FALSE000132611000013261102023-09-112023-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 11, 2023

ImmunityBio, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37507 | | 43-1979754 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

3530 John Hopkins Court

San Diego, California 92121

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (844) 696-5235

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | IBRX | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

$200.0 million Convertible Promissory Note

On September 11, 2023, ImmunityBio, Inc. (the “Company”) executed a $200.0 million convertible promissory note with Nant Capital, LLC (“Nant Capital” or the “Investor”), an entity affiliated with Dr. Patrick Soon-Shiong, the Company’s Executive Chairman and Global Chief Scientific and Medical Officer. The note bears interest at Term Secured Overnight Financing Rate (“Term SOFR”) plus 8.0% per annum. The accrued interest shall be payable monthly on the last business day of each month, commencing on September 30, 2023. The outstanding principal amount and any accrued and unpaid interest are due on the earlier of (i) September 11, 2026 or (ii) upon the occurrence and during the continuance of an Event of Default (as defined in the note). We may prepay the outstanding principal amount, together with any accrued interest, at any time, in whole or in part, without premium or penalty, upon five (5) days written notice to the Investor. The note is convertible at the Investor’s option, in whole, into common stock of the Company, par value $0.0001 (“Common Stock”), at a conversion price of $1.935 per share.

Net proceeds of $199.0 million from this financing, net of transaction fees, are intended to be used, together with other available funds, to progress our regulatory approval efforts, pre-commercialization activities and clinical development programs, fund other research and development activities, for capital expenditures, and for other general corporate purposes. We may also use a portion of the net proceeds to license intellectual property or to make acquisitions or investments.

Stock Purchase Agreement

Also on September 11, 2023, the Company, the Company’s wholly-owned subsidiary NantCell, Inc., Nant Capital, NantMobile, LLC (“NantMobile”) and NantCancerStemCell, LLC (“NCSC” and together with Nant Capital and NantMobile, the “Purchasers”), entered into a Stock Purchase Agreement (the “SPA”) pursuant to which the Purchasers exchanged certain existing convertible promissory notes, identified in the SPA as the “Notes,” representing approximately $270 million in aggregate principal amount and accrued and unpaid interest, in exchange for an aggregate of 209,291,936 shares of Common Stock. As a result of the exchange, the Company is forever released and discharged from all its obligations and liabilities under the Notes.

Promissory Note Extensions

Also on September 11, 2023, the Company and Nant Capital entered into a series of letter agreements pursuant to which the maturity dates of certain existing promissory notes with an aggregate principal amount of approximately $535 million entered into between the Company and Nant Capital were each extended from December 31, 2023 to December 31, 2024.

The foregoing description of the related-party convertible promissory note, the SPA and the amendments does not purport to be complete and is qualified in its entirety by reference to the full text of the note, the SPA and the amendments, copies of which will be filed with the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2023 and are incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

To the extent relevant, the information set forth in Item 1.01 above is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

To the extent relevant, the information set forth in Item 1.01 above is incorporated by reference into this Item 3.02.

Item 8.01 Other Events.

Also on September 11, 2023, the Company issued a press release regarding the matters described above. A copy of the press release is furnished as Exhibit 99.1 and incorporated by reference.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit

Number | | Description of Exhibit |

| | |

| 99.1** | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

_______________

** Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | IMMUNITYBIO, INC. |

| | | Registrant |

| | | |

| Date: September 11, 2023 | By: | | /s/ David C. Sachs |

| | | David C. Sachs |

| | | Chief Financial Officer |

ImmunityBio Announces $470 Million Equity and Debt Financing

From Founder, Dr. Patrick Soon-Shiong and Nant Entities

•Financing improves the company’s balance sheet and provides $200 million of capital, as follows:

◦Exchange of $270 million of debt held by Nant Entities into ImmunityBio equity resulting in deleveraging of the Company’s balance sheet

