0001758021

false

0001758021

2023-08-30

2023-08-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 30, 2023

Karat Packaging Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40336 |

|

83-2237832 |

| (State or other jurisdiction of incorporation |

|

(Commission File Number |

|

(IRS Employer Identification No.) |

6185 Kimball Avenue, Chino, CA 91708

(Address of principal executive offices) (Zip Code)

(626) 965-8882

Registrant’s telephone number, including

area code:

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange

on which registered |

| Common Stock, $0.001 par value per share |

|

KRT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b -2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by checkmark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Retirement of Chief Operating Officer/Director

On August 30, 2023, Joanne Wang notified Karat

Packaging Inc. (the “Company”) of her retirement as Chief Operating Officer of the Company, effective December 1, 2023. Also, effective August 30, 2023, Ms. Wang relinquished her seat on

the Company’s board of directors. Ms.

Wang’s retirement is not a result of any disagreement with the Company or its independent auditor on any matter relating to the Company’s

accounting, strategy, management, operations, policies, regulatory matters, or practices.

On August 30, 2023, the Company and Ms. Wang

entered into a Separation Agreement and General Release (the “Separation Agreement”), setting forth the terms of Ms.

Wang’s separation from employment with the Company, effective as of December 1, 2023 (the “Separation Date”). Pursuant

to the Separation Agreement, Ms. Wang will receive the following payments and benefits from the Company in exchange for agreeing to

a general release of claims in favor of the Company and other promises by Ms. Wang in the Separation Agreement: (i) cash severance

payments totaling a gross amount of $126,000, less applicable taxes and withholdings, including $7,500 payable in lump sum on the

Separate Date, and $118,500 payable in equal, bi-weekly installments over a five month period on the Company’s normal payroll dates

with the first installment to be paid on the first payroll date of the Company following the Separation Date, (ii) a lump sum, less

applicable taxes and withholdings, equivalent to five weeks of paid time off as of the Separation, (iii) continued use of the

Company vehicle until December 31, 2024, and (iv) provided Ms. Wang timely elects coverage under the Consolidated Omnibus Budget

Reconciliation Act (“COBRA”), the Company will pay Ms. Wang’s COBRA premiums for health, dental and vision coverage for

up to thirteen (13) months from the Separation Date. Additionally, pursuant to the Separation Agreement, Ms. Wang’s 16,667 unvested

stock options will accelerate and vest in full as of November 30, 2024.

The foregoing summary does not purport to be complete

and is qualified in its entirety by reference to the full text of the Separation Agreement, a copy of which is filed herewith as Exhibit

10.1.

A copy of the press release announcing Ms. Wang’s retirement is attached to this report as Exhibit 99.1 and incorporated herein by reference.

Item 8.01. Other Events.

On August 31, 2023, the Company announced that

Daniel Quire, the Company’s Vice President of Sales, has been appointed to the role of Chief Revenue Officer, effective as of August 31,

2023.

A copy of the press release announcing Mr. Quire’s

appointment is attached to this report as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: August 31, 2023 |

KARAT PACKAGING INC. |

| |

|

| |

By: |

/s/ Jian Guo |

| |

|

Jian Guo |

| |

|

Chief Financial Officer |

2

Exhibit 10.1

EMPLOYMENT SEPARATION AGREEMENT AND GENERAL

RELEASE

THIS EMPLOYMENT SEPARATION AGREEMENT AND GENERAL

RELEASE (this “Agreement”) is made by and between Joanne Tzu-Jung Wang (“Wang”) and Karat Packaging, Inc., a Delaware

corporation (“Karat” or the “Company”), with respect to the following facts:

A. Wang is currently serving as the Chief Operating

Officer of Karat and is currently employed by Karat pursuant to the terms of Employment Agreement between Wang and Karat (the “Employment

Agreement”). A copy of Employment Agreement is attached hereto as Exhibit A and incorporated herein by this reference.

B. Wang and Karat have agreed that Wang’s

employment with the Company and any direct or indirect subsidiary thereof (collectively, “Subsidiaries”) will terminate effective

as of December 1, 2023 (the “Termination Date”). Simultaneously with such termination, the Employment Agreement will be terminated

in accordance with section 5 of Employment Agreement, and Wang will leave the Company and cease to serve as the Chief Operating Officer

of Karat and its Subsidiaries.

