UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

July 17, 2023

Date of Report (Date of earliest event reported)

REPUBLIC FIRST BANCORP, INC.

(Exact name of registrant as specified in its charter)

|

Pennsylvania

|

|

000-17007

|

|

23-2486815

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

50 South 16th Street, Suite 2400, Philadelphia, Pennsylvania

|

|

19102

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(215) 735-4422

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☒

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

FRBK |

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of a Material Definitive Agreement.

As previously reported on the Current Report on Form 8-K filed by Republic First Bancorp, Inc. (the “Company”) on March 9, 2023, the Company entered into that certain Securities Purchase Agreement (the “Securities Purchase Agreement”), dated March 9, 2023, by and among the Company, Castle Creek Capital Partners VII, L.P. and Castle Creek Capital Partners VIII, L.P., (together, “Castle Creek”), certain co-investment funds managed by affiliates of Castle Creek (the “Castle Creek Co-Investors”), and CPV Republic Investment, LLC (“CPV” and collectively with Castle Creek, the Castle Creek Co-Investors and the other purchasers under the Securities Purchase Agreement, the “Purchasers”). On July 17, 2023, the Company and the Purchasers mutually terminated the Securities Purchase Agreement because the Company and the Purchasers did not believe that additional investors could be found to participate in the capital raise at $2.25 per share by September 9, 2023 as contemplated by the Securities Purchase Agreement. As a result of the termination, the Securities Purchase Agreement is of no further force and effect except for those provisions that expressly survive the termination. The Company did not incur any penalties in connection with the termination.

The foregoing description of the Securities Purchase Agreement does not purport to be complete and is qualified in its entirety by the full text of the Securities Purchase Agreement, which was previously filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K on March 13, 2023.

Item 8.01 Other Events.

On July 17, 2023, the Company issued a press release (the “Press Release”) announcing (i) the mutual termination of the Securities Purchase Agreement; (ii) a letter from Chairman of the Company’s Board of Directors, Andrew B. Cohen, and President and Chief Executive Officer of the Company, Thomas X. Geisel, to shareholders of the Company (the “Letter to Shareholders”); and (iii) an investor presentation covering the strategic initiatives underway at the Company (the “Investor Presentation”). A copy of the Press Release, Letter to Shareholders and Investor Presentation are attached as Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

Forward-Looking Statements

Certain statements and information contained in this current report on Form 8-K may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained herein are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected in the forward-looking statements. For example, risks and uncertainties can arise with changes in: general economic conditions, including turmoil in the financial markets and related efforts of government agencies to stabilize the financial system; the impact of the COVID-19 pandemic on our business and results of operation; geopolitical conflict and inflationary pressures including Federal Reserve interest rate hikes; the adequacy of our allowance for credit losses and our methodology for determining such allowance; adverse changes in our loan portfolio and credit risk-related losses and expenses; concentrations within our loan portfolio, including our exposure to commercial real estate loans; inflation; changes to our primary service area; changes in interest rates; our ability to identify, negotiate, secure and develop new branch locations and renew, modify, or terminate leases or dispose of properties for existing branch locations effectively; business conditions in the financial services industry, including competitive pressure among financial services companies, new service and product offerings by competitors, price pressures and similar items; deposit flows; loan demand; the regulatory environment, including evolving banking industry standards, changes in legislation or regulation; our securities portfolio and the valuation of our securities; accounting principles, policies and guidelines as well as estimates and assumptions used in the preparation of our financial statements; rapidly changing technology; our ability to regain compliance with Nasdaq Listing Rules 5250(c)(1) and 5620(a); the failure to consummate the transactions contemplated in the Press Release; the failure to maintain current technologies; failure to attract or retain key employees; our ability to access cost-effective funding; fluctuations in real estate values; litigation liabilities, including costs, expenses, settlements and judgments; and other economic, competitive, governmental, regulatory and technological factors affecting our operations, pricing, products and services. You should carefully review the risk factors described in the Annual Report on Form 10-K for the year ended December 31, 2021, and other documents the Company files from time to time with the Securities and Exchange Commission (the “SEC”). The words “would be,” “could be,” “should be,” “probability,” “risk,” “target,” “objective,” “may,” “will,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect” and similar expressions or variations on such expressions are intended to identify forward-looking statements. All such statements are made in good faith by the Company pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. We do not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company, except as may be required by applicable law or regulations.

For additional information regarding known material factors that could cause our actual results to differ from our projected results, please see our filings with the SEC, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events, or otherwise.

