0000932696false00009326962024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 15, 2024

INSIGHT ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

_____________________________

| | | | | | | | | | | | | | | | | |

| Delaware | | 0-25092 | | 86-0766246 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

| 2701 East Insight Way, | | | | |

| Chandler, | Arizona | | | | 85286 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number, including area code:

(480) 333-3000

Not Applicable

(Former name or former address, if changed since last report)

_____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.01 | | NSIT | | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 15, 2024, Insight Enterprises, Inc. announced by press release its results of operations for the fourth quarter and full year ended December 31, 2023. A copy of the press release and accompanying investor presentation are attached hereto as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein. The information disclosed under this Item 2.02, including Exhibits 99.1 and 99.2 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | Insight Enterprises, Inc. |

| | | | |

| Date: | February 15, 2024 | By: | | /s/ Rachael A. Crump |

| | | | Rachael A. Crump |

| | | | Chief Accounting Officer |

| | | | | |

| FOR IMMEDIATE RELEASE | NASDAQ: NSIT |

INSIGHT ENTERPRISES, INC. REPORTS

FOURTH QUARTER AND FULL YEAR RESULTS

Strong execution leads to record gross margin

for the fourth quarter and full year

CHANDLER, AZ – February 15, 2024 – Insight Enterprises, Inc. (NASDAQ: NSIT) (the “Company”) today reported financial results for the quarter and full year ended December 31, 2023. Highlights include:

•Gross profit increased 4% year over year to $436.2 million with gross margin expanding 270 basis points to a record 19.5% for the fourth quarter and up 2% for the full year

•Insight Core Services gross profit grew 7% year over year for the fourth quarter and up 8% for the full year

•Cloud gross profit grew 43% year over year for the fourth quarter and up 26% for the full year

•Earnings from operations increased 16% year over year to $131.9 million for the fourth quarter and up 1% for the full year

•Adjusted earnings from operations increased 16% year over year to $148.7 million for the fourth quarter and up 5% for the full year

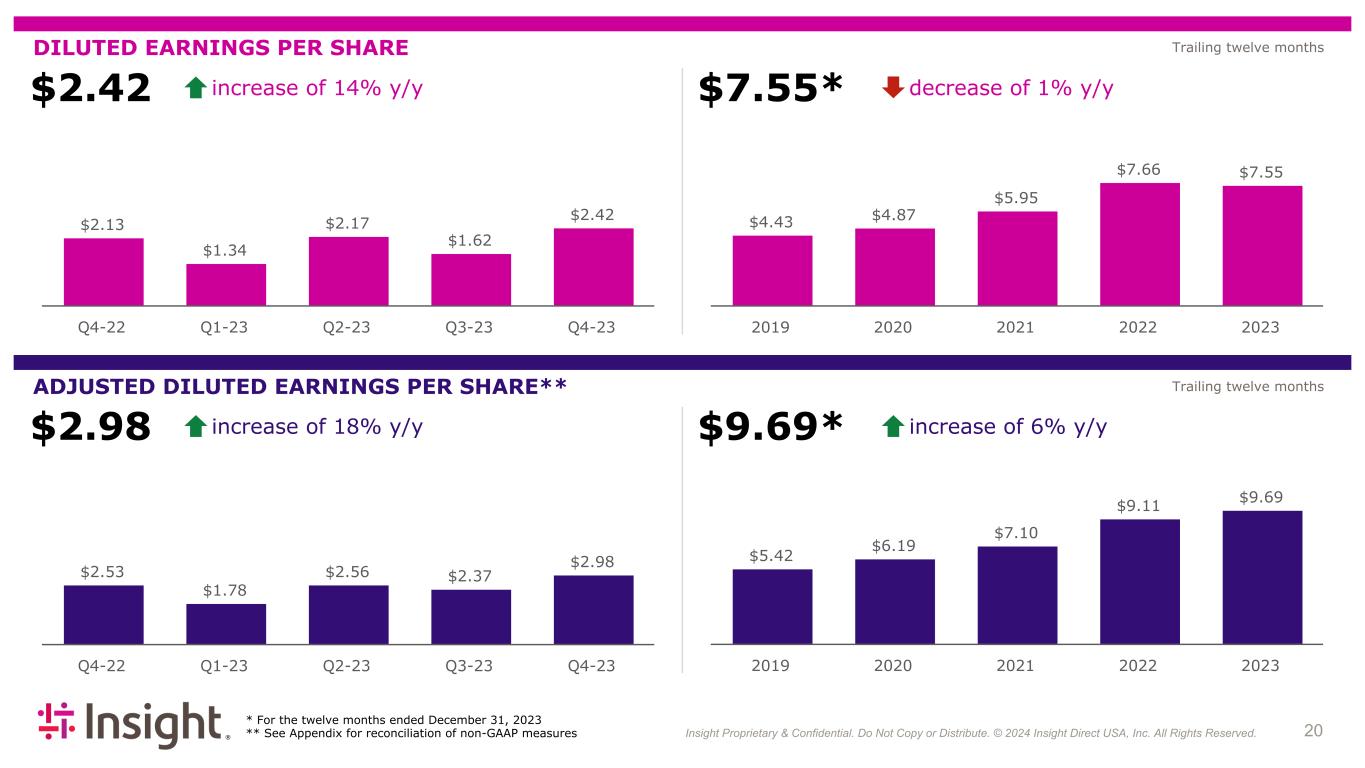

•Diluted earnings per share of $2.42 increased 14% year over year for the fourth quarter and decreased 1% for the full year

•Adjusted diluted earnings per share of $2.98 increased 18% year over year for the fourth quarter and of $9.69 increased 6% for the full year

•Cash flows provided by operating activities were $205.8 million for the fourth quarter and $619.5 million for the full year

In the fourth quarter of 2023, net sales were down 11%, year to year, while gross profit increased 4%. Gross margin expanded 270 basis points compared to the fourth quarter of 2022 to a record 19.5%. Earnings from operations of $131.9 million increased 16% compared to $114.0 million in the fourth quarter of 2022. Adjusted earnings from operations of $148.7 million increased 16% compared to $128.3 million in the fourth quarter of 2022. Consolidated net earnings were $90.6 million, or 4.1% of net sales, in the fourth quarter of 2023, and adjusted consolidated net earnings were $103.1 million or 4.6% of net sales. Diluted earnings per share for the quarter was $2.42, up 14%, year over year, and Adjusted diluted earnings per share was a quarterly record $2.98, up 18%, year over year.

“In the fourth quarter, we achieved gross profit growth of 4% and impressive adjusted diluted earnings per share growth of 18%, strengthened by acquisitions we made in the second half of the year,” stated Joyce Mullen, President and Chief Executive Officer. “We continued to see strength in cloud and services gross profit, which offset a decline in gross profit from hardware,” Mullen stated.

For the full year 2023, net sales decreased 12%, year to year, to $9.2 billion. Gross profit increased 2% while gross margin of 18.2% expanded 250 basis points compared to the prior year. Earnings from operations of $419.8 million increased 1% compared to $413.7 million in 2022. Adjusted earnings from operations of $492.1 million increased 5% compared to $466.6 million in 2022. Diluted earnings per share for the full year 2023 was $7.55, down 1%, year to year. Adjusted diluted earnings per share was a full year record $9.69, up 6%, year over year.

“We made critical shifts in our operational model to position us well for the future as a solutions integrator,” stated Mullen. “In a tough year from a demand perspective, we achieved record gross margin of 18.2% driven by 26% growth in cloud gross profit and 8% growth in Insight Core Services gross profit. We also generated record cash flows from operating activities of $620 million and record Adjusted diluted earnings per share of $9.69 for the year” stated Mullen.

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

KEY HIGHLIGHTS

Results for the Quarter:

•Consolidated net sales for the fourth quarter of 2023 of $2.2 billion decreased 11%, year to year, when compared to the fourth quarter of 2022. Product net sales decreased 14%, year to year, and services net sales increased 6%, year over year.

•Net sales in North America decreased 14%, year to year, to $1.8 billion;

◦Product net sales decreased 16%, year to year, to $1.5 billion;

◦Services net sales increased 2%, year over year, to $318.6 million;

•Net sales in EMEA increased 4%, year over year, to $390.5 million; and

•Net sales in APAC increased 1%, year over year, to $55.1 million.

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated net sales decreased 11%, year to year, with declines in net sales in North America and EMEA of 14% and 1%, year to year, respectively, partially offset by an increase in net sales in APAC of 1%, year over year.

•Consolidated gross profit increased 4% compared to the fourth quarter of 2022 to $436.2 million, with consolidated gross margin expanding 270 basis points to a record 19.5% of net sales. Product gross profit decreased 9%, year to year, and services gross profit increased 16%, year over year. Cloud gross profit grew 43%, year over year, and Insight Core Services gross profit increased 7%, year over year. By segment, gross profit:

•increased 2% in North America, year over year, to $353.8 million (19.8% gross margin);

•increased 10% in EMEA, year over year, to $67.3 million (17.2% gross margin); and

•increased 6% in APAC, year over year, to $15.0 million (27.2% gross margin).

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated gross profit was up 3%, year over year, with gross profit growth in North America, EMEA and APAC of 2%, 5% and 7%, respectively, year over year.

•Consolidated earnings from operations increased 16% compared to the fourth quarter of 2022 to $131.9 million, or 5.9% of net sales. By segment, earnings from operations:

•increased 18% in North America, year over year, to $117.4 million, or 6.6% of net sales;

•decreased 8% in EMEA, year to year, to $9.9 million, or 2.5% of net sales; and

•increased 16% in APAC, year over year, to $4.6 million, or 8.3% of net sales.

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated earnings from operations were up 16%, year over year, with increased earnings from operations in North America and APAC of 18% and 17%, year over year, respectively, partially offset by a decrease in earnings from operations in EMEA of 8%, year to year.

•Adjusted earnings from operations increased 16% compared to the fourth quarter of 2022 to $148.7 million, or 6.6% of net sales. By segment, adjusted earnings from operations:

•increased 17% in North America, year over year, to $131.7 million, or 7.4% of net sales;

•increased 3% in EMEA, year over year, to $12.1 million, or 3.1% of net sales; and

•increased 15% in APAC, year over year, to $4.8 million, or 8.7% of net sales.

