0000874238December 312023Q3falsehttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#LongTermDebtCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtNoncurrenthttp://fasb.org/us-gaap/2023#LongTermDebtNoncurrent00008742382023-01-012023-09-3000008742382023-11-03xbrli:shares00008742382023-07-012023-09-30iso4217:USD00008742382022-07-012022-09-3000008742382022-01-012022-09-30iso4217:USDxbrli:shares0000874238us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-09-300000874238us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-3100008742382023-09-3000008742382022-12-3100008742382021-12-3100008742382022-09-300000874238us-gaap:CommonStockMember2022-12-310000874238us-gaap:AdditionalPaidInCapitalMember2022-12-310000874238us-gaap:RetainedEarningsMember2022-12-310000874238us-gaap:ParentMember2022-12-310000874238us-gaap:NoncontrollingInterestMember2022-12-310000874238us-gaap:RetainedEarningsMember2023-01-012023-03-310000874238us-gaap:ParentMember2023-01-012023-03-310000874238us-gaap:NoncontrollingInterestMember2023-01-012023-03-3100008742382023-01-012023-03-310000874238us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000874238us-gaap:CommonStockMember2023-01-012023-03-310000874238us-gaap:CommonStockMember2023-03-310000874238us-gaap:AdditionalPaidInCapitalMember2023-03-310000874238us-gaap:RetainedEarningsMember2023-03-310000874238us-gaap:ParentMember2023-03-310000874238us-gaap:NoncontrollingInterestMember2023-03-3100008742382023-03-310000874238us-gaap:RetainedEarningsMember2023-04-012023-06-300000874238us-gaap:ParentMember2023-04-012023-06-300000874238us-gaap:NoncontrollingInterestMember2023-04-012023-06-3000008742382023-04-012023-06-300000874238us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000874238us-gaap:CommonStockMember2023-04-012023-06-300000874238us-gaap:CommonStockMember2023-06-300000874238us-gaap:AdditionalPaidInCapitalMember2023-06-300000874238us-gaap:RetainedEarningsMember2023-06-300000874238us-gaap:ParentMember2023-06-300000874238us-gaap:NoncontrollingInterestMember2023-06-3000008742382023-06-300000874238us-gaap:RetainedEarningsMember2023-07-012023-09-300000874238us-gaap:ParentMember2023-07-012023-09-300000874238us-gaap:NoncontrollingInterestMember2023-07-012023-09-300000874238us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000874238us-gaap:CommonStockMember2023-07-012023-09-300000874238us-gaap:CommonStockMember2023-09-300000874238us-gaap:AdditionalPaidInCapitalMember2023-09-300000874238us-gaap:RetainedEarningsMember2023-09-300000874238us-gaap:ParentMember2023-09-300000874238us-gaap:NoncontrollingInterestMember2023-09-300000874238us-gaap:CommonStockMember2021-12-310000874238us-gaap:AdditionalPaidInCapitalMember2021-12-310000874238us-gaap:RetainedEarningsMember2021-12-310000874238us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000874238us-gaap:ParentMember2021-12-310000874238us-gaap:NoncontrollingInterestMember2021-12-310000874238us-gaap:RetainedEarningsMember2022-01-012022-03-310000874238us-gaap:ParentMember2022-01-012022-03-310000874238us-gaap:NoncontrollingInterestMember2022-01-012022-03-3100008742382022-01-012022-03-310000874238us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310000874238us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310000874238us-gaap:CommonStockMember2022-01-012022-03-310000874238us-gaap:CommonStockMember2022-03-310000874238us-gaap:AdditionalPaidInCapitalMember2022-03-310000874238us-gaap:RetainedEarningsMember2022-03-310000874238us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310000874238us-gaap:ParentMember2022-03-310000874238us-gaap:NoncontrollingInterestMember2022-03-3100008742382022-03-310000874238us-gaap:RetainedEarningsMember2022-04-012022-06-300000874238us-gaap:ParentMember2022-04-012022-06-300000874238us-gaap:NoncontrollingInterestMember2022-04-012022-06-3000008742382022-04-012022-06-300000874238us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300000874238us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300000874238us-gaap:CommonStockMember2022-04-012022-06-300000874238us-gaap:CommonStockMember2022-06-300000874238us-gaap:AdditionalPaidInCapitalMember2022-06-300000874238us-gaap:RetainedEarningsMember2022-06-300000874238us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300000874238us-gaap:ParentMember2022-06-300000874238us-gaap:NoncontrollingInterestMember2022-06-3000008742382022-06-300000874238us-gaap:RetainedEarningsMember2022-07-012022-09-300000874238us-gaap:ParentMember2022-07-012022-09-300000874238us-gaap:NoncontrollingInterestMember2022-07-012022-09-300000874238us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300000874238us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300000874238us-gaap:CommonStockMember2022-07-012022-09-300000874238us-gaap:CommonStockMember2022-09-300000874238us-gaap:AdditionalPaidInCapitalMember2022-09-300000874238us-gaap:RetainedEarningsMember2022-09-300000874238us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300000874238us-gaap:ParentMember2022-09-300000874238us-gaap:NoncontrollingInterestMember2022-09-30strl:segment0000874238us-gaap:SegmentDiscontinuedOperationsMemberstrl:MyersSonsConstructionLPMember2022-11-30xbrli:pure0000874238strl:MyersMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-09-300000874238us-gaap:SegmentDiscontinuedOperationsMemberstrl:MyersSonsConstructionLPMember2022-11-302022-11-300000874238us-gaap:SegmentDiscontinuedOperationsMemberstrl:MyersSonsConstructionLPMember2023-01-012023-03-31strl:numberOfPayment0000874238us-gaap:SegmentDiscontinuedOperationsMember2022-07-012022-09-300000874238us-gaap:SegmentDiscontinuedOperationsMember2022-01-012022-09-300000874238us-gaap:SegmentDiscontinuedOperationsMember2022-01-012022-09-300000874238strl:EInfrastructureSolutionsSegmentMember2023-09-300000874238strl:EInfrastructureSolutionsSegmentMember2022-12-310000874238strl:TransportationSolutionsSegmentMember2023-09-300000874238strl:TransportationSolutionsSegmentMember2022-12-310000874238strl:BuildingSolutionsSegmentMember2023-09-300000874238strl:BuildingSolutionsSegmentMember2022-12-3100008742382023-10-012023-09-300000874238strl:EInfrastructureSolutionsSegmentMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300000874238strl:EInfrastructureSolutionsSegmentMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300000874238strl:EInfrastructureSolutionsSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300000874238strl:EInfrastructureSolutionsSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300000874238strl:TransportationSolutionsSegmentMemberstrl:HeavyHighwayMember2023-07-012023-09-300000874238strl:TransportationSolutionsSegmentMemberstrl:HeavyHighwayMember2022-07-012022-09-300000874238strl:TransportationSolutionsSegmentMemberstrl:HeavyHighwayMember2023-01-012023-09-300000874238strl:TransportationSolutionsSegmentMemberstrl:HeavyHighwayMember2022-01-012022-09-300000874238strl:AviationMemberstrl:TransportationSolutionsSegmentMember2023-07-012023-09-300000874238strl:AviationMemberstrl:TransportationSolutionsSegmentMember2022-07-012022-09-300000874238strl:AviationMemberstrl:TransportationSolutionsSegmentMember2023-01-012023-09-300000874238strl:AviationMemberstrl:TransportationSolutionsSegmentMember2022-01-012022-09-300000874238strl:TransportationSolutionsSegmentMemberstrl:OtherRevenueMember2023-07-012023-09-300000874238strl:TransportationSolutionsSegmentMemberstrl:OtherRevenueMember2022-07-012022-09-300000874238strl:TransportationSolutionsSegmentMemberstrl:OtherRevenueMember2023-01-012023-09-300000874238strl:TransportationSolutionsSegmentMemberstrl:OtherRevenueMember2022-01-012022-09-300000874238us-gaap:OperatingSegmentsMemberstrl:TransportationSolutionsSegmentMember2023-07-012023-09-300000874238us-gaap:OperatingSegmentsMemberstrl:TransportationSolutionsSegmentMember2022-07-012022-09-300000874238us-gaap:OperatingSegmentsMemberstrl:TransportationSolutionsSegmentMember2023-01-012023-09-300000874238us-gaap:OperatingSegmentsMemberstrl:TransportationSolutionsSegmentMember2022-01-012022-09-300000874238strl:BuildingSolutionsSegmentMemberstrl:ResidentialConstructionMember2023-07-012023-09-300000874238strl:BuildingSolutionsSegmentMemberstrl:ResidentialConstructionMember2022-07-012022-09-300000874238strl:BuildingSolutionsSegmentMemberstrl:ResidentialConstructionMember2023-01-012023-09-300000874238strl:BuildingSolutionsSegmentMemberstrl:ResidentialConstructionMember2022-01-012022-09-300000874238strl:CommercialMemberstrl:BuildingSolutionsSegmentMember2023-07-012023-09-300000874238strl:CommercialMemberstrl:BuildingSolutionsSegmentMember2022-07-012022-09-300000874238strl:CommercialMemberstrl:BuildingSolutionsSegmentMember2023-01-012023-09-300000874238strl:CommercialMemberstrl:BuildingSolutionsSegmentMember2022-01-012022-09-300000874238us-gaap:OperatingSegmentsMemberstrl:BuildingSolutionsSegmentMember2023-07-012023-09-300000874238us-gaap:OperatingSegmentsMemberstrl:BuildingSolutionsSegmentMember2022-07-012022-09-300000874238us-gaap:OperatingSegmentsMemberstrl:BuildingSolutionsSegmentMember2023-01-012023-09-300000874238us-gaap:OperatingSegmentsMemberstrl:BuildingSolutionsSegmentMember2022-01-012022-09-300000874238us-gaap:OperatingSegmentsMember2023-07-012023-09-300000874238us-gaap:OperatingSegmentsMember2022-07-012022-09-300000874238us-gaap:OperatingSegmentsMember2023-01-012023-09-300000874238us-gaap:OperatingSegmentsMember2022-01-012022-09-300000874238strl:LumpSumMember2023-07-012023-09-300000874238strl:LumpSumMember2022-07-012022-09-300000874238strl:LumpSumMember2023-01-012023-09-300000874238strl:LumpSumMember2022-01-012022-09-300000874238us-gaap:FixedPriceContractMember2023-07-012023-09-300000874238us-gaap:FixedPriceContractMember2022-07-012022-09-300000874238us-gaap:FixedPriceContractMember2023-01-012023-09-300000874238us-gaap:FixedPriceContractMember2022-01-012022-09-300000874238strl:ResidentialAndOtherMember2023-07-012023-09-300000874238strl:ResidentialAndOtherMember2022-07-012022-09-300000874238strl:ResidentialAndOtherMember2023-01-012023-09-300000874238strl:ResidentialAndOtherMember2022-01-012022-09-300000874238strl:CostsAndEstimatedEarningsInExcessOfBillingsMember2023-09-300000874238strl:CostsAndEstimatedEarningsInExcessOfBillingsMember2022-12-310000874238us-gaap:OperatingIncomeLossMember2023-07-012023-09-300000874238us-gaap:OperatingIncomeLossMember2023-01-012023-09-300000874238us-gaap:OperatingIncomeLossMember2022-07-012022-09-300000874238us-gaap:OperatingIncomeLossMember2022-01-012022-09-300000874238strl:JointVenturesMemberstrl:RLWMember2023-01-012023-09-300000874238strl:SEMAConstructionIncMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-07-012023-09-300000874238strl:SEMAConstructionIncMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-07-012022-09-300000874238strl:SEMAConstructionIncMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-09-300000874238strl:SEMAConstructionIncMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-01-012022-09-300000874238us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-09-300000874238us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-12-310000874238us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-07-012023-09-300000874238us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-07-012022-09-300000874238us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-01-012023-09-300000874238us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-01-012022-09-300000874238strl:ConstructionEquipmentMember2023-09-300000874238strl:ConstructionEquipmentMember2022-12-310000874238us-gaap:BuildingMember2023-09-300000874238us-gaap:BuildingMember2022-12-310000874238us-gaap:LandMember2023-09-300000874238us-gaap:LandMember2022-12-310000874238us-gaap:OfficeEquipmentMember2023-09-300000874238us-gaap:OfficeEquipmentMember2022-12-310000874238us-gaap:CustomerRelationshipsMember2023-01-012023-09-300000874238us-gaap:CustomerRelationshipsMember2023-09-300000874238us-gaap:CustomerRelationshipsMember2022-12-310000874238us-gaap:TradeNamesMember2023-01-012023-09-300000874238us-gaap:TradeNamesMember2023-09-300000874238us-gaap:TradeNamesMember2022-12-310000874238us-gaap:NoncompeteAgreementsMember2023-01-012023-09-300000874238us-gaap:NoncompeteAgreementsMember2023-09-300000874238us-gaap:NoncompeteAgreementsMember2022-12-310000874238us-gaap:SecuredDebtMemberstrl:TermLoanFacilityMember2023-09-300000874238us-gaap:SecuredDebtMemberstrl:TermLoanFacilityMember2022-12-310000874238us-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2023-09-300000874238us-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2022-12-310000874238us-gaap:SecuredDebtMemberstrl:TheCreditFacilityMember2023-09-300000874238us-gaap:SecuredDebtMemberstrl:TheCreditFacilityMember2022-12-310000874238strl:OtherDebtMember2023-09-300000874238strl:OtherDebtMember2022-12-310000874238us-gaap:SecuredDebtMemberstrl:CreditAgreementMember2023-09-300000874238us-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMemberstrl:TermLoanFacilityMember2023-09-300000874238us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberstrl:TheRevolvingCreditFacilityMember2023-09-300000874238us-gaap:LineOfCreditMemberstrl:TheRevolvingCreditFacilityMemberstrl:SwingLineLoanMember2023-09-300000874238us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberstrl:TheRevolvingCreditFacilityMember2023-01-012023-09-300000874238us-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMemberstrl:TheRevolvingCreditFacilityMember2023-01-012023-09-300000874238us-gaap:SecuredDebtMemberstrl:TermLoanFacilityMembersrt:ScenarioForecastMember2023-01-012023-12-310000874238us-gaap:SecuredDebtMemberstrl:TermLoanFacilityMembersrt:ScenarioForecastMember2024-01-012024-12-310000874238us-gaap:SecuredDebtMemberstrl:TermLoanFacilityMember2023-07-012023-09-300000874238us-gaap:SecuredDebtMemberstrl:TermLoanFacilityMember2023-01-012023-09-300000874238strl:PlateauExcavationMember2019-10-022019-12-310000874238us-gaap:NotesPayableOtherPayablesMemberstrl:PlateauExcavationMember2019-12-310000874238srt:MinimumMember2023-01-012023-09-300000874238srt:MaximumMember2023-01-012023-09-300000874238strl:RestrictedStockAwardsRSAsMember2023-01-012023-09-300000874238us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300000874238us-gaap:PhantomShareUnitsPSUsMember2023-01-012023-09-300000874238us-gaap:EmployeeStockMember2023-01-012023-09-300000874238strl:EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2023-07-012023-09-300000874238strl:EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2023-01-012023-09-300000874238strl:EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2022-07-012022-09-300000874238strl:EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2022-01-012022-09-300000874238strl:LiabilityBasedAwardsMemberus-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000874238strl:LiabilityBasedAwardsMemberus-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300000874238strl:LiabilityBasedAwardsMemberus-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300000874238strl:LiabilityBasedAwardsMemberus-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300000874238strl:RestrictedStockUnitsAndPhantomShareUnitsMember2023-07-012023-09-300000874238strl:RestrictedStockUnitsAndPhantomShareUnitsMember2023-01-012023-09-300000874238us-gaap:CorporateNonSegmentMember2023-07-012023-09-300000874238us-gaap:CorporateNonSegmentMember2022-07-012022-09-300000874238us-gaap:CorporateNonSegmentMember2023-01-012023-09-300000874238us-gaap:CorporateNonSegmentMember2022-01-012022-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | | | | |

| ☑ | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

or

| | | | | | | | |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| For the transition period from ___ to ___ |

| | | | | |

| Commission File Number | 1-31993 |

| | | | | |

|

| STERLING INFRASTRUCTURE, INC. |

(Exact name of registrant as specified in its charter) |

| |

| Delaware | 25-1655321 |

(State or other jurisdiction of incorporation

or organization) | (I.R.S. Employer

Identification No.) |

| | |

1800 Hughes Landing Blvd. The Woodlands, Texas | 77380 |

| (Address of principal executive offices) | (Zip Code) |

| | |

Registrant’s telephone number, including area code: (281) 214-0777 |

|

|

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

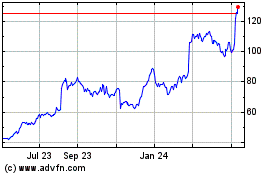

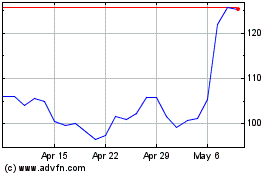

| Common Stock, $0.01 par value per share | STRL | The NASDAQ Stock Market LLC |

| (Title of each class) | (Trading Symbol) | (Name of each exchange on which registered) |

| | |

|

| | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. þYes ¨ No |

|

| | |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). þ Yes ¨ No |

|

| | | | | | | | | | | |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| Large accelerated filer | ¨ | Accelerated filer | þ |

| Non-accelerated filer | ¨ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

| | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ |

| | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes þ No |

|

The number of shares outstanding of the registrant’s common stock as of November 3, 2023 – 30,838,207

STERLING INFRASTRUCTURE, INC.

