UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement. |

| | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| | |

| ☒ | Definitive Proxy Statement. |

| | |

| ☐ | Definitive Additional Materials. |

| | |

| ☐ | Soliciting Material Pursuant to §240.14a-12. |

Aramark

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all the boxes that apply):

| | | | | |

| ☒ | No fee required |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

A Message From Our Chief Executive Officer

To Our Shareholders,

Aramark’s performance in fiscal 2023 reflected the continued momentum we’ve established and represented another significant step toward delivering on our strategic and financial goals as we drove strong results in a challenging environment.

Our fiscal 2023 performance speaks to this progress:

•Our profitable growth mindset is well established across the organization, as our third consecutive year of strong Net New Business performance demonstrates;

•Revenue and Organic Revenue increased 15% and 16%, respectively, compared to the prior year, and both Operating Income and Adjusted Operating Income (AOI) grew at more than twice those rates, resulting in significant AOI margin expansion;

•We strengthened our balance sheet through focused cash management and strategic asset optimization, leading to net debt reduction of more than $800 million in the fiscal year, and a 1.4x improvement in our leverage ratio; and

•EPS increased 243% led by the gain on sales from our non-controlling equity investments, and Adjusted EPS increased by 50% year-over-year on a constant currency basis.

The spin-off of our Uniform Services business—now its own public company called Vestis—was a major milestone right after the end of the fiscal year, and we expect it to result in enhanced performance and value creation for both organizations as we each pursue our distinct strategic visions.

With the spin-off complete, Aramark enters a new era solely focused on food and facilities, empowered by our 262,550 dedicated, hospitality-driven, customer-centric team members across the globe.

For People and the Planet

As we move into fiscal 2024, we remain centered on our people and our teams, and dedicated to our stakeholders, who include our clients, employees, shareholders, the communities in which we serve, and the planet we all share.

We are committed to creating a welcoming and inclusive culture across the organization, and diversity, equity, and inclusion (DEI) will continue to be a top priority for us. We believe that our focus on our people is a key differentiator and has led to remarkable outcomes.

We remain devoted to environmental, social, and governance issues, guided by our Be Well. Do Well. ESG plan. Each year we identify and track our progress and our results in sustainability, DEI, and community involvement. In fiscal 2023, our achievements included:

•Recognition as a Best Place to Work for Disability Inclusion, and again awarded a perfect 100% score on the Disability Equality Index. Selection as a top 50 employer by Fair360 (formerly DiversityInc), and named as the Top Company for Supplier Diversity;

•The launch of our HBCU Emerging Leaders Program in partnership with the Thurgood Marshall College Fund, which focuses on career exploration and professional development for students at Historically Black Colleges and Universities; and

•Confirmation from the Science Based Targets initiative of our goals to reduce our carbon footprint according to their net-zero standard.

A New Chapter

I’m proud of the milestones we’ve accomplished in this past year. With fiscal 2024 now underway, we at Aramark look to the future with great confidence.

The work we have done over the last few years has centered on a sustainable business model built on providing valued services in a highly attractive, sizeable, and resilient market that can create long-term value for you, our shareholders.

The fundamentals of the business remain unchanged. Our strategy maintains its focus on delivering profitable growth and margin through scale. The foundation has been set for our continued success, and we expect our momentum to continue in fiscal 2024 and beyond.

We look forward to delivering on our promises, and I couldn’t be more excited about what’s to come.

Sincerely,

John Zillmer

Notice of 2024 Annual Meeting of Shareholders

DATE AND TIME:

Tuesday, January 30, 2024 at 10:00 am (Eastern Standard Time)

PLACE:

Meeting live via the internet – please visit www.virtualshareholdermeeting.com/ARMK2024. To participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on your Notice of Availability of Proxy Materials. You will not be able to attend the 2024 Annual Meeting in person.

ITEMS OF BUSINESS:

| | | | | |

| PROPOSAL 1. | To elect the 10 director nominees listed in the proxy statement to serve until the 2025 Annual Meeting of Shareholders and until their respective successors have been duly elected and qualified; |

| |

PROPOSAL 2. | To consider and vote upon a proposal to ratify the appointment of Deloitte & Touche LLP as Aramark’s independent registered public accounting firm for the fiscal year ending September 27, 2024; and |

| |

PROPOSAL 3. | To hold a non-binding advisory vote on executive compensation. |

To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

RECORD DATE:

The Board of Directors has fixed December 8, 2023, as the record date for the meeting. This means that only shareholders as of the close of business on that date are entitled to receive this notice of the meeting and vote at the meeting and any adjournments or postponements of the meeting.

HOW TO VOTE:

Shareholders of record can vote their shares by using the internet or the telephone or by attending the meeting and voting online. Instructions for voting by using the internet or the telephone are set forth in the Notice of Internet Availability that has been provided to you. Shareholders of record who received a paper copy of the proxy materials also may vote their shares by marking their votes on the proxy card provided, signing and dating it, and mailing it in the envelope provided, or by attending the meeting and voting online.

| | | | | |

| |

| By Order of the Board of Directors, |

| |

| Harold B. Dichter |

| Secretary |

December 21, 2023

Table of Contents

Proxy Statement Summary

This summary highlights information contained elsewhere in this proxy statement, which is first being sent or made available to shareholders on or about December 21, 2023. You should read the entire proxy statement carefully before voting. For more information regarding the Company’s fiscal 2023 performance, please review Aramark’s Annual Report.

VOTING MATTERS AND BOARD RECOMMENDATIONS

| | | | | |

Proposal | Board’s Recommendation |

Proposal 1. Election of 10 Director Nominees (page 2) | FOR Each Director Nominee |

Proposal 2. Ratification of Deloitte & Touche LLP as Independent Registered Public Accounting Firm for 2024 (page 22) | FOR |

Proposal 3. Advisory Approval of Executive Compensation (page 25) | FOR |

2024 ANNUAL MEETING OF SHAREHOLDERS

| | | | | |

Date and Time: | Tuesday, January 30, 2024 at 10:00 am EST |

| | |

Record Date: | December 8, 2023 |

| | |

Place: | Meeting live via the internet – please visit www.virtualshareholdermeeting.com/ARMK2024 |

Corporate Governance Matters

PROPOSAL NO. 1 — ELECTION OF DIRECTORS | | | | | | | | | | | | | | | | | |

| PROPOSAL SUMMARY What Are You Voting On? We are asking our shareholders to elect 10 director nominees listed below to serve on the Board of Directors for a one-year term. Information about the Board and each director nominee is included in this section. Voting Recommendation The Board recommends that you vote “FOR” each director nominee listed below. After consideration of the individual qualifications, skills and experience of each of our director nominees and his or her prior contributions to the Board, if applicable, it believes a Board composed of the 10 director nominees would be well-balanced and effective. The Board, upon recommendation from the Nominating, Governance and Corporate Responsibility Committee (the “Nominating Committee”), has nominated 10 directors for election at the Annual Meeting. Each of the directors elected at the Annual Meeting will hold office until the Annual Meeting of Shareholders to be held in 2025 or until his or her successor has been elected and qualified, or until his or her earlier death, resignation, removal or disqualification. Unless contrary instructions are given, the shares represented by a properly executed proxy will be voted “FOR” each of the director nominees presented below. If, at the time of the meeting, one or more of the director nominees has become unavailable to serve, shares represented by proxies will be voted for the remaining director nominees and for any substitute director nominee or nominees designated by the Board of Directors, unless the size of the Board is reduced. The Board knows of no reason why any of the director nominees will be unavailable or unable to serve. Proxies cannot be voted for a greater number of persons than the director nominees listed.

| |

| | | The Board of Directors recommends a vote “FOR” each nominee for director | | |

OVERVIEW OF OUR DIRECTOR NOMINEES

Each of our 10 nominees has extensive leadership experience and relevant expertise and, except for Mr. DelGhiaccio, currently serves as a director for the Company. The Board undergoes an annual self-assessment and review to ensure that it has a balanced mix of skills and attributes to best oversee our business. Arthur B. Winkleblack is not standing for election at the Annual Meeting.

