As

filed with the Securities and Exchange Commission on August 30, 2023

Registration

No. 333-270087

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

POST-EFFECTIVE

AMENDMENT NO. 1 TO

FORM

S-1 ON FORM S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Mama’s

Creations, Inc.

(Exact

Name of Registrant as Specified in its Charter)

| Nevada |

27-0607116 |

(State

or Other Jurisdiction of

Incorporation or Organization) |

(I.R.S.

Employer

Identification Number) |

25

Branca Road

East

Rutherford, NJ 07073

+(201)

531-1212

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Adam

Michaels

25

Branca Road

East

Rutherford, NJ 07073

+(201)

531-1212

(Name,

Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies

to:

Adam

L. Michaels

Chief

Executive Officer

Mama’s

Creations, Inc.

25

Branca Road

East

Rutherford, NJ 07073

(201)

532-1212 |

Jonathan

R. Zimmerman

Charles

Lange

Faegre

Drinker Biddle & Reath LLP

2200

Wells Fargo Center

90

South Seventh Street

Minneapolis,

Minnesota 55402

Telephone:

(612) 766-7000 |

Approximate

date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

On

March 9, 2023, Mama’s Creations, Inc. (“Mama’s Creations” or the “Company”) filed a registration

statement on Form S-1, as amended (File No. 333-270087), as amended on March 16, 2023 and March 28, 2023 (the “Registration Statement”)

with the Securities and Exchange Commission (the “SEC”). The Registration Statement, which was subsequently declared effective

by the SEC on April 10, 2023. The Registration System, as amended, registered the resale by certain stockholders of Mama’s Creations

of up to 835,939 shares of common stock comprising 822,229 shares of common stock underlying the conversion right for the Company’s

Series B Preferred Stock and 13,650 shares underlying Placement Agent Warrants issued by the Company in connection with its offering

of Series B Preferred Stock.

On

June 30, 2023, all outstanding shares of Series B Preferred Stock were converted into an aggregate of 819,000 shares of common stock.

On July 7, 2023, the holders of the Placement Agent Warrants exercised their warrants in full for an aggregate of 13,650 shares of common

stock. Thus, the total number of common shares available for resale pursuant to this registration statement is 832,650.

This

Post-Effective Amendment No. 3 is being filed to convert the Registration Statement into a registration statement on Form S-3.

No

additional securities are being registered under this post-effective amendment. All applicable registration fees were paid at the time

of the original filing of the Registration Statement.

The

information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell the securities described

in this preliminary prospectus until the registration statement filed with the Securities and Exchange Commission is declared effective.

This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any

jurisdiction where the offer or sale is not permitted.

PRELIMINARY—SUBJECT

TO COMPLETION, DATED AUGUST 30, 2023

MAMA’S

CREATIONS, INC

832,650

COMMON SHARES

Par

Value $0.00001 Per Share

This

prospectus relates to the offering by the selling stockholders of Mama’s Creations, Inc. of up to 832,650 shares of our common

stock comprising 822,229 shares underlying the conversion right for the Company’s Series B Preferred Stock and 13,650 shares underlying

warrants issued by the Company in connection with its offering of Series B Preferred Stock (the “Placement Agent Warrants”).

We will not receive any proceeds from the sale of common stock.

The

selling stockholders have advised us that they will sell the shares of common stock from time to time in broker’s transactions,

in the open market, on the NASDAQ, in privately negotiated transactions or a combination of these methods, at market prices prevailing

at the time of sale, at prices related to the prevailing market prices or at negotiated prices. We will pay the expenses incurred to

register the shares for resale, but the selling stockholders will pay any underwriting discounts, commissions or agent’s commissions

related to the sale of their shares of common stock.

We

are registering the offer and sale of these securities to satisfy certain registration rights we have granted. The selling securityholders

may sell the securities described in this prospectus in a number of different ways and at varying prices. We will not receive any of

the proceeds from such sales, but we will receive the proceeds from the exercise of the warrants. The selling securityholders will pay

any underwriting discounts and commissions and expenses incurred by them in disposing of these securities. We will bear all other costs,

fees and expenses incurred in effecting the registration of these securities, as described in more detail in the section titled “Use

of Proceeds” appearing elsewhere in this prospectus. We provide more information about how the selling securityholders may sell

their securities in the section titled “Plan of Distribution” appearing elsewhere in this prospectus.

The

selling securityholders may sell any, all or none of the securities and we do not know when or in what amount the selling securityholders

may sell their securities hereunder following the effective date of this registration statement.

Our

common shares are traded on the Nasdaq Stock Market (“Nasdaq”) under the symbol “MAMA.” On August 28, 2023, the

last quoted sale price for our common shares as reported on Nasdaq was $3.49.

Investing

in our securities involves risks. You should carefully read and consider the “Risk Factors“ included in this prospectus,

in our periodic reports, in any applicable prospectus supplement relating to a specific offering of securities and in any other documents

we file with the U.S. Securities and Exchange Commission (“SEC”). See the section entitled “Risk Factors“ on

page 8 of this prospectus, in our other filings with the SEC and in the applicable prospectus supplement, if any.

You

should rely only on the information contained in this prospectus or any prospectus supplement or amendment hereto. We have not authorized

anyone to provide you with different information.

Neither

the Securities Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2023.

