false000164440600016444062023-08-082023-08-080001644406dei:FormerAddressMember2023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2023 Hostess Brands, Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | 1-37540 | 47-4168492 | |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | |

| 7905 Quivira Road | | |

| Lenexa, | KS | 66215 | |

| (Address of principal executive offices) | (Zip Code) | |

(816) 701-4600

(Registrant’s telephone number, including area code)

7905 Quivira Lenexa, Kansas 66215

(Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each Class | Trading Symbol | Name of exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | TWNK | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2023, Hostess Brands, Inc. (the "Company") issued a press release announcing financial results for the three and six months ended June 30, 2023, a copy of which is attached as Exhibit 99.1.

The information in this Item 2.02 and Exhibit 99.1 attached hereto is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

On August 8, 2023, the Company disseminated an investor presentation. A copy of the investor presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information furnished in this Item 7.01, and Exhibit 99.2 attached hereto is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, except as may be expressly set forth by specific reference in such filing.

The Company expressly disclaims any obligation to update or revise any of the information contained in the investor presentation. The investor presentation is available on the Company's website located at www.hostessbrands.com, although the Company reserves the right to discontinue that availability at any time.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

Exhibit No. | | Description of Exhibits |

| 99.1 | | |

| 99.2 | | |

| 104.1 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereto duly authorized. | | | | | | | | | | | |

| | HOSTESS BRANDS, INC. |

| | | |

Date: August 8, 2023 | | By: | /s/ Travis E. Leonard |

| | Name: | Travis E. Leonard |

| | Title: | Executive Vice President, Chief Financial Officer |

Hostess Brands Reports Second Quarter 2023 Results

Delivers Strong Profit Growth

Reaffirms Full-Year Net Revenue Guidance

Raises EBITDA and EPS Guidance Toward Higher End of Previous Range

LENEXA, KS, August 8, 2023 - Hostess Brands, Inc. (NASDAQ: TWNK) (the “Company,” “Hostess Brands,” “we,” “us,” and “our”) today reported its financial results for the three and six months ended June 30, 2023.

“Hostess Brands delivered another strong quarter with double-digit profit growth and higher margins driven by favorable net price realization, normalizing supply chain, and contributions from productivity initiatives. Our foundation for sustainable growth remains strong. We are executing well against our growth initiatives with strong customer support behind back-to-school merchandising, leading innovation in the category, and increased investment in our brands, which provide confidence in our ability to generate stronger sales growth in the second half of 2023,” said Andy Callahan, President and Chief Executive Officer, Hostess Brands.

Callahan added, “We believe we continue to be well-positioned for attractive shareholder returns as we build a premier, pure-play snacking company. Given our strong first-half performance, we are raising our full-year adjusted EBITDA and adjusted EPS guidance toward the higher end of our previous range, delivering above long-term algorithm profit growth in 2023.”

Second Quarter 2023 Financial Highlights as Compared to the Prior Year Period1

▪Net revenue of $352.4 million increased 3.5% from the same period last year, as 10.4% contribution from price/mix more than offset lower volume in the quarter.

▪Gross profit increased 11.8% to $126.0 million, or 35.8% of net revenue. On an adjusted basis, gross profit increased 12.1% to $126.4 million, or 35.9% of net revenue. Gross margin increased by 265 basis points, 275 basis points on an adjusted basis, from year-ago levels, as favorable net price realization, normalizing supply chain, and productivity more than offset high single-digit inflation.

▪Net income was $32.5 million, or $0.24 per diluted share, compared to $30.5 million, or $0.22 per diluted share, in the same period last year. Adjusted net income increased to $37.7 million, resulting in $0.28 adjusted EPS, as compared to $0.22 in the prior period.

▪Adjusted EBITDA increased 16.1% to $80.0 million. Adjusted EBITDA margins increased by 247 basis points to 22.7%.

▪Cash and cash equivalents were $99.4 million as of June 30, 2023, resulting in a net leverage ratio of 2.9x.

▪Capital expenditures were $58.2 million, including the build-out of the new bakery in Arkadelphia, Arkansas, which remains on track to begin operations in the 4th quarter of 2023.

▪Reaffirms full-year 2023 guidance for net revenue growth of 4% to 6%, raises adjusted EBITDA and adjusted EPS guidance toward the higher end of its previous $315 million to $325 million and $1.08 to $1.13 guidance ranges, respectively.

Other Highlights

▪The Company’s Sweet Baked Goods point-of-sale (“POS”) increased 2.9% for the quarter, 18.5% on a two-year stacked basis. Its share of the category decreased approximately 90 basis points to 20.8%.

▪Voortman® branded POS grew 7.2% in the quarter, 32.2% on a two-year stacked basis. Its share of the Cookie category was relatively flat at 2.1% for the quarter.

▪The Company refinanced its term loan, extending the maturity from 2025 to 2030, and increased the capacity on its revolving line of credit from $100 million to $200 million, extending the maturity to 2028 with a minimal impact to the Company's expected effective interest rate.

▪Repurchased shares for an aggregate purchase price of $19.4 million year-to-date through June 30, 2023.

▪Continued on our journey of transparency and progress through the June release of our most recent corporate responsibility report.

