0001640384false00016403842023-09-112023-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 11, 2023 |

LM FUNDING AMERICA, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37605 |

47-3844457 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1200 West Platt Street Suite 100 |

|

Tampa, Florida |

|

33606 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 813 222-8996 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock par value $0.001 per share |

|

LMFA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD.

Also on September 11, 2023, representatives of the Company began making presentations to investors, analysts, and others using the investor presentation attached to this Current Report on Form 8-K as Exhibit 99.1 (the “Investor Presentation”). The Company expects to use the Investor Presentation, in whole or in part, and possibly with modifications, in connection with presentations to investors, analysts and others from time to time.

By filing this Current Report on Form 8-K and furnishing the information contained herein, the Company makes no admission as to the materiality of any information in this report, which is required to be disclosed solely by reason of Regulation FD. The information contained in the Investor Presentation is summary information that is intended to be considered in the context of the Company's Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

The information in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2 attached hereto, is being furnished, shall not be deemed “filed” for any purpose, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

Exhibit Number |

|

Description |

|

|

|

|

|

99.1 |

|

Investor Presentation |

|

EX-104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|

* Certain schedules and attachments to these exhibits have been omitted pursuant to Regulation S-K, Item 601(a)(5). The registrant hereby undertakes to furnish copies of any of the omitted schedules and exhibits upon request by the U.S. Securities and Exchange Commission.

***

Forward-Looking Statements

This Current Report on Form 8-K may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainty. Words such as “anticipate,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Such statements are based on the Company’s current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Investors are cautioned that there can be no assurance actual results or business conditions will not differ materially from those projected or suggested in such forward-looking statements as a result of various risks and uncertainties. These risks and uncertainties include, without limitation, uncertainty created by the COVID-19 pandemic, the risk of not successfully commercializing or realizing value from the Symbiont assets, the risks of operating in the cryptocurrency mining business, the capacity of the Company’s bitcoin mining machines and the Company’s related ability to purchase power at reasonable prices, and the ability to finance the Company’s cryptocurrency mining operations. Investors should refer to the risks detailed from time to time in the reports the Company files with the SEC, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, as well as other filings on Form 10-Q and periodic filings on Form 8-K, for additional factors that could cause actual results to differ materially from those stated or implied by such forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

LM Funding America, Inc. |

|

|

|

|

Date: |

September 11, 2023 |

By: |

/s/ Richard Russell |

|

|

|

Richard Russell, Chief Financial Officer |

Bitcoin Mining and Specialty Finance Investor Presentation September 2023

Forward-Looking Statements This presentation may contain forward-looking statements the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Some of these risks and uncertainties are identified in the company's most recent Annual Report on Form 10-K and its other filings with the SEC, which are available at www.sec.gov. These risks and uncertainties include, without limitation, the risks of operating in the cryptocurrency mining business, the early stage of our cryptocurrency mining business and our lack of operating history in such business, the capacity of our bitcoin mining machines and our related ability to purchase power at reasonable prices, the ability to finance our cryptocurrency mining business, our ability to acquire new accounts in our specialty finance business at appropriate prices, the need for capital, our ability to hire and retain new employees, changes in governmental regulations that affect our ability to collected sufficient amounts on defaulted consumer receivables, changes in the credit or capital markets, changes in interest rates, and negative press regarding the debt collection industry. The occurrence of any of these risks and uncertainties could have a material adverse effect on our business, financial condition, and results of operations. For additional disclosure regarding risks faced by LM Funding America, Inc., please see our public filings with the Securities and Exchange Commission, available on the Investor Relations section of our website at www.lmfunding.com and on the SEC's website at www.sec.gov. © 2022 LM Funding America, Inc. All Right Reserved.

