0000850141false00008501412024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report: February 7, 2024

HORACE MANN EDUCATORS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-10890 | 37-0911756 |

| (State of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1 Horace Mann Plaza, Springfield, Illinois 62715‑0001

(Address of principal executive offices, including zip code)

Registrant's telephone number, including area code: 217‑789‑2500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange

on which registered |

| Common Stock, $0.001 par value | | HMN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Forward-looking Information

Statements included in the accompanying news release that state Horace Mann Educators Corporation’s (Company) or its management’s intentions, hopes, beliefs, expectations or predictions of future events or the Company’s future financial performance are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995 and are subject to known and unknown risks, uncertainties and other factors. The Company is not under any obligation to (and expressly disclaims any such obligation to) update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. It is important to note that the Company’s actual results could differ materially from those projected in such forward-looking statements. Please refer to the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q and the Company’s past and future filings and reports filed with the Securities and Exchange Commission for information concerning the important factors that could cause actual results to differ materially from those in forward-looking statements.

Item 2.02: Results of Operations and Financial Condition

On February 7, 2024, the Company issued a news release reporting its financial results for the three and twelve months ended December 31, 2023. A copy of the news release is attached as Exhibit 99.2 and is incorporated herein by reference.

The Company’s Investor Supplement and Investor Presentation will also be posted on the investors page of its website, investors.horacemann.com.

Item 9.01: Financial Statements and Exhibits

(d)Exhibits.

Exhibit 104 Cover Page Interactive Data File (formatted as Inline XBRL)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| HORACE MANN EDUCATORS CORPORATION |

| |

| By: | /s/ Kimberly A. Johnson |

| | Name: | Kimberly A. Johnson |

| | Title: | Senior Vice President & Controller |

| | | (Principal Accounting Officer) |

Date: February 7, 2024

Glossary of Selected Terms

The following measures are used by the Company’s management to evaluate performance against historical results and establish targets on a consolidated basis. A number of these measures are components of net income or the balance sheet but, in some cases, are not based on accounting principles generally accepted in the United States of America (non-GAAP) under applicable SEC rules because they are not displayed as separate line items in the Consolidated Statements of Operations and Comprehensive Income (Loss) or Consolidated Balance Sheets or are not required to be disclosed in the Notes to the Consolidated Financial Statements or, in some cases, there is inclusion or exclusion of certain items not ordinarily included or excluded in accordance with accounting principles generally accepted in the United States of America (GAAP).

In the opinion of the Company’s management, a discussion of these measures provides investors, financial analysts, rating agencies and other financial statement users with a better understanding of the significant factors that comprise the Company’s periodic results of operations and how management evaluates the Company's financial performance. Internally, the Company's management uses the measures to evaluate performance against historical results, to establish financial targets on a consolidated basis and for other reasons.

Some of these measures exclude net investment gains (losses), net unrealized investment gains (losses) on fixed maturity securities and net reserve remeasurements attributable to discount rates which can be significantly impacted by both discretionary and other economic factors and are not necessarily indicative of operating trends. Also, some of these measures exclude goodwill and intangible asset impairments and intangible asset amortization.

Other companies may calculate these measures differently, and, therefore, their measures may not be comparable to those used by the Company’s management.

Adjusted book value per share - The result of dividing (1) total shareholders’ equity excluding after-tax net unrealized investment gains (losses) on fixed maturity securities and after-tax net reserve remeasurements attributable to discount rates by (2) ending shares outstanding. Book value per share is the most directly comparable GAAP measure. Management believes it is useful to consider the trend in book value per share excluding net unrealized investment gains (losses) on fixed maturity securities and net reserve remeasurements attributable to discount rates in conjunction with book value per share to identify and analyze the change in net worth. Management also believes the non-GAAP measure is useful to investors because it eliminates the effect of items that can fluctuate significantly from period to period and are generally driven by economic developments, primarily financial market conditions, the magnitude and timing of which are generally not influenced by the Company’s underlying insurance operations.

Tangible book value per share - The result of dividing (1) total shareholders’ equity excluding after-tax net unrealized investment gains (losses) on fixed maturity securities after-tax net reserve remeasurements attributable to discount rates, goodwill and other intangible assets (including the related impact of deferred taxes) by (2) ending shares outstanding. Book value per share is the most directly comparable GAAP measure.

Debt to total capitalization ratio, excluding net unrealized investment gains (losses) on fixed maturity securities and net reserve remeasurements attributable to discount rates - The result of dividing (1) total debt by (2) total debt plus common shareholders' equity excluding after-tax net unrealized investment gains (losses) on fixed maturity securities and after-tax net reserve remeasurements attributable to discount rates from common shareholders' equity. The debt to total capitalization ratio is the most directly comparable GAAP measure.

Catastrophe costs - The sum of catastrophe losses, net of reinsurance and before income tax benefits that includes allocated loss adjustment expenses and reinsurance reinstatement premiums, excluding unallocated loss adjustment expenses.

Catastrophe losses - In categorizing property and casualty claims as being from a catastrophe, the Company utilizes the designations of the Property Claim Services, a subsidiary of Insurance Services Office, Inc., and additionally beginning in 2007, includes losses from all such events that meet the definition of a covered loss in the Company’s primary catastrophe excess of loss reinsurance contract, and reports claims and claim expense amounts net of reinsurance recoverables. A catastrophe is a severe loss resulting from natural and man-made events within a particular territory, including risks such as hurricane, fire, earthquake, windstorm, explosion, terrorism and other similar events, that causes $25 million or more in insured property and casualty losses for the industry and affects a significant number of property and casualty insurers and policyholders. Each catastrophe has unique characteristics. Catastrophes are not predictable as to timing or amount of loss in advance. Their

effects are not included in earnings or claim and claim expense reserves prior to occurrence. In the opinion of the Company’s management, a discussion of the impact of catastrophes is meaningful for investors to understand the variability in periodic earnings.

Core earnings (loss) - Consolidated net income (loss) excluding the after-tax impact of net investment gains (losses), discontinued operations, the after-tax impact of goodwill and intangible asset impairments and the cumulative effect of changes in accounting principles when applicable. Net income is the most directly comparable GAAP measure.

•Pretax core earnings (loss) - Pretax net income (loss) excluding the pretax impact of net investment gains (losses), discontinued operations, the pretax impact of goodwill and intangible asset impairments and cumulative effect of changes in accounting principles when applicable. Income before income taxes is the most directly comparable GAAP measure.

•Segment core earnings (loss) - Determined in the same manner as core earnings (loss) on a consolidated basis. Management uses segment core earnings to analyze each segment's performance and as a tool in making business decisions. Financial statement users also consider core earnings when analyzing the results and trends of insurance companies.

Core earnings (loss) per share - Core earnings on a per common share basis. Earnings per share is the most directly comparable GAAP measure.

Adjusted core earnings (loss) – Determined in the same manner as core earnings (loss) but this measure is further adjusted to exclude intangible asset amortization and the change in market risk benefits to calculate adjusted core earnings (loss). Net income is the most directly comparable GAAP measure.

•Pretax adjusted core earnings (loss) – Determined in the same manner as pretax core earnings (loss) but this measure is further adjusted to exclude pretax intangible asset amortization and the pretax change in market risk benefits to calculate pretax adjusted core earnings (loss). Income before income taxes is the most directly comparable GAAP measure.

Net premiums written and contract deposits – Management utilizes this non-GAAP measure, which is based on statutory accounting principles, in analyzing and evaluating business growth. Premiums and contract charges earned is the most directly comparable GAAP measure.

Net premiums written and contract deposits for the Company’s operating segments are as follows:

Property & Casualty

Net premiums written: Reflects the direct and assumed contractually determined amounts charged to policyholders for the effective period of the contract based on the terms and conditions of the contract and reflect gross premiums written less premiums ceded to reinsurers. The difference between premiums written and premiums earned is premiums unearned.

