0001758021

false

0001758021

2023-10-05

2023-10-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 5, 2023

Karat Packaging Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40336 |

|

83-2237832 |

(State or other jurisdiction

of incorporation |

|

(Commission File Number |

|

(IRS Employer

Identification No.) |

6185 Kimball Avenue, Chino, CA 91708

(Address of principal executive offices) (Zip Code)

(626) 965-8882

Registrant’s telephone number, including

area code:

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

KRT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by checkmark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02. Departure of Certain Officer; Election of Directors;

Appointment of Certain Officer; Compensatory Arrangements of Certain Officers.

Employment Agreement with the Chief Revenue Officer

On October 5, 2023, Karat Packaging

Inc. (the "Company") entered into an employment agreement with Daniel Quire to serve as Chief Revenue Officer of the Company

(the “Employment Agreement”). Pursuant to the Employment Agreement, Mr. Quire will be paid an annual salary of $250,000 ("Base

Salary") and will be eligible for an annual bonus upon the discretion of the Compensation Committee.

Pursuant to the Employment Agreement, Mr. Quire

will be an at-will employee of the Company. If Mr. Quire is terminated with Cause (as defined in the Employment Agreement), the Company

will provide Mr. Quire the following compensation, in accordance with the terms of the Employment Agreement: (a) any accrued but unpaid

Base Salary and accrued but unused vacation; (b) reimbursement for unreimbursed business expenses properly incurred; and (c) employee

benefits, including equity compensation, if any, to which she may be entitled to. If Mr. Quire is terminated without Cause but for Good

Reason (as defined in the Employment Agreement), the Company will provide Good Cause all compensation stated above in (a)-(c).

The foregoing summary of the terms of the Employment

Agreement with Mr. Quire does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Employment

Agreement, a copy of which is included as Exhibit 10.1 to this report, and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| + | Management contract or compensatory plan or arrangement. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: October 11, 2023 |

KARAT PACKAGING INC. |

| |

|

| |

By: |

/s/ Jian Guo |

| |

|

Jian Guo |

| |

|

Chief Financial Officer |

2

Exhibit 10.1

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT (“Agreement”)

is made as of October 5, 2023 (the “Effective Date”), by and between Karat Packaging, Inc. (together with its successors and assigns,

the “Company”), and Daniel Quire (hereinafter “Quire” or referred to as “You,” “your” or “yours”).

RECITALS

WHEREAS, the Company desires to employ

Quire, and Quire desires to be employed by the Company, as the Company’s Chief Revenue Officer.

NOW, THEREFORE, in consideration of the

foregoing recitals, the mutual covenants and conditions herein, and other good and valuable consideration, the receipt and adequacy of

which is hereby acknowledged, the parties hereby agree as follows:

1. Duties

and Scope of Employment.

| a. | Position. The Company hereby agrees to employ Quire in the position of Chief Revenue Officer,

and Quire hereby accepts employment by the Company, on the terms and conditions hereinafter set forth. You will perform the

duties and have the responsibilities and authority customarily performed and held by an employee in this position and such additional

duties commensurate with the position as may be assigned or delegated to you. You will act in the best interests of the Company during

your employment and will comply with the fiduciary duties and duty of loyalty during your employment with the Company. This is a full-time,

exempt position. |

| b. | Principal Work Location. Your principal office, and principal place of employment,

shall be at the Company’s offices in 3201 Capital Boulevard, Rockwall, TX 75032; provided that you may be required under business circumstances

to travel outside of such location in connection with performing your duties under this Agreement. |

| c. | Obligations to the Company. You agree to devote your full business efforts, energies, and

skill to the discharge of the duties and responsibilities attributable to your position and, except as set forth herein, agrees to devote

all of your professional time and attention to the business and affairs of the Company. Without express written consent of the Company’s

Chief Executive Officer, you shall not render services in any capacity to any other person or entity and shall not act as a sole proprietor,

board member, or partner of any other person or entity or, except as set forth on Attachment A, own more than five percent