1This press release contains certain non-GAAP financial measures, including adjusted gross profit, adjusted gross profit margin, adjusted operating income, adjusted EBITDA, adjusted EBITDA margin, adjusted net income and adjusted earnings per share (“EPS”). Please refer to the schedules in this press release for reconciliations of non-GAAP financial measures to the comparable GAAP measure. Unless otherwise stated, all comparisons of financial measures in this press release are to the second quarter of 2022. All measures of market performance contained in this press release, including point of sale and market share include all Company-branded products within the U.S. SBG or Cookie categories as reported by Nielsen but do not include other products sold outside of those categories. All market data in this press release refers to the thirteen-week period ended July 1, 2023. The Company’s leverage ratio is net debt (total long-term debt less cash and short-term investments) divided by the trailing twelve months adjusted EBITDA.

Guidance and Outlook

The Company is raising its full-year 2023 adjusted EBITDA and adjusted EPS guidance:

| | | | | | | | | | | | | |

| Updated Guidance | | Previous Guidance | | |

| Net revenue growth | 4% to 6% | | 4% to 6% | | |

| Adjusted EBITDA | Toward the higher end of $315 - $325 million | | $315 - $325 million | | |

| Adjusted EPS (diluted) | Toward the higher end of $1.08 - $1.13 | | $1.08 - $1.13 | | |

| Capital expenditures | $150 - $170 million | | $150 - $170 million | | |

| Effective tax rate | 27.0% | | 27.0% | | |

| Weighted average shares outstanding | Approximately 135 million | | Approximately 135 million | | |

The Company provides guidance on a non-generally accepted accounting principles (non-GAAP) basis and does not provide a reconciliation of the Company’s forward-looking financial expectations to the most directly comparable GAAP financial measure because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments that could be made for deferred taxes, remeasurement of the tax receivable agreement, and other non-operating gains or losses reflected in the Company’s reconciliation of historic non-GAAP financial measures, the amount of which could be material. Please refer to the Reconciliation of Non-GAAP Financial Measures included in this press release for further information about the use of these measures.

Second Quarter 2023 Compared to Second Quarter 2022

Net revenue was $352.4 million, an increase of 3.5%, or $11.9 million, from the prior-year period. Favorable price/mix provided 10.4% of the net revenue growth driven by net price realization, offset by a 6.9% decline from volume. Sweet baked goods net revenue increased $14.1 million, or 4.6%, while cookies net revenue decreased $2.2 million, or 5.9%.

Gross profit increased 11.8% and was 35.8% of net revenue, an increase of 265 basis points from a gross margin of 33.1% for the same period last year. The increase in gross profit was due to favorable net price realization, normalizing supply chain, and productivity, which more than offset high single-digit inflation and lower volume. Adjusted gross profit increased 12.1% and adjusted gross margin increased 275 basis points.

Operating income was $61.7 million, an increase of 21.0% from the prior-year period. Adjusted operating income of $62.1 million increased 20.1% from the same period last year. Second quarter operating costs increased by 4.2%, as compared to the prior-year period primarily due to the planned increase in advertising and marketing investments, partially offset by lower general and administrative costs.

Adjusted EBITDA of $80.0 million, or 22.7% of net revenue, increased 16.1% from the same period last year.

Our effective tax rate for the three months ended June 30, 2023 was 26.0% compared to 27.0% for the three months ended June 30, 2022. The decrease in the tax rate was attributed to a discrete tax benefit of $0.7 million recognized during the three months ended June 30, 2023. The current period effective tax rate, excluding discrete items, was 27.3% compared to 27.2% in the prior year period.

Net income was $32.5 million, an increase of 6.6% from $30.5 million in the prior-year period. Adjusted net income of $37.7 million increased $7.1 million, as compared to the same period last year. Diluted EPS was $0.24 compared to $0.22 in the prior-year period. Adjusted EPS of $0.28 increased from $0.22 in the prior period largely due to higher adjusted net income and lower shares outstanding.

Operating cash flows for the six months ended June 30, 2023 were $88.3 million, as compared to $87.2 million for the same period last year. Operating cash flows were higher driven by favorable operating income, partially offset by higher interest due to an accelerated payment of accrued interest resulting from the June 2023 debt refinancing.

Conference Call and Webcast

The Company will host a conference call and webcast with an accompanying presentation today, August 8, 2023 at 4:30 p.m. ET to discuss the results for the second quarter. Investors interested in participating in the live call can dial 877-451-6152 from the U.S. and +1-201-389-0879 internationally. A telephone replay will be available approximately three hours after the call concludes and will be available through August 22, 2023, by dialing 844-512-2921 from the U.S., or +1-412-317-6671 internationally, and entering confirmation code 13739286. The simultaneous, live webcast and presentation will be available on the Investor Relations section of the Company’s website at www.hostessbrands.com. The webcast will be archived for 30 days.

About Hostess Brands, Inc.