Table

of Contents

We

have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus or in

any free writing prospectus prepared by or on behalf of us or to which we have referred you. We do not take responsibility for, nor can

we provide any assurance as to the reliability of, any other information that others may give you. We are not making an offer of these

securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in or incorporated

by reference in this prospectus or any applicable prospectus supplement or in any such free writing prospectus is accurate as of any

date other than their respective dates.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the SEC using the “shelf” registration process.

Under this shelf registration process, the selling securityholders hereunder may, from time to time, sell the securities offered by them

as described in the section titled “Plan of Distribution” in this prospectus. We will not receive any proceeds from the sale

by such selling securityholders of the securities offered by them described in this prospectus.

Neither

we nor the selling securityholders have authorized anyone to provide you with any information or to make any representations other than

those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf

of us or to which we have referred you. Neither we nor the selling securityholders take responsibility for, and can provide no assurance

as to the reliability of, any other information that others may give you. Neither we nor the selling securityholders will make an offer

to sell these securities in any jurisdiction where the offer or sale is not permitted.

We

may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or

change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective

amendment to the registration statement together with the additional information to which we refer you in the section of this prospectus

titled “Where You Can Find More Information.”

Unless

stated otherwise, references to “we,” “us,” “our,” the “Company” or “Mama’s

Creations” refer to Mama’s Creations, Inc. and includes its consolidated subsidiaries. References to the “selling securityholders”

refer to the securityholders listed herein under the heading “Selling Securityholders” and any of their pledgees, donees,

permitted transferees, assignees and successors.

The

Company

Overview

Mama’s

Creations’ roots go back to our founder Dan Dougherty, whose grandmother Anna “Mama” Mancini emigrated from Bari, Italy

to Bay Ridge, Brooklyn in 1921. Our products were developed using her old-world Italian recipes that were handed down to her grandson,

Dan Dougherty. Today we market a line of all-natural specialty prepared, refrigerated foods for sale in retailers around the country.

Our primary products include beef and turkey meatballs, meat loaf, chicken, sausage-related products and pasta entrees. Formerly called

MamaMancini’s Holdings, Inc., on July 31, 2023, we changed our name to Mama’s Creations, Inc., reflecting our evolution into

a national deli prepared foods platform company.

The

Company’s broad product portfolio, born from a rich history in Italian foods, now consists of a variety of high quality, fresh,

clean and easy to prepare foods to address the needs of both our consumers and retailers. Our vision is to become a one-stop-shop deli

solutions platform, leveraging vertical integration and a diverse family of brands to offer a wide array of prepared foods to meet the

changing demands of the modern consumer.

Our

products are all natural, contain a minimum number of ingredients and are generally derived from the original recipes of Anna “Mama”

Mancini. Our products appeal to health-conscious consumers who seek to avoid artificial flavors, synthetic colors and preservatives that

are used in many conventional packaged foods.

Our

products are principally sold to supermarkets, club chains and mass-market retailers. We currently have more than 50 primary product

offerings across our beef, chicken, salad & olive portfolios which are packaged in different sized retail and bulk packages. Our

products are principally sold in the deli section of the supermarket, including hot bars, salad bars, prepared foods (meals), sandwich,

as well as cold deli and foods-to-go sections. Our products are also sold in the fresh meat section. We sell directly to both food retailers

and food distributors.

Finally,

we also sell our products on QVC through live on-air offerings, auto ship programs and for everyday purchases on their web site. QVC

is the world’s largest direct to consumer marketer.

Our

Strengths

We

believe that the following strengths differentiate our products and our brand:

| |

● |

Authentic

recipes and great taste. Our Mama’s Creations’ products are founded upon Anna “Mama” Mancini’s

old-world Italian recipes. We believe the authenticity of our products has enabled us to build and maintain loyalty and trust among

our current customers and will help us attract new customers. Additionally, we continuously receive positive customer testimonials

regarding the great taste and quality of our products. |

| |

|

|

| |

● |

Healthy

and convenient. Our products are made only from high quality natural ingredients, including domestic inspected beef, whole Italian

tomatoes, genuine imported Pecorino Romano, real eggs, natural breadcrumbs, olive oil and other herbs and spices. Our products are

also simple to prepare. Virtually every product we offer is ready-to-serve within 12 minutes, thereby providing quick and easy meal

solutions for our customers. By including the sauce and utilizing a tray with our packaging, our meatballs can be prepared quickly

and easily. |

| |

|

|

| |

● |

Great

value. We strive to provide our customers with a great tasting product using all-natural ingredients at an affordable price.

Typical retail prices range from $5.99 to $9.99 for products sold in fresh meat sections, delis or hot bars. We believe the sizes

of our product offerings represent a great value for the price. |

| |

|

|

| |

● |

New

products and innovation. Since our inception, we have continued to introduce new and innovative products. While we pride on ourselves

on our traditional beef and turkey meatballs and meat loaf, we have continuously made efforts to grow and diversify our line of products

while maintaining our high standards for all natural, healthy ingredients and great taste. Fiscal Year 2022 introductions of Meal-For-One

ready to eat home meals and our Meatballs-in-a-Cup snack are examples of continued product innovation. Our new lines of chicken cutlets,

breaded chicken products and gourmet pasta salads and savory olive products will be a natural extension to our national customers

and club stores. |

| |

|

|

| |

● |

Key

Market Concentration. Through the acquisition of T&L Creative Salads and Olive Branch products (collectively, T&L”)

