false0000216228Indiana00002162282023-12-032023-12-0300002162282023-05-102023-05-10

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: December 3, 2023

(Date of earliest event reported)

ITT INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Indiana | 001-05672 | 81-1197930 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

100 Washington Boulevard

6th Floor

Stamford, CT 06902

(Principal Executive Office)

Telephone Number: (914) 641-2000

Not Applicable

Former name or former address, if changed since last report Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $1 per share | ITT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 under the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 under the Securities Exchange Act of 1934 (17 CFR 240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 6, 2023, ITT Inc. (the “Company”) entered into the Second Amendment (the “Amendment”) to the Company’s Credit Agreement, dated as of August 5, 2021 (as amended, the “Credit Agreement”), among the Company, certain subsidiaries of the Company party thereto, the lenders party thereto and Bank of America, N.A., as the administrative agent, the L/C issuer and a U.S. swingline lender. The Amendment relates to the Company’s previously announced pending acquisition of Svanehøj Group A/S (“Svanehøj”) and, among other amendments, provides the ability of an Italian subsidiary of the Company to incur up to €300.0 million of unsecured indebtedness the proceeds of which are to be used for general corporate purposes, including to finance the acquisition of Svanehøj.

The foregoing description of the Amendment and the Credit Agreement does not purport to be complete and is subject to, and qualified in its entirety by, reference to the Amendment, a copy of which is attached hereto and filed as Exhibit 10.1 and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth above under “Item 1.01 Entry into a Material Definitive Agreement” is hereby incorporated by reference into this Item 2.03.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Arrangements of Certain Officers

(b) On December 3, 2023, Mr. Richard P. Lavin notified the Company of his retirement from the Board due to personal reasons, effective December 4, 2023. The retirement was not as a result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | | | | |

| Exhibit No. | Description |

| 10.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ITT Inc. |

| (Registrant) |

| | | |

| December 7, 2023 | By: | /s/ Lori B. Marino |

| | Name: | Lori B. Marino |

| | Title: | Senior Vice President, General Counsel and Corporate Secretary |

| | | (Authorized Officer of Registrant) |

SECOND AMENDMENT TO CREDIT AGREEMENT

THIS SECOND AMENDMENT TO CREDIT AGREEMENT (this “Amendment”) is entered into as of December 6, 2023 (the “Second Amendment Effective Date”) among ITT Inc., an Indiana corporation (the “Company”), the Borrowing Subsidiaries party hereto, each Lender party hereto, and Bank of America, N.A., as the Administrative Agent.

WHEREAS, the Borrowers, the Lenders from time to time party thereto, Bank of America, N.A., as the Administrative Agent, the L/C Issuer, and a U.S. Swing Line Lender, each other U.S. Swing Line Lender from time to time party thereto, and each Euro Swing Line Lender from time to time party thereto, entered into that certain Credit Agreement, dated as of August 5, 2021 (as amended, restated, amended and restated, supplemented, extended, replaced or otherwise modified from time to time prior to the Second Amendment Effective Date, the “Existing Credit Agreement”; the Existing Credit Agreement, as amended by this Amendment, the “Amended Credit Agreement”);

WHEREAS, the Borrowers have requested that the Existing Credit Agreement be amended as set forth below, subject to the terms and conditions specified in this Amendment; and

WHEREAS, the parties hereto are willing to amend the Existing Credit Agreement, subject to the terms and conditions specified in this Amendment.

NOW, THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

SECTION 1. Defined Terms. Each capitalized term used and not otherwise defined herein shall have the meaning set forth in the Existing Credit Agreement. The provisions of Section 1.02 of the Existing Credit Agreement shall apply to this Amendment, mutatis mutandis.

SECTION 2. Amendments to Existing Credit Agreement.

(a) The following definitions are hereby added to Section 1.01 of the Existing Credit Agreement in the appropriate alphabetical order:

“ITT Italia” means ITT Italia s.r.l., an entity organized under the laws of Italy.