Hostess Brands, Inc. (NASDAQ: TWNK) is a premier snacking company with a portfolio of iconic brands and a mission to inspire moments of joy by putting our heart into everything we do. Hostess Brands is proud to make America’s No. 1 cupcake, mini donut and zero sugar cookie brands. With annual sales of $1.4 billion and approximately 3,000 dedicated team members, Hostess Brands produces new and classic snacks, including Hostess® Donettes®, Twinkies®, CupCakes, Ding Dongs® and Zingers®, as well as a variety of Voortman® cookies and wafers. For more information about Hostess Brands please visit hostessbrands.com.

| | | | | | | | |

| Investor Contact: | | Media Contact: |

| Amit Sharma | | Jenna Greene |

| asharma@hostessbrands.com | | jenna.green@clynch.com |

Forward-Looking Statements

This press release contains statements reflecting the Company’s views about its future performance that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. Forward-looking statements are generally identified through the inclusion of words such as “believes,” “expects,” “intends,” “estimates,” “projects,” “anticipates,” “will,” “plan,” “may,” “should,” or similar language. Statements addressing the Company’s future operating and financial performance and statements addressing events and developments that the Company expects or anticipates will occur are also considered as forward-looking statements. All forward-looking statements included herein are made only as of the date hereof.

These statements inherently involve risks and uncertainties that could cause actual results to differ materially from those anticipated in such forward-looking statements. These risks and uncertainties include, but are not limited to, maintaining, extending and expanding the Company’s reputation and brand image; leveraging the Company’s brand value to compete against lower-priced alternative brands; the ability to pass cost increases on to our customers; correctly predicting, identifying and interpreting changes in consumer preferences and demand and offering new products to meet those changes; protecting intellectual property rights; operating in a highly competitive industry; the ability to maintain or add additional shelf or retail space for the Company’s products; the ability to identify or complete strategic acquisitions, alliances, divestitures or joint ventures; our ability to successfully integrate, achieve expected synergies and manage our acquired businesses and brands; the ability to integrate and manage capital investments; the ability to manage changes in our manufacturing processes resulting from the expansion of our business and operations, including with respect to cost-savings initiatives and the introduction of new technologies and products; the ability to drive revenue growth in key products or add products that are faster-growing and more profitable; volatility in commodity, energy, and other input prices due to inflationary pressures and the ability to adjust pricing to cover increased costs; loss of one or more of our co-manufacturing arrangements; significant changes in the availability and pricing of transportation; negative impacts of climate change; dependence on major customers; increased labor and employee related costs; strikes or work stoppages; product liability claims, product recalls, or regulatory enforcement actions; the ability to produce and successfully market products with extended shelf life; dependence on third parties for significant services; unanticipated business disruptions; adverse impact or disruption to our business caused by pandemics or outbreaks of highly infectious or contagious diseases; disruptions in global economy due to the Russia and Ukraine conflict; geographic focus could make the Company particularly vulnerable to economic and other events and trends in North America; consolidation of retail customers; unsuccessful implementation of business strategies to reduce costs; increased costs to comply with governmental regulation; failures, unavailability, or disruptions of the Company’s information technology systems; dependence on key personnel or a highly skilled and diverse workforce; the Company’s ability to finance indebtedness on terms favorable to the Company; and other risks as set forth from time to time in the Company’s Securities and Exchange Commission (the “SEC”) filings.

As a result of a number of known and unknown risks and uncertainties, the Company’s actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Risks and uncertainties are identified and discussed in Item 1A-Risk Factors in the Company’s Annual Report on Form 10-K for 2022, filed on February 21, 2023 and as revised and updated in our subsequent filings with the SEC. All subsequent written or oral forward-looking statements attributable to us or persons acting on the Company’s behalf are expressly qualified in their entirety by these risk factors. Except as may be required by law, the Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

HOSTESS BRANDS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, amounts in thousands, except shares and per share data) | | | | | | | | | | | | | | |

| June 30,

2023 | | | December 31,

2022 |

| ASSETS | | | | |

| Current assets: |

| | | |

| Cash and cash equivalents | $ | 99,368 | | | | $ | 98,584 | |

| Short-term investments | — | | | | 17,914 | |

| Accounts receivable, net | 181,729 | | | | 168,783 | |

| Inventories | 67,240 | | | | 65,406 | |

| Prepaids and other current assets | 18,083 | | | | 16,375 | |

| Total current assets | 366,420 | | | | 367,062 | |

| Property and equipment, net | 464,565 | | | | 425,313 | |

| Intangible assets, net | 1,909,124 | | | | 1,920,880 | |

| Goodwill | 706,615 | | | | 706,615 | |

| Other assets, net | 70,688 | | | | 72,329 | |

| Total assets | $ | 3,517,412 | | | | $ | 3,492,199 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current liabilities: | | | | |

| Long-term debt and lease obligations payable within one year | $ | 12,543 | | | | $ | 3,917 | |

| Tax receivable agreement payments payable within one year | 7,400 | | | | 12,600 | |

| Accounts payable | 87,502 | | | | 85,667 | |

| Customer trade allowances | 67,952 | | | | 62,194 | |

| Accrued expenses and other current liabilities | 27,837 | | | | 59,933 | |

| Total current liabilities | 203,234 | | | | 224,311 | |

| Long-term debt and lease obligations | 982,046 | | | | 999,089 | |

| Tax receivable agreement obligations | 117,157 | | | | 123,092 | |

| Deferred tax liability | 361,928 | | | | 347,030 | |

| Other long-term liabilities | 1,302 | | | | 1,593 | |

| Total liabilities | 1,665,667 | | | | 1,695,115 | |

| | | | |

Class A common stock, $0.0001 par value, 200,000,000 shares authorized, 143,184,870 issued and 132,859,461 shares outstanding as of June 30, 2023 and 142,650,344 shares issued and 133,117,224 shares outstanding as of December 31, 2022 | 14 | | | | 14 | |