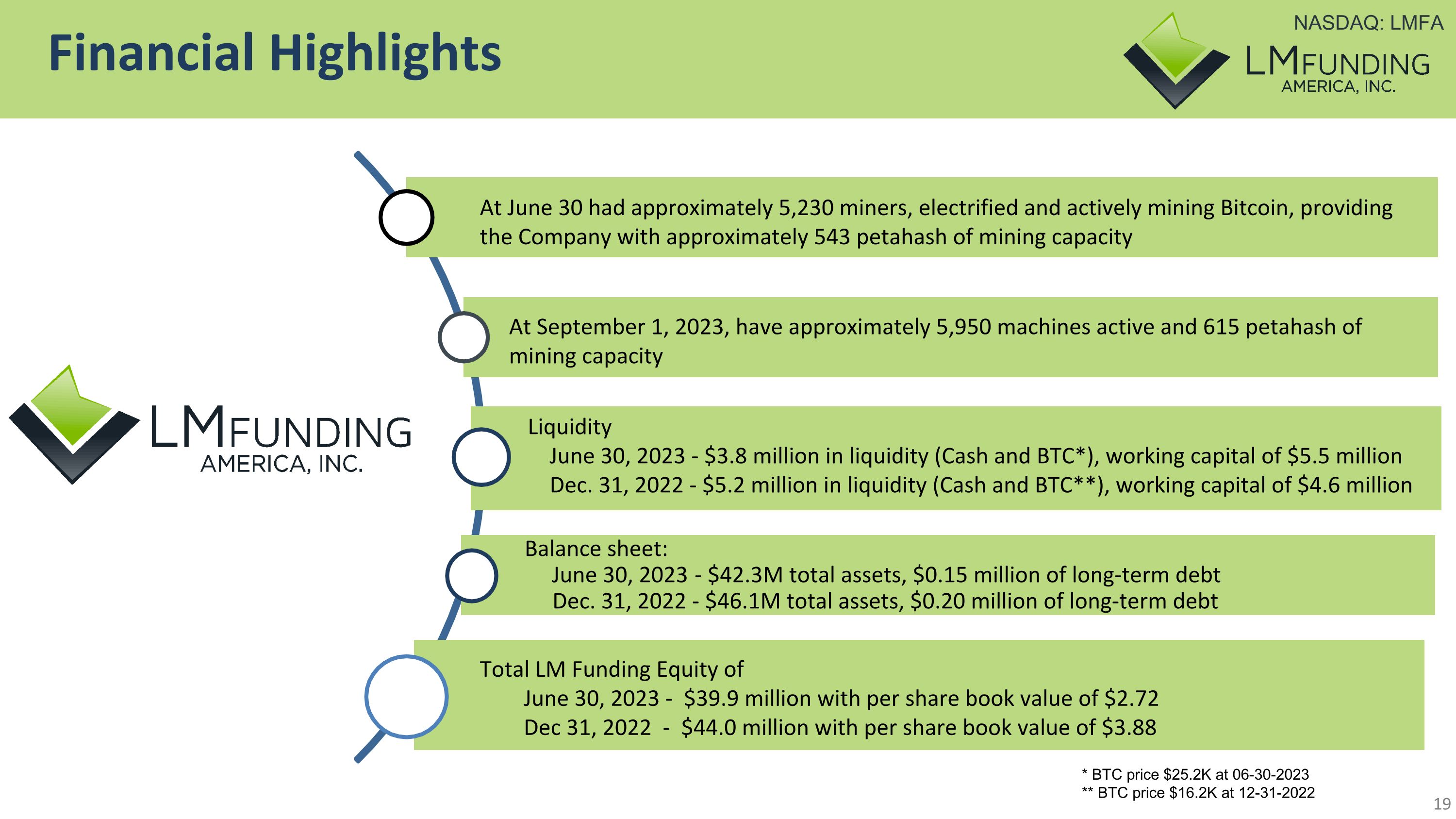

Financial Highlights Balance sheet: June 30, 2023 - $42.3M total assets, $0.15 million of long-term debt Dec. 31, 2022 - $46.1M total assets, $0.20 million of long-term debt Total LM Funding Equity of June 30, 2023 - $39.9 million with per share book value of $2.72 Dec 31, 2022 - $44.0 million with per share book value of $3.88 At June 30 had approximately 5,230 miners, electrified and actively mining Bitcoin, providing the Company with approximately 543 petahash of mining capacity At September 1, 2023, have approximately 5,950 machines active and 615 petahash of mining capacity Liquidity June 30, 2023 - $3.8 million in liquidity (Cash and BTC*), working capital of $5.5 million Dec. 31, 2022 - $5.2 million in liquidity (Cash and BTC**), working capital of $4.6 million * BTC price $25.2K at 06-30-2023 ** BTC price $16.2K at 12-31-2022

LM Funding America: Our Management Bruce Rodgers, Founder, Chief Executive Officer & President Entrepreneur developed business model and led LMFA through multiple private fundraising rounds leading to IPO in 2015 Led LMFA through 3 subsequent public offerings and purchased and sold complimentary businesses Former Partner at Foley & Lardner with transaction experience in banking, shipping, energy, technology, hospitality, cannabis, and real estate development Former Chairman and CEO of LMF Acquisition Opportunities, Inc. (Nasdaq:LMAO now ICU) Director of SeaStar Medical (Nasdaq: ICU) B.S. Engineering from Vanderbilt University and a Juris Doctor, with honors, from the University of Florida, Lieutenant, Surface Warfare Officer, United States Navy (1985 – 1989) Richard Russell, Chief Financial Officer Mr. Russell has broad financial skills with a focus on public companies in the healthcare, beverage, food service, transportation and logistics, T.V. Broadcast, manufacturing and office technology industries Former CFO of LMF Acquisition Opportunities, Inc (Nasdaq: LMAO) and Generation Income Properties (Nasdaq:GIPR) Director for two public companies: SeaStar Medical (Nasdaq: ICU) and Trident Brands (TDNT) and former Chairman of Hillsborough County (Florida) Internal Audit Committee Bachelor of Science in Accounting and a Master’s in Tax Accounting from the University of Alabama, and an M.B.A. in Business Administration from the University of Tampa

Why Bitcoin? “Trust(lessness)” Bitcoin is a technology enabling decentralized transactions between parties not requiring an intermediary bank or institution.