(see our current Report on Form 8-K dated December 30, 2021 filed with the SEC on December 30, 2021), Mama’s Creations believes

it is now deeply established in the New York-New Jersey-Connecticut tristate metro market with strong new distribution to delis,

independent end retailers, bagel shops and provision distributors. Mama’s Creations’ products will fit well into the

needs of this market extending our brand. In addition, our legacy Mama’s Creations’ national distribution footprint allows

our new T&L and Olive Branch products to gain broader national distribution. |

Corporate

Information

Mama’s

Creations, Inc. (formerly MamaMancini’s Holdings, originally Mascot Properties, Inc.) was incorporated in the State of Nevada on

July 22, 2009. Our principal executive office is located at 25 Branca Road, East Rutherford, NJ 07073. Our telephone number is (201)

531-1212. Our website is located at https://www.mamascreations.com. The information contained on or connected to our website is not incorporated

by reference in, and is not a part of, this prospectus. We have included our website address as a factual reference and do not intend

it to be an active link to our website. You should not rely on such information in making your decision whether to purchase our securities.

THE

OFFERING

Resale

of the common shares

| Shares

of common stock offered by the Selling Stockholders |

|

832,650

shares, consisting of:

●

822,229 shares underlying the conversion right for the Company’s Series B Preferred; and

●

13,650 shares underlying Placement Agent Warrants. |

| |

|

|

| Use

of proceeds |

|

We will not receive any proceeds from the sale of common stock to be offered by the Selling Stockholders |

| |

|

|

| Risk

factors |

|

Investing

in our common shares involves a high degree of risk. You should carefully read and consider the information set forth under “Risk

Factors“ in this prospectus supplement, the accompanying prospectus and in the documents incorporated by reference herein

and therein to read about factors you should consider before buying our common shares. |

| |

|

|

| Nasdaq

Stock Market symbol |

|

“MAMA” |

Where

You Can Find More Information

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet site that

contains our reports, proxy and other information regarding us and other issuers that file electronically with the SEC, at http://www.sec.gov.

Our SEC filings are also available at our website (https://ir.mamascreations.com). However, except for our filings with the SEC that

are incorporated by reference into this prospectus, the information on our website is not, and should not be deemed to be, a part of,

or incorporated by reference into this prospectus.

INCORPORATION

BY REFERENCE

The

SEC allows “incorporation by reference” into this prospectus of information that we file with the SEC. This permits us to

disclose important information to you by referencing these filed documents. Any information referenced this way is considered to be a

part of this prospectus and any information filed by us with the SEC subsequent to the date of this prospectus automatically will be

deemed to update and supersede this information. We incorporate by reference the following documents which we have filed with the SEC

(excluding any documents or portions of such documents that have been “furnished” but not “filed” for purposes

of the Exchange Act):

| |

(1)

|

The

Registrant’s Annual Report on Form 10-K for the fiscal year ended January 31, 2023 filed on April 26, 2023, including the information

specifically incorporated therein by reference from our Definitive Proxy Statement on Schedule 14A, as filed on June 15, 2023; |

| |

|

|

| |

(2)

|

The

Registrant’s Current Reports on Form 10-Q for the fiscal quarter ended April 30, 2023 filed on June 13, 2023, as amended on

June 21, 2023. |

| |

|

|

| |

(3)

|

The

Registrant’s Current Reports on Form 8-K filed on February 1, 2023, March 9, 2023, June 28, 2023, June 29, 2023 and August 1, 2023 (in each case other than any portions thereof deemed furnished and not filed); and |

| |

|

|

| |

(4)

|

The

description of the Registrant’s common shares, included in Form 8-A filed with the SEC on July 12, 2021, under the Exchange

Act, including any amendment or report filed for the purpose of updating such description. |

We

incorporate by reference any filings made by us with the SEC in accordance with Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act

on or after the date of the initial registration statement and prior to effectiveness of the registration statement, and on or after

the date of this prospectus and the date all of the securities offered hereby are sold or the offering is otherwise terminated, with

the exception of any information furnished under Item 2.02 and Item 7.01 (including any financial statements or exhibits relating thereto

furnished pursuant to Item 9.01) of Form 8-K, which is not deemed filed and which is not incorporated by reference herein. Any such filings

shall be deemed to be incorporated by reference and to be a part of this prospectus from the respective dates of filing of those documents.

This

prospectus and any accompanying prospectus supplement are part of a registration statement that we filed with the SEC and do not contain

all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided

below. Statements in this prospectus or any accompanying prospectus supplement or free writing prospectus about these documents are summaries

and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents

for a more complete description of the relevant matters. You may inspect a copy of the registration statement at the SEC’s website,

as provided above.

Any

statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified

or superseded to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed

to be incorporated by reference in this prospectus modifies or supersedes that statement. Any statement so modified or superseded will

not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We

will provide to each person, including any beneficial owner, to whom a prospectus is delivered, without charge, upon written or oral

request, a copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with this prospectus,

excluding any exhibits to those documents unless the exhibit is specifically incorporated by reference as an exhibit in this prospectus.

You should direct requests for documents to:

Mama’s

Creations, Inc.