| | | | |

| Additional paid in capital | 1,315,418 | | | | 1,311,629 | |

| Accumulated other comprehensive income | 34,602 | | | | 35,078 | |

| Retained earnings | 710,370 | | | | 639,595 | |

| Treasury stock | (208,659) | | | | (189,232) | |

| Stockholders’ equity | 1,851,745 | | | | 1,797,084 | |

| | | | |

| Total liabilities and stockholders’ equity | $ | 3,517,412 | | | | $ | 3,492,199 | |

HOSTESS BRANDS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, amounts in thousands, except shares and per share data) | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, 2023 | | | June 30, 2022 | | June 30, 2023 | | June 30, 2022 |

| | | | | | | | |

| Net revenue | $ | 352,360 | | | | $ | 340,472 | | | $ | 697,763 | | | $ | 672,523 | |

| Cost of goods sold | 226,366 | | | | 227,772 | | | 451,052 | | | 444,199 | |

| Gross profit | 125,994 | | | | 112,700 | | | 246,711 | | | 228,324 | |

| Operating costs and expenses: | | | | | | | | |

Advertising and marketing | 20,176 | | | | 15,587 | | | 34,075 | | | 27,537 | |

| Selling | 10,025 | | | | 10,137 | | | 20,674 | | | 19,914 | |

General and administrative | 28,196 | | | | 30,127 | | | 56,394 | | | 59,799 | |

Amortization of customer relationships | 5,878 | | | | 5,878 | | | 11,756 | | | 11,756 | |

| | | | | | | | |

| | | | | | | | |

| Total operating costs and expenses | 64,275 | | | | 61,729 | | | 122,899 | | | 119,006 | |

| Operating income | 61,719 | | | | 50,971 | | | 123,812 | | | 109,318 | |

| Other (income) expense | | | | | | | | |

| Interest expense, net | 10,283 | | | | 9,741 | | | 20,468 | | | 19,407 | |

| Loss on modification and extinguishment of debt | 7,472 | | | | — | | | 7,472 | | | — | |

| | | | | | | | |

| | | | | | | | |

| Other (income) expense | 68 | | | | (507) | | | 249 | | | (71) | |

| Total other (income) expense | 17,823 | | | | 9,234 | | | 28,189 | | | 19,336 | |

| Income before income taxes | 43,896 | | | | 41,737 | | | 95,623 | | | 89,982 | |

| Income tax expense | 11,410 | | | | 11,261 | | | 24,848 | | | 24,948 | |

| Net income | $ | 32,486 | | | | $ | 30,476 | | | $ | 70,775 | | | $ | 65,034 | |

| | | | | | | | |

| Earnings per Class A share: | | | | | | | | |

| Basic | $ | 0.24 | | | | $ | 0.22 | | | $ | 0.53 | | | $ | 0.47 | |

| Diluted | $ | 0.24 | | | | $ | 0.22 | | | $ | 0.53 | | | $ | 0.47 | |

| Weighted-average shares outstanding: | | | | | | | | |

| Basic | 133,076,763 | | | | 137,909,156 | | | 133,298,117 | | | 138,255,803 | |

| Diluted | 134,211,771 | | | | 138,958,242 | | | 134,371,034 | | | 139,263,303 | |

HOSTESS BRANDS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, amounts in thousands) | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended | |

| | | June 30, 2023 | | | June 30, 2022 | |

| Operating activities | | | | | |

| Net income | $ | 70,775 | | | | $ | 65,034 | | |

| Depreciation and amortization | 30,054 | | | | 27,951 | | |

| | | | | | |

| Debt discount amortization | 530 | | | | 615 | | |

| | | | | | |

| Unrealized foreign exchange gains | (153) | | | | (217) | | |

| Loss on debt extinguishment | 721 | | | | — | | |

| Non-cash lease expense | 129 | | | | 247 | | |

| Share-based compensation | 6,538 | | | | 4,987 | | |

| Realized and unrealized gains on short-term investments | (86) | | | | — | | |

| Deferred taxes | 15,066 | | | | 10,374 | | |

| Change in operating assets and liabilities: | | | | | |

| | Accounts receivable | (12,863) | | | | (30,600) | | |

| | Inventories | (1,834) | | | | (7,996) | | |

| | Prepaids and other current assets | 5,243 | | | | (131) | | |

| | Accounts payable and accrued expenses | (31,489) | | | | 8,967 | | |

| | Customer trade allowances | 5,717 | | | | 7,934 | | |

| Net cash provided by operating activities | 88,348 | | | | 87,165 | | |

| | | | | | | |

| Investing activities | | | | | |

| Purchases of property and equipment | (55,161) | | | | (36,302) | | |

| | | | | | |

| Acquisition of short-term investments | — | | | | (20,918) | | |

| Proceeds from maturity of short-term investments | 18,000 | | | | — | | |

| Acquisition and development of software assets | (3,005) | | | | (5,607) | | |

| Net cash used in investing activities | (40,166) | | | | (62,827) | | |

| | | | | | | |

| Financing activities | | | | | |

| Repayments of long-term debt and lease obligations | — | | | | (5,584) | | |

| Debt fees paid | (10,306) | | | | — | | |

| Proceeds from origination of long-term debt | 336,663 | | | | — | | |

| Payments related to settlement of long-term debt | (334,883) | | | | — | | |

| Collateral payments | (5,980) | | | | — | | |

| Repurchase of common stock | (19,427) | | | | (48,506) | | |

| Tax payments related to issuance of shares to employees | (5,914) | | | | (5,512) | | |