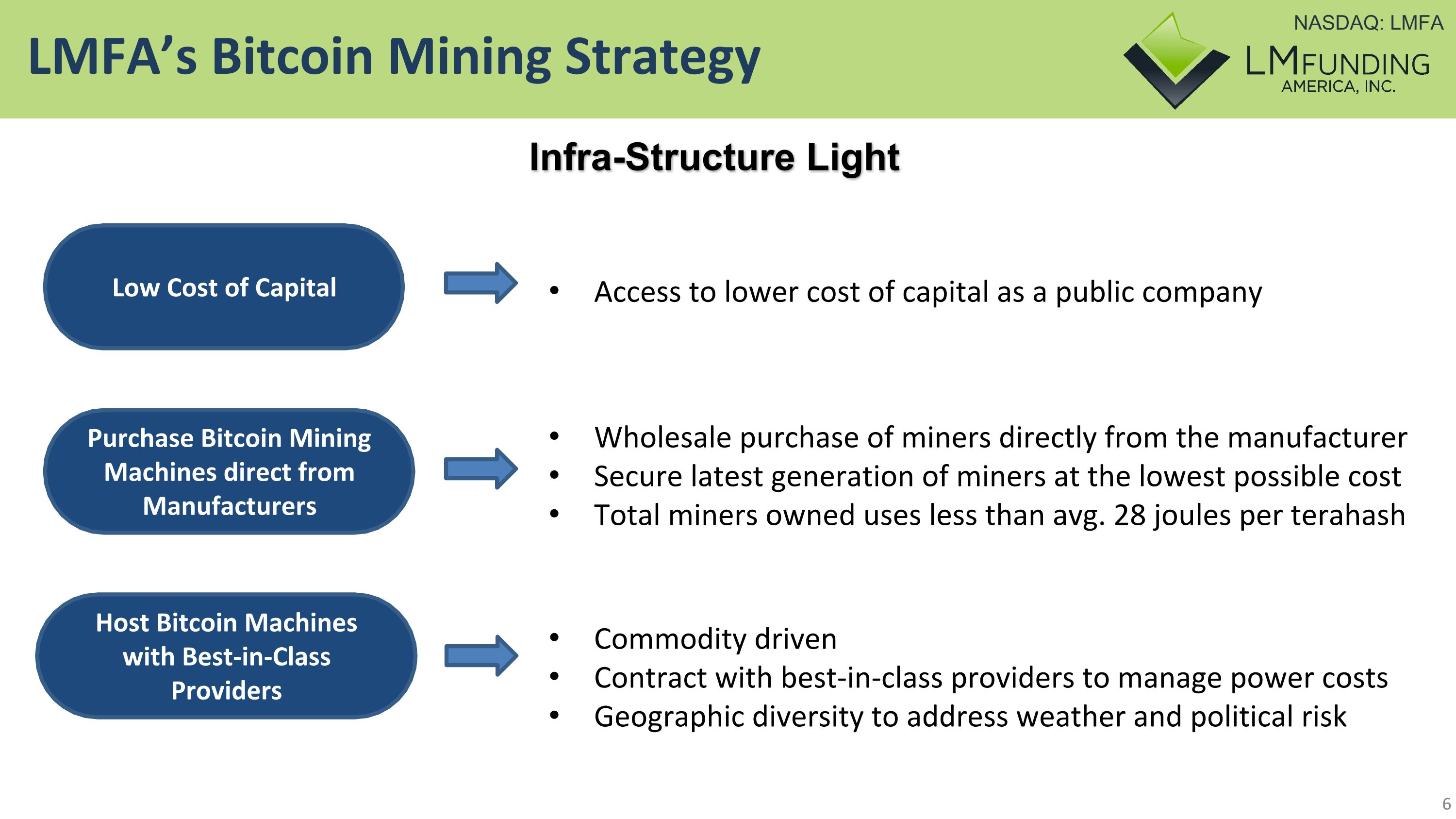

LMFA’s Bitcoin Mining Strategy Access to lower cost of capital as a public company Wholesale purchase of miners directly from the manufacturer Secure latest generation of miners at the lowest possible cost Total miners owned uses less than avg. 28 joules per terahash Commodity driven Contract with best-in-class providers to manage power costs Geographic diversity to address weather and political risk Infra-Structure Light Low Cost of Capital Purchase Bitcoin Mining Machines direct from Manufacturers Host Bitcoin Machines with Best-in-Class Providers

Current Bitcoin Environment FASB proposal — impairment versus mark to value Bitcoin regulated by CFTC as a commodity due to decentralized structure Bank financing for Bitcoin Miners non-existent White House Proposed 30% tax on Bitcoin Mining energy consumption 2024 Halving reduces mining reward from 6.25 to 3.125 BTC 2028 Halving reduces mining reward from 3.125 to 1.56 BTC Transaction fee increase must be driven by use cases https://tax.thomsonreuters.com/news/fasb-proposes-accounting-rules-for-measuring-presenting-and-disclosing-crypto-assets/

