Mama’s Creations, Inc. (NASDAQ: MAMA), a leading national marketer

and manufacturer of fresh Deli prepared foods, has reported its

financial results for the fiscal second quarter ended July 31,

2023.

Financial Summary:

| |

Three Months Ended July

31, |

| $ in millions |

|

2023 |

|

2022 |

|

% Increase |

| Revenues |

$ |

24.8 |

$ |

22.9 |

|

8.5 |

% |

| Gross

Profit |

$ |

7.5 |

$ |

2.7 |

|

175 |

% |

| Operating

Expenses |

$ |

5.2 |

$ |

3.6 |

|

47 |

% |

| Net Income

(Loss) |

$ |

1.7 |

$ |

(0.7 |

) |

335 |

% |

| Earnings per Share

(Diluted) |

$ |

0.05 |

$ |

(0.02 |

) |

- |

|

| Adj. EBITDA

(non-GAAP) |

$ |

2.9 |

$ |

(0.4 |

) |

857 |

% |

Key Second

Quarter Fiscal

2024 & Subsequent Operational

Highlights:

-

Acquired remaining 76% interest in sales agent Chef Inspirational

Foods (CIF) for $3.65 Million in a combination of cash and stock,

which is expected to immediately enhance gross margins, add sales

talent and drive meaningful overhead synergies.

-

Announced corporate name change to Mama’s Creations and ticker

symbol change to “MAMA”, reflecting the Company’s transition into a

national deli prepared foods platform company

-

Attended IDDBA 2023, a premier industry tradeshow with over 10,000

attendees hosted by the International Dairy Deli Bakery

Association, where the Company:

-

Launched Mama’s Creations, a new international deli foods platform

brand offering Asian, Tex-Mex, Indian and other incremental

international cuisine opportunities.

-

Introduced an expanded line of highly incremental on-the-go

snacking products – building upon the initial success of Meatballs

In a Cup tests in convenience stores – with enhanced packaging that

expanded shelf life from 5 days to 21 days.

-

Announced the expansion of the Company’s branded sleeve product

line, offering a lunch & dinner entrée in convenient

grab-and-go packaging easy for retailers to stock, with initial

orders already secured from two large national grocery chains.

-

Invited to present at leading investor conferences nationally,

including the 13th Annual LD Micro Invitational, the Planet

MicroCap Showcase, the H.C. Wainwright 25th Annual Global

Investment Conference and the Lake Street Capital Markets BIG7

Conference.

Management Commentary

“I am pleased to announce another strong quarter

– highlighted by 8.5% revenue growth and the expansion of our gross

margin profile into the 30% range – laying the foundation for more

robust, profitable growth in the second half,” said Adam L.

Michaels, Chairman and CEO of Mama’s Creations. “We continue to

fortify our balance sheet to support these near-term growth

expectations, growing our cash position to $5.6 million while

concurrently paying down $0.6 million in debt and paying the $1

million in cash due at closing as part of the CIF acquisition.

“Our strong gross margin profile was made

possible through countless small things done right, further aided

by one month of margin synergies from our acquisition of CIF in

late June 2023, which we anticipated would enhance corporate-level

gross margins by a further 1-2%. Looking ahead to next year, we see

further opportunities for improvement via several strategic CapEx

projects, which we expect to drive a higher level of automation

while concurrently building new in-house capabilities earlier in

the value-chain.

“Turning to the 3 C’s, we continue to formalize

processes throughout the company with the goal of building a more

standardized, resilient organization. These improvements span from

the operational basics – such as formalized hiring/HR processes, a

consistent company-wide employee handbook, or holding our

first-ever town hall meetings – to the more complex, such as a new

approach to trade promotion with defined policies and procedures.

In addition, by our next earnings call we expect to have our

NetSuite ERP software fully implemented across all divisions,

providing an incredible level of actionable insight into the

details of our operations. Mama’s Creations is committed to a

culture of transparency and engagement at all levels of the

organization, which will ultimately create long-term value for my

fellow shareholders,” concluded Michaels.