(5%) of the stock of any other corporation. Notwithstanding the foregoing, you may (i) serve on corporate, civic, or charitable boards

or committees, including the corporate boards on which you currently serves as set forth on Attachment A; (ii) continue

to provide advisory services to the entities set forth on Attachment A; or (iii) deliver lectures, fulfill speaking

engagements, teach at educational institutions, or manage personal investments, in the case of each of clauses (i), (ii), and (iii) of

this sentence, without such advance written consent; provided that such activities do not individually or in the aggregate interfere with

the performance of your obligations and duties hereunder. You will be subject to the Bylaws, policies, practices, procedures and rules

of the Company, including those policies and procedures set forth in the Company’s Code of Conduct and Ethics. Your violation of the terms

of such documents shall be considered a breach of the terms of this Agreement. |

| d. | No Conflicting Obligations. You represent and warrant that you are under no contractual

or other obligations or commitments that are inconsistent with your obligations under this Agreement, including but not limited to any

restrictions that would preclude you from providing services or fulfilling your duties to the Company. In connection with your employment,

you will not use or disclose any trade secrets or other proprietary information or intellectual property in which you or any other person

or entity has any right, title, or interest. You further represent and warrant that your employment will not infringe or violate the rights

of any other person or entity. You further represent and warrant that you have not removed or taken and will not remove or take any confidential

documents or proprietary data or materials of any kind with you from any former employer to the Company without written authorization

from that employer. You are hereby notified that you may be entitled to immunity from liability for certain disclosures of trade secrets

under the Defend Trade Secrets Act, 18 U.S.C. § 1833(b). |

| e. | Term. Quire’s term of employment by the Company under this Agreement shall be for

a period of one (1) year, commencing on the Effective Date and subject to earlier termination as provided in Section 5 (the “Initial

Term”). This Agreement shall be deemed to be automatically extended at the conclusion of Initial Term, under the same terms and

conditions, unless those conditions are otherwise changed by the Company, for successive periods of one year (each, a “Renewal Term”),

unless either party provides written notice of its intention not to extend the Employment Term at least 60 days’ prior to the conclusion

of the Initial Term or a Renewal Term (as the case may be) and subject to earlier termination as provided in Section 5 hereof. When used

herein, the term “Employment Term” shall mean the Initial Term together with any Renewal Term (if any). The Company reserves

the right to change existing conditions or impose new conditions on this Agreement at any time, provided that those terms comply with

applicable federal and state law. Despite the use of the word “Term” and any automatic renewal described in this subsection 1(e),

Quire’s employment with the Company is at will, and the Company expressly reserves the right to terminate Quire’s employment

at any time, with or without notice, and with or without cause. |

2. Compensation.

| a. | Salary. The Company shall pay you as compensation for your services an annual base

salary, currently $250,000 (the “Salary”), payable in accordance with the Company’s standard payroll procedures. The Salary

is determined by the Compensation Committee of the Board of Directors (“Compensation Committee”) and is subject to change at

any time during the Employment Term. The Compensation Committee Board will automatically review the Salary for the following calendar

year and will notify you of any changes prior to the first day of the following calendar year. The Compensation Committee’s automatic

review does not in any way limit the Company’s ability to adjust the Salary at any time. This is an exempt position, which means that

the Salary is intended to compensate Quire for all hours worked, and Quire will not be eligible for overtime pay or other certain rights

afforded by state and federal law. |

| b. | Bonus. The Compensation Committee retains the right in its sole discretion to issue an annual

bonus, if any, to Quire. |

| c. | Annual RSU Grant. Subject to the approval of the Company’s Compensation Committee,

the Company will grant Quire restricted stock units (“RSUs”) pursuant to the Company’s Stock Incentive Plan. Any grant

of RSUs shall be pursuant to separate Restricted Stock Award Agreement. |

| d. | Relocation Expenses. In the event that the Company and Quire mutually agree that a

relocation of Quire’s principal residence is warranted, Quire will be entitled to relocation benefits in accordance with the Company’s

applicable relocation policy then in effect. |

The foregoing provisions (a)-(d) are subject

to the terms and conditions of any applicable plans and/or policies of the Company, as amended from time to time. You agree to pay any

income or other taxes that are required to be paid in connection with your receipt of these benefits.

3. Paid

Time Off and Employee Benefits.

During the Employment Term, Quire shall be entitled

to participate in all fringe benefits and perquisites made available to other employees of the Company, subject to Quire’s satisfaction

of all applicable eligibility conditions to receive such fringe benefits and perquisites. In addition, Quire shall be eligible for paid

time off (“PTO”) per calendar year in accordance with the Company’s vacation and PTO policy, inclusive of vacation days and

sick days and excluding standard paid Company holidays, in the same manner as PTO days for employees of the Company generally accrue.