Life & Retirement

Life Insurance Product Lines:

•Net premiums written and contract deposits: Reflects (1) the direct and assumed contractually determined amounts charged to policyholders for the effective period of the contract based on the terms and conditions of the contract and reflect gross premiums written less premiums ceded to reinsurers, and (2) the amount charged for policies in force during a fiscal period for traditional life business. Contract deposits include amounts received from customers on deposit-type contracts.

Retirement Product Lines:

•Net annuity contract deposits: Reflects total recurring deposits and single deposits/rollovers – net of contract deposits ceded to reinsurers.

Supplemental & Group Benefits

Worksite Direct Product Lines:

•Net premiums written and contract deposits: Reflects (1) the direct and assumed contractually determined amounts charged to policyholders/certificate holders for the effective period of the contract based on the terms and conditions of the contract and reflect gross premiums written less premiums ceded to reinsurers, and (2) the amount charged for policies in force during a fiscal period for traditional life business. Contract deposits include amounts received from customers on deposit-type contracts.

Employer-Sponsored Product Lines:

•Net premiums written: Reflects (1) the direct and assumed contractually determined amounts charged to policyholders for the effective period of the contract based on the terms and conditions of the contract and reflect gross premiums written less premiums ceded to reinsurers, and (2) the amount charged for policies in force during a fiscal period for traditional life business.

Investment yield, excluding limited partnership interests - annualized, pretax and after-tax - For the three month periods presented, investment yields are calculated by annualizing the result of year-to-date total net investment income, pretax adjusted to exclude (1) investment income from deposit asset on reinsurance, (2) investment income from limited partnership interests (excluding investment income on commercial mortgage loan funds) and (3) FHLB interest credited for the corresponding periods, divided by the average quarter-end and beginning of quarter carrying amount of the total investment portfolio as presented in the Consolidated Balance Sheets adjusted to exclude (1) FHLB funding agreements, (2) the carrying amount of limited partnership interests (excluding the carrying amount of commercial mortgage loan funds), and (3) gross unrealized investment gains (losses) on fixed maturity securities. For full year periods presented, investment yields are calculated by (i) summing the investment yields for each respective three-month period applicable to the year and (ii) dividing that sum per the calculation in (i) by four. Net investment income is the most directly comparable GAAP measure.

Net income return on equity - LTM: The ratio of (1) trailing 12 month net income to (2) the average of ending shareholders’ equity for the current quarter end and the preceding four quarter ends - referred to as the 5 quarter average of shareholders' equity.

•Net income return on equity - Annualized: The ratio of (1) annualized net income to (2) the 2 quarter average of shareholders' equity.

•Core return on equity - LTM: The ratio of (1) trailing 12 month core earnings to (2) the 5 quarter average of shareholders’ equity excluding net unrealized investment gains (losses) on fixed maturity securities and net reserve remeasurements attributable to discount rates. Net income return on equity - LTM is the most directly comparable GAAP measure.

•Core return on equity - Annualized: The ratio of (1) annualized core earnings to (2) the 2 quarter average of shareholders’ equity excluding net unrealized investment gains (losses) on fixed maturity securities and net reserve remeasurements attributable to discount rates. Net income return on equity - Annualized is the most directly comparable GAAP measure.

•Adjusted core return on equity - LTM: The ratio of (1) trailing 12 month adjusted core earnings to (2) the 5 quarter average of shareholders’ equity excluding net unrealized investment gains (losses) on fixed maturity securities and net reserve remeasurements attributable to discount rates. Net income return on equity - LTM is the most directly comparable GAAP measure.

•Adjusted core return on equity - Annualized: The ratio of (1) annualized adjusted core earnings to (2) the 2 quarter average of shareholders’ equity excluding net unrealized investment gains (losses) on fixed maturity securities and net reserve remeasurements attributable to discount rates. Net income return on equity - Annualized is the most directly comparable GAAP measure.

Net reserves - Property and casualty unpaid claim and claim expense reserves net of anticipated reinsurance recoverables.

Prior years’ reserve development - A measure which the Company reports for its Property & Casualty segment which identifies the increase or decrease in net incurred claim and claim expense reserves at successive valuation dates for claims which occurred in previous calendar years. In the opinion of management, a discussion of prior

years’ reserve development is useful to investors as it allows them to assess the impact on current period earnings of incurred claims experience from the current calendar year and previous calendar years.

Property & Casualty operating statistics - Operating measures utilized by the Company and the insurance industry regarding the relative profitability of property and casualty underwriting results.

•Loss ratio - The ratio of (1) the sum of net incurred losses and loss adjustment expenses to (2) net premiums earned.

•Underlying loss ratio - The sum of the loss ratio adjusted to remove the effect of catastrophe losses and prior years' reserve development. The loss ratio is the most directly comparable GAAP measure. Management believes this ratio provides a valuable measure of the Company's underlying underwriting performance that may be obscured by the effects of catastrophe losses and prior years' reserve development, the amounts of which may be significant and may vary significantly between periods.

•Expense ratio - The ratio of (1) the sum of operating expenses and the amortization of policy acquisition costs to (2) net earned premiums.

•Combined ratio - The sum of the loss ratio and the expense ratio. A combined ratio less than 100% generally indicates profitable underwriting prior to the consideration of net investment income.

•Underlying combined ratio or combined ratio excluding catastrophe losses and prior years’ reserve development - The sum of the loss ratio and the expense ratio adjusted to remove the effect of catastrophe losses and prior years’ reserve development. The combined ratio is the most directly comparable GAAP measure. Management believes this ratio provides a valuable measure of the Company’s underlying underwriting performance that may be obscured by the effects of catastrophe losses and prior years’ reserve development, the amounts of which may be significant and may vary significantly between periods.

Supplemental & Group Benefits operating statistics - Operating measures utilized by the Company and the insurance industry regarding the relative profitability of supplemental and group benefits underwriting results.

•Benefits ratio - The ratio of (1) the sum of benefits, settlement expenses and change in reserves to (2) net premiums and contract charges earned.

•Operating expense ratio - The ratio of (1) the sum of operating expenses and DAC amortization expense to (2) total revenues.

•Pretax profit margin - The ratio of (1) income before income taxes to (2) total revenues.

Sales – Sales data pertains to Horace Mann products and excludes authorized products sold by exclusive agents that are underwritten by third-party vendors. Sales should not be viewed as a substitute for any GAAP measure, including "sales" as it relates to non-insurance companies, and the Company’s definition of sales, sales deposits or new annualized sales might differ from that used by other companies. The Company utilizes sales information as a performance measure that indicates the productivity of its agency force. Sales are also a leading indicator of future revenue trends.

Sales for the Company’s operating segments are as follows:

Property & Casualty

•Sales: Sales are measured as premiums to be collected over the 12 months following the sale of new automobile and property policies.

Life & Retirement

Life Insurance Product Lines:

•Annualized sales: Annualized sales are based on the total yearly premium that the Company would expect to receive if all first year recurring premium policies would remain in force, plus 10% of single and indexed universal life excess premiums. Annualized sales measure activity associated with gaining new insurance business in the current period, and includes deposits received related to universal-life-type products.

Supplemental & Group Benefits

Worksite Direct Product Lines:

•Sales: Based on application received date on the submitted policy and measured as the submitted annual premium.