Second Quarter

Fiscal 2024 Financial

Results

Revenue for the second quarter of fiscal 2024

increased 8.5% to $24.8 million, as compared to $22.9 million in

the same year-ago quarter. The increase was largely attributable to

strong organic growth, driven by successful cross selling efforts,

which increased average items carried to over 7 in the second

quarter.

Gross profit increased 175% to $7.5 million, or

30.3% of total revenues, in the second quarter of fiscal 2024, as

compared to $2.7 million, or 11.9% of total revenues, in the same

year-ago quarter. The increase in gross margin was primarily

attributable to the normalization of commodity costs, successful

pricing actions and improvements in operational efficiencies across

the organization. The Company continues to identify procurement and

logistics efficiencies and cost savings through stronger buying

power created through the acquisitions of T&L Creative Salads,

Olive Branch and CIF.

Operating expenses totaled $5.2 million in the

second quarter of fiscal 2024, as compared to $3.6 million in the

same year-ago quarter. As a percentage of sales, operating expenses

increased in the second quarter of fiscal 2024 to 21.1% from 15.6%.

Operating expenses, as a percentage of sales, increased due to the

addition of several new key hires, who brought new and

differentiated capabilities to the organization.

Net income for the second quarter of fiscal 2024

increased 335% to $1.7 million, or $0.05 per diluted share, as

compared to a net loss of $0.7 million, or $0.02 per diluted share,

in the same year-ago quarter. This quarter’s net income totaled

7.0% of revenue, in line with management expectations in the

mid-single-digit range.

Adjusted EBITDA, a non-GAAP term, increased 857%

to $2.9 million for the second quarter of fiscal 2024, as compared

to an adjusted EBITDA loss of $0.4 million in the same year-ago

quarter.

Cash and cash equivalents as of July 31, 2023

were $5.6 million, as compared to $4.4 million as of January 31,

2023. The increase in cash and cash equivalents was driven by $1.8

million in cash flow from operations in the second quarter of

fiscal 2024, $0.6 million of which was used to pay down the

Company’s debt and $1 million of which was used to pay the cash due

at closing as part of the CIF acquisition. As of July 31, 2023

total debt stood at $10.8 million.

Conference Call

Management will host an investor conference call

at 4:30 p.m. Eastern time today, September 12, 2023 to discuss the

Company’s second quarter fiscal 2024 financial results, provide a

corporate update, and conclude with Q&A from participants. To

participate, please use the following information:

Q2 FY2024 Earnings

Conference CallDate: Tuesday, September 12, 2023 Time:

4:30 p.m. Eastern time U.S. Dial-in: 1-877-451-6152International

Dial-in: 1-201-389-0879Conference ID: 13740711Webcast: MAMA Q2

FY2024 Earnings Conference Call

Please join at least five minutes before the

start of the call to ensure timely participation.

A playback of the call will be available through

Thursday, October 12, 2023. To listen, please call 1-844-512-2921

within the United States and Canada or 1-412-317-6671 when calling

internationally, using replay pin number 13740711. A webcast replay

will also be available using the webcast link above.

About Mama’s

Creations, Inc.

Mama’s Creations, Inc. (NASDAQ: MAMA) is a

leading marketer and manufacturer of fresh deli prepared foods,

found in over 8,400 grocery, mass, club and convenience stores

nationally. The Company’s broad product portfolio, born from

MamaMancini’s rich history in Italian foods, now consists of a

variety of high quality, fresh, clean and easy to prepare foods to

address the needs of both our consumers and retailers. Our vision

is to become a one-stop-shop deli solutions platform, leveraging

vertical integration and a diverse family of brands to offer a wide

array of prepared foods to meet the changing demands of the modern

consumer. For more information, please visit

https://mamascreations.com.

