0001362004false00013620042023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 02, 2023 |

ICF International, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

001-33045 |

22-3661438 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1902 Reston Metro Plaza |

|

Reston, Virginia |

|

20190 |

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 703 934-3000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2 below):

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

ICFI |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On November 2, 2023, ICF International, Inc. (the “Company”) announced its financial results for the third quarter ended September 30, 2023. The press release containing this announcement is attached hereto as Exhibit 99.1.

The information contained in this report, including Exhibit 99.1, is considered to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. The information in this report shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

The release contains forward-looking statements regarding the Company and includes a cautionary statement identifying important factors that could cause actual result to differ materially from those anticipated.

Item 8.01 Other Events

On November 2, 2023, the Company's Board of Directors declared a quarterly dividend in an amount equal to $0.14 per share. This quarterly cash dividend will be paid on January 12, 2024, to stockholders of record as of the close of business on December 8, 2023.

The cash dividend policy and the payment of future cash dividends under that policy will be made at the discretion of the Company's Board of Directors and will depend on earnings, operating and financial conditions, capital requirements, and other factors deemed relevant by the Board, including the applicable requirements of the Delaware General Corporation Law and the best interests of the Company’s stockholders.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

ICF International, Inc. |

|

|

|

|

Date: November 2, 2023 |

|

By: |

/s/ Barry Broadus |

|

|

|

Barry Broadus |

|

|

|

Chief Financial Officer |

Exhibit 99.1

NEWS RELEASE

ICF Reports Third Quarter 2023 Results

— Strong Revenue Growth Across Major Markets —

— New Business Pipeline at $9.8 Billion After Record Q3 Contract Awards —

— Raising GAAP and Non-GAAP EPS Guidance to Reflect Lower Tax Rate —

•Revenue Was $502 Million, Up 7%

•Net Income Was $24 Million, Up 24%; Diluted EPS Was $1.25, Up 24%

•Non-GAAP EPS Was $1.81, Up 12%

•EBITDA1 Was $49.2 Million, Up 14%; Adjusted EBITDA1 Was $54.3 Million, Up 7%

•Contract Awards Were a Record $875 Million Representing a Book-to-Bill Ratio of 1.7; TTM Contract Awards Were $2.5 Billion for a Book-to-Bill Ratio of 1.3

RESTON, Va.— Nov. 2, 2023-- ICF (NASDAQ: ICFI), a global consulting and technology services provider, reported results for the third quarter ended September 30, 2023.

Commenting on the results, John Wasson, chair and chief executive officer, said, “This was another quarter of strong execution for ICF. Revenues increased 7.2% year-on-year. Adjusting for the sale of the Commercial Marketing Group that was completed in the third quarter and the commercial U.K. events business that we exited at the end of the second quarter, revenue growth is estimated at 8.4%1, with our two major market categories, Energy, Environment & Infrastructure and Disaster Recovery and Health & Social Programs posting revenue increases of 14% and 7%, respectively.

“This also was a robust period for contract wins, which reached a third quarter record of $875 million and included record federal government awards led by IT modernization, public health, and cybersecurity. Year-to-date contract awards increased 10%, and 70% of the dollar amount of the awards represented new business, a strong indication of how well aligned ICF’s capabilities and priority markets are with client demand and funding.

“Third quarter profitability benefited from higher utilization, lower facility costs, favorable mix, and scale efficiencies. Additionally, net income and per share earnings were bolstered by tax optimization strategies that have helped to offset higher interest expense.

1

“At quarter-end, our business development pipeline was $9.8 billion, 10% above the same period last year. The pipeline represents a diversified set of opportunities, which together with our strong backlog and book-to-bill metrics, support our expectation that 2024 will be another year of considerable recurring revenue growth for ICF.”

Third Quarter 2023 Results

Third quarter 2023 total revenue increased 7.2% to $501.5 million from $467.8 million in the third quarter of 2022. Subcontractor and other direct costs were 27.1% of total revenues compared to 28.3% in last year’s third quarter. Operating income increased 13.0% to $31.9 million, up from $28.2 million, and operating margin on total revenue increased to 6.4%. Net income totaled $23.7 million, and diluted EPS was $1.25 per share in the 2023 third quarter, representing increases of 24.3% and 23.8%, respectively. Third quarter 2023 net income and diluted EPS included $5.1 million, or $0.20 per share, in tax-effected special charges, net of the gain on the sale of the company’s Commercial Marketing Group. Special charges in the third quarter of 2023 related to facilities reductions (including the previously disclosed one-time non-cash stranded facilities charge), M&A, and severance costs. Also included was a one-time tax benefit and other tax optimization strategies representing $0.13 per share.