•Excluding the effects of fluctuating foreign currency exchange rates, Adjusted consolidated earnings from operations were up 16%, year over year, with increased Adjusted earnings from operations in North America, EMEA and APAC of 17%, 2% and 16%, respectively, year over year.

•Consolidated net earnings and diluted earnings per share for the fourth quarter of 2023 were $90.6 million and $2.42, respectively, at an effective tax rate of 25.8%.

•Adjusted consolidated net earnings and Adjusted diluted earnings per share for the fourth quarter of 2023 were $103.1 million and $2.98, respectively. Excluding the effects of fluctuating foreign currency exchange rates, Adjusted diluted earnings per share increased 18% year over year.

Results for the Year:

•Consolidated net sales of $9.2 billion for 2023 decreased 12%, year to year, when compared to 2022.

•Net sales in North America decreased 13%, year to year, to $7.4 billion;

◦Product net sales decreased 15%, year to year, to $6.2 billion;

◦Services net sales increased 2%, year over year, to $1.2 billion;

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

•Net sales in EMEA decreased 9%, year to year, to $1.6 billion; and

•Net sales in APAC decreased 2%, year to year, to $229.8 million.

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated net sales decreased 12%, year to year, with declines in net sales in North America and EMEA of 13% and 9%, year to year, respectively, partially offset by an increase in net sales in APAC of 1%.

•Consolidated gross profit increased 2% compared to 2022 to $1.7 billion, with consolidated gross margin expanding 250 basis points to 18.2% of net sales. Product gross profit decreased 8%, year to year, and services gross profit increased 12%, year over year. Cloud gross profit grew 26%, year over year, and Insight core services gross profit increased 8%, year over year. By segment, gross profit:

•increased 1% in North America, year over year, to $1.3 billion (18.2% gross margin);

•increased 5% in EMEA, year over year, to $260.0 million (16.6% gross margin); and

•increased 4% in APAC, year over year, to $63.6 million (27.7% gross margin).

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated gross profit was up 2%, year over year, with gross profit growth in North America, EMEA and APAC of 2%, 4% and 8%, respectively, year over year.

•Consolidated earnings from operations increased 1% compared to the full year of 2022 to $419.8 million, or 4.6% of net sales. By segment, earnings from operations:

•increased 3% in North America, year over year, to $362.1 million, or 4.9% of net sales;

•decreased 14% in EMEA, year to year, to $38.1 million, or 2.4% of net sales; and

•increased 3% in APAC, year over year, to $19.6 million, or 8.5% of net sales.

•Excluding the effects of fluctuating foreign currency exchange rates, consolidated earnings from operations were up 2%, year over year, with increased earnings from operations in North America and APAC of 4% and 6%, year over year, respectively, partially offset by a decrease in earnings from operations in EMEA of 14%, year to year.

•Adjusted earnings from operations increased 5% compared to the full year of 2022 to $492.1 million, or 5.4% of net sales. By segment, adjusted earnings from operations:

•increased 6% in North America, year over year, to $424.4 million, or 5.7% of net sales;

•decreased 1% in EMEA, year to year, to $47.6 million, or 3.0% of net sales; and

•increased 3% in APAC, year over year, to $20.2 million, or 8.8% of net sales.

•Excluding the effects of fluctuating foreign currency exchange rates, Adjusted consolidated earnings from operations were up 6%, year over year, with increased Adjusted earnings from operations in North America and APAC of 7% and 6%, year over year, respectively, partially offset by a decrease in Adjusted earnings from operations in EMEA of 1%, year to year.

•Consolidated net earnings and diluted earnings per share for the full year of 2023 were $281.3 million and $7.55, respectively, at an effective tax rate of 25.6%.

•Adjusted consolidated net earnings and Adjusted diluted earnings per share for the full year of 2023 were $335.6 million and $9.69, respectively. Excluding the effects of fluctuating foreign currency exchange rates, Adjusted diluted earnings per share increased 7% year over year.

In discussing financial results for the three and twelve months ended December 31, 2023 and 2022 in this press release, the Company refers to certain financial measures that are adjusted from the financial results prepared in accordance with United States generally accepted accounting principles (“GAAP”). When referring to non-GAAP measures, the Company refers to them as “Adjusted.” See “Use of Non-GAAP Financial Measures” for additional information. A tabular reconciliation of financial measures prepared in accordance with GAAP to the non-GAAP financial measures is included at the end of this press release.

In some instances, the Company refers to changes in net sales, gross profit, earnings from operations and Adjusted earnings from operations on a consolidated basis and in North America, EMEA and APAC excluding the effects of fluctuating foreign currency exchange rates. In addition, the Company refers to changes in Adjusted diluted earnings per share on a consolidated basis excluding the effects of fluctuating foreign currency exchange rates. In computing these changes and percentages, the Company compares the current year amount as translated into U.S. dollars under the applicable accounting standards to the prior year amount in local currency translated into U.S. dollars utilizing the weighted average translation rate for the current period.

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

The tax effect of Adjusted amounts referenced herein were computed using the statutory tax rate for the taxing jurisdictions in the operating segment in which the related expenses were recorded, adjusted for the effects of valuation allowances on net operating losses in certain jurisdictions.

GUIDANCE

For the full year 2024, the Company expects Adjusted diluted earnings per share to be between $10.50 and $10.80. We expect to deliver gross profit growth in the mid to high teens and expect that our gross margin will be approximately 19%. We expect that operating expenses will grow at a higher rate than gross profit.

This outlook assumes:

•interest expense of $40 to $42 million;

•an effective tax rate of 26% for the full year;

•capital expenditures of $50 to $55 million; and

•an average share count for the full year of 35.2 million shares.

This outlook excludes acquisition-related intangibles amortization expense of approximately $60 million, assumes no acquisition or integration related expenses, transformation or severance and restructuring expenses, net and no significant change in our debt instruments or the macroeconomic environment. Due to the inherent difficulty of forecasting some of these types of expenses, which impact net earnings, diluted earnings per share and selling and administrative expenses, the Company is unable to reasonably estimate the impact of such expenses, if any, to net earnings, diluted earnings per share and selling and administrative expenses. Accordingly, the Company is unable to provide a reconciliation of GAAP to non-GAAP diluted earnings per share for the full year 2024 forecast.

CONFERENCE CALL AND WEBCAST

The Company will host a conference call and live webcast today at 9:00 a.m. ET to discuss fourth quarter and full year 2023 results of operations. A live webcast of the conference call (in listen-only mode) will be available on the Company’s web site at http://investor.insight.com/, and a replay of the webcast will be available on the Company’s web site for a limited time following the call. To access the live conference call, please register in advance using the event link on the Company's web site. Upon registering, participants will receive dial-in information via email, as well as a unique registrant ID, event passcode, and detailed instructions regarding how to join the call.

USE OF NON-GAAP FINANCIAL MEASURES

The non-GAAP financial measures are referred to as “Adjusted”. Adjusted earnings from operations, Adjusted net earnings and Adjusted diluted earnings per share exclude (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration related expenses, (vi) certain third-party data center service outage related expenses and recoveries, and (vii) the tax effects of each of these items, as applicable. Transformation costs represent costs we are incurring to transform our business, to help us achieve our strategic objectives, including becoming a leading solutions integrator. The Company excludes these items when internally evaluating earnings from operations, tax expense, net earnings and diluted earnings per share for the Company and earnings from operations for each of the Company’s operating segments. Adjusted diluted earnings per share also includes the impact of the benefit from the note hedge where the Company’s average stock price for the fourth quarter of 2023 was in excess of $68.32, which is the initial conversion price of the convertible senior notes. Adjusted EBITDA excludes (i) interest expense, (ii) income tax expense, (iii) depreciation and amortization of property and equipment, (iv) amortization of intangible assets, (v) severance and restructuring expenses, net, (vi) certain executive recruitment and hiring related expenses, (vii) transformation costs (viii) certain acquisition and integration related expenses, and (ix) certain third-party data center service outage related expenses and recoveries. Adjusted return on invested capital (“ROIC”) excludes (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration related expenses, (vi) certain third-party data center service outage related expenses and recoveries, and (vii) the tax effects of each of these items, as applicable.

These non-GAAP measures are used by the Company and its management to evaluate financial performance against budgeted amounts, to calculate incentive compensation, to assist in forecasting future performance and to compare the Company’s results to those of the Company’s competitors. The Company believes that

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

these non-GAAP financial measures are useful to investors because they allow for greater transparency, facilitate comparisons to prior periods and the Company’s competitors’ results and assist in forecasting performance for future periods. These non-GAAP financial measures are not prepared in accordance with GAAP and may be different from non-GAAP financial measures presented by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP.

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

FINANCIAL SUMMARY TABLE

(DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | | | | | | | | | |

| | | | | | | | 2023 | | 2022 | | change | | 2023 | | 2022 | | change | | | | | | | | | | |

| Insight Enterprises, Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Products | | | | | | | | $ | 1,827,980 | | $ | 2,119,061 | | (14%) | | $ | 7,631,388 | | $ | 8,947,787 | | (15%) | | | | | | | | | | |

| Services | | | | | | | | $ | 408,031 | | $ | 383,549 | | 6% | | $ | 1,544,452 | | $ | 1,483,404 | | 4% | | | | | | | | | | |

| Total net sales | | | | | | | | $ | 2,236,011 | | $ | 2,502,610 | | (11%) | | $ | 9,175,840 | | $ | 10,431,191 | | (12%) | | | | | | | | | | |

| Gross profit | | | | | | | | $ | 436,150 | | $ | 420,559 | | 4% | | $ | 1,669,525 | | $ | 1,636,567 | | 2% | | | | | | | | | | |

| Gross margin | | | | | | | | 19.5% | | 16.8% | | 270 bps | | 18.2% | | 15.7% | | 250 bps | | | | | | | | | | |

| Selling and administrative expenses | | | | | | | | $ | 298,206 | | $ | 304,766 | | (2%) | | $ | 1,236,243 | | $ | 1,216,660 | | 2% | | | | | | | | | | |

| Severance and restructuring expenses, net | | | | | | | | $ | 3,136 | | $ | 1,451 | | > 100% | | $ | 6,091 | | $ | 4,235 | | 44% | | | | | | | | | | |