Use of Non-GAAP Financial Measures

This press release includes the following

non-GAAP measure – adjusted EBITDA, which is not a measure of

financial performance under GAAP and should not be considered as an

alternative to net income as a measure of financial performance.

The company believes this non-GAAP measure, when considered

together with the corresponding GAAP measures, provides useful

information to investors and management regarding financial and

business trends relating to the company’s results of operations.

However, this non-GAAP measure has significant limitations in that

it does not reflect all the costs and other items associated with

the operation of the company’s business as determined in accordance

with GAAP. In addition, the company’s non-GAAP measures may be

calculated differently and are therefore not comparable to similar

measures by other companies. Therefore, investors should consider

non-GAAP measures in addition to, and not as a substitute for, or

superior to, measures of financial performance in accordance with

GAAP. For a definition and reconciliation of EBITDA to net income,

its corresponding GAAP measure, please see the reconciliation table

shown in this press release below.

US-GAAP NET INCOME (LOSS) TO ADJUSTED

EBITDA RECONCILIATION(Unaudited)

| |

THREE MONTHS ENDED |

|

|

July 31, |

|

|

|

2023 |

2022 |

|

|

Net Income (Loss) |

$ |

1,743,911 |

|

$ |

(743,246 |

) |

|

Depreciation |

$ |

263,176 |

|

$ |

192,297 |

|

|

Amortization of Debt Discount |

$ |

5,530 |

|

$ |

2,596 |

|

|

Amortization of Right of Use Assets |

$ |

106,447 |

|

$ |

113,518 |

|

|

Amortization of Intangibles |

$ |

202,947 |

|

$ |

116,986 |

|

|

Taxes |

$ |

429,764 |

|

$ |

(208,992 |

) |

|

Interest |

$ |

181,658 |

|

|

139,064 |

|

| Adjusted EBITDA

(Non-GAAP) |

$ |

2,933,433 |

|

$ |

(387,777 |

) |

Forward-Looking Statements

This press release may contain "forward-looking

statements" within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934. "Forward-looking statements" describe future expectations,

plans, results, or strategies and are generally preceded by words

such as "may," "future," "plan" or "planned," "will" or "should,"

"expected," "anticipates," "draft," "eventually" or "projected."

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in the Company's 10-K for the fiscal year ended January

31, 2023 and other filings made by the Company with the Securities

and Exchange Commission.

Investor Relations Contact:Lucas A.

ZimmermanDirectorMZ Group - MZ North America(949)

259-4987MAMA@mzgroup.us www.mzgroup.us

Mama’s Creations, Inc.

