0001819574FALSE00018195742023-11-222023-11-220001819574bark:CommonStockPareValue00001Member2023-11-222023-11-220001819574bark:WarrantsEachWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareMember2023-11-222023-11-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date Earliest Event Reported):

November 22, 2023

BARK, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-39691 | | 85-1872418 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

120 Broadway, Floor 12 New York, NY | | 10271 (Zip Code) |

| (Address of Principal Executive Offices) | | |

(855) 501-2275

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 | | BARK | | New York Stock Exchange |

| | |

| Warrants, each warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | | BARK WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On November 22, 2023, BARK, Inc. (the “Company”) received written notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) that it is not in compliance with the continued listing standard set forth in Section 802.01C of the NYSE’s Listed Company Manual (“Section 802.01C”) because the average closing price of the Company’s common stock was less than $1.00 per share over a consecutive 30 trading-day period ended November 21, 2023. The Notice does not result in the immediate delisting of the Company’s common stock from the NYSE.

In accordance with applicable NYSE rules, the Company has notified the NYSE that it intends to cure the stock price deficiency and return to compliance with the applicable NYSE continued listing standards. The Company can regain compliance at any time within a six-month cure period following its receipt of the Notice if, on the last trading day of any calendar month during such cure period (or the last trading day of the cure period), the Company has both: (i) a closing share price of at least $1.00 and (ii) an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of the applicable calendar month or the cure period. The Company intends to remain listed on the NYSE and is considering all available options to regain compliance with the NYSE’s continued listing standards, including, but not limited to, a reverse stock split, subject to stockholder approval. Section 802.01C provides for an exception to the six-month cure period if the action required to cure the price condition requires stockholder approval, in which case, the action needs to be approved by no later than the Company’s next annual meeting of stockholders.

The Notice has no immediate impact on the listing of the Company’s common stock, which will continue to be listed and traded on the NYSE during such cure period, subject to the Company’s compliance with other NYSE continued listing standards. Furthermore, the Notice is not anticipated to impact the ongoing business operations of the Company or its reporting requirements with the U.S. Securities and Exchange Commission.

Item 7.01 Regulation FD Disclosure.

As required by Section 802.01C, the Company issued a press release on November 24, 2023, announcing that it had received the Notice. A copy of the press release is being furnished herewith as Exhibit 99.1 and is incorporated herein by reference in its entirety.

The information furnished pursuant to this Item 7.01 and Exhibit 99.1 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| BARK, Inc. |

| |

| |

| By: | /s/ Allison Koehler |

| Name: Allison Koehler |

| Title: General Counsel and Secretary |

Date: November 24, 2023

BARK Announces Receipt of Notice of Non-Compliance with the NYSE Continued Listing Standards

NEW YORK – November 24, 2023 – BARK, Inc. (“BARK” or the “Company”) (NYSE: BARK), a leading global omnichannel dog brand with the mission to make all dogs happy, announced today that the New York Stock Exchange (the “NYSE”) issued a notice (the “Notice”) informing the Company that it is no longer in compliance with its continued listing standards set forth in Section 802.01C (the “Minimum Stock Price Standard”) because the average closing price of the Company’s common stock was less than $1.00 per share over a consecutive 30 trading-day period ended November 21, 2023.

Under Section 802.01C, the Company has six months following receipt of the Notice to regain compliance with the listing standard. Compliance can be achieved if on the last trading day of any calendar month during the cure period (or the last trading day of the cure period) the Company has a closing share price of at least $1.00 and an average closing share price of at least $1.00 over the prior 30 trading-day period ending on the last trading day of the applicable calendar month or the cure period. The Company intends to remain listed on the NYSE and is considering all available options to regain compliance with the NYSE’s continued listing standards, including, but not limited to, a reverse stock split, subject to stockholder approval. Section 802.01C provides for an exception to the six-month cure period if the action required to cure the price condition requires stockholder approval, in which case, the action needs to be approved by no later than the Company’s next annual stockholder’s meeting.

The Notice has no immediate impact on the listing of the Company’s common stock, which will continue to be listed and traded on the NYSE during such cure period, subject to the Company’s compliance with other NYSE continued listing standards. Furthermore, the Notice is not anticipated to impact the ongoing business operations of the Company or its reporting requirements with the U.S. Securities and Exchange Commission.

About BARK

BARK is the world’s most dog-centric company, devoted to making dogs happy with the best products, services and content. BARK’s dog-obsessed team applies its unique, data-driven understanding of what makes each dog special to design playstyle-specific toys, wildly satisfying treats, great food for your dog’s breed, effective and easy to use dental care, and dog-first experiences that foster the health and happiness of dogs everywhere. Founded in 2011, BARK loyally serves dogs nationwide with themed toys and treats subscriptions, BarkBox and BARK Super Chewer; custom product collections through its retail partner network, including Target and Amazon; its high-quality, nutritious meals made for your breed with BARK Food; and products that meet dogs’ dental needs with BARK Bright®. At BARK, we want to make dogs as happy as they make us because dogs and humans are better together. Sniff around at BARK.co for more information.

Forward Looking Statements

This press release contains “forward-looking statements” for purposes of the federal securities laws. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements under the US securities laws. All statements, other than statements of present or historical facts, contained in this press release, regarding the listing of our common stock on the NYSE and expectations, plans and objectives of management are forward-looking statements. Forward-looking statements are typically identified by such words as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook, “estimate,” “will,” “should,” “would” and “could” and other similar words and expressions. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by the forward-looking statements, including, but not limited to: our ability to implement business plans, forecasts, and other expectations; our ability to finance and invest in growth initiatives; the ability to get

the stockholder approval to effectuate a reverse stock-split, if necessary; and the other risks disclosed in the Company's quarterly report on Form 10-Q, copies of which may be obtained by visiting the Company’s Investor Relations website at https://investors.bark.co/ or the SEC’s website at www.sec.gov. Undue reliance should not be placed on the forward-looking statements in this press release, which are based on information available to the Company on the date hereof. The Company assumes no obligation to update such statements.

Contacts

Investors:

Michael Mougias

investors@barkbox.com

Media:

Garland Harwood

press@barkbox.com

v3.23.3

Cover

|

Nov. 22, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 22, 2023

|

| Entity Registrant Name |

BARK, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39691

|

| Entity Tax Identification Number |

85-1872418

|

| Entity Address, Address Line One |

120 Broadway, Floor 12

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10271

|

| City Area Code |

855

|

| Local Phone Number |

501-2275

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001819574

|

| Amendment Flag |

false

|

| Common Stock, par value $0.0001 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001

|

| Trading Symbol |

BARK

|

| Security Exchange Name |

NYSE

|

| Warrants, each warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

BARK WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bark_CommonStockPareValue00001Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bark_WarrantsEachWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

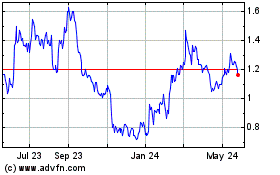

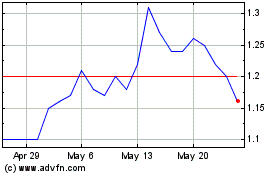

BARK (NYSE:BARK)

Historical Stock Chart

From Apr 2024 to May 2024

BARK (NYSE:BARK)

Historical Stock Chart

From May 2023 to May 2024