|

Filed by Frank’s International N.V.

|

|

Pursuant to Rule 425 of the Securities Act of 1933

|

|

and deemed filed pursuant to Rule 14a-12

|

|

of the Securities Exchange Act of 1934

|

|

Subject Company: Frank’s International N.V.

|

|

Commission File No.: 001-36053

|

[The following passages are excerpts from a transcript of the Frank’s International second quarter 2021 earnings conference call, which occurred on August 3, 2021.]

I will now turn the call over to Mike who will give some financial and operational highlights from our second quarter and an update on our merger with Expro Group after which I will review the financial performance details.

* * *

Finally, referring to Slide 8, I would like to provide an update on our announced merger with Expro Group. Over the last several months, integration teams have been making great strides in the identification of synergies and making preparations for Day 1 of the New Expro. We remain on schedule to close in the third quarter and begin realizing our shared vision of a new global full-cycle leader in energy services. Our integration teams have plans well underway to bring together our two companies in a way that will enable us to hit the ground running and take advantage of significant synergies and truly unleash the power of our combined platform. Working with the Expro team over the past several months has only strengthened my conviction in the opportunities ahead for our combined company. We are confident of the opportunities before us to build substantial value for shareholders, employees and customers. As a combined company, we will have significant scale, and an expanded portfolio to offer customers cost-effective, innovative solutions, to address their requirements at every stage of the well life cycle. By combining Expro and Frank’s portfolios and global footprints, we will benefit from significant growth and cost savings opportunities, as well as opportunities to strengthen our relationships with, and better serve, our collective blue-chip customer base. With a very robust balance sheet and enhanced cash flow profile, we will have the capacity to continue to invest in our technology platforms. Our next generation of solutions will assist our customers in their energy transition plans to achieve a lower carbon future. Frank’s Board and management team have been strong believers in the benefits of industry consolidation, and I am proud to say we moved aggressively to gain scale in a thoughtful way that will benefit our shareholders.

* * *

Additionally, $4.3 million dollars of merger related expenses were paid during the second quarter.

* * *

While we expect additional merger and acquisition related payments upon closing of the transaction with Expro, we continue to focus on managing our cash flows through the quarters and feel the back half of the year will provide for stronger results in this regard.

* * *

First, we are very excited about our planned combination with Expro Group, which is expected to close by the end of the third quarter. The teams of both respective companies are dedicated to creating one of the strongest oilfield services companies in the industry, and providing some of the most innovative solutions to our customers globally.

* * *

Finally, we will continue our focus on operational execution, capital discipline, and cost reduction efforts which has enabled us to maintain one of the strongest balance sheets in the oilfield services space. This enviable position puts the new combined company on solid footing as it progresses through the integration process and positions itself for future growth and expansion.

As we approach the closing of the Expro merger, I would like to reiterate my continued thanks to all of our employees, for their hard work and dedication to the Frank’s organization. Your unselfish drive to excel, even through the difficulties brought about by COVID, has enabled our organization to stay focused on providing the absolute best service quality for our customers and safety for our employees.

We look forward to updating you on our progress in the near future as a combined entity. Many thanks to everyone on the call for your continued interest in Frank’s. We hope you enjoy the rest of your day, good-bye.

No Offer or Solicitation

This communication relates to a proposed merger and related transactions (the “Transactions”) between Frank’s International N.V. (“Frank’s”) and Expro Group Holdings International Limited (“Expro”). This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Transactions or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Important Additional Information

In connection with the Transactions, Frank’s has filed a registration statement on Form S-4 (the “Registration Statement”) with the U.S. Securities and Exchange Commission (the “SEC”), which includes a preliminary proxy statement/prospectus of Frank’s. In addition, Frank’s intends to file other relevant materials with the SEC regarding the Transactions. After the Registration Statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to the shareholders of Frank’s and Expro. SHAREHOLDERS OF FRANK’S AND EXPRO ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE TRANSACTIONS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS. Such shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important information about Frank’s and Expro once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Additional information is available on the Frank’s website, www.franksinternational.com.

