false

0001844149

0001844149

2023-11-13

2023-11-13

0001844149

SPEC:CommonStockParValue0.0001PerShareMember

2023-11-13

2023-11-13

0001844149

SPEC:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf11.50Member

2023-11-13

2023-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November 13, 2023

Spectaire Holdings Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40976 |

|

98-1578608 |

(State or other jurisdiction

of

incorporation) |

|

(Commission File

Number) |

|

(I.R.S. Employer

Identification No.) |

155 Arlington St.,

Watertown, MA |

|

02472 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (508) 213-8991

3109

W 50th St., #207, Minneapolis, MN 55410

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.0001 per share |

|

SPEC |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50 |

|

SPECW |

|

The Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Entry into a Material Definitive Agreement

On

November 13, 2023, Spectaire Holdings Inc. (the “Company”) issued a press release announcing the sale of 12,500 carbon offset

credits for $750,000. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated in this Item 7.01 by reference.

The

information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is intended to be furnished and shall not be deemed

“filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Spectaire

Holdings Inc. |

| |

|

|

| Date:

November 13, 2023 |

By: | /s/

Brian Semkiw |

| |

Name: | Brian

Semkiw |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

SPECTAIRE

AND SANKOFA LTD ANNOUNCE SALE OF $750,000 USD OF

CARBON OFFSET CREDITS

WATERTOWN,

Mass., Nov. 13, 2023 – Spectaire Holdings Inc. (NASDAQ: SPEC) (“Spectaire”), a provider of air quality monitoring

and emissions reduction services, is pleased to announce the sale of 12,500 carbon offset credits for $750,000 USD with Sankofa LTD (“Sankofa”)

acting as broker to the transaction. This transaction marks a significant milestone in the carbon offset marketplace, as management believes

these credits will be some of the first credits sold based on measurement of actual emissions in the field.

Traditionally,

carbon offsets are approved at the program level where the environmental impact is estimated, and carbon credits are issued based on

those projections. Through AireCore, Spectaire measures emissions directly in the field resulting in what management believes are some

of the first carbon credits sold based on the measurement of actual reductions.

Carbon

credits play a pivotal role in the infrastructure of emissions reduction. However, the market is challenged by the lack of precision

and credit level auditability. With AireCore, each credit can be audited to see when and where the reductions occurred as well as what

specific gases were impacted. Management expects the specificity and traceability of Spectaire’s next generation offsets to give

consumers enduring value through carbon credits backed by measured results.

“As

the demand for carbon credits increases, the historical land-use based supply does not offer the same level of traceability and specificity

as those measured through AireCore. The world needs carbon credits that are accurately measured to achieve the NET ZERO targets confidently,”

said Brian Semkiw, Founder and CEO of Spectaire. “Sankofa continues to be an excellent partner finding environmentally progressive

companies, who are taking affirmative action to reduce Scope 1 and Scope 2 emissions and complementing those efforts through investment

in carbon credits.”

“Sankofa

is committed to the use of carbon offsets in addition to operational reduction in emissions,” said Aviram Malik, CEO of Sankofa

LTD. “This initial placement of 12,500 credits with a client who understands the value in carbon credits that are measured not estimated

is a great first step in the adoption of a new baseline of carbon credit transparency. Sankofa recommends to our clients to not just

invest in carbon offsets but to take ownership of the selection criteria and we believe educated clients understand Spectaire measured

carbon credits will appreciate in value over time.”

About

Spectaire

Spectaire

(Nasdaq: SPEC) is a provider of air quality monitoring and emissions reduction services. Spectaire is dedicated to delivering effective

solutions that help businesses worldwide reduce their carbon footprint, with a focus on creating high-quality, traceable carbon credits.

About

Sankofa

Sankofa

(https://sankofa.earth/) is positioned to impact the carbon credit market by injecting liquidity and transparency into carbon credit

transactions. Through their active role in transactions connecting progressive buyers and sellers of innovative technology-driven credits,

Sankofa helps restore a direct flow of capital, with the aim to ensure optimal impact to the United Nations Sustainable Development agenda.

Forward-Looking

Statements

This

release contains certain forward-looking statements within the meaning of the federal securities laws, including statements regarding

the anticipated value of Spectaire’s next-generation carbon credit offsets. These forward-looking statements generally are identified

by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“would,” “will continue,” “will likely result” and similar expressions.

The

forward-looking statements are based on the current expectations of the management of Spectaire and are inherently subject to uncertainties

and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that

future developments will be those that have been anticipated. Forward-looking statements reflect material expectations and assumptions,

including, without limitation, expectations, and assumptions. Such expectations and assumptions are inherently subject to uncertainties

and contingencies regarding future events and, as such, are subject to change. Forward-looking statements involve a number of risks,

uncertainties or other factors that may cause actual results or performance to be materially different from those expressed or implied

by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in

public filings made by Spectaire with the U.S. Securities and Exchange Commission (the “SEC”) and the following: Spectaire’s

ability to operate as a going concern; Spectaire’s requirement of significant additional capital; Spectaire’s limited operating

history; Spectaire’s history of losses; Spectaire’s ability to attract qualified management; Spectaire’s ability to

adapt to rapid and significant technological change and respond to introductions of new products in order to remain competitive; the

loss of, or nonperformance by, one or more significant customers; disruptions of Spectaire’s manufacturing operation; changes in

governmental regulations reducing demand for Spectaire’s products or increasing Spectaire’s expenses; the effects of global

health crises on Spectaire’s business plans, financial condition and liquidity; changes or disruptions in the securities markets;

legislative, political or economic developments; Spectaire’s failure to obtain any necessary permits or comply with laws and regulations

and other regulatory requirements; accidents, equipment breakdowns, labor disputes or other unanticipated difficulties or interruptions;

potential cost overruns or unanticipated expenses in development programs; potential legal proceedings; and Spectaire’s failure

to obtain or maintain insurance covering all of Spectaire’s operations.

Should

one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of Spectaire prove incorrect,

actual results may vary in material respects from those projected in these forward-looking statements.

All

subsequent written and oral forward-looking statements concerning matters addressed herein and attributable to Spectaire or any person

acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Except to

the extent required by applicable law or regulation, Spectaire undertakes no obligation to update these forward-looking statements to

reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events.

Press

Contact: Chris Grossman, CGrossman@Spectaire.com

Website:

Spectaire.com

###

v3.23.3

Cover

|

Nov. 13, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 13, 2023

|

| Entity File Number |

001-40976

|

| Entity Registrant Name |

Spectaire Holdings Inc.

|

| Entity Central Index Key |

0001844149

|

| Entity Tax Identification Number |

98-1578608

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

155 Arlington St.

|

| Entity Address, City or Town |

Watertown

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02472

|

| City Area Code |

508

|

| Local Phone Number |

213-8991

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

SPEC

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50

|

| Trading Symbol |

SPECW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SPEC_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SPEC_RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

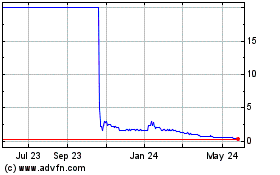

Spectaire (NASDAQ:SPEC)

Historical Stock Chart

From Apr 2024 to May 2024

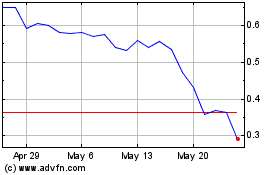

Spectaire (NASDAQ:SPEC)

Historical Stock Chart

From May 2023 to May 2024