0001021096FALSE25 W 39th StreetNew YorkNYNASDAQ00010210962023-07-282023-07-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) July 28, 2023

| | | | | | | | |

| TROIKA MEDIA GROUP, INC. | |

| (Exact name of registrant as specified in its charter) | |

| | | | | | | | | | | | | | | | | | | | |

| Nevada | | 001-40329 | | 83-0401552 | |

| (State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) | |

| | | | | | | | | | | | | | |

| 25 W 39th Street New York, NY | | 10018 | |

| (Address of principal executive offices) | | (Zip Code) | |

Registrant’s telephone number, including area code (212) 213-0111

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions :

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares $0.001 par value | TRKA | The NASDAQ Capital Market |

| Redeemable Warrants to acquire Common Shares | TRKAW | The NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

ITEM 8.01 OTHER EVENTS

A&R Limited Waiver

As previously disclosed, on February 10, 2023, Troika Media Group, Inc. (the “Company”) and Blue Torch Finance LLC (“Blue Torch”) entered into an Amended and Restated Limited Waiver (the “A&R Limited Waiver”) of certain events of default (such events of default, the “Specified Events of Default”) under the Financing Agreement dated March 21, 2022, by and among the Company, the lenders from time-to-time party thereto, and Blue Torch as collateral agent and administrative agent for such lenders (the “Financing Agreement”). The A&R Limited Waiver would have expired on the earliest of (x) the occurrence of an Event of Default under the Financing Agreement that is not a Specified Event of Default, (y) a failure by the Company to comply with certain sale and refinancing milestones and (z) June 30, 2023, subject to potential extension of up to 60 days to obtain regulatory and/or shareholder approval in the event the Company is pursuing a sale transaction (the “A&R Waiver Period,” and the date such period expires, the “Outside Date”).

On May 8, 2023, the Company and Blue Torch entered into a first amendment to the A&R Limited Waiver (the “First Amended A&R Limited Waiver”) pursuant to which the Company affirmed its commitment to work in good faith to consummate a sale of the Company’s business or assets and/or a refinancing transaction by the Outside Date, and Blue Torch agreed to remove the aforementioned milestones and to extend the Outside Date from June 30, 2023 to July 14, 2023, subject to potential extension if a definitive written agreement was delivered on or prior to July 14, 2023 providing for cash repayment in full of all obligations owed to Blue Torch or which was otherwise acceptable to Blue Torch.

On July 14, 2023, the Company and Blue Torch entered into a second amendment to the A&R Limited Waiver (the “Second Amended A&R Limited Waiver”) pursuant to which Blue Torch agreed to extend the Outside Date from July 14, 2023 to July 28, 2023, subject to potential extension if a definitive written agreement is delivered on or prior to July 28, 2023 providing for cash repayment in full of all obligations owed to Blue Torch or which is otherwise acceptable to Blue Torch.

On July 28, 2023, the Company and Blue Torch entered into a third amendment to the A&R Limited Waiver (the “Third Amended A&R Limited Waiver”) pursuant to which Blue Torch agreed to extend the Outside Date from July 28, 2023 to August 28, 2023, subject to potential extension if a definitive written agreement is delivered on or prior to August 28, 2023 providing for cash repayment in full of all obligations owed to Blue Torch or which is otherwise acceptable to Blue Torch.

The foregoing summaries do not purport to be complete and are subject to, and qualified in their entirety by, (i) the A&R Limited Waiver attached as Exhibit 99.1 to the Company’s Periodic Report on Form 8-K filed with the SEC on February 16, 2023, (ii) the First Amended A&R Limited Waiver attached as Exhibit 10.23 to the Company’s Form 10-K/A filed with the SEC on May 15, 2023, (iii) the Second A&R Limited Waiver attached as Exhibit 99.1 to the Company’s Periodic Report on Form 8-K filed with the SEC on July 17, 2023, and (iv) the Third A&R Limited Waiver attached as Exhibit 99.1 hereto, each of which is incorporated by reference herein.

The Company continues to engage in good faith negotiations with Blue Torch, as agent for the Lenders, to amend the Financing Agreement and cure the events of default, although the Company cannot assure you that the Company will be successful in doing so. If the Company is unsuccessful in renegotiating the Financing Agreement and curing the continuing events of default by the Outside Date, the Company intends to seek further Limited Waivers with Blue Torch, although the Company cannot assure you that Blue Torch would be willing to grant additional waivers. For further information on the terms of the Financing Agreement please refer to the Company’s Amended Annual Report on Form 10-K/A for the fiscal year ended June 30, 2022, filed with the SEC on November 22, 2022.

