Housing in the Spotlight - Earnings Preview

December 15 2011 - 7:00PM

Zacks

Earnings Preview 12/16/11

There will only be a handful of firms reporting next week as the

third quarter reporting season is almost over. A total of just 34

firms are scheduled to report, including 13 of the S&P 500.

Most of the firms reporting have November fiscal period-ends, which

means that they are reporting fourth quarter results.

While few in number, some of the reports come from firms that are

highly significant in that they will give clues to the overall

direction of earnings in the fourth quarter.

The firms reporting next week include:

Bed Bath &

Beyond (BBBY),

Carnival Cruise Lines

(CCL),

ConAgra (CAG),

General

Mills (GIS),

Micron Technology

(MU),

Nike (NKE) and

Walgreens (WAG).

There will, however, be plenty of economic data for the market to

chew on. The theme for the week will be housing. Just about all of

the key housing numbers will come out next week, starting with the

Homebuilders index and followed by Housing Starts and Building

Permits, Existing Home Sales and New Home Sales. Non-housing data

due include the final word on 3rd quarter GDP, Durable Goods Orders

and Personal Income and Spending.

Monday

- The National Association of Homebuilders index is expected to

slip back to a dismal level of 19 in December from 20 in

November. This is a “magic 50” index, so any reading below 50

indicates that homebuilders see conditions as poor. The index had

been mired in the mid-to-low teens for over two years now, but has

lately been trending upwards -- from “atrocious” to just “awful.”

In every previous recovery, residential investment has led the

economy out of the swamp. This time it has been pulling us further

into it, and remains one of the key reasons why the recovery is

anemic.

Tuesday

- We find out if the Homebuilders pessimism is well founded when

the data on Housing Starts are released. In October, they ran

at an annual rate of only 628,000, about a quarter of the level at

the peak of the bubble. They have been extraordinarily distressed

for over two years now and show little sign of improvement.

In some ways, the low level of starts is a blessing in disguise,

since it indicates that few housing units are being added to the

glut of unsold homes. However, that is very cold comfort to the

unemployed construction workers, a group harder hit than almost any

other in the Great Recession. It is hard to see how we have a

robust recovery until housing starts start to rebound

significantly. The consensus is looking for starts to fall edge up

to 631,000 in November. Given that Permits were much higher than

starts last month, I would not be surprised to see things a little

bit higher than that, perhaps a rise towards the 640,000 level, but

that is still downright ugly.

- The best leading indicator of Housing Starts is Building

Permits. In October they ran at an annual rate of only 653,000.

That was higher than the starts rate -- which is one reason that

the starts number is likely to rise in November -- but it is still

a very low level. In November, the consensus is looking for

Permits to fall back to just a 633,000 annual rate, which seems

about right to me.

Wednesday

- In October, Existing Home Sales ran at a 4.97 million annual

pace. In November, they are expected to edge up slightly further to

a 5.04 million rate. However, the National Assoication of Realtors

has indicated that it will be revising several years’ worth of

Sales and Inventory data -- both downward -- so that might be a

bigger story than the rate for November. Of at least equal concern

is the level of inventories available for sale relative to the

sales pace. In Ocober there were 8.0 months of supply on the

market, well above the normal level of about 6 months. That

suggests continued moderate downward pressure on existing home

prices. As sales of used homes are just the transfer of an existing

asset, they do not represent that much in the way of economic

activity. However, as the major store of wealth for the middle

class, existing home prices are vital. Also, the more prices fall,

the greater the number of people who are underwater on their

mortages and thus vulnerable to foreclosure.

Thursday

- Weekly Initial Claims for Unemployment Insurance have been

plunging over the last two weeks. Last week they dropped by 19,000

to 366,000. That is comfortably below the key 400,000 level (which

they were above two weeks ago). The consensus is looking for them

to bounce back to 380,000 this week. A rebound after such a big

drop is reasonable to expect, as this does not tend to move in a

straight line. Even that big a rebound would not be terrible news,

as it would indicate that the last two weeks of declines were not a

fluke. The 400,000 level is important in that it has historically

been the inflection point below which we tend to create enough jobs

to bring down the unemployment rate. The week-to-week numbers can

be very volatile, so the four-week average is the thing to focus on

(it was 387,750 last week). Keep an eye on the prior week’s

revision as well.

