0000858470false00008584702023-08-072023-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): August 7, 2023

COTERRA ENERGY INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-10447 | | 04-3072771 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| Three Memorial City Plaza | | |

| 840 Gessner Road, Suite 1400 | | |

Houston, Texas | | 77024 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (281) 589-4600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.10 per share | CTRA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 7, 2023, we issued a press release with respect to our 2023 second quarter earnings. The press release is furnished as Exhibit 99.1 to this Current Report. The press release contains certain measures which may be deemed “non-GAAP financial measures” as defined in Item 10 of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In each case, the most directly comparable GAAP financial measure and information reconciling the GAAP and non-GAAP measures is also included in the press release.

Exhibit 99.1 shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any registration statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act unless specifically identified in such filing as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | COTERRA ENERGY INC. |

| | |

| | |

| | By: | /s/ TODD M. ROEMER |

| | | Todd M. Roemer |

| | | Vice President and Chief Accounting Officer |

Date: August 7, 2023

News Release

Coterra Energy Reports Second-Quarter 2023 Results, Announces Quarterly Dividend

HOUSTON, August 7, 2023 - Coterra Energy Inc. (NYSE: CTRA) (“Coterra” or the “Company”) today reported second-quarter 2023 financial and operating results. Thomas E. Jorden, Chairman, Chief Executive Officer and President, commented, “Coterra continues to demonstrate outstanding operational execution, with a notable production beat this quarter driven primarily by strong well performance. As such we are increasing our 2023 BOE and natural gas production guidance by 2% and our oil guidance by 3%, at the mid-point. Coterra remains committed to maximizing shareholder value through consistent, profitable growth.”

Second-Quarter 2023 Highlights

•Net Income (GAAP) totaled $209 million, or $0.28 per share. Adjusted Net Income (non-GAAP) was $291 million, or $0.39 per share.

•Cash Flow From Operating Activities (GAAP) totaled $646 million. Discretionary Cash Flow (non-GAAP) totaled $705 million.

•Cash capital expenditures for drilling, completion and other fixed asset additions (GAAP) totaled $592 million. Accrued capital expenditures from drilling, completion and other fixed asset additions (non-GAAP) totaled $537 million, within our guidance range of $510 - $570 million.

•Free Cash Flow (non-GAAP) totaled $113 million.

•Unit operating cost totaled $8.27 per BOE (barrel of oil equivalent), within our annual guidance range of $7.30-$9.40 per BOE.

•Total equivalent production of 665 MBoepd (thousand barrels of oil equivalent per day), exceeded the high-end of guidance (650 MBoepd), driven by strong well performance and improved cycle times in all three of our regions.

◦Oil production averaged 95.8 MBopd (thousand barrels of oil per day), exceeding the high-end of guidance (91.5 MBopd).

◦Natural gas production averaged 2,904 MMcfpd (million cubic feet per day), exceeding the high-end of guidance (2,850 MMcfpd).

◦Natural Gas Liquids (NGLs) production averaged 85.0 MBoepd.

•Realized average prices:

◦Oil: $71.88 per Bbl (barrel), excluding the effect of commodity derivatives, and $72.17 per Bbl, including the effect of commodity derivatives

◦Natural Gas: $1.65 per Mcf (thousand cubic feet), excluding the effect of commodity derivatives, and $1.95 per Mcf, including the effect of commodity derivatives

◦Natural Gas Liquids (NGLs): $16.67 per BOE (barrel of oil equivalent)

Shareholder Return Highlights

Jorden noted, "Given that commodity prices were down more than 30% quarter-over-quarter, Coterra will return 184% of 2Q23 Free Cash Flow to shareholders, which is significantly above our minimum 50% return commitment, as our cash position has afforded us the luxury to transact counter-cyclically on share repurchases."

•Common Dividend: On August 7, 2023, Coterra's Board of Directors (the "Board") approved a quarterly base dividend of $0.20 per share, which will be paid on August 31, 2023 to holders of record on August 17, 2023.

•Share Repurchases: During the quarter, the Company repurchased 2.4 million shares for $57 million at an average price of $23.55 per share, leaving $1.7 billion remaining on the $2.0 billion share repurchase authorization as of June 30, 2023.

•Total Shareholder Return: During the quarter, total shareholder return amounted to $208 million, comprised of $151 million of declared dividends and $57 million of share repurchases, representing 184% of Free Cash Flow. Year-to-date, total shareholder return amounted to $628 million, comprised of $303 million of declared dividends and $325 million of share repurchases, representing 94% of Free Cash Flow.

•Reiterate Shareholder Return Strategy: Coterra remains committed to returning 50%+ of Free Cash Flow to shareholders through its $0.80/share annual dividend and share repurchases. Based on the share repurchases executed to date and expected declared dividends for the year, Coterra is on track to return at least 75% of currently forecasted Free Cash Flow.