| Cash received from exercise of options and warrants | 3,165 | | | | 2,241 | | |

| Payments on tax receivable agreement | (11,135) | | | | (9,313) | | |

| Net cash used in financing activities | (47,817) | | | | (66,674) | | |

| Effect of exchange rate changes on cash and cash equivalents | 419 | | | | 8 | | |

| Net increase (decrease) in cash and cash equivalents | 784 | | | | (42,328) | | |

| Cash and cash equivalents at beginning of period | 98,584 | | | | 249,159 | | |

| Cash and cash equivalents at end of period | $ | 99,368 | | | | $ | 206,831 | | |

| | | | | | | |

| Supplemental Disclosures of Cash Flow Information: | | | | | |

| Cash paid during the period for: | | | | | |

| Interest, net of amounts capitalized | $ | 28,077 | | | | $ | 18,599 | | |

| Net taxes paid | $ | 11,496 | | | | $ | 11,489 | | |

| Supplemental disclosure of non-cash investing: | | | | | |

| Accrued capital expenditures | $ | 9,421 | | | | $ | 6,358 | | |

HOSTESS BRANDS, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Adjusted gross profit, adjusted gross profit margin, adjusted operating income, adjusted net income, adjusted EBITDA, adjusted EBITDA margin and adjusted EPS (collectively referred to as “Non-GAAP Financial Measures”) are commonly used in the Company’s industry and should not be construed as an alternative to net revenue, gross profit, operating income, net income or earnings per share as indicators of operating performance (as determined in accordance with GAAP). These Non-GAAP Financial Measures may not be comparable to similarly-titled measures reported by other companies. The Company has included these Non-GAAP Financial Measures because it believes that the measures provide management and investors with additional information to measure the Company’s performance, estimate the Company’s value and evaluate the Company’s ability to service debt.

Non-GAAP Financial Measures are adjusted to exclude certain items that affect comparability. The adjustments are itemized in the tables below. You are encouraged to evaluate these adjustments and the reason the Company considers them appropriate for supplemental analysis. In evaluating adjustments, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments set forth below. The presentation of Non-GAAP Financial Measures should not be construed as an inference that future results will be unaffected by unusual or recurring items.

The Company defines adjusted EBITDA as net income adjusted to exclude (i) interest expense, net, (ii) depreciation and amortization, (iii) income taxes and (iv) share-based compensation, as further adjusted to eliminate the impact of certain items that the Company does not consider indicative of its ongoing operating performance. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of the Company’s results as reported under GAAP. For example, adjusted EBITDA:

•does not reflect the Company’s capital expenditures, future requirements for capital expenditures or contractual commitments;

•does not reflect changes in, or cash requirements for, the Company’s working capital needs;

•does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on the Company’s debt; and

•does not reflect payments related to income taxes or the tax receivable agreement.

HOSTESS BRANDS, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Unaudited, amounts in thousands, except percentages and per share data) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended June 30, 2023 | | | | | | |

| | | | Gross Profit | | Gross Margin | | Operating Income | | Net Income | | | | Net Income Margin | | Diluted EPS | | | | | | |

| GAAP Results | | | | $ | 125,994 | | | 35.8 | % | | $ | 61,719 | | | $ | 32,486 | | | | | 9.2 | % | | $ | 0.24 | | | | | | | |

| Non-GAAP adjustments: | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency remeasurement | | | | — | | | — | | | — | | | (205) | | | | | (0.1) | | | — | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Accelerated depreciation related to network optimization | | | | 398 | | | 0.1 | | | 398 | | | 398 | | | | | 0.1 | | | — | | | | | | | |

| Loss on modification and extinguishment of debt | | | | — | | | — | | | — | | | 7,472 | | | | | 2.1 | | | 0.07 | | | | | | | |

| Other (1) | | | | — | | | — | | | — | | | 274 | | | | | 0.1 | | | — | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Discrete income tax expense | | | | — | | | — | | | — | | | (667) | | | | | (0.2) | | | — | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Tax impact of adjustments | | | | — | | | — | | | — | | | (2,085) | | | | | (0.6) | | | (0.03) | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Non-GAAP results | | | | $ | 126,392 | | | 35.9 | % | | $ | 62,117 | | | 37,673 | | | | | 10.7 | | | $ | 0.28 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Income tax | | | | | | | | | | 14,162 | | | | | 4.0 | | | | | | | | | |

| Interest expense | | | | | | | | | | 10,283 | | | | | 2.9 | | | | | | | | | |

| Depreciation and amortization | | | | | | | | | | 14,328 | | | | | 4.1 | | | | | | | | | |

| Share-based compensation | | | | | | | | | | 3,527 | | | | | 1.0 | | | | | | | | | |

| Adjusted EBITDA | | | | | | | | | | $ | 79,973 | | | | | 22.7 | % | | | | | | | | |

