Maiden Holdings, Ltd. (NASDAQ:MHLD) ("Maiden" or the "Company")

today reported a first quarter 2019 net loss attributable to Maiden

common shareholders of $36.6 million or $0.44 per diluted common

share, compared to a net income attributable to Maiden common

shareholders of $13.7 million or $0.16 per diluted common share in

the first quarter of 2018. The non-GAAP operating loss(11) was

$26.9 million, or $0.32 per diluted common share compared with a

non-GAAP operating income of $5.8 million, or $0.07 per diluted

common share in the first quarter of 2018.

Maiden's book value per common share(1) was $1.44 at

March 31, 2019, an increase of 33.3% from December 31,

2018.

Consolidated Results for the Quarter

Ended March 31, 2019

In the first quarter of 2019, gross premiums written were

$(561.1) million, compared to $623.3 million in the prior year

quarter, primarily due to the termination of both quota share

contracts in the AmTrust Reinsurance segment and the return of

unearned premiums on certain lines covered by the Partial

Termination Agreement with AmTrust. As previously reported, both

terminations were effective January 1, 2019. Net premiums earned

were $183.1 million in first quarter 2019, compared to $516.8

million in first quarter 2018 due to the combined impact of the

terminated quota share contracts within the AmTrust Reinsurance

segment and non-renewals in Maiden's European Capital Solutions

business and a reduction in the German Auto programs produced by

the Company's IIS unit within its Diversified Reinsurance

segment.

First quarter 2019 net loss and loss adjustment expenses

decreased to $152.7 million from $353.2 million in the first

quarter of 2018, due primarily to lower earned premiums for the

AmTrust Reinsurance segment. The first quarter 2019 loss ratio(6)

was 83.0% compared to 67.9% reported in first quarter 2018. The

increase in the loss ratio was primarily due to a change in the mix

of business resulting from the Partial Termination Amendment

entered into with AmTrust. Prior year adverse loss development was

$7.3 million for the first quarter of 2019, compared to $9.8

million for the same period in 2018.

Commission and other acquisition expenses decreased to $69.6

million in first quarter 2019, from $166.6 million in the first

quarter of 2018 due to significantly lower earned premiums

resulting from the terminations in the AmTrust Reinsurance segment.

The commission and other acquisition expense ratio increased 5.9

points to 37.9% for the first quarter of 2019 from 32.0% for the

same period in 2018 as a result of the additional ceding commission

agreed to as part of the Partial Termination Amendment with

AmTrust.

General and administrative expenses for the first quarter of

2019 totaled $15.9 million, compared to $15.7 million in the first

quarter of 2018. Non-recurring expenses were $3.0 million during

the first quarter of 2019, primarily related to salaries and

related benefits for headcount reductions occurring in 2019. The

general and administrative expense ratio(8) in the first quarter of

2019 increased to 8.7% from 3.0% in first quarter 2018 primarily as

a result of lower earned premiums, while the total expense ratio(9)

was 46.6% in first quarter 2019 compared with 35.0% for the same

period last year.

The combined ratio(10) for first quarter 2019 totaled 129.6%,

compared with 102.9% in first quarter 2018.

First quarter 2019 net investment income decreased modestly to

$32.0 million from $32.9 million in the first quarter of 2018

largely due to the decline in average yield to 3.1% from 3.2% in

the same period in 2018.

Additional information regarding the Company’s results of

operations can be found in the Company’s Quarterly Report on Form

10-Q filing made concurrent with this news release.

Quarterly Dividends

The Company's Board of Directors did not authorize any quarterly

dividends related to either its common shares or any series of its

preferred shares. Additional information regarding the Company’s

dividends can be found in the Company’s Quarterly Report on Form

10-Q filing made concurrent with this news release.

Other Financial Matters

Total assets were $4.6 billion at March 31, 2019, compared

to $5.3 billion at December 31, 2018. Shareholders'

equity was $584.3 million at March 31, 2019, compared to

$554.3 million at December 31, 2018.

(1)(11) Please see the Non-GAAP Financial Measures table for

additional information on these non-GAAP financial measures and

reconciliation of these measures to GAAP measures.

(6)(7)(8)(9)(10) Loss ratio, commission and other acquisition

expense ratio, general and administrative expense ratio, expense

ratio and combined ratio are non-GAAP operating metrics. Please see

the additional information on these measures under Non-GAAP

Financial Measures tables.