Litigation Update

On July 17, 2023, Michael Carrano, Thomas Marianacci, Maarten Terry, and Sadiq Toama, in their capacities as the sellers of Converge Direct, LLC and certain of its affiliates (collectively, the “Plaintiffs”) filed a complaint (the “Complaint”) under the caption Carrano et al. v. Troika Media Group, Inc. and CD Acquisition Corporation, Case No. 653449/2023 (the “Action”) in the Supreme Court of the State of New York, New York County against the Company and CD Acquisition Corporation (together, the “Defendants”). The Defendants have not yet been served with a Summons or the Complaint.

On July 28, 2023, Plaintiff Mr. Toama, who is chief executive officer of the Company, has informed the Company that he intends to withdraw from the Action without prejudice. Mr. Toama has recused himself from all deliberations by the Company’s Board of Directors (the “Board”) concerning the Action.

The Complaint generally alleges that the Defendants owe sums to the Plaintiffs under a Membership Interest Purchase Agreement effective as of March 21, 2022 (the “Agreement”). The Complaint seeks, among other things, a judgment that the Defendants breached the Agreement and damages relating to the purported breach. Nothing in this Current Report on Form 8-K shall be deemed an admission of liability.

All inquiries regarding the Action should be directed to the Company’s general counsel, Derek McKinney, who will report any inquiries directly to the Special Litigation Committee of the Board, which has been constituted to determine appropriate actions to be taken on behalf of the Company with respect to the Action. Such inquiries will be handled on a case-by-case basis. The Company does not intend to comment on or disclose further developments regarding the Action unless and until it deems further disclosure is appropriate or required.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Troika Media Group, Inc. |

| (Registrant) |

| | |

| Date: July 28, 2023 | By: | /s/ Erica Naidrich |

| | (Signature) |

| | Erica Naidrich

Chief Financial Officer |

Execution Version THIRD AMENDMENT TO THE AMENDED AND RESTATED LIMITED WAIVER TO FINANCING AGREEMENT This Third Amendment to the Amended and Restated Limited Waiver to Financing Agreement (this “Amendment”), dated July 28, 2023, is entered into by and among TROIKA MEDIA GROUP, INC., a Nevada corporation (the “Borrower”), each subsidiary of Borrower listed as a “Guarantor” on the signature pages hereto (together with Borrower and each other Person that executes a joinder agreement and becomes a “Guarantor” under the Financing Agreement referenced below, each a “Guarantor” and collectively, the “Guarantors”), the Lenders party hereto, BLUE TORCH FINANCE LLC, a Delaware limited liability company (“Blue Torch”), as collateral agent for the Lenders (in such capacity, together with its successors and assigns in such capacity, the “Collateral Agent”), and Blue Torch, as administrative agent for the Lenders (in such capacity, together with its successors and assigns in such capacity, the “Administrative Agent” and together with the Collateral Agent, each an “Agent” and collectively, the “Agents”, and together with the Borrower, the Guarantors and Lenders, the “Parties” and each a “Party”). WHEREAS, reference is made to that certain Amended and Restated Limited Waiver to Financing Agreement, dated as of February 10, 2023 (as amended by that certain First Amendment to the Amended and Restated Limited Waiver to Financing Agreement, dated as of May 8, 2023, and that certain Second Amendment to the Amended and Restated Limited Waiver to Financing Agreement, dated as of July 14, 2023, and as amended, supplemented or otherwise modified from time to time prior to the date hereof, the “Limited Waiver Agreement”), by and among the Parties; and WHEREAS, the Parties wish to modify the Limited Waiver Agreement as hereinafter described. NOW THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby agree as follows: 1. Definitions. Capitalized terms used but not otherwise defined herein shall have the meanings ascribed thereto in the Limited Waiver Agreement. 2. Amendment to the Limited Waiver Agreement. Section 2(a) of the Limited Waiver Agreement is hereby amended to (x) replace the text reading “July 28, 2023” contained therein with the text reading “August 28, 2023” and (y) replace the text reading “September 29, 2023” contained therein with the text reading “October 27, 2023”. 3. Conditions Precedent. This Amendment shall become effective on and as of the date on which the Agents shall have received counterparts of this Amendment executed and delivered by a duly authorized officer of the Borrower, the Guarantors, the Agents and Lenders constituting the Required Lenders (such date, the “Amendment Effective Date”). Without

2 limitation of the foregoing, the Parties irrevocably agree that the Amendment Effective Date has occurred on and as of July 28, 2023. 4. Representations. Each Party represents and warrants that its execution, delivery and performance of this Amendment has been duly authorized and that this Amendment constitutes its legal, valid and binding obligations. 5. Governing Law. This Amendment shall be governed by, construed and enforced under the same choice of law that governs the Limited Waiver Agreement. 6. Entire Agreement. This Amendment and the Limited Waiver Agreement constitute the entire agreement and understanding of the Parties with respect to their subject matter and supersede all oral communication and prior writings with respect thereto. 7. Limitation. Except for any amendment to the Limited Waiver Agreement made pursuant to this Amendment, all terms and conditions of the Limited Waiver Agreement will continue in full force and effect in accordance with its provisions on the date of this Amendment. All provisions of the Limited Waiver Agreement shall be deemed to be amended consistent with the terms of this Amendment. 8. Counterparts. This Amendment may be executed in any number of counterparts and by different Parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute but one and the same agreement. Any party hereto may execute and deliver a counterpart of this Amendment by delivering by facsimile or other electronic transmission a signature page of this Amendment signed by such party, and any such facsimile or other electronic signature shall be treated in all respects as having the same effect as an original signature [signature pages follow]