| Acquisition and integration related expenses | | | | | | | | $ | 2,947 | | $ | 326 | | > 100% | | $ | 7,396 | | $ | 1,972 | | > 100% | | | | | | | | | | |

| Earnings from operations | | | | | | | | $ | 131,861 | | $ | 114,016 | | 16% | | $ | 419,795 | | $ | 413,700 | | 1% | | | | | | | | | | |

| Net earnings | | | | | | | | $ | 90,608 | | $ | 77,477 | | 17% | | $ | 281,309 | | $ | 280,608 | | —% | | | | | | | | | | |

| Diluted earnings per share | | | | | | | | $ | 2.42 | | $ | 2.13 | | 14% | | $ | 7.55 | | $ | 7.66 | | (1%) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| North America | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Products | | | | | | | | $ | 1,471,761 | | $ | 1,760,826 | | (16%) | | $ | 6,167,512 | | $ | 7,291,301 | | (15%) | | | | | | | | | | |

| Services | | | | | | | | $ | 318,591 | | $ | 311,780 | | 2% | | $ | 1,214,842 | | $ | 1,193,091 | | 2% | | | | | | | | | | |

| Total net sales | | | | | | | | $ | 1,790,352 | | $ | 2,072,606 | | (14%) | | $ | 7,382,354 | | $ | 8,484,392 | | (13%) | | | | | | | | | | |

| Gross profit | | | | | | | | $ | 353,812 | | $ | 345,287 | | 2% | | $ | 1,345,955 | | $ | 1,328,333 | | 1% | | | | | | | | | | |

| Gross margin | | | | | | | | 19.8% | | 16.7% | | 310 bps | | 18.2% | | 15.7% | | 250 bps | | | | | | | | | | |

| Selling and administrative expenses | | | | | | | | $ | 230,913 | | $ | 244,965 | | (6%) | | $ | 976,172 | | $ | 973,798 | | —% | | | | | | | | | | |

| Severance and restructuring expenses, net | | | | | | | | $ | 2,741 | | $ | 912 | | > 100% | | $ | 3,793 | | $ | 2,384 | | 59% | | | | | | | | | | |

| Acquisition and integration related expenses | | | | | | | | $ | 2,781 | | $ | 69 | | > 100% | | $ | 3,908 | | $ | 1,715 | | >100% | | | | | | | | | | |

| Earnings from operations | | | | | | | | $ | 117,377 | | $ | 99,341 | | 18% | | $ | 362,082 | | $ | 350,436 | | 3% | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales Mix | | | | | | | | | | | | ** | | | | | | ** | | | | | | | | | | |

| Hardware | | | | | | | | 57 | % | | 64 | % | | (23%) | | 61 | % | | 68 | % | | (22%) | | | | | | | | | | |

| Software | | | | | | | | 25 | % | | 21 | % | | 2% | | 23 | % | | 18 | % | | 7% | | | | | | | | | | |

| Services | | | | | | | | 18 | % | | 15 | % | | 2% | | 16 | % | | 14 | % | | 2% | | | | | | | | | | |

| | | | | | | | 100 | % | | 100 | % | | (14%) | | 100 | % | | 100 | % | | (13%) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EMEA | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Products | | | | | | | | $ | 325,122 | | $ | 324,625 | | —% | | $ | 1,331,338 | | $ | 1,511,897 | | (12%) | | | | | | | | | | |

| Services | | | | | | | | $ | 65,406 | | $ | 50,558 | | 29% | | $ | 232,316 | | $ | 200,624 | | 16% | | | | | | | | | | |

| Total net sales | | | | | | | | $ | 390,528 | | $ | 375,183 | | 4% | | $ | 1,563,654 | | $ | 1,712,521 | | (9%) | | | | | | | | | | |

| Gross profit | | | | | | | | $ | 67,343 | | $ | 61,180 | | 10% | | $ | 259,987 | | $ | 247,269 | | 5% | | | | | | | | | | |

| Gross margin | | | | | | | | 17.2% | | 16.3% | | 90 bps | | 16.6% | | 14.4% | | 220 bps | | | | | | | | | | |

| Selling and administrative expenses | | | | | | | | $ | 56,993 | | $ | 49,763 | | 15% | | $ | 216,246 | | $ | 200,988 | | 8% | | | | | | | | | | |

| Severance and restructuring expenses, net | | | | | | | | $ | 285 | | $ | 450 | | (37%) | | $ | 2,125 | | $ | 1,760 | | 21% | | | | | | | | | | |

| Acquisition and integration related expenses | | | | | | | | $ | 166 | | $ | 257 | | (35%) | | $ | 3,488 | | $ | 257 | | >100% | | | | | | | | | | |

| Earnings from operations | | | | | | | | $ | 9,899 | | $ | 10,710 | | (8%) | | $ | 38,128 | | $ | 44,264 | | (14%) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales Mix | | | | | | | | | | | | ** | | | | | | ** | | | | | | | | | | |

| Hardware | | | | | | | | 29 | % | | 37 | % | | (16%) | | 35 | % | | 38 | % | | (16%) | | | | | | | | | | |

| Software | | | | | | | | 54 | % | | 50 | % | | 12% | | 50 | % | | 50 | % | | (8%) | | | | | | | | | | |

| Services | | | | | | | | 17 | % | | 13 | % | | 29% | | 15 | % | | 12 | % | | 16% | | | | | | | | | | |

| | | | | | | | 100 | % | | 100 | % | | 4% | | 100 | % | | 100 | % | | (9%) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

FINANCIAL SUMMARY TABLE (CONTINUED)

(DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | | | | | | | | | |

| | | | | | | | 2023 | | 2022 | | change | | 2023 | | 2022 | | change | | | | | | | | | | |

| APAC | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net sales: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Products | | | | | | | | $ | 31,097 | | $ | 33,610 | | (7%) | | $ | 132,538 | | $ | 144,589 | | (8%) | | | | | | | | | | |

| Services | | | | | | | | $ | 24,034 | | $ | 21,211 | | 13% | | $ | 97,294 | | $ | 89,689 | | 8% | | | | | | | | | | |

| Total net sales | | | | | | | | $ | 55,131 | | $ | 54,821 | | 1% | | $ | 229,832 | | $ | 234,278 | | (2%) | | | | | | | | | | |

| Gross profit | | | | | | | | $ | 14,995 | | $ | 14,092 | | 6% | | $ | 63,583 | | $ | 60,965 | | 4% | | | | | | | | | | |

| Gross margin | | | | | | | | 27.2% | | 25.7% | | 150 bps | | 27.7% | | 26.0% | | 170 bps | | | | | | | | | | |

| Selling and administrative expenses | | | | | | | | $ | 10,300 | | $ | 10,038 | | 3% | | $ | 43,825 | | $ | 41,874 | | 5% | | | | | | | | | | |

| Severance and restructuring expenses | | | | | | | | $ | 110 | | $ | 89 | | 24% | | $ | 173 | | $ | 91 | | 90% | | | | | | | | | | |

| Earnings from operations | | | | | | | | $ | 4,585 | | $ | 3,965 | | 16% | | $ | 19,585 | | $ | 19,000 | | 3% | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales Mix | | | | | | | | | | | | ** | | | | | | ** | | | | | | | | | | |

| Hardware | | | | | | | | 18 | % | | 24 | % | | (28%) | | 19 | % | | 25 | % | | (24)% | | | | | | | | | | |

| Software | | | | | | | | 39 | % | | 37 | % | | 6% | | 39 | % | | 37 | % | | 2% | | | | | | | | | | |

| Services | | | | | | | | 43 | % | | 39 | % | | 13% | | 42 | % | | 38 | % | | 8% | | | | | | | | | | |

| | | | | | | | 100 | % | | 100 | % | | 1% | | 100 | % | | 100 | % | | (2%) | | | | | | | | | | |

** Change in sales mix represents growth/decline in category net sales on a U.S. dollar basis and does not exclude the effects of fluctuating foreign currency exchange rates

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

FORWARD-LOOKING INFORMATION

Certain statements in this release and the related conference call, webcast and presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, including those related to the impact of inflation and higher interest rates, the Company’s future financial performance and results of operations, including gross profit growth, Adjusted diluted earnings per share, and Adjusted selling and administrative expenses, as well as the Company’s other key performance indicators, the Company’s expectation that operating expenses will grow at a higher rate than gross profit for 2024, the Company’s anticipated effective tax rate, capital expenditures, and expected average share count, the Company’s expectation that the majority of holders of our convertible senior notes (the “Notes”) will not opt to convert their Notes early, the Company’s expectations regarding cash flow, the Company’s expectations regarding supply constraints and shipment of backlog, future trends in the IT market, the Company’s business strategy and strategic initiatives, which are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. There can be no assurances that the results discussed by the forward-looking statements will be achieved, and actual results may differ materially from those set forth in the forward-looking statements. Some of the important factors that could cause the Company’s actual results to differ materially from those projected in any forward-looking statements include, but are not limited to, the following, which are discussed in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” sections of the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings with the SEC:

•actions of our competitors, including manufacturers and publishers of products we sell;

•our reliance on our partners for product availability, competitive products to sell and marketing funds and purchasing incentives, which can change significantly in the amounts made available and in the requirements year over year;

•our ability to keep pace with rapidly evolving technological advances and the evolving competitive marketplace;

•general economic conditions, economic uncertainties and changes in geopolitical conditions, including the possibility of a recession or as a result of the ongoing conflicts in Ukraine and Gaza;

•changes in the IT industry and/or rapid changes in technology;

•our ability to provide high quality services to our clients;

•our reliance on independent shipping companies;

•the risks associated with our international operations;

•supply constraints for products;

•natural disasters or other adverse occurrences, including public health issues such as pandemics or epidemics;

•disruptions in our IT systems and voice and data networks;

•cyberattacks, outages, or third-party breaches of data privacy as well as related breaches of government regulations;

•intellectual property infringement claims and challenges to our patents, registered trademarks and trade names;

•potential liability and competitive risk based on the development, adoption, and use of Generative Artificial Intelligence;

•legal proceedings, client audits and failure to comply with laws and regulations;

•risks of termination, delays in payment, audits and investigations related to our public sector contracts;

•exposure to changes in, interpretations of, or enforcement trends related to tax rules and regulations;

•our potential to draw down a substantial amount of indebtedness;

•the conditional conversion feature of the Notes, which has been triggered, and may adversely affect the Company’s financial condition and operating results;

•the Company is subject to counterparty risk with respect to certain hedge and warrant transactions entered into in connection with the issuance of the Notes (the "Call Spread Transactions");

•increased debt and interest expense and the possibility of decreased availability of funds under our financing facilities;

•possible significant fluctuations in our future operating results as well as seasonality and variability in client demands;

•potential contractual disputes with our clients and third-party suppliers;

•our dependence on certain key personnel and our ability to attract, train and retain skilled teammates;

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

•risks associated with the integration and operation of acquired businesses, including achievement of expected synergies and benefits; and

•future sales of the Company’s common stock or equity-linked securities in the public market could lower the market price for our common stock.