Employer-Sponsored Product Lines:

•Sales: Sales are measured based on estimated annualized premium on the effective date of sale.

| | | | | | | | |

| | News release for immediate release |

Contact information:

Heather J. Wietzel, Vice President, Investor Relations

217-788-5144 | investorrelations@horacemann.com

Horace Mann reports strong fourth-quarter and full-year 2023 results

SPRINGFIELD, Ill., February 7, 2024 — Horace Mann Educators Corporation (NYSE:HMN), the largest financial services company focused on helping America’s educators and a core small-cap value equity in the Financials sector, today reported financial results for the three months and full year ended December 31, 2023:

•Diversified business delivered full-year net income of $45 million, or $1.09 per share, and core earnings* of $64 million, or $1.54 per share, with reported book value of $28.78 and adjusted book value* of $36.29 at year end; fourth-quarter net income was $0.95 per share, with core earnings of $0.84 per share

•Total revenue rose 8% for the year and 16% for the fourth quarter with net premiums and contract charges earned up 3% and record net premiums written and contract deposits* up 6% for the year and fourth quarter, total net investment income up 11% for the year and 17% for the fourth quarter

•Property & Casualty segment results improved over 2022 with fourth-quarter segment profit of $9 million; Supplemental & Group Benefits and Life & Retirement segments continued to deliver strong results

•Full-year 2024 EPS estimated at $3.00-$3.30 as Property & Casualty segment expected to return to full-year profitability; reflects higher year-over-year corporate interest expense following the 2023 senior debt offering

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions, except per share amounts) | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Total revenues | | $ | 402.9 | | | $ | 346.4 | | | 16.3 | % | | $ | 1,491.9 | | | $ | 1,381.6 | | | 8.0 | % |

Net income (loss) | | 39.5 | | | (16.7) | | | N.M. | | 45.0 | | | 19.8 | | | 127.3 | % |

Net investment gains (losses), after tax | | 4.6 | | | (10.0) | | | N.M. | | (18.8) | | | (44.5) | | | N.M. |

Other expense - goodwill and intangible asset

impairments, after tax | | — | | | (3.8) | | | N.M. | | — | | | (3.8) | | | N.M. |

Core earnings (loss)* | | 34.9 | | | (2.9) | | | N.M. | | 63.8 | | | 68.1 | | | -6.3 | % |

| Adjusted core earnings* | | 37.8 | | | (1.5) | | | N.M. | | 72.0 | | | 79.8 | | | -9.8 | % |

| Per diluted share: | | | | | | | | | | | | |

Net income (loss) | | 0.95 | | | (0.40) | | | N.M. | | 1.09 | | | 0.47 | | | 131.9 | % |

Net investment gains (losses), after tax | | 0.11 | | | (0.25) | | | N.M. | | (0.45) | | | (1.07) | | | N.M. |

Other expense - goodwill and intangible asset

impairments, after tax | | — | | | (0.09) | | | N.M. | | — | | | (0.09) | | | N.M. |

Core earnings (loss) per diluted share* | | 0.84 | | | (0.06) | | | N.M. | | 1.54 | | | 1.63 | | | -5.5 | % |

Adjusted core earnings (loss) per diluted share* | | 0.91 | | | (0.04) | | | N.M. | | 1.74 | | | 1.91 | | | -8.9 | % |

| Book value per share | | | | | | | | 28.78 | | | 26.85 | | | 7.2 | % |

| Adjusted book value per share* | | | | | | | | 36.29 | | | 36.40 | | | -0.3 | % |

| Tangible book value per share* | | | | | | | | 30.79 | | | 30.58 | | | 0.7 | % |

N.M. - Not meaningful.

* These measures are not based on accounting principles generally accepted in the United States of America (non-GAAP). They are reconciled to the most directly comparable GAAP measures in the Appendix to the Investor Supplement. An explanation of these measures is contained in the Glossary of Selected Terms included as an exhibit in the Company’s reports filed with the Securities and Exchange Commission.

“We enter 2024 focused on helping all educators protect what they have today and prepare for a successful tomorrow while we also help school districts and other municipal employers attract and retain employees by providing more comprehensive benefits,”said Horace Mann President & CEO Marita Zuraitis. “We are diversifying

The Horace Mann Companies 1 Horace Mann Plaza Springfield, Illinois 62715-0001

217-789-2500 www.horacemann.com

to expand our reach in our core markets while managing our businesses to deliver consistent and reliable value to shareholders with a solid balance sheet and a compelling dividend.

“We remain highly confident in our ability to achieve the company’s long-term objectives of expanding our share of the education market and achieving a sustainable double-digit ROE in 2025.” Zuraitis added. “We are executing on our plan. In particular, 2023 results and our 2024 guidance clearly reflect the benefit of the property and casualty rate and non-rate underwriting actions we are taking. Our expectations for 2024 keep us on track to a core return on equity for the year near 9%.”

Details of the company’s guidance and outlook are included in the Q4 2023 investor presentation available on the Quarterly Results page of investors.horacemann.com.

Reporting Segment Results

Horace Mann reports financial results in three reporting segments: (1) Property & Casualty, (2) Life & Retirement, and (3) Supplemental & Group Benefits. The retail business, consisting of the Property & Casualty and Life & Retirement segments, provides insurance and financial services to individual educators through exclusive agents and direct capabilities. The Supplemental & Group Benefits segment provides worksite direct and employer-sponsored benefits through employers. These worksite offerings help school districts attract and retain staff.

Horace Mann adopted the Financial Accounting Standards Board’s Accounting Standard Update 2018-12 Financial Services - Insurance: Targeted Improvements to the Accounting for Long-Duration Contracts as of January 1, 2023, with a January 1, 2021 transition date. The company’s 2022 results have been recast to reflect the ASU and are reflected in this release on that basis.

Property & Casualty segment results reflect benefit of rate and non-rate actions

(All comparisons vs. same period in 2022, unless noted otherwise)

The Property & Casualty segment primarily markets private passenger auto insurance and residential home insurance. Horace Mann offers standard auto coverages, including liability, collision and comprehensive. Property coverage includes both homeowners and renters policies. For both auto and property coverage, Horace Mann offers educators a discounted rate and the Educator Advantage® package of features. The Property & Casualty segment represented 46% of total revenues in 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Property & Casualty net premiums written* | | $ | 176.0 | | | $ | 153.5 | | | 14.7 | % | | $ | 684.4 | | | $ | 617.5 | | | 10.8 | % |

Property & Casualty net income (loss) /

core earnings (loss)* | | 8.8 | | | (25.0) | | | 135.2 | % | | (35.5) | | | (44.4) | | | 20.0 | % |

| Property & Casualty combined ratio | | 100.9 | % | | 128.0 | % | | -27.1 | pts | | 113.3 | % | | 115.3 | % | | -2.0 | pts |

| Property & Casualty underlying loss ratio* | | 71.1 | % | | 81.6 | % | | -10.5 | pts | | 71.2 | % | | 71.3 | % | | -0.1 | pts |

| Property & Casualty expense ratio | | 26.9 | % | | 29.4 | % | | -2.5 | pts | | 27.0 | % | | 27.4 | % | | -0.4 | pts |

| Property & Casualty catastrophe losses | | 2.9 | % | | 8.0 | % | | -5.1 | pts | | 15.1 | % | | 13.0 | % | | 2.1 | pts |

| Property & Casualty underlying combined ratio* | | 98.0 | % | | 111.0 | % | | -13.0 | pts | | 98.2 | % | | 98.7 | % | | -0.5 | pts |

| Auto combined ratio | | 112.7 | % | | 143.6 | % | | -30.9 | pts | | 111.7 | % | | 119.0 | % | | -7.3 | pts |

| Auto underlying loss ratio* | | 84.7 | % | | 99.8 | % | | -15.1 | pts | | 81.7 | % | | 82.8 | % | | -1.1 | pts |

| Property combined ratio | | 80.1 | % | | 101.0 | % | | -20.9 | pts | | 116.1 | % | | 108.8 | % | | 7.3 | pts |

| Property underlying loss ratio* | | 47.0 | % | | 49.9 | % | | -2.9 | pts | | 52.2 | % | | 50.1 | % | | 2.1 | pts |

Including a profit of $8.8 million in the fourth quarter, the Property & Casualty segment’s net loss for the full year was in line with the company’s recent guidance, reflecting elevated catastrophe and non-catastrophe weather activity for much of the year. Property & Casualty net premiums written were up 10.8% for the year and 14.7% for the quarter. Segment net investment income was up 20.7% for the year and 32.9% for the quarter.