Guidance Update and Activity Outlook:

•Increasing full-year 2023 production guidance to the following:

◦Total production volumes of 630-655 MBoepd; mid-point +2% from prior guidance

◦Oil production of 91.0-94.0 MBopd; mid-point +3% from prior guidance

◦Natural gas production of 2,750-2,900 MMcfpd; mid-point +2% from prior guidance

•2023 capital budget (accrual basis) remains unchanged at $2.0 - $2.2 billion

•Estimate 2023 Discretionary Cash Flow of approximately $3.4 billion, at recent strip prices

•Estimate 2023 Free Cash Flow of approximately $1.2 billion, at recent strip prices

Third-quarter 2023 production and capital guidance:

•Total production volumes of 625-655 MBoepd

•Oil production of 88.0-91.0 MBopd

•Natural gas production of 2,775-2,875 MMcfpd

•Expect capital expenditures (accrual basis) of $540 – $610 million

Coterra is currently running six rigs and three completion crews in the Permian Basin, one rig and one completion crew in the Anadarko Basin, and two rigs and one completion crew in the Marcellus.

Strong Financial Position

Coterra maintains a strong financial position with an investment-grade credit rating and approximately $2.3 billion of liquidity. As of June 30, 2023, Coterra had total long-term debt of $2.2 billion with a principal amount of $2.1 billion. The company exited the quarter with a cash balance of $841 million, no debt outstanding under its $1.5 billion five-year revolving credit facility, and no near-term debt maturities. Coterra's net debt to trailing twelve months Adjusted EBITDAX ratio (non-GAAP) at June 30, 2023 was 0.2x.

Year-to-date 2023 Summary Highlights

•Net Income (GAAP) totaled $886 million, or $1.16 per share. Adjusted Net Income (non-GAAP) totaled $953 million, or $1.25 per share.

•Cash Flow From Operating Activities of $2,140 million. Discretionary Cash Flow (non-GAAP) totaled $1,744 million.

•Cash capital expenditures for drilling, completion and other fixed asset additions (GAAP) totaled $1,075 million. Accrued capital expenditures for drilling, completion and other fixed asset additions (non-GAAP) totaled $1,105 million.

•Free Cash Flow equaled $669 million (non-GAAP).

See “Supplemental non-GAAP Financial Measures” below for descriptions of the above non-GAAP measures as well as reconciliations of these measures to the associated GAAP measures.

Committed to Sustainability and ESG Leadership

Coterra is committed to environmental stewardship, sustainable practices, and strong corporate governance. The Company's sustainability report can be found under "A Sustainable Future" on www.coterra.com. Coterra plans to publish its 2023 Sustainability Report in the fourth quarter of 2023.

Second-Quarter 2023 Conference Call

Coterra will host a conference call tomorrow, Tuesday, August 8, 2023, at 9:00 AM CT (10:00 AM ET), to discuss second-quarter 2023 financial and operating results.

Conference Call Information

Date: August 8, 2023

Time: 10:00 AM ET / 9:00 AM CT

Dial-in (for callers in the U.S. and Canada): (888) 550-5424

International dial-in: (646) 960-0819

Conference ID: 3813676

The live audio webcast and related earnings presentation can be accessed on the "Events & Presentations" page under the "Investors" section of the Company's website at www.coterra.com. The webcast will be archived and available at the same location after the conclusion of the live event.

About Coterra Energy

Coterra is a premier exploration and production company based in Houston, Texas with focused operations in the Permian Basin, Marcellus Shale, and Anadarko Basin. We strive to be a leading energy producer, delivering sustainable returns through the efficient and responsible development of our diversified asset base. Learn more about us at www.coterra.com.

Cautionary Statement Regarding Forward-Looking Information

This press release contains certain forward-looking statements within the meaning of federal securities laws. Forward-looking statements are not statements of historical fact and reflect Coterra's current views about future events. Such forward-looking statements include, but are not limited to, statements about returns to shareholders, enhanced shareholder value, reserves estimates, future financial and operating performance and goals and commitment to sustainability and ESG leadership, strategic pursuits and goals, including with respect to the publication of Coterra's first Sustainability Report, and other statements that are not historical facts contained in this press release. The words "expect," "project," "estimate," "believe," "anticipate," "intend," "budget," "plan," "predict," "potential," "possible," "may," "should," "could," "would," "will," "strategy," "outlook" and similar expressions are also intended to identify forward-looking statements. We can provide no assurance that the forward-looking statements contained in this press release will occur as projected and actual results may differ materially from those projected. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, without limitation, the risk that the combined businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the Merger may not be fully realized or may take longer to realize than expected; the volatility in commodity prices for crude oil and natural gas; cost increases; supply chain disruptions; the effect of future regulatory or legislative actions, including the risk of new restrictions with respect to well spacing, hydraulic fracturing, natural gas flaring, seismicity, produced water disposal, or other oil and natural gas development activities; disruption from the Merger making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time on integration-related issues; the potential effects of further developments to the long-term impact of the COVID-19 pandemic and variants thereof on Coterra’s business, financial condition and results of operations; actions by, or disputes among or between, the Organization of Petroleum Exporting Countries and other producer countries; market factors; market prices (including geographic basis differentials) of oil and natural gas; impacts of inflation; labor shortages and economic disruption (including as a result of the pandemic or geopolitical disruptions such as the war in Ukraine); determination of reserves estimates, adjustments or revisions, including factors impacting such determination such as commodity prices, well performance, operating expenses and completion of Coterra's annual PUD reserves process, as well as the impact on our financial statements resulting therefrom; the presence or recoverability of estimated reserves; the ability to replace reserves; environmental risks; drilling and operating risks; exploration and development risks; competition; the ability of management to execute its plans to meet its goals; and other risks inherent in Coterra's businesses. In addition, the declaration and payment of any future dividends, whether