Important Additional Information

The Company intends to file a definitive proxy statement and may file a WHITE proxy card with the SEC in connection with the Company’s 2022 annual meeting of shareholders (the “2022 Annual Meeting”) and, in connection therewith, the Company, certain of its directors and executive officers will be participants in the solicitation of proxies from the Company’s shareholders in connection with such meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE 2022 ANNUAL MEETING. The Company’s definitive proxy statement for the 2021 annual meeting of shareholders contains information regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers in the Company’s securities. Information regarding subsequent changes to their holdings of the Company’s securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the Company’s website at http://investors.myrepublicbank.com/ or through the SEC’s website at www.sec.gov. Information can also be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 on file with the SEC. Updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the definitive proxy statement and other materials to be filed with the SEC in connection with the 2022 Annual Meeting. Shareholders will be able to obtain the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Company’s website at http://investors.myrepublicbank.com.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

REPUBLIC FIRST BANCORP, INC.

|

| |

|

|

|

Dated: July 17, 2023

|

|

|

| |

|

|

| |

By:

|

/s/ Brian F. Doran

|

|

| |

Name:

|

Brian F. Doran

|

| |

Title:

|

Executive Vice President and General Counsel

|

Exhibit 99.1

Republic First Bancorp, Inc. Chairman Andrew Cohen and CEO Thomas Geisel Send Letter to Shareholders Outlining Progress on Strategy to Transform Company, Increase Profitability and Drive Long-Term Value

Company Announces that Republic and Affiliates of Castle Creek Capital and Cohen Private Ventures Have Agreed to Mutually Terminate Previously Announced Capital Raise

Releases Presentation Detailing Strategic Initiatives and Republic’s Significant Opportunities

PHILADELPHIA, July 17, 2023 (GLOBE NEWSWIRE) -- Republic First Bancorp, Inc. (NASDAQ: FRBK) (“Republic” or the “Company”), the parent company of Republic First Bank d/b/a Republic Bank (the "Bank"), today announced that Chairman Andrew B. Cohen and President and Chief Executive Officer Thomas X. Geisel have sent a letter to shareholders. The letter explains the challenges Republic has faced, details the elements of the strategy being executed by the new management team and overseen by a refreshed Board, and highlights the significant opportunities the Company has to deliver long-term value. The Company also issued a new presentation covering in detail the strategic initiatives underway at Republic.

| |

●

|

The letter to shareholders is available here.

|

| |

●

|

The new presentation is available here.

|

Republic also announced that it, affiliates of Castle Creek Capital (together with its affiliates and co-investors, “Castle Creek”) and an affiliate of Cohen Private Ventures, LLC (“Cohen Private Ventures”) have mutually decided to terminate the previously announced agreement (the “Agreement”) to raise $125 million in capital (the “Capital Raise”) for the Company through a private placement of equity securities. The Capital Raise was predicated on identifying additional investors to participate at the same $2.25 price per share as Castle Creek and Cohen Private Ventures by September 9, 2023. Given current market conditions – especially the widespread tightening of access to the equity capital markets across the banking sector – the parties do not believe that participants could be found on those terms by September 9th.

Thomas Geisel commented:

“We are executing on a clear strategy to address legacy issues stemming from prior management, drive profitability and enhance shareholder value. Importantly, this plan does not necessitate raising new capital in the near term. Given the dislocation in the banking sector that has occurred since the announcement of the Capital Raise, we believe its termination is in the best interests of Republic and all our stakeholders. We of course remain open to evaluating a future capital transaction as part of our value-creating strategy as market conditions stabilize and improve.”

Tony Scavuzzo, Managing Principal of Castle Creek, stated:

“We continue to remain impressed with how the new Republic First management team is managing the bank in a very challenged environment. We look forward to following them as they continue to execute on their strategic plan.”

Shareholders can sign up to receive updates and announcements from Republic by visiting the investor relations page of the Company’s website.

About Republic Bank

Republic Bank is the operating name for Republic First Bank. Republic First Bank is a full-service, state-chartered commercial bank, whose deposits are insured up to the applicable limits by the Federal Deposit Insurance Corporation (FDIC). The Bank provides diversified financial products through its 34 offices located in Atlantic, Burlington, Camden, and Gloucester Counties in New Jersey; Bucks, Delaware, Montgomery and Philadelphia Counties in Pennsylvania and New York County in New York. For more information about Republic Bank, please visit myrepublicbank.com.