4. Business

Expenses.

The Company shall reimburse Quire for all reasonable

pre-approved business and travel expenses incurred in the performance of Quire’s job duties, promptly upon presentation of appropriate

supporting documentation and otherwise in accordance with and subject to the expense reimbursement policy of the Company.

5. Termination.

| a. | Employment at Will. Quire’s employment is “at will,” meaning that

either Quire or the Company is entitled to terminate Quire’s employment at any time and for any reason, with or without cause and

with or without notice, notwithstanding any contrary representations that may have been made to Quire. The at will nature of Quire’s

employment is not altered in any way by this Agreement. The at will nature of Quire’s employment means that the Company can make

other changes to the terms and conditions of the employment with Quire (including compensation, benefits, duties, and title) with or without

cause or notice. This Agreement will constitute the full and complete understanding between you and the Company on the “at

will” nature of your employment, which may be changed only in a writing signed by you and a duly authorized Company officer. |

| b. | Rights Upon Termination. |

1. Termination for Any Reason.

Upon the termination of your employment for any reason, you will be entitled to the compensation and benefits earned and the reimbursements

described in this Agreement through the date of termination.

1.1 Non-Renewal of this Agreement,

Termination For Cause or Without Good Reason.

| a) | Your employment hereunder may be terminated upon either your or the Company’s failure to renew the Agreement

in accordance with this Agreement or by the Company for Cause or by you without Good Reason. If your employment is terminated or upon

either party’s failure to renew the Agreement, by the Company for Cause or by y without Good Reason, you will be entitled to receive: |

| i. | any accrued but unpaid salary (as described in Section 2(a) or as otherwise agreed by you and

the Company in writing, and accrued but unused vacation which shall be paid on the Termination Date (as defined below); |

| ii. | reimbursement for unreimbursed business expenses properly incurred by you, which shall be subject to and

paid in accordance with the Company’s expense reimbursement policy; and |

| iii. | such employee benefits, including equity compensation, if any, to which you may be entitled under the

Company’s employee benefit plans as of the Termination Date; provided that, in no event shall you be entitled to any payments in the nature

of severance or termination payments except as specifically provided herein. |

| b) | If your employment is terminated by you without Cause but for Good Reason, you will be entitled to receive: |

| i. | all compensation described in Section 5(b)(1.1)(a)(i)-(iii); |

| c) | In lieu of the definitions of “Good Reason” and “Cause,” the following definitions

shall apply, respectively: |

| i. | “Good Reason” means the occurrence of any of the following events without your prior

written consent: (i) the Company (or a successor, if appropriate) requires you to relocate to a facility or location more than fifty

(50) miles away from the location at which you were working immediately prior to the required relocation; (ii) a material reduction

of the Salary; (iii) a material reduction in your responsibilities, where you do not report directly to the Chief Executive Officer

or do not continue to perform the duties of a Chief Revenue Officer; (iv) a diminution in your title or position or (v) a material

breach of any of your agreements with the Company, including the failure to make any of the equity award grants set forth in this Agreement;

provided, however, that, in each case under sub-clauses (i) through (v) above, any such termination by you shall only

be for “Good Reason” if: (1) you give the Company written notice, within ninety (90) days following your knowledge

of the first occurrence of the condition(s) that you believe constitute(s) “Good Reason”, which notice shall describe

such condition(s); (2) the Company fails to remedy such condition(s) within thirty (30) days following receipt of the written

notice (such 30-day period, the “Company Cure Period”); and (3) you voluntarily terminate your

employment within thirty (30) days following the end of the Company Cure Period. |

| ii. | “Cause” means the occurrence of any of the following events: (i) your conviction

of, or plea of nolo contendere to, any felony (other than a vehicular-related felony); (ii) your commission of, or participation

in, intentional acts of fraud or dishonesty against the Company that in either case results in material harm to the business of the Company;

(iii) your intentional violation of any contract or agreement between you and the Company or any statutory duty you owe to the Company

that in either case results in harm to the business of the Company; (iv) your conduct that constitutes insubordination or neglect

of duties and that in either case results in harm to the business of the Company; (v) your intentional refusal to follow the lawful

directions of the Chief Executive Officer (other than as a result of physical or mental illness); (vi) your intentional failure to

follow the Company’s written policies that are generally applicable to all employees or all officers of the Company and that results

in harm to the business of the Company; (vii) failure to perform your duties; or (viii) your disclosure of proprietary or Confidential