About Maiden Holdings, Ltd.

Maiden Holdings, Ltd. is a Bermuda-based holding company formed

in 2007. The Company is focused on serving the needs of regional

and specialty insurers in Europe and select other global markets by

providing innovative reinsurance solutions designed to support

their capital needs.

Forward Looking Statements

This release contains "forward-looking statements" which are

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements are based on the Company's current expectations and

beliefs concerning future developments and their potential effects

on the Company. There can be no assurance that actual developments

will be those anticipated by the Company. Actual results may differ

materially from those projected as a result of significant risks

and uncertainties, including non-receipt of the expected payments,

changes in interest rates, effect of the performance of financial

markets on investment income and fair values of investments,

developments of claims and the effect on loss reserves, accuracy in

projecting loss reserves, the impact of competition and pricing

environments, changes in the demand for the Company's products, the

effect of general economic conditions and unusual frequency of

storm activity, adverse state and federal legislation, regulations

and regulatory investigations into industry practices, developments

relating to existing agreements, heightened competition, changes in

pricing environments, and changes in asset valuations. In addition,

the Company may not be able to complete the proposed transaction

with Enstar on the terms summarized above or other acceptable

terms, or at all, due to a number of factors, including but not

limited to failure to obtain governmental and regulatory approvals

or to satisfy other closing conditions. Additional information

about these risks and uncertainties, as well as others that may

cause actual results to differ materially from those projected is

contained in Item 1A. Risk Factors in the Company's Annual Report

on Form 10-K for the year ended December 31, 2018 as updated in

periodic filings with the SEC. However these factors should not be

construed as exhaustive. Forward-looking statements speak only as

of the date they are made and the Company undertakes no obligation

to update or revise any forward-looking statement that may be made

from time to time, whether as a result of new information, future

developments or otherwise, except as required by law.

Maiden Holdings, Ltd.

Consolidated Balance Sheets (in thousands (000's), except

per share data) March 31, 2019 December 31,

2018 (Unaudited) (Audited) Assets

Fixed maturities, available-for-sale, at

fair value (Amortized cost 2019: $3,130,981 ; 2018:$3,109,980)

$ 3,131,934 $ 3,051,568 Fixed

maturities, held-to-maturity, at amortized cost (Fair value 2018:

$998,012)

- 1,015,681 Other investments, at fair

value

24,693 23,716 Total

investments 3,156,627 4,090,965 Cash and cash

equivalents

89,521 200,841 Restricted cash and cash

equivalents

42,334 130,148 Accrued investment income

27,788 27,824 Reinsurance balances receivable, net

72,867 67,308 Loan to related party

167,975

167,975 Deferred commission and other acquisition expenses,

net

161,976 388,442 Funds withheld receivable

652,087 27,039 Other assets

14,729

12,443 Assets held for sale

177,452

174,475 Total Assets $ 4,563,356

$ 5,287,460 Liabilities and Equity

Liabilities Reserve for loss and loss adjustment expenses

$ 2,980,113 $ 3,055,976 Unearned

premiums

455,175 1,200,419 Reinsurance balances

payable, net

117,943 52,594 Accrued expenses and

other liabilities

12,087 12,900 Senior notes -

principal amount

262,500 262,500 Less: unamortized

debt issuance costs

7,753 7,806 Senior

notes, net

254,747 254,694 Liabilities

held for sale

159,002 155,961 Total

Liabilities 3,979,067 4,732,544

Commitments and Contingencies

Equity Preference Shares

465,000 465,000 Common shares

881 879

Additional paid-in capital

750,670 749,418

Accumulated other comprehensive loss

(220) (65,616)

Accumulated deficit

(600,527) (563,891) Treasury

shares, at cost

(31,515) (31,515)

Total Maiden Shareholders’ Equity 584,289

554,275 Noncontrolling interest in subsidiaries

- 641 Total Equity

584,289 554,916 Total Liabilities and

Equity $ 4,563,356 $ 5,287,460

Book value per common share(1) $

1.44 $ 1.08 Common shares

outstanding 83,064,173 82,948,577

Maiden Holdings, Ltd. Consolidated Statements of

Income (in thousands (000's), except per share data)