| | | | | | | | | | | |

| | | | |

Director | Age | Background | Current Committee Memberships |

| | | |

Susan M. Cameron | 65 | Former Chairman and Chief Executive Officer, Reynolds American Inc. | Compensation and Human Resources Nominating, Governance and Corporate Responsibility |

| | | |

| | | |

Greg Creed | 66 | Former Chief Executive Officer, Yum! Brands, Inc. | Finance and Technology Compensation and Human Resources |

| | | |

| | | |

Brian M. DelGhiaccio | 50 | Executive Vice President, Chief Financial Officer, Republic Services, Inc. | New Director Nominee |

| | | |

| | | |

Bridgette P. Heller | 62 | Founder and Chief Executive Officer, The Shirley Procter Puller Foundation | Finance and Technology Nominating, Governance and Corporate Responsibility |

| | | |

| | | |

Kenneth M. Keverian | 66 | Former Chief Strategy Officer, IBM Corporation | Audit Finance and Technology |

| | | |

| | | |

Karen M. King | 67 | Former Executive Vice President, Chief Field Officer, McDonald’s Corp. | Audit Finance and Technology |

| | | |

| | | |

Patricia E. Lopez | 62 | Former Chief Executive Officer, High Ridge Brands Co. | Audit Compensation and Human Resources |

| | | |

| | | |

Stephen I. Sadove | 72 | Former Chairman and Chief Executive Officer, Saks Incorporated | Compensation and Human Resources Nominating, Governance and Corporate Responsibility |

| | | |

| | | |

Kevin G. Wills | 58 | Chief Financial Officer, Authentic Brands Group | Audit Finance and Technology |

| | | |

| | | |

John J. Zillmer | 68 | Chief Executive Officer, Aramark | None |

| | | |

DIRECTOR NOMINEES

The following sections describe certain information regarding our director nominees as of December 8, 2023.

Director Nominee Composition

| | | | | | | | |

| | |

| Board Diversity Matrix |

| Total Number of Directors | 10 |

| Part I: Gender Identity | Female | Male |

| Directors | 4 | 6 |

| Part II: Demographic Background |

| African American or Black | 1 | 0 |

| Hispanic or Latinx | 1 | 0 |

| White | 2 | 6 |

| Part III: Tenure (avg. 3.4 years) |

| 0-3 Years | 5 |

| 4-6 Years | 4 |

| 7+ Years | 1 |

Director Nominee Skills, Experience, and Background

The Board regularly reviews the skills, experience, and background that it believes are desirable to be represented on the Board and that align with the Company’s strategic vision, and business and operations. The following is a description of some of these skills, experience, and background:

| | | | | | | | | | | |

| Strategy Development | | Disruptive Risk and Innovation |

| Experience driving strategic direction and growth of an organization | Experience or expertise in preparing for and responding to natural or man made business disruptions |

| | | |

| ARMK and Related Industry Experience | | Public Company Board Service |

Knowledge of or experience in one or more of the Company's specific industries (e.g., food and facilities management) | Experience as a board member of another publicly-traded company |

| | | |

| Accounting & Finance | | Corporate Finance & Capital Markets |

Experience or expertise in financial accounting and reporting or the financial management of a major organization | Experience in capital structure strategy, corporate debt. capital market transactions, private equity or investment banking |

| | | |

| C-Suite Leadership | | IT & Cyber Security |

Experience serving in a senior leadership role of a major organization (e.g., Chief Financial Officer, General Counsel, President, or Division Head) | Experience or expertise in information technology or the use of digital media or technology to facilitate business objectives |

| | | |

| CEO Leadership | | International Operations |

| Experience serving as the Chief Executive Officer of a major organization | Experience doing business internationally |

| | | |

| Compensation, Human Resources & Culture | | Traditional and Digital Marketing & Sales |

| Experience or expertise in human resources and fostering organizational goals, values and behaviors | Experience in creating, communicating and delivering offerings of goods and services for customers and clients through either traditional or digital means |

| | | |

| Supply Chain | | M&A and Business Development |

| Experience in the large-scale procurement and distribution of goods for an enterprise | Experience and involvement with significant mergers and acquisitions |

The following is a summary of some of the skills, experience, and background that our director nominees bring to the Board:

| | | | | | | | | | | | | | | | | | | | |

| SKILLS, EXPERIENCE AND BACKGROUND |

| | | | | | |

10 Director Nominees | | | | | STRATEGY DEVELOPMENT | 100% |

| | |

| | | | DISRUPTIVE RISK AND INNOVATION | 60% |

| | |

| | | | ARMK AND RELATED INDUSTRY BACKGROUND | 70% |

| | |

| | | | PUBLIC COMPANY BOARD SERVICE | 80% |

| | |

| | | | ACCOUNTING & FINANCE | 80% |

| | |

| | | | CORPORATE FINANCE & CAPITAL MARKETS | 40% |

| | |

| | | | C-SUITE LEADERSHIP | 100% |

| | |

| | | | IT & CYBER SECURITY | 30% |

| | |

| | | | CEO LEADERSHIP | 60% |

| | |

| | | | INTERNATIONAL OPERATIONS | 80% |

| | |

| | | | COMPENSATION, HUMAN RESOURCES & CULTURE | 90% |

| | |

| | | | TRADITIONAL AND DIGITAL MARKETING & SALES | 70% |

| | |

| | | | SUPPLY CHAIN | 60% |

| | |

| | | | M&A AND BUSINESS DEVELOPMENT | 80% |

| | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | | |

| | Susan M. Cameron | Director since: 2019 | Age: 65 |

| | | | |

| | Former Chairman and Chief Executive Officer, Reynolds American Inc. |

| | | | |

| | Biography: Susan M. Cameron most recently served as the Non-Executive Chairman of Reynolds American Inc. from May 2017 to July 2017, its Executive Chairman from January 2017 to May 2017, and its President and Chief Executive Officer and member of the board of directors from 2014 to December 2016 and 2004 to 2011. Prior to that, Ms. Cameron held various marketing, management and executive positions at Brown & Williamson Tobacco Corporation, a U.S. tobacco company. She currently serves as a director of nVent Electric plc and Tupperware Brands Corporation. Ms. Cameron previously served as a director of Reynolds American Inc. and R.R. Donnelley & Sons Company. Skills & Qualifications: Ms. Cameron’s experience as a public company CEO, her experience on the boards of other public companies and her considerable experience in the marketing for international name-brand consumer products companies enable her to provide key leadership and strategic perspectives to the Board. |

| Experience Highlights: | |

| CEO Leadership, Public Company Board Service, C-Suite Leadership, Compensation, Human Resources & Culture, Marketing & Sales, Strategy Development | |

| Independent Director

Aramark Committees: | |

| Compensation & Human Resources (Chair); Nominating, Governance and Corporate Responsibility | |

| Other Public Boards: | |

| Tupperware Brands Corporation, nVent Electric plc | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | | |

| | Greg Creed | Director since: 2020 | Age: 66 |

| | | | |

| | Former Chief Executive Officer, Yum! Brands, Inc. |

| | | | |

| | Biography: Greg Creed most recently served as the Chief Executive Officer of YUM! Brands, Inc. from January 2015 to January 1, 2020, its Chief Executive Officer of Taco Bell Division from 2011 to 2014, and as President and Chief Concept Officer of Taco Bell U.S. from 2007 to 2011 after holding various other positions with the company since 1994. Mr. Creed currently serves as a director of Whirlpool Corporation, Delta Air Lines, Inc., and privately-held NetBase/Quid. He previously served as a director of YUM! Brands, Inc. and Sow Good Inc. Skills & Qualifications: Mr. Creed’s expertise as a public company CEO for a leading global operator of quick service restaurants allows him to contribute key insights and strategic leadership to the Board. His international experience is also very valuable to the Board. |

| Experience Highlights: | |

| CEO Leadership, Public Company Board Service, Related Industry Experience, C-Suite Leadership, Strategy Development, International Operations, Marketing & Sales | |

| Independent Director

Aramark Committees: | |

| Compensation & Human Resources; Finance and Technology (Chair) | |

| Other Public Boards: | |

| Whirlpool Corporation, Delta Air Lines, Inc. | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | | |

Brian M. DelGhiaccio | Director since: New Nominee | Age: 50 | | |

| | | | |

| Executive Vice President and Chief Financial Officer, Republic Services, Inc. | | |

| | | | |

Biography: Brian DelGhiaccio is currently Executive Vice President and Chief Financial Officer of Republic Services, Inc., and has been in such position since 2020. Prior to that, Mr. DelGhiaccio served as Executive Vice President and Chief Transformation Officer from 2019 to 2020. Before that, Mr. DelGhiaccio served Senior Vice President, Business Transformation from 2017 to 2019, Senior Vice President, Finance from 2014 to 2017 and as Vice President, Investor Relations from 2012 to 2014. Prior to his time at Republic Services, Mr. DelGhiaccio was a senior consultant with Arthur Andersen. Skills & Qualifications: Mr. DelGhiaccio’s executive experience as a Chief Financial Officer will enable him to provide our Board with knowledgeable perspectives on accounting and auditing matters as well as strategic planning and mergers & acquisitions. | | |

| Experience Highlights: | |

| C-Suite Leadership, Accounting & Finance, Corporate Finance & Capital Markets, IT & Cyber Security; M&A and Business Development, Strategy Development | |

| Independent Director Aramark Committees: | |

| New Nominee | |

| Other Public Boards: | |

| None | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

Bridgette P. Heller | Director since: 2021 | Age: 62 | | | |

| | | | | |

Founder and Chief Executive Officer, The Shirley Procter Puller Foundation | | | |

| | | | | |

Biography: Bridgette P. Heller is the founder and CEO of the Shirley Proctor Puller Foundation, a small non-profit committed to generating better educational outcomes for underserved children in St. Petersburg, Florida. Previously, Ms. Heller served as the Executive Vice President and President of Nutricia, the Specialized Nutrition Division of Danone from July 2016 to August 2019. From 2010 to 2015, she served as Executive Vice President of Merck & Co., Inc. and President of Merck Consumer Care. Prior to joining Merck, Ms. Heller was President of Johnson & Johnson’s Global Baby Business Unit from 2007 to 2010 and President of its Global Baby, Kids, and Wound Care business from 2005 to 2007. She also worked for Kraft Foods from 1985 to 2002, ultimately serving as Executive Vice President and General Manager for the North American Coffee Portfolio. Ms. Heller serves as a director of Dexcom, Inc., Integral Ad Science Holding Corp., Novartis AG, and privately-held Newman’s Own Inc. She previously served as a director of Tech Data Corporation and ADT Corporation. Skills & Qualifications: Ms. Heller’s substantial experience and expertise in the food and nutrition industries provides the Board with key insights on that significant portion of the Company’s business as well as consumer focused businesses generally. | | | |

| | Experience Highlights: | |

| | C-Suite Leadership, Strategy Development, Marketing & Sales, International Operations, Public Company Board Service

| |

| | Independent Director Aramark Committees: | |

| | Finance and Technology; Nominating, Governance and Corporate Responsibility | |

| | Other Public Boards: | |

| | DexCom, Inc., Novartis AG, Integral Ad Science Corp. | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | | |

| | Kenneth M. Keverian | Director since: 2022 | Age: 66 |

| | | | |

| | Former Chief Strategy Officer, IBM Corporation |

| | | | |

| | Biography: Kenneth M. Keverian currently serves as a Senior Advisor to Boston Consulting Group and as advisor to several other companies. From 2014 until July 2020, Mr. Keverian was the Chief Strategy Officer of IBM Corporation. Prior to joining IBM Corporation, Mr. Keverian was a Senior Partner of Boston Consulting Group, where he served clients in the computing, transportation, consumer, retail, media and entertainment sectors from 1988 until 2014. Prior to that, he was a Development Team Leader for AT&T Bell Laboratories. Skills & Qualifications: Mr. Keverian’s extensive experience developing business strategies and executable plans for complex organizations, including over 30 years in the technology industry, provides important insights to the Board. |

| Experience Highlights: | |

| C-Suite Leadership, Strategy Development, M&A and Business Development, IT and Cyber Security, R&D and Innovation, Disruptive Risk and Innovation | |

| Independent Director

Aramark Committees: | |

| Audit; Finance and Technology | |

| Other Public Boards: | |

| None | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | | |

| | Karen M. King | Director since: 2019 | Age: 67 |

| | | | |

| | Former Executive Vice President, Chief Field Officer, McDonald’s Corp. |

| | | | |

| | Biography: Karen M. King is the former Executive Vice President, Chief Field Officer of McDonald’s Corp. from 2015 to 2016. Prior to that, Ms. King held various management and executive positions at McDonald’s Corp. since 1994, including having served as its Chief People Officer, President, East Division, Vice-President, Strategy and Business Development and General Manager and Vice President, Florida Region, among others. Skills & Qualifications: Ms. King’s substantial experience and expertise in field operations and talent development for a high head count business in the quick service food industry provides the Board with key insights and perspective on operations, consumer focused marketing and service delivery. |

| Experience Highlights: | |

| C-Suite Leadership, Strategy Development, Related Industry Experience, Compensation, Human Resources & Culture, Marketing & Sales | |

| Independent Director

Aramark Committees: | |

| Audit; Finance and Technology | |

| Other Public Boards: | |

| None | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

Patricia E. Lopez | Director since: 2022 | Age: 62 | | | |

| | | | | |

Former Chief Executive Officer, High Ridge Brands Co. | | | |

| | | | | |

Biography: Patricia E. Lopez most recently served as Chief Executive Officer and member of the board of directors of High Ridge Brands Co., a Clayton, Dubilier & Rice Company, from 2017 until April 2020. Before joining High Ridge Brands Co., Ms. Lopez served as a Senior Vice President of The Estée Lauder Companies Inc. from 2015 until 2016 and Chief Marketing Officer of Avon Products, Inc. from 2012 until 2015. Prior to that, Ms. Lopez worked for The Procter & Gamble Company from 1983 to 2012, where she held various roles in the Latin America and United States before ultimately serving as Vice President and General Manager of Eastern Europe in Russia. Ms. Lopez currently serves as a director of Domino’s Pizza, Inc. and Express, Inc. Skills & Qualifications: Ms. Lopez’s diverse global business experience in both marketing and operations as well as her experience on the boards of other public companies provides key insights to the Board. | | | |

| | Experience Highlights: | |

| | C-Suite Leadership, Marketing & Sales, Strategy Development, International Operations | |

| | Independent Director Aramark Committees: | |

| | Audit; Compensation & Human Resources | |

| | Other Public Boards: | |

| | Domino’s Pizza, Inc., Express, Inc. | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

Stephen I. Sadove | Director since: 2013 | Age: 72 | | | |

| | | | | |

Former Chairman and Chief Executive Officer, Saks Incorporated | | | |

| | | | | |

Biography: Stephen I. Sadove is currently principal of Stephen Sadove & Associates and a founding partner of JW Levin Partners. He served as Chief Executive Officer of Saks Incorporated from 2006 until November 2013 and Chairman and CEO from May 2007 until November 2013. He was Chief Operating Officer of Saks from 2004 to 2006. Prior to joining Saks in 2002, Mr. Sadove was with Bristol-Myers Squibb Company from 1991 to 2002, first as President, Clairol from 1991 to 1996, then President, Worldwide Beauty Care from 1996 to 1997, then President, Worldwide Beauty Care and Nutritionals from 1997 to 1998, and finally, Senior Vice President and President, Worldwide Beauty Care. He was employed by General Foods Corporation from 1975 to 1991 in various managerial roles, most recently as Executive Vice President and General Manager, Desserts Division from 1989 until 1991. Mr. Sadove currently serves as a director of Colgate-Palmolive Company, Park Hotels & Resorts Inc., and Movado Group, Inc. and previously served as director of Ruby Tuesday, Inc., J.C. Penney Company, Inc. and privately-held Buy It Mobility. Skills & Qualifications: Mr. Sadove’s extensive knowledge of financial and operational matters in the retail industry, including as to technology matters, and his experience as a public company Chief Executive Officer are highly valuable to the Board. In addition, Mr. Sadove’s service on a number of public company boards provides important insights to the Board on governance and similar matters. | | | |

| | Experience Highlights: | |

| | CEO Leadership, C-Suite Leadership, Related Industry Experience, International Operations, Strategy Development, Marketing & Sales, Public Company Board Service | |

| | Independent Director Aramark Committees: | |

| | Compensation & Human Resources; Nominating, Governance and Corporate Responsibility (Chair) | |

| | Other Public Boards: | |

| | Colgate-Palmolive Company, Park Hotels & Resorts Inc., Movado Group, Inc. | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | | |

| | Kevin G. Wills | Director since: 2023 | Age: 58 |

| | | | |

| | Chief Financial Officer, Authentic Brands Group |

| | | | |

| | Biography: Kevin G. Wills is currently Chief Financial Officer of Authentic Brands Group. Prior to joining Authentic Brands Group, he served as Chief Financial Officer of Pilot Company, a private company, from 2019 to 2023, and Chief Financial Officer of Tapestry Incorporated, a publicly traded company, from 2017 to 2019. Mr. Wills was formerly an independent director of Tivity Health, for which he was the Audit Committee Chair for two years and the Chairman of the Board for five years. Skills & Qualifications: Mr. Wills executive experience as a Chief Financial Officer for several large companies provides the board with invaluable insights on accounting and auditing matters, strategy, corporate finance, and mergers and acquisitions. The Board has determined Mr. Wills to be an audit committee financial expert. |