25

Branca Road

East

Rutherford, NJ 07073

Attention:

Chief Financial Officer

(201)

532-1212

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934,

as amended” (the “Exchange Act”). The forward-looking statements involve substantial risks and uncertainties. All statements,

other than statements related to present facts or current conditions or of historical facts, contained in this prospectus, including

statements regarding our strategy, future operations, future financial position, future revenues, and projected costs, prospects, plans

and objectives of management, are forward-looking statements. Accordingly, these statements involve estimates, assumptions and uncertainties

which could cause actual results to differ materially from those expressed in them. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,”

“ongoing,” “plan,” “potential,” “predict,” “project,” “should,”

“target,” “will,” “would,” or the negative of these terms or other comparable terminology are intended

to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Any forward-looking

statements are qualified in their entirety by reference to the factors discussed throughout our SEC reports, and in particular those

factors referenced in the sections entitled “Risk Factors” in this prospectus on page 8, in our Registration Statement

on Form S-1 filed with the SEC on February 28, 2023 and in our Annual Report on Form 10-K for the year ended January 31, 2023 filed with

the SEC on April 26, 2023, as well as in any of our subsequent filings with the SEC, and in, or incorporated by reference into, the applicable

prospectus supplement and in any free writing prospectuses we may authorize for use in connection with a specific offering, and under

similar headings in the other documents that are incorporated by reference into this prospectus, to read about factors you should consider,

including the risk of leverage, before investing in our securities.

Forward-looking

statements are not guarantees of future performance and our actual results could differ materially from the results discussed in the

forward-looking statements. Factors that could cause actual results to differ materially from those in the forward-looking statements

include:

| |

● |

the

adequacy of our liquidity to pursue our business objectives; |

| |

● |

reliance

on a limited number of customers; |

| |

● |

loss

or retirement of key executives, including prior to identifying a successor; |

| |

● |

adverse

economic conditions or intense competition; |

| |

● |

pricing

pressures in the market and lack of control over the pricing of raw materials and freight; |

| |

● |

entry

of new competitors and products; |

| |

● |

adverse

federal, state and local government regulation (including, but not limited to, the FDA); |

| |

● |

liability

related to the consumption of our products |

| |

● |

ability

to secure placement of our products in key retail locations; |

| |

● |

our

ability to integrate acquisitions and related businesses; |

| |

● |

wage

and price inflation; |

| |

● |

maintenance

of quality control; and |

| |

● |

issues

related to the enforcement of our intellectual property rights. |

Consider

these factors carefully in evaluating the forward-looking statements. Additional factors that may cause results to differ materially

from those described in the forward-looking statements are set forth in the in the sections entitled “Risk Factors” in this

prospectus on page 8, in our Registration Statement on Form S-1 filed with the SEC on February 28, 2023 and in our Annual Report

on Form 10-K for the year ended January 31, 2023 filed with the SEC on April 26, 2023, as well in “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” as well as in subsequent reports filed by us with the SEC, including

on Forms 10-K, 10-Q and 8-K. Because of the foregoing, you are cautioned against relying on forward-looking statements, which speak only

as of the date hereof. We do not undertake to update any of these statements in light of new information or future events, except as

required by applicable law.

Risk

Factors

Investing

in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully consider

the risks and uncertainties described the section titled “Risk Factors” in the applicable prospectus supplement and any related

free writing prospectus, and discussed in the sections titled “Item 1A. Risk Factors” in our most recent Annual Report on

Form 10-K and in any subsequent filings we have made with the SEC that are incorporated by reference into this prospectus, together with

other information in this prospectus, the documents incorporated by reference, and any prospectus supplement or free writing prospectus

that we may authorize for use in connection with this offering. See “Where You Can Find More Information” for more information.

The risks described these documents are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that

we currently believe are not material, may also become important factors that adversely affect our business. Past financial performance

may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future

periods. If any of these risks actually occurs, our business, reputation, financial condition, results of operations, revenue, and future

prospects could be seriously harmed. This could cause the trading price of our securities to decline, resulting in a loss of all or part

of your investment. Please also read carefully the section titled “Cautionary Statement Regarding Forward-Looking Statements and

Projections.”

Risks

Related to the Common Shares Offered by the Selling Stockholders

If

the Selling Stockholders sell significant amounts of our common shares, or the perception exists that these sales could occur, such events

could cause our common share price to decline.

This

prospectus covers the resale from time to time by the Selling Stockholders of up to 832,650 of our common shares. Once the registration

statement of which this prospectus is a part is declared effective, all of these shares will be available for resale in the public market.

If the Selling Stockholders sell significant amounts of our common shares following the effectiveness of the registration statement of

which this prospectus is a part, the market price of our common shares could decline. Further, the perception of these sales could impair

our ability to raise additional capital through the sale of our equity securities.

The

proceeds from the sale of our common shares by the Selling Stockholders in this offering will not be available to us.

We

will not receive any proceeds from the sale of our common shares by the Selling Stockholders in this offering. The Selling Stockholders

will receive all proceeds from the sale of such shares. Consequently, none of the proceeds from such sale by the Selling Stockholders

will be available to us for our use.

Use

of Proceeds

This

prospectus relates to the resale of our common stock that may be offered and sold from time to time by the selling stockholders. We will

not receive any proceeds from the sale of shares of common stock in this offering.

DESCRIPTION

OF COMMON SHARES

The

following description of our capital stock is not complete and may not contain all the information you should consider before investing

in our capital stock. This description is summarized from, and qualified in its entirety by reference to, our articles of incorporation

(as amended) and amended and restated bylaws, copies of which are incorporated by reference as exhibits to the registration statement

of which this prospectus is a part.