Forward Looking Statements

This press release, and oral statements made regarding the subjects of this release, contains “forward-looking statements” within the meaning of the Securities Litigation Reform Act of 1995, or the Reform Act, which may include, but are not limited to, statements regarding the Company’s estimates, plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts, including statements identified by words such as “believe,” “plan,” “seek,” “expect,” “intend,” “estimate,” “anticipate,” “will,” and similar expressions. All statements addressing the Company’s future plans, strategies and operating results are forward-looking statements within the meaning of the Reform Act. The forward-looking statements are based on management’s current views and assumptions regarding future events and operating performance, and are inherently subject to significant uncertainties and contingencies and changes in circumstances, many of which are beyond the Company’s control. The statements in this press release are made as of the date of this press release, even if subsequently made available by the Company on its website or otherwise. The Company does not undertake any obligation to update or revise these statements to reflect events or circumstances occurring after the date of this press release. You should carefully review the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and other documents the Company files from time to time with the SEC.

Important Additional Information

The Company intends to file a definitive proxy statement and may file a WHITE proxy card with the SEC in connection with the Annual Meeting and, in connection therewith, the Company, certain of its directors and executive officers will be participants in the solicitation of proxies from the Company’s shareholders in connection with such meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING. The Company’s definitive proxy statement for the 2021 annual meeting of shareholders contains information regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers in the Company’s securities. Information regarding subsequent changes to their holdings of the Company’s securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the Company’s website at http://investors.myrepublicbank.com/ or through the SEC’s website at www.sec.gov. Information can also be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 on file with the SEC. Updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the definitive proxy statement and other materials to be filed with the SEC in connection with the Annual Meeting. Shareholders will be able to obtain the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Company’s website at http://investors.myrepublicbank.com.

Contacts

Longacre Square Partners

Greg Marose / Joe Germani, (646) 277-8813

frbk@Longacresquare.com

Exhibit 99.2

Letter to Shareholders from Republic First Bancorp, Inc. Chairman Andrew B. Cohen and President and Chief Executive Officer Thomas X. Geisel

July 17, 2023

Fellow Shareholder,

Thank you for your ongoing investment in Republic. We are writing to you today to make clear that this is the beginning of a new day at Republic, and our revamped leadership team is working to address legacy issues and transform the Company.

Both of us have recently assumed new leadership roles. We are committed to transparency, which is why we want to be clear at the outset that there are no quick fixes or silver bullets for Republic. We are executing a new strategy that focuses on core business lines in our core markets, while realizing new efficiencies across the organization and winding down non-core operations.

The two of us and our fellow Board members collectively own a very sizable stake in Republic, meaning our interests are highly aligned with yours. We recognize that it has been an extremely disappointing few years for all shareholders due to the prior executive team’s mistakes and lack of Board oversight.

In the following pages, we discuss where we’ve been, where we are now and where we’re going. We look forward to continuing to communicate with you more in the coming weeks and months.

Where We’ve Been

As noted, Republic has been through some difficult times. These include former leadership’s ill-advised expansion of the Bank’s physical footprint and building of long-term fixed-rate residential loan and bond portfolios during a period of historically low interest rates. The former executive team also failed to maintain appropriate internal controls related to a system’s conversion in June 2022, leading to delays with our audits and financial reports.

Unfortunately, these delays have prevented us from holding a 2022 Annual Meeting of Shareholders, which is now scheduled for October of this year. We have also faced distracting public campaigns from two different activist investors, a management transition and incessant litigation. At the same time, the credit markets tightened, interest rates rose rapidly and depositors became worried about the safety of regional and community banks across the country. This has resulted in a once-in-generation dislocation in the sector.

By detailing these headwinds, we are being transparent with you about the challenges that exist. Make no mistake, we are neither discouraged nor overwhelmed by these challenges. We have been tackling them head-on.

Where We Are: A New Era for Republic

We believe we will drive a turnaround by targeting the tremendous opportunities in our core service areas and core markets. We are building on a very strong foundation that includes our presence and brand recognition in the Metropolitan Philadelphia and Southern New Jersey markets, sterling reputation for customer service, strong commercial banking capabilities for small and mid-sized businesses, a disciplined credit culture and a diversified commercial loan portfolio. Unlike the larger banks with footprints in these markets, Republic can offer a high-touch, community-based feel that only comes from a local institution. Unlike smaller banks, we have the resources and scale to provide a modern banking experience and serve a broad array of client needs.

These strengths are helping us weather the 2023 banking sector storm. While deposit balances declined a mere 2.7% during the first quarter of 2023, the number of deposit relationships with the Bank increased by 5.2% in the period. This is a testament to the strength of our relationship-focused model.