C. Karat and Wang desire to amicably compromise

and finally settle and resolve all controversies between them including, but not limited to any differences or claims that might also

arise out of the Employment Agreement, Wang’s employment with Karat or any Subsidiaries, Wang’s position as a member of the

Board of Directors of Karat or any Subsidiaries, and Wang’s termination or resignation as an employee and an officer, to bring these

matters to a conclusion and to avoid incurring costs and expenses which would be incident to the prosecution and defense of claims arising

from any disputed matters.

NOW, THEREFORE, in consideration for the covenants

and agreements contained herein, and other good and valuable consideration, the parties hereto agree as follows:

1. Termination of Employment.

Wang’s employment with Karat and its Subsidiaries shall terminate as of 5:00 p.m. (Pacific Time) on the Termination Date. Such termination

shall be deemed as resignation of Wang from all positions that she holds as an officer and employee of Karat and its Subsidiaries pursuant

to section 5.b. subsection 1.2 of Employment Agreement. Wang agrees to relinquish her position as a board member of Karat upon her execution

of this Agreement. Except as otherwise specifically set forth in this Agreement, Karat and its Subsidiaries shall have no further obligations

to Wang and all compensation and benefits payable to Wang shall cease as of the Termination Date. Except for accrued but unpaid amounts

due Wang pursuant to the terms of the Employment Agreement for periods up to and including the Termination Date, and except as specifically

contemplated by this Agreement, Wang hereby acknowledges that she has been paid all accrued compensation, wages, bonus or vacation pay,

benefits and other compensation owed to her by Karat and its Subsidiaries or to which she may be entitled up to and through the Termination

Date and hereby releases Karat and its Subsidiaries of any further obligations to pay any such amounts.

2. Severance Benefits.

In consideration of Wang’s execution of this Agreement and her compliance with its terms and conditions, the Company agrees to pay

or provide Wang with the severance benefits described in this section 2 (“Severance Benefits”).

2.1 Separation Payments. Karat

shall pay Wang an aggregate amount equal to One Hundred Twenty Six Thousand Dollars ($126,000.00) (“Separation Payment”).

Among the Separation Payment, Seventy-Five Hundred Dollars ($7,500.00) shall be paid to Wang in lump sum on the Termination Date. The

remaining One hundred Eighteen Thousand and Five Hundred Dollars ($118,500.00), subject to applicable deductions and withholdings required

by applicable law, shall be paid to Wang in one of the following manners:

☐ A

lump sum payable on the Termination Date. Wang Initials: ________

☐ In

the form of equal bi-weekly installments over a period of five (5) months in accordance with the Company’s payroll practices. First

installment shall be paid on the first payroll date of the Company following the Termination Date. Wang Initials: ________

2.2 Continuation of Group Health Benefits.

For a period of thirteen (13) months following the Termination Date, the Company agrees to pay for Wang’s cost of premiums

to maintain the health, dental and vision insurance coverage currently in effect for Wang and her dependents. Wang

may be entitled to group health insurance continuation benefits pursuant to the relevant provisions of the Consolidated Omnibus Budget

Reconciliation Act of 1985 and any other statutory health insurance rights at her sole cost and expense. Separate notice of COBRA rights

and an election form will be provided to Wang, as applicable.

2.3 Options. The Company acknowledges

that Wang was granted options (the “Options”) to purchase 50,000 shares of Company common stock subject to the Karat Packaging,

Inc. 2019 Stock Incentive Plan (the “Plan”), which can be viewed at: https://www.sec.gov/Archives/edgar/data/1758021/000110465921025272/tm2029131d1_ex10-1.htm.

A copy of Stock Option Agreement between Karat and Wang (“Stock Option Agreement”) is attached hereto as Exhibit B and

incorporated herein by this reference. The Compensation Committee of the Company hereby agrees that any unvested Options held by Wang

shall be accelerated and vested in full as of December 1, 2023 pursuant to section 6(j) of the Plan, and Wang may exercise the Options,

in whole or in part, at any time subsequent to December 1, 2023 and prior to February 29, 2024 (90 days after Termination Date) as set

forth in subsection 6(j)(i) of the Plan. Exercise of any portion of the Options shall be made in compliance with section (h) of the Plan.

The Company and Wang acknowledge that the Committee consented to change the exercise price for the Options from $18.80 to $18.86 per share

on February 16, 2022. A copy of Written Consent of the Committee is attached hereto as Exhibit C and incorporated herein by

this reference.