QUARTERLY REPORT ON FORM 10-Q

TABLE OF CONTENTS

PART I—FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Continuing Operations: | | | | | | | |

| Revenues | $ | 560,347 | | | $ | 493,040 | | | $ | 1,486,251 | | | $ | 1,320,829 | |

| Cost of revenues | (468,480) | | | (413,596) | | | (1,240,368) | | | (1,115,228) | |

| Gross profit | 91,867 | | | 79,444 | | | 245,883 | | | 205,601 | |

| General and administrative expense | (25,237) | | | (22,235) | | | (72,592) | | | (63,376) | |

| Intangible asset amortization | (3,736) | | | (3,509) | | | (11,209) | | | (10,591) | |

| Acquisition related costs | (103) | | | (77) | | | (352) | | | (562) | |

| Other operating expense, net | (5,654) | | | (4,148) | | | (11,703) | | | (8,245) | |

| Operating income | 57,137 | | | 49,475 | | | 150,027 | | | 122,827 | |

| Interest income | 4,150 | | | 165 | | | 8,327 | | | 201 | |

| Interest expense | (7,257) | | | (5,135) | | | (22,516) | | | (14,262) | |

| | | | | | | |

| Income before income taxes | 54,030 | | | 44,505 | | | 135,838 | | | 108,766 | |

| Income tax expense | (13,891) | | | (13,173) | | | (35,429) | | | (30,966) | |

| Net income, including noncontrolling interests | 40,139 | | | 31,332 | | | 100,409 | | | 77,800 | |

| Less: Net income attributable to noncontrolling interests | (786) | | | (634) | | | (1,927) | | | (1,316) | |

| Net income from Continuing Operations | $ | 39,353 | | | $ | 30,698 | | | $ | 98,482 | | | $ | 76,484 | |

| | | | | | | |

Discontinued Operations (Note 3): | | | | | | | |

| Pretax loss | $ | — | | | $ | (1,786) | | | $ | — | | | $ | (3,287) | |

| | | | | | | |

| Income tax benefit | — | | | 611 | | | — | | | 1,539 | |

| Net loss from Discontinued Operations | $ | — | | | $ | (1,175) | | | $ | — | | | $ | (1,748) | |

| | | | | | | |

| Net income attributable to Sterling common stockholders | $ | 39,353 | | | $ | 29,523 | | | $ | 98,482 | | | $ | 74,736 | |

| | | | | | | |

| Net income per share from Continuing Operations: | | | | | | | |

| Basic | $ | 1.28 | | | $ | 1.01 | | | $ | 3.20 | | | $ | 2.54 | |

| Diluted | $ | 1.26 | | | $ | 1.01 | | | $ | 3.17 | | | $ | 2.52 | |

| | | | | | | |

| Net loss per share from Discontinued Operations: | | | | | | | |

| Basic | $ | — | | | $ | (0.04) | | | $ | — | | | $ | (0.06) | |

| Diluted | $ | — | | | $ | (0.04) | | | $ | — | | | $ | (0.06) | |

| | | | | | | |

| Net income per share attributable to Sterling common stockholders: | | | | | | | |

| Basic | $ | 1.28 | | | $ | 0.98 | | | $ | 3.20 | | | $ | 2.48 | |

| Diluted | $ | 1.26 | | | $ | 0.97 | | | $ | 3.17 | | | $ | 2.46 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 30,800 | | 30,278 | | 30,733 | | 30,156 |

| Diluted | 31,217 | | 30,540 | | 31,048 | | 30,364 |

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income from Continuing Operations, including noncontrolling interests | $ | 40,139 | | | $ | 31,332 | | | $ | 100,409 | | | $ | 77,800 | |

| Net loss from Discontinued Operations | — | | | (1,175) | | | — | | | (1,748) | |

| Net income, including noncontrolling interests | 40,139 | | | 30,157 | | | 100,409 | | | 76,052 | |

| Other comprehensive income, net of tax | | | | | | | |

Change in interest rate swap, net of tax (Note 12) | — | | | (101) | | | — | | | 2,301 | |

| Total comprehensive income | 40,139 | | | 30,056 | | | 100,409 | | | 78,353 | |

| Less: Comprehensive income attributable to noncontrolling interests | (786) | | | (634) | | | (1,927) | | | (1,316) | |

| Comprehensive income attributable to Sterling common stockholders | $ | 39,353 | | | $ | 29,422 | | | $ | 98,482 | | | $ | 77,037 | |

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | |

| | September 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

Cash and cash equivalents ($28,478 and $25,014 related to variable interest entities (“VIEs”)) | $ | 409,398 | | | $ | 181,544 | |

Accounts receivable ($2,299 and $0 related to VIEs) | 326,331 | | | 262,646 | |

Contract assets ($112 and $0 related to VIEs) | 107,327 | | | 109,803 | |

| Receivables from and equity in construction joint ventures | 14,593 | | | 14,122 | |

| Other current assets | 18,315 | | | 29,139 | |

| Total current assets | 875,964 | | | 597,254 | |

| Property and equipment, net | 231,058 | | | 215,482 | |

| Operating lease right-of-use assets, net | 58,492 | | | 59,415 | |

| Goodwill | 262,692 | | | 262,692 | |

| Other intangibles, net | 287,914 | | | 299,123 | |

| | | |

| Other non-current assets, net | 7,685 | | | 7,654 | |

| Total assets | $ | 1,723,805 | | | $ | 1,441,620 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

Accounts payable ($4,260 and $2,540 related to VIEs) | $ | 150,218 | | | $ | 121,887 | |

Contract liabilities ($16,588 and $15,551 related to VIEs) | 432,213 | | | 239,297 | |

| Current maturities of long-term debt | 35,142 | | | 32,610 | |

| Current portion of long-term lease obligations | 18,403 | | | 19,715 | |

| Accrued compensation | 35,506 | | | 24,136 | |

| Other current liabilities | 14,355 | | | 8,966 | |

| Total current liabilities | 685,837 | | | 446,611 | |

| Long-term debt | 321,589 | | | 398,735 | |

| Long-term lease obligations | 40,204 | | | 40,103 | |

| Members’ interest subject to mandatory redemption and undistributed earnings | 22,612 | | | 21,597 | |

| Deferred tax liability, net | 61,847 | | | 51,659 | |

| Other long-term liabilities | 6,242 | | | 5,116 | |

| Total liabilities | 1,138,331 | | | 963,821 | |

Commitments and contingencies (Note 10) | | | |

| Stockholders’ equity: | | | |

Common stock, par value $0.01 per share; 58,000 and 38,000 shares authorized, 30,828 and 30,585 shares issued and outstanding | 308 | | | 306 | |

| Additional paid in capital | 295,178 | | | 287,914 | |

| | | |

| Retained earnings | 284,861 | | | 186,379 | |

| | | |

| Total Sterling stockholders’ equity | 580,347 | | | 474,599 | |

| Noncontrolling interests | 5,127 | | | 3,200 | |

| Total stockholders’ equity | 585,474 | | | 477,799 | |

| Total liabilities and stockholders’ equity | $ | 1,723,805 | | | $ | 1,441,620 | |

