UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(D)

OF THE SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date

of earliest event reported): August 11, 2023

REDWOODS ACQUISITION

CORP.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-41340 |

|

86-2727441 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

1115 Broadway, 12th Floor

New York, NY 10010

(Address of principal

executive offices, including zip code)

(646) 916-5315

(Registrant’s

telephone number, including area code)

N/A

(Former name or former

address, if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☒ | Written communication pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Units |

|

RWODU |

|

The Nasdaq Stock Market LLC |

| Common Stock |

|

RWOD |

|

The Nasdaq Stock Market LLC |

| Warrants |

|

RWODW |

|

The Nasdaq Stock Market LLC |

| Rights |

|

RWODR

|

|

The Nasdaq Stock Market LLC |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure.

As previously disclosed, on May 30, 2023, Redwoods

Acquisition Corp., a Delaware corporation (“Redwoods”), entered into a business combination agreement (the “Business

Combination Agreement”) by and among Redwoods, ANEW MEDICAL SUB, INC., a Wyoming corporation (“Merger Sub”), and ANEW

MEDICAL, INC., a Wyoming corporation (“ANEW”). The Business Combination Agreement provides, among other things, that on the

terms and subject to the conditions set forth therein, Merger Sub will merge with and into ANEW, with ANEW surviving (the “Merger”)

as a wholly-owned subsidiary of Redwoods. Upon the closing of the Merger, Redwoods will change its name to “ANEW MEDICAL, INC.”

A copy of the Agreement is filed as Exhibit 2.1 to Redwoods’ Current Report on Form 8-K filed on June 5, 2023, and is incorporated

herein by reference.

Furnished as Exhibit 99.1 hereto and incorporated

into this Item 7.01 by reference is an investor presentation that Redwoods and ANEW have prepared for use in connection with the Merger.

The information in this Item 7.01 and Exhibit

99.1, attached hereto will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor will it be deemed incorporated by reference

in any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as expressly

set forth by specific reference in such filing.

IMPORTANT NOTICES

Important Notice Regarding Forward-Looking

Statements

This Current Report on Form 8-K contains certain

“forward-looking statements” within the meaning of the Securities Act and the Exchange Act both as amended. Statements that

are not historical facts, including statements about the pending transactions described above, and the parties’ perspectives and

expectations, are forward-looking statements. Such statements include, but are not limited to, statements regarding the proposed transaction,

including the anticipated initial enterprise value and post-closing equity value, the benefits of the proposed transaction, integration

plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates

for growth, the expected management and governance of the combined company, and the expected timing of the transactions. The words “expect,”

“believe,” “estimate,” “intend,” “plan” and similar expressions indicate forward-looking

statements. These forward-looking statements are not guarantees of future performance and are subject to various risks and uncertainties,

assumptions (including assumptions about general economic, market, industry and operational factors), known or unknown, which could cause

the actual results to vary materially from those indicated or anticipated.

The forward-looking statements are based on the

current expectations of the management of Redwoods and ANEW, as applicable, and are inherently subject to uncertainties and changes in

circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments

will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions

that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements

including: risks related to ANEW’s businesses and strategies; the ability to complete the proposed business combination due to the

failure to obtain approval from Redwoods’ stockholders or satisfy other closing conditions in the definitive merger agreement; the

amount of any redemptions by existing holders of Redwoods’ common stock; the ability to recognize the anticipated benefits of the

business combination; other risks and uncertainties included under the header “Risk Factors” in the Registration Statement

to be filed by Redwoods, in the final prospectus of Redwoods Acquisition Corp. for its initial public offering dated March 30, 2022; and

in Redwood Acquisition Corp.’s other filings with the SEC. Should one or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking

statements. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements

relate only to the date they were made, and Redwoods, ANEW and their subsidiaries undertake no obligation to update forward-looking statements

to reflect events or circumstances after the date they were made except as required by law or applicable regulation.

Important Information for Investors and Stockholders

This document relates to a proposed transaction

between Redwoods and ANEW. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange,

any securities, nor will there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior

to registration or qualification under the securities laws of any such jurisdiction. Redwoods intends to file a registration statement

on Form S-4 with the SEC, which will include a document that serves as a prospectus and proxy statement of Redwoods, referred to as a

proxy statement/prospectus. A proxy statement/prospectus will be sent to all of Redwoods’s stockholders. Redwoods also will file

other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of

Redwoods are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will

be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information

about the proposed transaction.

Once available, stockholders will also be able

to obtain a copy of the Form S-4, including the proxy statement/prospectus, and other documents filed with the SEC without charge, by

directing a request to: Redwoods Acquisition Corp., at 1115 Broadway, 12th Floor, New York, NY 10010. Investors and security holders will

also be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed

or that will be filed with the SEC by Redwoods through the website maintained by the SEC at www.sec.gov. INVESTORS AND SECURITY

HOLDERS OF REDWOODS ACQUISITION CORP. ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER

RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTIONS THAT REDWOODS ACQUISITION CORP. WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT REDWOODS ACQUISITION CORP., ANEW AND THE TRANSACTIONS.