Condensed Consolidated Balance Sheets

|

|

|

July 31, 2023 |

|

|

January 31, 2023 |

|

|

|

|

(Unaudited) |

|

|

|

|

| Assets: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

Assets: |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

5,560,176 |

|

|

$ |

4,378,383 |

|

| Accounts receivable, net |

|

|

8,843,756 |

|

|

|

6,832,046 |

|

| Inventories, net |

|

|

3,308,513 |

|

|

|

3,635,881 |

|

| Prepaid expenses and other

current assets |

|

|

474,301 |

|

|

|

828,391 |

|

| Total current

assets |

|

|

18,186,746 |

|

|

|

15,674,701 |

|

| |

|

|

|

|

|

|

|

|

| Property, plant, and

equipment, net |

|

|

4,067,648 |

|

|

|

3,423,096 |

|

| Intangible assets, net |

|

|

5,754,182 |

|

|

|

1,502,510 |

|

| Goodwill |

|

|

8,633,334 |

|

|

|

8,633,334 |

|

| Operating lease right of use

assets, net |

|

|

3,124,449 |

|

|

|

3,236,690 |

|

| Deferred tax asset |

|

|

67,908 |

|

|

|

717,559 |

|

| Equity method investment |

|

|

- |

|

|

|

1,343,486 |

|

| Deposits |

|

|

65,410 |

|

|

|

53,819 |

|

| Total

Assets |

|

$ |

39,899,677 |

|

|

$ |

34,585,195 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and accrued

expenses |

|

$ |

8,872,582 |

|

|

$ |

9,063,256 |

|

| Term loan, net of debt

discount of $49,022 and $60,082, respectively |

|

|

1,502,702 |

|

|

|

1,491,642 |

|

| Operating lease

liabilities |

|

|

414,937 |

|

|

|

391,802 |

|

| Finance leases payable |

|

|

335,119 |

|

|

|

182,391 |

|

| Promissory notes – related

parties |

|

|

1,950,000 |

|

|

|

750,000 |

|

| Total current

liabilities |

|

|

13,075,340 |

|

|

|

11,879,091 |

|

| |

|

|

|

|

|

|

|

|

| Line of credit |

|

|

500,000 |

|

|

|

890,000 |

|

| Operating lease liabilities –

net of current |

|

|

2,739,208 |

|

|

|

2,897,205 |

|

| Finance leases payable – net

of current |

|

|

906,476 |

|

|

|

248,640 |

|

| Promissory notes – related

parties, net of current |

|

|

3,000,000 |

|

|

|

1,500,000 |

|

| Term loan – net of

current |

|

|

3,879,318 |

|

|

|

4,655,181 |

|

| Total long-term

liabilities |

|

|

11,025,002 |

|

|

|

10,191,026 |

|

| |

|

|

|

|

|

|

|

|

| Total

Liabilities |

|

|

24,100,342 |

|

|

|

22,070,117 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies (Notes 10 and 11) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

Equity: |

|

|

|

|

|

|

|

|

| Series A Preferred stock,

$0.00001 par value; 120,000 shares authorized; 23,400 issued as of

July 31, 2023 and January 31, 2023, respectively, 0 shares

outstanding as of July 31, 2023 and January 31, 2023,

respectively |

|

|

- |

|

|

|

- |

|

| Series B Preferred stock,

$0.00001 par value; 200,000 shares authorized; 0 and 54,600 issued

and outstanding as of July 31, 2023 and January 31, 2023

respectively |

|

|

- |

|

|

|

- |

|

| Preferred stock, $0.00001 par

value; 19,680,000 shares authorized; no shares issued and

outstanding |

|

|

- |

|

|

|

- |

|

| Common stock, $0.00001 par

value; 250,000,000 shares authorized; 37,343,387 and 36,317,857

shares issued and outstanding as of July 31, 2023 and January 31,

2023 |

|

|

374 |

|

|

|

364 |

|

| Additional paid in

capital |

|

|

22,912,383 |

|

|

|

22,724,440 |

|

| Accumulated deficit |

|

|

(6,963,922 |

) |

|

|

(10,060,226 |

) |

| Less: Treasury stock, 230,000

shares at cost |

|

|

(149,500 |

) |

|

|

(149,500 |

) |

| Total Stockholders’

Equity |

|

|

15,799,335 |

|

|

|

12,515,078 |

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

39,899,677 |

|

|

$ |

34,585,195 |

|

Mama’s Creations,

Inc.Condensed Consolidated Statements of

Operations(Unaudited)