Additionally, there may be other risks that are otherwise described from time to time in the reports that the Company files with the SEC. Any forward-looking statements in this release, the related conference call, webcast and presentation speak only as of the date on which they are made and should be considered in light of various important factors, including the risks and uncertainties listed above, as well as others. The Company assumes no obligation to update, and, except as may be required by law, does not intend to update, any forward-looking statements. The Company does not endorse any projections regarding future performance that may be made by third parties.

| | | | | | | | |

CONTACT: | GLYNIS BRYAN | |

| CHIEF FINANCIAL OFFICER | |

| TEL. 480.333.3390 | |

| EMAIL glynis.bryan@insight.com | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Net sales: | | | | | | | | | | | |

| Products | $ | 1,827,980 | | | $ | 2,119,061 | | | $ | 7,631,388 | | | $ | 8,947,787 | | | | | |

| Services | 408,031 | | | 383,549 | | | 1,544,452 | | | 1,483,404 | | | | | |

| Total net sales | 2,236,011 | | | 2,502,610 | | | 9,175,840 | | | 10,431,191 | | | | | |

| Costs of goods sold: | | | | | | | | | | | |

| Products | 1,639,458 | | | 1,911,469 | | | 6,859,178 | | | 8,111,252 | | | | | |

| Services | 160,403 | | | 170,582 | | | 647,137 | | | 683,372 | | | | | |

| Total costs of goods sold | 1,799,861 | | | 2,082,051 | | | 7,506,315 | | | 8,794,624 | | | | | |

| Gross profit | 436,150 | | | 420,559 | | | 1,669,525 | | | 1,636,567 | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Selling and administrative expenses | 298,206 | | | 304,766 | | | 1,236,243 | | | 1,216,660 | | | | | |

| Severance and restructuring expenses, net | 3,136 | | | 1,451 | | | 6,091 | | | 4,235 | | | | | |

| Acquisition and integration related expenses | 2,947 | | | 326 | | | 7,396 | | | 1,972 | | | | | |

| Earnings from operations | 131,861 | | | 114,016 | | | 419,795 | | | 413,700 | | | | | |

| Non-operating (income) expense: | | | | | | | | | | | |

| Interest expense, net | 9,358 | | | 10,333 | | | 41,124 | | | 39,497 | | | | | |

| Other expense (income), net | 328 | | | 511 | | | 817 | | | (230) | | | | | |

| Earnings before income taxes | 122,175 | | | 103,172 | | | 377,854 | | | 374,433 | | | | | |

| Income tax expense | 31,567 | | | 25,695 | | | 96,545 | | | 93,825 | | | | | |

| Net earnings | $ | 90,608 | | | $ | 77,477 | | | $ | 281,309 | | | $ | 280,608 | | | | | |

| | | | | | | | | | | |

| Net earnings per share: | | | | | | | | | | | |

| Basic | $ | 2.78 | | | $ | 2.24 | | | $ | 8.53 | | | $ | 8.04 | | | | | |

| Diluted | $ | 2.42 | | | $ | 2.13 | | | $ | 7.55 | | | $ | 7.66 | | | | | |

| | | | | | | | | | | |

| Shares used in per share calculations: | | | | | | | | | | | |

| Basic | 32,583 | | | 34,604 | | | 32,991 | | | 34,903 | | | | | |

| Diluted | 37,513 | | | 36,336 | | | 37,241 | | | 36,620 | | | | | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In THOUSANDS)

(UNAUDITED)

| | | | | | | | | | | |

| December 31,

2023 | | December 31,

2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 268,730 | | | $ | 163,637 | |

| Accounts receivable, net | 3,568,290 | | | 3,272,371 | |

| Inventories | 184,605 | | | 265,154 | |

| Contract assets, net | 120,518 | | | 7,909 | |

| Other current assets | 189,158 | | | 191,597 | |

| Total current assets | 4,331,301 | | | 3,900,668 | |

| | | |

| Long-term contract assets, net | 132,780 | | | — | |

| Property and equipment, net | 210,061 | | | 204,260 | |

| Goodwill | 684,345 | | | 493,033 | |

| Intangible assets, net | 369,687 | | | 204,998 | |

| Long-term accounts receivable | 412,666 | | | 160,818 | |

| Other assets | 145,510 | | | 148,804 | |

| $ | 6,286,350 | | | $ | 5,112,581 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable – trade | $ | 2,255,183 | | | $ | 1,785,076 | |

| Accounts payable – inventory financing facilities | 231,850 | | | 301,314 | |

| | | |

| Accrued expenses and other current liabilities | 538,346 | | | 433,789 | |

| Current portion of long-term debt | 348,004 | | | 346,228 | |

| Total current liabilities | 3,373,383 | | | 2,866,407 | |

| | | |

| | | |

| Long-term debt | 592,517 | | | 291,672 | |

| Deferred income taxes | 27,588 | | | 32,844 | |

| Long-term accounts payable | 353,794 | | | 127,004 | |

| Other liabilities | 203,335 | | | 156,586 | |

| 4,550,617 | | | 3,474,513 | |

| Stockholders’ equity: | | | |

| Preferred stock | — | | | — | |

| Common stock | 326 | | | 340 | |

| Additional paid-in capital | 328,607 | | | 327,872 | |

| Retained earnings | 1,448,412 | | | 1,368,658 | |

Accumulated other comprehensive loss – foreign currency translation adjustments | (41,612) | | | (58,802) | |

| Total stockholders’ equity | 1,735,733 | | | 1,638,068 | |

| $ | 6,286,350 | | | $ | 5,112,581 | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)

(UNAUDITED)

| | | | | | | | | | | |

| Twelve Months Ended

December 31, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net earnings | $ | 281,309 | | | $ | 280,608 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

| Depreciation and amortization | 62,476 | | | 56,614 | |

| Provision for losses on accounts receivable | 6,879 | | | 6,066 | |

| Non-cash stock-based compensation | 28,951 | | | 22,710 | |

| Deferred income taxes | (13,080) | | | (9,251) | |

| Amortization of debt issuance costs | 4,870 | | | 6,105 | |

| Other adjustments | (1,583) | | | 2,035 | |

| Changes in assets and liabilities: | | | |

| Increase in accounts receivable | (11,892) | | | (406,370) | |

| Decrease in inventories | 75,729 | | | 53,711 | |

| Increase in contract assets | (13,840) | | | (3,152) | |

| Increase in long-term accounts receivable | (126,850) | | | (17,015) | |

| Decrease in other assets | 34,061 | | | 48,025 | |

| Increase in accounts payable | 216,229 | | | 53,607 | |

| Increase in long-term accounts payable | 111,790 | | | 7,931 | |

| Decrease in accrued expenses and other liabilities | (35,518) | | | (3,518) | |

| Net cash provided by operating activities: | 619,531 | | | 98,106 | |

| Cash flows from investing activities: | | | |

| Proceeds from sale of assets | 15,515 | | | 1,346 | |

| Purchases of property and equipment | (39,252) | | | (70,939) | |

| Acquisitions, net of cash and cash equivalents acquired | (481,464) | | | (68,248) | |

| Net cash used in investing activities: | (505,201) | | | (137,841) | |

| Cash flows from financing activities: | | | |

| Borrowings on ABL revolving credit facility | 4,587,596 | | | 4,678,212 | |

| Repayments on ABL revolving credit facility | (4,288,036) | | | (4,433,510) | |

| Net repayments under inventory financing facilities | (70,408) | | | (8,307) | |

| Repurchases of common stock | (217,108) | | | (107,922) | |

| Earnout and acquisition related payments | (15,615) | | | — | |

| Other payments | (13,141) | | | (14,466) | |

| Net cash (used in) provided by financing activities: | (16,712) | | | 114,007 | |

| Foreign currency exchange effect on cash, cash equivalents and restricted cash balances | 7,449 | | | (14,531) | |

| Increase in cash, cash equivalents and restricted cash | 105,067 | | | 59,741 | |

| Cash, cash equivalents and restricted cash at beginning of period | 165,718 | | | 105,977 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 270,785 | | | $ | 165,718 | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | |

| | 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Adjusted Consolidated Earnings from Operations: | | | | | | | | | | | | |

| GAAP consolidated EFO | | $ | 131,861 | | $ | 114,016 | | $ | 419,795 | | $ | 413,700 | | | | |

| Amortization of intangible assets | | 10,988 | | 8,077 | | 36,231 | | 32,892 | | | | |

| Other* | | 5,823 | | 6,172 | | 36,101 | | 20,018 | | | | |

| Adjusted non-GAAP consolidated EFO | | $ | 148,672 | | $ | 128,265 | | $ | 492,127 | | $ | 466,610 | | | | |

| | | | | | | | | | | | |

| GAAP EFO as a percentage of net sales | | 5.9% | | 4.6% | | 4.6% | | 4.0% | | | | |

| Adjusted non-GAAP EFO as a percentage of net sales | | 6.6% | | 5.1% | | 5.4% | | 4.5% | | | | |

| | | | | | | | | | | | |

| Adjusted Consolidated Net Earnings: | | | | | | | | | | | | |

| GAAP consolidated net earnings | | $ | 90,608 | | $ | 77,477 | | $ | 281,309 | | $ | 280,608 | | | | |

| Amortization of intangible assets | | 10,988 | | 8,077 | | 36,231 | | 32,892 | | | | |

| | | | | | | | | | | | |

| Other* | | 5,823 | | 6,172 | | 36,101 | | 20,018 | | | | |

| Income taxes on non-GAAP adjustments | | (4,287) | | (3,533) | | (18,016) | | (13,306) | | | | |