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income | $ | 100,409 | | | $ | 76,052 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 42,529 | | | 38,550 | |

| Amortization of debt issuance costs and non-cash interest | 1,334 | | | 1,636 | |

| Gain on disposal of property and equipment | (4,102) | | | (1,926) | |

| Gain on debt extinguishment, net | — | | | (2,428) | |

| | | |

| Deferred taxes | 10,188 | | | 24,975 | |

| Stock-based compensation | 10,975 | | | 7,971 | |

| Change in fair value of interest rate swap | — | | | (320) | |

Changes in operating assets and liabilities (Note 14) | 169,882 | | | (6,342) | |

| Net cash provided by operating activities | 331,215 | | | 138,168 | |

| Cash flows from investing activities: | | | |

| Acquisitions, net of cash acquired | — | | | (3,033) | |

| Disposition proceeds | 14,000 | | | — | |

| Capital expenditures | (49,244) | | | (47,832) | |

| Proceeds from sale of property and equipment | 9,607 | | | 3,043 | |

| Net cash used in investing activities | (25,637) | | | (47,822) | |

| Cash flows from financing activities: | | | |

| Repayments of debt | (76,850) | | | (17,612) | |

| | | |

| Withholding taxes paid on net share settlement of equity awards | (4,579) | | | (7,521) | |

| Other | (16) | | | — | |

| Net cash used in financing activities | (81,445) | | | (25,133) | |

| Net change in cash, cash equivalents, and restricted cash | 224,133 | | | 65,213 | |

| Cash, cash equivalents and restricted cash at beginning of period | 185,265 | | | 88,693 | |

| Cash, cash equivalents and restricted cash at end of period | 409,398 | | | 153,906 | |

| Less: restricted cash - Continuing Operations | — | | | (3,721) | |

| Less: cash, cash equivalents and restricted cash - Discontinued Operations | — | | | (13,999) | |

| Cash and cash equivalents at end of period - Continuing Operations | $ | 409,398 | | | $ | 136,186 | |

| | | |

| Non-cash items: | | | |

| Capital expenditures | $ | 4,151 | | | $ | 562 | |

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| Common Stock | | Additional Paid in Capital | | | | Retained Earnings | | | | Total Sterling Stockholders’ Equity | | Non-controlling Interests | | Total Stockholders’ Equity |

| Shares | | Amount | | | | | | | | | | |

| Balance at December 31, 2022 | 30,585 | | | $ | 306 | | | $ | 287,914 | | | | | | | $ | 186,379 | | | | | $ | 474,599 | | | $ | 3,200 | | | $ | 477,799 | |

| Net income | — | | | — | | | — | | | | | | | 19,649 | | | | | 19,649 | | | 391 | | | 20,040 | |

| Stock-based compensation | — | | | — | | | 4,486 | | | | | | | — | | | | | 4,486 | | | — | | | 4,486 | |

| | | | | | | | | | | | | | | | | | | |

| Issuance of stock | 316 | | | 2 | | | 216 | | | | | | | — | | | | | 218 | | | — | | | 218 | |

| Shares withheld for taxes | (111) | | | — | | | (4,288) | | | | | | | — | | | | | (4,288) | | | — | | | (4,288) | |

| | | | | | | | | | | | | | | | | | | |

| Balance at March 31, 2023 | 30,790 | | | $ | 308 | | | $ | 288,328 | | | | | | | $ | 206,028 | | | | | $ | 494,664 | | | $ | 3,591 | | | $ | 498,255 | |

| Net income | — | | | — | | | — | | | | | | | 39,480 | | | | | 39,480 | | | 750 | | | 40,230 | |

| | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 3,270 | | | | | | | — | | | | | 3,270 | | | — | | | 3,270 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Issuance of stock | 27 | | | — | | | 199 | | | | | | | — | | | | | 199 | | | — | | | 199 | |

| Shares withheld for taxes | (1) | | | — | | | (40) | | | | | | | — | | | | | (40) | | | — | | | (40) | |

| | | | | | | | | | | | | | | | | | | |

| Balance at June 30, 2023 | 30,816 | | | $ | 308 | | | $ | 291,757 | | | | | | | $ | 245,508 | | | | | $ | 537,573 | | | $ | 4,341 | | | $ | 541,914 | |

| Net income | — | | | — | | | — | | | | | | | 39,353 | | | | | 39,353 | | | 786 | | | 40,139 | |

| | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 3,448 | | | | | | | — | | | | | 3,448 | | | — | | | 3,448 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Issuance of stock | 15 | | | — | | | 240 | | | | | | | — | | | | | 240 | | | — | | | 240 | |

| Shares withheld for taxes | (3) | | | — | | | (251) | | | | | | | — | | | | | (251) | | | — | | | (251) | |

| Other | — | | | — | | | (16) | | | | | | | — | | | | | (16) | | | — | | | (16) | |

| Balance at September 30, 2023 | 30,828 | | | $ | 308 | | | $ | 295,178 | | | | | | | $ | 284,861 | | | | | $ | 580,347 | | | $ | 5,127 | | | $ | 585,474 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 |

| Common Stock | | Additional Paid in Capital | | | | Retained Earnings | | Accumulated Other Comprehensive Income (Loss) | | Total Sterling Stockholders’ Equity | | Non-controlling Interests | | Total Stockholders’ Equity |

| Shares | | Amount | | | | | | | | | | |

| Balance at December 31, 2021 | 29,838 | | | $ | 298 | | | $ | 280,274 | | | | | | | $ | 79,918 | | | $ | (1,723) | | | $ | 358,767 | | | $ | 1,460 | | | $ | 360,227 | |

| Net income | — | | | — | | | — | | | | | | | 19,252 | | | — | | | 19,252 | | | 271 | | | 19,523 | |

| Change in interest rate swap | — | | | — | | | — | | | | | | | — | | | 1,563 | | | 1,563 | | | — | | | 1,563 | |

| Stock-based compensation | — | | | — | | | 3,521 | | | | | | | — | | | — | | | 3,521 | | | — | | | 3,521 | |

| Issuance of stock | 688 | | | 7 | | | 185 | | | | | | | — | | | — | | | 192 | | | — | | | 192 | |

| Shares withheld for taxes | (263) | | | (3) | | | (7,383) | | | | | | | — | | | — | | | (7,386) | | | — | | | (7,386) | |

| Balance at March 31, 2022 | 30,263 | | | $ | 302 | | | $ | 276,597 | | | | | | | $ | 99,170 | | | $ | (160) | | | $ | 375,909 | | | $ | 1,731 | | | $ | 377,640 | |

| Net income | — | | | — | | | — | | | | | | | 25,961 | | | — | | | 25,961 | | | 411 | | | 26,372 | |

| Change in interest rate swap | — | | | — | | | — | | | | | | | — | | | 839 | | | 839 | | | — | | | 839 | |

| Stock-based compensation | — | | | — | | | 2,333 | | | | | | | — | | | — | | | 2,333 | | | — | | | 2,333 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Issuance of stock | 36 | | | 1 | | | 190 | | | | | | | — | | | — | | | 191 | | | — | | | 191 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Balance at June 30, 2022 | 30,299 | | | $ | 303 | | | $ | 279,120 | | | | | | | $ | 125,131 | | | $ | 679 | | | $ | 405,233 | | | $ | 2,142 | | | $ | 407,375 | |

| Net income | — | | | — | | | — | | | | | | | 29,523 | | | — | | | 29,523 | | | 634 | | | 30,157 | |

| Change in interest rate swap | — | | | — | | | — | | | | | | | — | | | (101) | | | (101) | | | — | | | (101) | |

| Stock-based compensation | — | | | — | | | 2,436 | | | | | | | — | | | — | | | 2,436 | | | — | | | 2,436 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Issuance of stock | 24 | | | — | | | 155 | | | | | | | — | | | — | | | 155 | | | — | | | 155 | |

| Shares withheld for taxes | (5) | | | — | | | (135) | | | | | | | — | | | — | | | (135) | | | — | | | (135) | |

| | | | | | | | | | | | | | | | | | | |

| Balance at September 30, 2022 | 30,318 | | | $ | 303 | | | $ | 281,576 | | | | | | | $ | 154,654 | | | $ | 578 | | | $ | 437,111 | | | $ | 2,776 | | | $ | 439,887 | |

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

STERLING INFRASTRUCTURE, INC. & SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2023

($ and share values in thousands, except per share data)

(Unaudited)

Business Summary

Sterling Infrastructure, Inc., (“Sterling,” “the Company,” “we,” “our” or “us”), a Delaware corporation, operates through a variety of subsidiaries within three segments specializing in E-Infrastructure, Transportation and Building Solutions in the United States, primarily across the Southern, Northeastern, Mid-Atlantic and Rocky Mountain regions and Hawaii. E-Infrastructure Solutions provides advanced, large-scale site development services for manufacturing, data centers, e-commerce distribution centers, warehousing, power generation and more. Transportation Solutions includes infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, rail and storm drainage systems. Building Solutions includes residential and commercial concrete foundations for single-family and multi-family homes, parking structures, elevated slabs and other concrete work. From strategy to operations, we are committed to sustainability by operating responsibly to safeguard and improve society’s quality of life. Caring for our people and our communities, our customers and our investors – that is The Sterling Way.

On November 30, 2022, we completed the disposition of our 50% ownership interest in our partnership with Myers & Sons Construction L.P. (“Myers”), which represented a strategic shift that had a major effect on our operations and consolidated financial results. Accordingly, the historical results of Myers have been presented as discontinued operations in our Consolidated Statements of Operations and Consolidated Balance Sheets. Prior to being disclosed as a discontinued operation, the results of Myers were included within our Transportation Solutions segment. The following footnotes reflect continuing operations only, unless otherwise indicated.

| | | | | |

| 2. | BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation

Presentation Basis—The accompanying Condensed Consolidated Financial Statements are presented in accordance with accounting policies generally accepted in the United States (“GAAP”) and reflect all wholly owned subsidiaries and those entities the Company is required to consolidate. See the “Consolidated 50% Owned Subsidiary” section of this Note and Note 5 - Construction Joint Ventures for further discussion of the Company’s consolidation policy for those entities that are not wholly owned. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, considered necessary for a fair presentation have been included. All significant intercompany accounts and transactions have been eliminated in consolidation. Values presented herein (excluding per share data) are in thousands. Reclassifications have been made to historical financial data in the Condensed Consolidated Financial Statements to conform to the current period presentation.