- Continuing Jobless Claims have been in a downtrend of late, but

the road down has been bumpy. Last week they rose by 4,000 to 3.603

million. That is down 563,000, or 13.5%, from a year ago. The

consensus is looking for a bounce to 3.650 million. Some (most?) of

the longer-term decline is due to people simply exhausting their

regular state benefits, which run out after 26 weeks. Those,

however, don’t last forever either. Federally paid extended claims

rose by 293,000 to 3.642 million last week but are down 1.189

million, or 25.4% over the last year. Looking at just the regular

continuing claims numbers is a serious mistake. They only include a

little over half of the unemployed now, given the unprecedentedly

high duration of unemployment figures. A better measure is the

total number of people getting unemployment benefits -- currently

at 7.449 million. The total number of people getting benefits is

now 1.743 million below year-ago levels. What is not known is how

many people have left the extended claims via the road to

prosperity -- finding a new job -- and how many have left on the

road to poverty, having simply exhausted even the extended

benefits. Unless the program is renewed, all extended benefits will

end in January. Make sure to look at both sets of numbers! Many of

the press reports will not, but we will here at Zacks.

- In the last look at GDP it was estimated that the economy grew

at a 2.0% pace in the third quarter, well above the 1.3% growth

rate of the second quarter and the nearly non-existent growth of

just 0.4% in the first quarter. The quality of the growth was also

quite high as that growth included a 1.55% drag from the change in

inventories. The overall growth rate is not expected to change;

however, the quality of the growth and the sources of growth might

shift. Put this in the category of old -- but important --

news. Most of the focus is now on fourth quarter growth, and it

looks like it should be substantially higher than in the third

quarter.

- The University of Michigan Consumer Sentement index for Decmber

is expected to rise to 69.0 from 67.7. That is up off the lows of

the summer, but still very depressed by any historical standard.

Personally, I think this is one of the most overrated economic

statistics around, since what consumers say in the survey is often

very different that what they actually do. Still, better seeing it

go up than down.

- The index of Leading Economic indicators is expected to

increase by 0.3% after rising 0.0% for October. While this is the

leading index, most of its components are already known by the time

it is released, so this number does not normally have a major

market impact. Indeed, the stock market itself is one of the key

leading indicators.

Friday

- New Orders for Durable Goods are expected to rise 2.0% in

November after falling 0.5% in October. Previous months are often

revised significantly for this data, and those revisions can be

just as important as the current month’s data. The weakness last

month came from the highly volatile transportation equipment

segment. Since they are so high-priced, a few orders for jetliners

can really push around the total number, but the orders tend to be

lumpy. Excluding transportation equipment, new orders are expected

to be up 0.3% after being up 1.1% in October due to some large

orders at Boeing (BA). Given the tone of the

other data, I will take the “over” on both headline and

ex-transportaion.

- Personal Income is expected to rise 0.2% In November, after it

rose 0.4% last month. Just as important as the total amount of

personal income is the source of that income. Recently, growth in

income from wages and salaries has been very weak, with most of the

growth we have seen coming from with rental income and higher

dividends. That suggests that most of the meager total income

growth is going to the top of the income distribution. Personal

Spending is expected to rise 0.3% after rising just 0.1% in

October. Of course, if spending rises by more than income, the

savings rate will fall. In October, the savings rate rose, but to

just 3.5% from a very low 3.3% in September. Over the long term,

the economy needs a higher savings rate. Short-term, though, a

falling savings rate tends to boost the economy.

- New Home Sales are expected to rise to a 314,000 rate from a

very weak 307,000 in October. That is simply a pathetic level, even

if it is slightly off the record low set in January. The records go

back to the Kennedy administration. If we do come in at 314,000,

that is still lower than any month prior to 2010. Unlike used home

sales, each new home sold represents a lot of economic activity.

Thus this is a very important report. Normally, new home sales are

what leads the economy out of recessions, but they have been a huge

drag this time around.

In the Earnings Calendar below, $999.00 should be read as N.A.