regular base quarterly dividends, variable dividends or special dividends, will depend on Coterra's financial results, cash requirements, future prospects and other factors deemed relevant by Coterra's Board. While the list of factors presented here is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. For additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to Coterra's annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other filings with the SEC, which are available on Coterra's website at www.coterra.com.

Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Except to the extent required by applicable law, Coterra does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Operational Data

The tables below provide a summary of production volumes, price realizations and operational activity by region and units costs for the Company for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| PRODUCTION VOLUMES | | | | | | | |

| Marcellus Shale | | | | | | | |

| Natural gas (Bcf) | 211.4 | | | 199.8 | | | 403.5 | | | 403.7 | |

| Equivalent production (MMBoe) | 35.2 | | | 33.3 | | | 67.2 | | | 67.3 | |

| Daily equivalent production (MBoepd) | 387.1 | | | 366.0 | | | 371.5 | | | 371.7 | |

| | | | | | | |

| Permian Basin | | | | | | | |

| Natural gas (Bcf) | 37.0 | | | 38.9 | | | 75.5 | | | 76.4 | |

| Oil (MMBbl) | 8.1 | | | 7.5 | | | 15.7 | | | 14.4 | |

| NGL (MMBbl) | 5.9 | | | 5.6 | | | 11.7 | | | 10.4 | |

| Equivalent production (MMBoe) | 20.2 | | | 19.6 | | | 40.0 | | | 37.5 | |

| Daily equivalent production (MBoepd) | 222.9 | | | 215.0 | | | 221.2 | | | 207.4 | |

| | | | | | | |

| Anadarko Basin | | | | | | | |

| Natural gas (Bcf) | 15.8 | | | 15.0 | | | 33.3 | | | 30.0 | |

| Oil (MMBbl) | 0.6 | | | 0.5 | | | 1.3 | | | 1.1 | |

| NGL (MMBbl) | 1.8 | | | 1.6 | | | 3.5 | | | 3.2 | |

| Equivalent production (MMBoe) | 4.9 | | | 4.6 | | | 10.3 | | | 9.3 | |

| Daily equivalent production (MBoepd) | 54.7 | | | 50.4 | | | 57.1 | | | 51.2 | |

| | | | | | | |

| Total Company | | | | | | | |

| Natural gas (Bcf) | 264.3 | | 253.9 | | 512.4 | | 510.3 |

| Oil (MMBbl) | 8.7 | | 8.0 | | | 17.0 | | 15.5 | |

| NGL (MMBbl) | 7.7 | | 7.2 | | | 15.2 | | 13.6 | |

| Equivalent production (MMBoe) | 60.5 | | 57.5 | | 117.7 | | 114.2 |

| Daily equivalent production (MBoepd) | 664.9 | | 631.7 | | 650.1 | | 630.8 |

| | | | | | | |

| AVERAGE SALES PRICE (excluding hedges) | | | | | | |

| Marcellus Shale | | | | | | | |

| Natural gas ($/Mcf) | $ | 1.78 | | | $ | 5.54 | | | $ | 2.70 | | | $ | 4.90 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Permian Basin | | | | | | | |

| Natural gas ($/Mcf) | $ | 0.92 | | | $ | 6.51 | | | $ | 1.16 | | | $ | 5.51 | |

| Oil ($/Bbl) | $ | 71.71 | | | $ | 109.25 | | | $ | 72.80 | | | $ | 101.67 | |

| NGL ($/Bbl) | $ | 15.36 | | | $ | 38.23 | | | $ | 18.85 | | | $ | 37.70 | |

| | | | | | | |

| Anadarko Basin | | | | | | | |

| Natural gas ($/Mcf) | $ | 1.57 | | | $ | 7.09 | | | $ | 2.40 | | | $ | 5.98 | |

| Oil ($/Bbl) | $ | 74.32 | | | $ | 108.74 | | | $ | 74.56 | | | $ | 100.90 | |

| NGL ($/Bbl) | $ | 21.02 | | | $ | 42.47 | | | $ | 24.27 | | | $ | 41.32 | |

| | | | | | | |

| Total Company | | | | | | | |

| Natural gas ($/Mcf) | $ | 1.65 | | | $ | 5.78 | | | $ | 2.46 | | | $ | 5.05 | |

| Oil ($/Bbl) | $ | 71.88 | | | $ | 109.23 | | | $ | 72.93 | | | $ | 101.62 | |

| NGL ($/Bbl) | $ | 16.67 | | | $ | 39.17 | | | $ | 20.11 | | | $ | 38.55 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| AVERAGE SALES PRICE (including hedges) | | | | | | | |

| Total Company | | | | | | | |

| Natural gas ($/Mcf) | $ | 1.95 | | | $ | 5.15 | | | $ | 2.81 | | | $ | 4.66 | |

| Oil ($/Bbl) | $ | 72.17 | | | $ | 92.78 | | | $ | 73.11 | | | $ | 84.76 | |

| NGL ($/Bbl) | $ | 16.67 | | | $ | 39.17 | | | $ | 20.11 | | | $ | 38.55 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