By way of demonstration, if Wang is to exercise

the entirety of Options, one of the payment methods is to tender a lump sum of $943,000.00 (50,000 shares X $18.86/per share) to the Company

pursuant to section 6(i) of the Plan.

2.4 Paid Time Off. The

Company shall pay Wang a lump sum equivalent to five (5) weeks of paid time off (PTO), less applicable deductions and withholdings required

by applicable law, as of the Termination Date.

2.5 Continue Use of Company

Vehicle. Upon the Termination Date, Wang shall have right to continue use of the Company vehicle, Tesla license plate number 9AFN937,

until December 31, 2024. The Company shall maintain the automobile liability insurance coverage on such vehicle in accordance with the

Company’s usual and customary practices. Wang is responsible for upkeep of the vehicle and any and all driving-related expenses

like parking, tickets, or tolls. Wang must report any damages or problems with the vehicle to the Company Human Resources Department as

soon as possible. Wang and Karat agree that this provision will not, in any way, extend, renew, or create an employment relationship with

Karat or any of its affiliates in any way.

2.6 Compliance with Agreement.

Wang acknowledges and agrees that all payments and other benefits provided to her under this Agreement are contingent upon her compliance

with all of the terms and conditions of this Agreement in all material respects.

3. Return of Company Property.

Wang warrants and represents that she has or will, within five (5) business days from the Termination Date, return to the Company

all property of the Company and the Subsidiaries in the possession, custody and/or control of Wang, her spouse or any affiliate(s) thereof.

Such property shall include any written records or computer files containing Confidential Information (and all copies thereof), as such

term is defined in Section 6.2 of this Agreement; provided, however, that Wang may retain copies of correspondence authored or addressed

to Wang.

4. Release of Claims.

4.1 Release by Wang.

As a material inducement to the Company to enter into this Agreement and in consideration of the Separation Payments and other valuable

consideration, Wang does hereby agree to and hereby does unconditionally and generally release and fully and forever waive and discharges,

on her own behalf and on behalf of any of her dependents, heirs, affiliates, successors and assigns, the Company, and its parent, subsidiary

and affiliated companies, partnerships, and each of their respective present or former affiliates, subsidiaries, officers and directors,

shareholders, partners, employees, agents, attorneys, accountants and representatives, and their respective successors and assigns (collectively,

the “Company Released Parties”) from any and all rights, claims, actions, suits, demands, causes of action, charges, obligations,

damages, breaches, attorneys’ fees, costs and liabilities of any nature whatsoever (collectively, “claims”), whether

or not now known, suspected or claimed, which Wang now holds or has at any time heretofore owned or held against the Company Released

Parties under any applicable federal, state, or local laws, including, but not limited to, claims (a) arising out of her employment

with or service as officer of the Company and/or her resignation or termination therefrom, except as set forth in the last sentence of

this Section 4.1 or as otherwise specifically provided in this Agreement, (b) except as specifically provided in this Agreement,

for compensation, severance payments, rights or benefits due to her under any plan or arrangement with the Company or its Subsidiaries,

including the Employment Agreement, (c) that the Company Released Parties or any of them discriminated against Wang on the basis

of her race, sex, religion, national origin, handicap, ancestry, sexual orientation, mental or physical disability, or age, (d) that

the Company Released Parties violated any promise or agreement either express or implied with Wang, or that the Company has terminated

her for any illegal reason or in an illegal fashion, including specifically without limiting the generality of the foregoing any claim

under the Employee Retirement Income Security Act, Title VII of the Civil Rights Act of 1964, the Age Discrimination in Employment Act,

the Americans with Disabilities Act, the Worker Pay Act, the Fair Labor Standards Act, or (e) for employment discrimination, defamation,

liable, interference with contract, business relationships, or prospective economic advantage, emotional distress, wrongful termination

and, except as specifically provided in this Agreement, wages, severance pay, deferred compensation, stock options, bonus, sick leave,

holiday pay, vacation pay, life insurance, health and medical insurance, or any other fringe benefit or commissions. Notwithstanding any

of the foregoing, nothing in this Agreement shall be deemed to constitute a release or waiver of any claims that Wang or her affiliates

may have against any of the Company Released Parties (i) relating to or arising out of any criminal or fraudulent actions by the

Company Released Parties, or (ii) for indemnification under the California Corporations Code, the Company’s Articles of Incorporation

or Bylaws or any existing officer or director liability or errors and omissions insurance policy.