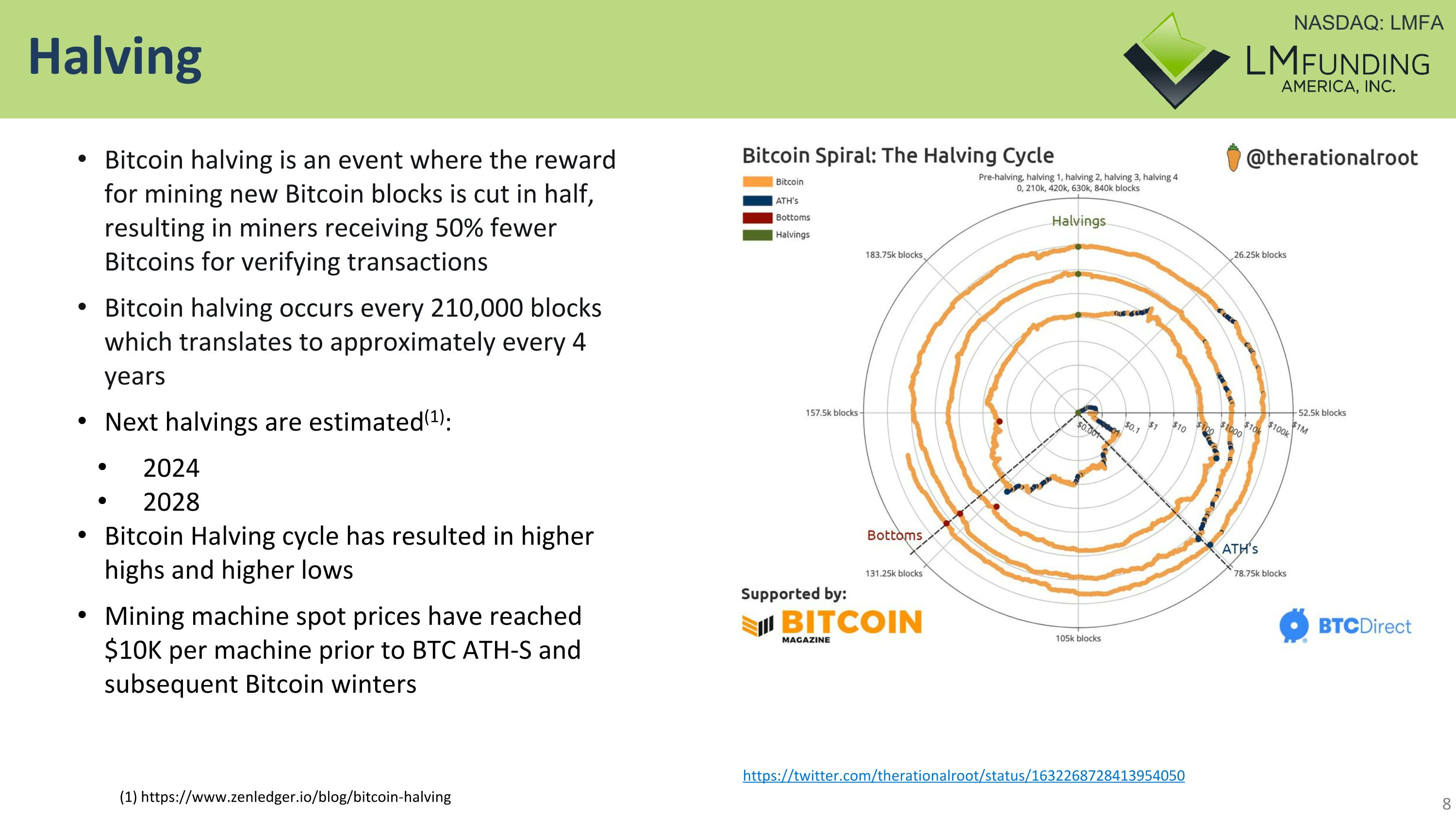

Halving Bitcoin halving is an event where the reward for mining new Bitcoin blocks is cut in half, resulting in miners receiving 50% fewer Bitcoins for verifying transactions Bitcoin halving occurs every 210,000 blocks which translates to approximately every 4 years Next halvings are estimated(1): 2024 2028 Bitcoin Halving cycle has resulted in higher highs and higher lows Mining machine spot prices have reached $10K per machine prior to BTC ATH-S and subsequent Bitcoin winters (1) https://www.zenledger.io/blog/bitcoin-halving https://twitter.com/therationalroot/status/1632268728413954050

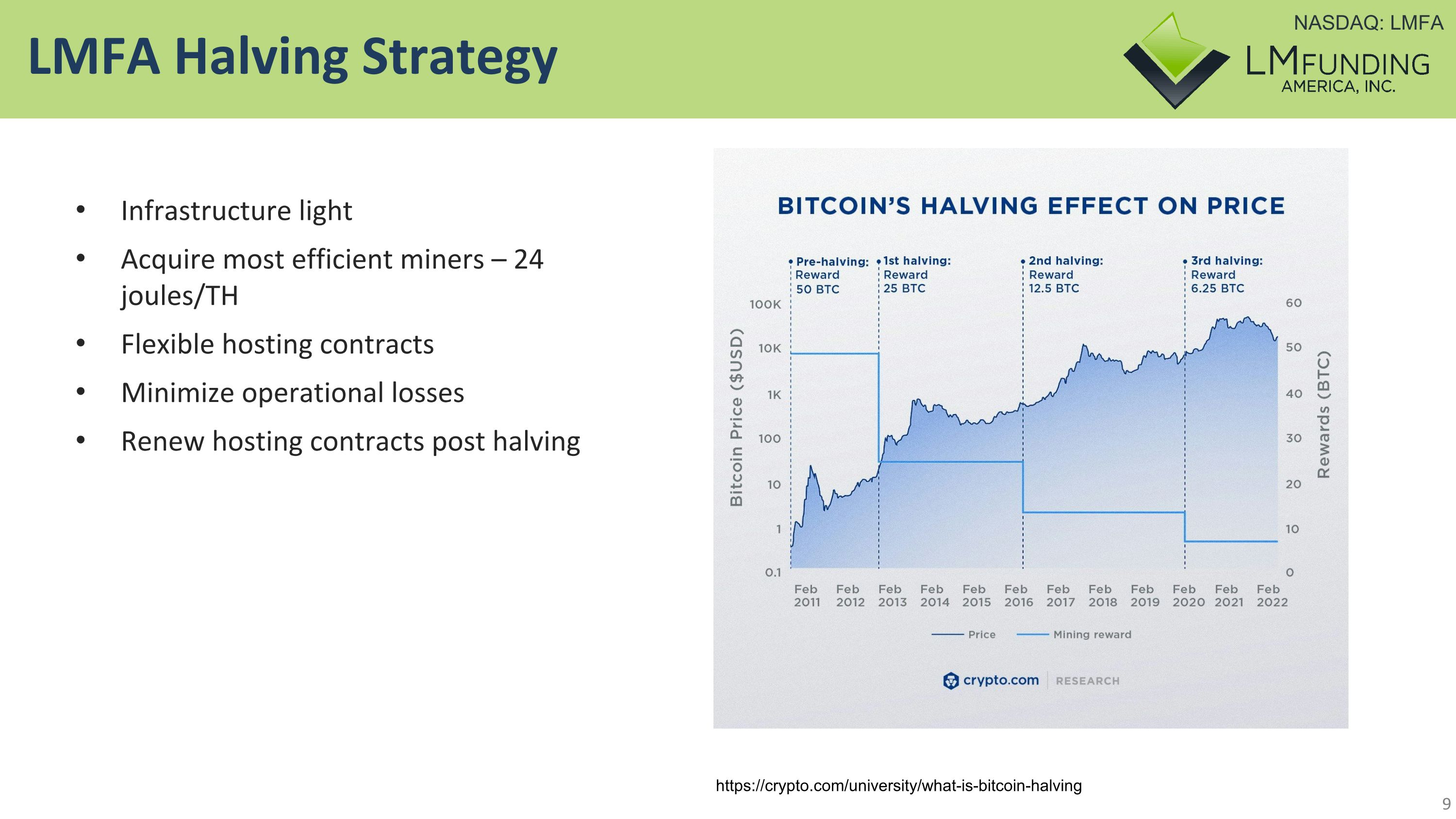

LMFA Halving Strategy Infrastructure light Acquire most efficient miners – 24 joules/TH Flexible hosting contracts Minimize operational losses Renew hosting contracts post halving https://crypto.com/university/what-is-bitcoin-halving

Expanded a hosting contract with Core Scientific for Core to host an additional 1,900 of the Company’s Bitcoin mining machines, bringing the total number of machines hosted by Core to approximately 4,900 Signed a new contract with Giga Energy to host approximately 1,080 Bitcoin mining machines Purchased additional 300 Bitmain XP mining machines in 2023 Recent Digital Mining Events