Participants in the Solicitation

Redwoods and its directors and executive officers

may be deemed participants in the solicitation of proxies from Redwoods’ stockholders with respect to the business combination.

Information about Redwoods’ directors and executive officers and a description of their interests in Redwoods will be included in

the proxy statement/prospectus for the proposed transaction and be available at the SEC’s website (www.sec.gov). Additional information

regarding the interests of such participants will be contained in the proxy statement/prospectus for the proposed transaction when available.

ANEW and its directors and executive officers

also may be deemed to be participants in the solicitation of proxies from the stockholders of Redwoods in connection with the proposed

business combination. Information about ANEW’s directors and executive officers and information regarding their interests in the

proposed transaction will be included in the proxy statement/prospectus for the proposed transaction.

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy

statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the transactions described

above and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Redwoods Acquisition Corp. or ANEW,

nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful

prior to registration or qualification under the securities laws of such state or jurisdiction. No offering of securities shall be made

except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Item 9.01. Financial

Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: August 11, 2023 |

|

|

| |

|

|

| |

REDWOODS ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/ Jiande Chen |

| |

Name: |

Jiande Chen |

| |

Title: |

Chief Executive Officer |

3

Exhibit 99.1

Using Gene Therapy to Address The Aging Process Investor Presentation Q3 2023

Disclaimer 2 This presentation is being furnished solely for the purpose of considering a potential transaction involving Redwoods Acquisition Corp . (“Redwoods”) and Anew Medical, Inc . (“ANEW”) . By accepting this presentation, the recipient acknowledges and agrees that all of the information contained herein is confidential, that the recipient will distribute, disclose and use such information only for such purpose and that the recipient shall not distribute, disclose or use such information in any way detrimental to ANEW . ANY SECURITIES OF REDWOODS TO BE OFFERED IN ANY TRANSACTION CONTEMPLATED HEREBY HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE SECURITIES ACT OF 1933 , AS AMENDED (THE “SECURITIES ACT”), OR ANY APPLICABLE STATE OR FOREIGN SECURITIES LAWS . ANY SECURITIES TO BE OFFERED IN ANY TRANSACTION CONTEMPLATED HEREBY HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES EXCHANGE COMMISSION (THE “SEC”), ANY STATE SECURITIES COMMISSION OR OTHER UNITED STATES OR FOREIGN REGULATORY AUTHORITY, AND WILL BE OFFERED AND SOLD SOLELY IN RELIANCE ON THE EXEMPTION FROM THE REGISTRATION REQUIREMENTS PROVIDED BY THE SECURITIES ACT AND RULES AND REGULATIONS PROMULGATED THEREUNDER (INCLUDING REGULATION D) OR REGULATION S UNDER THE SECURITIES ACT . THIS DOCUMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY IN ANY STATE OR OTHER JURISDICTION TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION IN SUCH STATE OR JURISDICTION . Any investment in or purchase of any securities of Redwoods is speculative and involves a high degree of risk and uncertainty . Certain statements in this presentation may constitute “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , Section 21 E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995 , each as amended . These forward - looking statements can generally be identified by the use of forward - looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will” or “should” or, in each case, their negative or other variations or comparable terminology . These forward - looking statements include all matters that are not historical facts . Actual results may differ materially from those discussed in forward - looking statements as a result of factors, risks and uncertainties over which Redwoods and ANEW have no control . These factors, risks and uncertainties include, but are not limited to, the following : (i) changes in domestic and foreign business, market, financial, political and legal conditions ; (ii) the inability of the parties to successfully or timely consummate the proposed transactions, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed transactions or that the approval of the stockholders of Redwoods or ANEW is not obtained ; (iii) the outcome of any legal proceedings that may be instituted against ANEW or Redwoods following announcement of the proposed transactions ; (iv) failure to realize the anticipated benefits of the proposed transactions ; (v) risks relating to the uncertainty of the projected financial information with respect to ANEW ; (vi) risks related to the timing of expected business milestones and commercial launch, including ANEW’s ability to mass produce the ANEW Air and complete the tooling of its manufacturing facility ; (vii) the effects of competition on ANEW’s future business ; (viii) ANEW’s ability to rapidly innovate ; (ix) ANEW’s ability to effectively manage its growth and recruit and retain key employees, including its chief executive officer and executive team ; (x) ANEW’s ability to establish its brand and capture additional market share, and the risks associated with negative press or reputational harm ; (xi) ANEW’s ability to manage expenses ; (xii) the amount of redemption requests made by Redwoods’ public stockholders ; (xiii) the amount of redemption requests made by Redwoods’ public stockholders ; (xiv) the ability of Redwoods or the combined company to issue equity or equity - linked securities in connection with the proposed transactions or in the future ; (xv) the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries ; (xvi) the impact of the global COVID - 19 pandemic on ANEW, Redwoods, the combined company’s projected results of operations, financial performance or other financial metrics, or on any of the foregoing risks ; and (xvii) such other factors as are set forth in Redwoods’s periodic public filings with the SEC, including but not limited to those described in its annual report on Form 10 - K, and in its other filings made with the SEC from time to time, which are available via the SEC’s website at www . sec . gov . None of the Placement Agent (as defined below), Redwoods or ANEW undertake any duty to update these forward - looking statements or the other information contained in this presentation . Neither Redwoods nor ANEW makes any representation or warranty, express or implied, as to the accuracy or completeness of this document or any other information (whether written or oral) that has been or will be provided to you . Nothing contained herein or in any other oral or written information provided to you is, nor shall be relied upon as, a promise or representation of any kind by Redwoods or ANEW . Without limitation of the foregoing, Redwoods and ANEW expressly disclaim any