Form 425 - Prospectuses and communications, business combinations

August 21 2023 - 4:30PM

Edgar (US Regulatory)

Filed pursuant to Rule 425

of the Securities Act of 1933, as amended

and deemed filed pursuant to Regulation 14A

under the Securities and Exchange Act of 1934, as amended

Subject Companies:

Kayne Anderson Energy Infrastructure Fund, Inc.

Commission File No. 811-21593

Kayne Anderson NextGen Energy & Infrastructure, Inc.

Commission File No. 811-22467

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 21, 2023

Kayne Anderson

NextGen Energy & Infrastructure, Inc.

(Exact name of registrant as specified in its charter)

| Maryland |

|

811-22467 |

|

27-3335731 |

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

811 Main Street, 14th

Floor

Houston, TX |

|

77002 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (877) 657-3863

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ☐ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Item 8.01. Other Events.

Pursuant to that certain Amended and Restated Agreement

and Plan of Merger, dated as of April 24, 2023, Kayne Anderson Energy Infrastructure Fund, Inc. (“KYN”) and Kayne Anderson

NextGen Energy & Infrastructure, Inc. (“KMF”) have entered into a definitive agreement to combine the two funds (the “Merger”).

The Merger and related transactions are subject to KYN and KMF stockholder approval. KYN and KMF have reestablished the record date for

purposes of voting on matters relating to the Merger. Accordingly, stockholders of record of KYN and KMF as of the close of business on

August 21, 2023 are entitled to notice of and to vote (on KYN’s and KMF’s matters, as applicable) at the special meeting (or

any adjournment or postponement of the special meeting thereof).

Where You Can Find Information on the Merger

For more information about the Merger, please see

Kayne Anderson’s press release dated April 24, 2023 announcing an update to the Merger and the presentation titled “Kayne

Anderson Closed-End Fund Update: Overview of KYN & KMF Merger” posted on www.kaynefunds.com/insights.

Additional information regarding the Merger is

included in the amended preliminary joint proxy statement/prospectus filed with the Securities and Exchange Commission (the

“SEC”). KYN and KMF expect to mail a definitive joint proxy statement/prospectus to stockholders that will contain

information about the Merger, including the date of the special meeting, following a review period with the SEC.

This report shall not constitute an offer to sell

or a solicitation to buy, nor shall there be any sale of any securities in any jurisdiction in which such offer or sale is not permitted.

Nothing contained in this report is intended to recommend any investment policy or investment strategy or consider any investor’s

specific objectives or circumstances. Before investing, please consult with your investment, tax, or legal adviser regarding your individual

circumstances.

Participants in the Solicitation

KYN, KMF and their directors and executive officers

may be deemed participants in the solicitation of proxies from KYN’s and KMF’s stockholders with respect to the Merger. Information

regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to KYN’s and KMF’s stockholders

and their interests in the solicitation of proxies in connection with the proposed Merger is included in the preliminary proxy statement/prospectus

filed with the SEC.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

KAYNE ANDERSON NEXTGEN ENERGY & INFRASTRUCTURE, INC. |

| |

|

| Date: August 21, 2023 |

By: |

/s/ A. Colby Parker |

| |

|

Name: |

A. Colby Parker |

| |

|

Title: |

Chief Financial Officer and Treasurer |

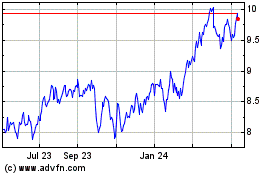

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Apr 2024 to May 2024

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From May 2023 to May 2024