The year-over-year improvement in the fourth-quarter combined ratio demonstrated the benefit of the company’s rate and non-rate underwriting actions as well as catastrophe losses below our five-year average for the fourth quarter. Catastrophe losses for the quarter were $5.0 million, pretax, and catastrophe losses for the full-year were

$97.6 million, pretax, In total, there were seven events designated as catastrophes by Property Claims Services (PCS) in this year’s fourth quarter versus 13 events in last year’s fourth quarter.

The year-over-year increase in average written premiums for auto policies improved again in the fourth quarter to 16.7%. The fourth-quarter auto underlying loss ratio improved 15.1 points year-over-year to 84.7%, but reflected typical seasonality in auto loss trends even as the benefit of rate and non-rate underwriting actions begins to be seen.

The year-over-year increase in average written premiums for property policies was 13.2% in the fourth quarter, as rate increases taken over the past two years and inflation adjustments to coverage values continue to take effect. The fourth-quarter property underlying loss ratio improved to 47.0%.

Life & Retirement segment full-year net income of $72 million

(All comparisons vs. same period in 2022, unless noted otherwise)

The Life & Retirement segment markets 403(b) tax-qualified fixed, fixed indexed and variable annuities; the Horace Mann Retirement Advantage® open architecture platform for 403(b)(7) and other defined contribution plans; and other retirement products to educators as well as traditional term and whole life insurance products. Horace Mann is one of the largest participants in the K-12 educator portion of the 403(b) tax-qualified annuity market, measured by 403(b) net premiums written on a statutory accounting basis. The Life & Retirement segment represented 36% of total revenues in 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Life & Retirement net income | | $ | 19.2 | | | $ | 6.7 | | | N.M. | | $ | 71.5 | | | $ | 63.8 | | | 12.1 | % |

| Life & Retirement core earnings* | | 19.2 | | | 10.5 | | | 82.9 | % | | 71.5 | | | 67.6 | | | 5.8 | % |

| Life & Retirement adjusted core earnings* | | 19.2 | | | 8.8 | | | 118.2 | % | | 68.2 | | | 66.9 | | | 1.9 | % |

| Life annualized sales* | | 2.7 | | | 3.1 | | | -12.9 | % | | 9.3 | | | 9.3 | | | — | % |

| Life mortality costs | | 16.4 | | | 14.9 | | | 10.1 | % | | 69.4 | | | 68.6 | | | 1.2 | % |

| Net annuity contract deposits* | | 108.3 | | | 105.0 | | | 3.1 | % | | 455.9 | | | 429.3 | | | 6.2 | % |

Annuity assets under management(1) | | | | | | | | 5,186.9 | | | 4,837.9 | | | 7.2 | % |

Total assets under administration(2) | | | | | | | | 8,687.1 | | | 8,120.3 | | | 7.0 | % |

(1) Amount reported as of December 31, 2023 excludes $711.7 million of assets under management held under modified coinsurance reinsurance.

(2) Includes Annuity AUM, Brokerage and Advisory AUA, and Recordkeeping AUA.

Life & Retirement segment net income for the full year was ahead of recent guidance, as segment net investment income rose 13.6% in the fourth-quarter and 9.3% for the full-year, benefiting from higher returns on floating rate securities. The net interest spread on our fixed annuity business remained near our longer-term targeted range of 220 to 230 basis points. The spread was affected by lower limited partnership returns as well as higher FHLB borrowing costs as credit spreads tightened year over year. The net dollar contribution from our FHLB funding agreements remained stable compared with 2022, with FHLB borrowing costs reflected in interest credited.

For the Retirement business, net annuity contract deposits were up 6.2% for the year to $455.9 million. Educators continue to begin their relationship with Horace Mann through 403(b) retirement savings products, including the company’s attractive annuity products, which provide encouraging cross-sell opportunities.

Horace Mann currently has $5.2 billion in annuity assets under management, including $2.2 billion of fixed annuities, $2.6 billion of variable annuities and $0.4 billion of fixed indexed annuities. Assets under administration, which includes Horace Mann Retirement Advantage® and other advisory and recordkeeping assets, continue to benefit from the strong equity markets.

Life annualized sales were $9.3 million for the year. Life insurance in force rose to $20.5 billion at year-end.

Supplemental & Group Benefits segment full-year net income of $55 million

(All comparisons vs. same period in 2022, unless noted otherwise)

The Supplemental & Group Benefits segment markets employer-sponsored group solutions for districts and other public employers, as well as worksite direct products typically distributed through the employer channel. The worksite business provides group term life, disability and specialty health insurance along with supplemental products including cancer, heart, hospital, supplemental disability and accident coverages. The Supplemental & Group Benefits segment represented 19% of total revenues in 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

Supplemental & Group Benefits net income /

core earnings* | | $ | 13.3 | | | $ | 17.0 | | | -21.8 | % | | $ | 54.9 | | | $ | 65.9 | | | -16.7 | % |

Supplemental & Group Benefits adjusted

core earnings* | | 16.2 | | | 20.1 | | | -19.4 | % | | 66.4 | | | 78.3 | | | -15.2 | % |

Pretax profit margin(1) | | 23.3 | % | | 30.9 | % | | -7.6 | pts | | 24.3 | % | | 28.5 | % | | -4.2 | pts |

| Net premiums earned | | $ | 64.6 | | | $ | 68.3 | | | -5.4 | % | | $ | 259.8 | | | $ | 275.5 | | | -5.7 | % |

| Worksite direct products sales* | | 4.4 | | | 3.4 | | | 29.4 | % | | 15.1 | | | 9.2 | | | 64.1 | % |

| Employer-sponsored products sales* | | 1.1 | | | 1.1 | | | — | % | | 11.1 | | | 6.9 | | | 60.9 | % |

| Worksite direct products benefit ratio | | 36.3 | % | | 16.9 | % | | 19.4 | pts | | 29.1 | % | | 23.0 | % | | 6.1 | pts |

| Employer-sponsored products benefit ratio | | 36.2 | % | | 33.3 | % | | 2.9 | pts | | 41.4 | % | | 41.8 | % | | -0.4 | pts |

(1) Measured to total revenues.

Supplemental & Group Benefits segment full-year net income was $54.9 million, at the top end of recent guidance. The full-year benefit ratio for the worksite direct product line continued to move toward the longer-term target although utilization remains below historical levels. The full-year benefit ratio for the employer-sponsored product lines was in line with the prior year but also remains below the longer-term target.

The non-cash impact of amortization of intangible assets under purchase accounting reduced full-year 2023 core earnings by $14.6 million, pretax, vs. $15.7 million in 2022. Segment net investment income rose 31.6% in the fourth-quarter and 16.8% for the full-year.

Total segment sales for the year were $26.2 million, up 62.7% over the prior year, with worksite direct supplemental product sales of $15.1 million and employer-sponsored products of $11.1 million. Fourth-quarter sales reflected normal seasonality in this business area. Persistency remains relatively stable for the segment.

Consolidated Results

The Corporate & Other segment reduced total revenues by $20.6 million in 2023, largely due to realized investment losses related to proactive repositioning of the portfolio to enhance book yield. Interest expense was $8.6 million for the fourth quarter of 2023 compared to $5.9 million for the fourth quarter of 2022.