representation regarding any projections concerning future operating results or any other forward - looking statement contained herein or that otherwise has been or will be provided to you . This document includes market data and other statistical information from third - party sources . Although Redwoods and ANEW believe these third - party sources are reliable as of their respective dates, none of Redwoods, ANEW, or any of their respective affiliates has independently verified the accuracy or completeness of this information . Neither Redwoods nor ANEW shall be liable to you or any prospective investor or any other person for any information contained herein or that otherwise has been or will be provided to you, or any action heretofore or hereafter taken or omitted to be taken, in connection with this potential transaction . You will be entitled to rely solely on the representations and warranties made to you by Redwoods in a definitive written agreement relating to a transaction involving Redwoods, when and if executed, and subject to any limitations and restrictions as may be specified in such definitive agreement . No other representations and warranties will have any legal effect . Redwoods has retained Chardan Capital Markets, LLC as placement agent (together with its affiliates, partners, directors, agents, employees, representatives, and controlling persons, the “Placement Agent”) on a potential transaction to which this document relates . The Placement Agent is acting solely as a placement agent (and, for the avoidance of doubt, not an underwriter, initial purchaser, dealer or any other principal capacity) for Redwoods in connection with a potential transaction . The Placement Agent has not independently verified any of the information contained herein or any other information that has been or will be provided to you . The Placement Agent does not make any representation or warranty, express or implied, as to the accuracy or completeness of this document or any other information (whether written or oral) that has been or will be provided to you . Nothing contained herein or in any other oral or written information provided to you is, nor shall be relied upon as, a promise or representation of any kind by the Placement Agent, whether as to the past or the future . Without limitation of the foregoing, the Placement Agent expressly disclaims any representation regarding any projections concerning future operating results or any other forward - looking statement contained herein or that otherwise has been or will be provided to you . The Placement Agent shall not be liable to you or any prospective investor or any other person for any information contained herein or that otherwise has been or will be provided to you, or any action heretofore or hereafter taken or omitted to be taken, in connection with this potential transaction . This document is being distributed solely for the consideration of sophisticated prospective purchasers who are institutional accredited investors with sufficient knowledge and experience in investment, financial and business matters and the capability to conduct their own due diligence investigation and evaluation in connection with a potential transaction . This document does not purport to summarize all of the conditions, risks and other attributes of an investment in Redwoods and ANEW . Information contained herein will be superseded by, and is qualified in its entirety by reference to, any other information that is made available to you in connection with your investigation of Redwoods and ANEW . Each prospective purchaser is invited to meet with a representative of Redwoods and/or ANEW and to discuss with, ask questions of, and receive answers from, such representative concerning ANEW and the terms and conditions of any potential transaction . Redwoods, ANEW and the Placement Agent are free to conduct the process for any transaction as they in their sole discretion determine (including, without limitation, negotiating with any prospective investors and entering into an agreement with respect to any transaction without prior notice to you or any other person), and any procedures relating to such transaction may be changed at any time without notice to you or any other person . No sales will be made, no commitments to invest in Redwoods will be accepted, and no money is being solicited or will be accepted at this time . Any indication of interest from prospective purchasers in response to this document involves no obligation or commitment of any kind . This document should not be distributed to any person other than the addressee to whom it was initially distributed . A full description of the terms of the proposed business combination was provided in the S - 4 Registration Statement and filed with the SEC by Redwoods on August 4 , 2023 (the “S - 4 Registration Statement”), which included a prospectus with respect to Redwood’s securities to be issued in connection with the proposed business combination and a preliminary proxy statement with respect to the stockholder meeting of Redwoods to vote on the proposed business combination . Redwoods urges its stockholders and other interested persons to read the preliminary proxy statement/prospectus included in the S - 4 Registration Statement and the amendments thereto and the definitive proxy statement/prospectus, as well as other documents filed with the SEC, because these documents will contain important information about Redwoods, ANEW and the proposed business combination . After the S - 4 Registration Statement is declared effective, the definitive proxy statement/prospectus to be included in the S - 4 Registration Statement will be mailed to stockholders of Redwoods as of a record date to be established for voting on the proposed business combination . Stockholders will also be able to obtain a copy of the S - 4 Registration Statement, including the proxy statement/prospectus, and other documents filed with the SEC without charge, at the SEC’s website at www . sec . gov, or by directing a request to : Redwoods Acquisition Corp . , 1115 Broadway, 12 th Floor , New York, NY 10010 . Redwoods and its directors and executive officers may be considered participants in the solicitation of proxies from Redwood’s stockholders with respect to the proposed business combination described in the Current Report on Form 8 - K, filed with the SEC on June 5 , 2023 . Information about the directors and executive officers of Redwoods is set forth in the S - 4 Registration Statement, filed with the SEC on August 4 , 2023 , and is available free of charge at the SEC’s website at www . sec . gov or by directing a request to : Redwoods Acquisition Corp . , Attn : Secretary, 1115 Broadway, 12 th Floor , New York, NY 10010 . ANEW and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of Redwoods in connection with the proposed business combination . A list of the names of such directors and executive officers and information regarding their interest in the proposed business combination is contained in the S - 4 Registration Statement . This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom.