(Unaudited) For the Three Months Ended March

31,

2019

2018

Revenues: Gross premiums written

$ (561,139)

$ 623,328 Net premiums written

$

(561,530) $ 622,651 Change in unearned

premiums 744,632 (105,838)

Net premiums earned

183,102 516,813 Other insurance revenue 750 3,726 Net investment

income 32,022 32,869 Net realized (losses) gains on investment

(11,101) 357

Total revenues 204,773 553,765

Expenses: Net loss and loss adjustment expenses 152,689

353,206 Commission and other acquisition expenses 69,617 166,628

General and administrative expenses 15,939 15,671

Total expenses 238,245 535,505

Non-GAAP

(loss) income from operations(2) (33,472)

18,260 Other expenses: Interest and

amortization expenses (4,829) (4,829) Foreign exchange and other

gains (losses) 4,979 (2,407)

Total other

expenses 150 (7,236)

(Loss) income before

income taxes (33,322) 11,024 Less: income tax

benefit (38) (1,324)

Net (loss) income from

continuing operations (33,284) 12,348 (Loss)

income from discontinued operations, net of income tax

(3,352) 9,995 Net (loss) income

(36,636) 22,343 Net income from continuing operations

attributable to noncontrolling interests - (71)

Net (loss) income attributable to Maiden (36,636)

22,272 Dividends on preference shares(3) -

(8,545)

Net loss attributable to Maiden common shareholders

$ (36,636) $ 13,727

Basic (loss) earnings from continuing

operations per share attributable to Maiden common

shareholders

$ (0.40) $ 0.05

Basic (loss) earnings from discontinued

operations per share attributable to Maiden common

shareholders

(0.04) 0.12 Basic (loss) earnings

per share attributable to Maiden common shareholders $

(0.44) $ 0.17

Diluted (loss) earnings from continuing

operations per share attributable to Maiden common

shareholders(15)

$ (0.40) $ 0.04

Diluted (loss) earnings from

discontinued operations per share attributable to Maiden

common shareholders(15)

(0.04) 0.12 Diluted (loss) earnings

per share attributable to Maiden common shareholders(15)

$ (0.44) $ 0.16 Dividends declared

per common share $ - $ 0.15

Annualized return on average common equity -142.5%

7.6% Weighted average number of common shares - basic

82,965,156 83,040,413

Adjusted weighted average number of common

shares and assumed conversions - diluted(15) 82,965,156

83,318,542

Maiden Holdings, Ltd. Supplemental

Financial Data - Segment Information (in thousands

(000's)) (Unaudited) For

the Three Months Ended March 31, 2019

Diversified Reinsurance

AmTrust Reinsurance

Other Total Gross premiums written $ 15,338 $

(576,477) $ - $ (561,139) Net premiums written $ 14,947 $ (576,477)

$ - $ (561,530) Net premiums earned $ 25,292 $ 157,810 $ - $

183,102 Other insurance revenue 750 - - 750 Net loss and loss

adjustment expenses ("loss and LAE") (14,391) (138,070) (228)

(152,689) Commissions and other acquisition expenses (9,261)

(60,356) - (69,617) General and administrative expenses(4)

(3,031) (1,266) - (4,297)

Underwriting

loss(5) $ (641) $ (41,882) $ (228) $ (42,751)

Reconciliation to net loss from continuing operations Net

investment income and realized losses on investment 20,921 Interest

and amortization expenses (4,829) Foreign exchange and other gains

4,979 Other general and administrative expenses(4) (11,642) Income

tax benefit 38

Net loss from continuing operations $

(33,284) Net loss and LAE ratio(6) 55.3%

87.5% 83.0% Commission and other acquisition expense

ratio(7) 35.6% 38.2% 37.9% General and administrative expense

ratio(8) 11.6% 0.8% 8.7% Expense ratio(9)

47.2% 39.0% 46.6%

Combined

ratio(10) 102.5% 126.5% 129.6%

For the Three Months Ended March 31,

2018

Diversified Reinsurance

AmTrust Reinsurance

Other Total Gross premiums written $ 49,400 $ 573,928

$ - $ 623,328 Net premiums written $ 48,271 $ 574,380 $ - $ 622,651

Net premiums earned $ 25,515 $ 491,298 $ - $ 516,813 Other

insurance revenue 3,726 - - 3,726 Net loss and LAE (15,899)