◦$200 million of a new 3-year term debt financing from Nant Capital convertible at a 50 percent premium to provide capital sufficient to support the Company’s ongoing operations and pre-commercialization activities through the anticipated potential FDA approval of Anktiva for BCG-unresponsive bladder cancer

◦Extension of nearest term current debt maturities to December 31, 2024

CULVER CITY, Calif., September 11, 2023 — ImmunityBio, Inc. (NASDAQ: IBRX), a clinical-stage immunotherapy company, today announced that it has executed financing transactions resulting in approximately $200 million of proceeds to the Company through a financing including an exchange into equity of current debt and a new convertible debt instrument from Nant Capital, LLC, an entity affiliated with Dr. Patrick Soon-Shiong, the Company’s Founder, Executive Chairman and Global Chief Scientific and Medical Officer. With this new financing from Dr. Soon-Shiong, including the extension of the maturity date of current debt, ImmunityBio believes that it is well-positioned to fund its ongoing business operations and pre-commercialization efforts as it continues to drive toward a potential regulatory approval of N-803 plus BCG for BCG-unresponsive non-muscle invasive bladder cancer.

The new $200 million convertible note with Nant Capital has a three-year term and is convertible into shares of ImmunityBio common stock at a conversion price of a fifty percent (50%) premium over the closing market price immediately preceding the date of the note.

In addition, the financing transactions restructure the Company’s existing debt obligations with the Nant entities, including an extension of the nearest term debt maturities by one year to December 2024.

Further, ImmunityBio executed a stock purchase agreement pursuant to which all of the outstanding fixed-rate promissory notes held by Nant Capital and certain other Nant entities, representing approximately $270 million in aggregate principal amount and accrued and unpaid interest as of September 8, 2023, were exchanged for ImmunityBio common stock, based on the closing stock price on September 8, 2023.

“Our Company, scientists, physicians and Board are grateful to Dr. Soon-Shiong for his continued financial support of our Company and its important mission, as well as for his involvement in our day-to-day operations,” said Richard Adcock, Chief Executive Officer and President of ImmunityBio. “With this additional financing, we are well positioned to execute on our commercialization plans in anticipation of the approval of N-803 plus BCG in bladder cancer. This funding will also help support the planned expansion of our current clinical trials and the opening of new studies to explore the untapped potential of N-803 and our other platforms across multiple indications.”

“I remain fully committed to ImmunityBio’s mission and to ensuring the company has the resources it needs to achieve its goals and be successful,” said Patrick Soon-Shiong, M.D., Executive Chairman and Global Chief Scientific and Medical Officer of ImmunityBio. “As a scientist and physician, I believe in the science behind our therapeutics and look forward to continuing to work with our team members through this critical stage in our Company’s evolution. ImmunityBio has taken on the enormous challenge of transforming the current approaches of cancer care and even preventing the onset of cancer, by activating the patient’s own immune system and developing a NANT cancer vaccine (NCV). The company is unique in that it owns the multiple immunotherapy platforms needed to orchestrate the trifecta approach (NK, T cell and Dendritic cell activation) to accomplish this vaccine, and that these unencumbered molecules and cell therapies are all at various stages of clinical trials. We recognize the enormity of such a challenge and this investment will enable the scientists and physicians to pursue the goal of potentially curing cancer in our lifetime.”

About ImmunityBio

ImmunityBio is a vertically-integrated, clinical-stage biotechnology company developing next-generation therapies and vaccines that bolster the natural immune system to defeat cancers and infectious diseases. The company’s range of immunotherapy and cell therapy platforms, alone and together, act to drive and sustain an immune response with the goal of creating durable and safe protection against disease. We are applying our science and platforms to treating cancers, including the development of potential cancer vaccines, as well as developing immunotherapies and cell therapies that we believe sharply reduce or eliminate the need for standard high-dose chemotherapy. These platforms and their associated product candidates are designed to be more effective, accessible, and easily administered than current standards of care in oncology and infectious diseases.