Estimates and Judgments—The preparation of the accompanying Condensed Consolidated Financial Statements in conformance with GAAP requires management to make estimates and judgments that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Certain accounting estimates of the Company require a higher degree of judgment than others in their application. These include the recognition of revenue and income from construction contracts over time, the valuation of long-lived assets, goodwill and purchase accounting estimates. Management continually evaluates all of its estimates and judgments based on available information and experience; however, actual results could differ from these estimates.

Significant Accounting Policies

Consistent with Regulation S-X Rule 10-1(a), the Company has omitted significant accounting policies in this quarterly report that would duplicate the disclosures contained in the Company’s annual report on Form 10-K for the year ended December 31, 2022 under “Part II, Item 8. - Notes to Consolidated Financial Statements.” This quarterly report should be read in conjunction with the Company’s most recent annual report on Form 10-K.

Accounts Receivable—Receivables are generally based on amounts billed to the customer in accordance with contractual provisions. Receivables are written off based on the individual credit evaluation and specific circumstances of the customer, when such treatment is warranted. The Company performs a review of outstanding receivables, historical collection information and existing economic conditions to determine if there are potential uncollectible receivables. At September 30, 2023 and December 31, 2022, our allowance for our estimate of expected credit losses was zero.

Contracts in Progress—For performance obligations satisfied over time, amounts are billed as work progresses in accordance with agreed-upon contractual terms, either at periodic intervals (e.g., biweekly or monthly) or upon achievement of contractual milestones. Typically, Sterling bills for advances or deposits from its customers before revenue is recognized, resulting in contract liabilities. However, the Company occasionally bills subsequent to revenue recognition, resulting in contract assets.

Many of the contracts under which the Company performs work also contain retainage provisions. Retainage refers to that portion of our billings held for payment by the customer pending satisfactory completion of the project. Unless reserved, the Company assumes that all amounts retained by customers under such provisions are fully collectible. These assets and liabilities are reported on the Condensed Consolidated Balance Sheet within “Contract assets” and “Contract liabilities” on a contract-by-contract basis at the end of each reporting period. At September 30, 2023 and December 31, 2022, contract assets included $64,268 and $65,682 of retainage, respectively, and contract liabilities included $83,928 and $63,848 of retainage, respectively. Retainage on active contracts is classified as current regardless of the term of the contract and is generally collected within one year of the completion of a contract. We anticipate collecting approximately 70% of our September 30, 2023 retainage during the next twelve months.

Contract assets decreased by $2,476 compared to December 31, 2022, primarily due to lower unbilled revenue and retainage. Contract liabilities increased by $192,916 compared to December 31, 2022, due to the timing of advance billings and work progression, partly offset by an increase in retainage. Revenue recognized for the three and nine months ended September 30, 2023 that was included in the contract liability balance on December 31, 2022 was $25,515 and $172,941, respectively. Revenue recognized for the three and nine months ended September 30, 2022 that was included in the contract liability balance on December 31, 2021 was $10,942 and $94,539, respectively.

Consolidated 50% Owned Subsidiary—The Company has a 50% ownership interest in a subsidiary that it fully consolidates as a result of its exercise of control of the entity. The results attributable to the 50% portion that the Company does not own is eliminated within “Other operating expense, net” within the Consolidated Statements of Operations and an associated liability is established within “Members’ interest subject to mandatory redemption and undistributed earnings” within the Consolidated Balance Sheets. The subsidiary also has a mandatory redemption provision which, under circumstances that are certain to occur, obligates the Company to purchase the remaining 50% interest for $20,000. The Company has purchased a $20,000 death and permanent total disability insurance policy to mitigate the Company’s cash draw if such events were to occur. The purchase obligation is also recorded in “Members’ interest subject to mandatory redemption and undistributed earnings” on the Condensed Consolidated Balance Sheets.

Cash and Restricted Cash—Our cash is comprised of highly liquid investments with maturities of three months or less. Restricted cash of zero and $3,721 is included in “Other current assets” on the Condensed Consolidated Balance Sheets at September 30, 2023 and December 31, 2022, respectively. This balance represented cash deposited by the Company into separate accounts and designated as collateral for standby letters of credit in the same amount in accordance with contractual agreements with the Company’s insurance providers.

Recently Adopted Accounting Pronouncements

In March 2020, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2020-04, Facilitation of the Effects of Reference Rate Reform on Financial Reporting, and in December 2022, the FASB issued ASU 2022-06, Deferral of the Sunset Date of Topic 848, to extend the temporary accounting rules under ASU 2020-04 from December 31, 2022 to December 31, 2024. The ASU provides temporary optional guidance to companies impacted by the transition away from the London Interbank Offered Rate (“LIBOR”) by providing certain expedients and exceptions to applying GAAP in order to lessen the potential accounting burden when contracts, hedging relationships and other transactions that reference LIBOR as a benchmark rate are modified. The Company adopted the optional guidance in the second quarter of 2023 and it did not have a material impact on the Condensed Consolidated Financial Statements.

Myers Disposition—On November 30, 2022, we entered into an agreement (the “Myers Agreement”) and sold the Company’s 50% ownership interest in its partnership with Myers for $18,000 in cash. The Company received two payments in the first quarter of 2023 totaling $14,000 and in accordance with the Myers Agreement’s payment terms, two payments of $2,000 each are due by the end of 2025 and 2027. The remaining $4,000 in deferred payments receivable is recorded within “Other non-current assets, net” on our September 30, 2023 Consolidated Balance Sheet at present value calculated using an implicit interest rate of 5.75%. The disposition is consistent with the Company’s strategic shift to reduce its portfolio of low-bid heavy highway and water containment and treatment projects in order to reduce risk, to improve the Company’s margins, and to focus on its strategic geographies outside of California. The disposition represented a strategic shift that had a major effect on

our operations and consolidated financial results, and accordingly, the historical results of Myers have been presented as discontinued operations in our Consolidated Statements of Operations and Consolidated Balance Sheets. Prior to being disclosed as a discontinued operation, the results of Myers were included within our Transportation Solutions segment.

The following table presents the components of net income from discontinued operations for the three and nine months ended September 30, 2022:

| | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2022 | | Nine Months Ended September 30, 2022 | | | | | |

| Revenues | $ | 63,902 | | | $ | 157,001 | | | | | | |

| Cost of revenues | (61,323) | | | (156,056) | | | | | | |

| Gross profit | 2,579 | | | 945 | | | | | | |

| General and administrative expense | (4,231) | | | (9,586) | | | | | | |

| Disposition related costs | (200) | | | (200) | | | | | | |

| Other operating income, net | 63 | | | 3,059 | | | | | | |

| Operating loss | (1,789) | | | (5,782) | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net interest income | 3 | | | 67 | | | | | | |

| Gain on extinguishment of debt | — | | | 2,428 | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Pretax loss | (1,786) | | | (3,287) | | | | | | |

| Income tax benefit | 611 | | | 1,539 | | | | | | |

| Net loss from Discontinued Operations | $ | (1,175) | | | $ | (1,748) | | | | | | |

| | | | | | | | |

The following table presents the cash flows from discontinued operations for the nine months ended September 30, 2022:

| | | | | | | | | | |

| Net cash used in: | Nine Months Ended September 30, 2022 | | | | | |

| Operating activities of Discontinued Operations | $ | (9,158) | | | | | | |

| Investing activities of Discontinued Operations | (688) | | | | | | |

| Financing activities of Discontinued Operations | (81) | | | | | | |

| Net change in cash, cash equivalents, and restricted cash of Discontinued Operations | $ | (9,927) | | | | | | |

Remaining Performance Obligations (“RPOs”)—RPOs represent the aggregate amount of our contract transaction price related to performance obligations that are unsatisfied or partially satisfied at the end of the period. RPOs include the entire expected revenue values for joint ventures we consolidate and our proportionate value for those we proportionately consolidate. RPOs may not be indicative of future operating results. Projects included in RPOs may be canceled or modified by customers; however, the customer would be required to compensate the Company for additional contractual costs for cancellation or modifications. The following table presents the Company’s RPOs, by segment:

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| E-Infrastructure Solutions RPOs | $ | 891,356 | | | $ | 603,227 | |

| Transportation Solutions RPOs | 1,022,927 | | | 713,173 | |

| Building Solutions RPOs - Commercial | 96,124 | | | 97,942 | |

| Total RPOs | $ | 2,010,407 | | | $ | 1,414,342 | |

The Company expects to recognize approximately 70% of its RPOs as revenue during the next twelve months, and the balance thereafter.