General

Our

authorized capital stock consists of 250,000,000 shares of Common Stock, par value $0.00001 per share, and 50,000,000 shares of preferred

stock, par value $0.00001 per share. As of August 28, 2023, we had 37,443,387 shares of Common Stock outstanding and no shares of Series

B Preferred Stock outstanding.

Common

Stock

Voting

Rights and Election of Directors

Except

as otherwise provided by law or by resolution adopted by the Board of Directors (the “Board of Directors”) designating the

rights, powers and preferences of any series of preferred stock, holders of our Common Stock have the exclusive right to vote for the

election of directors and for all other purposes. All shares of Common Stock are entitled to one vote per share and do not have any cumulative

voting rights.

An

election of directors by our stockholders is determined by a plurality of the votes cast by the stockholders entitled to vote in the

election. Except as otherwise required by our articles of incorporation (as amended), other matters are decided by the affirmative vote

of a majority of the shares of stock represented at a meeting and entitled to vote on the subject matter. Any director or the entire

Board of Directors may be removed, with or without cause, by holders of a majority of the voting power of the outstanding shares of the

Common Stock. Notwithstanding the provisions of NRS Sec. 78.335, a vacancy on the Board of Directors caused by any such removal may be

filled by a majority of the remaining directors even if less than a quorum, at any time before the end of the unexpired term.

Dividends

Subject

to the rights of holders of any then outstanding shares of our preferred stock, our Common Stockholders are entitled to any dividends

that may be declared by our Board of Directors, each share of our Common Stock is entitled to equal dividends and distributions per share

with respect to the Common Stock when, as and if declared by our Board of Directors.

Other

Rights and Preferences

Holders

of Common Stock have no preemptive or conversion rights or other subscription rights.

Liquidation,

Dissolution and Winding Up

Upon

our liquidation, dissolution or winding-up, the holders of Common Stock would be entitled to share ratably in all assets remaining after

payment of all debts and other liabilities and the satisfaction of any liquidation preferences granted to the holders of outstanding

shares of preferred stock.

Fully

Paid and Non-Assessable

All

outstanding shares of Common Stock are fully paid and non-assessable.

Listing

Our

common shares are currently traded on The Nasdaq Capital Market under the symbol “MAMA.” As of August 9, 2023, the last reported

closing price of our common shares on the Nasdaq Global Market was $3.69.

Transfer

Agent

The

transfer agent and registrar for our Common Stock is Equity Stock Transfer, LLC.

Series

B Preferred Stock

On

June 2, 2015, the Board of Directors authorized the issuance of up to 120,000 shares, par value $0.00001 per share, of Series A Preferred

Stock, all of which were converted to shares of our Common Stock on July 27, 2017. On July 15, 2022, the Board of Directors authorized

the issuance of up to 200,000 shares, par value $0.00001 per share, of Series B Preferred Stock.

On

June 30, 2023, the 54,600 outstanding shares of Series B Preferred Stock were converted into an aggregate of 819,000 shares of common

stock. No Series B Preferred Stock remain outstanding as of the date hereof.

Nevada

Anti-Takeover Law, Provisions of our Articles of Incorporation and Bylaws

Anti-Takeover

Effects of Provisions of Nevada State Law

We

may be, or in the future we may become, subject to Nevada’s control share laws. A corporation is subject to Nevada’s control

share law if it has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and if the corporation

does business in Nevada, including through an affiliated corporation. This control share law may have the effect of discouraging corporate

takeovers. As of May 31, 2023, we have less than 100 stockholders of record who are residents of Nevada.

The

control share law focuses on the acquisition of a “controlling interest,” which means the ownership of outstanding voting

shares that would be sufficient, but for the operation of the control share law, to enable the acquiring person to exercise the following

proportions of the voting power of the corporation in the election of directors: (1) one-fifth or more but less than one-third; (2) one-third

or more but less than a majority; or (3) a majority or more. The ability to exercise this voting power may be direct or indirect, as

well as individual or in association with others.

The

effect of the control share law is that an acquiring person, and those acting in association with that person, will obtain only such

voting rights in the control shares as are conferred by a resolution of the stockholders of the corporation, approved at a special or

annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders.

Thus, there is no authority to take away voting rights from the control shares of an acquiring person once those rights have been approved.

If the stockholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent

non-voting shares. The acquiring person is free to sell the shares to others. If the buyer or buyers of those shares themselves do not

acquire a controlling interest, the shares are not governed by the control share law.

If

control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting

power, a stockholder of record, other than the acquiring person, who did not vote in favor of approval of voting rights, is entitled

to demand fair value for such stockholder’s shares.

In

addition to the control share law, Nevada has a business combination law, which prohibits certain business combinations between Nevada

publicly traded corporations and “interested stockholders” for two years after the interested stockholder first becomes an

interested stockholder, unless the corporation’s Board of Directors approves the combination in advance. For purposes of Nevada

law, an interested stockholder is any person who is: (a) the beneficial owner, directly or indirectly, of 10% or more of the voting power

of the outstanding voting shares of the corporation, or (b) an affiliate or associate of the corporation and at any time within the previous

two years was the beneficial owner, directly or indirectly, of 10% or more of the voting power of the then-outstanding shares of the

corporation. The definition of “business combination” contained in the statute is sufficiently broad to cover virtually any

kind of transaction that would allow a potential acquirer to use the corporation’s assets to finance the acquisition or otherwise

to benefit its own interests rather than the interests of the corporation and its other stockholders.