Non-GAAP EPS1 increased 12.4% to $1.81 per share, from the $1.61 per share reported in the comparable period in 2022, inclusive of a one-time tax benefit and other tax optimization strategies totaling $0.13 per share. EBITDA was $49.2 million, an increase of 14.3% compared to the $43.0 million reported for the year-ago period. Adjusted EBITDA increased 7.3% to $54.3 million, from $50.6 million for the comparable period in 2022.

Backlog and New Business

Total backlog was $3.8 billion at the end of the third quarter of 2023. Funded backlog was $1.8 billion, or approximately 47% of the total backlog. The total value of contracts awarded in the 2023 third quarter was $875 million representing a book-to-bill ratio of 1.7, and trailing-twelve-month contract awards totaled $2.5 billion for a book-to-bill ratio of 1.3.

Government Revenue Third Quarter 2023 Highlights

Revenue from government clients was $383.3 million, up 6.6% year-over-year.

•U.S. federal government revenue was $279.3 million, 2.8% above the $271.6 million reported in the third quarter of 2022 and was impacted by a year-over-year decrease in subcontractor and other direct costs of $5 million in the quarter. Excluding this decrease, federal government revenues grew by approximately 6.5%. Federal government revenue accounted for 55.7% of total revenue, compared to 58.1% of total revenue in the third quarter of 2022.

•U.S. state and local government revenue increased 17.7% to $76.4 million, from $64.9 million in the year-ago quarter. State and local government clients represented 15.2% of total revenue, compared to 13.9% in the third quarter of 2022.

2

•International government revenue was $27.6 million, up 19.9% from the $23.0 million reported in the year-ago quarter. International government revenue represented 5.5% of total revenue, compared to 4.9% in the third quarter of 2022.

Key Government Contracts Awarded in the Third Quarter 2023

Notable government contract awards won in the third quarter of 2023 included:

Health and Social Programs

•A recompete contract with a value of $143.3 million with a U.S. federal agency to provide advanced data science and analysis services.

•Two agreements with a combined value of $31.0 million with the U.S. National Institutes of Health’s National Library of Medicine to provide biomedical and technical expertise as well as data management and digital modernization services.

•Three call orders comprised of two recompetes and one modification with a combined value of $26.0 million with a U.S. federal agency to provide training and technical assistance to support grant management activities.

•A subcontract modification with a value of $10.5 million to continue to provide support and infrastructure to a contractor responsible for providing services to immigrants for the U.S. Department of Health and Human Services (HHS) Administration for Children and Families.

•Several new cooperative agreements with a combined multimillion-dollar value with the U.S. Department of Housing and Urban Development to provide community development and advanced technology and analytics services to its Community Compass program.

Digital Modernization

•Two new task orders with a combined value of $67.2 million with U.S. Immigration and Customs Enforcement to modernize its technology systems.

•Multiple contract modifications with a combined value of $65.9 million with an agency within HHS to continue to provide digital modernization services.

•A new task order through a contractor teaming agreement with a value of $54.7 million to modernize wildfire management applications and services for the U.S. Department of Agriculture’s U.S. Forest Service.

•Two new task orders and a task order modification with a combined value of $21.3 million with a U.S. federal agency to continue to provide digital modernization services.

•A contract modification with a value of $15.4 million with an agency within HHS to continue to support its digital service center.

Disaster Management and Mitigation

•A recompete contract with a value of $24.0 million with the Government of Puerto Rico's Public Private Partnership Authority (P3) to provide disaster recovery project development services.

•A new contract with a value of $22.6 million with the Oregon Housing and Community Services Department to provide technology-enabled disaster management and program implementation servicesto support wildfire recovery efforts.

3

Energy and Environment

•A contract renewal with a value of $10.4 million with the department of environmental protection of a Northeastern U.S. city to provide technical assistance to new and existing buildings that must comply with a local decarbonization law.

•A recompete subcontract with a value of $10.1 million to support the U.S. Department of Energy’s National Renewable Energy Laboratory Clean Cities program.

Commercial Revenue Third Quarter 2023 Highlights

Commercial revenue was $118.2 million, 9.2% above the $108.2 million reported in the third quarter of 2022.

•Commercial revenue accounted for 23.6% of total revenue compared to 23.1% of total revenue in the 2022 third quarter.

•Energy markets, which includes energy efficiency programs, represented 76.5% of commercial revenue. Marketing services and aviation consulting accounted for 15.6% of commercial revenue.

Key Commercial Contracts Awarded in the Third Quarter

Notable commercial awards won in the third quarter of 2023 included:

Energy Markets

•A new contract with a Northeastern U.S. diversified energy company to provide marketing services as its agency of record.

