Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 29 2023 - 4:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2023

Commission File Number: 001-34238

THE9 LIMITED

17 Floor, No. 130 Wu Song Road

Hong Kou District, Shanghai 200080

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

EXHIBIT INDEX

| * | Exhibit 99.1 is furnished herewith solely for the purpose of meeting the requirements under Nasdaq Stock Market Rule 5250(c)(2) in

connection with submission of an interim balance sheet and income statement as of the end of its second quarter. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

THE9 LIMITED |

| |

|

|

|

| |

By |

: |

/s/ George Lai |

| |

Name: |

: |

George Lai |

| |

Title: |

: |

Director and Chief Financial Officer |

Date: December 29,

2023

Exhibit 99.1

The9

Limited Announces Unaudited Financial Information

As of and For the Six Months Ended June 30, 2023

In

compliance with NASDAQ Rule 5250(c)(2), The9 Limited (the “Company”) hereby announces its unaudited condensed consolidated

statements of operations for the six months ended June 30,

2023 and its unaudited condensed consolidated balance sheets as of June 30, 2023.

THE9 LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS INFORMATION

(Expressed in Renminbi - RMB and US Dollars - US$. All amounts in thousands, except for share and per date, or otherwise noted.)

| | |

Six months ended June 30, | |

| | |

2022 | | |

2023 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| | |

| | |

| | |

(Note1) | |

| Revenues: | |

| | | |

| | | |

| | |

| Cryptocurrency mining revenue | |

| 41,801 | | |

| 93,894 | | |

| 12,949 | |

| Other revenues | |

| 2,476 | | |

| 3,151 | | |

| 434 | |

| | |

| | | |

| | | |

| | |

| Total net revenues | |

| 44,277 | | |

| 97,045 | | |

| 13,383 | |

| Cost of cyptocurrency mining | |

| (51,410 | ) | |

| (95,834 | ) | |

| (13,216 | ) |

| Other cost | |

| (3,498 | ) | |

| (9,883 | ) | |

| (1,363 | ) |

| Total cost | |

| (54,908 | ) | |

| (105,717 | ) | |

| (14,579 | ) |

| | |

| | | |

| | | |

| | |

| Gross loss | |

| (10,631 | ) | |

| (8,672 | ) | |

| (1,196 | ) |

| | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Product development | |

| (641 | ) | |

| (848 | ) | |

| (117 | ) |

| Sales and marketing | |

| (554 | ) | |

| (1,617 | ) | |

| (223 | ) |

| General and administrative | |

| (230,943 | ) | |

| (131,012 | ) | |

| (18,067 | ) |

| Impairment of cryptocurrency | |

| (64,888 | ) | |

| (32,733 | ) | |

| (4,515 | ) |

| Impairment of mining machines | |

| (141,599 | ) | |

| (150,204 | ) | |

| (20,714 | ) |

| Realized gain on exchange digital assets | |

| - | | |

| 44,666 | | |

| 6,160 | |

| Total operating expenses | |

| (438,625 | ) | |

| (271,748 | ) | |

| (37,476 | ) |

| Other operating income | |

| 1 | | |

| - | | |

| - | |

| Loss from operations | |

| (449,255 | ) | |

| (280,420 | ) | |

| (38,672 | ) |

| | |

| | | |

| | | |

| | |

| Impairment on equity investments | |

| | | |

| | | |

| | |

| Impairment on equity investments | |

| (31,076 | ) | |

| - | | |

| - | |

| Gain (impairment) on other investments | |

| (20,030 | ) | |

| 5,630 | | |

| 776 | |

| Interest expenses, net | |

| (6,048 | ) | |

| (23,751 | ) | |

| (3,275 | ) |

| Gain from change in fair value of convertible feature derivative liability | |

| (6,500 | ) | |

| 31,264 | | |

| 4,312 | |

| Gain on disposal of equity investee and available-for-sale investments | |

| - | | |

| 1,112 | | |

| 153 | |

| Other income, net | |

| 8,453 | | |

| 5,023 | | |

| 693 | |

| Foreign transaction exchange loss | |

| (2,522 | ) | |

| (10,856 | ) | |

| (1,497 | ) |

| Loss from continuing operations before income taxs | |

| (506,978 | ) | |

| (271,998 | ) | |

| (37,510 | ) |

| Income tax | |

| - | | |

| | | |

| | |

| Loss from continuing operations | |

| (506,978 | ) | |

| (271,998 | ) | |

| (37,510 | ) |

| Discontinued operations (Note2) | |

| | | |

| | | |

| | |

| Loss from discontinued operation | |

| (75,806 | ) | |

| (1,412 | ) | |

| (195 | ) |

| Net loss | |

| (582,784 | ) | |

| (273,410 | ) | |

| (37,705 | ) |

| Net loss attributable to noncontrolling interest | |

| (3,114 | ) | |

| (3,601 | ) | |

| (497 | ) |

| Net loss attributable to The9 Limited | |

| (579,669 | ) | |

| (269,809 | ) | |

| (37,208 | ) |

