BNY Mellon Records Slimmer 3Q Profit, Revenue

October 16 2020 - 7:19AM

Dow Jones News

By Matt Grossman

Bank of New York Mellon Corp. Friday posted a smaller profit in

the latest quarter, with fee- and interest-based revenue declining

as the custodian bank grappled with the economic fallout of the

coronavirus pandemic.

The New York City-based company logged a third-quarter profit of

$876 million, or 98 cents a share, compared with a profit of $1

billion, or $1.07 a share, in the same three-month period a year

earlier.

Analysts polled by FactSet had forecast earnings of 94 cents a

share.

Revenue was $3.85 billion, down from $3.86 billion in last

year's third quarter. Analysts had forecast revenue of $3.83

billion.

BNY Mellon's third-quarter fee revenue was $3.11 billion, down

from $3.13 billion in the year-ago period. The decrease reflected

higher money-market fee waivers, partially offset by higher client

balances and activity in some segments, the company said. Net

interest revenue fell to $703 million in the quarter, compared with

$730 million in the equivalent quarter last year, as interest rates

declined in the wake of the coronavirus pandemic.

The bank's provision for credit losses was $9 million, which it

said reflected a relatively consistent macroeconomic outlook

compared with the second quarter. In the previous three-month

period, the bank's provision for credit losses was $143

million.

Non-interest expenses increased 4% in the quarter.

Write to Matt Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

October 16, 2020 07:04 ET (11:04 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

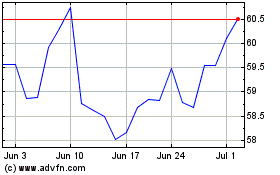

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024