Filed Pursuant to Rule 424(b)(3)

Registration No. 333-269627

Supplement No. 1, Dated October 20, 2023

(to the Proxy Statement/Prospectus/Consent Solicitation dated October

2, 2023)

SUPPLEMENT TO

JOINT PROXY STATEMENT/CONSENT

SOLICITATION STATEMENT/PROSPECTUS FOR THE

EXTRAORDINARY GENERAL MEETING

OF SHAREHOLDERS OF INNOVATIVE INTERNATIONAL ACQUISITION CORP.

This Supplement No.

1, dated October 20, 2023 (this “Supplement”), updates and supplements the joint proxy statement/consent

solicitation statement/prospectus dated October 2, 2023 (the “Proxy Statement/Prospectus/Consent Solicitation”) of

Innovative International Acquisition Corp. (“IOAC”) in connection with the proposed transactions (collectively,

including the issuance of IOAC securities in connection therewith, the “Business Combination”) that are the subject of

the Agreement and Plan of Merger and Reorganization (as may be amended or supplemented, the “Merger Agreement”), dated

as of October 13, 2022, by and among IOAC, Zoomcar, Inc. (“Zoomcar”),

Innovative International Merger Sub Inc. and Greg Moran, in the capacity as the representative of the Zoomcar stockholders

and certain matters related to the prospective consummation (the “Closing”) of the Business Combination, including,

without limitation, Zoomcar’s contingent expectation to waive, in whole or in part, a material condition to the Closing set

forth in the Merger Agreement.

As previously disclosed,

an extraordinary general meeting of IOAC’s shareholders will be held on October 25, 2023 to approve the Business Combination, among

other proposals described in the Proxy Statement/Prospectus/Consent Solicitation. IOAC filed the Proxy Statement/Prospectus/Consent

Solicitation with the U.S. Securities and Exchange Commission (“SEC”) as part of a Registration Statement on Form S-4 (Registration No.

333-269627) (the “Registration Statement”).

This Supplement is

being filed by IOAC with the SEC to supplement certain information contained in the Proxy Statement/Prospectus/Consent Solicitation.

Except as otherwise set forth below, the information set forth in the Proxy Statement/Prospectus/Consent Solicitation remains

unchanged. Capitalized terms used but not defined herein have the meanings ascribed to them in the Proxy Statement/Prospectus/Consent

Solicitation.

This Supplement is

not complete without, and may not be utilized except in connection with, the Proxy Statement/Prospectus/Consent Solicitation,

including any additional supplements and amendments thereto.

You should read carefully

and in their entirety this Supplement and the Proxy Statement/Prospectus/Consent Solicitation and all accompanying annexes.

In particular, you should review and consider carefully the matters discussed under the heading “Risk Factors” beginning on

page 59 of the Proxy Statement/Prospectus/Consent Solicitation.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the Business

Combination or otherwise, or passed upon the adequacy or accuracy of this proxy statement/prospectus/consent solicitation. Any representation

to the contrary is a criminal offense.

This supplement to

the Proxy Statement/Prospectus/Consent Solicitation is dated October 20, 2023.

Contingent Waiver

of Closing Condition

The

Merger Agreement contains a condition to Closing (the “Minimum Cash Condition”), which is waivable by Zoomcar, that, as

of the Closing, IOAC have cash and cash equivalents, including funds remaining in IOAC’s trust account (the “Trust

Account”) (after deducting the aggregate amount of payments required to be made in connection with the redemption rights to

IOAC shareholders) and the proceeds from the certain financing transactions described in the Merger Agreement, and after payment of

IOAC transaction expenses, Zoomcar transaction expenses and other liabilities due at the Closing, of at least $50,000,000.