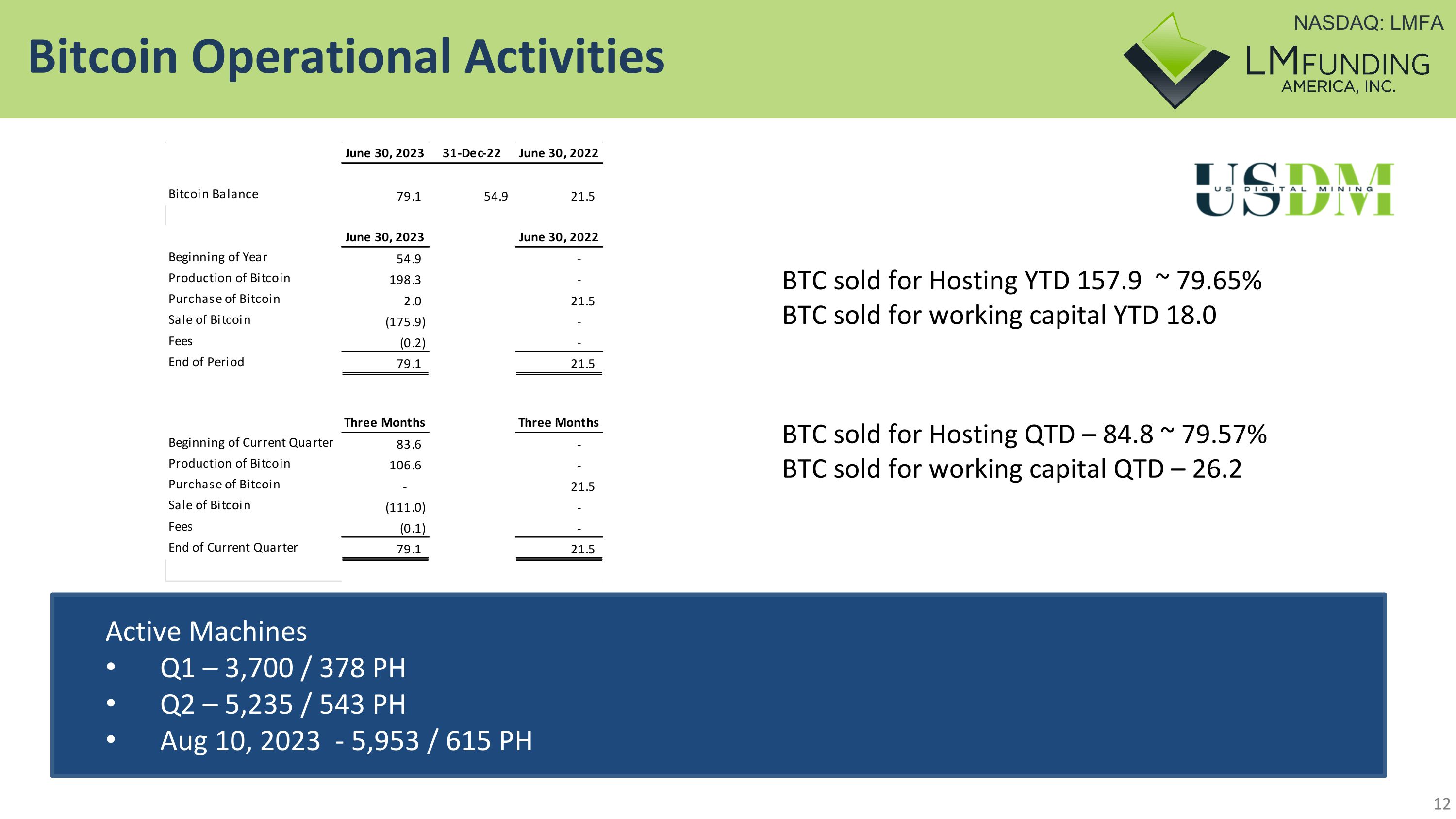

Bitcoin Operational Activities Recent shift in focus towards Bitcoin mining is transforming the Company for the future

Bitcoin Operational Activities Active Machines Q1 – 3,700 / 378 PH Q2 – 5,235 / 543 PH Aug 10, 2023 - 5,953 / 615 PH BTC sold for Hosting YTD 157.9 ~ 79.65% BTC sold for working capital YTD 18.0 BTC sold for Hosting QTD – 84.8 ~ 79.57% BTC sold for working capital QTD – 26.2

Symbiont Asset Acquisition Acquired the assets of Symbiont, including those related to its Assembly™ financial services blockchain enterprise platform. Symbiont Assembly™ is a blockchain platform for building and running decentralized applications called “smart contracts” Plan to pursue joint ventures and/or other strategic relationships to offer Assembly™ to institutions to issue, track and manage financial instruments, such as data, loans, and securities. Additionally, we plan to explore, and consider, other use cases for the Symbiont assets and Assembly™ platform.

The Company began in 2008 with a focus on specialty finance – providing funding to nonprofit community associations primarily located in the state of Florida Offer incorporated nonprofit community associations a variety of financial products customized to each association’s financial needs Provide funding against delinquent accounts in exchange for a portion of the proceeds collected from the account debtors of the association Business prospers in declining residential real estate market Specialty Finance & Association Collections