“ITT Italia Indebtedness” means unsecured Indebtedness incurred by ITT Italia, the proceeds of which will be used for general corporate purposes, including to finance the Acquisition by ITT Italia of one hundred percent (100%) of the outstanding share capital of Svanehøj Group A/S (Svanehøj), a company organized under the laws of Denmark.

(b) Section 7.01 of the Existing Credit Agreement is hereby (i) amended to delete the “and” at the end of subclause (h) thereof, (ii) amended to re-style subclause (i) thereof as subclause (j), and new subclause (j) is amended as set forth below, and (iii) amended to add a new subclause (i) immediately following subclause (h) thereof to read as follows:

(i) (i) the ITT Italia Indebtedness, and any extensions, renewals or replacements thereof (A) that do not increase the outstanding principal amount thereof, and (B) so long as no additional Subsidiaries will be added as obligors or guarantors in respect of such Indebtedness in connection with any such extension, renewal or replacement; provided, that, the aggregate principal amount of the Indebtedness incurred pursuant to this Section 7.01(i)(i) outstanding at any time shall not exceed €300,000,000 (or the equivalent thereof at the time of the incurrence of such Indebtedness); and (ii) obligations (contingent or otherwise) existing under any Hedging Agreement entered into in connection with the Indebtedness permitted pursuant to Section 7.01(i)(i), so long as such obligations are (or were) entered into in the ordinary course of business and not for purposes of speculation; and

(j) other Priority Indebtedness; provided, that, the aggregate principal amount of all such Priority Indebtedness outstanding at any time, when taken together (and without duplication) with the aggregate principal amount of all obligations outstanding at such time and secured by Liens incurred in reliance on Section 7.02(h), shall not exceed the greater of (i) $250,000,000, and (ii) an amount equal to twelve and one-half percent (12.5%) of Consolidated Net Tangible Assets.

(c) The reference to “Priority Indebtedness” in the proviso to Section 7.02(h) of the Existing Credit Agreement is hereby amended to read “Priority Indebtedness incurred in reliance on Section 7.01(j) and”.

SECTION 3. Representations and Warranties. To induce the other parties hereto to enter into this Amendment, each of the Company and, solely as to itself, each Borrowing Subsidiary represents and warrants, on and as of the Second Amendment Effective Date, that:

(a) This Amendment has been duly authorized, executed and delivered by it, and this Amendment and the Amended Credit Agreement constitute its legal, valid and binding obligations, enforceable against it in accordance with their terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

(b) Before or after the effectiveness of the amendments provided for herein, the representations and warranties contained in the Amended Credit Agreement (except for those contained in Section 5.05(b) and Section 5.06(a) of the Amended Credit Agreement) or any other Loan Document (with all references therein to the “Transactions” being deemed to include the execution, delivery, performance and effectiveness of this Amendment) shall (i) with respect to representations and warranties that contain a materiality qualification, be true and correct on and as of the Second Amendment Effective Date, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they shall be true and correct as of such earlier date, and (ii) with respect to representations and warranties that do not contain a materiality qualification, be true and correct in all material respects on and as of the Second Amendment Effective Date, except to the extent that such representations and

warranties specifically refer to an earlier date, in which case they shall be true and correct in all material respects as of such earlier date, and except that for purposes of this Section 3(b), the representations and warranties contained in Section 5.05(a) of the Amended Credit Agreement shall be deemed to refer to the most recent statements furnished pursuant to Sections 6.03(a) and (b), respectively, of the Existing Credit Agreement.

(c) No Default or Event of Default has occurred and is continuing on and as of the Second Amendment Effective Date (either before or after the effectiveness of the amendments provided for herein).

SECTION 4. Effectiveness. This Amendment shall be effective upon receipt by the Administrative Agent of counterparts of this Amendment duly executed by each Borrower, Lenders constituting the Required Lenders, and the Administrative Agent.