•A new contract with a North American energy system operator to provide lighting energy efficiency program implementation services.

•A contract modification with a Southern U.S. utility to provide a habitat conservation plan.

•A new contract with a mid-Atlantic U.S. utility to provide the engineering design for a transmission substation.

•A contract modification with a Northeastern U.S. utility to provide fleet advisory services.

•A new contract with a Southern U.S. utility to provide implementation services for its beneficial electrification program.

Dividend Declaration

On November 2, 2023, ICF declared a quarterly cash dividend of $0.14 per share, payable on January 12, 2024, to shareholders of record on December 8, 2023.

4

Summary and Outlook

“ICF’s strong year-to-date performance has put us firmly on track to achieve our full-year guidance and has set the stage for continued growth in 2024. Our key growth markets, utility consulting, disaster management, IT modernization/digital transformation, and climate, environment, and infrastructure services, represented approximately 80% of our total nine-month revenues, adjusted for the sale of our Commercial Marketing Group and the exit of our commercial U.K. events business. We are also encouraged by our year-to-date profitability metrics, which reflect actions we have taken to deploy our resources to support these growth markets, strengthen operating efficiencies, and streamline our business.

“Based on our results to date, the recent sale of our Commercial Marketing Group and the exit of our commercial U.K. events business in the second quarter, we are narrowing our guidance range for full-year 2023 revenue to $1,950 million to $1,980 million, and we anticipate subcontractor and other direct costs will be approximately 27% of total revenue. Adjusted EBITDA is expected to range from $212 million to $218 million. We are raising our guidance ranges for diluted EPS to $5.00 to $5.10, exclusive of special charges, and Non-GAAP EPS to $6.40 to $6.50 due to a lower than anticipated tax rate. Operating cash flow is projected at approximately $150 million in 2023. Included in full year 2023 guidance are $60 million in year-to-date revenues from our Commercial Marketing Group and our commercial U.K. events business, which were divested in 2023. At similar margins to the rest of our business, these service lines are estimated to have contributed EPS of approximately $0.20 that will not recur in 2024.

“Looking ahead to 2024, our record sales, substantial backlog, and robust business development pipeline support our expectations for high single-digit organic growth in recurring revenues.

“In the third quarter, Forbes named ICF one of America’s Best Employers for Women for the second consecutive year, and in 2023 ICF also was included on Forbes’ America’s Best Management Consulting Firms list for the eighth straight year and on its Best Employers for Diversity List for the third straight year. These recognitions speak volumes about the collaborative and inclusive corporate culture that we work every day to maintain. We encourage all our stakeholders to read our latest Corporate Citizenship Report, which details how ICF and our people are impacting society,” Mr. Wasson concluded.

1 Non-GAAP EPS, EBITDA, and Adjusted EBITDA are non-GAAP measurements. A reconciliation of all non-GAAP measurements to the most applicable GAAP number is set forth below. Special charges are items that were included within our consolidated statements of comprehensive income but are not indicative of ongoing performance and have been presented net of applicable U.S. GAAP taxes. The presentation of non-GAAP measurements may not be comparable to other similarly titled measures used by other companies.

5

About ICF

ICF is a global consulting and technology services company with approximately 9,000 employees, but we are not your typical consultants. At ICF, business analysts and policy specialists work together with digital strategists, data scientists and creatives. We combine unmatched industry expertise with cutting-edge engagement capabilities to help organizations solve their most complex challenges. Since 1969, public and private sector clients have worked with ICF to navigate change and shape the future. Learn more at icf.com.

Caution Concerning Forward-looking Statements

Statements that are not historical facts and involve known and unknown risks and uncertainties are "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995. Such statements may concern our current expectations about our future results, plans, operations and prospects and involve certain risks, including those related to the government contracting industry generally; our particular business, including our dependence on contracts with U.S. federal government agencies; and our ability to acquire and successfully integrate businesses. These and other factors that could cause our actual results to differ from those indicated in forward-looking statements that are included in the "Risk Factors" section of our securities filings with the Securities and Exchange Commission. The forward-looking statements included herein are only made as of the date hereof, and we specifically disclaim any obligation to update these statements in the future.

Note on Forward-Looking Non-GAAP Measures

The company does not reconcile its forward-looking non-GAAP financial measures to the corresponding U.S. GAAP measures, due to the variability and difficulty in making accurate forecasts and projections and because not all of the information necessary for a quantitative reconciliation of these forward-looking non-GAAP financial measures (such as the effect of share-based compensation or the impact of future extraordinary or non-recurring events like acquisitions) is available to the company without unreasonable effort. For the same reasons, the company is unable to estimate the probable significance of the unavailable information. The company provides forward-looking non-GAAP financial measures that it believes will be achievable, but it cannot accurately predict all of the components of the adjusted calculations, and the U.S. GAAP financial measures may be materially different than the non-GAAP financial measures.