4.2 Acknowledgment of Wang.

This Agreement also is intended to waive all rights and claims, if any, arising under the Age Discrimination in Employment Act of 1967,

as amended, 29 U.S.C. § 621 et seq. Wang acknowledges that the consideration in the Agreement exceeds payment or

remuneration to which she is already entitled. Wang acknowledges that she has been advised to consult with an attorney prior to executing

this Agreement. Wang acknowledges that she has been given a minimum of 21 days to consider the terms of this Agreement and that she may

use as much or as little of this 21-day period as desired. The Parties further agree that any non-material changes to this Agreement does

not restart the running of the 21-day period. Wang fully understands that, except as specifically provided in this Agreement to the contrary,

this Agreement constitutes a waiver of all rights available under federal and state statutes, municipal charter and common law with regard

to any matter related to her employment and her termination of employment with the Company.

4.3 Release by Company.

Company does hereby agree to and hereby does unconditionally and generally release and fully and forever waive and discharge, on its own

behalf and on behalf of any of its affiliates, successors and assigns, Wang and each of her present or former affiliates, agents, attorneys,

accountants and representatives, and their respective successors and assigns (collectively, the “Wang Released Parties”) from

any and all claims, whether or not now known, suspected or claimed, which the Company now holds or have at any time heretofore owned or

held against the Wang Released Parties including, but not limited to, claims arising out of her employment with and service on the Board

of Directors of the Company and/or her resignation or termination therefrom, Notwithstanding the foregoing, nothing in this Agreement

shall be deemed to constitute a release or waiver of any claims that the Company or its affiliates may have against any of the Wang Released

Parties (i) relating to or arising out of any criminal or fraudulent actions by the Wang Released Parties, or (ii) relating

to or arising out of any actions or circumstances with respect to which indemnification of Wang would not be permitted under applicable

law.

4.4 No Assignment of Claims.

Wang and the Company represent and warrant that they have not heretofore assigned or transferred to any person or entity of any kind any

matter released herein. To the extent that the release set forth in Section 4 of this Agreement runs in favor of persons or entities

not signatory hereto, this Agreement is hereby declared to be made for each of their express benefits and uses.

4.5 Waiver of Unknown Claims.

It is a further condition of the consideration herein and is the intention of Wang and the Company in executing this instrument that the

same shall be effective as a bar to each and every claim, demand, and cause of action hereinabove specified and, in furtherance of this

intention, Wang and the Company hereby expressly waive any and all rights or benefits conferred by the provisions of SECTION 1542 OF THE

CALIFORNIA CIVIL CODE and/or any similar rule of law adopted by statute or otherwise in any other of the United States and expressly consents

that this Agreement shall be given full force and effect according to each and all of its express terms and conditions, including those

relating to unknown and unsuspected claims, demands and causes of actions, if any, as well as those relating to any other claims, demands

and causes of actions hereinabove specified. Section 1542 of the California Civil Code provides:

“A general release does not extend to claims

that the creditor or releasing party does not know or suspect to exist in his or her favor at the time of executing the release and that,

if known by him or her, would have materially affected his or her settlement with the debtor or released party.”

Wang and the Company acknowledge that they may

hereafter discover claims or facts in addition to or different from those which they now know or believe to exist with respect to the

subject matter of this Agreement and which, if known or suspected at the time of executing this Agreement, might have materially affected

this settlement. Nonetheless, Wang and the Company hereby waive any right, claim or causes of action that might arise as a result of such

different or additional claims or facts. Wang and the Company hereby acknowledge that they understand the significance and consequence

of such release and such specific waiver of SECTION 1542 or any similar laws in any of the United States.

4.6 No Prior Assignment; Covenant

Not to Sue. No party to this Agreement has heretofore assigned, transferred, or granted, or purported to assign, transfer or grant,

any of the claims released pursuant to this Agreement. Each party hereby covenants not to sue the other with respect to any of the claims

that such party is releasing pursuant to this Agreement. Wang represents that she is the owner of the claims that she is releasing, and

shall indemnify, defend, and hold the Company Released Parties free and harmless from and against all claims, demands, and cause or causes

of action made or asserted by any other person, firm or entity purporting to be the owner of any claims, demands, and cause or causes

of action so released. The Company represents that it is the owner of the claims that it is releasing, and shall indemnify, defend, and

hold the Wang Released Parties free and harmless from and against all claims made or asserted by any other person, firm or entity purporting

to be the owner of any claims, demands, and cause or causes of action so released.