WELLS DRILLED(1) | | | | | | | |

| Gross wells | | | | | | | |

| Marcellus Shale | 16 | | | 20 | | | 36 | | | 42 | |

| Permian Basin | 33 | | | 43 | | | 72 | | | 72 | |

| Anadarko Basin | 11 | | | 10 | | | 17 | | | 13 | |

| 60 | | 73 | | | 125 | | 127 |

| | | | | | | |

| Net wells | | | | | | | |

| Marcellus Shale | 16.0 | | | 20.0 | | | 36.0 | | | 42.0 | |

| Permian Basin | 21.3 | | | 21.8 | | | 37.9 | | | 39.8 | |

| Anadarko Basin | 5.1 | | | 5.1 | | | 8.4 | | | 6.5 | |

| 42.4 | | 46.9 | | 82.3 | | 88.3 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| TURN IN LINES | | | | | | | |

| Gross wells | | | | | | | |

| Marcellus Shale | 20 | | | 18 | | | 45 | | | 30 | |

| Permian Basin | 34 | | | 36 | | | 79 | | | 67 | |

| Anadarko Basin | 3 | | | 1 | | | 7 | | | 8 | |

| 57 | | 55 | | 131 | | 105 |

| | | | | | | |

| Net wells | | | | | | | |

| Marcellus Shale | 20.0 | | | 18.0 | | | 45.0 | | | 27.1 | |

| Permian Basin | 19.1 | | | 13.9 | | | 42.2 | | | 29.8 | |

| Anadarko Basin | — | | | 0.1 | | | 0.1 | | | 0.1 | |

| 39.1 | | 32.0 | | 87.3 | | 57.0 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Quarter Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

AVERAGE UNIT COSTS ($/Boe)(2) | | | | | | | |

| Direct operations | $ | 2.16 | | | $ | 2.03 | | | $ | 2.24 | | | $ | 1.90 | |

| Transportation, processing and gathering | 4.27 | | | 4.13 | | | 4.20 | | | 4.12 | |

| Taxes other than income | 1.05 | | | 1.72 | | | 1.27 | | | 1.53 | |

| General and administrative (excluding stock-based compensation, severance expense and merger-related expense) | 0.79 | | | 0.92 | | | 0.85 | | | 0.92 | |

| Unit Operating Cost | $ | 8.27 | | | $ | 8.80 | | | $ | 8.56 | | | $ | 8.47 | |

| Depreciation, depletion and amortization | 6.54 | | | 7.21 | | | 6.50 | | | 6.78 | |

| Exploration | 0.09 | | | 0.12 | | | 0.08 | | | 0.11 | |

| Stock-based compensation | 0.11 | | | 0.36 | | | 0.19 | | | 0.39 | |

| Merger-related expense | — | | | — | | | — | | | 0.06 | |

| Severance expense | 0.05 | | | 0.24 | | | 0.09 | | | 0.34 | |

| Interest expense | 0.09 | | 0.36 | | 0.09 | | | 0.37 | |

| $ | 15.15 | | | $ | 17.09 | | | $ | 15.51 | | | $ | 16.52 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

_______________________________________________________________________________(1)Wells drilled represents wells drilled to total depth during the period. Wells completed includes wells completed during the period, regardless of when they were drilled.

(2)Total unit costs may differ from the sum of the individual costs due to rounding.

Derivatives Information

As of June 30, 2023, the Company had the following outstanding financial commodity derivatives: | | | | | | | | | | | | | | |

| |

| | | 2023 |

| Natural Gas | | Third Quarter | | Fourth Quarter |

| | | | |

| | | | |

| | | | |

| | | | |

Waha gas collars | | | | |

| Volume (MMBtu) | | 8,280,000 | | | 8,280,000 | |

| Weighted average floor ($/MMBtu) | | $ | 3.03 | | | $ | 3.03 | |

| Weighted average ceiling ($/MMBtu) | | $ | 5.39 | | | $ | 5.39 | |

| | | | |

| NYMEX collars | | | | |

| Volume (MMBtu) | | 32,200,000 | | | 29,150,000 | |

| Weighted average floor ($/MMBtu) | | $ | 4.07 | | | $ | 4.03 | |

| Weighted average ceiling ($/MMBtu) | | $ | 6.78 | | | $ | 6.61 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | |

| | 2023 | |

| Oil | | Third Quarter | | Fourth Quarter | |

| WTI oil collars | | | | | |

| Volume (MBbl) | | 920 | | | 920 | | |

| Weighted average floor ($/Bbl) | | $ | 65.00 | | | $ | 65.00 | | |

| Weighted average ceiling ($/Bbl) | | $ | 89.66 | | | $ | 89.66 | | |

| | | | | |

| WTI Midland oil basis swaps | | | | | |

| Volume (MBbl) | | 920 | | | 920 | | |

| Weighted average differential ($/Bbl) | | $ | 1.01 | | | $ | 1.01 | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Six Months Ended