Information. |

| iii. | For purposes of this Agreement, “Confidential Information” includes, but is not limited to,

all information not generally known to the public, in spoken, printed, electronic or any other form or medium, relating directly or indirectly

to: business know-how, business processes, practices, methods, policies, plans, publications, documents, research, operations, services,

strategies, techniques, agreements, contracts, terms of agreements, transactions, potential transactions, negotiations, pending negotiations,

know-how, trade secrets, computer programs, computer software, applications, operating systems, software design, web design, work-in-process,

databases, manuals, records, articles, systems, material, sources of material, supplier information, vendor information, financial information,

results, accounting information, accounting records, legal information, marketing information, advertising information, pricing information,

credit information, design information, payroll information, staffing information, personnel information, employee lists, supplier lists,

vendor lists, developments, reports, internal controls, security procedures, graphics, drawings, sketches, market studies, sales information,

revenue, costs, formulae, notes, communications, algorithms, product plans, designs, styles, models, ideas, audiovisual programs, inventions,

unpublished patent applications, original works of authorship, discoveries, experimental processes, experimental results, specifications,

customer information, customer lists, client information, client lists, manufacturing information, factory lists, distributor lists, and

buyer lists of the Company or its businesses or any existing or prospective customer, supplier, investor or other associated third party,

or of any other person or entity that has entrusted information to the Company in confidence. |

Quire represents, understands, and agrees

that the above list is not exhaustive, and that Confidential Information also includes other information that is marked or otherwise identified

as confidential or proprietary, or that would otherwise appear to a reasonable person to be confidential or proprietary in the context

and circumstances in which the information is known or used.

Quire further represents, understands,

and agrees that Confidential Information includes information developed by Quire during the Employment Term as if the Company furnished

the same Confidential Information to Quire in the first instance.

1.2 Resignation of All

Other Positions. Upon termination of your employment hereunder for any reason, you agree to resign, effective on the last day

of employment and shall be deemed to have resigned, from all positions that you hold as an officer or member of the Board (or a committee

thereof) of the Company or any of its affiliates.

1.3 Internal Revenue

Code Section 280G. If any of the payments or benefits received or to be received by you, including, without limitation, any

payment or benefits received in connection with your termination of employment, whether pursuant to the terms of this Agreement or any

other plan, arrangement, agreement, undertaking, or otherwise (“280G Payments”) constitute “parachute payments” within

the meaning of Section 280G of the Internal Revenue Code (“Code”) and would, but for this Section, be subject to the

excise tax imposed under Section 4999 of the Code (“Excise Tax”), then such 280G Payments shall be reduced in a manner

determined by the Company that is consistent with the requirements of Section 409A until no amount payable to you will be subject

to the Excise Tax. If two economically equivalent amounts are subject to reduction but are payable at different times, the amounts shall

be reduced on a pro rata basis.

6. Successors.

| a. | Company’s Successors. The terms of this Agreement will be binding upon any successor

(whether direct or indirect and whether by purchase, lease, merger, consolidation, liquidation, or otherwise) to all or substantially

all of the Company’s business and/or assets. For all purposes under this Agreement, the term “Company” will include

any successor to the Company’s business or assets that becomes bound by this Agreement. |

| b. | Your Successors. This Agreement and all of your rights hereunder will inure to the

benefit of, and be enforceable by, your personal or legal representatives, executors, administrators, successors, heirs, distributees,

devisees, and legatees. |

7. Miscellaneous

Provisions.

| a. | Modifications and Waivers. No provision of this Agreement will be modified, waived,

or discharged unless the modification, waiver or discharge is reflected in a writing signed by you (or your authorized representative)

and by an authorized officer of the Company (other than you). No waiver by either party of any breach of, or of compliance with, any condition

or provision of this Agreement by the other party will be considered a waiver of any other condition or provision or of the same condition

or provision at another time. |

| b. | Whole Agreement. No other arrangements, agreements, representations, or understandings