(1) Costs related to certain corporate initiatives and are included in other expense on the condensed consolidated statement of operations.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, 2022 |

| | | | Gross Profit | | Gross Margin | | Operating Income | | Net Income | | | | Net Income Margin | | Diluted EPS |

| GAAP Results | | | | $ | 112,700 | | | 33.1 | % | | $ | 50,971 | | | $ | 30,476 | | | | | 9.0 | % | | $ | 0.22 | |

| Non-GAAP adjustments: | | | | | | | | | | | | | | | | |

| Foreign currency remeasurement | | | | — | | | — | | | — | | | (537) | | | | | (0.2) | | | — | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Project consulting costs (1) | | | | — | | | — | | | 559 | | | 559 | | | | | 0.2 | | | — | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Other (2) | | | | 144 | | | — | | | 144 | | | 175 | | | | | — | | | — | |

| Discrete income tax expense | | | | — | | | — | | | — | | | (80) | | | | | — | | | — | |

| Tax impact of adjustments | | | | — | | | — | | | — | | | (53) | | | | | — | | | — | |

| | | | | | | | | | | | | | | | |

| Adjusted Non-GAAP results | | | | $ | 112,844 | | | 33.1 | % | | $ | 51,674 | | | 30,540 | | | | | 9.0 | | | $ | 0.22 | |

| | | | | | | | | | | | | | | | |

| Income tax | | | | | | | | | | 11,394 | | | | | 3.3 | | | |

| Interest expense | | | | | | | | | | 9,742 | | | | | 2.9 | | | |

| Depreciation and amortization | | | | | | | | | | 14,560 | | | | | 4.2 | | | |

| Share-based compensation | | | | | | | | | | 2,648 | | | | | 0.8 | | | |

| Adjusted EBITDA | | | | | | | | | | $ | 68,884 | | | | | 20.2 | % | | |

(1) Project consulting costs are included in general and administrative on the condensed consolidated statement of operations.

(2) Costs related to certain corporate initiatives, including $0.1 million of accelerated depreciation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Six Months Ended June 30, 2023 |

| | | | Gross Profit | | Gross Margin | | Operating Income | | Net Income | | | | Net Income Margin | | Diluted EPS |

| GAAP Results | | | | $ | 246,711 | | | 35.4 | % | | $ | 123,812 | | | $ | 70,775 | | | | | 10.1 | % | | $0.53 |

| Non-GAAP adjustments: | | | | | | | | | | | | | | | | |

| Foreign currency remeasurement | | | | — | | | — | | | — | | | (153) | | | | | — | | | — | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Accelerated depreciation related to network optimization | | | | 797 | | | 0.1 | | | 797 | | | 797 | | | | | 0.1 | | | 0.01 | |

| Loss on modification and extinguishment of debt | | | | — | | | — | | | — | | | 7,472 | | | | | 1.1 | | | 0.06 | |

| Other (1) | | | | — | | | — | | | — | | | 403 | | | | | 0.1 | | | — | |

| Discrete income tax expense | | | | — | | | — | | | — | | | (1,149) | | | | | (0.2) | | | (0.01) | |

| Tax impact of adjustments | | | | — | | | — | | | — | | | (2,241) | | | | | (0.3) | | | (0.02) | |

| | | | | | | | | | | | | | | | |

| Adjusted Non-GAAP results | | | | $ | 247,508 | | | 35.5 | % | | $ | 124,609 | | | 75,904 | | | | | 10.9 | | | $ | 0.57 | |

| | | | | | | | | | | | | | | | |

| Income tax | | | | | | | | | | 28,238 | | | | | 4.0 | | | |

| Interest expense | | | | | | | | | | 20,468 | | | | | 2.9 | | | |

| Depreciation and amortization | | | | | | | | | | 29,257 | | | | | 4.2 | | | |

| Share-based compensation | | | | | | | | | | 6,538 | | | | | 0.9 | | | |

| Adjusted EBITDA | | | | | | | | | | $ | 160,405 | | | | | 22.9 | % | | |

(1) Costs related to certain corporate initiatives and are included in other expense on the condensed consolidated statement of operations.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2022 |

| | | | Gross Profit | | Gross Margin | | Operating Income | | Net Income | | | | Net Income Margin | | Diluted EPS |

| GAAP Results | | | | $ | 228,324 | | | 34.0 | % | | $ | 109,318 | | | $ | 65,034 | | | | | 9.7 | % | | $ | 0.47 | |

| Non-GAAP adjustments: | | | | | | | | | | | | | | | | |

| Foreign currency remeasurement | | | | — | | | — | | | — | | | (220) | | | | | — | | | — | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Project consulting costs (1) | | | | — | | | — | | | 3,887 | | | 3,887 | | | | | 0.6 | | | 0.03 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Other (2) | | | | 273 | | | — | | | 273 | | | 422 | | | | | 0.1 | | | — | |