Investor Contacts:

Lynn Morgen, ADVISIRY PARTNERS, lynn.morgen@advisiry.com +1.212.750.5800

David Gold, ADVISIRY PARTNERS, david.gold@advisiry.com +1.212.750.5800

Company Information Contact:

Lauren Dyke, ICF, lauren.dyke@ICF.com+1.571.373.5577

6

ICF International, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

(in thousands, except per share amounts) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue |

|

$ |

501,519 |

|

|

$ |

467,777 |

|

|

$ |

1,484,886 |

|

|

$ |

1,304,355 |

|

Direct costs |

|

|

323,504 |

|

|

|

307,295 |

|

|

|

961,473 |

|

|

|

834,358 |

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Indirect and selling expenses |

|

|

131,553 |

|

|

|

118,290 |

|

|

|

381,808 |

|

|

|

350,145 |

|

Depreciation and amortization |

|

|

5,917 |

|

|

|

5,297 |

|

|

|

19,052 |

|

|

|

15,198 |

|

Amortization of intangible assets |

|

|

8,644 |

|

|

|

8,661 |

|

|

|

27,154 |

|

|

|

18,941 |

|

Total operating costs and expenses |

|

|

146,114 |

|

|

|

132,248 |

|

|

|

428,014 |

|

|

|

384,284 |

|

Operating income |

|

|

31,901 |

|

|

|

28,234 |

|

|

|

95,399 |

|

|

|

85,713 |

|

Interest, net |

|

|

(10,557 |

) |

|

|

(7,420 |

) |

|

|

(30,146 |

) |

|

|

(14,096 |

) |

Other income |

|

|

2,736 |

|

|

|

833 |

|

|

|

1,501 |

|

|

|

438 |

|

Income before income taxes |

|

|

24,080 |

|

|

|

21,647 |

|

|

|

66,754 |

|

|

|

72,055 |

|

Provision for income taxes |

|

|

340 |

|

|

|

2,542 |

|

|

|

6,304 |

|

|

|

16,691 |

|

Net income |

|

$ |

23,740 |

|

|

$ |

19,105 |

|

|

$ |

60,450 |

|

|

$ |

55,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.26 |

|

|

$ |

1.01 |

|

|

$ |

3.22 |

|

|

$ |

2.94 |

|

Diluted |

|

$ |

1.25 |

|

|

$ |

1.01 |

|

|

$ |

3.19 |

|

|

$ |

2.91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average Shares: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

18,815 |

|

|

|

18,826 |

|

|

|

18,795 |

|

|

|

18,806 |

|

Diluted |

|

|

18,974 |

|

|

|

19,009 |

|

|

|

18,958 |

|

|

|

19,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per common share |

|

$ |

0.14 |

|

|

$ |

0.14 |

|

|

$ |

0.42 |

|

|

$ |

0.42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss, net of tax |

|

|

(4,053 |

) |

|

|

(1,555 |

) |

|

|

(2,236 |

) |

|

|

(3,107 |

) |

Comprehensive income, net of tax |

|

$ |

19,687 |

|

|

$ |

17,550 |

|

|

$ |

58,214 |

|

|

$ |

52,257 |

|

7

ICF International, Inc. and Subsidiaries

Reconciliation of Non-GAAP Financial Measures(2)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

(in thousands, except per share amounts) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Reconciliation of Revenue, Adjusted for Impact of Exited Business |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

501,519 |

|

|

$ |

467,777 |

|

|

$ |

1,484,886 |

|

|

$ |

1,304,355 |

|

Less: Adjustment to 2022 revenue from exited business (3) |

|

|

— |

|

|

|

(5,015 |

) |

|

|

— |

|

|

|

(5,015 |

) |

Total Revenue, Adjusted for Impact of Exited Business |

|

$ |

501,519 |

|

|

$ |

462,762 |

|

|

$ |

1,484,886 |

|

|

$ |

1,299,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of EBITDA and Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