| Adjusted non-GAAP consolidated net earnings | | $ | 103,132 | | $ | 88,193 | | $ | 335,625 | | $ | 320,212 | | | | |

| | | | | | | | | | | | |

| GAAP net earnings as a percentage of net sales | | 4.1% | | 3.1% | | 3.1% | | 2.7% | | | | |

| Adjusted non-GAAP net earnings as a percentage of net sales | | 4.6% | | 3.5% | | 3.7% | | 3.1% | | | | |

| | | | | | | | | | | | |

| Adjusted Diluted Earnings Per Share: | | | | | | | | | | | | |

| GAAP diluted EPS | | $ | 2.42 | | | $ | 2.13 | | | $ | 7.55 | | | $ | 7.66 | | | | | |

| Amortization of intangible assets | | 0.29 | | | 0.22 | | | 0.97 | | | 0.90 | | | | | |

| | | | | | | | | | | | |

| Other | | 0.16 | | | 0.17 | | | 0.97 | | | 0.55 | | | | | |

| Income taxes on non-GAAP adjustments | | (0.11) | | | (0.10) | | | (0.48) | | | (0.36) | | | | | |

| Impact of benefit from note hedge | | 0.22 | | | 0.11 | | | 0.68 | | | 0.36 | | | | | |

| Adjusted non-GAAP diluted EPS | | $ | 2.98 | | | $ | 2.53 | | | $ | 9.69 | | | $ | 9.11 | | | | | |

| | | | | | | | | | | | |

| Shares used in diluted EPS calculation | | 37,513 | | 36,336 | | 37,241 | | 36,620 | | | | |

| Impact of benefit from note hedge | | (2,874) | | (1,459) | | (2,619) | | (1,466) | | | | |

| Shares used in Adjusted non-GAAP diluted EPS calculation | | 34,639 | | 34,877 | | 34,622 | | 35,154 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (CONTINUED)

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | |

| | 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Adjusted North America Earnings from Operations: | | | | | | | | | | | | |

| GAAP EFO from North America segment | | $ | 117,377 | | | $ | 99,341 | | | $ | 362,082 | | | $ | 350,436 | | | | | |

| Amortization of intangible assets | | 9,245 | | | 7,563 | | | 32,514 | | | 30,735 | | | | | |

| Other* | | 5,122 | | | 5,376 | | | 29,763 | | | 17,910 | | | | | |

| Adjusted non-GAAP EFO from North America segment | | $ | 131,744 | | | $ | 112,280 | | | $ | 424,359 | | | $ | 399,081 | | | | | |

| | | | | | | | | | | | |

| GAAP EFO as a percentage of net sales | | 6.6 | % | | 4.8 | % | | 4.9 | % | | 4.1 | % | | | | |

| Adjusted non-GAAP EFO as a percentage of net sales | | 7.4 | % | | 5.4 | % | | 5.7 | % | | 4.7 | % | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Adjusted EMEA Earnings from Operations: | | | | | | | | | | | | |

| GAAP EFO from EMEA segment | | $ | 9,899 | | | $ | 10,710 | | | $ | 38,128 | | | $ | 44,264 | | | | | |

| Amortization of intangible assets | | 1,635 | | | 405 | | | 3,277 | | | 1,696 | | | | | |

| Other | | 591 | | | 707 | | | 6,165 | | | 2,017 | | | | | |

| Adjusted non-GAAP EFO from EMEA segment | | $ | 12,125 | | | $ | 11,822 | | | $ | 47,570 | | | $ | 47,977 | | | | | |

| | | | | | | | | | | | |

| GAAP EFO as a percentage of net sales | | 2.5 | % | | 2.9 | % | | 2.4 | % | | 2.6 | % | | | | |

| Adjusted non-GAAP EFO as a percentage of net sales | | 3.1 | % | | 3.2 | % | | 3.0 | % | | 2.8 | % | | | | |

| | | | | | | | | | | | |

| Adjusted APAC Earnings from Operations: | | | | | | | | | | | | |

| GAAP EFO from APAC segment | | $ | 4,585 | | | $ | 3,965 | | | $ | 19,585 | | | $ | 19,000 | | | | | |

| Amortization of intangible assets | | 108 | | | 109 | | | 440 | | | 461 | | | | | |

| Other | | 110 | | | 89 | | | 173 | | | 91 | | | | | |

| Adjusted non-GAAP EFO from APAC segment | | $ | 4,803 | | | $ | 4,163 | | | $ | 20,198 | | | $ | 19,552 | | | | | |

| | | | | | | | | | | | |

| GAAP EFO as a percentage of net sales | | 8.3 | % | | 7.2 | % | | 8.5 | % | | 8.1 | % | | | | |

| Adjusted non-GAAP EFO as a percentage of net sales | | 8.7 | % | | 7.6 | % | | 8.8 | % | | 8.3 | % | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | - MORE - | | |

| Insight Enterprises, Inc. | 2701 E. Insight Way | Chandler, Arizona 85286 | 800.467.4448 | FAX 480.760.8958 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (CONTINUED)

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | |

| | 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Adjusted EBITDA: | | | | | | | | | | | | |

| GAAP consolidated net earnings | | $ | 90,608 | | $ | 77,477 | | $ | 281,309 | | $ | 280,608 | | | | |

| Interest expense | | 11,958 | | 11,271 | | 48,576 | | 41,577 | | | | |

| Income tax expense | | 31,567 | | 25,695 | | 96,545 | | 93,825 | | | | |

| Depreciation and amortization of property and equipment | | 6,790 | | 6,333 | | 26,245 | | 23,722 | | | | |

| Amortization of intangible assets | | 10,988 | | 8,077 | | 36,231 | | 32,892 | | | | |

| | | | | | | | | | | | |

| Other* | | 5,823 | | 6,172 | | 36,101 | | 20,018 | | | | |

| Adjusted non-GAAP EBITDA | | $ | 157,734 | | $ | 135,025 | | $ | 525,007 | | $ | 492,642 | | | | |

| | | | | | | | | | | | |

| GAAP consolidated net earnings as a percentage of net sales | | 4.1% | | 3.1% | | 3.1% | | 2.7% | | | | |

| Adjusted non-GAAP EBITDA as a percentage of net sales | | 7.1% | | 5.4% | | 5.7% | | 4.7% | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

* Includes transformation costs of $2.6 million and $4.1 million for the three months ended December 31, 2023 and 2022, respectively, and $16.6 million and $12.4 million for the twelve months ended December 31, 2023 and 2022, respectively. Includes data center service outage related recoveries of $3.0 million for the three months ended December 31, 2023 and data center service outage related expenses, net of recoveries of $5.0 million for the twelve months ended December 31, 2023 with no comparable costs in the prior year periods.

| | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, |

| | 2023 | | 2022 |

| Adjusted return on invested capital: | | | | |

| GAAP consolidated EFO | | $ | 419,795 | | $ | 413,700 |

| Amortization of intangible assets | | 36,231 | | 32,892 |

Other5 | | 36,101 | | 20,018 |

| Adjusted non-GAAP consolidated EFO | | 492,127 | | 466,610 |

Income tax expense1 | | 127,953 | | 121,319 |

| Adjusted non-GAAP consolidated EFO, net of tax | | $ | 364,174 | | $ | 345,291 |

Average stockholders’ equity2 | | $ | 1,628,480 | | $ | 1,584,075 |

Average debt2 | | 690,402 | | 713,279 |

Average cash2 | | (209,674) | | (131,283) |

| Invested Capital | | $ | 2,109,208 | | $ | 2,166,071 |

| | | | |

Adjusted non-GAAP ROIC (from GAAP consolidated EFO)3 | | 14.73 | % | | 14.13 | % |

Adjusted non-GAAP ROIC (from non-GAAP consolidated EFO)4 | | 17.27 | % | | 15.94 | % |

1 Assumed tax rate of 26.0%.

2 Average of previous five quarters.

3 Computed as GAAP consolidated EFO, net of tax of $109,147 and $107,562 for the twelve months ended December 31, 2023 and 2022, respectively, divided by invested capital.

4 Computed as Adjusted non-GAAP consolidated EFO, net of tax, divided by invested capital.

5 Includes transformation costs of $16.6 million and $12.4 million for the twelve months ended December 31, 2023 and 2022, respectively. Includes certain third-party data center service outage related expenses, net of recoveries of $5.0 million for the twelve months ended December 31, 2023.

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2024 Insight Direct USA, Inc. All Rights Reserved. 1 Insight Enterprises, Inc. Fourth Quarter and Full Year 2023 Earnings Conference Call and Webcast

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 24 Disclosures ◦ Safe harbor statement This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 related to Insight’s plans and expectations. Statements that are not historical facts, including those related to our expectations about future financial results and the assumptions related thereto, including expectations related to SADA, our expectations regarding supply constraints, our expectations regarding backlog shipments, our expectations as it relates to the holders of our convertible senior notes, future expected trends in the IT market and our opportunities for growth, are forward-looking statements. These forward-looking statements are subject to assumptions, risks and uncertainties which could cause actual results or future events to differ materially from such statements. Insight Enterprises, Inc. (the "Company") undertakes no obligation to update publicly or revise any of the forward-looking statements, except as otherwise required by law. More detailed information about forward-looking statements and risk factors is included in today’s press release and discussed in the Company’s most recently filed periodic reports and subsequent filings with the Securities and Exchange Commission. ◦ Non-GAAP measures This presentation will reference certain non-GAAP financial information as ‘Adjusted’. A reconciliation of non-GAAP financial measures presented in this document to our actual GAAP results is attached to the back of this presentation and included in the press release issued today, which you may find on the Investor Relations section of our website at investor.insight.com. These non-GAAP measures are used by the Company and its management to evaluate financial performance against budgeted amounts, to calculate incentive compensation, to assist in forecasting future performance and to compare the Company’s results to those of the Company’s competitors. The Company believes that these non-GAAP financial measures are useful to investors because they allow for greater transparency, facilitate comparisons to prior periods and the Company’s competitors’ results and assist in forecasting performance for future periods. These non-GAAP financial measures are not prepared in accordance with GAAP and may be different from non- GAAP financial measures presented by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. ◦ Constant currency In some instances, the Company refers to changes in net sales, gross profit, earnings from operations and Adjusted earnings from operations on a consolidated basis and in North America, EMEA and APAC excluding the effects of fluctuating foreign currency exchange rates. In addition, the Company refers to changes in Adjusted diluted earnings per share on a consolidated basis excluding the effects of fluctuating foreign currency exchange rates. In computing these changes and percentages, the Company compares the current year amount as translated into U.S. dollars under the applicable accounting standards to the prior year amount in local currency translated into U.S. dollars utilizing the weighted average translation rate for the current period.

