors —

Delisting and Deregistration”

“Special Factors —

Dissenters’ or Appraisal Rights”

“Proposal One: Merger —

Information About the Merger”

“Proposal One: Merger —

Terms of the Agreement and Plan of Merger”

“Proposal One: Merger —

Election and Exchange Procedures”

“Proposal One: Merger —

Material U.S. Federal Income Tax Consequences of the Merger”

“Proposal One: Merger —

Required Vote”

“More Information About the

Meeting — Dissenters’ or Appraisal Rights”

Appendix A: Merger Agreement

| (c) | Different Terms. Not applicable. |

| (d) | Appraisal Rights. The information

set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“Special Factors —

Dissenters’ or Appraisal Rights”

“More Information About the

Meeting — Dissenters’ or Appraisal Rights”

| (e) | Provisions for Unaffiliated Security

Holders. The information set forth in the Proxy Statement under the following caption

is incorporated herein by reference: |

“Special Factors —

Provisions for Unaffiliated Stockholders”

| (f) | Eligibility for Listing or Trading.

The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference: |

“Proposal

One: Merger — Market and Net Asset Value Information — KYN/Acquirer”

“Proposal

Two: Issuance of Additional KYN Common Stock in Connection with the Merger”

ITEM 5. PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS

AND AGREEMENTS

Regulation M-A Item 1005

| (a) | Transactions. The information

set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“Special Factors —

Background of the Merger”

| (b) | through (c) Significant Corporate

Events; Negotiations or Contacts. The information set forth in the Proxy Statement under

the following caption is incorporated herein by reference: |

“Special Factors —

Background of the Merger”

| (e) | Agreements Involving the Subject

Company’s Securities. The information set forth in the Proxy Statement under the

following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors —

Interests of the Directors and Officers of KYN and KMF in the Merger”

“Proposal One: Merger —

Market and Net Asset Value Information”

ITEM 6. PURPOSES OF THE TRANSACTION AND

PLANS OR PROPOSALS.

Regulation M-A Item 1006

| (a) | Purposes. The information set

forth in the Proxy Statement under the following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors —

Reasons for the Merger and Board Considerations”

“Special Factors —

Position of KYN as to the Fairness of the Merger”

“Special Factors —

Background of the Merger”

“Special Factors —

Interests of the Directors and Officers of KYN and KMF in the Merger”

| (b) | Use of Securities Acquired.

The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Proposal One: Merger —

Information About the Merger”

“Proposal One: Merger —

Terms of the Agreement and Plan of Merger”

“Proposal One: Merger —

Election and Exchange Procedures”

“Special Factors —

Financing of the Cash Consideration”

“Special Factors —

Delisting and Deregistration”

“Special Factors —

Interests of the Directors and Officers of KYN and KMF in the Merger”

Appendix A: Merger Agreement

| (c) | (1) through (8) Plans. The

information set forth in the Proxy Statement under the following captions is incorporated

herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors —

Reasons for the Merger and Board Considerations”

“Special Factors —

Background of the Merger”

“Proposal One: Merger —

Investment Policies and Objectives of KYN”

“Proposal One: Merger —

Comparison of the Companies”

“Special Factors —

Primary Benefits and Detriments of the Merger”

“Special Factors —

Delisting and Deregistration”

ITEM 7. PURPOSES, ALTERNATIVES, REASONS

AND EFFECTS

Regulation M-A Item 1013

| (a) | Purposes. The information set

forth in the Proxy Statement under the following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors —

Reasons for the Merger and Board Considerations”

“Special Factors —

Position of KYN as to the Fairness of the Merger”

“Special Factors —

Background of the Merger”

“Special Factors —

Primary Benefits and Detriments of the Merger”

“Special Factors —

Interests of the Directors and Officers of KYN and KMF in the Merger”

| (b) | Alternatives. The information

set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

“Special Factors —

Reasons for the Merger and Board Considerations”

“Special Factors —

Background of the Merger”

| (c) | Reasons. The information set

forth in the Proxy Statement under the following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors —

Reasons for the Merger and Board Considerations”

“Special Factors —

Position of KYN as to the Fairness of the Merger”

“Special Factors —

Background of the Merger”

“Special Factors —

Primary Benefits and Detriments of the Merger”

| (d) | Effects. The information set

forth in the Proxy Statement under the following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors —

Reasons for the Merger and Board Considerations”

“Special Factors —

Position of KYN as to the Fairness of the Merger”

“Special Factors —

Background of the Merger”

“Proposal One: Merger —

Information About the Merger”

“Proposal One: Merger —

Terms of the Agreement and Plan of Merger”

“Proposal One: Merger —

Election and Exchange Procedures”

“Special Factors —

Financing of the Cash Consideration”

“Special Factors —

Delisting and Deregistration”

“Special Factors —

Interests of the Directors and Officers of KYN and KMF in the Merger”

“Proposal One: Merger —

Material U.S. Federal Income Tax Consequences of the Merger”

Appendix A: Merger Agreement

ITEM 8. FAIRNESS OF THE TRANSACTION

Regulation M-A Item 1014

| (a) | through (b) Fairness; Factors Considered

in Determining Fairness. |

The information set forth in the Proxy

Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors —

Reasons for the Merger and Board Considerations”

“Special Factors —

Position of KYN as to the Fairness of the Merger”

“Special Factors —

Background of the Merger”

“More Information About the

Meeting — Outstanding Stock”

| (c) | Approval of Security Holders.

The Merger is not structured to technically require the approval of at least a majority of

unaffiliated stockholders of KMF. However, the affiliated stockholders (consisting of KAFA

and the officers and directors of KYN and KMF) own only a nominal amount of KMF common stock.

As a result, affiliated stockholders are not able to exert significant influence over the

approval of the Merger, which is required to be approved by majority of the outstanding KMF

common and preferred stock (voting as a class). |

In addition, the

information set forth in the Proxy Statement under the following caption is incorporated by reference:

“More Information

About the Meeting — Outstanding Stock”

| (d) | Unaffiliated Representative.

The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference: |

“Special Factors —

Position of KYN as to the Fairness of the Merger”

“More Information About the

Meeting — Outstanding Stock”

| (e) | Approval of Directors. The

information set forth in the Proxy Statement under the following captions is incorporated

herein by reference: |

“Questions and Answers”

“Special Factors —

Reasons for the Merger and Board Considerations”

“Special Factors —

Position of KYN as to the Fairness of the Merger”

“Special Factors —

Background of the Merger”

| (f) | Other Offers. Not applicable. |

ITEM 9. REPORTS, OPINIONS, APPRAISALS AND

CERTAIN NEGOTIATIONS

Regulation M-A Item 1015

| (a) | through (b) Report, Opinion or

Appraisal; Preparer and Summary of the Report, Opinion or Appraisal. |

The information set forth in the Proxy

Statement under the following caption is incorporated herein by reference:

“Special Factors —

Position of KYN as to the Fairness of the Merger”

| (c) | Availability of Documents.

Not applicable. |

ITEM 10. SOURCE AND AMOUNTS OF FUNDS OR

OTHER CONSIDERATION

Regulation M-A Item 1007

| (a) | through (d) Source of Funds; Conditions;

Expenses; Borrowed Funds. The information set forth in the Proxy Statement under the

following captions is incorporated herein by reference: |

“Summary Term Sheet—Costs

of the Merger”

“Summary Term Sheet—Financing

of the Cash Consideration”

“Special Factors —

Financing of the Cash Consideration”

“Special Factors —

Costs of the Merger”

ITEM 11. INTEREST IN SECURITIES OF THE SUBJECT

COMPANY

Regulation M-A Item 1008

| (a) | through (b) Securities Ownership;

Securities Transactions. The information set forth or incorporated by reference in the

Proxy Statement under the following captions is incorporated herein by reference: |

“Summary Term Sheet—Parties

to the Merger Agreement”

“Summary Term Sheet—The

Merger”

“Proposal One: Merger —

Information About the Merger”

“Proposal One: Merger —

Terms of the Agreement and Plan of Merger”

“Special Factors —

Interests of the Directors and Officers of KYN and KMF in the Merger”

“More Information About the

Meeting — Outstanding Stock”

ITEM 12. THE SOLICITATION OR RECOMMENDATION

Regulation M-A Item 1012

| (d) | Intent to Tender or Vote in a Going-Private

Transaction. The information set forth in the Proxy Statement under the following captions

is incorporated herein by reference: |

“Summary

Term Sheet — Interests of the Directors and Officers of KYN and KMF in the Merger”

“Special

Factors — Interests of the Directors and Officers of KYN and KMF in the Merger”

| (e) | Recommendations of Others.