About the Transaction

($ millions) ANEW Medical, Inc. (“ANEW”) is expected to combine with Redwoods Acquisition Corp. (“RWOD”) Sources of Funds $5.0 to create a publicly - listed, disruptive gene therapy company PIPE Investment (4) 54.0 ▪ ANEW is a Wyoming corporation with a primary focus on developing disruptive new therapies to alleviate and/or Cash in Trust (assuming no redemptions) $59.0 reverse the progression of neurodegenerative diseases through the use of cell and gene therapy Total Uses of Funds $54.0 Cash Funding to ANEW Balance Sheet 5.0 Assumed Transaction Expenses $59.0 Total 4 Transaction Overview Key Transaction Terms ▪ RWOD to issue 6.0 million common shares to ANEW equityholders (1) , with pre - money valuation of $60 million and post transaction equity value of approximately $151 million (2) ▪ Strong incentive structure facilitated by earn - out provisions, providing ANEW equity holders with additional upside upon realizing share price - based milestones (3) ▪ 2,000,000 earn - out shares upon Redwoods achieving a closing price equal to or exceeding $12.50 for 10 trading days within a 20 - day trading period in the first three years following Closing ▪ 2,000,000 earn - out shares upon Redwoods achieving a closing price equal to or exceeding $15.00 for 10 trading days within a 20 - day trading period in the first three years following Closing ▪ 1,000,000 earn - out shares upon Redwoods achieving a closing price equal to or exceeding $20.00 for 10 trading days within a 20 - day trading period in the first five years following Closing ▪ Approximately $54 million of gross proceeds is currently in RWOD Trust (assuming no redemptions are affected) ▪ Additional $5M from PIPE investment contemplated (no agreements or commitments currently in place) ▪ ANEW existing equity holders to own approximately 40% of the pro forma entity at transaction close, taking into account rollover of a 100% of vested equity ▪ Transaction expected to close no later than Q4 2023 ( 1 ) ( 2 ) ( 3 ) ( 4 ) Shares issued as of transaction close, excluding potential future effect of 5.0M earn - out shares to be issued to ANEW insiders Based on $60.0M pre - money equity value, $54M of funds in RWOD Trust (assuming no redemptions are effected) and approximately $15M equity value of sponsor shares; RWOD Public Shareholders will receive a total of 1.15M shares from contingent rights at close Earnout milestones based on closing price during any 20 out of a 30 - day period No agreements currently in place ($ millions) Pro - forma Valuation 15.1 Pro - forma Shares Outstanding (shares, millions) (2) $10.0 (x) Illustrative Share Price $151.3 Pro - forma Equity Value $0.0 (+) Debt $54.0 ( - ) Cash $97.3 Pro - forma Enterprise Value

Company Overview

6 Mission Statement ANEW MEDICAL, INC. is developing AAV - based gene therapies and disruptive new diagnostics to identify, alleviate and/or reverse the progression of age - related neurodegenerative diseases. We are laser focused on novel anti - aging medicines based on proprietary applications of the human α - Klotho gene and proteins.

7 Exec u tive T eam Dr. Joseph Sinkule Chief Executive Officer & Chairman Dr. Miguel Chillon Rodriguez Chief Scientific Advisor & Director Dr. Shalom Hirschman Chief Medical Advisor & Independent Director Mr. Rick Basse Interim Chief Financial Officer Board of Directors Dr. Samuel Zentman Independent Director Mr. Jon McGarity Independent Director Scientific Founders and Team Full resumes available upon request.

• A bioactive Klotho recombinant protein is very difficult to produce . We have produced bioactive Klotho in CHO cells. • To our knowledge, there is no direct competition in the clinic involving human clinical trials of full - length p - KL or truncated “secreted Klotho” or s - KL. • Our “Cognition” patent for Alzheimer’s was issued in China and Europe. • Patents are pending on the AAV.myo vector that we licensed in 2023. • Target Product Profile favors clinical development in ALS . • ALS is a rare, orphan disease with less competition. • Only 25% survival beyond 2 years from diagnosis. • Use of novel muscle - specific promoter and muscle - targeted delivery in our intellectual property (“I.P.”) • Other indications may include Alzheimer’s disease, Parkinson’s, Huntington’s disease, severe dementia, MCI, and inherited ADAD – neurodegenerative diseases. • “ Newsworthy ”, large markets, extensive competition, (but novel product candidate with s - KL - AAVmyo). • Protein, gene, viral, and non - viral vectors can be used to treat several different age - related diseases and “aging” itself using our Klotho s - KL product candidates. O ther Company Highligh ts 8 Investment Highlights Competitive advantages in technology, product development knowledge, experience, and IP Diversified business model with in vitro diagnostics programs providing a near - term revenue opportunity Highly experienced management team in drug commercialization and in cell and gene therapy Unique Advantages To Our Klotho Program

