Illumina Submits SEC Form For Grail Divestiture

December 11 2023 - 1:58PM

Dow Jones News

By Ben Glickman

Illumina has submitted paperwork for its potential divestiture

of its subsidiary Grail, after being ordered by the European

Commission to shed the recent acquisition.

The San Diego-based gene-sequencing equipment and services

company said on Monday it had submitted a Form 10 draft

registration statement to the Securities and Exchange

Commission.

Illumina was ordered in October to unwind its $7.1 billion

acquisition of Grail due to antitrust concerns from the European

Commission.

The company said it maintains the European Commission doesn't

have jurisdiction over the deal, and wouldn't divest Grail if its

challenge to the order in court was successful.

Form 10 allows companies to register sales of securities. The

company said the confidential submission was an "important next

step in evaluating divestiture options" for Grail, which develops

tests for cancer.

The company is allowed to explore multiple options for unwinding

its acquisition, including a third-party sale or capital markets

transaction.

This is just the latest development since Illumina reached an

agreement to acquire Grail in 2020. Chief Executive Francis deSouza

resigned in June after losing support from some board members amid

regulatory challenges to the deal. It also prompted a proxy battle

with activist investor Carl Icahn, who argued the company had cost

shareholders billions by continuing with the acquisition.

Write to Ben Glickman at ben.glickman@wsj.com

(END) Dow Jones Newswires

December 11, 2023 13:43 ET (18:43 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

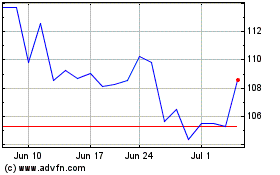

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Apr 2024 to May 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From May 2023 to May 2024