5. No Admission. The Company

and Wang understand and agree that neither this Agreement nor the consideration referenced herein is to be construed as an admission on

the part of the Company Released Parties or the Wang Released Parties, or any of them, of any liability or wrongdoing whatsoever and neither

this Agreement nor anything contained herein shall be admissible in any proceeding as evidence of or an admission by the Company Released

Parties or the Wang Released Parties, or any of them, of any liability or wrongdoing.

6. Confidentiality, Non-Solicitation

and Non-Disparagement Covenants. Wang agrees that it is reasonable and necessary for the protection of the goodwill and business

of the Company that Wang make the covenants contained in Sections 6.1 through 6.6 herein and that the Company is relying upon and is induced

by the agreements made by Wang in this Section 6.

6.1 Non-Solicitation. Wang

agrees that for a period ending one (1) year after the Termination Date:

| a. | Wang will not, either directly or indirectly, either for herself or for any other person, partnership,

firm, company, corporation or other entity, solicit any of the customers or suppliers of the Company. |

| b. | Wang will not solicit any employee of the Company to leave the employ of the Company for any reason whatsoever;

nor will Wang directly or indirectly aid, assist or abet any other person or entity in soliciting any employee of the Company, nor will

Wang otherwise interfere with any contractual or other business relationships between the Company and its employees. |

6.2 Confidentiality.

| a. | Confidential Information. From and after the Termination Date, Wang shall not, except as may be

required by applicable law or court order, disclose to others for use, whether directly or indirectly, any Confidential Information regarding

the Company. The term “Confidential Information” as used in this Agreement shall mean information about the Company, its Subsidiaries

and affiliates, and their respective clients, suppliers and customers that is not available to the general public or that does not otherwise

become available to the general public, and that was learned by Wang in the course of her employment by the Company, including, without

limitation, any data, formulae, recipes, methods, information, proprietary knowledge, trade secrets, client, supplier and customer lists,

and all papers, resumes, records and other documents containing such Confidential Information. Wang acknowledges that such Confidential

Information is specialized, unique in nature and of great value to the Company, and that such information gives the Company a competitive

advantage. |

| b. | Importance of Confidential Information. Wang acknowledges and agrees that the Company’s Confidential

Information is a valuable, special and unique asset of the Company which is extremely important in a highly competitive business such

as the Company’s. Wang acknowledges that the disclosure of any Confidential Information may cause substantial injury and loss to

the Company. Wang acknowledges that the Company retains a proprietary interest in its Confidential Information that persists beyond the

termination of Wang’s employment by the Company. |

| c. | Right to Company Materials. Wang agrees that all styles, designs, recipes, lists, materials, books,

files, reports, correspondence, records and other documents (“Company Material”) used, prepared, or made available to Wang,

shall be and shall remain the property of the Company. All Company Materials shall be returned to the Company in accordance with the provisions

of Section 3 of this Agreement, and Wang shall not make or retain any copies thereof other than as specifically permitted pursuant

to Section 3 of this Agreement. |

| d. | Confidentiality of this Agreement. Wang and the Company acknowledge and agree that unless and until

this Agreement is disclosed or filed with the United States Securities and Exchange Commission, its contents and the terms of this Agreement

are confidential, and agree not to disclose, publicize, or cause to be publicized, any of the terms or conditions of this Agreement (other

than the fact of the existence of this Agreement), and except as the Company and Wang may mutually agree in writing or as required by

judicial process or applicable law or to Wang’s immediate family, financial advisors or attorneys who shall be advised of this Agreement

and bound by it. Wang understands and agrees that the material terms of this Agreement may be required to be disclosed or filed as part

of the Company’s required filings pursuant to the requirements of the Securities Exchange Act of 1934, as amended. |

6.3 Non-Disparagement. Except

for statements of fact, internal Company communications relating to the performance of the Company, disclosures required under applicable

law or in connection with any legal proceedings with respect to which Wang is a party or witness, Wang will not make any disparaging remarks

regarding the Company at any time following execution of this Agreement. Except for statements of fact, internal communications relating

to the performance of Wang or termination of her employment, and disclosures required under applicable law or in connection with any legal

proceedings with respect to which the Company is a party or witness, the Company will not make any disparaging remarks regarding Wang

at any time following the termination of her employment with the Company.