Total net investment income rose 11% in 2023

(All comparisons vs. same period in 2022, unless noted otherwise)

Horace Mann’s investment strategy is primarily focused on generating income to support product liabilities, and balances principal protection and risk. Total net investment income includes net investment income on the investment portfolio managed by Horace Mann, as well as accreted investment income on the deposit asset on reinsurance related to the company’s reinsurance of policy liabilities related to legacy individual annuities written in 2002 or earlier.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Pretax net investment income - investment portfolio | | $ | 90.9 | | | $ | 74.1 | | | 22.7 | % | | $ | 339.9 | | | $ | 297.4 | | | 14.3 | % |

Pretax investment income - deposit asset

on reinsurance | | 26.1 | | | 26.1 | | | — | % | | 104.9 | | | 103.5 | | | 1.4 | % |

| Total pretax net investment income | | 117.0 | | | 100.2 | | | 16.8 | % | | 444.8 | | | 400.9 | | | 11.0 | % |

Pretax net investment gains (losses) | | 5.7 | | | (12.7) | | | N.M | | (24.0) | | | (56.5) | | | N.M. |

Pretax net unrealized investment gains (losses) on fixed

maturity securities | | | | | | | | (417.6) | | | (571.9) | | | N.M. |

Investment yield, excluding limited partnership interests,

pretax - annualized | | 4.94 | % | | 4.01 | % | | 0.93 | pts | | 4.74 | % | | 4.26 | % | | 0.48 | pts |

N.M. - Not meaningful.

For the full year, total net investment income rose 11.0% and net investment income on the managed portfolio increased 14.3%, ahead of recent guidance due to strong fourth-quarter results. The full-year increase reflected

the benefit of the higher interest rate environment on floating rate investments. Investment yield on the portfolio excluding limited partnership interests was 4.74%, with new money yields continuing to exceed portfolio yields in the core fixed maturity securities portfolio.

The fixed maturity securities portfolio was in a net unrealized investment loss position of $417.6 million pretax at December 31, 2023, primarily due to higher interest rates. Net investment gains were $4.6 million after tax for the quarter.

Adjusted book value per share of $36.29 at year end

At December 31, 2023, shareholders’ equity was $1.18 billion, or $28.78 per share, as the net unrealized investment losses on fixed maturity securities continued to reflect the higher interest rate environment. Excluding the unrealized losses and effect of net reserve remeasurements attributable to discount rates*, shareholders’ equity was $1.48 billion, or $36.29 per share*. During 2023, Horace Mann repurchased 196,934 shares at an average price of $32.85. As of December 31, 2023, $34.9 million remained authorized for future repurchases under the share repurchase program.

At December 31, 2023, total debt was $546.0 million, reflecting $300.0 million of 7.25% senior notes issued in September 2023. The net proceeds from the sale of the 2028 Senior Notes were used to fully repay the $249.0 million balance on the company’s revolving credit facility. The ratio of debt-to-capital excluding net unrealized investment gains/losses and effect of net reserve remeasurements attributable to discount rates* was 26.9% at December 31, 2023, which aligns with levels appropriate for the company’s current financial strength ratings.

Quarterly webcast

Horace Mann’s senior management will discuss the company’s fourth-quarter and full-year financial results with investors on February 8, 2024 at 11:00 a.m. Eastern Time. The conference call will be webcast live at investors.horacemann.com and available later in the day for replay.

About Horace Mann

Horace Mann Educators Corporation (NYSE: HMN) is the largest financial services company focused on helping America’s educators and others who serve the community achieve lifelong financial success. The company offers individual and group insurance and financial solutions tailored to the needs of the educational community. Founded by Educators for Educators® in 1945, Horace Mann is headquartered in Springfield, Illinois. For more information, visit horacemann.com.

Safe Harbor Statement and Non-GAAP Measures

Certain statements included in this news release, including those regarding our earnings outlook, expected catastrophe losses, our investment strategies, our plans to implement additional rate actions, our plans relating to share repurchases and dividends, our efforts to enhance customer experience and expand our products and solutions to more educators, our strategies to create sustainable long-term growth and double-digit ROEs, our strategy to achieve a larger share of the education market, and other business strategies, constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are made based on management’s current expectations and beliefs concerning future developments and their potential effects upon Horace Mann and its subsidiaries. Horace Mann cautions investors that such statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond Horace Mann’s control, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking statements included in this document. Certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements can be found in the “Risk Factors” and “Forward-Looking Information” sections included in Horace Mann’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission (SEC). The forward-looking statements herein are subject to the risk, among others, that we will be unable to execute our strategy because of market or competitive conditions or other factors. Horace Mann does not undertake to update any particular forward-looking statement included in this document if we later become aware that such statement is not likely to be achieved.

Information contained in this news release include measures which are based on methodologies other than accounting principles generally accepted in the United States of America (GAAP). Reconciliations of non-GAAP measures to the closest GAAP measures are contained in the Appendix to the Investor Supplement and additional

descriptions of the non-GAAP measures are contained in the Glossary of Selected Terms included as an exhibit to Horace Mann’s SEC filings.

# # #

HORACE MANN EDUCATORS CORPORATION

Financial Highlights (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions, except per share data) | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Earnings Summary | | | | | | | | | | | | |

| Net income (loss) | | $ | 39.5 | | | $ | (16.7) | | | N.M. | | $ | 45.0 | | | $ | 19.8 | | | 127.3 | % |

| Net investment gains (losses), after tax | | 4.6 | | | (10.0) | | | N.M. | | (18.8) | | | (44.5) | | | N.M. |

Other expense - goodwill and intangible asset

impairments, after tax | | — | | | (3.8) | | | N.M. | | — | | | (3.8) | | | N.M. |

| Core earnings (loss)* | | 34.9 | | | (2.9) | | | N.M. | | 63.8 | | | 68.1 | | | -6.3 | % |

| Adjusted core earnings (loss)* | | 37.8 | | | (1.5) | | | N.M. | | 72.0 | | | 79.8 | | | -9.8 | % |

| | | | | | | | | | | | |

Per diluted share:(1) | | | | | | | | | | | | |

| Net income (loss) | | $ | 0.95 | | | $ | (0.40) | | | N.M. | | $ | 1.09 | | | $ | 0.47 | | | 131.9 | % |

| Net investment gains (losses), after tax | | 0.11 | | | (0.25) | | | N.M. | | (0.45) | | | (1.07) | | | N.M. |

Other expense - goodwill and intangible asset

impairments, after tax | | — | | | (0.09) | | | N.M. | | — | | | (0.09) | | | N.M. |

| Core earnings (loss)* | | 0.84 | | | (0.06) | | | N.M. | | 1.54 | | | 1.63 | | | -5.5 | % |

| Adjusted core earnings (loss)* | | 0.91 | | | (0.04) | | | N.M. | | 1.74 | | | 1.91 | | | -8.9 | % |

| | | | | | | | | | | | |

Weighted average number of shares and equivalent

shares (in millions) - Basic | | 41.3 | | | 41.4 | | | -0.2 | % | | 41.3 | | | 41.6 | | | -0.7 | % |

Weighted average number of shares and equivalent

shares (in millions) - Diluted | | 41.5 | | | 41.6 | | | -0.2 | % | | 41.4 | | | 41.8 | | | -1.0 | % |

| | | | | | | | | | | | |

| Return on Equity | | | | | | | | | | | | |

Net income return on equity - LTM(2) | | 4.0 | % | | 1.6 | % | | | | 4.0 | % | | 1.6 | % | | |

| Net income return on equity - annualized | | 14.2 | % | | (6.1) | % | | | | | | | | |

Core return on equity - LTM*(3) | | 4.3 | % | | 4.5 | % | | | | 4.3 | % | | 4.5 | % | | |

| Core return on equity - annualized* | | 9.5 | % | | (0.8) | % | | | | | | | | |

Adjusted core return on equity - LTM*(4) | | 4.9 | % | | 5.2 | % | | | | 4.9 | % | | 5.2 | % | | |

| Adjusted core return on equity - annualized* | | 10.3 | % | | (0.4) | % | | | | | | | | |

| | | | | | | | | | | | |

| Financial Position | | | | | | | | | | | | |

Per share:(5) | | | | | | | | | | | | |

| Book value | | | | | | | | $ | 28.78 | | | $ | 26.85 | | | 7.2 | % |

Effect of net unrealized investment (losses) on

fixed maturity securities | | | | | | | | (8.04) | | | (10.99) | | | N.M. |

Per share impact of net reserve

remeasurements attributable to discount rates* | | | | | | | | 0.53 | | | 1.44 | | | N.M. |

| Adjusted book value* | | | | | | | | $ | 36.29 | | | $ | 36.40 | | | -0.3 | % |

| Dividends paid | | $ | 0.33 | | | $ | 0.32 | | | 3.1 | % | | $ | 1.32 | | | $ | 1.28 | | | 3.1 | % |

Ending number of shares outstanding (in millions)(5) | | | | | | | | 40.8 | | | 40.9 | | | -0.2 | % |

| Total assets | | | | | | | | $ | 14,045.5 | | | $ | 13,306.1 | | | 5.6 | % |

| Short-term debt | | | | | | | | — | | | 249.0 | | | -100.0 | % |

| Long-term debt | | | | | | | | 546.0 | | | 249.0 | | | 119.3 | % |

| Total shareholders’ equity | | | | | | | | 1,175.3 | | | 1,098.3 | | | 7.0 | % |

N.M. - Not meaningful.