| Experience Highlights: | |

| Accounting & Finance, Compensation, Human Resources & Culture, Corporate Finance & Capital Markets, C-Suite Leadership, International Operations, M&A and Business Development, Public Company Board Service, Strategy Development | |

| Independent Director

Aramark Committees: | |

| Audit; Finance and Technology | |

| Other Public Boards: | |

| None | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | | |

| | John J. Zillmer | Director since: 2019 | Age: 68 |

| | | | |

| | Chief Executive Officer, Aramark |

| | | | |

| | Biography: John J. Zillmer has been our Chief Executive Officer (“CEO”) since October 2019. Prior to joining us, Mr. Zillmer served as Chief Executive Officer and Executive Chairman of Univar from 2009 until 2012. Prior to that, Mr. Zillmer served as Chairman and Chief Executive Officer of Allied Waste Industries from 2005 to 2008 and various positions at Aramark, including Vice President of Operating Systems, Regional Vice President, Area Vice President, Executive Vice President Business Dining Services, President of Business Services Group, President of International and President of Global Food and Support Services, from 1986 to 2005. Mr. Zillmer serves on the board of directors as Non-Executive Chairman of CSX Corporation, as well as a director of Ecolab, Inc. Mr. Zillmer was formerly on the board of directors of Veritiv Corporation, Performance Food Group (PFG) Company, Inc. and Reynolds American, Inc. Skills & Qualifications: Having served as our CEO since October 2019 and with over 30 years of experience in the managed food and services hospitality industry, including 23 years with Aramark, Mr. Zillmer’s extensive knowledge of the Company and the industries in which it is engaged are invaluable to the Board. In addition, Mr. Zillmer’s experience prior to joining Aramark as a Chief Executive Officer of two public companies provides key leadership experience and perspective and is greatly valued by the Board. |

| Experience Highlights: | |

| CEO Leadership, Strategy Development, Industry Experience, International Operations, M&A and Business Development, Supply Chain, Public Company Board Service | |

| Aramark Committees: | |

| None | |

| Other Public Boards: | |

| CSX Corporation, Ecolab, Inc. | |

CORPORATE GOVERNANCE

Agreement with Mantle Ridge

On October 6, 2019, the Company entered into a Stewardship Framework Agreement (as amended, the “Stewardship Framework Agreement”) with MR BridgeStone Advisor LLC (“Mantle Ridge”), on behalf of itself and its affiliated funds (such funds, together with Mantle Ridge, collectively, the “Mantle Ridge Group”). Pursuant to the Stewardship Framework Agreement, each of Mr. Paul Hilal, Messrs. Zillmer and Winkleblack and Mses. Cameron and King were elected to the Board, and it was agreed that Mr. Creed would be nominated to the Board at the next annual meeting. Messrs. Zillmer, Hilal, Creed and Winkleblack and Mses. Cameron and King were then nominated for election to the Board and elected at the 2020 Annual Meeting. This group was then elected to the Board at the 2021, 2022 and 2023 Annual Meetings. Pursuant to the Stewardship Framework Agreement, Mr. Hilal was also appointed Vice Chairman of the Board. On August 9, 2023, Mr. Hilal resigned from the Board and Mantle Ridge waived its right to appoint a successor director under the Stewardship Framework Agreement. In addition, Mr. Winkleblack is not standing for election at the Annual Meeting.

Board Structure and Leadership

The Board manages or directs the business and affairs of the Company, as provided by Delaware law, and conducts its business through meetings of the Board and four standing committees: the Audit Committee, the Compensation and Human Resources Committee (the “Compensation Committee”), the Nominating, Governance and Corporate Responsibility Committee (the “Nominating Committee”) and the Finance and Technology Committee (the “Finance Committee”). The Board is currently led by Mr. Sadove, our Chairman.

The Board, upon the recommendation of the Nominating Committee, has determined that, at this time, having a separate Chairman and Chief Executive Officer is the best board organization for Aramark. Nine of the ten Board nominees, if elected, will be independent directors. The Board’s committees are composed solely of, and chaired by, independent directors. Our independent directors meet at each regularly scheduled Board meeting in separate executive sessions, without Mr. Zillmer present, chaired by the Chairman.

Aramark’s strong Board, with an independent Chairman and independent committee chairs, ensures that the Board, and not the Chief Executive Officer alone, determines the Board’s areas of focus.

Director Independence and Independence Determinations

Under our Corporate Governance Guidelines and New York Stock Exchange ("NYSE") rules, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with the Company or any of its subsidiaries.

The Board has established guidelines of director independence to assist it in making independence determinations, which conform to the independence requirements in the NYSE listing standards. In addition to applying these guidelines, which are set forth in our Corporate Governance Guidelines (which may be found on the Corporate Governance page of the Investor Relations section on our website at www.aramark.com), the Board will consider all relevant facts and circumstances in making an independence determination. Our Corporate Governance Guidelines provide that none of the following relationships will disqualify any director or nominee from being considered “independent” and such relationships will be deemed to be an immaterial relationship with Aramark:

•A director’s or a director’s immediate family member’s ownership of five percent or less of the equity of an organization that has a relationship with Aramark;

•A director’s service as an executive officer or director of or employment by, or a director’s immediate family member’s service as an executive officer of, a company that makes payments to or receives payments from Aramark for property or services in an amount which, in any fiscal year, is less than the greater of $1 million or two percent of such other company’s consolidated gross revenues; or

•A director’s service as an executive officer of a charitable organization that received annual contributions from Aramark and its charitable foundation that have not exceeded the greater of $1 million and two percent of the charitable organization’s annual gross revenues (Aramark’s automatic matching of employee contributions will not be included in the amount of Aramark’s contributions for this purpose).

The policy of the Board is to review the independence of all directors at least annually. The Nominating Committee undertook its annual review of director independence and made a recommendation to the Board of Directors regarding director independence. In making its independence determinations, the Nominating Committee and the Board considered various transactions and relationships between Aramark and the directors or nominees or between Aramark and certain entities affiliated with a director or nominee. As a result of this review, the Board affirmatively determined that each of Messrs. Creed, DelGhiaccio, Keverian, Sadove, Wills, and Winkleblack, and Mses. Cameron, Heller, King and Lopez is independent and Messrs. Heinrich and Hilal were independent under the guidelines for director independence set forth in our Corporate Governance Guidelines and for purposes of applicable NYSE standards. In addition, at the committee level, the Board has also determined that each member of the Audit Committee is “independent” for purposes of Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and each member of the Compensation Committee is independent for purposes of applicable NYSE standards.

Board Assessment

The Board is focused on enhancing its performance through a rigorous assessment process of the effectiveness of the Board and its committees in order to increase shareholder value. We have designed our Board evaluation process to solicit input and perspective from all of our directors on various matters, including:

•the effectiveness of the Board and its operations;

•the Board’s leadership structure;

•Board composition, including the directors’ capabilities, experiences and knowledge;

•the quality of Board interactions; and

•the effectiveness of the Board’s committees.

As set forth in its charter, the Nominating Committee oversees the Board and committee evaluation process. Annually, the Nominating Committee determines the appropriate form of evaluation and considers the design of the process to ensure it is both meaningful and effective. In 2023, the Board engaged an independent third party to assist in the evaluation of the Board and its committees. The results of this process were reviewed by the Chairman of the Nominating Committee and presented to the full Board by the independent third party.

Board Committees and Meetings

The Board held 6 meetings during fiscal 2023. During fiscal 2023, each director, other than Mr. Heinrich, attended at least 75% of the aggregate of all Board meetings and all meetings of committees on which he or she served, in each case with respect to the portion of fiscal 2023 that they each served. Mr. Heinrich did not stand for re-election at the 2023 Annual Meeting held on February 3, 2023. All Aramark directors standing for election are expected to attend the annual meeting of shareholders. All of the directors standing for re-election attended the 2023 Annual Meeting.

Each of our four standing committees operates under a written charter approved by the Board. The charters of each of our standing committees are available in the Investor Relations section of our website at www.aramark.com.