For more information, please visit: www.immunitybio.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements regarding the financing transactions described herein and use of proceeds to be received from such financing, the regulatory submission and review process and timing thereof, the Company’s commercialization strategy for N-803 for intravesical administration, the potential of ImmunityBio’s investigational agents as compared to existing treatment options, and development of therapeutics for cancers and infectious diseases, among others. Statements in this press release that are not statements of historical fact are considered forward-looking statements, which are usually identified by the use of words such as “anticipates,” “believes,” “continues,” “goal,” “could,” “estimates,” “scheduled,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “indicate,” “projects,” “seeks,” “should,” “will,” “strategy,” and variations of such words or similar expressions. Statements of past performance, efforts, or results of our preclinical and clinical trials, about which inferences or assumptions may be made, can also be forward-looking statements and are not indicative of future performance or results. Forward-looking statements are neither forecasts, promises nor guarantees, and are based on the current beliefs of ImmunityBio’s management as well as assumptions made by and information currently available to ImmunityBio. Such information may be limited or incomplete, and ImmunityBio’s statements should not be read to indicate that it has conducted a thorough inquiry into, or review of, all potentially available relevant information. Such statements reflect the current views of ImmunityBio with respect to future events and are subject to known and unknown risks, including business, regulatory, economic and competitive risks, uncertainties, contingencies and assumptions about ImmunityBio, including, without limitation, (i) the risks and uncertainties associated with the regulatory review process, (ii) the ability of ImmunityBio and its third party contract manufacturing organizations to adequately address the issues raised in the FDA’s complete response letter, (iii) the ability of ImmunityBio to execute a partnering relationship with a large biopharmaceutical company for commercialization of N-803 plus BCG for intravesical administration on acceptable terms, if at all, (iv) the ability of ImmunityBio to continue its planned preclinical and clinical development of its development programs, and the timing and success of any such continued preclinical and clinical development and planned regulatory submissions, (v) ImmunityBio’s ability to retain and hire key personnel, (vi) ImmunityBio’s need and ability to obtain additional financing to fund its operations and complete the development and commercialization of its various product candidates, (vii) ImmunityBio’s ability to successfully commercialize its product candidates and uncertainties around regulatory reviews and approvals, (viii) ImmunityBio’s ability to scale its manufacturing and commercial supply operations for its product candidates and future approved products, and (ix) ImmunityBio’s ability to obtain, maintain, protect and enforce patent protection and other proprietary rights for its product candidates and technologies. More details about these and other risks that may impact ImmunityBio’s business are described under the heading “Risk Factors” in the Company’s Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 1, 2023 and the Company’s Form 10-Q filed with the SEC on August 8, 2023, and in subsequent filings made by ImmunityBio with the SEC, which are available on the SEC’s website at www.sec.gov. ImmunityBio cautions you not to place undue reliance on any forward-looking statements, which speak only as of the date hereof. ImmunityBio does not undertake any duty to update any forward-looking statement or other information in this press release, except to the extent required by law.

Contacts:

| | | | | |

| Investors | Media |

| Sarah Singleton | Greg Tenor |

| ImmunityBio, Inc. | Salutem |

| 844-696-5235, Option 5 | +1 717-919-6794 |

| Sarah.Singleton@ImmunityBio.com | Gregory.Tenor@Salutem.com |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

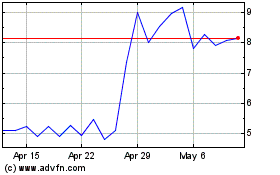

ImmunityBio (NASDAQ:IBRX)

Historical Stock Chart

From Apr 2024 to May 2024

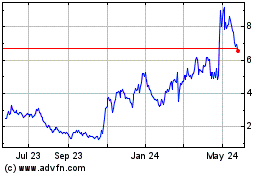

ImmunityBio (NASDAQ:IBRX)

Historical Stock Chart

From May 2023 to May 2024