(1) Calculated using basic shares when in a net loss or core loss position.

(2) Based on last twelve months net income and average quarter-end shareholders’ equity.

(3) Based on last twelve months core earnings and average quarter-end shareholders’ equity which has been adjusted to exclude the fair value adjustment for investments, net of the related impact on deferred policy acquisition costs and applicable deferred taxes.

(4) Based on last twelve months adjusted core earnings and average quarter-end shareholders’ equity which has been adjusted to exclude the fair value adjustment for investments, net of the related impact on deferred policy acquisition costs and applicable deferred taxes.

(5) Ending shares outstanding were 40,836,734 at December 31, 2023 and 40,904,312 at December 31, 2022.

HORACE MANN EDUCATORS CORPORATION

Consolidated Statements of Operations and Data (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions, except per share data) | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Consolidated Statements of Operations | | | | | | | | | | | | |

| Net premiums and contract charges earned | | $ | 274.5 | | | $ | 259.1 | | | 5.9 | % | | $ | 1,057.1 | | | $ | 1,027.7 | | | 2.9 | % |

| Net investment income | | 117.0 | | | 100.2 | | | 16.8 | % | | 444.8 | | | 400.9 | | | 11.0 | % |

| Net investment gains (losses) | | 5.7 | | | (12.7) | | | N.M. | | (24.0) | | | (56.5) | | | N.M. |

| Other income | | 5.7 | | | (0.2) | | | N.M. | | 14.0 | | | 9.5 | | | 47.4 | % |

| Total revenues | | 402.9 | | | 346.4 | | | 16.3 | % | | 1,491.9 | | | 1,381.6 | | | 8.0 | % |

| | | | | | | | | | | | |

| Benefits, claims and settlement expenses | | 181.5 | | | 201.3 | | | -9.8 | % | | 769.1 | | | 747.0 | | | 3.0 | % |

| Interest credited | | 53.6 | | | 47.5 | | | 12.8 | % | | 205.7 | | | 173.4 | | | 18.6 | % |

| Operating expenses | | 82.5 | | | 86.1 | | | -4.2 | % | | 318.1 | | | 315.5 | | | 0.8 | % |

| DAC amortization expense | | 25.8 | | | 22.5 | | | 14.7 | % | | 101.2 | | | 88.2 | | | 14.7 | % |

| Intangible asset amortization expense | | 3.7 | | | 4.2 | | | -11.9 | % | | 14.8 | | | 16.8 | | | -11.9 | % |

| Interest expense | | 8.6 | | | 5.9 | | | 45.8 | % | | 29.7 | | | 19.4 | | | 53.1 | % |

Other expense - goodwill and intangible asset

impairments | | — | | | 4.8 | | | N.M. | | — | | | 4.8 | | | N.M. |

| Total benefits, losses and expenses | | 355.7 | | | 372.3 | | | -4.5 | % | | 1,438.6 | | | 1,365.1 | | | 5.4 | % |

| | | | | | | | | | | | |

| Income (loss) before income taxes | | 47.2 | | | (25.9) | | | N.M. | | 53.3 | | | 16.5 | | | N.M. |

| Income tax expense (benefit) | | 7.7 | | | (9.2) | | | N.M. | | 8.3 | | | (3.3) | | | N.M. |

| Net income (loss) | | $ | 39.5 | | | $ | (16.7) | | | N.M. | | $ | 45.0 | | | $ | 19.8 | | | 127.3 | % |

| | | | | | | | | | | | |

| Net Premiums Written and Contract Deposits* | | | | | | | | |

| Property & Casualty | | $ | 176.0 | | | $ | 153.5 | | | 14.7 | % | | $ | 684.4 | | | $ | 617.5 | | | 10.8 | % |

| Life & Retirement | | 140.5 | | | 136.8 | | | 2.7 | % | | 573.3 | | | 544.8 | | | 5.2 | % |

| Supplemental & Group Benefits | | 63.7 | | | 67.9 | | | -6.2 | % | | 259.8 | | | 274.7 | | | -5.4 | % |

| Total | | $ | 380.2 | | | $ | 358.2 | | | 6.1 | % | | $ | 1,517.5 | | | $ | 1,437.0 | | | 5.6 | % |

| | | | | | | | | | | | |

| Segment Net Income (Loss) | | | | | | | | | | | | |

| Property & Casualty | | $ | 8.8 | | | $ | (25.0) | | | 135.2 | % | | $ | (35.5) | | | $ | (44.4) | | | 20.0 | % |

| Life & Retirement | | 19.2 | | | 6.7 | | | 186.6 | % | | 71.5 | | | 63.8 | | | 12.1 | % |

| Supplemental & Group Benefits | | 13.3 | | | 17.0 | | | -21.8 | % | | 54.9 | | | 65.9 | | | -16.7 | % |

Corporate & Other(1) | | (1.8) | | | (15.4) | | | 88.3 | % | | (45.9) | | | (65.5) | | | 29.9 | % |

| Consolidated net income | | $ | 39.5 | | | $ | (16.7) | | | N.M. | | $ | 45.0 | | | $ | 19.8 | | | 127.3 | % |

| | | | | | | | | | | | |

| Net investment losses | | | | | | | | | | | | |

| Before tax | | $ | 5.7 | | | $ | (12.7) | | | N.M. | | $ | (24.0) | | | $ | (56.5) | | | N.M. |

| After tax | | 4.6 | | | (10.0) | | | N.M. | | (18.8) | | | (44.5) | | | N.M. |

| Per share, diluted | | $ | 0.11 | | | $ | (0.25) | | | N.M. | | $ | (0.45) | | | $ | (1.07) | | | N.M. |

N.M. - Not meaningful.

(1) Corporate & Other includes interest expense on debt and the impact of net investment gains and losses and other Corporate level items. The Company does not allocate the impact of corporate level transactions to the insurance segments consistent with how management evaluates the results of those segments. See detail for this segment on page 11.