The

effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of the Company from

doing so if it cannot obtain the approval of our Board of Directors.

Articles

of Incorporation and Bylaws

Provisions

of our articles of incorporation (as amended) and amended and restated bylaws may delay or discourage transactions involving an actual

or potential change in control of our company or change in our management, including transactions in which stockholders might otherwise

receive a premium for their shares, or transactions that our stockholders might otherwise deem to be in their best interests. Therefore,

these provisions could adversely affect the price of our Common Stock.

Among

other things, our amended articles of incorporation (as amended) and amended and restated bylaws:

| |

● |

permit

our Board of Directors to issue up to 20,000,000 shares of preferred stock, with any rights, preferences and privileges as they may

designate, including the right to approve an acquisition or other change in control; |

| |

● |

provide

that the authorized number of directors may be changed by resolution of the Board of Directors and the affirmative vote of a majority

of the outstanding shares; |

| |

● |

provide

that all vacancies, including newly created directorships, may, except as otherwise required by law, be filled by the affirmative

vote of a majority of directors then in office, even if less than a quorum; |

| |

● |

A

vacancy on the Board of Directors caused by any such removal may be filled by a majority of the remaining directors at any time before

the end of the unexpired term. |

| |

● |

provide

that a special meeting of stockholders entitled to vote at such meeting may only be called by the Chairman of the Board of Directors,

the President (if he is also a member of the Board of Directors) or the Board of Directors, to be held at such date, time and place,

if any, either within or outside the State of Nevada as may be determined by such person or persons calling the meeting and stated

in the notice of the meeting. A special meeting shall be called by the President or the Secretary upon receipt of one or more written

demands (which shall state the purpose or purposes therefore) signed and dated by the holders of shares representing not less than

ten percent of all votes entitled to be cast on any issue(s) that may be properly proposed to be considered at the special meeting.

If no place is designated in the notice, the place of the meeting shall be the principal office of the Corporation; |

| |

● |

provide

that our by-laws may be amended or repealed by our Board of Directors or the affirmative vote of the holders of at least a majority

of the votes that all our stockholders would be entitled to cast in an election of directors; |

| |

● |

provide

that stockholders seeking to present proposals before a meeting of stockholders or to nominate candidates for election as directors

at a meeting of stockholders must provide notice in writing in a timely manner, and also specify requirements as to the form and

content of a stockholder’s notice; and |

| |

● |

do

not provide for cumulative voting rights (therefore allowing the holders of a majority of the shares of Common Stock entitled to

vote in any election of directors to elect all of the directors standing for election, if they should so choose). |

SELLING

STOCKHOLDERS

This

prospectus relates to (i) the resale of up to 819,000 shares of common stock issued to the holders of Series B Preferred Stock upon the

conversion of the Series B Preferred on June 30, 2023 and (ii) the resale of up to 13,650 shares of common stock issued upon the exercise

of the Placement Agent Warrants on July 7, 2023. No Series B Preferred Stock or Placement Agent Warrants remain outstanding after their

respective conversions and exercises.

The

following table sets forth the number of shares of Company common stock beneficially owned by the Selling Stockholders prior to the offering

contemplated herein, the number of shares which each selling stockholder would own beneficially if all such offered shares are sold.

Each of the selling stockholders has acquired his, her or its shares solely for investment and not with a view to or for resale or distribution

of such securities. Beneficial ownership is determined in accordance with SEC rules and includes voting or investment power with respect

to the securities.

| Name | |

Shares

of Common Stock Owned Prior to the Offering | | |

Shares

of Common Stock to be Sold (1) | | |

Shares

of Common Stock Owned After the Offering | | |

Percentage

of Common Stock Owned After the Offering | |

| | |

| | |

| | |

| | |

| |

| Yiani,

LLC (2) | |

| 45,000 | | |

| 45,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Felte

JTWROS (2) | |

| 30,000 | | |

| 30,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| ET

Albany Living Trust (2) | |

| 45,000 | | |

| 45,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Fratus

JTWROS (2) | |

| 27,000 | | |

| 27,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Richard

J Freedman Trust (2) | |

| 135,000 | | |

| 135,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Richardson

JTWROS (2) | |

| 30,000 | | |

| 30,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Watermelon

Investments (2) | |

| 36,000 | | |

| 36,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| John

S. Metz (2) | |

| 60,000 | | |

| 60,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Michael

Metz (2) | |

| 60,000 | | |

| 60,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Second

Wind, LLC (2) | |

| 45,000 | | |

| 45,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Mark

P Mokoff (2) | |

| 30,000 | | |

| 30,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Robert

J Pease Roth IRA (2) | |

| 60,000 | | |

| 60,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| William

D Pease Roth IRA (2) | |

| 90,000 | | |

| 90,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Charles

J Lesueur IRA (2) | |

| 15,000 | | |

| 15,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Randy

& Kaydel Shelton JTWROS (2) | |

| 66,000 | | |

| 66,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Regina

Keough (2) | |

| 45,000 | | |

| 45,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Kyle

Kadish (3) | |

| 1,105 | | |

| 1,105 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Todd

Felte (3) | |

| 10,498 | | |

| 10,498 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| AGES

Financial Services, Ltd. (3) | |

| 2,047 | | |

| 2,047 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Total | |

| 832,650 | | |

| 832,650 | | |

| 0 | | |

| 0 | % |

| (1) |

Assumes

the sale of all shares of common stock registered pursuant to this prospectus. The selling stockholders are under no obligation known

to us to sell any shares of common stock at this time. |

| |

|

(2)

|

Beneficial

ownership shown represents common shares issued upon the conversion of Series B Preferred