Pursuant

to a Contingent Waiver of Minimum Cash Condition, as of October 19, 2023, Zoomcar’s conditional expectation to waive, in whole

or in part, the Minimum Cash Condition, is contingent upon fulfillment by IOAC, Innovative International Sponsor I LLC

(“Sponsor”) and Ananda Small Business Trust (“Ananda Trust,” and together with IOAC and the Sponsor, the

“IOAC Parties”) of the following conditions (collectively, including fulfillment by the IOAC Parties of the best efforts

commitments described in this paragraph, the “Closing Financing Condition”), such that at the Closing, IOAC shall have

cash and cash equivalents, including funds remaining in the Trust Account (after giving effect to the completion and payment of

redemptions), and proceeds from prospective financing transactions, if any, in which the IOAC Parties and Zoomcar may engage

(together, the “Prospective Financing Transactions,” provided, however, that, as of the date of such Contingent Waiver

of Minimum Cash Condition, no such transactions have been conclusively identified or binding terms thereof negotiated or agreed)

prior to the Closing that result in cash proceeds deliverable to Zoomcar at the Closing of no less than $20,000,000, after payment

of all unpaid IOAC transaction expenses, Zoomcar transaction expenses and any other liabilities due at the Closing, including the

taking of the actions described below by the IOAC Parties. As part of the Contingent Waiver of Minimum Cash Condition, including the

Closing Financing Condition contained therein, the Sponsor agreed to use best efforts to support the satisfaction of the Closing

Financing Condition, including by agreeing to utilize, whether by transfer, forfeiture and cancellation or otherwise, the Class B

ordinary shares, par value $0.0001 per share, of IOAC held by the Sponsor to incentivize non-redeeming IOAC shareholders or other

investors to buy or hold and not redeem IOAC public shares through the date on which the Business Combination occurs (the

“Closing Date”) and by agreeing, contingent upon and concurrent with the Closing, forgive or, to the extent permissible

under the existing terms of outstanding promissory notes or other applicable instruments, to convert to equity any liabilities or

repayment obligations to Sponsor or its affiliates. In addition also as part of the Contingent Waiver of Minimum Cash Condition,

including the Closing Financing Condition contained therein, Ananda Trustor affiliates thereof, may, prior to the Closing, purchase

up to such number of newly-issued IOAC securities, as determined in the sole discretion of Ananda Trust, as may be needed for the

fulfillment, together with any amounts retained in the Trust Account as of the Closing Date and proceeds from other Prospective

Financing Transactions, if any, of the Closing Financing Condition, on mutually agreeable terms that are not materially less

economically favorable than the terms of other equivalent investments in IOAC securities that may occur prior to the Closing and are

not in effect as of October 19, 2023. Zoomcar has also agreed to reasonably cooperate with IOAC and take necessary and commercially

reasonable actions relative to the satisfaction of unpaid IOAC transaction expenses and Zoomcar transaction expenses.

Zoomcar Marketing Service Agreement

Additionally,

Zoomcar entered into a Marketing Services Agreement, effective as of October 2, 2023, with Outside The Box Capital

(“OTBC”), pursuant to which Zoomcar agreed to issue, within seven business days following the Closing, 20,000 shares of

New Zoomcar common stock to OTBC in consideration for services to be provided to Zoomcar or New Zoomcar thereunder. The New Zoomcar

shares issuable to OTBC will be subject to a six-month trading restriction from the issue date, subject to customary limited

exceptions.

Important Information

About the Business Combination and Where to Find It

In

connection with the Business Combination, IOAC has filed with the SEC the Registration Statement, which includes the Proxy Statement/Prospectus/Consent

Solicitation. The Registration Statement was declared effective on September 29, 2023. IOAC has mailed the Proxy Statement/Prospectus/Consent

Solicitation and other relevant documents to its shareholders. This document is not a substitute for the Proxy Statement/Prospectus/Consent

Solicitation. INVESTORS AND SECURITY HOLDERS AND OTHER INTERESTED PARTIES ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS/CONSENT SOLICITATION

AND ANY OTHER RELEVANT DOCUMENTS THAT HAVE BEEN FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE

DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ZOOMCAR, IOAC,

THE PROPOSED TRANSACTION AND RELATED MATTERS. The documents filed or that will be filed with the SEC relating to the Business Combination

(when they are available) can be obtained free of charge from the SEC’s website at www.sec.gov.

Forward-Looking

Statements

This

document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations

and intentions with respect to future operations, products and services; and other statements identified by words such as “will

likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,”

“believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning.