6.4 Consideration for Covenants.

The covenants of Wang set forth in this Section 6 are made in consideration of the payments made, and other benefits given, to Wang

pursuant to this Agreement, the receipt, adequacy and sufficiency of which are acknowledged by Wang, and such covenants have been made

by Wang to induce the Company to enter into this Agreement.

6.5 Scope of Covenants; Judicial Modification.

It is specifically agreed and understood that because of the nature of the business and the fact that the Company has customers and clients

throughout the United States, the provisions of this Section 6 are reasonable. However, in furtherance of the provisions of this

Section 6 and subsections hereunder, Wang and the Company agree that in the event a court should decline to enforce all of the covenants

contained in this Section 6, or any part thereof, the other covenants and the remainder of any of the covenants so impaired shall

not thereby be affected and shall be given full effect, without regard to the invalid portions. If any court determines that any of the

covenants contained in this Section 6 or any parts thereof are unenforceable because of the duration or scope thereof, such court

shall have the power to reduce the duration or scope, as the case may be and such covenants shall then be enforceable in their reduced

form.

6.6 Compliance with Prior Covenants.

Wang represents, warrants and agrees that (i) prior to the Termination Date she had not breached any provisions of the Employment

Agreement in any material respect (the “Prior Covenants”), and (ii) any such material pre-Termination Date breach of

the Prior Covenants shall be deemed a breach of this Agreement and shall entitle the Company to seek the same remedies as would be available

with respect to a breach of Section 6 of this Agreement.

7. Material Breach.

7.1 Injunctive Relief.

In the event any party breaches any of the provisions, covenants or promises set forth in Sections 3, 4 and 6 or other provisions of this

Agreement, the injured party will be entitled, in addition to damages, to injunctive relief from a court of competent jurisdiction, enjoining

the party which committed the breach, or any of them, their agents, attorneys, and all others acting on her or its behalf from any further

disclosure or dissemination of information or any activity in breach of Sections 3, 4 and 6 of this Agreement.

7.2 Cessation of Severance Benefits

in Certain Circumstances. Notwithstanding anything to the contrary contained in this Agreement, in the event that Wang breaches

her obligations under this Agreement in any material respect, the Company shall give notice of such breach to Wang and, to the extent

that such breach is not cured by Wang (to the extent curable) to the reasonable satisfaction of the Company within ten (10) business

days of the date of such notice, the Company shall have the right to terminate making Separation Payments and cease providing any other

benefits or reimbursements to which Wang may otherwise be entitled to pursuant to the terms of this Agreement by giving three (3) business

days advance written notice of such termination.

8. Costs. Each party

shall bear her or its own costs and attorneys’ fees in connection with the negotiation and preparation of this Agreement.

9. Entire Agreement. This Agreement

contains the sole and entire agreement and understanding of the parties with respect to the entire subject matter hereof, and any and

all prior discussions, negotiations, commitments or understandings related thereto, if any are hereby merged herein and therein. No representations,

oral or otherwise, express or implied, other than those specifically referred to in this Agreement have been made by any party hereto.

No other agreements not specifically contained or referenced herein, oral or otherwise, shall be deemed to exist or to bind any of the

parties hereto.

10. Waiver, Modification and

Amendment. No provision hereof may be waived unless in writing signed by all parties hereto. Waiver of any one provision herein

shall not be deemed to be a waiver of any provision herein. This Agreement may be amended or modified only by a written agreement executed

by all of the parties hereto.

11. Binding on Parties.

This Agreement, and all the terms and provisions hereof, shall be binding on the parties and their respective heirs, legal representatives,

successors and assigns, and shall inure to the benefit of the parties and their respective heirs, legal representatives, successors and

assigns. The parties shall defend, indemnify and hold the other parties harmless from any claim or action brought by any third party related

to this Agreement or any claim or matter released herein.

12. Voluntary Agreement. This

Agreement in all respects has been voluntarily and knowingly executed by the parties after each party has had the opportunity to review

it with their respective legal counsel. Wang acknowledges and agrees that the Company has advised her to obtain counsel. All parties have

participated in the drafting of this Agreement. Accordingly, no rule of construction shall apply against any party or in favor of any

party, and any uncertainty or ambiguity shall not be interpreted against any party and in favor of another.