| Other comprehensive loss: | |

| | | |

| | | |

| | |

| Currency translation adjustments | |

| 5,217 | | |

| 1,255 | | |

| 173 | |

| Total comprehensive loss | |

| (577,567 | ) | |

| (272,155 | ) | |

| (37,532 | ) |

| Comprehensive loss attributable to: | |

| | | |

| | | |

| | |

| Noncontrolling interest | |

| (3,114 | ) | |

| (3,601 | ) | |

| (497 | ) |

| The9 Limited | |

| (574,451 | ) | |

| (268,554 | ) | |

| (37,035 | ) |

| Net loss attributable to holders of ordinary shares per share | |

| | | |

| | | |

| | |

| - Basic and diluted | |

| (0.89 | ) | |

| (0.31 | ) | |

| (0.04 | ) |

| | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding | |

| | | |

| | | |

| | |

| - Basic and diluted | |

| 650,181 | | |

| 881,666 | | |

| 881,666 | |

THE9 LIMITED

CONDENSED CONSOLIDATED BALANCE SHEETS INFORMATION

(Expressed in Renminbi - RMB and US Dollars - US$. All amounts in thousands, except for share and per date, or otherwise noted.)

| | |

As of December 31, 2022 | | |

As of June 30, 2023 | | |

As of June 30, 2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| | |

| | |

(UNAUDITED) | | |

(UNAUDITED) | |

| | |

| | |

| | |

(Note1) | |

| Assets | |

| | | |

| | | |

| | |

| Current Assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 56,794 | | |

| 20,914 | | |

| 2,884 | |

| Accounts receivable, net of allowance for doubtful accounts | |

| 151 | | |

| 94 | | |

| 13 | |

| Advances to suppliers | |

| 30 | | |

| 8 | | |

| 1 | |

| Prepayments and other current assets, net of allowance for doubtful accounts | |

| 272,462 | | |

| 80,621 | | |

| 11,119 | |

| Amounts due from related parties | |

| 600 | | |

| 600 | | |

| 83 | |

| Intangible assets - cryptocurrencies | |

| 62,820 | | |

| 56,594 | | |

| 7,805 | |

| Current assets classified as held for sale | |

| 1,296 | | |

| 254 | | |

| 35 | |

| Other Current Asset | |

| - | | |

| 324 | | |

| 45 | |

| Total current assets | |

| 394,153 | | |

| 159,409 | | |

| 21,985 | |

| | |

| | | |

| | | |

| | |

| Investments | |

| 35,297 | | |

| 39,942 | | |

| 5,508 | |

| Property, equipment and software, net | |

| 142,848 | | |

| 133,428 | | |

| 18,402 | |

| Operating lease right-of-use assets | |

| 12,062 | | |

| 8,795 | | |

| 1,213 | |

| Non-current assets classified as held for sale | |

| 3,521 | | |

| 156 | | |

| 21 | |

| Other long-lived assets, net | |

| 11,226 | | |

| 11,015 | | |

| 1,519 | |

| Total Assets | |

| 599,107 | | |

| 352,745 | | |

| 48,648 | |

| | |

| | | |

| | | |

| | |

| Liabilities, Redeemable Noncontrolling Interest and Shareholders' Equity | |

| | | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | | |

| | |

| Accounts payable | |

| 7,147 | | |

| 9,157 | | |

| 1,263 | |

| Other taxes payable | |

| 1,651 | | |

| 1,575 | | |

| 217 | |

| Advances from customers | |

| 17,728 | | |

| 17,835 | | |

| 2,460 | |

| Amounts due to related parties | |

| 21,160 | | |

| 19,736 | | |

| 2,722 | |

| Refund of game points | |

| 169,999 | | |

| 169,999 | | |

| 23,443 | |

| Convertible notes, net of debt discount | |

| 60,984 | | |

| 82,394 | | |

| 11,362 | |

| Conversion feature derivative liability | |

| 51,775 | | |

| 20,511 | | |

| 2,829 | |

| Interest payables | |

| 2,130 | | |

| 3,339 | | |

| 460 | |

| Accrued expense and other current liabilities | |

| 66,437 | | |

| 42,019 | | |

| 5,798 | |

| Current portion of operating lease liabilities of the consolidated VIE without recourse to the Group | |

| 5,793 | | |

| 4,915 | | |

| 678 | |

| Deferred revenue | |

| 22 | | |

| 139 | | |

| 19 | |

| Liabilities directly associated with assets classified as held for sale | |

| 159,337 | | |

| 158,947 | | |

| 21,919 | |

| Total current liabilities | |

| 564,163 | | |

| 530,566 | | |

| 73,170 | |

| Long-term Bank borrowing | |

| - | | |

| 2,679 | | |

| 370 | |

| Non-current portion of operating lease liabilities of the consolidated VIE without recourse to the Group | |

| 7,406 | | |

| 4,524 | | |

| 624 | |

| Total Liabilities | |

| 571,569 | | |

| 537,769 | | |

| 74,164 | |

| | |

| | | |

| | | |

| | |

| Shareholders' Equity | |

| | | |

| | | |

| | |

| Class A ordinary shares (US$0.01 par value; 4,300,000,000 shares authorized, 847,437,583 and 942,894,433 shares issued and outstanding as of December 31, 2022 and June 30, 2023 respectively) | |