Not applicable. |

ITEM 13. FINANCIAL INFORMATION

Regulation M-A Item 1010

| (a) | Financial Statements. The information

set forth or incorporated by reference in this Transaction Statement or in the Proxy Statement

under the following captions is incorporated herein by reference: |

KYN’s Semi-Annual Report on Form

N-CSRS for the semi-annual period ended May 31, 2023

KYN’s Annual Report on Form

N-CSR for the fiscal year ended November 30, 2022

KYN’s Annual Report on Form

N-CSR for the fiscal year ended November 30, 2021

KMF’s Semi-Annual Report on Form

N-CSRS for the semi-annual period ended May 31, 2023

KMF’s Annual Report on Form N-CSR

for the fiscal year ended November 30, 2022

KMF’s Annual Report on Form N-CSR

for the fiscal year ended November 30, 2021

| (b) | Pro Forma Information. Not

applicable. |

ITEM 14. PERSONS/ASSETS, RETAINED, EMPLOYED,

COMPENSATED OR USED

Regulation M-A Item 1009

| (a) | through (b) Solicitations or Recommendations;

Employees and Corporate Assets. The information set forth in the Proxy Statement under

the following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors —

Reasons for the Merger and Board Considerations”

“Special Factors —

Background of the Merger”

“Special Factors —

Interests of the Directors and Officers of KYN and KMF in the Merger”

ITEM 15. ADDITIONAL INFORMATION

Regulation M-A Item 1011

| (b) | Golden Parachute Compensation.

Not applicable. |

| (c) | Other Material Information.

The information set forth in the Proxy Statement, including all annexes to the joint proxy

statement/prospectus included therein, is incorporated herein by reference. |

ITEM 16. EXHIBITS

Regulation M-A Item 1016

Exhibit

No. |

|

Description |

| |

|

|

| (a)(5) |

|

Investor

Presentation relating to the Merger (filed with the SEC on March 27, 2023 by KYN pursuant to Rule 425 under the Securities Act). |

| (a)(6) |

|

KYN

Quarterly Letter Q1 2023 (filed with the SEC on April 6, 2023 by KYN pursuant to Rule 425 under the Securities Act). |

| (a)(7) |

|

KMF

Quarterly Letter Q1 2023 (filed with the SEC on April 6, 2023 by KYN pursuant to Rule 425 under the Securities Act). |

| (a)(8) |

|

KYN

Quarterly Letter (filed with the SEC on April 24, 2023 by KYN pursuant to Rule 425 under the Securities Act). |

| (a)(9) |

|

KMF

Quarterly Letter (filed with the SEC on April 24, 2023 by KYN pursuant to Rule 425 under the Securities Act). |

| (a)(10) |

|

Press

Release dated April 24, 2023 (filed with the SEC on April 24, 2023 by KYN pursuant to Rule 425 under the Securities Act). |

| (a)(11) |

|

KYN

KMF Combination Announcement Updated (filed with the SEC on April 24, 2023 by KYN pursuant to Rule 425 under the Securities Act). |

| (a)(12) |

|

Frequently

Asked Questions relating to the Merger (filed with the SEC on May 2, 2023 by KYN pursuant to Rule 425 under the Securities Act). |

| (a)(13) |

|

KYN

Quarterly Letter (filed with the SEC on June 30, 2023 by KYN pursuant to Rule 425 under the Securities Act). |

| (a)(14) |

|

KMF

Quarterly Letter (filed with the SEC on June 30, 2023 by KYN pursuant to Rule 425 under the Securities Act). |

| (a)(15) |

|

Frequently Asked Questions relating to the Merger (filed with the SEC on August 9, 2023 by KYN

pursuant to Rule 425 under the Securities Act). |

| (a)(16) |

|

Current Report on Form 8-K of KYN (filed with the SEC on August 21, 2023 by KYN pursuant to Rule 425 under the Securities Act). |

| (b) |

|

Sixth

Amended and Restated Credited Agreement dated as of February 24, 2023 between KYN and JPMorgan Chase Bank, N.A. (incorporated by