23,740 |

|

|

$ |

19,105 |

|

|

$ |

60,450 |

|

|

$ |

55,364 |

|

Interest, net |

|

|

10,557 |

|

|

|

7,420 |

|

|

|

30,146 |

|

|

|

14,096 |

|

Provision for income taxes |

|

|

340 |

|

|

|

2,542 |

|

|

|

6,304 |

|

|

|

16,691 |

|

Depreciation and amortization |

|

|

14,561 |

|

|

|

13,958 |

|

|

|

46,206 |

|

|

|

34,139 |

|

EBITDA (4) |

|

$ |

49,198 |

|

|

$ |

43,025 |

|

|

$ |

143,106 |

|

|

$ |

120,290 |

|

Impairment of long-lived assets (5) |

|

|

2,912 |

|

|

|

— |

|

|

|

3,806 |

|

|

|

— |

|

Acquisition and divestiture-related expenditures (6) |

|

|

1,779 |

|

|

|

1,940 |

|

|

|

4,685 |

|

|

|

5,521 |

|

Severance and other costs related to staff realignment (7) |

|

|

595 |

|

|

|

3,757 |

|

|

|

4,455 |

|

|

|

5,168 |

|

Charges for facility consolidations and office closures (8) |

|

|

2,220 |

|

|

|

— |

|

|

|

2,579 |

|

|

|

— |

|

Pre-tax gain from divestiture of a business (9) |

|

|

(2,425 |

) |

|

|

— |

|

|

|

(2,425 |

) |

|

|

— |

|

Expenses related to the transfer to our new corporate headquarters (10) |

|

|

— |

|

|

|

1,883 |

|

|

|

— |

|

|

|

5,647 |

|

Total Adjustments |

|

|

5,081 |

|

|

|

7,580 |

|

|

|

13,100 |

|

|

|

16,336 |

|

Adjusted EBITDA |

|

$ |

54,279 |

|

|

$ |

50,605 |

|

|

$ |

156,206 |

|

|

$ |

136,626 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income Margin Percent on Revenue (11) |

|

|

4.7 |

% |

|

|

4.1 |

% |

|

|

4.1 |

% |

|

|

4.2 |

% |

EBITDA Margin Percent on Revenue (12) |

|

|

9.8 |

% |

|

|

9.2 |

% |

|

|

9.6 |

% |

|

|

9.2 |

% |

Adjusted EBITDA Margin Percent on Revenue (12) |

|

|

10.8 |

% |

|

|

10.8 |

% |

|

|

10.5 |

% |

|

|

10.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Diluted EPS |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP Diluted EPS |

|

$ |

1.25 |

|

|

$ |

1.01 |

|

|

$ |

3.19 |

|

|

$ |

2.91 |

|

Impairment of long-lived assets |

|

|

0.15 |

|

|

|

— |

|

|

|

0.20 |

|

|

|

— |

|

Acquisition and divestiture-related expenditures |

|

|

0.09 |

|

|

|

0.10 |

|

|

|

0.25 |

|

|

|

0.29 |

|

Severance and other costs related to staff realignment |

|

|

0.03 |

|

|

|

0.20 |

|

|

|

0.23 |

|

|

|

0.27 |

|

Charges for facility consolidations and office closures |

|

|

0.12 |

|

|

|

— |

|

|

|

0.14 |

|

|

|

— |

|

Pre-tax gain from divestiture of a business |

|

|

(0.13 |

) |

|

|

— |

|

|

|

(0.13 |

) |

|

|

— |

|

Expenses related to the transfer to our new corporate headquarters |

|

|

— |

|

|

|

0.10 |

|

|

|

— |

|

|

|

0.30 |

|

Amortization of intangibles |

|

|

0.46 |

|

|

|

0.46 |

|

|

|

1.43 |

|

|

|

1.00 |

|

Income tax effects of the adjustments (13) |

|

|

(0.16 |

) |

|

|

(0.26 |

) |

|

|

(0.50 |

) |

|

|

(0.54 |

) |

Non-GAAP Diluted EPS |

|

$ |

1.81 |

|

|

$ |

1.61 |

|

|

$ |

4.81 |

|

|

$ |

4.23 |

|

8

|

|

|

|

|

(2) These tables provide reconciliations of non-GAAP financial measures to the most applicable GAAP numbers. While we believe that these non-GAAP financial measures may be useful in evaluating our financial information, they should be considered supplemental in nature and not as a substitute for financial information prepared in accordance with GAAP. Other companies may define similarly titled non-GAAP measures differently and, accordingly, care should be exercised in understanding how we define these measures. |

|

|

|

|

|

(3) Includes adjustment to revenue for the three and nine months ended September 30, 2022 to reflect the impact of exiting our U.K. commercial marketing business as of June 30, 2023 and the divestiture of our U.S. commercial marketing business on September 11, 2023. The adjustment of revenue related to our U.K. commercial marketing business was for the period July 1 to September 30 totaling $2.8 million for both the three and the nine months ended September 30, 2022, respectively. The adjustment of revenue related to our U.S. commercial marketing business was for the period September 12 to September 30 totaling $2.2 million for both the three and nine months ended September 30, 2022, respectively. |