The current composition of each Board committee is set forth below:

| | | | | | | | | | | | | | |

| | | | | |

| Director | Audit Committee* | Compensation Committee | Finance Committee | Nominating Committee |

| | | | |

| John J. Zillmer | | | | |

| | | | |

| Susan M. Cameron | | Chair | | X |

| | | | |

| Greg Creed | | X | Chair | |

| | | | |

| Bridgette P. Heller | | | X | X |

| | | | | |

| Kenneth M. Keverian | X | | X | |

| | | | | |

| Karen M. King | X | | X | |

| | | | | |

| Patricia E. Lopez | X | X | | |

| | | | | |

| Stephen I. Sadove, Chairman | | X | | Chair |

| | | | |

| Kevin G. Wills | X# | | X | |

| | | | | |

| Arthur B. Winkleblack | Chair # | | | X |

| | | | | |

| Meetings in fiscal 2023 | 10 | 6 | 4 | 5 |

* All members of the Audit Committee are financially literate within the meaning of the NYSE listing standards

# Qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K

| | | | | |

| | |

| Committee | Responsibilities |

| | |

| Audit Committee | •Prepares the audit committee report required by the U.S. Securities and Exchange Commission (the “SEC”) to be included in our proxy statement •Assists the Board in overseeing and monitoring the quality and integrity of our financial statements •Oversees the Company’s management of enterprise risk and monitors our compliance with legal and regulatory requirements •Oversees the Company’s Information Technology ("IT") Security Program •Oversees the work of the internal auditors and the qualifications, independence, and performance of our independent registered public accounting firm |

| | |

| Compensation and Human Resources Committee | •Sets our compensation program and compensation of our executive officers and recommends the compensation program for our directors •Monitors our incentive and equity-based compensation plans and reviews our contribution policy and practices for our retirement benefit plans •Prepares the compensation committee report required to be included in our proxy statement and annual report under the rules and regulations of the SEC •Oversees Human Capital Management and diversity and inclusion |

| | |

| Nominating, Governance and Corporate Responsibility Committee | •Identifies individuals qualified to become new members of the Board, consistent with criteria approved by the Board of Directors •Reviews the qualifications of incumbent directors to determine whether to recommend them for reelection and selecting, or recommending that the Board select, the director nominees for the next annual meeting of shareholders •Identifies Board members qualified to fill vacancies on any Board committee and recommends that the Board appoint the identified member or members to the applicable committee •Reviews the succession planning for the Chief Executive Officer •Reviews and recommends to the Board applicable corporate governance guidelines •Oversees the evaluation of the Board and handles such other matters that are specifically delegated to the Committee by the Board from time to time •Oversees the Company’s Environmental, Social and Governance activities except for those matters specifically reserved for other committees |

| | |

| Finance and Technology Committee | •Reviews our long-term business and financial strategies and plans •Reviews with management and recommends to the Board our overall financial plans, including operating budget, capital expenditures, acquisitions and divestitures, securities issuances, incurrences of debt and the performance of our retirement benefit plans and recommends to the Board specific transactions involving these matters •Approves certain financial commitments and acquisitions and divestitures by the Company up to specified levels •Reviews and advises the Board on the Corporation’s technology strategy, including related to IT |

Oversight of Risk Management

Aramark’s management is responsible for day-to-day risk management activities. The Board, acting directly and through its committees, is responsible for the oversight of Aramark’s risk management.

Our Audit Committee periodically reviews our accounting, reporting and financial practices, including the integrity of our financial statements, the oversight of administrative and financial controls and our compliance with legal and regulatory requirements. In addition, our Audit Committee reviews risks related to compliance with ethical standards, including our Business Conduct Policy, the Company’s approach to enterprise risk management and operational risks, including those related to information security and system disruption. With respect to cybersecurity, the Audit Committee monitors Aramark’s cybersecurity risk profile, receives periodic updates from management on all matters related to cybersecurity and reports out to the full Board. Through its regular meetings with management, including the accounting, finance, legal, information technology and internal audit functions, our Audit Committee reviews and discusses the risks related to its areas of oversight and reports to the Board with regard to its review. Our Finance Committee focuses on financial risks associated with the Company’s capital structure and acquisitions and divestitures that the Company is considering. Our Compensation Committee oversees compensation-related risk management, as discussed further in this proxy statement under “Compensation Matters-Compensation Discussion and Analysis-Compensation Risk Disclosure.” Our Nominating Committee oversees risks associated with board structure and other corporate governance policies and practices, including those related to ESG goals and objectives that relate to areas within the Nominating Committee's responsibilities. Our Finance, Compensation and Nominating Committees also regularly report their findings to the Board.

Our Chief Executive Officer and other executive officers regularly report to the non-executive directors and the Audit, the Compensation, the Nominating and the Finance Committees to ensure effective and efficient oversight of our activities and to assist in proper risk management and the ongoing evaluation of management controls. In addition, the Board receives periodic detailed operating performance reviews from management. Our Vice President of Internal Audit reports functionally and administratively to our Chief Financial Officer and directly to the Audit Committee. We believe that the leadership structure of the Board provides appropriate risk oversight of our activities.

Environmental Social Governance ("ESG")

Board and Management Oversight

The Nominating Committee and the Board oversee, and support implementation of, Aramark’s ESG goals and objectives, other than those relating to Diversity, Equity, and Inclusion ("DEI"), which are overseen by the Board's Compensation Committee, and those relating to ethics and compliance issues, which are overseen by the Board's Audit Committee. Be Well. Do Well., our ESG platform, articulates the Company’s priorities and centers on positively promoting both people and planet as core elements of Aramark’s business strategy and purpose. Delivery of Be Well. Do Well. is supported and driven by leaders of our Sustainability; Diversity, Equity and Inclusion; Safety; and Compliance organizations. The Vice President of Sustainability and other members of senior management report to the Nominating Committee quarterly, as well as other committees on an ad hoc basis, regarding key recommendations, progress, and outcomes related to our ESG goals. The Vice President of DEI reports to the Compensation quarterly.

Execution of Aramark’s ESG Be Well. Do Well. program is overseen by Aramark’s executive leadership team. Specifically, Aramark’s ESG Steering Committee, comprised of executive leaders who report to the CEO, is responsible for setting direction and driving accountability as we address material issues, work with key stakeholders, and track and report our progress.

Aramark’s ESG Operating Committee, a global cross-functional team, supports the ESG Steering Committee and is responsible for embedding our initiatives across our lines of business, identifying significant emerging issues, and driving measurable progress. A Sustainability Community of Practice, comprised of a field and function network, advisory council, and international working collaborative, drives cross-business collaboration, strategic alignment, and program implementation across the global organization. Together, our subject matter experts, business teams, and governance bodies work to anticipate future challenges and opportunities, manage risks, and identify innovative ideas to drive continual performance improvements. Our ESG International Working Collaborative drives integration and execution of Be Well. Do Well. initiatives across our International organization and local country organizations.

ESG Governance Framework

Sustainability Begins with Integrity

Sustainability begins with integrity, and our Business Conduct Policy ("BCP") codifies the rules that guide all our operations, including a sustainability section which requires that sustainability goals and performance reporting are accurate and truthful. We are committed to conducting business according to the highest ethical standards and in compliance with the law. Our BCP details our commitment to operating ethically and transparently, explaining the basic rules and principles that apply to every Aramark team member. Annual training addresses anti-corruption, human rights and the workplace environment, accurate books and records, privacy and confidentiality, and safety, as well as how to report potential BCP violations.

Priorities and Goals

Be Well. Do Well. accelerates our sustainability efforts and aligns with our vision for our future around two specific, interconnected goals. Our people goal is to enable equity and well-being for millions of people, including our employees, consumers, communities, and people in our supply chain. Our planet goal is to promote planetary health on our path to net-zero greenhouse gas ("GHG") emissions. These goals convey our priorities and ambitions, focus our efforts, and inspire our organization. Our approach is to foster growth and longevity and to create long-term stakeholder value by considering every dimension of how our Company operates – ethical, economic, and environmental. Through this platform, we strive to reduce inequity, support and grow our communities, promote diversity, and protect our planet, while continuously strengthening the core foundation and long-term value proposition of our business.