These

forward-looking statements and factors that may cause actual results and the timing of events to differ materially from the anticipated

results include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination

of the Merger Agreement or could otherwise cause the transactions contemplated therein to fail to close; (2) the outcome of any legal

proceedings that may be instituted against IOAC, Zoomcar, the combined company or others following the announcement of the Business Combination

and any definitive agreements with respect thereto; (3) the inability to complete the Business Combination due to the failure to obtain

approval of the shareholders of IOAC or stockholders of Zoomcar; (4) the inability of Zoomcar to satisfy other conditions to closing;

(5) changes to the proposed structure of the Business Combination that may be required or appropriate as a result of applicable laws or

regulations or as a condition to obtaining regulatory approval of the Business Combination; (6) the ability to meet stock exchange listing

standards in connection with and following the consummation of the Business Combination; (7) the risk that the Business Combination disrupts

current plans and operations of Zoomcar as a result of the announcement and consummation of the Business Combination; (8) the ability

to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability

of the combined company to grow and manage growth profitably, maintain its reputation, grow its customer base, maintain relationships

with customers and suppliers and retain its management and key employees; (9) the impact of the COVID-19 pandemic on the business of Zoomcar

and the combined company (including the effects of the ongoing global supply chain shortage); (10) Zoomcar’s limited operating history

and history of net losses; (11) Zoomcar’s customer concentration and reliance on a limited number of key technology providers and

payment processors facilitating payments to and by Zoomcar’s customers; (12) costs related to the Business Combination; (13) unfavorable

interpretations of laws or regulations or changes in applicable laws or regulations; (14) the possibility that Zoomcar or the combined

company may be adversely affected by other economic, business, regulatory, and/or competitive factors; (15) Zoomcar’s estimates

of expenses and profitability; (16) the evolution of the markets in which Zoomcar competes; (17) political instability associated with

operating in current and future emerging markets Zoomcar has entered or may later enter; (18) risks associated with Zoomcar maintaining

inadequate insurance to cover risks associated with business operations now or in the future; (19) the ability of Zoomcar to implement

its strategic initiatives and continue to innovate its existing products; (20) the ability of Zoomcar to adhere to legal requirements

with respect to the protection of personal data and privacy laws; (21) cybersecurity risks, data loss and other breaches of Zoomcar’s

network security and the disclosure of personal information or the infringement upon Zoomcar’s intellectual property by unauthorized

third parties; (22) risks associated with the performance or reliability of infrastructure upon which Zoomcar relies, including, but not

limited to, internet and cellular phone services; (23) the risk of regulatory lawsuits or proceedings relating to Zoomcar’s products

or services; (24) increased compliance risks associated with operating in multiple foreign jurisdictions at once, including regulatory

and accounting compliance issues; (25) Zoomcar’s exposure to operations in emerging markets where improper business practices may

be prevalent; and (26) Zoomcar’s ability to obtain additional capital when necessary.

The

foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties

described in the “Risk Factors” section of the Registration Statement referenced above and other documents filed by IOAC from

time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and

results to differ materially from those contained in the forward-looking statements. There can be no assurance that the data contained

herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements

as a predictor of future performance as projected financial information and other information are based on estimates and assumptions that

are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control. Forward-looking

statements speak only as of the date they are made, and IOAC and Zoomcar disclaim any intention or obligation to update or revise any

forward-looking statements, whether as a result of developments occurring after the date of this communication. Forecasts and estimates

regarding Zoomcar’s industry and end markets are based on sources we believe to be reliable, however there can be no assurance these

forecasts and estimates will prove accurate in whole or in part. Annualized, pro forma, projected and estimated numbers are used for illustrative

purpose only, are not forecasts and may not reflect actual results.

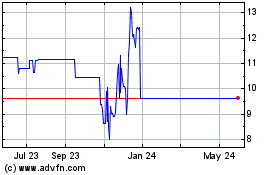

Innovative International... (NASDAQ:IOACU)

Historical Stock Chart

From Apr 2024 to May 2024

Innovative International... (NASDAQ:IOACU)

Historical Stock Chart

From May 2023 to May 2024