United Security Bancshares - Earnings Restatement

November 14 2003 - 7:42PM

PR Newswire (US)

United Security Bancshares - Earnings Restatement FRESNO, Calif.,

Nov. 14 /PRNewswire-FirstCall/ -- Dennis R. Woods, President and

Chief Executive Officer of United Security Bank

http://www.unitedsecuritybank.com/ reported today that on November

14, 2003, the Company filed a Form 12b-25 with the Securities and

Exchange Commission notifying of a delay in the filing of the

Company's 10Q for the period ended September 30, 2003. In addition,

the Company will restate financial information for the year ended

December 31, 2002 and will file an amended Form 10-K. The

adjustments are the result of a change in accounting treatment for

certain Investment CD's the Company carries as assets on its books.

The changes will result in a decrease in net income for 2002 and an

increase in income for 2003. However, these adjustments will have

no permanent affect on income or shareholders equity. The net

cumulative adjustment decreases net income by $342,000 through

9/30/03. This difference will continue to dissipate over the

remaining life of the CDs. Once all CDs have matured, the

adjustment reaches zero. Generally, the affect of the adjustments

reduces income and equity in 2002 and increases income and equity

thereafter until the certificates mature. Tax rate changes, tax law

changes or selling the CD's prior to maturity could result in other

differences, but none of these events is anticipated. In May of

2002, USB entered into a Funds Agreement with a broker which

provided that USB would agree to issue FDIC insured certificates of

deposit and would invest in one similar reinvestment CD for every

$594,000 (6) certificates issued. From May 2002 through December

2002, USB purchased approximately 100 of these reinvestment CDs.

The broker's business model is based on a rate differential between

the accrual rate utilized by the purchaser of the reinvestment CD

(USB) and the issuing bank. Each depository institution recorded

the certificates at present value utilizing different discount

rates with the future value to be equal at maturity. Following an

examination by the Federal Reserve Bank of San Francisco ("Fed"),

the examiners contended that USB was accounting for these

transactions incorrectly. The Fed considered the rate differential

to be a cost associated with obtaining deposits to be recognized as

interest expense. In an effort to determine the proper accounting

treatment, USB submitted the matter to the Securities and Exchange

Commission ("SEC") in July 2003. After three conference calls and

the submission of additional details as requested by the SEC, the

SEC ruled in favor of accounting for the CDs in accordance with the

methods proposed by the FED. In summary, the 2002 restatement

resulted in changes to USB's financial statements for the year

ended December 31, 2002 as follows; Investment CDs were reduced by

$775,000 from $10,224,000 to $9,449,000 with a corresponding

decrease in Net Interest Income from $17,975,000 to $17,200,000.

Income tax expense was decreased by approximately $238,000 to

reflect the tax effect of the lower net interest income and Income.

Tax Reserves were increased by the same amount. The change to Net

Income was $538,000 for year 2002. This amount was subtracted from

Shareholders Equity reducing it from $41,099,000 to $40,651,000.

The change in accounting treatment increases net income for the

period ended September 30, 2003. The net result is to increase

year-to-date net income by $196,000. The net impact to

Shareholders' Equity from the 2002 restatement and 2003 adjustments

were a decrease of Shareholders' Equity of $342,000. Year to date

(dollars in 000's) 12/31/02 9/30/03 Net Change Net income as

reported 7,371 6,309 Income adjustment (538) 196 (342) Restated net

income 6,833 6,505 Income adjusted as a % of restated income -7.3%

3.1% Weighted average shares outstanding 5,401,000 5,443,000 EPS as

reported 1.36 1.16 Restated EPS 1.26 1.20 Decrease in EPS -0.10

0.04 -0.06 DATASOURCE: United Security Bank CONTACT: Ken Donahue of

United Security Bank, +1-559-248-4943, or Web site:

http://www.unitedsecuritybank.com/

Copyright

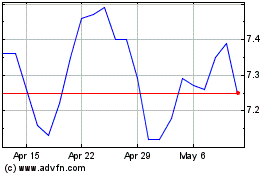

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From May 2024 to Jun 2024

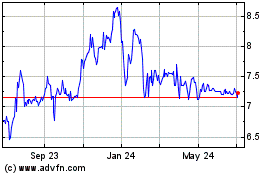

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From Jun 2023 to Jun 2024