Revenue Disaggregation—The following tables present the Company’s revenue disaggregated by major end market and contract type:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, | | |

| Revenues by major end market | 2023 | | 2022 | | 2023 | | 2022 | | | | | | |

| E-Infrastructure Solutions Revenues | $ | 253,948 | | | $ | 255,530 | | | $ | 719,936 | | | $ | 658,005 | | | | | | | |

| | | | | | | | | | | | | |

| Heavy Highway | 146,864 | | | 112,615 | | | 327,440 | | | 307,070 | | | | | | | |

| Aviation | 18,948 | | | 25,441 | | | 50,694 | | | 61,558 | | | | | | | |

| Other Non-Highway Services | 27,184 | | | 19,168 | | | 77,089 | | | 47,377 | | | | | | | |

| Transportation Solutions Revenues | 192,996 | | | 157,224 | | | 455,223 | | | 416,005 | | | | | | | |

| | | | | | | | | | | | | |

| Residential | 77,866 | | | 51,304 | | | 204,993 | | | 166,045 | | | | | | | |

| Commercial | 35,537 | | | 28,982 | | | 106,099 | | | 80,774 | | | | | | | |

| Building Solutions Revenues | 113,403 | | | 80,286 | | | 311,092 | | | 246,819 | | | | | | | |

| Total Revenues | $ | 560,347 | | | $ | 493,040 | | | $ | 1,486,251 | | | $ | 1,320,829 | | | | | | | |

| | | | | | | | | | | | | |

| Revenues by contract type | | | | | | | | | | | | | |

| Lump-Sum | $ | 291,149 | | | $ | 279,185 | | | $ | 822,663 | | | $ | 723,637 | | | | | | | |

| Fixed-Unit Price | 190,170 | | | 161,993 | | | 454,359 | | | 427,153 | | | | | | | |

| Residential and Other | 79,028 | | | 51,862 | | | 209,229 | | | 170,039 | | | | | | | |

| Total Revenues | $ | 560,347 | | | $ | 493,040 | | | $ | 1,486,251 | | | $ | 1,320,829 | | | | | | | |

Variable Consideration

The Company has projects that it is in the process of negotiating, or awaiting final approval of, unapproved change orders and claims with its customers. The Company is proceeding with its contractual rights to recoup additional costs incurred from its customers based on completing work associated with change orders, including change orders with pending change order pricing, or claims related to significant changes in scope which resulted in substantial delays and additional costs in completing the work. Unapproved change order and claim information has been provided to the Company’s customers and negotiations with the customers are ongoing. If additional progress with an acceptable resolution is not reached, legal action will be taken. Based upon the Company’s review of the provisions of its contracts, specific costs incurred and other related evidence supporting the unapproved change orders and claims, together in some cases as necessary with the views of the Company’s outside claim consultants, the Company concluded it was appropriate to include in project price amounts of $7,825 and $8,649, at September 30, 2023 and December 31, 2022, respectively, relating to unapproved change orders and claims. Provisions for estimated losses on uncompleted contracts are made in the period in which such losses are determined.

Contract Estimates

Accounting for long-term contracts and programs involves the use of various techniques to estimate total contract revenue and costs. For long-term contracts, the Company estimates the profit on a contract as the difference between the total estimated revenue and expected costs to complete a contract and recognizes such profit over the life of the contract. Contract estimates are based on various assumptions to project the outcome of future events that often span several years. These assumptions include labor productivity and availability, the complexity of the work to be performed, the cost and availability of materials and the performance of subcontractors. Changes in job performance, job conditions and estimated profitability, including those changes arising from contract penalty provisions and final contract settlements, may result in revisions to costs and income and are recognized in the period in which the revisions are determined. Changes in contract estimates resulted in net increases of $19,822 and $36,557 for the three and nine months ended September 30, 2023, respectively, and net increases of $14,641 and $43,634 for the three and nine months ended September 30, 2022, respectively, included in “Operating income” on the Condensed Consolidated Statements of Operations.

| | | | | |

| 5. | CONSTRUCTION JOINT VENTURES |

Joint Ventures with a Controlling Interest—We consolidate any venture that is determined to be a VIE for which we are the primary beneficiary, or which we otherwise effectively control. The equity held by the remaining owners and their portions of net income (loss) are reflected in stockholders’ equity on the Condensed Consolidated Balance Sheets line item “Noncontrolling interests” and in the Condensed Consolidated Statements of Operations line item “Net income attributable to noncontrolling interests,” respectively. The Company determined that a joint venture in which the Company’s Ralph L. Wadsworth Construction subsidiary is a 51% owner is a VIE and the Company is the primary beneficiary.

Summary financial information for this construction joint venture is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | $ | 8,964 | | | $ | 16,544 | | | $ | 34,227 | | | $ | 37,006 | |

| Operating income | $ | 599 | | | $ | 1,285 | | | $ | 2,281 | | | $ | 2,673 | |

| Net income | $ | 966 | | | $ | 1,294 | | | $ | 3,119 | | | $ | 2,688 | |

Joint Ventures with a Noncontrolling Interest—The Company accounts for unconsolidated joint ventures using a pro-rata basis in the Condensed Consolidated Statements of Operations and as a single line item (“Receivables from and equity in construction joint ventures”) in the Condensed Consolidated Balance Sheets. This method is a permissible modification of the equity method of accounting which is a common practice in the construction industry. Combined financial amounts of joint ventures in which the Company has a noncontrolling interest and the Company’s share of such amounts which are included in the Company’s Condensed Consolidated Financial Statements are shown below:

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Current assets | $ | 47,490 | | | $ | 68,258 | |

| Current liabilities | $ | (12,306) | | | $ | (33,944) | |

| Sterling’s receivables from and equity in construction joint ventures | $ | 14,593 | | | $ | 14,122 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | $ | 17,296 | | | $ | 31,848 | | | $ | 49,073 | | | $ | 109,486 | |

| Income before tax | $ | 7,876 | | | $ | 6,299 | | | $ | 16,204 | | | $ | 16,766 | |

| Sterling’s noncontrolling interest: | | | | | | | |

| Revenues | $ | 6,891 | | | $ | 12,881 | | | $ | 19,674 | | | $ | 45,798 | |

| Income before tax | $ | 3,187 | | | $ | 2,533 | | | $ | 6,605 | | | $ | 6,909 | |

The caption “Receivables from and equity in construction joint ventures” includes undistributed earnings and receivables owed to the Company. Undistributed earnings are typically released to the joint venture partners after the customer accepts the project as completed and the warranty period, if any, has passed.

Other—The use of joint ventures exposes us to a number of risks, including the risk that our partners may be unable or unwilling to provide their share of capital investment to fund the operations of the venture or complete their obligations to us, the venture, or ultimately, the customer. Differences in opinions or views among joint venture partners could also result in delayed decision-making or failure to agree on material issues, which could adversely affect the business and operations of the joint venture. In addition, agreement terms may subject us to joint and several liability for our venture partners, and the failure of our venture partners to perform their obligations could impose additional performance and financial obligations on us. The aforementioned factors could result in unanticipated costs to complete the projects, liquidated damages or contract disputes, including claims against our partners.

Property and equipment are summarized as follows:

| | | | | | | | | | | | | | |

| | September 30,

2023 | | December 31,

2022 |

| Construction and transportation equipment | | $ | 383,869 | | | $ | 345,647 | |

| Buildings and improvements | | 21,220 | | | 20,500 | |

| Land | | 3,402 | | | 3,402 | |

| Office equipment | | 3,623 | | | 3,352 | |

| Total property and equipment | | 412,114 | | | 372,901 | |

| Less accumulated depreciation | | (181,056) | | | (157,419) | |

| Total property and equipment, net | | $ | 231,058 | | | $ | 215,482 | |

Depreciation Expense—Depreciation expense is primarily included within cost of revenues and was $11,121 and $31,320 for the three and nine months ended September 30, 2023, respectively, and $9,219 and $26,731 for the three and nine months ended September 30, 2022, respectively.

| | | | | |

| 7. | OTHER INTANGIBLE ASSETS |

The following table presents our acquired finite-lived intangible assets, including the weighted-average useful lives for each major intangible asset category and in total:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | September 30, 2023 | | December 31, 2022 |

| Weighted

Average

Life (Years) | | Gross

Carrying

Amount | | Accumulated

Amortization | | Gross

Carrying

Amount | | Accumulated

Amortization |

| Customer relationships | 24 | | $ | 284,923 | | | $ | (46,131) | | | $ | 284,923 | | | $ | (37,044) | |

| Trade names | 24 | | 57,607 | | | (8,920) | | | 57,607 | | | (7,150) | |

| Non-compete agreements | 5 | | 2,487 | | | (2,052) | | | 2,487 | | | (1,700) | |

| Total | 24 | | $ | 345,017 | | | $ | (57,103) | | | $ | 345,017 | | | $ | (45,894) | |

The Company’s intangible amortization expense was $3,736 and $11,209 for the three and nine months ended September 30, 2023, respectively, and $3,509 and $10,591 for the three and nine months ended September 30, 2022, respectively.