13. Acknowledgment.

Wang acknowledges that she has been given a reasonable period of time to study this Agreement before signing it. Wang certifies that she

has fully read, has received an explanation of, and completely understands the terms, nature and effect of this Agreement. Wang further

acknowledges that he is executing this Agreement freely, knowingly and voluntarily and that her execution of this Agreement is not the

result of any fraud, duress, mistake or undue influence whatsoever. In executing this Agreement, Wang does not rely on any inducements,

promises or representations by the Companies or any person other than the terms and conditions of this Agreement.

14. No Reliance. The

parties acknowledge that they have read this Agreement, that they are relying solely upon the contents of this Agreement, and are not

relying upon any other representations, warranties, or inducements whatsoever as an inducement to enter into this Agreement, other than

those referenced herein, and acknowledge that no representations, warranties, or covenants have been made which are not referenced in

this Agreement.

15. No Waiver. Failure

to insist on compliance with any term, covenant, or condition contained in this Agreement shall not be deemed a waiver of that term, covenant,

or condition, nor shall any waiver or relinquishment of any right or power contained in this Agreement at any one time or more times be

deemed a waiver or relinquishment of any right or power at any other time or times.

16. Governing Law; Arbitration.

This Agreement shall be construed and enforced in accordance with the laws of the State of California. Except as provided herein, any

controversy or claim arising out of or relating in any way to this Agreement or the breach thereof, or Wang’s termination as an

employee, officer of the Company or its Subsidiaries and any statutory claims including all claims of employment discrimination shall

be subject to private and confidential arbitration in San Bernardino County, California in accordance with the laws of the State of California.

The arbitration shall be conducted in a procedurally fair manner by a mutually agreed upon neutral arbitrator selected in accordance with

the National Rules for the Resolution of Employment Disputes (“Rules”) of the American Arbitration Association or if none

can be mutually agreed upon, then by one arbitrator appointed pursuant to the Rules. The arbitration shall be conducted confidentially

in accordance with the Rules. The arbitration fees shall be equally shared by both parties. Each party shall have the right to conduct

discovery including depositions, requests for production of documents and such other discovery as permitted under the Rules or ordered

by the arbitrator. The statute of limitations or any cause of action shall be that prescribed by law. The arbitrator shall have the authority

to award any damages authorized by law for the claims presented including punitive damages and shall have the authority to award reasonable

attorneys fees to the prevailing party in accordance with applicable law. The decision of the arbitrator shall be final and binding on

all parties and shall be the exclusive remedy of the parties. The award shall be in writing in accordance with the Rules, and shall be

subject to judicial enforcement in accordance with California law. Notwithstanding anything to the contrary contained in this Section 16,

nothing herein shall prevent or restrict the Company or Wang from seeking provisional injunctive relief from any forum having competent

jurisdiction over the parties.

17. Severability. Should

any portion, word, clause, phrase, sentence or paragraph of this Agreement be declared void or unenforceable, such portion shall be considered

independent of and severable from the remainder, the validity of which shall remain unaffected.

18. Titles and Captions.

Paragraph titles or captions contained in this Agreement are inserted only as a matter of convenience and for reference and in no way

define, limit, extend or describe the scope of this Agreement or the intent of any provisions hereof.

19. Counterparts. This Agreement

may be executed in counterparts, and when each party has signed and delivered at least one such counterpart, each counterpart shall be

deemed an original, and, when taken together with the other signed counterparts, shall constitute one agreement, which shall be binding

and effective as to the parties. This Agreement shall be effective on the date last executed by one of the parties hereto if so executed

in counterparts.

20. Further Assurances; Cooperation

in Litigation. Wang hereby agrees that from time to time at the reasonable request of the Company, and without further consideration,

Wang will (i) execute and deliver such additional instruments and take such other actions as the Company may reasonably require to

carry out the terms of this Agreement, including, without limitation, the execution of a form of intellectual property assignment and

inventions agreement confirming and evidencing that Wang has no rights, claim or interest in or to any intellectual property assets used

or under development by the Company and that any such rights have been assigned to the Company, (ii) cooperate with the Company in

connection with preparing for, defending, and testifying in connection with any pending or future litigation or other proceeding or dispute

between any of the Company and any third party, and (iii) cooperate with the Company in connection with any financial audit of the

Company.

21. Revocation. Wang

will have the right for a period of up to, but not to exceed, seven (7) days from the date on which she signs this Agreement to revoke

it (the “Revocation Period”) by furnishing written notice of such revocation which must be delivered to the Company, prior

to midnight on the seventh day in accordance with Section 22 of this Agreement. This Agreement will not become effective or enforceable

until the expiration of the Revocation Period. No Separation Payments will be paid until ten days after the expiration of the Revocation

Period.