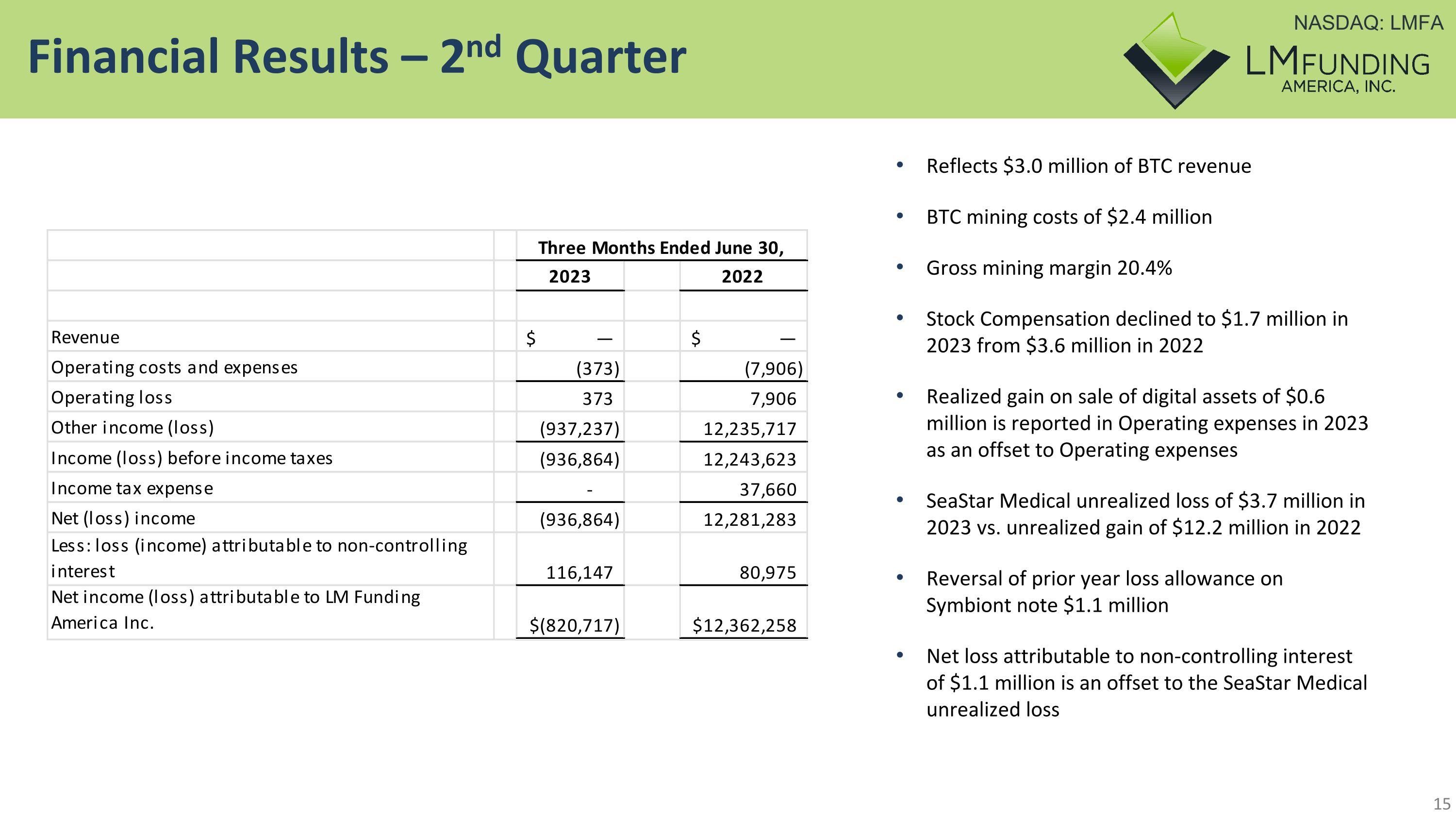

Reflects $3.0 million of BTC revenue BTC mining costs of $2.4 million Gross mining margin 20.4% Stock Compensation declined to $1.7 million in 2023 from $3.6 million in 2022 Realized gain on sale of digital assets of $0.6 million is reported in Operating expenses in 2023 as an offset to Operating expenses SeaStar Medical unrealized loss of $3.7 million in 2023 vs. unrealized gain of $12.2 million in 2022 Reversal of prior year loss allowance on Symbiont note $1.1 million Net loss attributable to non-controlling interest of $1.1 million is an offset to the SeaStar Medical unrealized loss Financial Results – 2nd Quarter