The Company’s outstanding debt was as follows:

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Term Loan Facility | $ | 347,438 | | | $ | 423,663 | |

| Revolving Credit Facility | — | | | — | |

| Credit Facility | 347,438 | | | 423,663 | |

| | | |

| Other debt | 10,928 | | | 10,901 | |

| Total debt | 358,366 | | | 434,564 | |

| Less - Current maturities of long-term debt | (35,142) | | | (32,610) | |

| Less - Unamortized debt issuance costs | (1,635) | | | (3,219) | |

| Total long-term debt | $ | 321,589 | | | $ | 398,735 | |

Credit Facility—Our amended credit agreement (as amended, the “Credit Agreement”) provides the Company with senior secured debt financing in an initial principal amount of up to $615,000 in the aggregate (collectively, the “Credit Facility”), consisting of (i) a senior secured first lien term loan facility (the “Term Loan Facility”) in the initial aggregate principal amount of $540,000 and (ii) a senior secured first lien revolving credit facility (the “Revolving Credit Facility”) in an aggregate principal amount of $75,000 (with a $75,000 limit for the issuance of letters of credit and a $15,000 sublimit for swing line loans). The obligations under the Credit Facility are secured by substantially all of the assets of the Company and the subsidiary guarantors, subject to certain permitted liens and interests of other parties. The Credit Facility will mature on October 2, 2024.

On June 5, 2023, the Credit Agreement was amended pursuant to an opt-in election to address the cessation of LIBOR and provide an alternative, replacement method of calculating the interest rates payable under the Credit Agreement with adjusted forward-looking term rates based on the Secured Overnight Financing Rate (“Term SOFR”).

The Term Loan Facility bears interest at either the base rate plus a margin, or at a one-, three- or six-month Term SOFR rate plus a margin, at the Company’s election. At September 30, 2023, the Company calculated interest using a Term SOFR rate of 5.43% and an applicable margin of 1.50% per annum, and had a weighted average interest rate of approximately 6.91% per annum during the nine months ended September 30, 2023. Scheduled principal payments on the Term Loan Facility are made quarterly and total approximately $31,900 and $26,100 for the years ending 2023 and 2024, respectively. A final payment of all principal and interest then outstanding on the Term Loan Facility is due on October 2, 2024. For the three and nine months ended September 30, 2023, the Company made scheduled Term Loan Facility payments of $8,709 and $23,225, respectively and voluntary early payments of $0 and $53,000, respectively.

The Revolving Credit Facility bears interest at the same rate options as the Term Loan Facility. In addition to interest on debt borrowings, we are assessed quarterly commitment fees on the unutilized portion of the facility as well as letter of credit fees on outstanding instruments. At September 30, 2023, we had no outstanding borrowings under the $75,000 Revolving Credit Facility.

Debt Issuance Costs—The costs associated with the Credit Facility are reflected on the Condensed Consolidated Balance Sheets as a direct reduction from the related debt liability and amortized over the term of the facility. Amortization of debt issuance costs was $504 and $1,585 for the three and nine months ended September 30, 2023, respectively, and $534 and $1,636 for the three and nine months ended September 30, 2022, respectively, and was recorded as interest expense.

Other Debt—Other debt primarily consists of a subordinated promissory note to one of the Plateau sellers. As part of the Plateau acquisition in 2019, the Company issued a $10,000 subordinated promissory note to one of the Plateau sellers that bears interest at 8% with interest payments due quarterly beginning January 1, 2020. The subordinated promissory note has no scheduled payments; however, it may be repaid in whole or in part at any time, subject to certain payment restrictions under a subordination agreement with the agent under our Credit Agreement, without premium or penalty, with final payment of all principal and interest then outstanding due on April 2, 2025.

Compliance and Other—The Credit Agreement contains various affirmative and negative covenants that may, subject to certain exceptions, restrict our ability and the ability of our subsidiaries to, among other things, grant liens, incur additional indebtedness, make loans, advances or other investments, make non-ordinary course asset sales, declare or pay dividends or make other distributions with respect to equity interests, purchase, redeem or otherwise acquire or retire capital stock or other equity interests, or merge or consolidate with any other person, among various other things. In addition, the Company is required to maintain certain financial covenants. As of September 30, 2023, we were in compliance with all of our restrictive and financial covenants. The Company’s debt is recorded at its carrying amount in the Condensed Consolidated Balance Sheets. Based upon the current market rates for debt with similar credit risk and maturities, at September 30, 2023 and December 31, 2022, the fair value of our debt outstanding approximated the carrying value, as interest is based on Term SOFR plus an applicable margin.

The Company has operating and finance leases primarily for construction and transportation equipment, as well as for office space. The Company’s leases have remaining lease terms of one month to nine years, some of which include options to extend the leases for up to ten years.

The components of lease expense are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Operating lease cost | $ | 5,577 | | | $ | 5,211 | | | $ | 16,041 | | | $ | 12,120 | |

| Short-term lease cost | $ | 4,512 | | | $ | 4,455 | | | $ | 12,637 | | | $ | 10,764 | |

| | | | | | | |

| Finance lease cost: | | | | | | | |

| Amortization of right-of-use assets | $ | 56 | | | $ | 35 | | | $ | 129 | | | $ | 112 | |

| Interest on lease liabilities | 9 | | | 3 | | | 13 | | | 10 | |

| Total finance lease cost | $ | 65 | | | $ | 38 | | | $ | 142 | | | $ | 122 | |

Supplemental cash flow information related to leases is as follows:

| | | | | | | | | | | | | |

| Nine Months Ended September 30, | | |

| Cash paid for amounts included in the measurement of lease liabilities: | 2023 | | 2022 | | |

| | | | | |

| Operating cash flows from operating leases | $ | 15,300 | | | $ | 12,079 | | | |

| Operating cash flows from finance leases | $ | 13 | | | $ | 10 | | | |

| Financing cash flows from finance leases | $ | 129 | | | $ | 112 | | | |

| | | | | |

| Right-of-use assets obtained in exchange for lease obligations (non-cash): | | | | | |

| Operating leases | $ | 13,102 | | | $ | 53,385 | | | |

| Finance leases | $ | 664 | | | $ | — | | | |

Supplemental balance sheet information related to leases is as follows:

| | | | | | | | | | | |

| | | |

| Operating Leases | September 30,

2023 | | December 31,

2022 |

| Operating lease right-of-use assets | $ | 58,492 | | | $ | 59,415 | |

| | | |

| Current portion of long-term lease obligations | $ | 18,403 | | | $ | 19,715 | |

| Long-term lease obligations | 40,204 | | | 40,103 | |

| Total operating lease liabilities | $ | 58,607 | | | $ | 59,818 | |

| Finance Leases | | | |

| Property and equipment, at cost | $ | 2,011 | | | $ | 1,479 | |

| Accumulated depreciation | (1,179) | | | (1,056) | |

| Property and equipment, net | $ | 832 | | | $ | 423 | |

| | | |

| Current maturities of long-term debt | $ | 230 | | | $ | 148 | |

| Long-term debt | 529 | | | 76 | |

| Total finance lease liabilities | $ | 759 | | | $ | 224 | |

| Weighted Average Remaining Lease Term | | | |

| Operating leases | 3.9 | | 4.5 |

| Finance leases | 4.2 | | 1.5 |

| Weighted Average Discount Rate | | | |

| Operating leases | 5.7 | % | | 5.6 | % |

| Finance leases | 6.5 | % | | 4.3 | % |

Maturities of lease liabilities are as follows:

| | | | | | | | | | | |

| Year Ending December 31, | Operating

Leases | | Finance

Leases |

| | | |

| 2023 (excluding the nine months ended September 30, 2023) | $ | 5,418 | | | $ | 78 | |

| 2024 | 20,747 | | | 235 | |

| 2025 | 18,148 | | | 157 | |

| 2026 | 11,794 | | | 157 | |

| 2027 | 2,892 | | | 157 | |

| 2028 | 4,567 | | | 92 | |

| Thereafter | 1,824 | | | — | |

| Total lease payments | $ | 65,390 | | | $ | 876 | |

| Less imputed interest | (6,783) | | | (117) | |

| Total | $ | 58,607 | | | $ | 759 | |

| | | | | |

| 10. | COMMITMENTS AND CONTINGENCIES |

The Company is required by its insurance providers to obtain and hold standby letters of credit. These letters of credit serve as a guarantee by the banking institution to pay the Company’s insurance providers the incurred claim costs attributable to its general liability, workers’ compensation and automobile liability claims, up to the amount stated in the standby letters of credit, in the event that these claims were not paid by the Company.