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 34 Table of Contents ◦ Solutions Integrator Strategy ◦ Areas of Expertise ◦ Solutions at Work ◦ Awards and Recognitions ◦ Fourth Quarter and Full Year 2023 Highlights and Performance ◦ 2027 KPIs for Success ◦ 2024 Outlook ◦ Appendix

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 44 Our strategy is to become THE leading SOLUTIONS INTEGRATOR The pillars of our strategy are: DRIVE PROFITABLE GROWTH We relentlessly pursue high performance, operational excellence and profitable growth. Put clients first We put our clients first, delivering essential value that contributes to their success and making us the partner they can't live without. Deliver differentiation Our combination of innovative and scalable solutions, exceptional talent and unique portfolio strategy gives us a differentiated advantage. Champion culture Our teammates and our culture are our biggest assets. We champion them to deliver the best.

5Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2024 Insight Direct USA, Inc. All Rights Reserved. Our services Managed Services Eliminate business disruption and strategically align resources Consulting Services Create competitive advantages and improve operations by aligning business goals to IT and product strategies Lifecycle Services Simplify supply chain and streamline costs across the global hardware and software lifecycle Intelligent Edge Gather and utilize data in the most efficient way possible to enable real-time decision- making and affect pivotal outcomes Data and Al Leverage analytics and Al to transform business operations and user experiences Modern Infrastructure Architect and modernize multicloud and networking solutions to drive business transformation Modern Apps Create new product experiences and transform legacy applications to drive increased business value Modern Workplace Create a productive, flexible and secure workplace Cybersecurity Mitigate risks and secure business assets Well Positioned to Help Organizations Our expertise

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 64 2023 Records • Gross margin: 18.2% • Cloud gross profit: $429 million • Insight Core Services gross profit: $273 million • Adjusted diluted earnings per share*: $9.69 • Operating cash flow: $620 million • Adjusted EBITDA* margin: 5.7% • Diluted earnings per share**: $7.55 * See Appendix for reconciliation of non-GAAP measures ** Included for presentation of closest GAAP measure (not a record)

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 74 Acquisitions Amdaris • Increased our digital and cloud enablement capabilities in EMEA • A Microsoft Gold certified partner for >10 years and award-winning Cloud and application modernization company based in the UK • Brings more than 800 employees, the majority of whom are engineers and developers, making it an ideal addition to our existing application and data practices SADA • Expanded our multi-cloud capabilities and services business in North America • Positions us as a leader with two of the three major hyperscalers, including the leaders in generative AI • A leading Google Cloud and technology consultancy and six-time Google Cloud Partner of the Year • Adds approximately 850 employees, over 400 technical experts with deep capabilities across the Google Cloud Platform, Google Workspace, Security, and Data Analytics

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 84 Global Consumer Products Company Overcomes Cyber Attack The challenge: The results: • This global manufacturer had a cyber breach • Critical systems were impacted, including infrastructure and credentials, leading to a total outage • Operations teams were offshore and unavailable to help in recovery efforts with remote access being revoked • Hundreds of millions in revenue were ultimately lost due to the significance of this breach • Enhanced security with isolated IT and OT operations • Developed network security architecture and roadmap to protect against future incidents • Improved management and visibility of systems globally The solution: • The Insight team responded immediately with: • Resources on site within two days to provide strategic guidance to secure the client's operating systems • Expert engineers at global on-prem sites to restore critical infrastructure • Support for recovery at HQ, including MFA resets for 10k+ employees • Comprehensive roadmap and pipeline of projects to bolster security posture going forward • Improved management and visibility of systems • Isolation of IT and OT (Operational Technology) through network and security segmentations: a future incident at one location would not impact the entire enterprise

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 94 Efficient, Secured, Scalable and Unified Data Platform for a Large Retailer The challenge: The results: • Disparate technology stack due to multiple acquisitions and rapid expansion • Disparate data sources hampered agility and informed decision-making • No systematic way to drive data and extract valuable insights • Streamlined data flow, slashing processing times and enabling faster data access and analysis • Quicker decision-making and improved business agility • Overall Impact: A secure, scalable, and unified data platform that empowers data-driven decisions across the company, driving business growth • A secure and reliable data warehouse on Google Cloud with robust security integrated to reduce exfiltration • Central data repository consolidating fragmented data sources for a unified view of critical business info • Agile and efficient data platform designed for scalability, meeting growing data volume and processing needs The solution:

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 104 Awards U.S. Best Places to Work International Best Places to Work No. 1 | Inland Northwest No. 3 | Phoenix Business Journal No. 9 | Phoenix Healthiest Workplaces No. 13 | Forbes Best Employers in Ohio No. 16 | Best Tech Internships Achievers 50 Most Engaged Workplaces No. 7 | Italy Best Workplaces No. 11 | UK Best Workplaces No. 13 | Spain Best Workplaces No. 16 | UK Best Workplaces for Wellbeing No. 27 | UK Best Workplaces for Women UK Best Workplaces in Tech No. 2 | Singapore Best Workplaces in Tech No. 11 | Australia Best Workplaces in Tech No. 15 | Australia Best Workplaces No. 27 | Australia Best Workplaces for Women 100% | AsianUpward Workplace Excellence Certified | Great Place to Work in China, Hong Kong, New Zealand, Philippines

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 114 2023 Industry and Partner Recognitions • Magic Quadrant™ for Software Asset Management Managed Services • Magic Quadrant™ for Public Cloud IT Transformation Services • Microsoft Azure Expert MSP (4 years in a row) • Achieved all 6 MS Security specializations • Solution Assessments Partner of the Year • Australia Partner of the Year • Western Europe Managed Service Provider Partner of the Year • Hong Kong Partner of the Year • EMEA Surface Reseller Partner of the Year • Canada Inclusion Changemaker Impact Award • Canada Modern Marketing Impact Award • U.S. Azure Cloud Native App Development Partner of the Year • U.S. Retail & Consumer Goods Partner of the Year

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 124 Q4/Full Year 2023 Performance (Changes against prior year period) Q4 2023 $130M increase of 43% CLOUD GROSS PROFIT Q4 2023 $69M increase of 7% INSIGHT CORE SERVICES GROSS PROFIT FY 2023 $429M increase of 26% FY 2023 $273M increase of 8%

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 134 Q4/Full Year 2023 Performance (Changes against prior year period) * See Appendix for reconciliation of non-GAAP measures ** Reference “Constant currency” section on slide 2 of this presentation *** For the twelve months ended December 31, 2023 Q4 2023 $2.2B decrease of 11% NET SALES MARGINS Q4 2023 $436M increase of 4% GROSS PROFIT 54% services as a % of total gross profit and 26% cloud as a % of total gross profit*** FY 2023 $9.2B decrease of 12% FY 2023 $1.7B increase of 2% Q4 2023 FY 2023 GROSS MARGIN 18.2% up 250 bps EFO MARGIN 4.6% up 60 bps ADJUSTED EFO* MARGIN 5.4% up 90 bps EARNINGS FROM OPERATIONS Q4 2023 $132M increase of 16% FY 2023 $420M increase of 1% ADJUSTED EARNINGS FROM OPERATIONS* Q4 2023 $149M increase of 16% GROSS MARGIN 19.5% up 270 bps EFO MARGIN 5.9% up 130 bps ADJUSTED EFO* MARGIN 6.6% up 150 bps FY 2023 $492M increase of 5%

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 144 Q4/Full Year 2023 Performance (Changes against prior year period) * See Appendix for reconciliation of non-GAAP measures Q4 2023 $91M increase of 17% EARNINGS HEADCOUNT Skilled, certified consulting, and service delivery professionals NET EARNINGS DILUTED EARNINGS PER SHARE FY 2023 $281M flat YoY Q4 2023 $2.42 increase of 14% FY 2023 $7.55 decrease of 1% Q4 2023 $158M increase of 17% FY 2023 $525M increase of 7% CASH CONVERSION CYCLE 29 DAYS down 11 days ADJUSTED EBITDA* NET CASH FROM OPERATIONS $206M QTD/$620M YTD Days sales outstanding (DSO) +27 days Days inventory outstanding (DIO) -3 days Days purchases outstanding (DPO) +(35) days Q4 2023 $2.98 increase of 18% FY 2023 $9.69 increase of 6% ADJUSTED DILUTED EARNINGS PER SHARE* CASH FLOWS AND CASH CYCLE SERVICE DELIVERY SCALE 6,000+