| Discrete income tax expense | | | | — | | | — | | | — | | | 512 | | | | | 0.1 | | | — | |

| Tax impact of adjustments | | | | — | | | — | | | — | | | (1,104) | | | | | (0.2) | | | (0.01) | |

| | | | | | | | | | | | | | | | |

| Adjusted Non-GAAP results | | | | $ | 228,597 | | | 34.0 | % | | $ | 113,478 | | | 68,531 | | | | | 10.3 | | | $ | 0.49 | |

| | | | | | | | | | | | | | | | |

| Income tax | | | | | | | | | | 25,540 | | | | | 3.8 | | | |

| Interest expense | | | | | | | | | | 19,407 | | | | | 2.9 | | | |

| Depreciation and amortization | | | | | | | | | | 27,857 | | | | | 4.1 | | | |

| Share-based compensation | | | | | | | | | | 4,987 | | | | | 0.7 | | | |

| Adjusted EBITDA | | | | | | | | | | $ | 146,322 | | | | | 21.8 | % | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

(1) Project consulting costs are included in general and administrative on the condensed consolidated statement of operations.

(2) Costs related to certain corporate initiatives, including $0.1 million of accelerated depreciation.

__________________________________ Investor Presentation August 8, 2023

Forward Looking Statements This investor presentation contains statements reflecting our views about the future performance of Hostess Brands, Inc. and its subsidiaries (referred to as “Hostess Brands,” the “Company,” “we,” “us,” or “our”) that constitute “forward- looking statements” that involve substantial risks and uncertainties. Forward-looking statements are generally identified through the inclusion of words such as “believes,” “expects,” “intends,” “estimates,” “projects,” “anticipates,” “will,” “plan,” “may,” “should,” or similar language. Statements addressing our future operating and financial performance and statements addressing events and developments that we expect or anticipate will occur are also considered forward-looking statements. All forward looking statements included herein are made only as of the date hereof. Except as may be required by law, we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise. These statements inherently involve risks and uncertainties that could cause actual results to differ materially from those anticipated in such forward-looking statements. These risks and uncertainties include, but are not limited to, maintaining, extending and expanding the Company’s reputation and brand image; leveraging the Company’s brand value to compete against lower-priced alternative brands; the ability to pass cost increases on to our customers; correctly predicting, identifying and interpreting changes in consumer preferences and demand and offering new products to meet those changes; protecting intellectual property rights; operating in a highly competitive industry; the ability to maintain or add additional shelf or retail space for the Company’s products; the ability to identify or complete strategic acquisitions, alliances, divestitures or joint ventures; our ability to successfully integrate, achieve expected synergies and manage our acquired businesses and brands; the ability to integrate and manage capital investments; the ability to manage changes in our manufacturing processes resulting from the expansion of our business and operations, including with respect to cost-savings initiatives and the introduction of new technologies and products; the ability to drive revenue growth in key products or add products that are faster-growing and more profitable; volatility in commodity, energy, and other input prices due to inflationary pressures and the ability to adjust pricing to cover increased costs; loss of one or more of our co-manufacturing arrangements; significant changes in the availability and pricing of transportation; negative impacts of climate change; dependence on major customers; increased labor and employee related costs; strikes or work stoppages; product liability claims, product recalls, or regulatory enforcement actions; the ability to produce and successfully market products with extended shelf life; dependence on third parties for significant services; unanticipated business disruptions; adverse impact or disruption to our business caused by pandemics or outbreaks of highly infectious or contagious diseases; disruptions in global economy due to the Russia and Ukraine conflict; geographic focus could make the Company particularly vulnerable to economic and other events and trends in North America; consolidation of retail customers; unsuccessful implementation of business strategies to reduce costs; increased costs to comply with governmental regulation; failures, unavailability, or disruptions of the Company’s information technology systems; dependence on key personnel or a highly skilled and diverse workforce; the Company’s ability to finance indebtedness on terms favorable to the Company; and other risks as set forth from time to time in the Company’s Securities and Exchange Commission (the “SEC”) filings, including, without limitation, the risk identified and discussed in Item 1A-Risk Factors in the Company’s Annual Report on Form 10-K for 2022, filed on February 21, 2023 and as revised and updated in our subsequent filings with the SEC. The long-term algorithms contained in this presentation are goals that are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of the Company and are based on assumptions with respect to future actions which are subject to change. Industry and Market Data In this Investor Presentation, Hostess Brands relies on and refers to information and statistics regarding market shares in the sectors in which it competes and other industry data. Hostess Brands obtained this information and statistics from third-party sources, including reports by market research firms, such as Nielsen. Prior period Nielsen data was adjusted to exclude the Cloverhill® and Big Texas® brands in the periods they were not owned by Hostess. Hostess Brands has supplemented this information where necessary with information from discussions with Hostess customers and its own internal estimates, taking into account publicly available information about other industry participants and Hostess Brands’ management’s best view as to information that is not publicly available. Use of Non-GAAP Financial Measures Adjusted net revenue, adjusted gross profit, adjusted gross margin, adjusted operating income, adjusted net income, adjusted diluted shares and adjusted EPS (collectively referred to as “Non-GAAP Financial Measures”) are commonly used in the Company’s industry and should not be construed as an alternative to net revenue, gross profit, operating income, net income, net income attributed to Class A stockholders, diluted shares outstanding or earnings per share as indicators of operating performance (as determined in accordance with GAAP). These Non-GAAP financial measures exclude certain items included in the comparable GAAP financial measure. This Investor Presentation also includes non-GAAP financial measures, including earnings before interest, taxes, depreciation, amortization and other adjustments to eliminate the impact of certain items that we do not consider indicative of our ongoing performance (“Adjusted EBITDA”) and Adjusted EBITDA Margin. Adjusted EBITDA Margin represents Adjusted EBITDA divided by adjusted net revenues. Hostess Brands believes that these Non-GAAP Financial Measures provide useful information to management and investors regarding certain financial and business trends relating to Hostess Brands’ financial condition and results of operations. Hostess Brands’ management uses these Non-GAAP Financial Measures to compare Hostess Brands’ performance to that of prior periods for trend analysis, for purposes of determining management incentive compensation, and for budgeting and planning purposes. Hostess Brands believes that the use of these Non- GAAP Financial Measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. Management of Hostess Brands does not consider these Non-GAAP Financial Measures in isolation or as an alternative to financial measures determined in accordance with GAAP. Other companies may calculate non-GAAP measures differently, and therefore Hostess Brands’ Non-GAAP Measures may not be directly comparable to similarly titled measures of other companies. The Company does not provide a reconciliation of the forward-looking information to the most directly comparable GAAP measures because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Totals in this Investor Presentation may not add up due to rounding. 2 Disclaimer