(337,307) - (353,206) Commissions and other acquisition expenses

(9,312) (157,316) - (166,628) General and administrative

expenses(4) (4,481) (920) - (5,401)

Underwriting loss(5) $ (451) $ (4,245) $ - $ (4,696)

Reconciliation to net income from continuing

operations Net investment income and realized gains on

investment 33,226 Interest and amortization expenses (4,829)

Foreign exchange losses (2,407) Other general and administrative

expenses(4) (10,270) Income tax benefit 1,324

Net income

from continuing operations $ 12,348 Net loss and LAE

ratio(6) 54.4% 68.7% 67.9% Commission and

other acquisition expense ratio(7) 31.8% 32.0% 32.0% General and

administrative expense ratio(8) 15.3% 0.2%

3.0% Expense ratio(9) 47.1% 32.2% 35.0%

Combined ratio(10) 101.5% 100.9%

102.9%

Maiden Holdings, Ltd.

Non - GAAP Financial Measures (in thousands (000's),

except per share data) (Unaudited) For the

Three Months Ended March 31, 2019 2018

Non-GAAP operating (loss) income attributable to Maiden common

shareholders(11) $ (26,934) $ 5,782

Non-GAAP basic

and diluted operating (loss) earnings per share attributable to

Maiden common shareholders $ (0.32) $ 0.07

Annualized

non-GAAP operating return on average common equity(12)

-104.7% 3.2%

Reconciliation of net (loss) income

attributable to Maiden common shareholders to non-GAAP operating

(loss) income attributable to Maiden common

shareholders:

Net (loss) income attributable to Maiden common shareholders $

(36,636) $ 13,727 Add (subtract) Net realized losses (gains) on

investment 11,101 (357) Foreign exchange and other (gains) losses

(4,979) 2,407 Loss (income) from discontinued operations, net of

income tax 3,352 (9,995) Divested NGHC Quota Share run-off

228 -

Non-GAAP operating (loss) income attributable to

Maiden common shareholders(11) $ (26,934)

$ 5,782 Weighted average number of common

shares - basic 82,965,156 83,040,413

Adjusted weighted

average number of common shares and assumed conversions -

diluted(15) 82,965,156 83,318,542

Reconciliation of diluted (loss)

earnings per share attributable to Maiden common shareholders to

non-GAAP diluted operating (loss) earnings per share

attributable to Maiden common shareholders:

Diluted (loss) earnings per share attributable to Maiden common

shareholders $ (0.44) $ 0.16 Add (subtract) Net realized

losses (gains) on investment 0.13 - Foreign exchange and other

(gains) losses (0.06) 0.03 Loss (income) from discontinued

operations, net of income tax 0.04 (0.12) Divested NGHC Quota Share

run-off 0.01 -

Non-GAAP diluted operating (loss)

earnings per share attributable to Maiden common shareholders

$ (0.32) $ 0.07

Reconciliation of net (loss) income attributable to Maiden to

non-GAAP (loss) income from operations: Net (loss) income

attributable to Maiden $ (36,636) $ 22,272 Add (subtract) Foreign

exchange and other (gains) losses (4,979) 2,407 Interest and

amortization expenses 4,829 4,829 Income tax benefit (38) (1,324)

Loss (income) from discontinued

operations, net of income tax

3,352

(9,995)

Net income attributable to noncontrolling

interest

-

71

Non-GAAP (loss) income from operations(2) $

(33,472) $ 18,260

Maiden Holdings, Ltd.

Non - GAAP Financial Measures (in thousands (000's),

except per share data) (Unaudited)

March 31, 2019 December 31, 2018 Investable

assets: Total investments $ 3,156,627 $ 4,090,965 Cash and cash

equivalents 89,521 200,841 Restricted cash and cash equivalents

42,334 130,148 Loan to related party 167,975 167,975 Funds withheld

652,087 27,039 Total investable

assets(13)

$ 4,108,544 $

4,616,968 March 31, 2019 December 31,

2018 Capital: Preference shares $ 465,000 $ 465,000

Common shareholders' equity 119,289

89,275

Total Maiden shareholders' equity 584,289 554,275

2016 Senior Notes 110,000 110,000 2013 Senior Notes

152,500 152,500

Total capital

resources(14) $ 846,789

$ 816,775 (1) Book value per common share is

calculated using Maiden common shareholders’ equity (shareholders'

equity excluding the aggregate liquidation value of our preference

shares) divided by the number of common shares outstanding.

