0001431959false00014319592023-09-132023-09-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 13, 2023 |

Meta Materials Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Nevada |

001-36247 |

74-3237581 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

60 Highfield Park Dr |

|

Dartmouth, Nova scotia, Canada |

|

B3A 4R9 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 902 482-5729 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

MMAT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Resignation of Director

On September 13, 2023, Eric Leslie notified Meta Materials Inc. (the “Company”) of his resignation as a member of the Board of Directors (the “Board”) of the Company and from all committees of the Board on which he served, in each case effective immediately. Prior to his resignation, Mr. Leslie served on the Audit Committee and Human Resources and Compensation Committee of the Board. The resignation is not the result of any disagreement with the Company related to the Company’s operations, policies or practices. Mr. Leslie will move into a Strategic Advisor role at the Company.

In connection with Mr. Leslie's resignation the Board has appointed John R. Harding, a member of the Board, to replace Mr. Leslie as a member of Audit Committee of the Board. In addition, the Board has appointed Vyomesh Joshi, a member of the Board, to replace Mr. Leslie as a member of Human Resources and Compensation Committee of the Board.

|

|

Item 3.01. |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard. |

As previously disclosed, on March 20, 2023, the Company received notice from the Listing Qualifications staff of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, based on the previous 30 consecutive business days, the Company’s listed security no longer met the minimum $1 bid price per share requirement. In accordance with its Listing Rules, Nasdaq granted the Company 180 calendar days, or until September 18, 2023, to regain compliance. In order to regain compliance, the closing bid price of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), must have been at least $1 per share for a minimum of ten consecutive business days during this 180-day period. The Company’s Common Stock has not regained compliance with the minimum $1 bid price per share requirement as of that date. By letter dated September 11, 2023, the Company requested an extension of an additional 180 days in which to regain compliance.

On September 19, 2023, the Company received notice from Nasdaq indicating that, while the Company has not regained compliance with the minimum bid price requirement, staff of Nasdaq has determined that the Company is eligible for an additional 180-day period, or until March 18, 2024, to regain compliance. Staff’s determination was based on (i) the Company meeting the continued listing requirement for market value of our publicly held shares and all other applicable requirements for initial listing on the Capital Market, with the exception of the bid price requirement, and (ii) the Company's written notice to Nasdaq of its intention to cure the deficiency during this second compliance period by effecting a reverse stock split, if necessary. If at any time during this second 180-day period the closing bid price of the Company’s Common Stock is at least $1 per share for at least a minimum of 10 consecutive business days, Nasdaq staff have stated they will provide written confirmation of compliance, although Nasdaq may use its discretion to require up to 20 consecutive business days based on certain factors. If compliance cannot be demonstrated by March 18, 2024, Nasdaq staff will provide written notification that the Company’s securities will be delisted. At that time, the Company may appeal staff’s determination to a hearings panel. We can give no assurance that the Company will regain or demonstrate compliance by March 18, 2024.

On September 19, 2023, the Company issued a press release announcing the Nasdaq minimum bid compliance extension described above under Item 3.01 of this Current Report on Form 8-K. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K (this “Form 8-K”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements that express the Company’s intentions, beliefs, expectations, strategies, predictions or any other statements related to the Company’s future activities, or future events or conditions, which can be identified by terminology such as “may,” “will,” “expects,” “anticipates,” “aims,” “potential,” “future,” “intends,” “plans,” believes,” “estimates,” “continue,” “likely to,” and other similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These statements are not historical facts and are based on current expectations, estimates and projections about the Company’s business based, in part, on assumptions made by its management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict, many of which are beyond the Company’s control, including, among other things, the Company’s ability to maintain its listing of Common Stock on The Nasdaq Capital Market, which may cause the Company’s actual results, performance and achievements to differ materially from those contained in any forward-looking statement. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those risks that may be included in the periodic reports and other filings that the Company files from time to time with the SEC. Any forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation

to update any forward-looking statement to reflect events or circumstances after the date of this Form 8-K, except as required by applicable law.

|

|

Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

META MATERIALS INC. |

|

|

|

|

Date: |

September 19, 2023 |

By: |

/s/ George Palikaras |

|

|

|

George Palikaras

President and Chief Executive Officer |

Exhibit 99.1

Meta Materials Receives 180-Day Extension to Achieve Nasdaq Minimum Bid Compliance

No Immediate Effect on Nasdaq Listing or Trading of the Company’s Common Stock

HALIFAX, NS / ACCESSWIRE / September 19, 2023 / Meta Materials Inc. (the “Company” or “META”) (Nasdaq: MMAT), a global leader in advanced materials and nanotechnology, today announced that it has received a 180-day extension, until March 18, 2024, to achieve compliance with the Nasdaq $1 minimum bid price rule. The Nasdaq staff has determined that META is eligible, based on the Company meeting the continued listing requirements for market value of publicly held shares and all other applicable requirements for initial listing on the Capital Market with the exception of the bid price requirement, and the Company’s written notice of its intention to cure the deficiency during the second compliance period by effecting a reverse stock split, if necessary.