|

|

|

|

|

(4) The calculation of EBITDA for the three and nine months ended September 30, 2022 has been revised to conform to the current period calculation of EBITDA. Specifically, interest income of $0.1 million and $0.2 million, respectively, was reclassified from "Other expense" to "Interest, net" on the consolidated statements of comprehensive income. |

|

|

|

|

|

(5) We recorded impairment of $0.9 million and $2.9 million in the first and the third quarter of 2023, respectively, related to impairment of an intangible asset and operating lease right-of-use assets. |

|

|

|

|

|

(6) These costs consist primarily of third-party costs and integration costs associated with our acquisitions and/or potential acquisitions and separation costs associated with business discontinuation/divestitures. |

|

|

|

|

|

(7) These costs are mainly due to involuntary employee termination benefits for our officers, and/or groups of employees who have been notified that they will be terminated as part of a consolidation or reorganization. |

|

|

|

|

|

(8) These costs are exit costs associated with terminated leases or full office closures. The exit costs include charges incurred under a contractual obligation that existed as of the date of the accrual and for which (i) we will continue to pay until the contractual obligation is satisfied but with no economic benefit to us or (ii) we contractually terminated the obligation and ceased utilizing the facilities. |

|

|

|

|

|

(9) During the third quarter of 2023, we recognized a pre-tax gain of $2.4 million from sale of assets related to the divestiture of our U.S. commercial marketing business. |

|

|

|

|

|

(10) These costs represent incremental non-cash lease expense associated with a straight-line rent accrual during the “free rent” period in the lease for our new corporate headquarters in Reston, Virginia. We took possession of the new facility during the fourth quarter of 2021, while also maintaining and incurring lease costs for the former headquarters in Fairfax, Virginia. The transition to the new corporate headquarters was completed in the fourth quarter of 2022. |

|

|

|

|

|

(11) Net Income Margin Percent on Revenue was calculated by dividing net income by revenue. |

|

|

|

|

|

(12) EBITDA Margin Percent and Adjusted EBITDA Margin Percent on Revenue were calculated by dividing the non-GAAP measure by the corresponding revenue. |

|

|

|

|

|

(13) Income tax effects were calculated using the effective tax rate, adjusted for certain discrete items, if any, of 21.7% and 29.4% for the three months ended September 30, 2023 and 2022, respectively, and 23.5% and 28.5% for the nine months ended September 30, 2023 and 2022, respectively. |

9

ICF International, Inc. and Subsidiaries

Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

(in thousands, except share and per share amounts) |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,084 |

|

|

$ |

11,257 |

|

Restricted cash |

|

|

2,770 |

|

|

|

1,711 |

|

Contract receivables, net |

|

|

214,818 |

|

|

|

232,337 |

|

Contract assets |

|

|

209,267 |

|

|

|

169,088 |

|

Prepaid expenses and other assets |

|

|

34,294 |

|

|

|

40,709 |

|

Income tax receivable |

|

|

11,175 |

|

|

|

11,616 |

|

Total Current Assets |

|

|

477,408 |

|

|

|

466,718 |

|

Property and Equipment, net |

|

|

78,706 |

|

|

|

85,402 |

|

Other Assets: |

|

|

|

|

|

|

Goodwill |

|

|

1,219,326 |

|

|

|

1,212,898 |

|

Other intangible assets, net |

|

|

103,211 |

|

|

|

126,537 |

|

Operating lease - right-of-use assets |

|

|

134,172 |

|

|

|

149,066 |

|

Other assets |

|

|

42,297 |

|

|

|

51,637 |

|

Total Assets |

|

$ |

2,055,120 |

|

|

$ |

2,092,258 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Current portion of long-term debt |