| 56,659 | | |

| 63,164 | | |

| 8,711 | |

| Class B ordinary shares (US$0.01 par value; 600,000,000 shares authorized, 13,607,334 and 13,607,334 shares issued and outstanding as of December 31, 2022 and June 30, 2023, respectively) | |

| 944 | | |

| 944 | | |

| 130 | |

| Additional paid-in capital | |

| 4,371,228 | | |

| 4,424,482 | | |

| 610,164 | |

| Statutory reserves | |

| 7,327 | | |

| 7,327 | | |

| 1,010 | |

| Accumulated other comprehensive loss | |

| (12,528 | ) | |

| (11,439 | ) | |

| (1,577 | ) |

| Accumulated deficit | |

| (4,378,321 | ) | |

| (4,648,130 | ) | |

| (641,007 | ) |

| The9 Limited shareholders' equity | |

| 45,309 | | |

| (163,652 | ) | |

| (22,569 | ) |

| Noncontrolling interest | |

| (17,771 | ) | |

| (21,372 | ) | |

| (2,947 | ) |

| Total shareholder's equity | |

| 27,538 | | |

| (185,024 | ) | |

| (25,516 | ) |

| Total liabilities, redeemable noncontrolling interest and shareholders' equity | |

| 599,107 | | |

| 352,745 | | |

| 48,648 | |

Note 1: The United States dollar (“US dollar” or “US$”)

amounts disclosed in the accompanying unaudited condensed consolidated financial statements are presented solely for the convenience of

the readers at the rate of US$1.00 = RMB7.2513, representing the noon buying rate on the last trading day of June 2023 (June 30,

2023) as set forth in the H.10 statistical release of the U.S. Federal Reserve Board.

Note 2: Discontinued operations

In January 2023, the Company ceased operations of its NFT business.

The decision was primarily a result of unfavorable financial performance. The Company reclassified the operations of NFT business as discontinued

operations. The Company has reflected the reclassification of assets and liabilities of these entities as held for sale and the operations

as discontinued operations as of and for the six months ended June 30, 2023. Loss from discontinued operations reflects the results

of the NFT business, and does not include any allocation of general corporate overhead expense or interest expense of the Company. The

prior periods presented in the unaudited condensed consolidated statements of operations information and unaudited condensed consolidated

balance sheet information were also reclassified to reflect the discontinued operations.

Subsequent

events:

|

1. |

In September 2023, pursuant to the Tenth Amended and Restated 2004 Stock Option Plan, the Company granted and issued an aggregate number of 214,650,000 Class A ordinary shares of the Company (equivalent to 715,500 American depositary shares of the Company, each representing 300 Class A ordinary shares (the “ADSs”)) pursuant to the restricted shares and restricted share units granted to the directors, officers and employees of the Company. The 205,200,000 Class A ordinary shares issued pursuant to the restricted share grants to the executive officers and employees of the Company are subject to a three-year vesting schedule and lock-up restrictions, provided that the second-year and the third-year tranches of the restricted share grants shall be released from the lock-up restrictions only upon the satisfaction of certain pre-agreed performance targets. The remaining 9,450,000 Class A ordinary shares were issued pursuant to the restricted share units granted to the independent directors of the Company as part of their compensation for their services as independent directors of the Company for the next three years. |

| 2. | In November 2023, the Company closed a private placement securities purchase transaction with Bripheno Pte. Ltd., a Singapore

limited liability company, pursuant to which the Company sold and issued: |

●150,000,000 Class A

ordinary shares (equivalent to 500,000 ADSs) at a price of US$12 per ADS,

●Two-year 3% per

annum convertible promissory note at the purchase price of US$6 million with the conversion price of US$15 per ADS and

●Warrants to purchase

an aggregate of 120,000,000 Class A ordinary shares (equivalent to 400,000 ADSs) at an exercise price of US$60 per ADS. The warrants

will expire two years from the date of issuance.

All the above securities are subject to a 6-month lock up

period. The Company has raised a total of US$12 million as the aggregate consideration for the securities. The Company plans to use proceeds

to fund future growth.

About The9 Limited

The9 Limited (The9) is an Internet company listed on Nasdaq in 2004.

The9 aims to become a global diversified high-tech Internet company, and is engaged in blockchain business including the operation of

cryptocurrency mining.

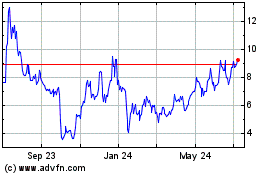

The9 (NASDAQ:NCTY)

Historical Stock Chart

From Apr 2024 to May 2024

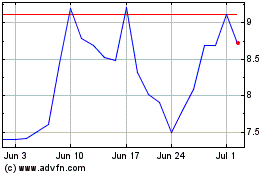

The9 (NASDAQ:NCTY)

Historical Stock Chart

From May 2023 to May 2024