Each goal is supported by four priorities, which align with the United Nations Sustainable Development Goals ("UN SDGs") and are integrated with our business objectives. Our priorities include commitments to engage our employees; empower healthy consumers; build local communities; source ethically and inclusively; source sustainably; operate efficiently; minimize food waste; and embed circularity. We have identified key performance indicators and internal targets tied to our business objectives to drive outcomes against these priorities.

| | | | | |

| We are proud of the progress we made in fiscal 2023, including: •In July 2023, we raised our ambition level on climate by securing validation of our enterprise-wide near-term and net zero science-based targets to reduce GHG emissions, from the Science Based Targets initiative ("SBTi"). We are building our pathway to net-zero GHG emissions, which will involve reducing the carbon intensity of the food we serve, the services we provide and the energy we use. Our science-based targets build upon our existing GHG commitments, including our Coolfood Pledge to reduce our food-related emissions in the US 25% by 2030 against a 2019 baseline. We are also working to proactively manage and integrate climate-related threats and opportunities related to our operations. •In June 2023, we launched our first campaign to encourage all employees to self-identify in the company’s human resources systems voluntarily and confidentially. The myWholeSelf self-ID campaign aims to help the company better understand our LGBTQ+ population, inform DEI strategy, and better understand racial, ethnic, LGBTQ+, veteran, and disability representation within our workforce. •Aramark was named a 2023 honoree of The Civic 50 Greater Philadelphia, which showcases how employers use their time and resources to drive social impact in their business and community. •Aramark was ranked number 40 on Fair360’s (formerly DiversityInc’s) 2023 Top 50 Companies for Diversity list, up five spots from last year’s ranking. This is the seventh consecutive year Aramark appeared on the Top 50 list. For the first time, the company was also ranked on the Top Companies for Supplier Diversity list, at number 20. |

•Our 10th annual Aramark Building Community ("ABC") Day generated positive outcomes in our communities and fostered deep employee engagement. In addition to driving the impact highlighted in the infographic below, we distributed 10 one-time grants to nonprofits recommended by employee volunteers.

Public Reporting

On our journey of continuous improvement, we are committed to data transparency and accuracy as we work to deliver our Be Well. Do Well. commitments and targets. In 2023, we initiated implementation of an integrated ESG data management and carbon accounting software platform to improve our data accuracy, prepare for regulatory requirements, and facilitate development of a net zero pathway. Aramark has been reporting to CDP (formerly Carbon Disclosure Project), a global non-profit that runs the world’s leading environmental disclosure platform, for more than 10 years and has made its CDP Climate and Forestry responses publicly available since 2020. Our 2023 Be Well. Do Well. Progress Report, to be released in January 2024, will report on our ESG commitments and goals. The data and Key Performance Indicators ("KPIs") in our report align with multiple reporting frameworks and standards, including the Sustainability Accounting Standards Board ("SASB"), the Global Reporting Initiative ("GRI"), and the Task Force for Climate-Related Financial Disclosures ("TCFD").

Management Succession Planning

The Board’s responsibilities include succession planning for the Chief Executive Officer and other executive officer positions. The Nominating Committee oversees the development and implementation of our succession plans for the Chief Executive Officer and the Compensation Committee oversees succession plans for other key executives. At least once annually, the Chief Executive Officer provides the Board with an assessment of senior leaders and their potential to succeed to the position of Chief Executive Officer. This assessment is developed in consultation with the Chair of the Nominating Committee. High potential executives meet regularly with the members of the Board.

Executive Sessions

From time to time, and, consistent with our Corporate Governance Guidelines, at least at its regular quarterly meetings, the Board meets in executive session without members of management present. The Chairman presides at these executive sessions.

Code of Conduct

Our Business Conduct Policy, which applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer, is available on the Investor Relations section of our website at www.aramark.com. Our Business Conduct Policy contains a “code of ethics,” as defined in Item 406(b) of Regulation S-K. We will make any legally required disclosures regarding amendments to, or waivers of, provisions of our code of ethics on our Internet website.

Committee Charters and Corporate Governance Guidelines

The charters of the Compensation Committee, the Nominating Committee, the Audit Committee and the Finance Committee and our Corporate Governance Guidelines are available under the Investor Relations section of our website at www.aramark.com. Please note that all references to our website in this Proxy Statement are intended to be inactive textual references only. Copies of our Business Conduct Policy, the charters of the Compensation Committee, the Nominating Committee, the Audit Committee and the Finance Committee and our Corporate Governance Guidelines also are available at no cost to any shareholder who requests them by writing or telephoning us at the following address or telephone number:

Aramark

2400 Market Street

Philadelphia, PA 19103

Attention: Investor Relations

Telephone: (215) 409-7287

Director Nomination Process

The Nominating Committee does not set specific, minimum qualifications that directors must meet in order for the Nominating Committee to recommend them to the Board. Rather, it believes that directors and director candidates should be evaluated based on their individual merits, taking into account Aramark’s needs and the composition of the Board. In nominating a slate of directors, the Nominating Committee’s objective is to select individuals with skills and experience that can be of assistance in operating our business and providing effective oversight of the Company’s strategy and management. The Nominating Committee will consider candidates recommended by shareholders and all candidates are evaluated in the same manner regardless of who recommended such candidate for nomination. When reviewing the qualifications of potential director candidates, the Nominating Committee considers:

•whether individual directors possess the following personal characteristics: integrity, education, accountability, business judgment, business experience, reputation and high performance standards, and

•all other factors it considers appropriate, which may include accounting and financial expertise; industry knowledge; experience in compensation, human resources and culture; strategy development experience; CEO and senior management leadership experience; prior public company board service; international operations experience; corporate finance and capital markets experience; mergers and acquisitions and business development experience; supply chain experience; IT and cybersecurity experience; experience in R&D and innovation; both traditional and digital marketing and sales; experience with disruptive risk and innovation; age, gender and ethnic and racial background; civic and community relationships; existing commitments to other businesses; potential conflicts of interest with other pursuits; legal considerations, such as antitrust issues; and the size, composition and combined expertise of the existing Board.

The Board believes that, as a whole, it should strive to possess the following core competencies: accounting and finance, management, crisis response, industry knowledge, international leadership and strategy/vision, among others. While the Board does not have a formal policy with regard to diversity, the Nominating Committee and the Board strive to ensure that the Board is composed of individuals who together possess a breadth and depth of experience relevant to the Board’s oversight of Aramark’s business and strategy and a diversity of backgrounds and perspective in order to effectively understand the needs of our employees, clients and customers. The Company’s Corporate Governance Guidelines provide that, except as may be approved by the Nominating Committee, no person may serve as a non-employee director if he or she would be 75 years or older at the commencement of such term as a director.

Each of Messrs. Zillmer, Creed and Winkleblack and Mses. Cameron and King were previously nominated for election at the 2020 Annual Meeting in accordance with the Stewardship Framework Agreement. Prior to their election to the Board, each of Messrs. Creed and Winkleblack and Mses. Cameron and King entered into an Engagement and Indemnity Agreement with Mantle Ridge pursuant to which Mantle Ridge agreed to pay each of them certain amounts, and reimburse them for expenses incurred, in connection with their time and efforts relating to potentially joining the Board. The Engagement Agreements however did not provide for any agreements or obligations among Mantle Ridge or any of them with respect to any period following their joining the Board. Mr. Zillmer was party to a consulting agreement with Mantle Ridge that terminated when Mr. Zillmer was appointed to serve as the Chief Executive Officer of the Company.

In connection with the nomination of Mr. DelGhiaccio, the Nominating Committee retained an outside search firm to identify director candidates, in particular those with accounting and financial experience. A number of directors then met with such candidates. Following that process, and upon recommendation by the Nominating Committee, the Board nominated Mr. DelGhiaccio for election to the Board.

Proxy Access

Our By-laws, as amended, permit a shareholder, or a group of up to 20 shareholders, that has continuously owned for three years at least 3% of the Company’s outstanding common shares, to nominate and include in the Company’s annual meeting proxy materials up to the greater of two directors or 20% of the number of directors serving on the Board, provided that the shareholder(s) and the nominee(s) satisfy the requirements specified in our By-laws. For further information regarding submission of a director nominee using the Company’s proxy access By-law provision, see “General Information – 2025 Annual Shareholders Meeting – How can I nominate a director or submit a Shareholder proposal for the 2025 Annual Meeting of Shareholders?”.