June 30, |

| (In millions, except per share amounts) | 2023 | | 2022 | | 2023 | | 2022 |

| OPERATING REVENUES | | | | | | | |

| Natural gas | $ | 436 | | | $ | 1,468 | | | $ | 1,258 | | | $ | 2,579 | |

| Oil | 626 | | | 876 | | | 1,241 | | | 1,575 | |

| NGL | 129 | | | 280 | | | 306 | | | 525 | |

| Gain (loss) on derivative instruments | (12) | | | (66) | | | 126 | | | (457) | |

| | | | | | | |

| Other | 6 | | | 14 | | | 31 | | | 29 | |

| 1,185 | | | 2,572 | | | 2,962 | | | 4,251 | |

| OPERATING EXPENSES | | | | | | | |

| Direct operations | 130 | | | 116 | | | 264 | | | 216 | |

| Transportation, processing and gathering | 258 | | | 238 | | | 494 | | | 471 | |

| | | | | | | |

| Taxes other than income | 63 | | | 98 | | | 149 | | | 174 | |

| Exploration | 5 | | | 7 | | | 9 | | | 13 | |

| Depreciation, depletion and amortization | 395 | | | 414 | | | 764 | | | 774 | |

| | | | | | | |

| | | | | | | |

| General and administrative (excluding stock-based compensation, severance expense and merger-related expense) | 48 | | 52 | | 100 | | | 104 | |

Stock-based compensation(1) | 7 | | | 21 | | | 23 | | | 44 | |

| Merger-related expense | — | | | — | | | — | | | 7 | |

| Severance expense | 3 | | | 14 | | | 11 | | | 39 | |

| 909 | | | 960 | | | 1,814 | | | 1,842 | |

| | | | | | | |

| Gain (loss) on sale of assets | — | | | (3) | | | 5 | | | (1) | |

| INCOME FROM OPERATIONS | 276 | | | 1,609 | | | 1,153 | | | 2,408 | |

| Interest expense | 16 | | | 22 | | | 33 | | | 43 | |

| Interest income | (10) | | | (1) | | | (22) | | | (1) | |

| | | | | | | |

| | | | | | | |

| Income before income taxes | 270 | | | 1,588 | | | 1,142 | | | 2,366 | |

| Income tax expense | 61 | | | 359 | | | 256 | | | 529 | |

| NET INCOME | $ | 209 | | | $ | 1,229 | | | $ | 886 | | | $ | 1,837 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per share - Basic | $ | 0.28 | | | $ | 1.53 | | | $ | 1.16 | | | $ | 2.28 | |

| Weighted-average common shares outstanding | 755 | | | 803 | | | 760 | | | 806 | |

_______________________________________________________________________________

(1)Includes the impact of our performance share awards and restricted stock.

CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited)

| | | | | | | | | | | |

| (In millions) | June 30,

2023 | | December 31,

2022 |

| ASSETS | | | |

| Current assets | $ | 1,640 | | | $ | 2,211 | |

| Properties and equipment, net (successful efforts method) | 17,801 | | | 17,479 | |

| | | |

| Other assets | 438 | | | 464 | |

| $ | 19,879 | | | $ | 20,154 | |

| | | |

| LIABILITIES, REDEEMABLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities | $ | 941 | | | $ | 1,193 | |

| | | |

| Long-term debt, net (excluding current maturities) | 2,171 | | | 2,181 | |

| Deferred income taxes | 3,367 | | | 3,339 | |

| | | |

| Other long term liabilities | 733 | | | 771 | |

| Cimarex redeemable preferred stock | 8 | | | 11 | |

| Stockholders’ equity | 12,659 | | | 12,659 | |

| $ | 19,879 | | | $ | 20,154 | |

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Six Months Ended

June 30, |

| (In millions) | 2023 | | 2022 | | 2023 | | 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | |

| Net income | $ | 209 | | | $ | 1,229 | | | $ | 886 | | | $ | 1,837 | |

| Depreciation, depletion and amortization | 395 | | | 414 | | | 764 | | | 774 | |

| Deferred income tax expense | 4 | | | 65 | | | 27 | | | 101 | |

| | | | | | | |

| | | | | | | |

| (Gain) loss on sale of assets | — | | | 3 | | | (5) | | | 1 | |

| | | | | | | |

| (Gain) loss on derivative instruments | 12 | | | 66 | | | (126) | | | 457 | |

| Net cash received (paid) in settlement of derivative instruments | 84 | | | (293) | | | 184 | | | (464) | |

| | | | | | | |

| Stock-based compensation and other | 7 | | | 18 | | | 24 | | | 38 | |

| Income charges not requiring cash | (6) | | | (9) | | | (10) | | | (19) | |

| Changes in assets and liabilities | (59) | | | (614) | | | 396 | | | (524) | |

| Net cash provided by operating activities | 646 | | | 879 | | | 2,140 | | | 2,201 | |

| | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | |

| Capital expenditures for drilling, completion and other fixed asset additions | (592) | | | (471) | | | (1,075) | | | (741) | |

| Capital expenditures for leasehold and property acquisitions | (5) | | | (3) | | | (6) | | | (4) | |

| | | | | | | |

| Proceeds from sale of assets | 28 | | | 2 | | | 33 | | | 4 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net cash used in investing activities | (569) | | | (472) | | | (1,048) | | | (741) | |

| | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | |

| | | | | | | |

| Repayment of finance leases | (1) | | | (1) | | | (3) | | | (3) | |

| Common stock repurchases | (57) | | | (303) | | | (325) | | | (487) | |

| | | | | | | |

| Dividends paid | (152) | | | (484) | | | (588) | | | (940) | |

| Tax withholding on vesting of stock awards | — | | | (1) | | | (1) | | | (7) | |

| | | | | | | |

| Capitalized debt issuance costs | — | | | — | | | (7) | | | — | |

| Cash received for stock option exercises | — | | | 4 | | | — | | | 10 | |

| | | | | | | |

| Cash paid for conversion of redeemable preferred stock | — | | | (10) | | | (1) | | | (10) | |

| Net cash used in financing activities | (210) | | | (795) | | | (925) | | | (1,437) | |

| | | | | | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | $ | (133) | | | $ | (388) | | | $ | 167 | | | $ | 23 | |

Supplemental Non-GAAP Financial Measures (Unaudited)

We report our financial results in accordance with accounting principles generally accepted in the United States (GAAP). However, we believe certain non-GAAP performance measures may provide financial statement users with additional meaningful comparisons between current results and results of prior periods. In addition, we believe these measures are used by analysts and others in the valuation, rating and investment recommendations of companies within the oil and natural gas exploration and production industry. See the reconciliations below that compare GAAP financial measures to non-GAAP financial measures for the periods indicated.

We have also included herein certain forward-looking non-GAAP financial measures. Due to the forward-looking nature of these non-GAAP financial measures, we cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measures, such as future impairments and future changes in capital. Accordingly, we are unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measures to their most directly comparable forward-looking GAAP financial measures. Reconciling items in future periods could be significant.

Present Value Index (PVI10) is often used by management as a return-on-investment metric and defined as the estimated net present value (using a 10% discount rate) of the future net cash flows from such reserves (for which we utilize certain assumptions regarding future commodity prices and operating costs), adding back our direct net costs incurred in drilling and adding back our completing, constructing facilities, and flowing back such wells, and then dividing that sum by our direct net costs incurred in drilling, completing, constructing facilities, and flowing back such wells.

Reconciliation of Net Income to Adjusted Net Income and Adjusted Earnings Per Share

Adjusted Net Income and Adjusted Earnings per Share are presented based on our management's belief that these non-GAAP measures enable a user of financial information to understand the impact of identified adjustments on reported results. Adjusted Net Income is defined as net income plus gain and loss on sale of assets, non-cash gain and loss on derivative instruments, stock-based compensation expense, severance expense, merger-related expenses and tax effect on selected items. Adjusted Earnings per Share is defined as Adjusted Net Income divided by weighted-average common shares outstanding. Additionally, we believe these measures provide beneficial comparisons to similarly adjusted measurements of prior periods and use these measures for that purpose. Adjusted Net Income and Adjusted Earnings per Share are not measures of financial performance under GAAP and should not be considered as alternatives to net income and earnings per share, as defined by GAAP.

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Six Months Ended

June 30, |

| (In millions, except per share amounts) | 2023 | | 2022 | | 2023 | | 2022 |

| As reported - net income | $ | 209 | | | $ | 1,229 | | | $ | 886 | | | $ | 1,837 | |

| Reversal of selected items: | | | | | | | |

| | | | | | | |

| | | | | | | |

| (Gain) loss on sale of assets | — | | | 3 | | | (5) | | | 1 | |

(Gain) loss on derivative instruments(1) | 96 | | | (227) | | | 58 | | | (7) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Stock-based compensation expense | 7 | | | 21 | | | 23 | | | 44 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Merger-related expense | — | | | — | | | — | | | 7 | |

| Severance expense | 3 | | | 14 | | | 11 | | | 39 | |

| Tax effect on selected items | (24) | | | 43 | | | (20) | | | (19) | |

| Adjusted net income | $ | 291 | | | $ | 1,083 | | | $ | 953 | | | $ | 1,902 | |

| As reported - earnings per share | $ | 0.28 | | | $ | 1.53 | | | $ | 1.16 | | | $ | 2.28 | |

| Per share impact of selected items | 0.11 | | | (0.18) | | | 0.09 | | | 0.08 | |

| Adjusted earnings per share | $ | 0.39 | | | $ | 1.35 | | | $ | 1.25 | | | $ | 2.36 | |

| Weighted-average common shares outstanding | 755 | | | 803 | | | 760 | | | 806 | |

_______________________________________________________________________________

(1)This amount represents the non-cash mark-to-market changes of our commodity derivative instruments recorded in Gain (loss) on derivative instruments in the Condensed Consolidated Statement of Operations.