(2) Non-GAAP (loss) income from operations is a non-GAAP financial

measure defined by the Company as net loss attributable to Maiden

excluding foreign exchange and other gains and losses, interest and

amortization expenses, income tax expense, net income or loss

attributable to noncontrolling interest and loss from discontinued

operations, net of income tax and should not be considered as an

alternative to net income (loss). The Company’s management believes

that non-GAAP (loss) income from operations is a useful measure of

the Company’s underlying earnings fundamentals based on its

underwriting and investment income before financing costs. This

(loss) income from operations enables readers of this information

to more clearly understand the essential operating results of the

Company. The Company’s measure of non-GAAP (loss) income from

operations may not be comparable to similarly titled measures used

by other companies. (3) Dividends on preference shares

consist of $0 and $3,094 paid to Preference shares - Series A for

the three months ended March 31, 2019 and 2018, respectively, $0

and $2,939 paid to Preference shares - Series C for the three

months ended March 31, 2019 and 2018, respectively, and $0 and

$2,512 paid to Preference shares - Series D for the three months

ended March 31, 2019 and 2018, respectively. (4)

Underwriting related general and administrative expenses is a

non-GAAP measure and includes expenses which are segregated for

analytical purposes as a component of underwriting income.

(5) Underwriting loss is a non-GAAP measure and is calculated as

net premiums earned plus other insurance revenue less net loss and

LAE, commission and other acquisition expenses and general and

administrative expenses directly related to underwriting

activities. Management believes that this measure is important in

evaluating the underwriting performance of the Company and its

segments. This measure is also a useful tool to measure the

profitability of the Company separately from the investment results

and is also a widely used performance indicator in the insurance

industry. (6) Calculated by dividing net loss and LAE by the

sum of net premiums earned and other insurance revenue. (7)

Calculated by dividing commission and other acquisition expenses by

the sum of net premiums earned and other insurance revenue.

(8) Calculated by dividing general and administrative expenses by

the sum of net premiums earned and other insurance revenue.

(9) Calculated by adding together the commission and other

acquisition expense ratio and general and administrative expense

ratio. (10) Calculated by adding together the net loss and

LAE ratio and the expense ratio. (11) Non-GAAP operating

(loss) income is a non-GAAP financial measure defined by the

Company as net loss attributable to Maiden common shareholders

excluding realized and unrealized investment gains and losses,

foreign exchange and other gains and losses, Divested NGHC Quota

Share run-off and loss from discontinued operations, net of income

tax and should not be considered as an alternative to net loss. The

Company's management believes that non-GAAP operating (loss) income

is a useful indicator of trends in the Company's underlying

operations. The Company's measure of non-GAAP operating (loss)

income may not be comparable to similarly titled measures used by

other companies. (12) Non-GAAP operating return on average

common equity is a non-GAAP financial measure. Management uses

non-GAAP operating return on average common shareholders' equity as

a measure of profitability that focuses on the return to Maiden

common shareholders. It is calculated using non-GAAP operating

(loss) income attributable to Maiden common shareholders divided by

average Maiden common shareholders' equity. (13) Investable

assets is the total of the Company's investments, cash and cash

equivalents, funds withheld receivable and loan to a related party.

(14) Total capital resources is the sum of the Company's

principal amount of debt and Maiden shareholders' equity.

(15) During a period of loss, the basic weighted average common

shares outstanding is used in the denominator of the diluted loss

per common share computation as the effect of including potential

dilutive shares would be anti-dilutive.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190510005537/en/

Sard Verbinnen & Co.Maiden-SVC@sardverb.com

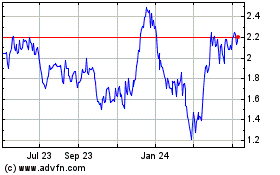

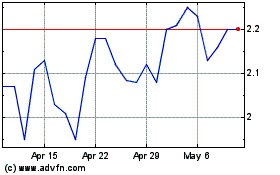

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Apr 2023 to Apr 2024