If at any time before March 18, 2024, the closing bid price of the Company’s common stock is at least $1.00 per share for a minimum of 10 consecutive business days (or longer, up to 20 consecutive business days, if Nasdaq so determines in its sole discretion based on certain factors), the Company will regain compliance with this Nasdaq rule and this matter will be closed.

This current notification from Nasdaq has no immediate effect on the listing or trading of the Company’s common stock, which will continue to trade on the Nasdaq Capital Market under the symbol “MMAT.”

About Meta Materials Inc.

Meta Materials Inc. (META) is an advanced materials and nanotechnology company. We develop new products and technologies using innovative sustainable science. Advanced materials can improve everyday products that surround us, making them smarter and more sustainable. META® technology platforms enable global brands to develop new products to improve performance for customers in aerospace and defense, consumer electronics, 5G communications, batteries, authentication, automotive and clean energy. Learn more at www.metamaterial.com.

Media Inquiries

Rob Stone

Vice President, Corporate Development and Communications

Meta Materials Inc.

media@metamaterial.com

Investor Contact

Mark Komonoski

Senior Vice President

Integrous Communications

Phone: 1-877-255-8483

Email: ir@metamaterial.com

Forward Looking Information

This press release includes forward-looking information or statements within the meaning of Canadian securities laws and within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, regarding the Company,

which may include, but are not limited to, statements with respect to the business strategies, product development, expansion plans and operational activities of the Company. Often but not always, forward-looking information can be identified by the use of words such as “pursuing”, “potential”, “predicts”, “projects”, “seeks”, “plans”, “expect”, “intends”, “anticipated”, “believes” or variations (including negative variations) of such words and phrases, or statements that certain actions, events or results “may”, “could”, “should”, “would” or “will” be taken, occur or be achieved. Such statements are based on the current expectations and views of future events of the management of the Company and are based on assumptions and subject to risks and uncertainties. Although the management of the Company believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect. The forward-looking events and circumstances discussed in this release may not occur and could differ materially as a result of known and unknown risk factors and uncertainties affecting the Company, the capabilities of our facilities and the expansion thereof, research and development projects of the Company, the total available market and market potential of the products of the Company, the market position of the Company, the need to raise more capital and the ability to do so, the scalability of the Company’s production ability, capacity for new customer engagements, material selection programs timeframes, the ability to reduce production costs, enhance metamaterials manufacturing capabilities and extend market reach into new applications and industries, the ability to accelerate commercialization plans, the possibility of new customer contracts, the continued engagement of our employees, the technology industry, market strategic and operational activities, and management’s ability to manage and to operate the business. More details about these and other risks that may impact the Company’s businesses are described under the heading “Forward-Looking Information” and under the heading “Risk Factors” in the Company’s Form 10-K filed with the SEC on March 23, 2023, in the Company’s Form 10-K/A filed with the SEC on March 24, 2023, in the Company’s Form 10-Q filed with the SEC on August 9, 2023, and in subsequent filings made by Meta Materials with the SEC, which are available on SEC’s website at www.sec.gov. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on any forward-looking statements or information. No forward-looking statement can be guaranteed. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and the Company does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except to the extent required by law.

Page | 2

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

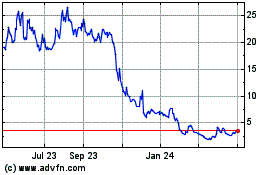

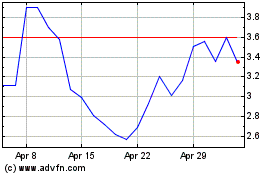

Meta Materials (NASDAQ:MMAT)

Historical Stock Chart

From Apr 2024 to May 2024

Meta Materials (NASDAQ:MMAT)

Historical Stock Chart

From May 2023 to May 2024