- Report of Foreign Issuer (6-K)

August 19 2011 - 9:45AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of August, 2011

Commission File Number 001-35052

Adecoagro S.A.

(Translation of registrant’s name into English)

13-15 Avenue de la Liberté

L-1931 Luxembourg

R.C.S. Luxembourg B 153 681

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20-F or Form 40-F.

Form 20-F

þ

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1):

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

o

Indicate by check mark whether the registrant by furnishing the information contained in this

Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes

o

No

þ

If “Yes” is marked, indicate below the file number assigned to the registrant in connection

with Rule 12g3-2(b): 82-___________.

PRESS RELEASE REGARDING THE ACQUISITION OF THE “EL COLORADO” FARM IN ARGENTINA

On August 19, 2011, the registrant issued a press release pertaining to the acquisition of a

4,960 hectares farm named “El Colorado”, located in the region of Bandera, in the province of

Santiago del Estero, Argentina, for a total price of US$18.0 million. A copy of the press release

is attached to this Report on Form 6-K

The attachment contains forward-looking statements. The registrant desires to qualify for the

“safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995, and consequently

is hereby filing cautionary statements identifying important factors that could cause the

registrant’s actual results to differ materially from those set forth in the attachment.

The registrant’s forward-looking statements are based on the registrant’s current

expectations, assumptions, estimates and projections about the registrant and its industry. These

forward-looking statements can be identified by words or phrases such as “anticipate,” “believe,”

“continue,” “estimate,” “expect,” “intend,” “is/are likely to,” “may,” “plan,” “should,” “would,”

or other similar expressions.

The forward-looking statements included in the attached relate to, among others: (i) the

registrant’s business prospects and future results of operations; (ii) weather and other natural

phenomena; (iii) developments in, or changes to, the laws, regulations and governmental policies

governing the registrant’s business, including limitations on ownership of farmland by foreign

entities in certain jurisdictions in which the registrant operate, environmental laws and

regulations; (iv) the implementation of the registrant’s business strategy, including its

development of the Ivinhema mill and other current projects; (v) the registrant’s plans relating to

acquisitions, joint ventures, strategic alliances or divestitures; (vi) the implementation of the

registrant’s financing strategy and capital expenditure plan; (vii) the maintenance of the

registrant’s relationships with customers; (viii) the competitive nature of the industries in which

the registrant operates; (ix) the cost and availability of financing; (x) future demand for the

commodities the registrant produces; (xi) international prices for commodities; (xii) the condition

of the registrant’s land holdings; (xiii) the development of the logistics and infrastructure for

transportation of the registrant’s products in the countries where it operates; (xiv) the

performance of the South American and world economies; and (xv) the relative value of the Brazilian

Real, the Argentine Peso, and the Uruguayan Peso compared to other currencies; as well as other

risks included in the registrant’s other filings and submissions with the United States Securities

and Exchange Commission.

These forward-looking statements involve various risks and uncertainties. Although the

registrant believes that its expectations expressed in these forward-looking statements are

reasonable, its expectations may turn out to be incorrect. The registrant’s actual results could be

materially different from its expectations. In light of the risks and uncertainties described

above, the estimates and forward-looking statements discussed in the attached might not occur, and

the registrant’s future results and its performance may

differ materially from those expressed in these forward-looking statements due to, inclusive,

but not limited to, the factors mentioned above. Because of these uncertainties, you should not

make any investment decision based on these estimates and forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

Adecoagro S.A.

|

|

|

|

By

|

/s/

Carlos A. Boero Hughes

|

|

|

|

|

Name:

|

Carlos A. Boero Hughes

|

|

|

|

|

Title:

|

Chief Financial Officer and

Chief Accounting Officer

|

|

|

|

Date: August 19, 2011

AUGUST 19, 2011 PRESS RELEASE

Adecoagro S.A. (NYSE: AGRO, Bloomberg: AGRO US, Reuters. AGRO.K), one of the leading

agricultural companies in South America, announced today that in line with its growth strategy, it

has acquired 100% of the common shares of Compañía Agroforestal de Servicios y Mandatos S.A., a

company which owns a 4,960 hectare farm named “El Colorado”, located in the region of Bandera, in

the province of Santiago del Estero, Argentina, for a total price of US$18.0 million. The

transaction is subject to anti-trust approval.

El Colorado is an attractive opportunity for Adecoagro to continue generating value through

the transformation of farmland and expanding its production of agricultural commodities.

Based on initial estimates, El Colorado has approximately 2,411 hectares currently used for

planting crops (including soybean, corn, wheat and sunflower) and an additional 1,820 hectares used

for cattle grazing activities with potential for crop production. Adecoagro plans to transform the

hectares currently used for cattle grazing and put them into crop production during the 2011/12

harvest season. As a result, Adecoagro expects this acquisition to expand its planted area during the 2011/12 harvest year by approximately 3,000 hectares.

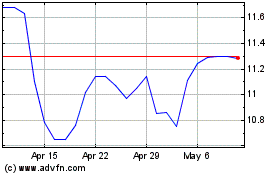

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Apr 2024 to May 2024

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From May 2023 to May 2024