Participants in the Solicitation

Frank’s and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Frank’s in connection with the Transactions. Expro and its officers and directors may also be deemed participants in such solicitation. Information regarding Frank’s directors and executive officers is contained in the preliminary proxy statement/prospectus, the proxy statement for Frank’s 2020 Annual Meeting of Shareholders, which was filed with the SEC on April 28, 2020, Frank’s Annual Report on Form 10-K for the year ended December 31, 2020, which was filed with the SEC on March 1, 2021, and certain of its Current Reports on Form 8-K. You can obtain a free copy of these documents at the SEC’s website at http://www.sec.gov or by accessing Frank’s website at http://www.franksinternational.com. Other information regarding persons who may be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the Registration Statement and the preliminary proxy statement/prospectus and will be contained in amendments thereto, as well as other relevant materials to be filed with the SEC when they become available.

Forward-Looking Statements and Cautionary Statements

The foregoing contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that Expro or Frank’s expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “goal,” “future,” “assume,” “forecast,” “build,” “focus,” “work,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance that convey the uncertainty of future events or outcomes identify the forward-looking statements, although not all forward-looking statements contain such identifying words. Without limiting the generality of the foregoing, forward-looking statements contained in this press release specifically include, but are not limited to, statements, estimates and projections regarding the Transactions, pro forma descriptions of the combined company, anticipated or expected revenues, EBITDA, synergies or cost-savings, operations, integration and transition plans, opportunities and anticipated future performance. These statements are based on certain assumptions made by Frank’s and Expro based on management’s experience, expectations and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate. Forward-looking statements are not guarantees of performance.

Although Frank’s and Expro believe the expectations reflected in these forward-looking statements are reasonable and are based on reasonable assumptions, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all) or will prove to have been correct. Moreover, such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of Frank’s, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Such risks and uncertainties include the risk of the failure to obtain the required votes of Frank’s and Expro’s shareholders; the timing to consummate the Transactions; the risk that the conditions to closing of the Transactions may not be satisfied or that the closing of the Transactions otherwise does not occur; the failure to close the Transactions on the anticipated terms, including the anticipated tax treatment; the risk that a regulatory approval, consent or authorization that may be required for the Transactions is not obtained in a timely manner or at all, or is obtained subject to conditions that are not anticipated; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement relating to the Transactions; unanticipated difficulties or expenditures relating to the Transactions; the diversion of management time on Transactions-related matters; the ultimate timing, outcome and results of integrating the operations of Frank’s and Expro; the effects of the business combination of Frank’s and Expro following the consummation of the Transactions, including the combined company’s future financial condition, results of operations, strategy and plans; the risk that any announcements relating to the Transactions could have adverse effects on the market price of Frank’s common stock; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Transactions; expected synergies and other benefits from the Transactions; the potential for litigation related to the Transactions; results of litigation, settlements and investigations; actions by third parties, including governmental agencies; volatility in customer spending and in oil and natural gas prices, which could adversely affect demand for Frank’s and Expro’s services and their associated effect on rates, utilization, margins and planned capital expenditures; unique risks associated with offshore operations; global economic conditions; liabilities from operations; decline in, and ability to realize, backlog; equipment specialization and new technologies; adverse industry conditions; adverse credit and equity market conditions; difficulty in building and deploying new equipment; difficulty in integrating acquisitions; shortages, delays in delivery and interruptions of supply of equipment, supplies and materials; weather; loss of, or reduction in business with, key customers; legal proceedings; ability to effectively identify and enter new markets; governmental regulation, including legislative and regulatory initiatives addressing global climate change or other environmental concerns; investment in and development of competing or alternative energy sources; ability to retain and hire key personnel, including management and field personnel; the length of time it will take for the United States and the rest of the world to slow the spread of the COVID-19 virus to the point where applicable authorities ease current restrictions on various commercial and economic activities; and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond Expro’s or Frank’s control, including those detailed in Frank’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on Frank’s website at http://www.franksinternational.com and on the SEC’s website at http://www.sec.gov. Any forward-looking statement speaks only as of the date on which such statement is made, and Expro and Frank’s undertake no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward- looking statements.

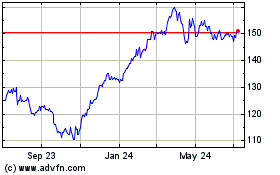

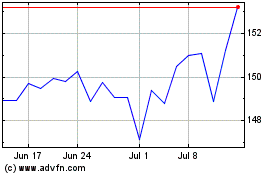

Fiserv (NYSE:FI)

Historical Stock Chart

From Apr 2024 to May 2024

Fiserv (NYSE:FI)

Historical Stock Chart

From May 2023 to May 2024