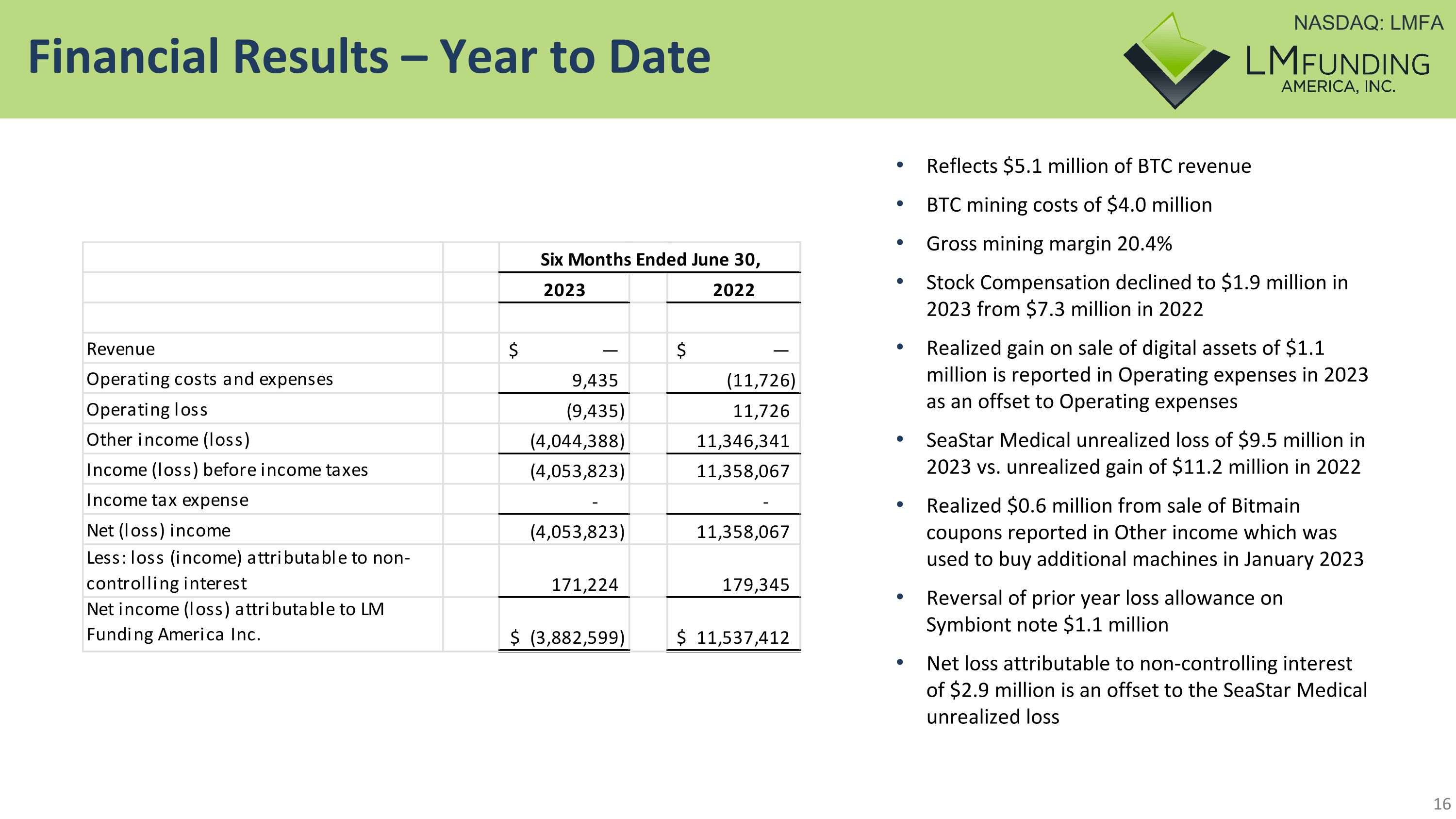

Reflects $5.1 million of BTC revenue BTC mining costs of $4.0 million Gross mining margin 20.4% Stock Compensation declined to $1.9 million in 2023 from $7.3 million in 2022 Realized gain on sale of digital assets of $1.1 million is reported in Operating expenses in 2023 as an offset to Operating expenses SeaStar Medical unrealized loss of $9.5 million in 2023 vs. unrealized gain of $11.2 million in 2022 Realized $0.6 million from sale of Bitmain coupons reported in Other income which was used to buy additional machines in January 2023 Reversal of prior year loss allowance on Symbiont note $1.1 million Net loss attributable to non-controlling interest of $2.9 million is an offset to the SeaStar Medical unrealized loss Financial Results – Year to Date

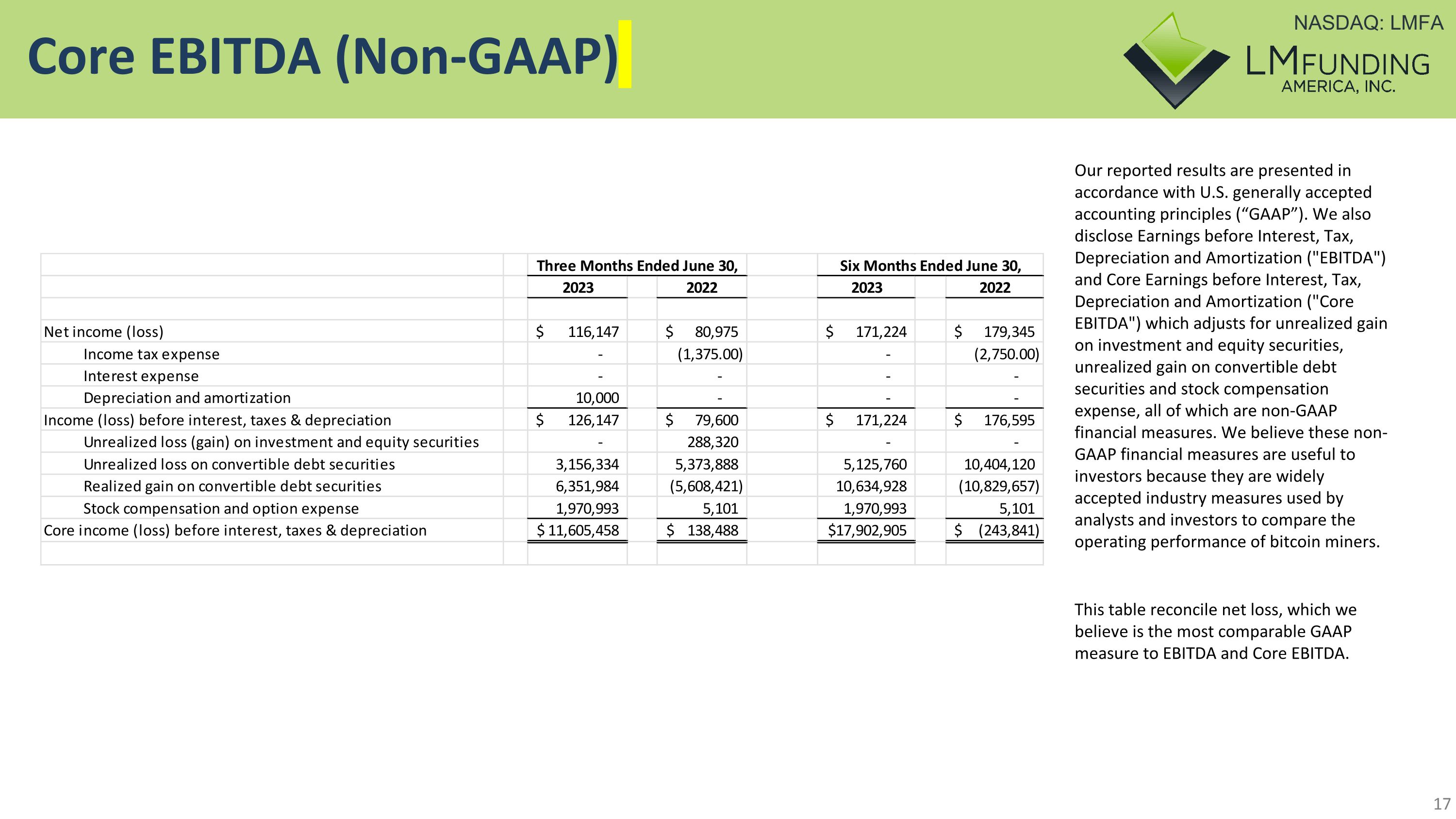

Core EBITDA (Non-GAAP) Our reported results are presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We also disclose Earnings before Interest, Tax, Depreciation and Amortization ("EBITDA") and Core Earnings before Interest, Tax, Depreciation and Amortization ("Core EBITDA") which adjusts for unrealized gain on investment and equity securities, unrealized gain on convertible debt securities and stock compensation expense, all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of bitcoin miners. This table reconcile net loss, which we believe is the most comparable GAAP measure to EBITDA and Core EBITDA.