| |

|

For the Three Months EndedJuly

31, |

|

|

For the Six Months EndedJuly

31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

sales |

|

$ |

24,790,085 |

|

|

$ |

22,846,474 |

|

|

$ |

47,910,901 |

|

|

$ |

44,677,054 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs of

sales |

|

|

17,283,847 |

|

|

|

20,119,862 |

|

|

|

34,033,663 |

|

|

|

38,090,179 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

7,506,238 |

|

|

|

2,726,612 |

|

|

|

13,877,238 |

|

|

|

6,586,875 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

94,871 |

|

|

|

41,792 |

|

|

|

166,056 |

|

|

|

68,327 |

|

|

Selling, general and administrative |

|

|

5,135,537 |

|

|

|

3,516,115 |

|

|

|

9,492,568 |

|

|

|

7,088,870 |

|

|

Total operating expenses |

|

|

5,230,408 |

|

|

|

3,557,907 |

|

|

|

9,658,624 |

|

|

|

7,157,197 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from

operations |

|

|

2,275,830 |

|

|

|

(831,295 |

) |

|

|

4,218,614 |

|

|

|

(570,322 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest, net |

|

|

(181,658 |

) |

|

|

(139,064 |

) |

|

|

(359,052 |

) |

|

|

(263,315 |

) |

|

Amortization of debt discount |

|

|

(5,530 |

) |

|

|

(3,015 |

) |

|

|

(11,060 |

) |

|

|

(6,655 |

) |

|

Other income |

|

|

7,449 |

|

|

|

2,596 |

|

|

|

27,449 |

|

|

|

2,596 |

|

|

Total other expenses |

|

|

(179,739 |

) |

|

|

(139,483 |

) |

|

|

(342,663 |

) |

|

|

(267,374 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

before income tax provision and income from equity method

investment |

|

|

2,096,091 |

|

|

|

(970,778 |

) |

|

|

3,875,951 |

|

|

|

(837,696 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from equity method

investment |

|

|

77,584 |

|

|

|

18,540 |

|

|

|

223,342 |

|

|

|

18,540 |

|

| Income tax (provision)

benefit |

|

|

(429,764 |

) |

|

|

208,992 |

|

|

|

(954,456 |

) |

|

|

179,607 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

|

|

1,743,911 |

|

|

|

(743,246 |

) |

|

|

3,144,837 |

|

|

|

(639,549 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: series B preferred

dividends |

|

|

(21,233 |

) |

|

|

- |

|

|

|

(48,533 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income available to common

stockholders |

|

|

1,722,678 |

|

|

|

(743,246 |

) |

|

|

3,096,304 |

|

|

|

(639,549 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per

common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– basic |

|

$ |

0.05 |

|

|

$ |

(0.02 |

) |

|

$ |

0.09 |

|

|

$ |

(0.02 |

) |

|

– diluted |

|

$ |

0.05 |

|

|

$ |

(0.02 |

) |

|

$ |

0.08 |

|

|

$ |

(0.02 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– basic |

|

|

36,855,181 |

|

|

|

35,811,087 |

|

|

|

36,628,429 |

|

|

|

35,785,719 |

|

|

– diluted |

|

|

37,490,567 |

|

|

|

35,811,087 |

|

|

|

37,195,314 |

|

|

|

35,785,719 |

|

Mama’s Creations, Inc.

Condensed Consolidated Statements of Cash

Flows(Unaudited)