HORACE MANN EDUCATORS CORPORATION

Business Segment Overview (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Property & Casualty | | | | | | | | | | | | |

| Net premiums written* | | $ | 176.0 | | | $ | 153.5 | | | 14.7 | % | | $ | 684.4 | | | $ | 617.5 | | | 10.8 | % |

| Net premiums earned | | 171.5 | | | 155.7 | | | 10.1 | % | | 645.6 | | | 608.2 | | | 6.1 | % |

| Net investment income | | 11.3 | | | 8.5 | | | 32.9 | % | | 37.9 | | | 31.4 | | | 20.7 | % |

| Other income | | 0.5 | | | 0.7 | | | -28.6 | % | | 2.8 | | | 3.4 | | | -17.6 | % |

| Losses and loss adjustment expenses (LAE) | | 127.0 | | | 153.5 | | | -17.3 | % | | 557.0 | | | 534.3 | | | 4.2 | % |

Operating expenses (includes amortization

expense) | | 46.1 | | | 45.8 | | | 0.7 | % | | 174.6 | | | 166.9 | | | 4.6 | % |

| Loss before income taxes | | 10.2 | | | (34.4) | | | 129.7 | % | | (45.3) | | | (58.2) | | | 22.2 | % |

| Net income (loss) / core income (loss)* | | 8.8 | | | (25.0) | | | 135.2 | % | | (35.5) | | | (44.4) | | | 20.0 | % |

| Net investment income, after tax | | 9.2 | | | 7.0 | | | 31.4 | % | | 31.1 | | | 26.4 | | | 17.8 | % |

| | | | | | | | | | | | |

| Catastrophe losses | | | | | | | | | | | | |

| After tax | | 3.9 | | | 9.8 | | | -60.2 | % | | 77.1 | | | 63.2 | | | 22.0 | % |

| Before tax | | 5.0 | | | 12.4 | | | -59.7 | % | | 97.6 | | | 80.0 | | | 22.0 | % |

Prior years’ reserve development, before tax(1) | | | | | | | | | | | | |

| Auto | | — | | | 14.0 | | | N.M. | | — | | | 28.0 | | | N.M. |

| Property and other | | — | | | — | | | N.M. | | — | | | (6.0) | | | N.M. |

| Total | | — | | | 14.0 | | | N.M. | | — | | | 22.0 | | | N.M. |

| | | | | | | | | | | | |

| Operating statistics: | | | | | | | | | | | | |

| Loss and loss adjustment expense ratio | | 74.0 | % | | 98.6 | % | | -24.6 | pts | | 86.3 | % | | 87.9 | % | | -1.6 | pts |

| Expense ratio | | 26.9 | % | | 29.4 | % | | -2.5 | pts | | 27.0 | % | | 27.4 | % | | -0.4 | pts |

| Combined ratio | | 100.9 | % | | 128.0 | % | | -27.1 | pts | | 113.3 | % | | 115.3 | % | | -2.0 | pts |

| Effect on the combined ratio of: | | | | | | | | | | | | |

| Catastrophe losses | | 2.9 | % | | 8.0 | % | | -5.1 | pts | | 15.1 | % | | 13.0 | % | | 2.1 | pts |

Prior years’ reserve development(1) | | — | % | | 9.0 | % | | -9.0 | pts | | — | % | | 3.6 | % | | -3.6 | pts |

Combined ratio excluding the effects of catastrophe losses and prior years’ reserve development (underlying combined ratio)* | | 98.0 | % | | 111.0 | % | | -13.0 | pts | | 98.2 | % | | 98.7 | % | | -0.5 | pts |

| | | | | | | | | | | | |

| Risks in force (in thousands) | | | | | | | | 526 | | | 538 | | | -2.2 | % |

Auto(2) | | | | | | | | 358 | | | 367 | | | -2.5 | % |

| Property | | | | | | | | 168 | | | 171 | | | -1.8 | % |

| | | | | | | | | | | | |

| Household Retention - LTM | | | | | | | | | | | | |

Auto(3) | | | | | | | | 86.3 | % | | 87.0 | % | | -0.7 | pts |

Property(3) | | | | | | | | 90.3 | % | | 89.6 | % | | 0.7 | pts |

N.M. - Not meaningful.

(1) (Favorable) unfavorable.

(2) Includes assumed risks in force of 4.

(3) Retention is based on retained households. History has been restated to reflect this change.

HORACE MANN EDUCATORS CORPORATION

Business Segment Overview (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Life & Retirement | | | | | | | | | | | | |

| Net premiums written and contract deposits* | | $ | 140.5 | | | $ | 136.8 | | | 2.7 | % | | $ | 573.3 | | | $ | 544.8 | | | 5.2 | % |

| | | | | | | | | | | | |

| Net premiums and contract charges earned | | 38.4 | | | 35.1 | | | 9.4 | % | | 151.7 | | | 144.0 | | | 5.3 | % |

| Net investment income | | 95.8 | | | 84.3 | | | 13.6 | % | | 369.9 | | | 338.3 | | | 9.3 | % |

| Other income | | 4.9 | | | 3.6 | | | 36.1 | % | | 17.0 | | | 17.0 | | | — | % |

| | | | | | | | | | | | |

Death benefits / mortality cost(1) | | 16.4 | | | 14.9 | | | 10.1 | % | | 69.4 | | | 68.6 | | | 1.2 | % |

| Interest credited | | 52.4 | | | 46.9 | | | 11.7 | % | | 201.8 | | | 172.1 | | | 17.3 | % |

| Change in reserves | | 15.8 | | | 15.5 | | | 1.9 | % | | 53.8 | | | 52.9 | | | 1.7 | % |

| Operating expenses | | 26.0 | | | 27.8 | | | -6.5 | % | | 98.7 | | | 102.4 | | | -3.6 | % |

| DAC amortization expense | | 6.2 | | | 5.9 | | | 5.1 | % | | 28.1 | | | 23.0 | | | 22.2 | % |

| Intangible asset amortization expense | | — | | | 0.3 | | | -100.0 | % | | 0.2 | | | 1.1 | | | -81.8 | % |

Other expense - goodwill and intangible asset

impairments | | — | | | 4.8 | | | N.M. | | — | | | 4.8 | | | N.M. |

| | | | | | | | | | | | |

| Income before income taxes | | 22.3 | | | 6.9 | | | N.M. | | 86.6 | | | 74.4 | | | 16.4 | % |

| Income tax expense | | 3.1 | | | 0.2 | | | N.M. | | 15.1 | | | 10.6 | | | 42.5 | % |

| Net income | | 19.2 | | | 6.7 | | | N.M. | | 71.5 | | | 63.8 | | | 12.1 | % |

| Core earnings* | | 19.2 | | | 10.5 | | | 82.9 | % | | 71.5 | | | 67.6 | | | 5.8 | % |

| Adjusted core earnings* | | 19.2 | | | 8.8 | | | 118.2 | % | | 68.2 | | | 66.9 | | | 1.9 | % |

| | | | | | | | | | | | |

| Life policies in force (in thousands) | | | | | | | | 162 | | | 162 | | | — | % |

| Life insurance in force | | | | | | | | $ | 20,476 | | | $ | 20,030 | | | 2.2 | % |

Lapse ratio - 12 months(1) | | | | | | | | 4.3 | % | | 4.0 | % | | 0.3 | pts |

| | | | | | | | | | | | |

| Annuity contracts in force (in thousands) | | | | | | | | 223 | | | 228 | | | -2.2 | % |

Horace Mann Retirement Advantage® contracts in force (in thousands) | | | | | | | | 19 | | | 17 | | | 11.8 | % |

| Total Persistency - LTM | | | | | | | | 91.5 | % | | 93.7 | % | | -2.2 | pts |

N.M. - Not meaningful.

(1) Ordinary life insurance.