α - Klotho and Longevity: Market Opportunity 9 3x Expected increase in population over 80 y/o by 2050. 1 95% Percentage of population over 65 y/o with at least one chronic condition. 2 80% Percentage of population over 65 y/o with two or more chronic conditions. 2 The absence of the α - Klotho gene has been identified as a key contributor to the progressive onset of aging - related diseases including Alzheimer’s and ALS. ANEW has secured exclusive rights to develop and commercialize certain intellectual property related to the production and commercialization of the human α - Klotho gene. As the global population ages, we expect the demand for α - Klotho - based therapies to increase. 1 NIH Report “An Aging World” March 28, 2016 2 National Council on Aging. Chronic Inequities: Measuring Disease Cost Burden Among Older Adults in the U.S. https://ncoa.org/article/the - inequities - in - the - cost - of - chronic - disease - why - it - matters - for - older - adults .

10 Anticipated Development Timeline s - K L A A V . m yo optimization s - K L A A V . m y o assay development ALS/AD - Phase 2 - 3 adaptive design Orphan drug ADAD & ALS BLAA/MLA approvals for ALS Klotho in vitro diagnostic CRO/CDMO collaborations - GMP product and ALS & AD sites Launch Klotho diagnostic Str e n g t h e n I P Portfol i o & ne w s - K L gen e constructs S t a r t Phas e 1 - 2 S t ud i e s i n A L S an d ADAD/MCI/dementia A nima l Studies : IN D toxicolo g y / e ffi c a c y Proof of gene expression in animals 2022 202 3 202 4 2025 2026 2027 Start preliminary human studies Anticipated FDA/EMA MAA/BLA Anticipated pharma licensing/acquisition

11 Product Pipeline Phase II/III Phase I/II IND Preclinical D e v elopme n t Research Potential Indications Product Name ls to d human tria 2024 Anticip a te begin in Q1 Amyotrophic lateral sclerosis (ALS), ataxia AM - 202 [AAVmyo.s - KL] Ge n e T h e rapy Programs Alzheimer’s, ADAD, MCI, Dementia, cognition, Parkinson's disease, Huntington's disease, MS AM - 101 [AAV.s - KL] (1) Acute and chronic kidney disease AM - 301 [AAV.p - KL] Amyotrophic lateral sclerosis (ALS), Ataxia Protein - based - LCMS and ELISA In Vitro Diagnostics Acute and chronic kidney disease Genomics - based – PCR and Microarrays Completed In Progress ( 1 ) Not actively developing

12 Intellectual Property & Know How • USPTO Application No .: 15 / 777 , 456 ; Filed : May 18 , 2018 . Title : SECRETED SPLICING VARIANT OF MAMMALIAN KLOTHO AS A MEDICAMENT FOR COGNITION AND BEHAVIOUR IMPAIRMENTS . • USPTO Application No .: 18 / 299 , 989 : Filed : April 13 , 2023 . Title : TREATMENT OF NEUROMUSCULAR DISEASES VIA GENE THERAPY THAT EXPRESSES KLOTHO PROTEIN . • USPTO Application No . 17 / 051 , 123 ; University of Heidelberg . PCT/ER 2019 / 060790 Filed : April 26 , 2019 . Title : MODIFIED AAV CAPSID POLYPEPTIDES FOR TREATMENT OF MUSCULAR DISEASES . • Exclusive worldwide rights to develop and commercialize medical products derived from know how and intellectual properties from the UAB laboratories of Assumpcio Bosch Merino and Miguel Chillon Rodriguez in the areas of neurodegenerative diseases (exclusive) and Dirk Grimm at University of Heidelberg (non - exclusive) . • Sponsored Research Agreements (“SRA”) with the UAB laboratories will continue to investigate neurodegenerative diseases and age - related diseases – e.g., osteoporosis, sarcopenia, cancer, chronic kidney disease and heart disease.

Background of α - Klotho and ANEW’s Approach to α - Klotho - based Therapies

A dvancing Potential α - Klotho - based Therapies 14 ANEW’s focus is to bring to market groundbreaking α - Klotho gene and cellular therapies, utilizing novel methods of gene and protein delivery for aging - related diseases and disorders . The α - Klotho gene was discovered in 1997 by Dr. Kuro - O at University of Texas - Southwestern who identified its unique mechanisms of action in the brain, CNS, and peripheral nervous system 3,4 . Klotho gene knock - out mice demonstrate remarkably reduced life - span and premature muscular, vascular, and CNS aging , also including memory deficits, alterations in axonal transport, reduced brain synapses in the hippocampus, hippocampal degeneration, neuroinflammation, and problems in myelin production. Overexpression of the α - Klotho gene product is associated with neuroprotection against oxidative stress, decreased neuroinflammation and fibrosis, increased neuromodulation of synapses, increased myelinating factor, increased axonal transport, and a cognition enhancer.