|

$ |

23,250 |

|

|

$ |

23,250 |

|

Accounts payable |

|

|

123,414 |

|

|

|

135,778 |

|

Contract liabilities |

|

|

16,989 |

|

|

|

25,773 |

|

Operating lease liabilities |

|

|

19,230 |

|

|

|

19,305 |

|

Finance lease liabilities |

|

|

2,441 |

|

|

|

2,381 |

|

Accrued salaries and benefits |

|

|

77,123 |

|

|

|

85,991 |

|

Accrued subcontractors and other direct costs |

|

|

42,049 |

|

|

|

45,478 |

|

Accrued expenses and other current liabilities |

|

|

64,681 |

|

|

|

78,036 |

|

Total Current Liabilities |

|

|

369,177 |

|

|

|

415,992 |

|

Long-term Liabilities: |

|

|

|

|

|

|

Long-term debt |

|

|

510,687 |

|

|

|

533,084 |

|

Operating lease liabilities - non-current |

|

|

174,718 |

|

|

|

182,251 |

|

Finance lease liabilities - non-current |

|

|

14,277 |

|

|

|

16,116 |

|

Deferred income taxes |

|

|

40,148 |

|

|

|

68,038 |

|

Other long-term liabilities |

|

|

52,783 |

|

|

|

23,566 |

|

Total Liabilities |

|

|

1,161,790 |

|

|

|

1,239,047 |

|

|

|

|

|

|

|

|

Commitments and Contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

Preferred stock, par value $.001; 5,000,000 shares authorized; none issued |

|

|

— |

|

|

|

— |

|

Common stock, par value $.001; 70,000,000 shares authorized; 23,948,590 and 23,771,596 shares issued at September 30, 2023 and December 31, 2022, respectively; 18,816,914 and 18,883,050 shares outstanding at September 30, 2023 and December 31, 2022, respectively |

|

|

24 |

|

|

|

23 |

|

Additional paid-in capital |

|

|

414,633 |

|

|

|

401,957 |

|

Retained earnings |

|

|

755,572 |

|

|

|

703,030 |

|

Treasury stock, 5,131,676 and 4,906,209 shares at September 30, 2023 and December 31, 2022 respectively |

|

|

(266,530 |

) |

|

|

(243,666 |

) |

Accumulated other comprehensive loss |

|

|

(10,369 |

) |

|

|

(8,133 |

) |

Total Stockholders’ Equity |

|

|

893,330 |

|

|

|

853,211 |

|

Total Liabilities and Stockholders’ Equity |

|

$ |

2,055,120 |

|

|

$ |

2,092,258 |

|

10

ICF International, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

September 30, |

|

(in thousands) |

|

2023 |

|

|

2022 |

|

Cash Flows from Operating Activities |

|

|

|

|

|

|

Net income |

|

$ |

60,450 |

|

|

$ |

55,364 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

Provision for credit losses |

|

|

691 |

|

|

|

91 |

|

Deferred income taxes and unrecognized income tax benefits |

|

|

(3,533 |

) |

|

|

6,023 |

|

Non-cash equity compensation |

|

|

10,134 |

|

|

|

10,023 |

|

Depreciation and amortization |

|

|

46,207 |

|

|

|

34,139 |

|

Facilities consolidation reserve |

|

|

— |

|

|

|

(236 |

) |

Amortization of debt issuance costs |

|

|

984 |

|

|

|

940 |

|

Impairment of long-lived assets |

|

|

3,801 |

|

|

|

— |

|

Gain on divestiture of a business |

|

|

(4,302 |

) |

|

|

— |

|

Other adjustments, net |

|

|

(2,222 |

) |

|

|

474 |

|

Changes in operating assets and liabilities, net of the effects of acquisitions: |

|

|

|

|

|

|

Net contract assets and liabilities |

|

|

(52,010 |

) |

|

|

(72,619 |

) |

Contract receivables |

|

|

12,087 |

|

|

|

(31,770 |

) |

Prepaid expenses and other assets |

|

|

11,893 |

|

|

|

(11,991 |

) |

Operating lease assets and liabilities, net |

|

|

3,897 |

|

|

|

(1,305 |

) |

Accounts payable |

|

|

(13,333 |

) |

|

|

23,394 |

|

Accrued salaries and benefits |

|

|

(8,521 |

) |

|

|

(13,971 |

) |

Accrued subcontractors and other direct costs |

|

|

(3,353 |

) |

|

|

9,441 |

|

Accrued expenses and other current liabilities |

|

|

(18,727 |

) |

|

|

(476 |

) |

Income tax receivable and payable |

|

|

450 |

|

|

|

(1,667 |

) |

Other liabilities |

|

|

959 |

|

|

|

742 |

|

Net Cash Provided by Operating Activities |

|

|

45,552 |

|

|

|

6,596 |

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities |

|

|

|

|

|

|

Capital expenditures for property and equipment and capitalized software |

|

|

(17,876 |

) |

|

|

(17,323 |

) |

Proceeds from working capital adjustments related to prior business acquisition |