SECTION 5. Expenses. The Company agrees to reimburse the Administrative Agent for its reasonable, documented out-of-pocket expenses in connection with this Amendment, including the reasonable, documented out-of-pocket fees, charges and disbursements of Moore & Van Allen PLLC, counsel for the Administrative Agent.

SECTION 6. Reaffirmation. Each Borrower hereby consents to this Amendment and hereby agrees that, notwithstanding the effectiveness of this Amendment, its obligations (including its guarantees) under the Loan Documents to which it is a party shall continue to be in full force and effect.

SECTION 7. Effect of Amendment.

(a) Except as expressly set forth herein, this Amendment shall not by implication or otherwise limit, impair, constitute a waiver of or otherwise affect the rights and remedies of the Administrative Agent, the Lenders, the L/C Issuer, the U.S. Swing Line Lenders, or the Euro Swing Line Lenders under the Existing Credit Agreement or any other Loan Document, and shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Existing Credit Agreement or any other Loan Document, all of which shall continue in full force and effect in accordance with the provisions thereof. Nothing herein shall be deemed to entitle any Borrower to a consent to, or a waiver, amendment, modification or other change of, any of the terms, conditions, obligations, covenants or agreements contained in the Existing Credit Agreement or any other Loan Document in similar or different circumstances, except as expressly set forth herein.

(b) On and after the Second Amendment Effective Date, each reference in the Existing Credit Agreement to “this Agreement”, “hereunder”, “hereof”, “herein”, or words of like import, shall refer to the Amended Credit Agreement and the term “Credit Agreement”, as used in each Loan Document, shall mean the Amended Credit Agreement.

(c) This Amendment shall constitute a “Loan Document” for all purposes of the Amended Credit Agreement and the other Loan Documents.

SECTION 8. Applicable Law; Jurisdiction; Venue; Waiver of Jury Trial. THE PROVISIONS OF SECTIONS 11.14 AND 11.15 OF THE EXISTING CREDIT AGREEMENT

ARE INCORPORATED INTO THIS AMENDMENT, MUTATIS MUTANDIS, WITH THE SAME EFFECT AS IF SET FORTH IN FULL HEREIN.

SECTION 9. Electronic Execution; Electronic Records; Counterparts. This Amendment may be in the form of an Electronic Record and may be executed using Electronic Signatures, including facsimile or .pdf, and shall be considered an original, and shall have the same legal effect, validity and enforceability as a paper record. This Amendment may be executed in as many counterparts as necessary or convenient, including both paper and electronic counterparts, but all such counterparts shall be one and the same Amendment. For the avoidance of doubt, subject to Section 11.17 of the Existing Credit Agreement, the authorization under this Section 9 may include use or acceptance by the Administrative Agent of a manually signed counterpart of this Amendment which has been converted into electronic form (such as scanned into .pdf), or an electronically signed counterpart of this Amendment converted into another format, for transmission, delivery and/or retention.

SECTION 10. Severability. In the event any one or more of the provisions contained in this Amendment should be held invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions contained herein shall not in any way be affected or impaired thereby. The parties shall endeavor in good-faith negotiations to replace the invalid, illegal or unenforceable provisions with valid provisions the economic effect of which comes as close as possible to that of the invalid, illegal or unenforceable provisions.

SECTION 11. Headings. Section headings used herein are for convenience of reference only, are not part of this Amendment and are not to affect the construction of, or to be taken into consideration in interpreting, this Amendment.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their respective authorized officers as of the day and year first above written.