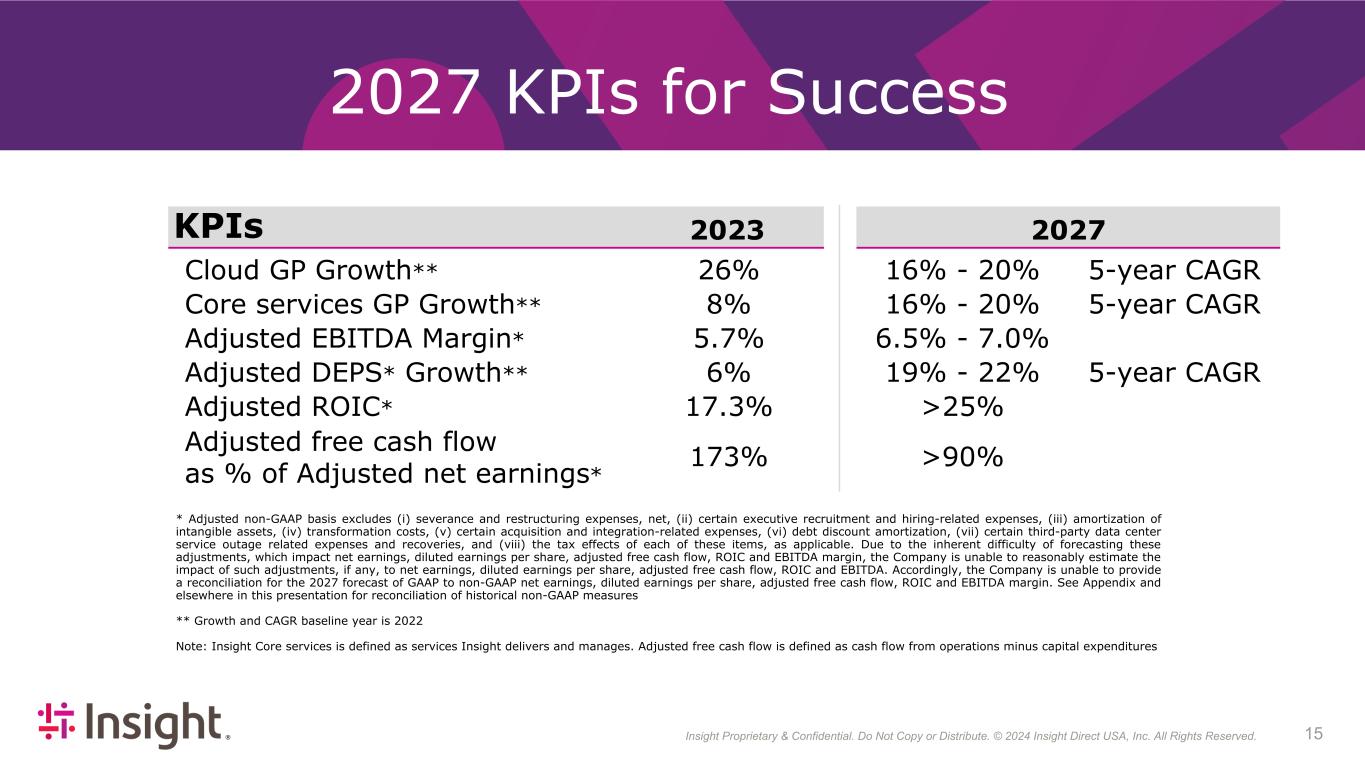

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 154 2027 KPIs for Success KPIs 2023 2027 Cloud GP Growth** 26% 16% - 20% 5-year CAGR Core services GP Growth** 8% 16% - 20% 5-year CAGR Adjusted EBITDA Margin* 5.7% 6.5% - 7.0% Adjusted DEPS* Growth** 6% 19% - 22% 5-year CAGR Adjusted ROIC* 17.3% >25% Adjusted free cash flow as % of Adjusted net earnings* 173% >90% * Adjusted non-GAAP basis excludes (i) severance and restructuring expenses, net, (ii) certain executive recruitment and hiring-related expenses, (iii) amortization of intangible assets, (iv) transformation costs, (v) certain acquisition and integration-related expenses, (vi) debt discount amortization, (vii) certain third-party data center service outage related expenses and recoveries, and (viii) the tax effects of each of these items, as applicable. Due to the inherent difficulty of forecasting these adjustments, which impact net earnings, diluted earnings per share, adjusted free cash flow, ROIC and EBITDA margin, the Company is unable to reasonably estimate the impact of such adjustments, if any, to net earnings, diluted earnings per share, adjusted free cash flow, ROIC and EBITDA. Accordingly, the Company is unable to provide a reconciliation for the 2027 forecast of GAAP to non-GAAP net earnings, diluted earnings per share, adjusted free cash flow, ROIC and EBITDA margin. See Appendix and elsewhere in this presentation for reconciliation of historical non-GAAP measures ** Growth and CAGR baseline year is 2022 Note: Insight Core services is defined as services Insight delivers and manages. Adjusted free cash flow is defined as cash flow from operations minus capital expenditures

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 164 $2.2B NET SALES decrease of 11% y/y $436M GROSS PROFIT increase of 4% y/y $9.2B* decrease of 12% y/y * For the twelve months ended December 31, 2023 $1.7B* increase of 2% y/y $2.5B $2.3B $2.3B $2.3B $2.2B Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $7.7B $8.3B $9.4B $10.4B $9.2B 2019 2020 2021 2022 2023 $421M $391M $433M $409M $436M Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $1.1B $1.3B $1.4B $1.6B $1.7B 2019 2020 2021 2022 2023 16.8% 16.8% 18.4% 18.0% 19.5% 14.7% 15.6% 15.3% 15.7% 18.2% Gross Margin Trailing twelve months Trailing twelve months

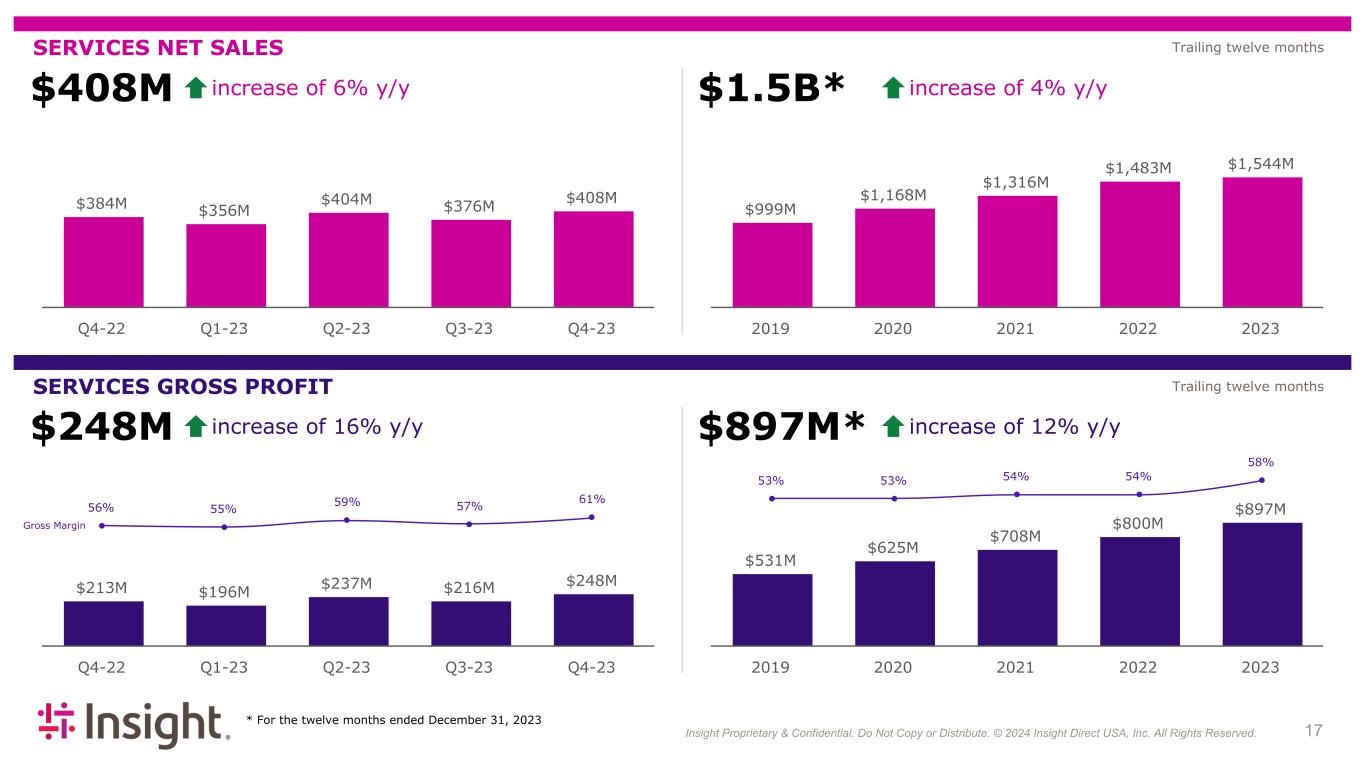

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 174 $897M* $408M SERVICES NET SALES increase of 6% y/y $248M SERVICES GROSS PROFIT increase of 16% y/y $1.5B* increase of 4% y/y * For the twelve months ended December 31, 2023 increase of 12% y/y $384M $356M $404M $376M $408M Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $213M $196M $237M $216M $248M Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $531M $625M $708M $800M $897M 2019 2020 2021 2022 2023 $999M $1,168M $1,316M $1,483M $1,544M 2019 2020 2021 2022 2023 56% 55% 59% 57% 61% Gross Margin 53% 53% 54% 54% 58% Trailing twelve months Trailing twelve months

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 184 $69M INSIGHT CORE SERVICES GROSS PROFIT $130M CLOUD GROSS PROFIT increase of 43% y/y $273M* increase of 8% y/y * For the twelve months ended December 31, 2023 Note: Insight Core services is defined as services Insight delivers and manages $429M* increase of 26% y/y $65M $61M $72M $71M $69M Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $167M $196M $221M $253M $273M 2019 2020 2021 2022 2023 $91M $88M $115M $96M $130M Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $162M $218M $264M $340M $429M 2019 2020 2021 2022 2023 28% 28% 30% 31% 30% Gross Margin 26% 27% 27% 27% 30% Trailing twelve months Trailing twelve months increase of 7% y/y