[Signature Page to Third Amendment to Amended and Restated Limited Waiver] IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed by their respective officers thereunto duly authorized, as of the date first written above. Borrower: TROIKA MEDIA GROUP, INC., as the Borrower By: Name: Derek McKinney Title: General Counsel Guarantors: TROIKA DESIGN GROUP, INC., as a Guarantor By: Name: Derek McKinney Title: General Counsel TROIKA PRODUCTION GROUP, LLC, as a Guarantor By: Name: Derek McKinney Title: General Counsel TROIKA-MISSION HOLDINGS, INC., as a Guarantor By: Name: Derek McKinney Title: General Counsel TROIKA IO, INC., as a Guarantor By: Name: Derek McKinney Title: General Counsel

[Signature Page to Third Amendment to Amended and Restated Limited Waiver] MISSION CULTURE LLC, as a Guarantor By: Name: Derek McKinney Title: General Counsel MISSION MEDIA USA, INC., as a Guarantor By: Name: Derek McKinney Title: General Counsel TROIKA SERVICES, INC., as a Guarantor By: Name: Derek McKinney Title: General Counsel TROIKA MISSION WORLDWIDE, INC., as a Guarantor By: Name: Derek McKinney Title: General Counsel CONVERGE DIRECT, LLC, as a Guarantor By: Name: Derek McKinney Title: General Counsel CONVERGE DIRECT INTERACTIVE, LLC, as a Guarantor By: Name: Derek McKinney Title: General Counsel

[Signature Page to Third Amendment to Amended and Restated Limited Waiver] CONVERGE MARKETING SERVICES, LLC, as a Guarantor By: Name: Derek McKinney Title: General Counsel LACUNA VENTURES, LLC, as a Guarantor By: Name: Derek McKinney Title: General Counsel CD ACQUISITION CORP, as a Guarantor By: Name: Derek McKinney Title: General Counsel

[Signature Page to Third Amendment to Amended and Restated Limited Waiver] Collateral Agent and Administrative Agent: BLUE TORCH FINANCE, LLC By: Blue Torch Capital LP, its managing member By: Name: Kevin Genda Title:

[Signature Page to Third Amendment to Amended and Restated Limited Waiver] Lenders: BLUE TORCH CREDIT OPPORTUNITIES FUND II LP, as a Lender By: Blue Torch Credit Opportunities GP II LLC, its general partner By: KPG BTC Management LLC, its sole member By: Name: Kevin Genda Title: Managing Member BTC HOLDINGS FUND II LLC, as a Lender By: Blue Torch Credit Opportunities Fund II LP, its sole member By: Blue Torch Credit Opportunities GP II LLC, its general partner By: KPG BTC Management LLC, its sole member By: Name: Kevin Genda Title: Managing Member BTC HOLDINGS SBAF FUND LLC, as a Lender By: Blue Torch Credit Opportunities SBAF Fund LP, its sole member By: Blue Torch Credit Opportunities SBAF GP LLC, its general partner By: KPG BTC Management LLC, its sole member By: Name: Kevin Genda Title: Managing Member

[Signature Page to Third Amendment to Amended and Restated Limited Waiver] BTC HOLDINGS KRS FUND LLC, as a Lender By: Blue Torch Credit Opportunities KRS Funding LP, its sole member By: Blue Torch Credit Opportunities KRS GP LLC, its general partner By: KPG BTC Management LLC, its sole member By: Name: Kevin Genda Title: Managing Member SWISS CAPITAL BTC OL PRIVATE DEBT FUND L.P., as a Lender By: Name: Kevin Genda, in his capacity as authorized signatory of Blue Torch Capital LP, as agent and attorney-in-fact for Swiss Capital BTC OL Private Debt Fund Title: Managing Member

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

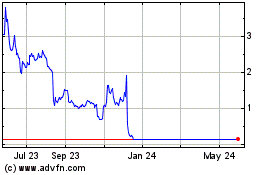

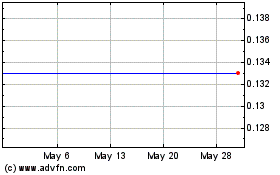

Troika Media (NASDAQ:TRKA)

Historical Stock Chart

From Apr 2024 to May 2024

Troika Media (NASDAQ:TRKA)

Historical Stock Chart

From May 2023 to May 2024