α - Klotho Proposed Mechanisms of Action 5 ,6 15 ▪ Inhibits inflammatory cytokines in brain & CNS. ▪ Promotes anti - inflammatory cytokines. ▪ Binds APP & protects CN S against amyloid toxicity. ▪ Autophagy clearance of amyloid & tau tangles (cell debris). ▪ Protects Neurons from Death ▪ Oxidative stress & ▪ M itochon d rial re d o x . ▪ Neuroinflammation ▪ Regulates cellular homeostasis & Organ protection via “ ALP ” ▪ Activates Autophagy - Lysosomal Protein ( ALP ) the “master regulator”, Transcription Factor EB ▪ Increases integrity of Myelin ▪ Increases motor neurons in brain & CNS ▪ Increase in muscle strength Enhanc e C o gniti v e Functions Mitigates Neuroin f l a mm ation Clearance of Aβ and phosphor Tau TFEB Activator R e g ulates A utop h a g y Lysosomal Pathway A n t i - A g ing Propertie s Secreted/Soluble Klotho ▪ Synaptic GluN2B and NMDA receptors. ▪ Maturation of oligodendritic cells. ▪ Axonal transport, Neuron plasticity, and Neurogenesis (growth of new neurons). Secreted α - Klotho and Aging – Multiple Potential Therapeutic Indications Increases -

The Secreted Klotho Isoform (s - KL) 16 The 5 exon Klotho (KL) gene on human chromosome 13 produces 2 different Klotho transcripts : 1. A transmembrane Klotho ( m - KL ), which may be metabolized further to a dimer termed p - KL . … and 2. Secreted - KL (s - KL ) , which is produced directly from the human DNA as a RNA splice variant isoform that is transcribed and makes a biologically active form of α - Klotho . s - KL (63 KDa) is our proprietary form of the gene and protein, with minor changes (C - terminal amino acid tail) to the natural - occurring hormone. Isoforms in plasma (p - KL and s - KL) Transmembrane isoform • Obligatory coreceptor of factor FGF - 23. • Regulates the concentration of phosphate in plasma • Produces the active form of vitamin D (prominent role in calcium metabolism). • Regulation of nitric oxide production and protection against endothelial dysfunction • Regulation of calcium channels • Inhibition of insulin and IGF - 1 mediated signaling • Suppression of oxidative stress • Suppression of Wnt - mediated signaling • s - KL – Shows no interference with calcium & phosphate homeostasis 7 . (63KDa) (135KDa) (140KDa) ( 1) ( 2) 7 Roig - Soriano, et al . 2023 1 5 AA “t ail”

Preclinical Studies & Results

Lead Disease Indications & Indication Selection Rationale 18 • Target Product Profile – ALS using AAVmyo.s - KL (ANEW 202) • Urgent medical need, no satisfactory treatment, and “rare disease” benefits. • Amyotrophic Lateral Sclerosis (ALS) is a progressive neurologic disorder characterized by the loss of cortical and spinal motor neurons, denervation of endplates, axonal retraction and death to motor neurons and muscle atrophy. • Patients die within 2 - 3 years of initial diagnosis – respiratory failure. • ALS neuropathology is mainly due to oxidative stress, neuroinflammation, excitotoxicity and mitochondrial dysfunction . • Our preclinical results show that overexpression of s - KL gene in muscles and CNS , mediated by our AAV.myo.s - KL vector and promoter enhances motor function, delays disease onset (by roto - rod and grip strength tests), yields higher number of innervated neuromuscular junctions, higher muscle action potential or major muscle groups, and stronger muscle strength overall versus controls. • Primary endpoints for proposed clinical trials – 2 year survival; secondary endpoints – severity of rate change of ALS biomarkers/symptoms and Quality of Life measures; tertiary endpoint – sustained s - KL blood levels.

Published Results and Know How 19 Our Barcelona team has over 25 years of experience selectively manipulating levels of therapeutic proteins like s - KL and m - KL in vivo by using gene therapy strategies.

α - Klotho as a Biomarker and Diagnostic – 2 Examples 20 9, 10 Highly significant differences Highly significant differences at p=0.006 Our in vitro diagnostic will measure blood levels of Klotho protein & gene, and the test results used to predict disease status and the need for treatment with our Products – Low Klotho levels means poor outcomes without treatment. 1. Significantly higher “all cause” mortality with low Klotho blood levels 8 . 2. Significantly lower Klotho levels in AD patients vs. equally - aged “normal” adults 9, 10 . 8 Kresovich, et al . 2022 9, 10 Semba, et al . 2015