Reconciliation of Discretionary Cash Flow and Free Cash Flow

Discretionary Cash Flow is defined as cash flow from operating activities excluding changes in assets and liabilities. Discretionary Cash Flow is widely accepted as a financial indicator of an oil and gas company’s ability to generate available cash to internally fund exploration and development activities, return capital to shareholders through dividends and share repurchases, and service debt and is used by our management for that purpose. Discretionary Cash Flow is presented based on our management’s belief that this non-GAAP measure is useful information to investors when comparing our cash flows with the cash flows of other companies that use the full cost method of accounting for oil and gas producing activities or have different financing and capital structures or tax rates. Discretionary Cash Flow is not a measure of financial performance under GAAP and should not be considered as an alternative to cash flows from operating activities or net income, as defined by GAAP, or as a measure of liquidity.

Free Cash Flow is defined as Discretionary Cash Flow less cash paid for capital expenditures. Free Cash Flow is an indicator of a company’s ability to generate cash flow after spending the money required to maintain or expand its asset base, and is used by our management for that purpose. Free Cash Flow is presented based on our management’s belief that this non-GAAP measure is useful information to investors when comparing our cash flows with the cash flows of other companies. Free Cash Flow is not a measure of financial performance under GAAP and should not be considered as an alternative to cash flows from operating activities or net income, as defined by GAAP, or as a measure of liquidity.

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Six Months Ended

June 30, |

| (In millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Cash flow from operating activities | $ | 646 | | | $ | 879 | | | $ | 2,140 | | | $ | 2,201 | |

| Changes in assets and liabilities | 59 | | | 614 | | | (396) | | | 524 | |

| Discretionary cash flow | 705 | | | 1,493 | | | 1,744 | | | 2,725 | |

| Cash paid for capital expenditures for drilling, completion and other fixed asset additions | (592) | | | (471) | | | (1,075) | | | (741) | |

| Free cash flow | $ | 113 | | | $ | 1,022 | | | $ | 669 | | | $ | 1,984 | |

Capital Expenditures | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended June 30, | | Six Months Ended

June 30, |

| (In millions) | | 2023 | | 2022 | | 2023 | | 2022 |

Cash paid for capital expenditures for drilling, completion and other fixed asset additions | | $ | 592 | | | $ | 471 | | | $ | 1,075 | | | $ | 741 | |

| | | | | | | | |

| Change in accrued capital costs | | (55) | | | (2) | | | 30 | | | 53 | |

| | | | | | | | |

| Capital expenditures for drilling, completion and other fixed asset additions | | $ | 537 | | | $ | 469 | | | $ | 1,105 | | | $ | 794 | |

Reconciliation of Adjusted EBITDAX

Adjusted EBITDAX is defined as net income plus interest expense, other expense, income tax expense, depreciation, depletion, and amortization (including impairments), exploration expense, gain and loss on sale of assets, non-cash gain and loss on derivative instruments, stock-based compensation expense, severance expense and merger-related expense. Adjusted EBITDAX is presented on our management’s belief that this non-GAAP measure is useful information to investors when evaluating our ability to internally fund exploration and development activities and to service or incur debt without regard to financial or capital structure. Our management uses Adjusted EBITDAX for that purpose. Adjusted EBITDAX is not a measure of financial performance under GAAP and should not be considered as an alternative to cash flows from operating activities or net income, as defined by GAAP, or as a measure of liquidity.

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended June 30, | | Six Months Ended

June 30, |

| (In millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 209 | | | $ | 1,229 | | | $ | 886 | | | $ | 1,837 | |

| Plus (less): | | | | | | | |

| Interest expense, net | 6 | | | 21 | | | 11 | | | 42 | |

| | | | | | | |

| | | | | | | |

| Income tax expense | 61 | | | 359 | | | 256 | | | 529 | |

| Depreciation, depletion and amortization | 395 | | | 414 | | | 764 | | | 774 | |

| | | | | | | |

| | | | | | | |

| Exploration | 5 | | | 7 | | | 9 | | | 13 | |

| (Gain) loss on sale of assets | — | | | 3 | | | (5) | | | 1 | |

| Non-cash (gain) loss on derivative instruments | 96 | | | (227) | | | 58 | | | (7) | |