BORROWERS: ITT INC.,

an Indiana corporation

By: /s/ Michael Savinelli

Name: Michael Savinelli

Title: Vice President, Treasurer, Chief Tax Officer and Assistant Secretary

ITT INDUSTRIES LUXEMBOURG S.À R.L.,

a société à responsabilité limitée organized under the laws of the Grand Duchy of Luxembourg

By: /s/ Michael Savinelli

Name: Michael Savinelli

Title: Class A Manager

ADMINISTRATIVE AGENT: BANK OF AMERICA, N.A.,

as the Administrative Agent

By: /s/ Michelle D. Diggs

Name: Michelle D. Diggs

Title: Officer

LENDERS: BANK OF AMERICA, N.A.,

as a Lender

By: /s/ Donald K. Bates

Name: Donald K. Bates

Title: Senior Vice President

BNP PARIBAS,

as a Lender

By: /s/ Tony Baratta

Name: Tony Baratta

Title: Managing Director

By: /s/ Monica Tilani

Name: Monica Tilani

Title: Director

CITIBANK, N.A.,

as a Lender

By: /s/ Daniel Boselli

Name: Daniel Boselli

Title: Vice President

U.S. BANK NATIONAL ASSOCIATION,

as a Lender

By: /s/ Daniel E. Von Herzen, CFA

Name: Daniel E. Von Herzen, CFA

Title: Authorized Officer

WELLS FARGO BANK, NATIONAL ASSOCIATION,

as a Lender

By: /s/ Steven Chen

Name: Steven Chen

Title: Vice President

ING BANK N.V., DUBLIN BRANCH,

as a Lender

By: /s/ Louise Gough

Name: Louise Gough

Title: Vice President

By: /s/ Padraig Matthews

Name: Padraig Matthews

Title: Director

COMMERZBANK AG, NEW YORK BRANCH,

as a Lender

By: /s/ Robert Sullivan

Name: Robert Sullivan

Title: Vice President

By: /s/ Jeff Sullivan

Name: Jeff Sullivan

Title: Vice President

INTESA SANPAOLO S.P.A., NEW YORK BRANCH,

as a Lender

By: /s/ Jordan Schweon

Name: Jordan Schweon

Title: Managing Director

By: /s/ Jennifer Feldman Facciola

Name: Jennifer Feldman Facciola

Title: Business Director

v3.23.3

Document and Entity Information Document

|

Dec. 03, 2023 |

May 10, 2023 |

| Document Information [Line Items] |

|

|

| Title of 12(b) Security |

|

Common Stock, par value $1 per share

|

| Entity Incorporation, State or Country Code |

IN

|

|

| Amendment Flag |

false

|

|

| Document Period End Date |

Dec. 03, 2023

|

|

| Entity Registrant Name |

ITT INC.

|

|

| Entity File Number |

001-05672

|

|

| Entity Tax Identification Number |

81-1197930

|

|

| Entity Address, Address Line One |

100 Washington Boulevard6th Floor

|

|

| Entity Address, City or Town |

Stamford

|

|

| Entity Address, State or Province |

CT

|

|

| Entity Address, Postal Zip Code |

06902

|

|

| City Area Code |

914

|

|

| Local Phone Number |

641-2000

|

|

| Entity Information, Former Legal or Registered Name |

|

Not Applicable

|

| Written Communications |

|

false

|

| Soliciting Material |

|

false

|

| Trading Symbol |

|

ITT

|

| Security Exchange Name |

|

NYSE

|

| Pre-commencement Tender Offer |

|

false

|

| Pre-commencement Issuer Tender Offer |

|

false

|

| Entity Emerging Growth Company |

|

false

|

| Entity Central Index Key |

0000216228

|

|

| Document Type |

8-K

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

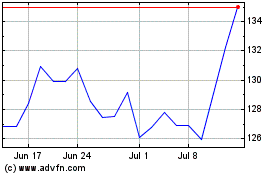

ITT (NYSE:ITT)

Historical Stock Chart

From Apr 2024 to May 2024

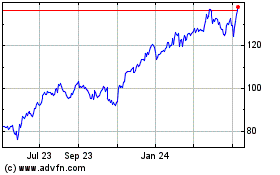

ITT (NYSE:ITT)

Historical Stock Chart

From May 2023 to May 2024