| Company |

Ticker |

Qtr End |

EPS Est |

Year Ago

EPS |

Last EPS

Surprise % |

Next EPS Report Date |

Time |

Daily Price |

| NORTHWEST PIPE |

NWPX |

201109 |

$0.44 |

$0.07 |

147.83 |

20111219 |

AMC |

$23.63 |

| OXYGEN BIOTHERA |

OXBT |

201110 |

($0.10) |

($0.09) |

-230 |

20111219 |

BTO |

$1.90 |

| RED HAT INC |

RHT |

201111 |

$0.19 |

$0.15 |

15.79 |

20111219 |

AMC |

$46.23 |

| CARNIVAL CORP |

CCL |

201111 |

$0.28 |

$0.31 |

4.91 |

20111220 |

BTO |

$33.07 |

| CINTAS CORP |

CTAS |

201111 |

$0.48 |

$0.38 |

10.64 |

20111220 |

AMC |

$30.52 |

| CONAGRA FOODS |

CAG |

201111 |

$0.43 |

$0.45 |

-6.45 |

20111220 |

BTO |

$25.55 |

| CPI CORP |

CPY |

201110 |

($0.95) |

($1.05) |

-97.37 |

20111220 |

BTO |

$5.26 |

| FSI INTL |

FSII |

201111 |

($0.06) |

($0.06) |

-28.57 |

20111220 |

AMC |

$3.24 |

| GENL MILLS |

GIS |

201111 |

$0.79 |

$0.76 |

3.23 |

20111220 |

BTO |

$39.96 |

| JABIL CIRCUIT |

JBL |

201111 |

$0.58 |

$0.52 |

10.2 |

20111220 |

AMC |

$19.51 |

| JEFFERIES GP-NW |

JEF |

201111 |

$0.14 |

$0.31 |

-56.52 |

20111220 |

BTO |

$12.36 |

| NAVISTAR INTL |

NAV |

201110 |

$3.21 |

$0.68 |

-41.48 |

20111220 |

BTO |

$37.35 |

| NIKE INC-B |

NKE |

201111 |

$0.97 |

$0.94 |

12.4 |

20111220 |

AMC |

$94.08 |

| ORACLE CORP |

ORCL |

201111 |

$0.55 |

$0.49 |

2.27 |

20111220 |

AMC |

$29.03 |

| PAYCHEX INC |

PAYX |

201111 |

$0.38 |

$0.37 |

7.89 |

20111220 |

AMC |

$29.35 |

| SANDERSON FARMS |

SAFM |

201110 |

($0.71) |

$2.08 |

-113.79 |

20111220 |

BTO |

$51.51 |

| SHUFFLE MASTER |

SHFL |

201110 |

$0.17 |

$0.14 |

13.33 |

20111220 |

AMC |

$11.52 |

| ACTUANT CORP |

ATU |

201111 |

$0.43 |

$0.36 |

6.38 |

20111221 |

BTO |

$20.57 |

| BED BATH&BEYOND |

BBBY |

201111 |

$0.88 |

$0.74 |

10.71 |

20111221 |

AMC |

$61.17 |

| CARMAX GP (CC) |

KMX |

201111 |

$0.38 |

$0.36 |

-3.92 |

20111221 |

BTO |

$30.05 |

| FINISH LINE-CLA |

FINL |

201111 |

$0.11 |

$0.08 |

2.63 |

20111221 |

AMC |

$20.66 |

| HERMAN MILLER |

MLHR |

201111 |

$0.41 |

$0.29 |

27.27 |

20111221 |

AMC |

$20.57 |

| KB HOME |

KBH |

201111 |

$0.04 |

$0.20 |

23.53 |

20111221 |

BTO |

$7.27 |

| LINDSAY CORP |

LNN |

201111 |

$0.46 |

$0.34 |

-28.13 |

20111221 |

BTO |

$50.34 |

| LUBY'S INC |

LUB |

201111 |

($0.05) |

($0.06) |

150 |

20111221 |

AMC |

$4.40 |

| SHAW GROUP INC |

SHAW |

201111 |

$0.43 |

$0.26 |

-174.58 |

20111221 |

BTO |

$22.53 |

| STEELCASE INC |

SCS |

201111 |

$0.19 |

$0.18 |

-11.76 |

20111221 |

AMC |

$6.80 |

| TIBCO SOFTWARE |

TIBX |

201111 |

$0.30 |

$0.26 |

6.25 |

20111221 |

AMC |

$23.60 |

| WALGREEN CO |

WAG |

201111 |

$0.67 |

$0.62 |

3.64 |

20111221 |

BTO |

$34.11 |

| AMER GREETINGS |

AM |

201111 |

$0.81 |

$0.78 |

2.63 |

20111222 |

BTO |

$16.60 |

| CALAMP CORP |

CAMP |

201111 |

$0.03 |

$0.00 |

100 |

20111222 |

AMC |

$4.69 |

| CHRISTOPHER&BNK |

CBK |

201111 |

($0.34) |

$0.00 |

2.63 |

20111222 |

AMC |

$2.48 |

| MICRON TECH |

MU |

201111 |

($0.06) |

$0.24 |

-1400 |

20111222 |

AMC |

$5.55 |

| NEOGEN CORP |

NEOG |

201111 |

$0.27 |

$0.26 |

-3.85 |

20111222 |

BTO |

$34.24 |

BED BATH&BEYOND (BBBY): Free Stock Analysis Report

CONAGRA FOODS (CAG): Free Stock Analysis Report

CARNIVAL CORP (CCL): Free Stock Analysis Report

GENL MILLS (GIS): Free Stock Analysis Report

MICRON TECH (MU): Free Stock Analysis Report

Zacks Investment Research

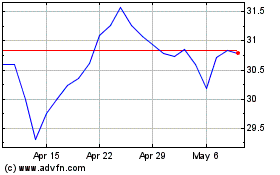

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From May 2024 to Jun 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Jun 2023 to Jun 2024