UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of November 2023

Commission

File Number: 001-41319

POET

TECHNOLOGIES INC.

(Translation of registrant’s name into English)

120

Eglinton Avenue East, Ste 1107

Toronto, Ontario, M4P 1E2, Canada

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

This

report on Form 6-K, including the press release attached hereto as Exhibit 99.1, shall be deemed to be incorporated by reference as an

exhibit to the Registration Statement on Form F-3 of POET Technologies Inc. (File No. 333-273853) and to be a part thereof from the date

on which this report was furnished, to the extent not superseded by documents or reports subsequently filed or furnished.

(c)

Exhibit

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

POET

TECHNOLOGIES INC. |

| |

(Registrant) |

| |

|

| Date:

November 30, 2023 |

/s/

THOMAS MIKA |

| |

Thomas

Mika |

| |

Executive

Vice President and Chief Financial Officer |

Exhibit

99.1

POET

Technologies Announces Pricing of US$1.4 Million Underwritten Public Offering of Common Shares and Warrants

TORONTO,

ONTARIO, Nov. 30, 2023 (GLOBE NEWSWIRE) — POET Technologies Inc. (“POET” or the “Company”) (TSX Venture:

PTK; NASDAQ: POET), the designer and developer of the POET Optical Interposer™, Photonic Integrated Circuits (PICs) and light sources

for the data center, tele-communication and artificial intelligence markets, today announced the pricing of its previously announced

underwritten public offering in the United States (the “Offering”). The Offering consists of 1,600,000 common shares

of the Company and warrants to purchase 1,600,000 common shares of the Company at a public offering price of US$0.90 (CAD$1.22)

per common share and accompanying warrant. Each warrant is exercisable at an exercise price of US$1.12 (CAD$1.52) per common

share for a period of five years from issuance. Gross proceeds from the Offering are expected to be approximately $1.4 million

(CAD$1.90 million) before deducting underwriting discounts, commissions and estimated offering expenses and without giving

effect to the exercise, if any, of the overallotment option described below.

Maxim

Group LLC is acting as sole book-running manager for the Offering.

POET

currently intends to use the net proceeds from the Offering for general working capital purposes, including revenue expansion and the

development and production of photonic modules for AI and related markets. In addition, POET has granted the underwriter a 45-day

option to purchase up to an additional 240,000 Common Shares and/or Warrants at the public offering price in any combination,

less underwriting discounts and commissions. The Offering is expected to close on or about December 4, 2023, subject to the satisfaction

of customary closing conditions. The Company is not completing its previously announced Canadian LIFE offering at this time.

The

Offering is being made pursuant to an effective shelf registration statement on Form F-3 (File No. 333-273853) previously filed with

the U.S. Securities and Exchange Commission (the “SEC”) on August 9, 2023 and declared effective on August 18, 2023. The

securities in the Offering may be offered in the United States only by means of a prospectus. A preliminary prospectus supplement and

the accompanying prospectus relating to and describing the terms of the Offering has been filed with the SEC, form a part of the effective

registration statement and are available on the SEC’s website at www.sec.gov. A final prospectus supplement will be filed

with the SEC. When available, copies of the final prospectus supplement and accompanying prospectus relating to the Offering may also

be obtained by contacting Maxim Group LLC at 300 Park Avenue, 16th Floor, New York, NY 10022, Attention: Syndicate Department, by telephone

at (212) 895-3745 or by email at syndicate@maximgrp.com. Before you invest, you should read the preliminary prospectus supplement

and accompanying prospectus and the other documents that POET has filed with the SEC for more complete information about POET and the

Offering.

This

press release does not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale

of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration

or qualification under the securities laws of any such state or other jurisdiction.

About

POET Technologies Inc.

POET

is a design and development company offering integration solutions based on the POET Optical Interposer™, a novel platform that

allows the seamless integration of electronic and photonic devices into a single multi-chip module using advanced wafer-level semiconductor

manufacturing techniques and packaging methods. POET’s Optical Interposer eliminates costly components and labor-intensive assembly,

alignment, burn-in and testing methods employed in conventional photonics. The cost-efficient integration scheme and scalability of the

POET Optical Interposer brings value to any device or system that integrates electronics and photonics, including some of the highest

growth areas of computing, such as Artificial Intelligence (AI), the Internet of Things (IoT), autonomous vehicles and high-speed networking

for cloud service providers and data centers. POET is headquartered in Toronto, with operations in Allentown, PA, Shenzhen, China and

Singapore. More information may be obtained at www.poet-technologies.com.

Forward-Looking

Statements

This

press release contains “forward-looking information” (within the meaning of applicable Canadian securities laws) and “forward-looking

statements” (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995). Such statements or information are

identified with words such as “anticipate”, “believe”, “expect”, “plan”, “intend”,

“potential”, “estimate”, “propose”, “project”, “outlook”, “foresee”

or similar words suggesting future outcomes or statements regarding an outlook. Such information and statements include the Company’s

anticipated use of the net proceeds of the public offering (if any).

Such

forward-looking information or statements are based on a number of risks, uncertainties and assumptions which may cause actual results

or other expectations to differ materially from those anticipated and which may prove to be incorrect. Assumptions have been made regarding,

among other things, the Company’s ability to complete the Offering in the manner described, or at all, the receipt of all required

regulatory approvals with respect to the Offering, management’s expectations regarding the success of the Company’s announced

products, the timing of completion of its development efforts, the successful implementation of its optical engine or light source products,

the success of its customers’ products, the capabilities of its operations, including its joint venture, the Company’s ability

to correctly gauge market needs and to produce products in the required amounts and on a timely basis. Actual results could differ materially

due to a number of factors, including, without limitation, delays or changes of plan with respect to the Offering described herein, termination

of the Offering in accordance with its terms, the dilutive effects of the Offering, market conditions, the failure of the Company’s

products to meet performance requirements, the failure to produce products on a timely basis or at all, the failure of the Company’s

optical engine or light source products to be incorporated into its customers’ products, the failure of its customers’ products

to achieve market penetration, operational risks including the ability to attract key personnel, and the Company’s ability to raise

additional capital if necessary. Although the Company believes that the expectations reflected in the forward-looking information or

statements are reasonable, prospective investors in the Company’s securities should not place undue reliance on forward-looking

information and statements because the Company can provide no assurance that such expectations will prove to be correct. Forward-looking

information and statements contained in this press release are as of the date of this press release and the Company assumes no obligation

to update or revise this forward-looking information and statements except as required by law.

Contacts:

Media

Relations Contact:

Adrian

Brijbassi

adrian.brijbassi@poet-technologies.com |

Company

Contact:

Thomas

R. Mika, EVP & CFO

tm@poet-technologies.com |

Neither

TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

120 Eglinton Avenue, East, Suite 1107, Toronto, ON, M4P 1E2- Tel: 416-368-9411 - Fax: 416-322-5075

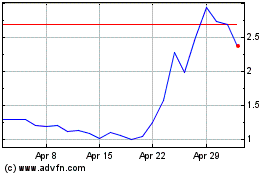

POET Technologies (NASDAQ:POET)

Historical Stock Chart

From Mar 2024 to Apr 2024

POET Technologies (NASDAQ:POET)

Historical Stock Chart

From Apr 2023 to Apr 2024