| |

|

For the Six Months Ended July 31, |

|

| |

|

2023 |

|

|

2022 |

|

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

3,144,837 |

|

|

$ |

(639,549 |

) |

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation |

|

|

511,589 |

|

|

|

401,126 |

|

| Amortization of debt

discount |

|

|

11,060 |

|

|

|

6,655 |

|

| Amortization of right of use

assets |

|

|

112,241 |

|

|

|

182,862 |

|

| Amortization of

intangibles |

|

|

303,949 |

|

|

|

230,156 |

|

| Stock-based compensation |

|

|

110,173 |

|

|

|

12,333 |

|

| Allowance for obsolete

inventory |

|

|

93,238 |

|

|

|

- |

|

| Change in deferred tax

asset |

|

|

649,651 |

|

|

|

(188,080 |

) |

| Income from equity method

investment |

|

|

(223,342 |

) |

|

|

(18,540 |

) |

| Paid in kind interest |

|

|

- |

|

|

|

53,356 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

| Allowance for doubtful

accounts |

|

|

140,442 |

|

|

|

- |

|

| Accounts receivable |

|

|

1,126,867 |

|

|

|

749,959 |

|

| Inventories |

|

|

234,130 |

|

|

|

(1,302,933 |

) |

| Prepaid expenses and other

current assets |

|

|

346,709 |

|

|

|

(248,113 |

) |

| Security deposits |

|

|

(17,941 |

) |

|

|

- |

|

| Accounts payable and accrued

expenses |

|

|

(3,049,114 |

) |

|

|

1,170,280 |

|

| Operating lease liability |

|

|

(134,862 |

) |

|

|

(176,534 |

) |

| Net Cash Provided by

Operating Activities |

|

|

3,359,627 |

|

|

|

232,978 |

|

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Cash paid for fixed

assets |

|

|

(252,853 |

) |

|

|

(305,547 |

) |

| Cash paid for investment in

Chef Inspirational Foods, LLC, net |

|

|

(645,641 |

) |

|

|

(500,000 |

) |

| Net Cash (Used in)

Investing Activities |

|

|

(898,494 |

) |

|

|

(805,547 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Proceeds in advance of

preferred stock offering |

|

|

- |

|

|

|

515,000 |

|

| Repayment of term loan |

|

|

(775,863 |

) |

|

|

(517,241 |

) |

| (Repayment) borrowings of line

of credit, net |

|

|

(390,000 |

) |

|

|

1,725,000 |

|

| Repayment of finance lease

obligations |

|

|

(92,724 |

) |

|

|

(130,626 |

) |

| Payment of Series B Preferred

dividends |

|

|

(48,533 |

) |

|

|

- |

|

| Proceeds from exercise of

options |

|

|

27,780 |

|

|

|

26,250 |

|

| Net Cash (Used in)

Provided by Financing Activities |

|

|

(1,279,340 |

) |

|

|

1,618,383 |

|

| |

|

|

|

|

|

|

|

|

| Net Increase in

Cash |

|

|

1,181,793 |

|

|

|

1,045,814 |

|

| |

|

|

|

|

|

|

|

|

| Cash - Beginning of

Period |

|

|

4,378,383 |

|

|

|

850,598 |

|

| |

|

|

|

|

|

|

|

|

| Cash - End of

Period |

|

$ |

5,560,176 |

|

|

$ |

1,896,412 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTARY CASH

FLOW INFORMATION: |

|

|

|

|

|

|

|

|

| Cash Paid During the Period

for: |

|

|

|

|

|

|

|

|

| Income taxes |

|

$ |

112,500 |

|

|

$ |

- |

|

| Interest |

|

$ |

313,488 |

|

|

$ |

182,873 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTARY

DISCLOSURE OF NON-CASH INVESTING AND FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

|

| Conversion of series b

preferred stock to common stock |

|

$ |

8 |

|

|

$ |

- |

|

| Finance lease asset

additions |

|

$ |

903,288 |

|

|

$ |

34,268 |

|

| Related party debt incurred

for purchase of Chef Inspirational Foods, LLC |

|

$ |

2,700,000 |

|

|

|

- |

|

| Non-cash consideration paid in

common stock for equity investment in Chef Inspirational |

|

$ |

- |

|

|

$ |

700,000 |

|

| Settlement of liability in

common stock |

|

$ |

50,000 |

|

|

$ |

- |

|

See accompanying notes to the condensed

consolidated financial statements.

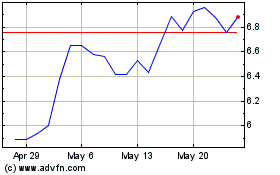

Mamas Creations (NASDAQ:MAMA)

Historical Stock Chart

From Apr 2024 to May 2024

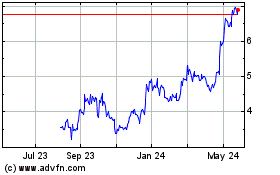

Mamas Creations (NASDAQ:MAMA)

Historical Stock Chart

From May 2023 to May 2024