(whether oral or written and whether express or implied) which are not expressly set forth in this Agreement have been made or entered

into by either party with respect to the subject matter hereof. This Agreement and the exhibits attached hereto contain the entire understanding

of the parties with respect to the subject matter hereof and supersede any prior agreements relating to such subject matter (including

any prior employment agreements) except the Company’s arbitration agreement, any standalone, company-wide policies, any compensation agreements

between You and the Company , and any equity or equity-based award agreements. |

| c. | Choice of Law and Severability. This Section 7(c) does not apply to the

Company’s Arbitration Agreement, and to the extent that this Section 7(c) conflicts with the Arbitration Agreement, the provisions

contained in the Arbitration Agreement control. Subject to the preceding sentence, this Agreement otherwise shall be interpreted in accordance

with the Laws of the State in which you work/last worked without giving effect to provisions governing the choice of Law, and if any provision

of this Agreement becomes or is deemed invalid, illegal, or unenforceable in any applicable jurisdiction by reason of the scope, extent,

or duration of its coverage, then such provision shall be deemed amended to the minimum extent necessary to conform to applicable law

so as to be valid and enforceable or, if such provision cannot be so amended without materially altering the intention of the parties,

then such provision shall be stricken and the remainder of this Agreement shall continue in full force and effect. If any provision of

this Agreement is rendered illegal by any present or future statute, law, ordinance, or regulation (collectively, the “Law”)

then that provision shall be curtailed or limited only to the minimum extent necessary to bring the provision into compliance with the

Law. All the other terms and provisions of this Agreement shall continue in full force and effect without impairment or limitation. |

Should any provision of this Agreement

be held by a court of competent jurisdiction to be enforceable only if modified, or if any portion of this Agreement shall be held as

unenforceable and thus stricken, such holding shall not affect the validity of the remainder of this Agreement, the balance of which shall

continue to be binding upon the parties with any such modification to become a part hereof and treated as though originally set forth

in this Agreement.

The parties further agree that any such

court is expressly authorized to modify any such unenforceable provision of this Agreement in lieu of severing such unenforceable provision

from this Agreement in its entirety, whether by rewriting the offending provision, deleting any or all of the offending provision, adding

additional language to this Agreement, or by making such other modifications as it deems warranted to carry out the intent and agreement

of the parties as embodied herein to the maximum extent permitted by law.

The parties expressly agree that this

Agreement as so modified by the court shall be binding upon and enforceable against each of them. In any event, should one or more of

the provisions of this Agreement be held to be invalid, illegal, or unenforceable in any respect, such invalidity, illegality, or unenforceability

shall not affect any other provisions hereof, and if such provision or provisions are not modified as provided above, this Agreement shall

be construed as if such invalid, illegal, or unenforceable provisions had not been set forth herein.

| d. | No Assignment. This Agreement and all of your rights and obligations hereunder are

personal to you and may not be transferred or assigned by you at any time. The Company may assign its rights under this Agreement only

to any entity that assumes the Company’s obligations hereunder in connection with any sale or transfer of all or a substantial portion

of the Company’s assets to such entity. |

| e. | Counterparts. This Agreement may be executed in two or more counterparts, each of

which shall be deemed an original, but all of which together shall constitute one and the same instrument. |

| f. | Indemnification. You will be indemnified under the Company’s bylaws for acts during

your employment, within the scope of your duties, and at the Company’s direction. In the event that the you are made a party or threatened

to be made a party to any action, suit, or proceeding, whether civil, criminal, administrative, or investigative (“Proceeding”),

other than any Proceeding initiated by you or the Company related to any contest or dispute between you and the Company or any of its

affiliates with respect to this Agreement or the your employment hereunder, by reason of the fact that you are a director or officer of

the Company, or any affiliate of the Company, or are or were serving at the request of the Company as a director, officer, member, employee,

or agent of another corporation or a partnership, joint venture, trust, or other enterprise, you will be indemnified and held harmless

by the Company, to the extent permitted under applicable law and the Company’s bylaws, from and against any liabilities, costs, claims,

and expenses, including all costs and expenses incurred in defense of any Proceeding. You will be named as an insured on the director

and officer liability insurance policy currently maintained by the Company or as may be maintained by the Company from time to time. |

| g. | Taxes; Section 409A. All forms of compensation paid to you by the Company, including

any payments made pursuant to this Agreement, are subject to reduction (or payment by you, to the extent that additional amounts are required)

to reflect applicable deductions, withholdings, and payroll taxes. You agree that the Company does not have a duty to design its compensation

policies in a manner that minimizes your tax liabilities, and you will not make any claim against the Company related to tax liabilities

