Allstate Slips to Underperform - Analyst Blog

November 14 2011 - 7:45AM

Zacks

We have downgraded our

recommendation on Allstate Corp. (ALL) to

Underperform from Neutral based on its consistent weak operating

performance in the third quarter of 2011, which raises a question on the

current sustainability factor.

Allstate’s third quarter operating

earnings per share of 16 cents came in a nickel higher than the

Zacks Consensus Estimate of 11 cents but significantly lagged the

year-ago quarter’s earnings of 83 cents. Operating earnings plunged

to $84 million from $452 million in the year-ago quarter.

The company’s net income for the

reported quarter came in at $165 million or 32 cents per share,

compared with $367 million or 68 cents in the

prior-year quarter, reflecting a radical decline.

Results for the reported quarter

reflected higher catastrophe (CAT) losses that also led to

increased claims expenses coupled with lower average premiums and

policies-in-force in Property-Liability insurance unit and lower

investment income. However, capital management

and liquidity were quite impressive during the reported

quarter. This is reflected from stability in book value per share

and combined ratio, excluding the effect of catastrophes.

As pricing pressures continue to

escalate, spreads between premium growth and loss cost inflation

are expected to remain negative, while claims and operating costs

continue to pose a rising trend, leading to further compression in

underlying margins. Particularly, a weak P&C cycle continues to

narrow down the growth prospects in the Property-Liability

segment.

As a result, premium growth

remains stunted

and the company is experiencing a decline in underwriting results,

policies in force (PIFs) and new issued applications.

Additionally, given the

consistent occurrence of weather-related events, catastrophe losses

surged to $3.75 billion in the first nine months of 2011, already

exceeding from $2.21 billion in 2010 and $2.07 billion in 2009.

Escalating losses from catastrophes have been weighing on the

company’s claims and benefits expenses while also significantly

deteriorating the combined ratio, bottom-line results and cash

flows.

Operating cash flow reduced

substantially to $1.7 billion from $3.0 billion, during the first

nine months of 2011 and 2010, respectively. The ongoing sluggish

and volatile economic dynamics besides weakening Allstate’s

operating leverage even undermined its cash and balance sheet

position.

Reduced cash flow also

restricts the company’s scope for acquisitions or returning

shareholder value. This is also evident from the latest $1.0

billion share repurchase program, which will be funded from

the planned issue of preferred stock offering and senior unsecured

notes, all worth $1.25 billion, rather than the company’s free

cash. These factors could weaken its competitive

leverage against arch rivals such as Berkshire

Hathaway-A (BRK.A) and The Travelers

Companies (TRV).

Nevertheless, Allstate is well

poised to be a long-term gainer in personal lines, given its scale,

pricing sophistication and product design. Moreover, the

acquisition of the third largest online auto insurance seller in

the U.S. – Esurance and Answer Financial from White Mountains

Insurance Group Ltd., in October 2011 for $1.0 billion, will most

likely boost online auto sales, and thereby generate cost synergies

in the Property-Liability segment.

Allstate is also repositioning its

product and distribution portfolio in order to enhance long-term

growth. Also, the company initiated an active role in reducing

future CAT losses through the establishment of an Enterprise Risk

and Return Management (ERRM) system.

Besides, on an immediate basis,

Allstate is working vigorously to maintain standard auto

margins,

improve returns in homeowners and Allstate Financial and manage

capital aggressively. We expect these initiatives to support the

bottom line in the upcoming quarters. Even a healthy ratings

outlook bodes well for Allstate’s long-term growth.

Overall, though continued

synergies are expected from Allstate’s industry-leading position,

diversification and pricing discipline, we believe that the current

volatile economy will continue to impact its fundamental growth

until the markets regain momentum.

Consequently, the Zacks

Consensus Estimate for the fourth quarter 2011 earnings is

currently pegged at 93 cents a share, drastically up from 50 cents

in the year-ago quarter, expecting a reduction or elimination in

CAT losses. For 2011, however, earnings are estimated to be 79

cents per share, radically down from $2.84, given the

overall yearly impact of CAT losses.

Additionally, the quantitative

Zacks Rank for Allstate is currently #3, indicating no clear

directional pressure on the shares over the near term.

ALLSTATE CORP (ALL): Free Stock Analysis Report

BERKSHIRE HTH-A (BRK.A): Free Stock Analysis Report

TRAVELERS COS (TRV): Free Stock Analysis Report

Zacks Investment Research

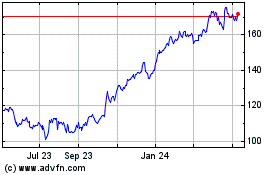

Allstate (NYSE:ALL)

Historical Stock Chart

From Jun 2024 to Jul 2024

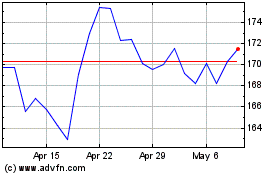

Allstate (NYSE:ALL)

Historical Stock Chart

From Jul 2023 to Jul 2024