Data & Results – Aging and Cognition Mice Models 11 21 • Th e s e c rete d Kl oth o is ofor m ( s - KL ) i s a l mo s t e x cl u siv e l y ( > 90 % ) foun d in the brain and high expression levels of s - KL corelate with brain health and healthy aging. • We have leveraged AAV - based vectors to target the CNS leading to in vivo expression of the secreted Klotho isoform s - KL in the brain and spinal fluid after i.v. administration in mice models of aging. • A single i.v. dose of AAV - expressing s - KL had long - term effects and protected memory decline in mouse models of normal aging . • Also, a single i.v. dose of AAV - expressing s - KL protected against memory decline in mouse models of accelerated aging . • s - KL reverses senescence epigenome in accelerated aging, rejuvenating the epigenetic profile in mouse models of aging. 11 Masso, et al . 2017 All groups showed the capacity to learn the task, reflected by the gradual reduction in time to perform it, though s - KL - treated animals learned it faster The group overexpressing s - KL showed better long - term memory. Shown by its significantly higher preference for the platform (P) quadrant as compared to the control group. Inhibition of s - KL had the opposite effect.

Data & Results – Aging and Cognition Animal Models 12 22 • In the brain, s - KL expression reduced neuroinflammation and normalized the levels of inflammatory markers and recovered normal levels of brain’s immune system cells in rodents. • Long - term expression of s - KL did not induce secondary side effects and did not modify Calcium and Phosphate levels in serum, while p - KL (the other Klotho isoforms) severely reduced Calcium and Phosphate levels in serum in mice. • s - KL had a therapeutic effect, both in the brain and systemically, but also had a positive biosafety profile in mouse models. • The full - length p - KL isoform caused alterations in Calcium and Phosphate homeostasis that could be dangerous, while s - KL isoform did not affect these ions in mouse models. Long - term expression of s - KL did not alter Pi and Ca2+ metabolism since its levels are similar to control (Null) animals. In contrast, long - term expression of p - KL led to significantly lower Pi and Ca2+ levels in serum Long - term expression of s - KL (light grey) did not affect the expression of ion channels in kidney (upper figure) nor affect the expresión of key genes involved in vitamin D metabolism (lower figure). Comparison with control healthy animals. In contrast, long - term expression of p - KL (dark grey) significantly altered by several fold, the expression of many genes (upper and lower figure). Comparison with control healthy animals. 12 Roig - Soriano, et al . 2023

Summary of Results in Murine ALS/Neuromuscular disease model 13 23 ↑ Amplitude of the muscle action potentials Improved the connectivity between cortex and spinal motor neurons Enhanced motor c oo r d i n at io n a n d balance Improved grip strength Delayed disease onset Promoted muscle end - plates reinnervation Increased muscle mass Secreted α - Klotho (s - KL, s - KL - AAV and AAV.myo) In SOD1 G93A female mice the treatment: D r . Assu m ptio Bo s c h Merino and a ss o c i a t e s * . 13 Abstracts presented at the 2022 ESGT and 2023 ASGCT meetings

14 Grimm, et al . 2020 AAV.myo Concentrates in Mouse Muscle Tissue 14 24 Very high concentrations of AAV.myo in major muscles in both mice and non - human primates (NHP). ANEW licensed this AAV.myo vector for the delivery of our payload to human muscle tissue and the neuromuscular junction for ALS treatment.

AAV.myo Concentrates in Mouse Muscle Tissue 14 25 “Regular” AAV9 is high in liver compared to our licensed AAV.myo vector. ANEW licensed this AAV.myo vector for the delivery of our payload to human muscle tissue and the neuromuscular junction for ALS treatment. 14 Grimm, et al . 2020

Conclusion

• A bioactive Klotho recombinant protein is very difficult to produce . We have produced bioactive Klotho in CHO cells. • To our knowledge, there is no direct competition in the clinic involving human clinical trials of full - length p - KL or truncated “secreted Klotho” or s - KL. • Our “Cognition” patent for Alzheimer’s was issued in China and Europe. • Patents are pending on the AAV.myo vector that we licensed in 2023. • Target Product Profile favors clinical development in ALS . • ALS is a rare, orphan disease with less competition. • Only 25% survival beyond 2 years from diagnosis. • Use of novel muscle - specific promoter and muscle - targeted delivery in our intellectual property (“I.P.”) • Other indications may include Alzheimer’s disease, Parkinson’s, Huntington’s disease, severe dementia, MCI, and inherited ADAD – neurodegenerative diseases. • “ Newsworthy ”, large markets, extensive competition, (but novel product candidate with s - KL - AAVmyo). • Protein, gene, viral, and non - viral vectors can be used to treat several different age - related diseases and “aging” itself using our Klotho s - KL product candidates. O ther Company Highligh ts 27 Investment Highlights Competitive advantages in technology, product development knowledge, experience, and IP Diversified business model with in vitro diagnostics programs providing a near - term revenue opportunity Highly experienced management team in drug commercialization and in cell and gene therapy Unique Advantages To Our Klotho Program