reference to Exhibit 13.12 of KYN’s Registration Statement on Form N-14 (File No. 333-270879) filed concurrently with the SEC). |

| (c) |

|

None. |

| (d)(1) |

|

Amended

and Restated Agreement and Plan of Merger, dated as of April 24, 2023, by and between KYN and KMF (incorporated herein by reference

to Appendix A of the Proxy Statement). |

| (d)(2) |

|

Amended

and Restated Support and Non-Election Agreement (incorporated by reference to Exhibit 13.15 of KYN’s Registration Statement

on Form N-14 (File No. 333-270879) filed concurrently with the SEC). |

| (e) |

|

None. |

| (f)(1) |

|

KYN’s

Articles of Amendment and Restatement (incorporated herein by reference to Exhibit 99.1 of Pre-Effective Amendment No. 3 to KYN’s

Registration Statement on Form N-2 (File Nos. 333-116479 and 811-21593) as filed with the Securities and Exchange Commission on September

1, 2004). |

| (f)(2) |

|

KYN’s

Amended and Restated Bylaws (incorporated herein by reference to Exhibit 99.1 of Pre-Effective Amendment No. 4 to KYN’s Registration

Statement on Form N-2 (File Nos. 333-116479 and 811-21593) as filed with the Securities and Exchange Commission on September 16,

2004). |

| (g) |

|

None. |

| (h) |

|

Tax

Opinions of Paul Hastings LLP (incorporated by reference to Exhibit 12 of KYN’s Registration Statement on Form N-14 (File No.

333-270879) filed concurrently with the SEC). |

SIGNATURES

After due inquiry and to

the best of each of the undersigned’s knowledge and belief, each of the undersigned certifies that the information set forth in

this statement is true, complete and correct.

Dated as of September 20, 2023

| |

KAYNE ANDERSON ENERGY INFRASTRUCTRE FUND, INC. |

| |

|

|

| |

By: |

/s/

A. Colby Parker |

| |

Name: |

A. Colby Parker |

| |

Title: |

Chief Financial Officer and Treasurer |

Exhibit 107

Calculation of

Filing Fee Tables

Form N-14

(Form Type)

Kayne Anderson Energy Infrastructure Fund, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| |

Security Type |

Security Class Title |

Fee Calculation Rule |

Amount to be

Registered |

Proposed

Maximum

Offering

Price

Per

Share |

Proposed

Maximum

Aggregate

Offering

Price(1) |

Fee Rate |

Amount of

Registration

Fee |

| Fees to be Paid |

Equity |

Common Stock, par value $0.001 per share |

Other |

45,000,000 |

$9.51(2) |

$427,950,000 |

$ 0.00011020 |

$47,160.09 |

| Fees Previously Paid |

Equity |

Common Stock, par value $0.001 per share |

Other |

45,000,000 |

$9.51(2) |

$427,950,000 |

$ 0.00011020 |

$47,160.09 |

| |

Total Offering Amounts |

|

$427,950,000 |

|

$47,160.09 |

| |

Total Fees Previously Paid |

|

$427,950,000 |

|

$47,160.09 |

| |

Total Fee Offsets |

|

$427,950,000 |

|

$47,160.09 |

| |

Net Fee Due |

|

|

|

— |

Table 2: Fee Offset Claims

and Sources

| |

Registrant or Filer Name |

Form or Filing Type |

File Number |

Initial Filing Date |

Filing Date |

Fee Offset Claimed |

Fee Paid with Fee Offset Source |

| Fee Offset Claims |

|

N-14 8C |

333-270879 |

March 27, 2023 |

|

$47,160.09 |

|

| Fee Offset Sources |

Kayne Anderson Energy Infrastructure Fund, Inc. |

N-14 8C |

333-270879 |

|

April 28, 2023 |

|

$47,160.09(3) |

| (1) | Estimated solely for the purpose of calculating the registration fee. |

| (2) | Net asset value per common share on March 24, 2023. |

| (3) | KYN previously paid $47,160.09 upon the filing of its Registration Statement on Form N-14 on March 27,

2023 in connection with the transaction reported hereby. |

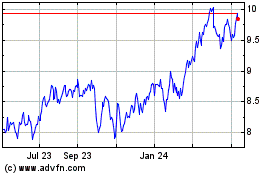

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Apr 2024 to May 2024

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From May 2023 to May 2024