|

|

— |

|

|

|

2,911 |

|

Payments for business acquisitions, net of cash acquired |

|

|

(32,664 |

) |

|

|

(238,991 |

) |

Proceeds from divestiture of a business |

|

|

47,151 |

|

|

|

— |

|

Net Cash Used in Investing Activities |

|

|

(3,389 |

) |

|

|

(253,403 |

) |

|

|

|

|

|

|

|

Cash Flows from Financing Activities |

|

|

|

|

|

|

Advances from working capital facilities |

|

|

972,266 |

|

|

|

1,358,335 |

|

Payments on working capital facilities |

|

|

(995,244 |

) |

|

|

(1,074,888 |

) |

Proceeds from other short-term borrowings |

|

|

25,394 |

|

|

|

— |

|

Repayments of other short-term borrowings |

|

|

(18,845 |

) |

|

|

— |

|

Receipt of restricted contract funds |

|

|

6,412 |

|

|

|

13,525 |

|

Payment of restricted contract funds |

|

|

(7,042 |

) |

|

|

(23,358 |

) |

Debt issuance costs |

|

|

— |

|

|

|

(4,852 |

) |

Payments of principal portion of finance leases |

|

|

(1,780 |

) |

|

|

— |

|

Proceeds from exercise of options |

|

|

279 |

|

|

|

412 |

|

Dividends paid |

|

|

(7,903 |

) |

|

|

(7,912 |

) |

Net payments for stock issuances and buybacks |

|

|

(20,601 |

) |

|

|

(21,105 |

) |

Payments on business acquisition liabilities |

|

|

— |

|

|

|

(1,132 |

) |

Net Cash (Used in) Provided by Financing Activities |

|

|

(47,064 |

) |

|

|

239,025 |

|

Effect of Exchange Rate Changes on Cash, Cash Equivalents, and Restricted Cash |

|

|

(213 |

) |

|

|

(2,175 |

) |

|

|

|

|

|

|

|

Decrease in Cash, Cash Equivalents, and Restricted Cash |

|

|

(5,114 |

) |

|

|

(9,957 |

) |

Cash, Cash Equivalents, and Restricted Cash, Beginning of Period |

|

|

12,968 |

|

|

|

20,433 |

|

Cash, Cash Equivalents, and Restricted Cash, End of Period |

|

$ |

7,854 |

|

|

$ |

10,476 |

|

|

|

|

|

|

|

|

Supplemental Disclosure of Cash Flow Information |

|

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

|

Interest |

|

$ |

29,173 |

|

|

$ |

13,595 |

|

Income taxes |

|

$ |

12,604 |

|

|

$ |

14,384 |

|

Non-cash investing and financing transactions: |

|

|

|

|

|

|

Tenant improvements funded by lessor |

|

$ |

— |

|

|

$ |

20,253 |

|

Acquisition of property and equipment through finance lease |

|

$ |

— |

|

|

$ |

15,027 |

|

11

ICF International, Inc. and Subsidiaries

Supplemental Schedule(14)(15)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, |

|

September 30, |

Client Markets: |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

Energy, environment, infrastructure, and disaster recovery |

|

41% |

|

38% |

|

40% |

|

40% |

Health and social programs |

|

42% |

|

42% |

|

42% |

|

39% |

Security and other civilian & commercial |

|

17% |

|

20% |

|

18% |

|

21% |

Total |

|

100% |

|

100% |

|

100% |

|

100% |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, |

|

September 30, |

Client Type: |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

U.S. federal government |

|

56% |

|

58% |

|

55% |

|

55% |

U.S. state and local government |

|

15% |

|

14% |

|

16% |

|

15% |

International government |

|

5% |

|

5% |

|

5% |

|

6% |

Total Government |

|

76% |

|

77% |

|

76% |

|

76% |

Commercial |

|

24% |

|

23% |

|

24% |

|

24% |

Total |

|

100% |

|

100% |

|

100% |

|

100% |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

September 30, |

|

September 30, |

Contract Mix: |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

Time-and-materials |

|

41% |

|

40% |

|

41% |

|

40% |

Fixed-price |

|

45% |

|

45% |

|

45% |

|

45% |

Cost-based |

|

14% |

|

15% |

|

14% |

|

15% |

Total |

|

100% |

|

100% |

|

100% |

|

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(14) As is shown in the supplemental schedule, we track revenue by key metrics that provide useful information about the nature of our operations. Client markets provide insight into the breadth of our expertise. Client type is an indicator of the diversity of our client base. Revenue by contract mix provides insight in terms of the degree of performance risk that we have assumed. |

|

|

|

|

|

|

|

|

|

(15) During the first quarter of 2023, we re-aligned our client markets from four to three and reclassified the 2022 percentages to conform to the current presentation. Certain immaterial revenue percentages in the prior year have also been reclassified due to minor adjustments and reclassification. |

12

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

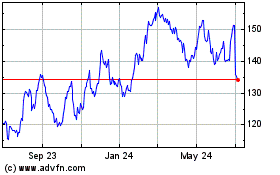

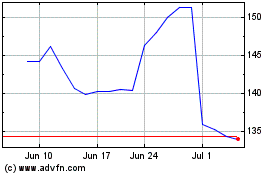

ICF (NASDAQ:ICFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

ICF (NASDAQ:ICFI)

Historical Stock Chart

From Apr 2023 to Apr 2024