Board Refreshment

The Board and the Nominating Committee regularly consider the long-term compensation of our Board and how the members of our Board change over time. The Board and Nominating Committee also consider the skills, experience, and backgrounds needed for the Board as our business and the industries and sectors in which we do business evolve. The Board and Nominating Committee also understand the importance of Board refreshment and aim to strike a balance between the knowledge that comes from longer-term service on the Board with the new experience, ideas and energy that can come from adding directors to the Board. In connection with our entry into the Stewardship Framework Agreement in October 2019, the Nominating Committee and Board recommended and elected five new directors to the Board and four of our directors retired. These five members and Mr. Creed were then nominated for election and elected to the Board at the 2020 Annual Meeting and then at the 2021, 2022 and 2023 Annual Meetings. At the 2021 Annual Meeting Ms. Heller was elected to the Board, Mses. Heller and Lopez and Mr. Keverian were elected to the Board at the 2022 Annual Meeting, and Mses. Heller and Lopez and Messrs. Keverian and Wills were elected to the Board at the 2023 Annual Meeting. Assuming the election of this year’s proposed director nominees is successful, we believe we will have a good balance between directors with experience with the Company and new directors with fresh perspectives, constituting a strong, independent Board that will be well-positioned to navigate the current challenging business environment and accelerate the Company’s growth.

DIRECTOR COMPENSATION

Annual Cash Compensation for Board Service

In fiscal 2023, each non-employee director received cash compensation at an annual rate of $105,000 for service on the Board, payable quarterly in arrears. The Chairman was eligible to receive an additional annual cash fee of $100,000. Additionally, the chairpersons of the Audit Committee and Compensation Committee were eligible to receive an additional annual cash retainer of $30,000 and the chairpersons of the Nominating Committee and Finance Committee were eligible to receive an additional annual cash retainer of $20,000, provided, in each case, that such committee chairperson was a non-employee director. Directors who join the Board during the fiscal year or serve as a committee chairperson for a portion of the fiscal year receive a prorated amount of the relevant annual cash compensation. Mr. Hilal declined his receipt of any cash compensation for his service on the Board and Mr. Sadove has declined his receipt of the retainer for serving as chairperson of the Nominating Committee.

In fiscal 2023, Messrs. Creed, Heinrich, Sadove and Winkleblack and Ms. Cameron each received additional fees for serving as Chairman and/or chairing the Nominating, Audit, Compensation or Finance Committee.

Annual Deferred Stock Unit Grant

Under the Company’s director compensation policy, which had been in effect from January 1, 2016 until August 2, 2022, non-employee directors were eligible for an annual grant of deferred stock units (“DSUs”) with a value of $160,000 on the date of the annual meeting of shareholders. Directors have the right to elect whether the DSUs granted will deliver shares on: (i) the vesting date of the DSUs or (ii) the first day of the seventh month after the date the director ceases to serve on the Board. On August 2, 2022, the value of the annual DSU grant was increased to $175,000 and the pro rata portion of such increase in equity from August 2, 2022 to the date of the 2023 Annual Meeting was added to the annual DSU grant that was granted on the date of the 2023 Annual Meeting. The Chairman of the Board is also entitled to an additional grant of DSUs with a value of $100,000 on the date of each annual meeting of shareholders.

In accordance with the director compensation policy, each member of the Board who was not an employee of the Company received a grant of approximately $182,561 worth of DSUs under the Amended and Restated 2013 Management Stock Incentive Plan (the “2013 Stock Plan”) in February 2023. Mr. Wills received a grant of approximately $175,000 upon his election to the Board. All of these DSUs will vest on the day prior to the Company’s first annual meeting of shareholders that occurs after the grant date, subject to the director’s continued service on the Board through the vesting date, and will be settled in shares of the Company’s common stock pursuant to each director’s election as described above. Mr. Heinrich did not stand for reelection and did not receive a grant in February 2023. Mr. Hilal declined his receipt of any DSUs for his service on the Board.

All DSUs accrue dividend equivalents from the date of grant until the date of settlement.

Ownership Guidelines

The Board of Directors has adopted a minimum ownership guideline, providing that each director must retain at least five times the value of the annual cash retainer in shares of common stock or DSUs, and that the required level of ownership be attained by five years after the director’s start date.

Director Deferred Compensation Plan

Non-employee directors are able to elect with respect to all or a portion of their cash board retainer fees to (i) receive all or a portion of such cash fees in the form of DSUs or (ii) defer all or a portion of such cash fees under our 2005 Deferred Compensation Plan. The DSUs that a director elects to receive in lieu of cash fees awarded under our 2013 Stock Plan or 2023 Stock Plan will be fully vested on grant and settled in shares of our common stock on the first day of the seventh month after the director ceases to serve on the Board. Cash amounts that a director elects to defer under the unfunded 2005 Deferred Compensation Plan are credited at an interest rate based on Moody’s Long Term Corporate Baa Bond Index rate for October of the previous year, which was 6.26% beginning January 1, 2023. From October 1, 2022 until December 31, 2022, we credited amounts deferred with an interest rate equal to 3.35%. The 2005 Deferred Compensation Plan permits participants to select a payment date and payment schedule at the time they make their deferral election, subject to a three-year minimum deferral period. All or a portion of the amount then credited to a deferral account may be withdrawn if the withdrawal is necessary in light of a severe financial hardship.

The interest rate for 2005 Deferred Compensation Plan will be adjusted on January 1, 2024, based on the Moody’s Long Term Corporate Baa Bond Index rate for October 2023 which was 6.63%.

Other Benefits

All directors are eligible for an annual matching contribution to a college or other non-profit organization in an amount up to $10,000 and directors are also eligible for matching contributions in an amount up to $10,000 in response to natural disasters through the Company’s community involvement efforts to the same extent as employees of the Company.

Director Compensation Table for Fiscal 2023

The following table sets forth compensation information for our non-employee directors in fiscal 2023.

| | | | | | | | | | | | | | | | | |

| NAME | FEES EARNED OR PAID IN CASH(1) ($) | STOCK AWARDS(2) ($) | OPTION

AWARDS

($) | ALL OTHER COMPENSA- TION(3) ($) | TOTAL ($) |

Susan M. Cameron | 135,000 | | 182,566 | | — | | — | | 317,566 | |

Greg Creed | 125,000 | | 182,566 | | — | | — | | 307,566 | |

Daniel J. Heinrich(4) | 46,125 | | — | | — | | 12,866 | | 58,991 | |

Bridgette P. Heller | 105,000 | | 182,566 | | — | | 10,000 | | 297,566 | |

Paul Hilal(5) | — | | — | | — | | — | | — | |

Kenneth M. Keverian | 105,000 | | 182,566 | | — | | 10,000 | | 297,566 | |

Karen M. King | 105,000 | | 182,566 | | — | | 15,000 | | 302,566 | |

Patricia E. Lopez | 105,000 | | 182,566 | | — | | — | | 287,566 | |

Stephen I. Sadove | 205,000 | | 282,575 | | — | | 12,866 | | 500,440 | |

Kevin G. Wills | 69,125 | | 175,005 | | — | | — | | 244,130 | |

Arthur B. Winkleblack | 131,583 | | 182,566 | | — | | 10,000 | | 324,149 | |

(1)Includes base director retainers at an annual rate of $105,000, as well as a Chairman retainer at an annual rate of $100,000 for Mr. Sadove. Committee chairperson retainers at an annual rate of $30,000 were provided to each of Messrs. Heinrich and Winkleblack and Ms. Cameron for the portion of the year they chaired the Audit Committee and the Compensation Committee and retainers at an annual rate of $20,000 were provided to each of Messrs. Creed and Winkleblack for the portion of the year they chaired the Finance Committee and the Nominating Committee. Ms. Cameron elected to defer 25% of her cash retainer (inclusive of chair retainer) into DSUs during the first three months of fiscal 2023 and Mr. Creed elected to defer 100% of his cash retainer (inclusive of chair retainer) into DSUs.

(2)Represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 with respect to the 4,153 DSUs granted to all directors on February 3, 2023 with a grant date fair value of $43.96 per DSU with the exception of Messrs. Sadove and Wills. Mr. Sadove was granted 6,428 DSUs on February 3, 2023 as Chairman. Mr. Wills received a grant of 3,981 DSUs upon his election to the board on February 3, 2023. As of the end of fiscal 2023, directors held the following deferred stock units (including dividend equivalent units), all of which are vested except for those granted on February 3, 2023 and related dividend equivalents. The following numbers do not reflect the adjustment to the DSUs following the separation of the Company's uniform and workplace supplies business (the "Separation") which occurred after fiscal 2023 year-end on September 30, 2023.

| | | | | | | | | | | | | | |

| Name | DSU and Equivalents | | Name | DSU and Equivalents |

| Susan M. Cameron | 22,325 | | Kenneth M. Keverian | 8,915 |

| Greg Creed | 28,377 | | Karen M. King | 8,700 |

| Daniel J. Heinrich | — | | Patricia E. Lopez | 8,915 |

Bridgette P. Heller | 13,583 | | Stephen I. Sadove | 44,619 |

| Paul Hilal | — | | Kevin G. Wills | 4,015 |

| | | Arthur B. Winkleblack | 4,189 |

For additional information on the valuation assumptions and more discussion with respect to the deferred stock units, refer to Note 12 to our audited consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended September 29, 2023.