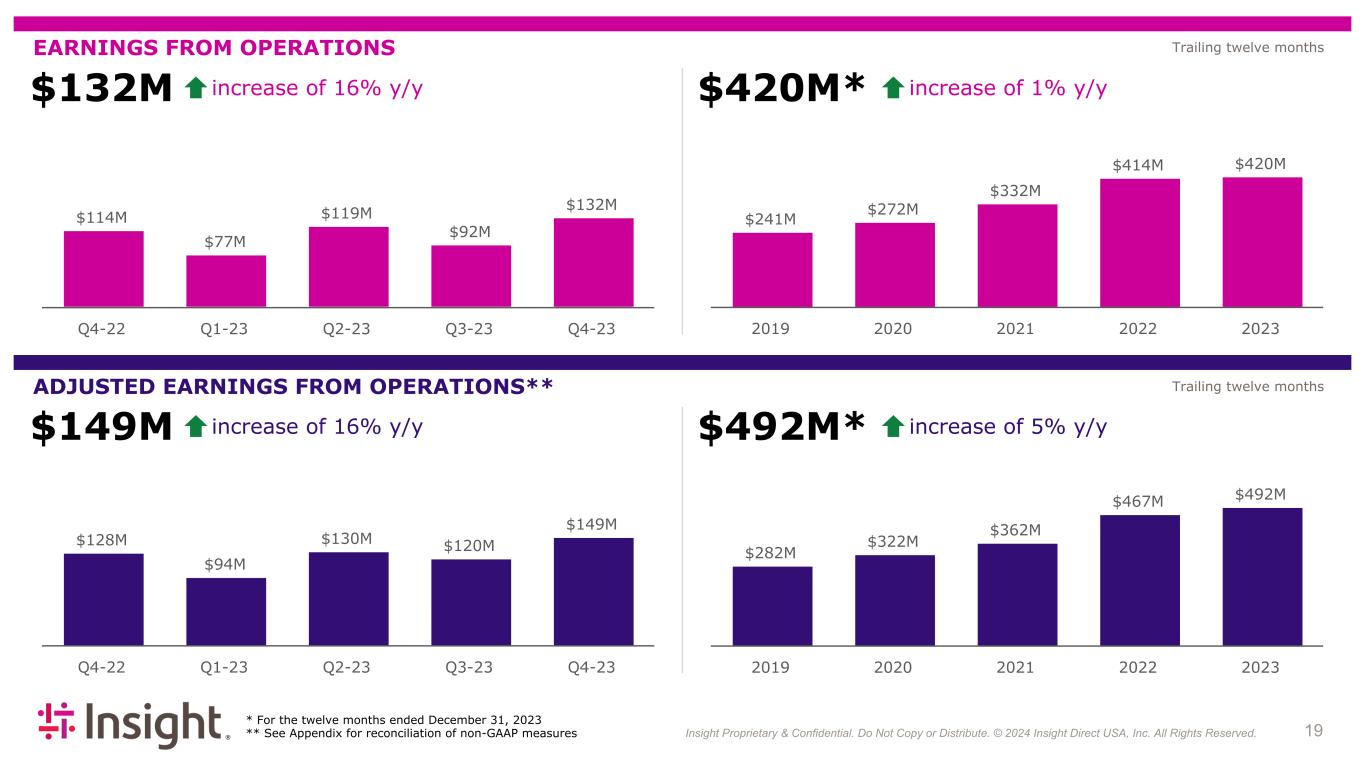

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 194 EARNINGS FROM OPERATIONS increase of 16% y/y ADJUSTED EARNINGS FROM OPERATIONS** $420M* $128M $94M $130M $120M $149M Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $282M $322M $362M $467M $492M 2019 2020 2021 2022 2023 * For the twelve months ended December 31, 2023 ** See Appendix for reconciliation of non-GAAP measures $149M increase of 16% y/y $492M* increase of 5% y/y $132M $114M $77M $119M $92M $132M Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 increase of 1% y/y $241M $272M $332M $414M $420M 2019 2020 2021 2022 2023 Trailing twelve months Trailing twelve months

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 204 DILUTED EARNINGS PER SHARE increase of 14% y/y ADJUSTED DILUTED EARNINGS PER SHARE** $7.55* $2.53 $1.78 $2.56 $2.37 $2.98 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $5.42 $6.19 $7.10 $9.11 $9.69 2019 2020 2021 2022 2023 * For the twelve months ended December 31, 2023 ** See Appendix for reconciliation of non-GAAP measures $2.98 increase of 18% y/y $9.69* increase of 6% y/y $2.42 $2.13 $1.34 $2.17 $1.62 $2.42 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 decrease of 1% y/y $4.43 $4.87 $5.95 $7.66 $7.55 2019 2020 2021 2022 2023 Trailing twelve months Trailing twelve months

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 214 SADA 2023 Results, Seasonality and Impact on 2024 Guidance Q4 • Immediately accretive to 2023 results - contributing 110 basis points to our Q4 margin expansion • Performed at top end of our December guidance range Annual Seasonality • The second half of the year typically contributes over 100% of full year SADA adjusted EBITDA ◦ Q4 is typically between 70-75% of the total adjusted EBITDA • SADA typically reports negative adjusted EBITDA in the first half ◦ Q1 is significantly negative with Q2 being breakeven • In 2024, we expect SADA to contribute between $0.55 to $0.65 of adjusted diluted earnings per share* • Cash flow dynamic of the SADA business is consistent and growing * Adjusted diluted earnings per share excludes severance and restructuring expense, net and other unique items as well as amortization expense related to acquired intangibles. Due to the inherent difficulty of forecasting some of these types of expenses, which impact net earnings, diluted earnings per share and selling and administrative expenses, the Company is unable to reasonably estimate the impact of such expenses, if any, to net earnings, diluted earnings per share and selling and administrative expenses. Accordingly, the Company is unable to provide a reconciliation of GAAP to non-GAAP diluted earnings per share for the full year 2024 forecast

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 224 Full Year 2024 Outlook Assumptions: As of February 15, 2024 Gross profit growth1 mid to high teens Gross margin approximately 19% Adjusted diluted EPS* $10.50 - $10.80 Interest expense $40 - $42 million Effective tax rate 26% Capital expenditures $50 - $55 million Average share count 35.2 million Other Exclusions and Assumptions: • Excludes acquisition-related intangibles amortization expense of approximately $60 million (posted on website) • Assumes no acquisition or integration-related, transformation or severance and restructuring expenses, net • Assumes no significant change in our debt instruments or the macroeconomic environment * Adjusted diluted earnings per share excludes severance and restructuring expense, net and other unique items as well as amortization expense related to acquired intangibles. Due to the inherent difficulty of forecasting some of these types of expenses, which impact net earnings, diluted earnings per share and selling and administrative expenses, the Company is unable to reasonably estimate the impact of such expenses, if any, to net earnings, diluted earnings per share and selling and administrative expenses. Accordingly, the Company is unable to provide a reconciliation of GAAP to non-GAAP diluted earnings per share for the full year 2024 forecast 1Operating expenses expected to grow at a higher rate than gross profit

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2024 Insight Direct USA, Inc. All Rights Reserved. 23 Appendix

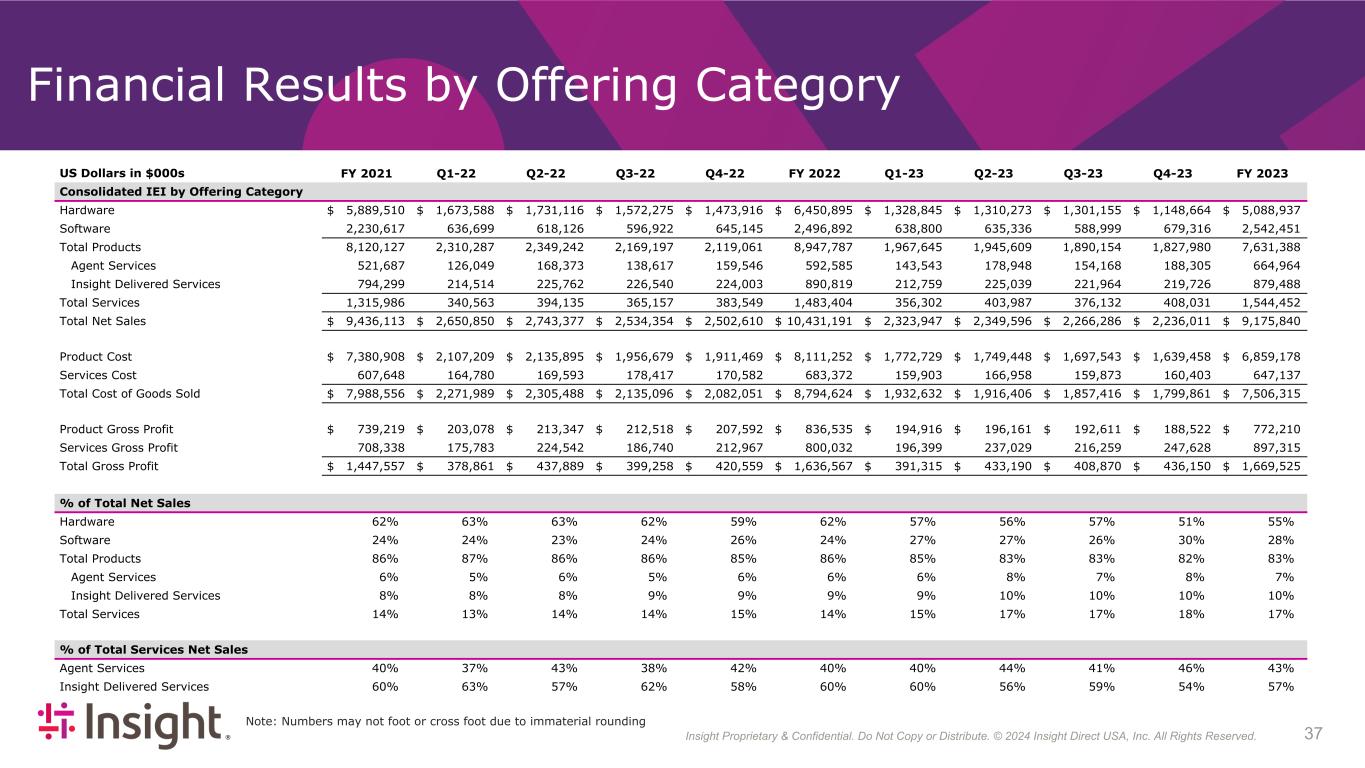

Insight Proprietary & Confidential. Do Not Copy or Distribute. © 2022 Insight Direct USA, Inc. All Rights Reserved. 244 FY 2023 | Financial Performance Twelve Months Ended December 31, US Dollars in $000s, except for per share data 2023 2022 Change Consolidated IEI Net sales $9,175,840 $10,431,191 (12) % Net sales, constant currency* (12) % Product net sales $7,631,388 $8,947,787 (15) % Services net sales $1,544,452 $1,483,404 4 % Gross profit $1,669,525 $1,636,567 2 % Gross margin 18.2 % 15.7 % 250 bps Gross profit, constant currency* 2 % Product gross profit $772,210 $836,535 (8) % Services gross profit $897,315 $800,032 12 % GAAP earnings from operations $419,795 $413,700 1 % Adjusted earnings from operations** $492,127 $466,610 5 % GAAP diluted earnings per share $7.55 $7.66 (1) % Adjusted diluted earnings per share** $9.69 $9.11 6 % * Reference “Constant currency” section on slide 2 of this presentation ** See Appendix for reconciliation of non-GAAP measures