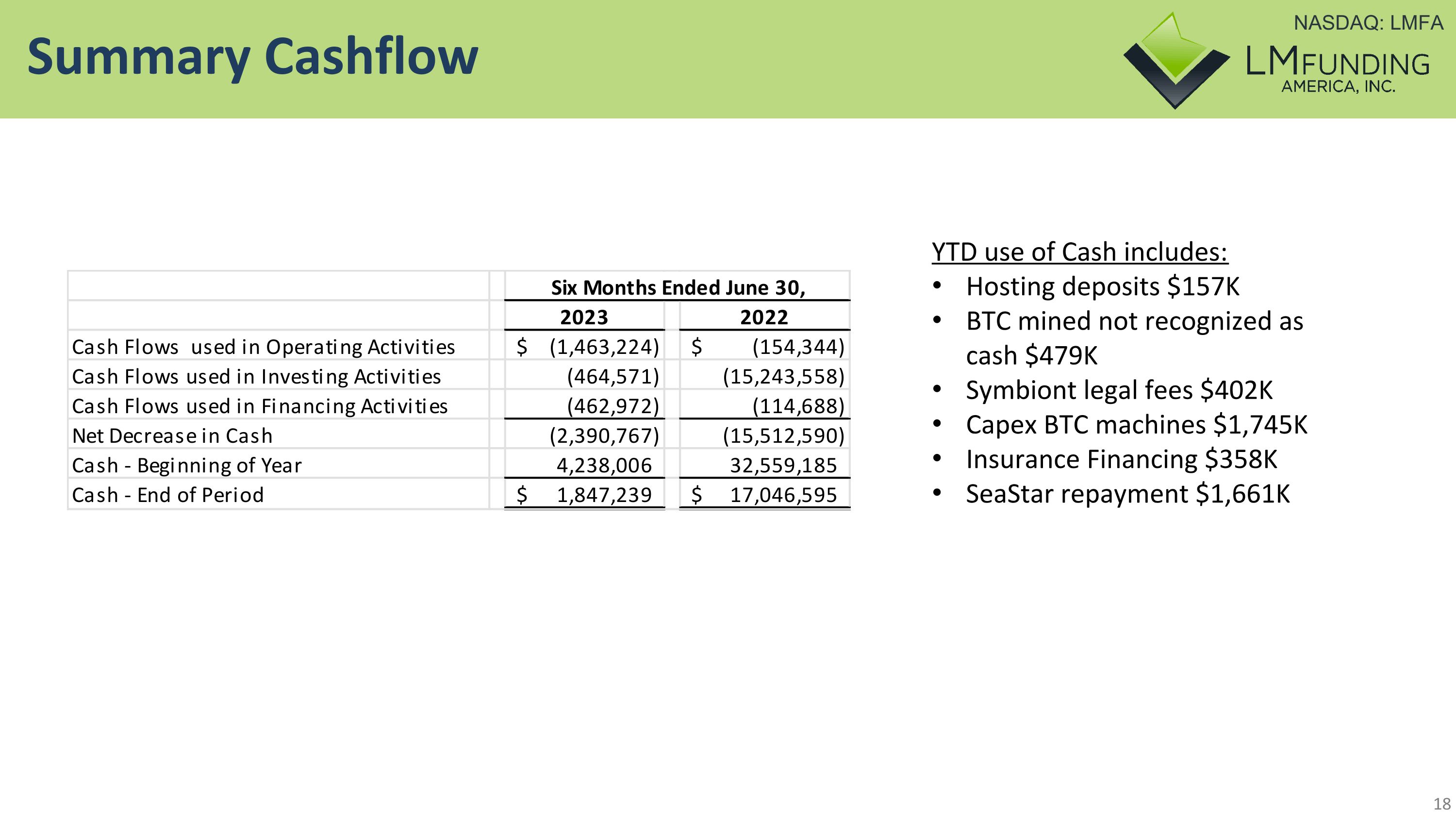

Summary Cashflow YTD use of Cash includes: Hosting deposits $157K BTC mined not recognized as cash $479K Symbiont legal fees $402K Capex BTC machines $1,745K Insurance Financing $358K SeaStar repayment $1,661K

Financial Highlights Balance sheet: June 30, 2023 - $42.3M total assets, $0.15 million of long-term debt Dec. 31, 2022 - $46.1M total assets, $0.20 million of long-term debt Total LM Funding Equity of June 30, 2023 - $39.9 million with per share book value of $2.72 Dec 31, 2022 - $44.0 million with per share book value of $3.88 At June 30 had approximately 5,230 miners, electrified and actively mining Bitcoin, providing the Company with approximately 543 petahash of mining capacity At September 1, 2023, have approximately 5,950 machines active and 615 petahash of mining capacity Liquidity June 30, 2023 - $3.8 million in liquidity (Cash and BTC*), working capital of $5.5 million Dec. 31, 2022 - $5.2 million in liquidity (Cash and BTC**), working capital of $4.6 million * BTC price $25.2K at 06-30-2023 ** BTC price $16.2K at 12-31-2022

Contact Us LM Funding Contact: Bruce M. Rodgers, Esq. 866.235.5001 investors@LMFunding.com www.lmfunding.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

LM Funding America (NASDAQ:LMFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

LM Funding America (NASDAQ:LMFA)

Historical Stock Chart

From Apr 2023 to Apr 2024