Stock, which occurred on June 30, 2023.

|

| |

|

| (3) |

Beneficial

ownership shown represents common Shares issued upon the exercise of Warrants, which were exercised in full on July 7, 2023. |

Plan

of Distribution

Each

Selling Stockholder (the “Selling Stockholders”) of the securities and any of their pledgees, assignees and successors-in-interest

may, from time to time, sell any or all of their securities covered hereby on the principal trading market or any other stock exchange,

market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices.

A Selling Stockholder may use any one or more of the following methods when selling securities:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

● |

in

transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated

price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

Selling Stockholders may also sell securities under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”),

if available, rather than under this prospectus.

Broker-dealers

engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or

markdown in compliance with FINRA IM-2440.

In

connection with the sale of the securities or interests therein, and in compliance with applicable laws and regulations, the Selling

Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short

sales of the securities in the course of hedging the positions they assume. The Selling Stockholders may also sell securities short and

deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell

these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions

or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities

offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus

(as supplemented or amended to reflect such transaction).

The

Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

The

Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company

has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under

the Securities Act.

Because

Selling Stockholders may be deemed to be “underwriters” within the meaning of the Securities Act, they will be subject to

the prospectus delivery requirements of the Securities Act including Rule 172 thereunder. In addition, any securities covered by this

prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus.

The Selling Stockholders have advised us that there is no underwriter or coordinating broker acting in connection with the proposed sale

of the resale securities by the Selling Stockholders.

We

agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholders

without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for

the Company to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar

effect or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule

of similar effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable

state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered

or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is

complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously

engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the

Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of securities

of the common stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling

Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the

sale (including by compliance with Rule 172 under the Securities Act).

LEGAL

MATTERS

The

Law Offices of Robert Diener passed upon the validity of the securities offered by this prospectus.

Experts

The

consolidated financial statements and the related consolidated financial statement schedules of Mama’s Creations, Inc. and its

subsidiaries as of January 31, 2023 and 2022 and for each of the years in the two-year period ended January 31, 2023 incorporated in

this prospectus and in the registration statement by reference from the Annual Report on Form 10-K for the year ended January 31, 2023

have been audited by Rosenberg Rich Baker Berman P.A., an independent registered public accounting firm, as stated in their reports thereon,

incorporated herein by reference, in this prospectus and registration statement in reliance upon such reports and upon the authority

of such firm as experts in accounting and auditing.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution

Although

we will receive no proceeds from the sale of shares pursuant to this prospectus, we have agreed to bear the costs and expenses of the

registration of the shares. Our expenses in connection with the issuance and distribution of the securities being registered are estimated

as follows:

| Nature

of expense | |

Amount | |

| SEC

Registration fee | |

$ | 173.29 | |

| Accounting

fees and expenses | |

$ | *

| |

| Legal

fees and expenses | |

$ | *

| |

| Printing

expenses | |

$ | *

| |

| Miscellaneous | |

$ | *

| |

| | |

| | |

| TOTAL | |

$ | * | |

*

Estimates not currently known.

Item

15. Indemnification of Directors and Officers

Pursuant

to our Certificate of Incorporation and By-Laws, we may indemnify an officer or director who is made a party to any proceeding, including

a lawsuit, because of his position, if he acted in good faith and in a manner he reasonably believed to be in our best interest. In certain

cases, we may advance expenses incurred in defending any such proceeding. To the extent that the officer or director is successful on

the merits in any such proceeding as to which such person is to be indemnified, we must indemnify him against all expenses incurred,

including attorney’s fees. With respect to a derivative action, indemnity may be made only for expenses actually and reasonably

incurred in defending the proceeding, and if the officer or director is judged liable, only by a court order. The prior discussion of

indemnification in this paragraph is intended to be to the fullest extent permitted by the laws of the State of Nevada.

Indemnification

for liabilities arising under the Securities Act of 1933, as amended, may be permitted to directors or officers pursuant to the foregoing

provisions. However, we are informed that, in the opinion of the Commission, such indemnification is against public policy, as expressed

in the Act and is, therefore, unenforceable.