22. Notice. For the

purpose of this Agreement, notices and all other communications provided for in this Agreement shall be in writing and shall be deemed

to have been duly given when delivered or when mailed by United States certified or registered mail, return receipt requested, postage

prepaid, addressed to the respective addresses set forth below, or to such other addresses as either party may have furnished to the other

in writing in accordance herewith, exception that notice of a change of address shall be effective only upon actual receipt:

| Company: |

|

Karat Packaging, Inc. |

| |

|

6185 Kimball Avenue |

| |

|

Chino, CA 91708 |

| |

|

Attention: Human Resources |

| |

|

| Wang: |

|

Joanne Tzu-Jung Wang |

| |

|

|

| |

|

|

| |

|

|

PLEASE READ THIS AGREEMENT CAREFULLY. THIS

SEPARATION AGREEMENT AND GENERAL RELEASE INCLUDES A RELEASE OF ALL KNOWN AND UNKNOWN CLAIMS.

IN WITNESS WHEREOF, the parties have executed

this Agreement on the date first set forth above.

| KARAT PACKAGING, Inc. |

|

JOANNE TZU-JUNG WANG |

| |

|

|

| By: |

/s/ Alan Yu |

|

Signature: |

/s/ Joanne Wang |

| Name: |

Alan Yu |

|

|

| Title: |

Chief Executive Officer |

|

|

| Date: |

August 30, 2023 |

|

Date: |

August 30, 2023 |

14

Exhibit

99.1

Karat

Packaging’s COO/Director to Retire;

Company

Appoints Chief Revenue Officer

CHINO,

Calif., Aug. 31, 2023 –Karat Packaging Inc. (Nasdaq: KRT) (the “Company” or “Karat”), a specialty

distributor and manufacturer of disposable foodservice products and related items, today announced that its Chief Operating Officer,

Joanne Wang, will retire as an officer effective December 1, 2023. Wang also will relinquish her seat on the Company’s five-person

board, which will remain vacant until a successor is appointed.

“Joanne

was among Karat’s first employees and played an instrumental role in the Company’s growth and development over the past twenty-plus

years,” said Alan Yu, Chief Executive Officer. “Joanne’s dedication, mentorship, and distinguished contribution will

always be appreciated and remembered. We wish her well in her future endeavors.

Karat

also announced the appointment of Daniel Quire as Chief Revenue Officer, a newly created position. Quire most recently was the Company’s

Vice President of Sales, with more than a decade of sales management experience in the foodservice sector. Previously, Quire was with

Bunzl Distribution N.A. for over 10 years, most recently as Sales Manager.

“Daniel

has been an integral part of the Company’s growth since joining Karat in 2018. As we continue to implement our strategic initiatives

to reduce our manufacturing footprint in California and increase import items, Joanne’s operational duties will be divided among

several key team members, focusing on manufacturing in Texas and distribution centers nationwide, as well as technology advancement for

our business operations.” Yu added.

About

Karat Packaging Inc.

Karat

Packaging Inc. is a specialty distributor and manufacturer of a wide range of disposable foodservice products and related items, primarily

used by national and regional restaurants and in foodservice settings throughout the United States. Its products include food and take-out

containers, bags, tableware, cups, lids, cutlery, straws, specialty beverage ingredients, equipment, gloves and other products. The company’s

eco-friendly Karat Earth® line offers quality, sustainably focused products that are made from renewable resources. Karat Packaging

also offers customized solutions, including new product development and design, printing, and logistics services. To learn more about

Karat Packaging, please visit the company’s website at www.karatpackaging.com.

Investor

Relations and Media Contacts:

PondelWilkinson

Inc.

Judy

Lin/Roger Pondel

310-279-5980

ir@karatpackaging.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

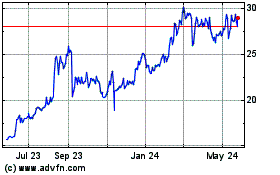

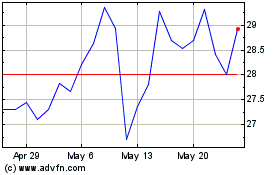

Karat Packaging (NASDAQ:KRT)

Historical Stock Chart

From Apr 2024 to May 2024

Karat Packaging (NASDAQ:KRT)

Historical Stock Chart

From May 2023 to May 2024