(3)The following are included in this column:

a)Charitable contributions of $10,000 made in the name of or on behalf of each of Messrs. Heinrich, Heller, Keverian, Sadove and Winkleblack and $15,000 made in the name of or on behalf of Ms. King in accordance with the Company’s director charitable contribution matching program.

b)The dollar value of dividend equivalents accrued on deferred stock units granted prior to February 5, 2014 (the date the Company announced the payment of its first quarterly dividend) where dividends were not factored into the grant date fair value are required to be reported for such awards. The total value of dividend equivalents accrued on deferred stock units for the directors during fiscal 2023, in each case for awards granted prior to February 5, 2014 for Messrs. Heinrich and Sadove is $2,866 each. For awards granted on or after February 5, 2014, the value of dividend equivalents allocated to deferred stock units in the form of additional units with the same vesting terms as the original awards is not included in this column because their value is factored into the grant date fair value of awards. Additional units awarded in connection with dividend adjustments are subject to vesting and delivery conditions as part of the underlying awards.

(4)Mr. Heinrich did not stand for re-election at the 2023 Annual Meeting.

(5)On August 9, 2023, Mr. Hilal resigned from the Board and Mantle Ridge waived its right to appoint a successor director under the Stewardship Framework Agreement.

Audit Committee Matters

PROPOSAL NO. 2 – RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| | | | | | | | | | | | | | | | | |

| PROPOSAL SUMMARY What Are You Voting On? We are asking our shareholders to ratify the appointment of Deloitte & Touche LLP (“Deloitte”) to serve as the Company’s independent registered public accounting firm for fiscal 2024, which ends on September 27, 2024. Although the Audit Committee has the sole authority to appoint the Company’s independent registered public accounting firm, the Audit Committee and the Board submit the selected firm to the Company’s shareholders as a matter of good corporate governance. Voting Recommendation The Board recommends that you vote “FOR” the ratification of the Audit Committee’s appointment of Deloitte as the Company’s independent registered public accounting firm for fiscal 2024. The Audit Committee has selected Deloitte to serve as the Company’s independent registered public accounting firm for fiscal 2024. Although action by the shareholders on this matter is not required, the Audit Committee values shareholder views on the Company’s independent registered public accounting firm and believes it is appropriate to seek shareholder ratification of this selection. If the shareholders do not ratify the appointment of Deloitte, the selection of the independent registered public accounting firm may be reconsidered by the Audit Committee. Even if the selection is ratified, the Audit Committee in its discretion may select a different independent registered public accounting firm at any time of the year if it determines that such a change would be in the best interests of the Company and its shareholders. The Company has been advised that representatives of Deloitte are scheduled to attend the Annual Meeting, and they will have an opportunity to make a statement if the representatives desire to do so. It is expected that the Deloitte representatives will also be available to respond to appropriate questions. The shares represented by your properly executed proxy will be voted “FOR” this proposal, which would be your vote to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal 2024, unless you specify otherwise. | |

| | | The Board recommends that you vote “FOR” the ratification of the appointment of Deloitte & Touche LLP | | |

The Audit Committee assists the Board in its oversight of the Company’s independent registered public accounting firm, which assistance includes the responsibility to appoint, compensate, retain, and oversee the firm. The independent registered public accounting firm reports directly to the Audit Committee. The Audit Committee reviews the independent registered public accounting firm’s qualifications, independence, and performance at least annually. In connection with this review, the Audit Committee considers whether there should be a regular rotation of the independent registered public accounting firm to assure continuing auditor independence. Further, in conjunction with the mandated rotation of the independent audit firm’s lead engagement partner, the Audit Committee is involved in the selection of the independent audit firm’s lead engagement partner.

Audit Committee Considerations in Appointing Deloitte

The Audit Committee has appointed Deloitte as the independent registered public accounting firm for the fiscal year ending September 27, 2024. The Audit Committee believes that the appointment of Deloitte as the Company’s independent registered public accounting firm is in the best interests of the Company and its shareholders. In addition to Deloitte’s independence, the Audit Committee considered:

| | | | | |

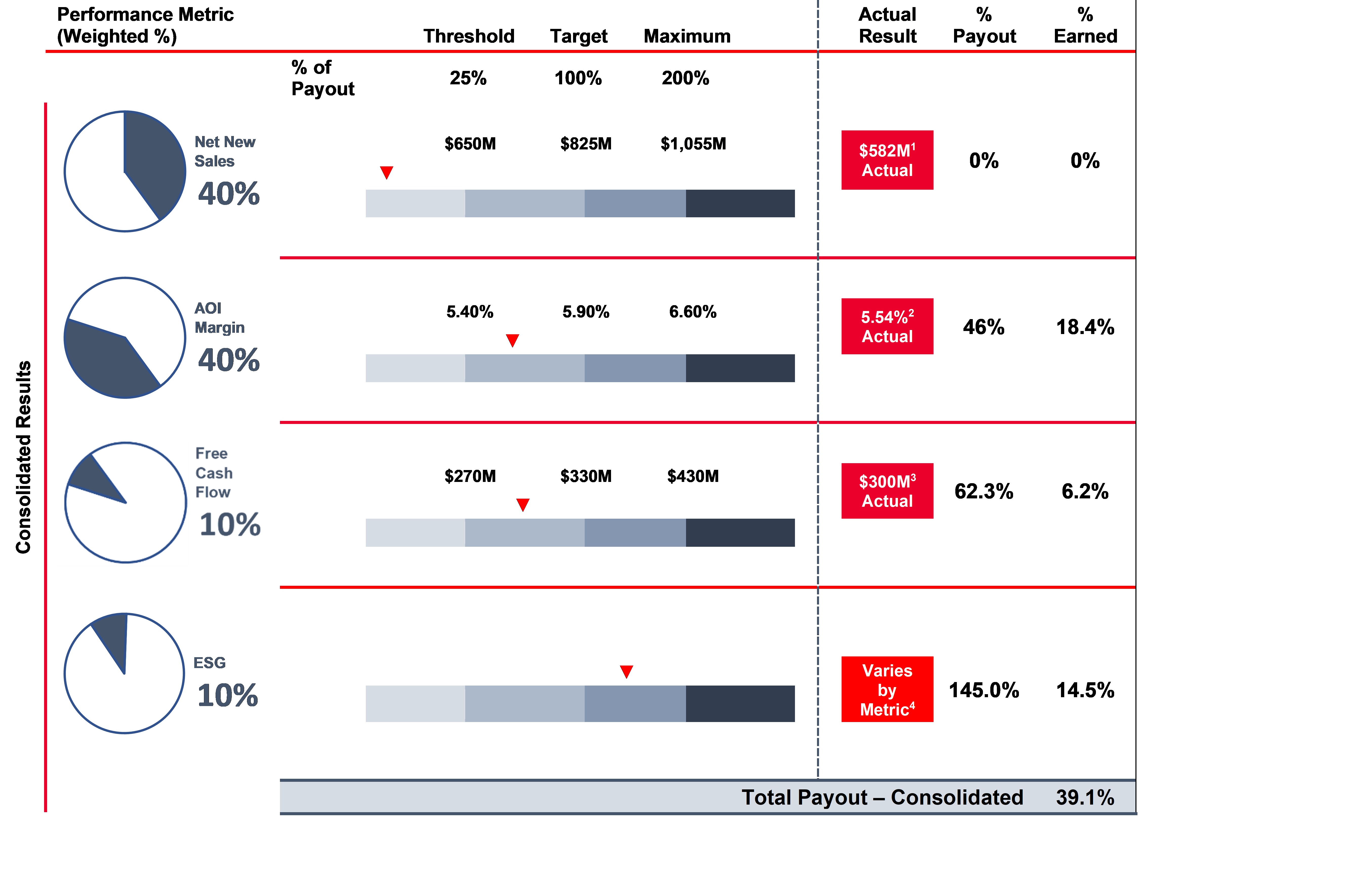

•Deloitte’s capabilities, qualifications and expertise; •The effectiveness and efficiency of Deloitte’s audit services; | •Deloitte’s compliance with regulations; and •Technological capabilities, relative benefits of tenure versus fresh perspective and fees. |