Item

16. Exhibits and Financial Statement Schedules

(a)

The following exhibits are filed as part of this registration statement:

| Exhibit

No. |

|

Description |

| 3.1 |

|

Articles

of Incorporation of Mama’s Creations, Inc. (incorporated by reference from Exhibit 3.1 to the Company’s Registration

Statement on Form S-1 filed on May 24, 2011). |

| 3.2 |

|

Certificate

of Amendment to Certificate of Incorporation of Mama’s Creations, Inc. (incorporated

by reference from Exhibit 3.4 to the Company’s Current Report on Form 8-K filed on

March 8, 2013).

|

| 3.3 |

|

Certificate of Amendment to Articles of Incorporation of Mama’s Creations, Inc. (incorporated by reference from Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on August 1, 2023). |

| 3.4 |

|

Second Amended and Restated Series A Convertible Preferred Stock Certificate of Designation (incorporated by reference from Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on September 10, 2015).

|

| 3.5 |

|

Series

B Preferred Stock Certificate of Designation (incorporated by reference from Exhibit 3.4

to the Company’s Registration Statement on Form S-3 filed on June 2, 2023.

|

| 3.6 |

|

Second Amended and Restated Bylaws of Mama’s Creations, Inc. (incorporated by reference from Exhibit 3.2 to the Company’s Current Report on Form 8-K filed on August 1, 2023). |

| 4.1 |

|

Form

of Warrant to Purchase Common Stock to Placement Agent in Series B Financing (incorporated by reference from Exhibit 4.1 to the Company’s

Quarterly Report on Form 10-Q filed on June 13, 2023). |

| 5.1 |

|

Legal Opinion of Robert Diener, Esq (incorporated by reference from Exhibit 5.1 to the Company’s Registration Statement on Form S-1, filed on March 28, 2023). |

| 23.1* |

|

Consent of Independent Registered Public Accounting Firm |

| 23.2 |

|

Consent of Law Offices of Robert Diener, Esq. (included in Exhibit 5.1) |

| 24.1* |

|

Power of Attorney (included on Signature Page) |

Item

17. Undertakings

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made of securities registered hereby, a post-effective amendment to this

registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate,

the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement;

provided,

however, that paragraphs (i), (ii) and (iii) above do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to Section

13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained

in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered herein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser, each prospectus filed pursuant to Rule

424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other

than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the

date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus

that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such

first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such date of first use.

(5)

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(6)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing

of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where

applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of

1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to

the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof.

Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the

event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid

by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question

whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of

such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in the City of East Rutherford, New Jersey, on August 30, 2023.

| |

Mama’s

Creations, Inc. |

| |

|

|

| |

By: |

/s/

Adam L. Michaels |

| |

|

Adam

L. Michaels |

| |

|

Chief

Executive Officer, Chairman of the Board of Directors |

| |

|

|

| |

By: |

/s/

Anthony Gruber |

| |

|

Anthony

Gruber |

| |

|

Chief

Financial Officer |

| |

|

(Principal

Financial and Accounting Officer) |

POWERS

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Adam L. Michaels, Anthony Gruber

and Matthew Brown, and each of them, as the true and lawful attorney-in-fact and agent with full power of substitution and resubstitution,

for him and in his name, place and stead, in any and all capacities to sign any and all amendments to this Registration Statement (including

post-effective amendments, or any abbreviated registration statement and any amendments thereto filed pursuant to Rule 462(b) and otherwise),

and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission

granting unto said attorney-in-fact and agent the full power and authority to do and perform each and every act and thing requisite and

necessary to be done in and about the foregoing, as to all intents and purposes as either of them might or could do in person, hereby

ratifying and confirming all that said attorney-in-fact and agent, or his substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons in

the capacities and on the dates indicated.

| |

By: |

/s/

Adam L. Michaels |

| |

|

Adam

L. Michaels |

| |

|

Chief

Executive Officer, Chairman of the Board of Directors |

| |

|

|

| |

Date |

August

30, 2023 |

| |

|

|

| |

By: |

/s/

Matthew Brown |

| |

|

Matthew

Brown |

| |

|

President,

Director |

| |

|

|

| |

Date |

August

30, 2023 |

| |

|

|

| |

By: |

/s/

Anthony Gruber |

| |

|

Anthony

Gruber |

| |

|

Chief

Financial Officer |

| |

|

|

| |

Date |

August

30, 2023 |

| |

By: |

/s/

Alfred D’Agostino |

| |

|

Alfred

D’Agostino |

| |

|

Director |

| |

|

|

| |

Date |

August

30, 2023 |

| |

|

|

| |

By: |

/s/

Tom Toto |

| |

|

Tom

Toto |

| |

|

Director |

| |

|

|

| |

Date |

August

30, 2023 |

| |

|

|

| |

|

/s/

Dean Janeway |

| |

|

Dean

Janeway |

| |

|

Director |

| |

|

|

| |

Date |

August

30, 2023 |

| |

|

|

| |

|

/s/

Meghan Henson |

| |

|

Meghan

Henson

Director |

| |

|

|

| |

Date |

August

30, 2023 |

Exhibit

23.1

INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM’S CONSENT

We consent to the incorporation by reference in this Post-Effective Amendment No. 1 to Form S-1 on Form S-3 Registration Statement, of

our report dated April 26, 2023 with respect to our audits of the financial statements of MamaMancini’s Holdings, Inc. as of January

31, 2023 and 2022, and for the years then ended.

We

also consent to the reference to our Firm under the heading “Experts” in such Prospectus.

| Somerset,

New Jersey |

|

| August

30, 2023 |

|

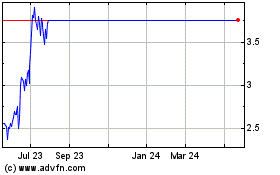

MamaMancinis (NASDAQ:MMMB)

Historical Stock Chart

From Apr 2024 to May 2024

MamaMancinis (NASDAQ:MMMB)

Historical Stock Chart

From May 2023 to May 2024