HORACE MANN EDUCATORS CORPORATION

Business Segment Overview (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Supplemental & Group Benefits | | | | | | | | | | | | |

| Net premiums and contract charges earned | | $ | 64.6 | | | $ | 68.3 | | | -5.4 | % | | $ | 259.8 | | | $ | 275.5 | | | -5.7 | % |

| Net investment income | | 10.4 | | | 7.9 | | | 31.6 | % | | 38.9 | | | 33.3 | | | 16.8 | % |

| Other income | | (2.9) | | | (5.0) | | | 42.0 | % | | (11.1) | | | (13.4) | | | 17.2 | % |

| Benefits, settlement expenses and change in reserves | | 22.3 | | | 17.4 | | | 28.2 | % | | 88.9 | | | 91.2 | | | -2.5 | % |

| Interest credited | | 1.2 | | | 0.6 | | | 100.0 | % | | 3.9 | | | 1.3 | | | N.M. |

| Operating expenses (includes DAC amortization expense) | | 28.2 | | | 27.2 | | | 3.7 | % | | 110.5 | | | 103.2 | | | 7.1 | % |

| Intangible asset amortization expense | | 3.7 | | | 3.9 | | | -5.1 | % | | 14.6 | | | 15.7 | | | -7.0 | % |

| Income before income taxes | | 16.7 | | | 22.1 | | | -24.4 | % | | 69.7 | | | 84.0 | | | -17.0 | % |

| Net income / core earnings* | | 13.3 | | | 17.0 | | | -21.8 | % | | 54.9 | | | 65.9 | | | -16.7 | % |

| Adjusted core earnings* | | 16.2 | | | 20.1 | | | -19.4 | % | | 66.4 | | | 78.3 | | | -15.2 | % |

| | | | | | | | | | | | |

Benefit ratio(1) | | 36.2 | % | | 26.2 | % | | 10.0 | pts | | 35.7 | % | | 33.5 | % | | 2.2 | pts |

Operating expense ratio(2) | | 39.1 | % | | 38.4 | % | | 0.7 | pts | | 38.4 | % | | 35.0 | % | | 3.4 | pts |

Pretax profit margin(3) | | 23.3 | % | | 30.9 | % | | -7.6 | pts | | 24.3 | % | | 28.5 | % | | -4.2 | pts |

| | | | | | | | | | | | |

| Worksite Direct products benefit ratio | | 36.3 | % | | 16.9 | % | | 19.4 | pts | | 29.1 | % | | 23.0 | % | | 6.1 | pts |

| Worksite Direct premium persistency (rolling 12 months) | | 91.4 | % | | 90.4 | % | | 1.0 | pts | | 91.4 | % | | 90.4 | % | | 1.0 | pts |

| Employer-sponsored products benefit ratio | | 36.2 | % | | 33.3 | % | | 2.9 | pts | | 41.4 | % | | 41.8 | % | | -0.4 | pts |

N.M. - Not meaningful.

(1) Ratio of benefits to net premiums earned.

(2) Ratio of operating expenses to total revenues.

(3) Ratio of income before taxes to total revenues.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

Corporate & Other(1) | | | | | | | | | | | | |

| Components of loss before tax: | | | | | | | | | | | | |

| Net investment gains (losses) | | $ | 5.7 | | | $ | (12.7) | | | N.M. | | $ | (24.0) | | | $ | (56.5) | | | N.M. |

| Interest expense | | (8.6) | | | (5.9) | | | -45.8 | % | | (29.7) | | | (19.4) | | | -53.1 | % |

Other operating expenses, net investment income

and other income | | 0.9 | | | (1.9) | | | 147.4 | % | | (4.0) | | | (7.8) | | | 48.7 | % |

| Loss before income taxes | | (2.0) | | | (20.5) | | | 90.2 | % | | (57.7) | | | (83.7) | | | 31.1 | % |

| Net loss | | (1.8) | | | (15.4) | | | 88.3 | % | | (45.9) | | | (65.5) | | | 29.9 | % |

| Core loss* | | (6.4) | | | (5.4) | | | -18.5 | % | | (27.1) | | | (21.0) | | | -29.0 | % |

N.M. - Not meaningful.

(1) The Corporate & Other segment includes interest expense on debt and the impact of investment gains and losses and other corporate level items. The Company does not allocate the impact of corporate level transactions to the insurance segments consistent with how management evaluates the results of those segments.

HORACE MANN EDUCATORS CORPORATION

Business Segment Overview (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Investments | | | | | | | | | | | | |

| Life & Retirement | | | | | | | | | | | | |

Fixed maturity securities, at fair value (amortized cost, net 2023, $4,293.5; 2022, $4,404.7) | | | | | | | | $ | 3,960.3 | | | $ | 3,960.1 | | | — | % |

| Equity securities, at fair value | | | | | | | | 62.8 | | | 75.6 | | | -16.9 | % |

| Short-term investments | | | | | | | | 36.5 | | | 70.4 | | | -48.2 | % |

| Policy loans | | | | | | | | 140.5 | | | 138.4 | | | 1.5 | % |

| Limited partnership interests | | | | | | | | 816.1 | | | 697.2 | | | 17.1 | % |

| Other investments | | | | | | | | 86.7 | | | 62.0 | | | 39.8 | % |

| Total Life & Retirement investments | | | | | | | | 5,102.9 | | | 5,003.7 | | | 2.0 | % |

| | | | | | | | | | | | |

| Property & Casualty | | | | | | | | | | | | |

Fixed maturity securities, at fair value (amortized cost, net 2023, $659.6; 2022, $591.6) | | | | | | | | 640.8 | | | 551.3 | | | 16.2 | % |

| Equity securities, at fair value | | | | | | | | 16.5 | | | 16.7 | | | -1.2 | % |

| Short-term investments | | | | | | | | 49.1 | | | 18.2 | | | N.M. |

| Limited partnership interests | | | | | | | | 200.6 | | | 190.1 | | | 5.5 | % |

| Other investments | | | | | | | | 1.0 | | | 1.0 | | | — | % |

| Total Property & Casualty investments | | | | | | | | 908.0 | | | 777.3 | | | 16.8 | % |

| | | | | | | | | | | | |

| Supplemental & Group Benefits | | | | | | | | | | | | |

Fixed maturity securities, at fair value (amortized cost, net 2023, $699.6; 2022, $760.4) | | | | | | | | 634.0 | | | 673.4 | | | -5.9 | % |

| Equity securities, at fair value | | | | | | | | 5.9 | | | 6.3 | | | -6.3 | % |

| Short-term investments | | | | | | | | 45.3 | | | 20.0 | | | 126.5 | % |

| Policy loans | | | | | | | | 0.9 | | | 0.9 | | | — | % |

| Limited partnership interests | | | | | | | | 122.1 | | | 96.4 | | | 26.7 | % |

| Other investments | | | | | | | | 8.2 | | | 7.6 | | | 7.9 | % |

| Total Supplemental & Group Benefits investments | | | | | | | | 816.4 | | | 804.6 | | | 1.5 | % |

| | | | | | | | | | | | |

| Corporate & Other | | | | | | | | | | | | |

Fixed maturity securities, at fair value (amortized cost, net 2023, $0.2; 2022, $0.2) | | | | | | | | 0.2 | | | 0.2 | | | — | % |

| Equity securities, at fair value | | | | | | | | 1.0 | | | 1.0 | | | — | % |

| Short-term investments | | | | | | | | 2.0 | | | 0.8 | | | 150.0 | % |

| Total Corporate & Other investments | | | | | | | | 3.2 | | | 2.0 | | | 60.0 | % |

| Total investments | | | | | | | | $ | 6,830.5 | | | $ | 6,587.6 | | | 3.7 | % |

| | | | | | | | | | | | |

| Net investment income - investment portfolio | | | | | | | | | | | | |

| Before tax | | $ | 90.9 | | | $ | 74.1 | | | 22.7 | % | | $ | 339.9 | | | $ | 297.4 | | | 14.3 | % |

| After tax | | 72.0 | | | 58.9 | | | 22.2 | % | | 269.6 | | | 236.6 | | | 13.9 | % |

| Investment income - deposit asset on reinsurance | | | | | | | | | | | | |

| Before tax | | $ | 26.1 | | | 26.1 | | | — | % | | $ | 104.9 | | | 103.5 | | | 1.4 | % |

| After tax | | 20.7 | | | 20.6 | | | 0.5 | % | | 82.9 | | | 81.7 | | | 1.5 | % |

N.M. - Not meaningful.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

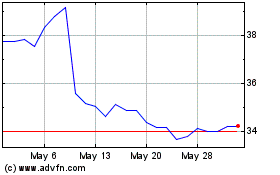

Horace Mann Educators (NYSE:HMN)

Historical Stock Chart

From Apr 2024 to May 2024

Horace Mann Educators (NYSE:HMN)

Historical Stock Chart

From May 2023 to May 2024