The Company, including its construction joint ventures and its consolidated 50% owned subsidiary, is now and may in the future be involved as a party to various legal proceedings that are incidental to the ordinary course of business. The Company regularly analyzes current information about these proceedings and, as necessary, provides accruals for probable liabilities on the eventual disposition of these matters. The opinion of Management, after seeking advice from legal counsel, is that there are no legal issues currently threatened or pending that would reasonably be expected to have a material adverse impact on the Company's Consolidated Results of Operations, Financial Position, or Cash Flows.

The Company and its subsidiaries are based in the U.S. and file federal and various state income tax returns. The components of the provision for income taxes were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Current tax expense | $ | 10,493 | | | $ | 2,216 | | | $ | 25,241 | | | $ | 4,663 | |

| Deferred tax expense | 3,398 | | | 10,957 | | | 10,188 | | | 26,303 | |

| Income tax expense | $ | 13,891 | | | $ | 13,173 | | | $ | 35,429 | | | $ | 30,966 | |

| | | | | | | |

| Cash paid for income taxes | $ | 10,025 | | | $ | 1,345 | | | $ | 24,539 | | | $ | 4,143 | |

The effective income tax rate for the three and nine months ended September 30, 2023 was 25.7% and 26.1%, respectively. The rate varied from the statutory rate primarily as a result of state income taxes, non-deductible compensation, and other permanent differences. The Company incurred a tax rate benefit for the three and nine months ended September 30, 2023 for increased tax deductions related to stock compensation. The Company anticipates an effective income tax rate for the full year 2023 of approximately 27%.

As a result of the Company’s analysis, management has determined that the Company does not have any material uncertain tax positions.

| | | | | |

| 12. | STOCK INCENTIVE PLAN AND OTHER EQUITY ACTIVITY |

General—The Company has a stock incentive plan (the “Stock Incentive Plan”) and an employee stock purchase plan (the “ESPP”) that are administered by the Compensation and Talent Development Committee of the Board of Directors. Under the Stock Incentive Plan, the Company can issue shares to employees and directors in the form of restricted stock awards (“RSAs”), restricted stock units (“RSUs”) and performance share units (“PSUs”). Changes in common stock and additional paid in capital during the nine months ended September 30, 2023 primarily relate to activity associated with the Stock Incentive Plan, the ESPP and shares withheld for taxes.

Share Grants—During the nine months ended September 30, 2023, the Company granted the following awards under the Stock Incentive Plan:

| | | | | | | | | | | | | | |

| | Shares | | Weighted Average Grant-Date Fair Value per Share |

| RSAs | | 20 | | | $ | 40.26 | |

| RSUs | | 97 | | | $ | 33.47 | |

| PSUs (at target) | | 143 | | | $ | 34.62 | |

| Total shares granted | | 260 | | | |

Share Issuances—During the nine months ended September 30, 2023, the Company issued the following shares under the Stock Incentive Plan and the ESPP:

| | | | | | | | |

| | Shares |

| RSAs (issued upon grant) | | 20 | |

| RSUs (issued upon vesting) | | 17 | |

| PSUs (issued upon vesting) | | 306 | |

| ESPP (issued upon sale) | | 15 | |

| Total shares issued | | 358 | |

Stock-Based Compensation—During the three and nine months ended September 30, 2023, the Company recognized $3,448 and $9,479, respectively, of stock-based compensation expense, and during the three and nine months ended September 30, 2022, the Company recognized $2,436 and $7,065, respectively, of stock-based compensation expense, primarily within general and administrative expenses. Included within total stock-based compensation expense for the three and nine months ended September 30, 2023 is $42 and $116, respectively, of expense related to the ESPP, and during the three and nine months ended September 30, 2022, the Company recognized $27 and $94, respectively, of expense related to the ESPP. Additionally, the Company has liability-based awards for which the number of units awarded is not determined until the vesting date. During the three and nine months ended September 30, 2023, the Company recognized $0 and $1,725, respectively, within additional paid in capital for the vesting of liability-based awards. During the three and nine months ended September 30, 2022, the Company recognized $0 and $1,225, respectively, within additional paid in capital for the vesting of liability-based awards. The Company recognizes forfeitures as they occur, rather than estimating expected forfeitures.

Shares Withheld for Taxes—The Company withheld 3 and 115 shares for taxes on RSU/PSU stock-based compensation vestings for $251 and $4,579 during the three and nine months ended September 30, 2023, respectively.

AOCI—During the nine months ended September 30, 2022, we utilized a swap arrangement to hedge against interest rate variability associated with the Term Loan Facility until the swap contract expired on December 12, 2022. The Company had designated its interest rate swap as a cash flow hedging derivative and changes in fair value were recognized in other comprehensive income (loss) (“OCI”) until the underlying hedged item was recognized in earnings. The following table presents the total value recognized in OCI and reclassified from accumulated other comprehensive income (“AOCI”) into earnings during the three and nine months ended September 30, 2022 for derivatives designated as cash flow hedges:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2022 | | September 30, 2022 |

| | Before Tax | | Tax | | Net of Tax | | Before Tax | | Tax | | Net of Tax |

| Net gain (loss) recognized in OCI | | $ | 165 | | | $ | (38) | | | $ | 127 | | | $ | 2,122 | | | $ | (484) | | | $ | 1,638 | |

| Net amount reclassified from AOCI into earnings | | (296) | | | 68 | | | (228) | | | 860 | | | (197) | | | 663 | |

| Change in other comprehensive income | | $ | (131) | | | $ | 30 | | | $ | (101) | | | $ | 2,982 | | | $ | (681) | | | $ | 2,301 | |

The following table reconciles the numerators and denominators of the basic and diluted earnings per share computations for the three and nine months ended September 30, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| Numerator: | 2023 | | 2022 | | 2023 | | 2022 |

| Net income from Continuing Operations | $ | 39,353 | | | $ | 30,698 | | | $ | 98,482 | | | $ | 76,484 | |

| Net income from Discontinued Operations | — | | | (1,175) | | | — | | | (1,748) | |

| Net income attributable to Sterling common stockholders | $ | 39,353 | | | $ | 29,523 | | | $ | 98,482 | | | $ | 74,736 | |

| | | | | | | |

| Denominator: | | | | | | | |

| Weighted average common shares outstanding — basic | 30,800 | | | 30,278 | | | 30,733 | | | 30,156 | |

| Shares for dilutive unvested stock and warrants | 417 | | | 262 | | | 315 | | | 208 | |

| Weighted average common shares outstanding — diluted | 31,217 | | | 30,540 | | | 31,048 | | | 30,364 | |

| | | | | | | |

| Net income per share from Continuing Operations: | | | | | | | |

| Basic | $ | 1.28 | | | $ | 1.01 | | | $ | 3.20 | | | $ | 2.54 | |

| Diluted | $ | 1.26 | | | $ | 1.01 | | | $ | 3.17 | | | $ | 2.52 | |

| | | | | | | |

| Net income per share from Discontinued Operations: | | | | | | | |

| Basic | $ | — | | | $ | (0.04) | | | $ | — | | | $ | (0.06) | |

| Diluted | $ | — | | | $ | (0.04) | | | $ | — | | | $ | (0.06) | |

| | | | | | | |

| Net income per share attributable to Sterling common stockholders: | | | | | | | |

| Basic | $ | 1.28 | | | $ | 0.98 | | | $ | 3.20 | | | $ | 2.48 | |

| Diluted | $ | 1.26 | | | $ | 0.97 | | | $ | 3.17 | | | $ | 2.46 | |

| | | | | |

| 14. | SUPPLEMENTAL CASH FLOW INFORMATION |

The following table summarizes the changes in the components of operating assets and liabilities:

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Accounts receivable | $ | (63,685) | | | $ | (97,447) | |

| Contracts in progress, net | 195,392 | | | 26,451 | |

| Receivables from and equity in construction joint ventures | (471) | | | 580 | |

| Other current and non-current assets | (5,322) | | | (1,486) | |

| Accounts payable | 24,180 | | | 47,411 | |

| Accrued compensation and other liabilities | 18,773 | | | 19,830 | |

| Members' interest subject to mandatory redemption and undistributed earnings | 1,015 | | | (1,681) | |

| Changes in operating assets and liabilities | $ | 169,882 | | | $ | (6,342) | |