| | | | | | | |

| | | | | | | |

| Merger-related expense | — | | | — | | | — | | | 7 | |

| Severance expense | 3 | | | 14 | | | 11 | | | 39 | |

| Stock-based compensation | 7 | | | 21 | | | 23 | | | 44 | |

| Adjusted EBITDAX | $ | 782 | | | $ | 1,841 | | | $ | 2,013 | | | $ | 3,279 | |

| | | | | | | | | | | | | | | |

| Trailing Twelve Months Ended | | | | |

| (In millions) | June 30,

2023 | | December 31,

2022 | | | | |

| Net income | $ | 3,114 | | | $ | 4,065 | | | | | |

| Plus (less): | | | | | | | |

| Interest expense, net | 39 | | | 70 | | | | | |

| Loss on debt extinguishment | (28) | | | (28) | | | | | |

| Other expense | (2) | | | (2) | | | | | |

| Income tax expense | 831 | | | 1,104 | | | | | |

| Depreciation, depletion and amortization | 1,625 | | | 1,635 | | | | | |

| | | | | | | |

| | | | | | | |

| Exploration | 25 | | | 29 | | | | | |

| (Gain) loss on sale of assets | (5) | | | 1 | | | | | |

| Non-cash (gain) loss on derivative instruments | (234) | | | (299) | | | | | |

| | | | | | | |

| | | | | | | |

| Merger-related expense | 1 | | | 7 | | | | | |

| Severance expense | 33 | | | 62 | | | | | |

| Stock-based compensation | 65 | | | 86 | | | | | |

| Adjusted EBITDAX (trailing twelve months) | $ | 5,464 | | | $ | 6,730 | | | | | |

Reconciliation of Net Debt

The total debt to total capitalization ratio is calculated by dividing total debt by the sum of total debt and total stockholders’ equity. This ratio is a measurement which is presented in our annual and interim filings and our management believes this ratio is useful to investors in assessing our leverage. Net Debt is calculated by subtracting cash and cash equivalents from total debt. The Net Debt to Adjusted Capitalization ratio is calculated by dividing Net Debt by the sum of Net Debt and total stockholders’ equity. Net Debt and the Net Debt to Adjusted Capitalization ratio are non-GAAP measures which our management believes are also useful to investors when assessing our leverage since we have the ability to and may decide to use a portion of our cash and cash equivalents to retire debt. Our management uses these measures for that purpose. Additionally, as our planned expenditures are not expected to result in additional debt, our management believes it is appropriate to apply cash and cash equivalents to reduce debt in calculating the Net Debt to Adjusted Capitalization ratio.

| | | | | | | | | | | |

| (In millions) | June 30,

2023 | | December 31,

2022 |

| | | |

| Long-term debt, net | 2,171 | | | 2,181 | |

| | | |

| Stockholders’ equity | 12,659 | | | 12,659 | |

| Total capitalization | $ | 14,830 | | | $ | 14,840 | |

| | | |

| Total debt | $ | 2,171 | | | $ | 2,181 | |

| Less: Cash and cash equivalents | (841) | | | (673) | |

| Net debt | $ | 1,330 | | | $ | 1,508 | |

| | | |

| Net debt | $ | 1,330 | | | $ | 1,508 | |

| Stockholders’ equity | 12,659 | | | 12,659 | |

| Total adjusted capitalization | $ | 13,989 | | | $ | 14,167 | |

| | | |

| Total debt to total capitalization ratio | 14.6 | % | | 14.7 | % |

| Less: Impact of cash and cash equivalents | 5.1 | % | | 4.1 | % |

| Net debt to adjusted capitalization ratio | 9.5 | % | | 10.6 | % |

Reconciliation of Net Debt to Adjusted EBITDAX

Total debt to net income is defined as total debt divided by net income. Net debt to Adjusted EBITDAX is defined as net debt divided by trailing twelve month Adjusted EBITDAX. Net debt to Adjusted EBITDAX is a non-GAAP measure which our management believes is useful to investors when assessing our credit position and leverage.

| | | | | | | | | | | |

| (In millions) | June 30,

2023 | | December 31,

2022 |

| Total debt | $ | 2,171 | | | $ | 2,181 | |

| Net income | 3,114 | | | 4,065 | |

| Total debt to net income ratio | 0.7 | x | | 0.5 | x |

| | | |

| Net debt | $ | 1,330 | | | $ | 1,508 | |

| Adjusted EBITDAX (Trailing twelve months) | 5,464 | | | 6,730 | |

| Net debt to Adjusted EBITDAX | 0.2 | x | | 0.2 | x |

Investor Contact

Daniel Guffey - Vice President of Finance, Planning & Analysis and Investor Relations

281.589.4875

Hannah Stuckey - Investor Relations Manager

281.589.4983

v3.23.2

Cover Page

|

Aug. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 07, 2023

|

| Entity Registrant Name |

COTERRA ENERGY INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-10447

|

| Entity Tax Identification Number |

04-3072771

|

| Entity Address, Address Line One |

Three Memorial City Plaza

|

| Entity Address, Address Line Two |

840 Gessner Road, Suite 1400

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77024

|

| City Area Code |

281

|

| Local Phone Number |

589-4600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Central Index Key |

0000858470

|

| Title of 12(b) Security |

Common Stock, par value $0.10 per share

|

| Trading Symbol |

CTRA

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

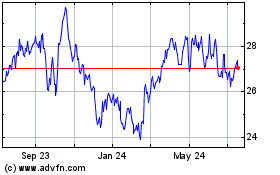

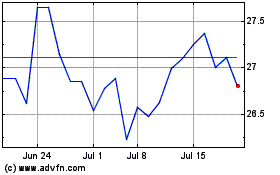

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Apr 2023 to Apr 2024