In close to a year, the building blocks of a stronger Republic have come into place, including:

| |

•

|

Substantial Board refreshment: Three of the seven members of the Board have joined since July of 2022, bringing important new perspectives and fresh thinking. One of these new directors – Benjamin C. Duster, IV – also chairs our Audit Committee. Additionally, we announced that we will be expanding the Board to eight directors at the 2022 Annual Meeting, meaning at that time 50% of the Board will have been replaced over a period of 15 months.

|

| |

•

|

Election of a shareholder-aligned Board Chairman: In May of this year, the Board elected Andy Cohen as independent Chairman, putting in place an individual who not only represents a major shareholder, but who also possesses strong capital markets acumen, corporate governance experience and institutional knowledge of Republic and the broader banking sector.

|

| |

•

|

Hiring of a new, deeply experienced executive team: Tom Geisel, who joined as President and CEO in December of 2022, brings more than two decades of strong leadership experience growing profitable banking businesses. Mike Harrington joined at the same time as CFO. We have continued to bolster the senior team with leaders who have the right experience and skill sets to support the execution of our strategy, including individuals heading the accounting, legal, treasury, facilities and human resources functions.

|

Our new management team and refreshed Board are driving a value-enhancing strategic plan to grow profitability. We are also strengthening internal controls and working to file our overdue financial reports.

While the group led by George E. Norcross, III continues to lob distracting and baseless criticisms at the Company and file costly lawsuits – in addition to now launching a proxy fight to take over nearly 40% of the Board – we remain focused on moving forward rather than re-litigating the past. We are also working to improve the Bank’s balance sheet and operations by implementing the following initiatives:

| |

•

|

Winding down non-core business lines: We have exited the mortgage origination business, streamlined our New York City operations, and are refocusing the Retail Banking division on its strengths in consumer banking, small business banking and supporting the communities in which they operate.

|

| |

•

|

Improving operational efficiencies: We have shortened branch hours and managers are optimizing the Bank’s retail footprint to better align with customers who are increasingly using our technology platforms.

|

| |

•

|

Exploring ways to leverage our real estate: We have engaged CBRE to evaluate the Bank’s real estate portfolio and help determine the best way to maximize its value.

|

| |

•

|

Aggressively managing liquidity: We are working to increase deposits and stabilize and shrink the balance sheet.

|

Where We Are Going

Our goal is to build a strong, resilient and profitable Republic that benefits all stakeholders and creates value for you. Importantly, while capital always provides optionality and quicker strategic plan execution, our current plan does not require any new capital for its successful execution.

We will continue to focus on enhancing efficiencies and growing profitability by taking the following steps:

| |

•

|

Strengthening franchise value in our highly attractive Metropolitan Philadelphia and Southern New Jersey markets, focusing on the core banking businesses.

|

| |

•

|

Reducing expenses and improving operating results.

|

| |

•

|

Restructuring the balance sheet to address legacy portfolio allocation decisions and enhance our liquidity position.

|

| |

•

|

Leveraging the strengths of the brand and strong consumer deposit culture.

|

| |

•

|

Better utilizing technology to support customers.

|

| |

•

|

Improving our capabilities to provide timely financial reports.

|

We have made headway this year and will continue to do the heavy lifting required to realize the potential of our plan. Ultimately, we believe our strategy can deliver significant value and are targeting an ROAA of ~1.0% and an efficiency ratio of <60% in the mid-term.

Conclusion

We have a strong foundation, an actionable strategy and the right team in place to improve value for all Republic stakeholders. We welcome your comments and engagement with us and look forward to communicating further with you. Your support is very important to us and the future of Republic.

|

Andrew B. Cohen,

Chairman of the Board

|

Thomas X. Geisel,

President and CEO

|

|

Important Additional Information

The Company intends to file a definitive proxy statement and may file a WHITE proxy card with the SEC in connection with the 2022 Annual Meeting and, in connection therewith, the Company, certain of its directors and executive officers will be participants in the solicitation of proxies from the Company’s shareholders in connection with such meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE 2022 ANNUAL MEETING. The Company’s definitive proxy statement for the 2021 annual meeting of shareholders contains information regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers in the Company’s securities. Information regarding subsequent changes to their holdings of the Company’s securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the Company’s website at http://investors.myrepublicbank.com/ or through the SEC’s website at www.sec.gov. Information can also be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 on file with the SEC. Updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the definitive proxy statement and other materials to be filed with the SEC in connection with the 2022 Annual Meeting. Shareholders will be able to obtain the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Company’s website at http://investors.myrepublicbank.com.

Exhibit 99.3

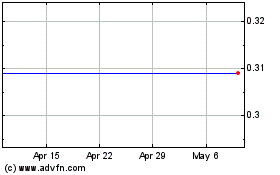

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Apr 2024 to May 2024

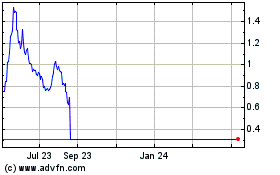

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From May 2023 to May 2024