- Report of Foreign Issuer (6-K)

September 16 2009 - 10:25AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM

6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE

SECURITIES EXCHANGE ACT OF

1934

For the

month of September, 2009

BANCO

LATINOAMERICANO DE COMERCIO EXTERIOR, S.A.

(Exact

name of Registrant as specified in its Charter)

FOREIGN TRADE BANK OF LATIN AMERICA,

INC.

(Translation

of Registrant’s name into English)

Calle 50

y Aquilino de la Guardia

P.O. Box

0819-08730

Panama

City, Republic of Panama

(Address

of Registrant’s Principal Executive Offices)

(Indicate

by check mark whether the registrant files or will file annual reports under

cover of Form 20-F or Form 40-F.)

Form 20-F

x

Form 40-F __

(Indicate

by check mark whether the registrant by furnishing the information contained in

this Form is also thereby furnishing information to the Commission pursuant to

Rule 12g-3-2(b) under the Securities Exchange Act of 1934.)

Yes __ No

x

(If “Yes”

is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b). 82__.)

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned, thereto duly

authorized.

September

16, 2009

|

|

FOREIGN

TRADE BANK OF LATIN AMERICA, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Pedro

Toll

|

|

|

|

Name:

Pedro Toll

|

|

|

|

Title: General

Manager

|

|

|

|

|

|

|

Bladex

Announces

the

S

uccessful

C

losing of

T

wo-

Y

ear

S

yndicated

L

oan

Panama City, Republic of Panama,

September 16, 2009 - Banco Latinoamericano de Comercio Exterior, S.A.

(“

Bladex”

, or “

the Bank”

, NYSE: BLX) announced today the

su

ccessful closing of a

US$100 million

two-year syndicated

loan structured and placed through Mizuho Corporate Bank, Ltd.

(“

Mizuho”

) and China Development Bank Corporation

(“

CDB”

)

with

in the Asian financial

markets.

Mr. Gregory Testerman, Senior Managing

D

irector for Treasury &

Capital Markets for Bladex stated,

“

This transaction is the first

syndication placed in Asia by a Latin American financial institution, without

mitigating the credit risk through the use of guarantees of any sort.

The loan

enhances t

he diversification of Bladex

’

s financing sources, while further

developing

the

Bank

’

s

presence in the Asian

markets

.

Proceeds from t

his financing will be used to promote

foreign trade,

as well

as

the economic development

of

Latin America

,

once again

demons

trating Bladex

’

s commitment to the Region

.

The knowledge, coverage, and experience

of Mizuho and CDB in the Asian financial markets was of vital importance to the

success of this transaction, which was closed under unique conditions in

the

global capital

markets.

Bladex is

very satisfied with the

result

.”

Bladex is a supranational bank

originally established by the Central Banks of Latin American and Caribbean

countries (“

the

Region”

), to support trade

finance in the Region. Established in Panama, its sh

areholders include central and

commercial banks in 23 countries in the Region, as well as international and

Latin American banks, and private investors.

Through June 30, 2009, Bladex had

disbursed accumulated credits of approximately $160 billion.

For mo

re information, please access our

website at

www.bladex.com

or

contact:

i-advize Corporate Communications,

Inc.,

Melanie Carpenter/Peter

Majeski

82 Wall Street, Suite

805

New York, NY 10005

Tel: (212) 406-3690,

E-mail address:

bladex@i-advize.com

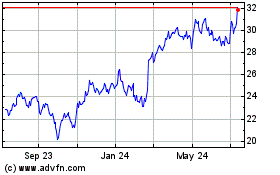

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From May 2024 to Jun 2024

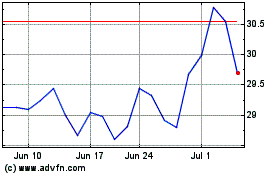

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jun 2023 to Jun 2024