Ref e rences Slide 9 1 NIH Report: “An Aging World: 2015”. Wan He, Daniel Goodkind, and Paul Kowal. U.S. Census Bureau, International Population Reports, P95/16 - 1, U.S. Government Publishing Office, Washington, DC, 2016. 2 National Council on Aging. Chronic Inequities: “Measuring Disease Cost Burden Among Older Adults in the U.S.” https://ncoa.org/article/the - inequities - in - the - cost - of - chronic - disease - why - it - matters - for - older - adults. Slide 14 3 “Mutation of the mouse klotho gene leads to a syndrome resembling ageing” Makoto Kuro - o, et.al. NATURE | VOL 390 | 6 NOVEMBER 1997. 4 “Klotho and aging”. Makoto Kuro - o. Biochim Biophys Acta. 2009 October ; 1790(10): 1049 – 1058. doi:10.1016/j.bbagen.2009.02.005. Slide 15 5 “Molecular Basis of Klotho: From Gene to Function in Aging”. Yuechi Xu and Zhongjie Sun. Endocrine Reviews 36: 174 – 193, 2015. 6 “New insights into the Mechanism of Action of Soluble Klotho”. George D. Dalton , Jian Xie2 , Sung - Wan An, and Chou - Long Huang. published: 17 November 2017 doi: 10.3389/fendo.2017.00323. Frontiers in Endocrinology 2017. Volume 8. Article 323| www.frontiersin.org. Slide 16 7 “AAV - mediated expression of secreted and transmembrane αKlotho isoforms rescues relevant aging hallmarks in senescent SAMP8 mice”. J. Roig - Soriano, C. Griñán - Ferré, J. F. Espinosa - Parrilla, C. R. Abraham, A. Bosch, M. Pallàs, Miguel Chillón. Aging Cell. 2022;21:e13581. pp 1 - 15 https://doi.org/10.1111/acel.13581. Slide 20 8 “Low Serum Klotho Associated With All - cause Mortality Among a Nationally Representative Sample of American Adults”. Jacob K. Kresovich and Catherine M. Bulka. Journals of Gerontology: Biological Sciences cite as: J Gerontol A Biol Sci Med Sci, 2022, Vol. 77, No. 3, 452 – 456 https://doi.org/10.1093/gerona/glab308. 28

Ref e rences Slide 20 (continued) 9 “Klotho in the cerebrospinal fluid of adults with and without Alzheimer's disease”. Semba, et.al. Published in final edited form as: Neurosci Lett. 2014 January 13; 558: 37 – 40. doi:10.1016/j.neulet.2013.10.058. 10 “Plasma Klotho and Cognitive Decline in Older Adults: Findings From the InCHIANTI Study” Michelle Shardell, Richard D. Semba, et.al. Journals of Gerontology: Medical Sciences cite as: J Gerontol A Biol Sci Med Sci, 2016, Vol. 71, No. 5, 677 – 682 doi:10.1093/gerona/glv140. Slide 21 11 “Secreted αKlotho isoform protects against age - dependent memory deficits”. A Massó, A Sánchez, A Bosch, L Giménez - Llort and M Chillón. Molecular Psychiatry (2018) 23, 1937 – 1947. Slide 22 12 “Differential toxicity profile of secreted and processed α - Klotho expression over mineral metabolism and bone microstructure”. Joan Roig - Soriano, Cristina Sánchez - de - Diego, Jon Esandi - Jauregui, Sergi Verdés, Carmela R. Abraham, Assumpció Bosch, Francesc Ventura & Miguel Chillón. Scientific Reports | (2023) 13:4211 | https://doi.org/10.1038/s41598 - 023 - 31117 - 6 . NATURE PORTFOLIO. Slide 23 13 “Gene therapy for ALS by specifically overexpressing a pleiotropic chronokine, soluble α - Klotho, in skeletal muscles”. Verdés S; Herrando - Grabulosa M; Leal M; Onieva A; Roig - Soriano J; Gaja - Capdevila N; Martín - Masegosa V; Chillón M; Navarro X; Bosch A. Abstract and Award Winner – 2023 American Society of Gene and Cell Therapy, Los Angeles, CA. Slide 24 and Slide 25 14 “Identification of a myotropic AAV by massively parallel in vivo evaluation of barcoded capsid variants”. Jonas Weinmann, Sabrina Weis, Josefine Sippel, Warut Tulalamba, Anca Remes, Jihad El Andari, Anne - Kathrin Herrmann, Quang H. Pham, Christopher Borowski, Susanne Hille, Tanja Schönberger, Norbert Frey, Martin Lenter, Thierry VandenDriessche, Oliver J. Müller, Marinee K. Chuah, Thorsten Lamla & Dirk Grimm. NATURE COMMUNICATIONS (2020) 11:5432. https://doi.org/10.1038/s41467 - 020 - 19230 - w | www.nature.com/naturecommunications. 29

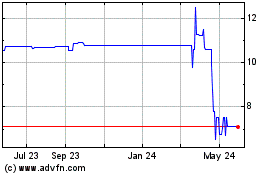

Redwoods Acquisition (NASDAQ:RWODU)

Historical Stock Chart

From Apr 2024 to May 2024

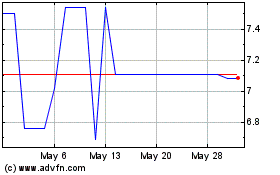

Redwoods Acquisition (NASDAQ:RWODU)

Historical Stock Chart

From May 2023 to May 2024