arising from your compensation. The payments and benefits under this Agreement are intended, and will be construed, to be exempt from

or comply with Section 409A of the Internal Revenue Code of 1986, as amended (Section 409A); provided, however, that

nothing in this Agreement shall be construed or interpreted to transfer any liability for any tax (including a tax or penalty due as a

result of a failure to comply with Section 409A) from you to the Company or to any other entity or person. Any payment to you under

this Agreement that is subject to Section 409A and that is contingent on a termination of employment is contingent on a “separation

from service” within the meaning of Section 409A. If, upon separation from service, you are a “specified employee”

within the meaning of Section 409A, any payment under this Agreement that is subject to Section 409A and triggered by a separation

from service that would otherwise be paid within six months after your separation from service will instead be paid in the seventh month

following your separation from service or, if earlier, upon your death (to the extent required by Section 409A(a)(2)(B)(i)). Payments

pursuant to this Agreement (or referenced in this Agreement), and each installment thereof, are intended to constitute separate payments

for purposes of Section 1.409A-2(b)(2) of the regulations under Section 409A. To the extent any nonqualified deferred

compensation subject to Section 409A payable to you could be paid in more than one taxable year depending upon you completing certain

employment-related actions, then any such payments will commence or occur in the latest such taxable year to the extent required to avoid

the adverse consequences of Section 409A. Any taxable reimbursement due under the terms of this Agreement shall be paid no later

than December 31 of the year after the year in which the expense is incurred, and all taxable reimbursements and in-kind benefits

shall be provided in accordance with Section 1.409A-3(i)(1)(iv) of the regulations under Section 409A. The parties

agree that if necessary to avoid non-compliance with Section 409A, they will cooperate in good faith to modify the terms

of this Agreement or any applicable equity award; provided, that such modification shall endeavor to maintain the economic intent of this

Agreement or any such equity award. |

| h. | Captions. Captions and headings of the sections and paragraphs of this Agreement are intended

solely for convenience and no provision of this Agreement is to be construed by reference to the caption or heading of any section or

paragraph. |

8. Your

Representations and Warranties.

You represent and warrant to the Company that:

| a. | No Conflicts. Your acceptance of employment with the Company and the performance of your

duties hereunder will not conflict with or result in a violation of, a breach of, or a default under any contract, agreement, or understanding

to which you are a party or are otherwise bound. |

Your acceptance of employment with the

Company and the performance of your duties hereunder will not violate any non-solicitation, non-competition, or other similar covenant

or agreement of a prior employer.

| b. | Withholding. The Company shall have the right to withhold from any amount payable hereunder

any federal, state, and local taxes in order for the Company to satisfy any withholding tax obligation it may have under any applicable

law or regulation. |

| c. | Survival. Upon the expiration or other termination of this Agreement, the respective rights

and obligations of the parties hereto shall survive such expiration or other termination to the extent necessary to carry out the intentions

of the parties under this Agreement. |

| d. | Acknowledgement of Full Understanding. YOU ACKNOWLEDGE AND AGREES THAT YOU HAVE FULLY READ,

UNDERSTANDS AND VOLUNTARILY ENTER INTO THIS AGREEMENT. YOU FURTHER ACKNOWLEDGE AND AGREE THAT YOU HAVE HAD AN OPPORTUNITY TO ASK QUESTIONS

AND CONSULT WITH AN ATTORNEY OF YOUR CHOICE BEFORE SIGNING THIS AGREEMENT. |

[Signature Page to Follow]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement

as of the date first written above.

| DANIEL QUIRE |

|

KARAT PACKAGING, INC. |

| |

|

|

|

| |

|

By: |

|

| Daniel Quire |

|

Name: |

Alan Yu |

| |

|

Title: |

Chief Executive Officer |

Page 10

of 10

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

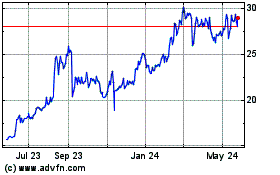

Karat Packaging (NASDAQ:KRT)

Historical Stock Chart

From Apr 2024 to May 2024

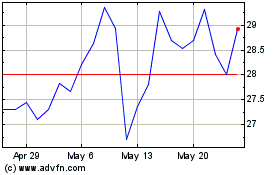

Karat Packaging (NASDAQ:KRT)

Historical Stock Chart

From May 2023 to May 2024