3 Key Takeaways Net revenue increased 3.5%, up 10.0% on a 2-year CAGR, driven by strong net price realization Executing well with clear progress on our customer and consumer growth initiatives to deliver strong volume-driven 2H growth Hostess Brands innovation continues to outperform the category led by recently launched Hostess® Kazbars™, Old Fashioned Donettes®, Family Packs, and Voortman® zero sugar mini wafers 16.1% Adjusted EBITDA growth as quarterly gross margin recovered by 275 basis points* Successfully refinanced term loan, extending maturity to 2030 and increased our revolver capacity to $200M with minimal impact to our expected effective interest rate Raised full-year EBITDA and EPS guidance to deliver above long-term algorithm profit growth for the full year * Adjusted EBITDA is a non-GAAP financial measures. See “Use of Non-GAAP Financial Measures” and the Appendix for an explanation of all non-GAAP financial measures and reconciliations to the comparable GAAP measures.

4 Above-algo Profit Growth Consolidated Financial Results Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted EPS are non-GAAP financial measures. See “Use of Non-GAAP Financial Measures” in the Appendix for an explanation of all non-GAAP financial measures and reconciliations to the comparable GAAP measures. Three Months Ended June 30, Six Months Ended June 30, ($ in millions, except per share data) 2023 2022 % Change 2023 2022 % Change Net Revenue $352.4 $340.5 3.5% $697.8 $672.5 3.8% Adjusted Gross Profit $126.4 $112.8 12.1% $247.5 $228.6 8.3% Adjusted Gross Margin 35.9% 33.1% 275bps 35.5% 34.0% 148bps Adjusted Operating Income $62.1 $51.7 20.1% $124.6 $113.5 9.8% Adjusted EBITDA $80.0 $68.9 16.1% $160.4 $146.3 9.6% Adjusted EBITDA Margin 22.7% 20.2% 247bps 22.9% 21.8% 123bps Adjusted EPS $0.28 $0.22 27.3% $0.57 $0.49 16.3%

YoY Growth 5 Adjusted EBITDA and Adjusted EPS are non-GAAP financial measures. See “Use of Non-GAAP Financial Measures” and the Appendix for an explanation of all non-GAAP financial measures and reconciliations to the comparable GAAP measures. Second Quarter Financial Highlights Continued Profitable Growth $291.5 $340.5 $352.4 2Q 2021 2Q 2022 2Q 2023 $0.23 $0.22 $0.28 2Q 2021 2Q 2022 2Q 2023 $68.4 $68.9 $80.0 2Q 2021 2Q 2022 2Q 2023 Net Revenue (in millions) Adjusted EBITDA (in millions) Adjusted EPS +10.0% 2 Year CAGR +8.1% 2 Year CAGR +10.3% 2 Year CAGR +16.8% +3.5% +0.7% +16.1% -4.3% +27.3%

Three Months Ended June 30, Six Months Ended June 30, ($ in millions) 2023 2022 % Change 2023 2022 % Change Sweet Baked Goods $317.5 $303.5 4.6% $626.0 $599.8 4.4% Cookies $34.8 $37.0 (5.9%) $71.8 $72.7 (1.2%) Total Net Revenue $352.4 $340.5 3.5% $697.8 $672.5 3.8% 6 Revenue Growth Driven by the Hostess® Brand Lapping Double-Digit Growth in both SBG and Cookies

7 Price/Mix Continues to Drive Topline Volume Declines Moderated Sequentially from the First Quarter 3.5% Organic Net Revenue Growth 10.4% (6.9)%

Q2 2021 Q2 2022 Q2 2023 8 Outstanding Execution Driving Growth in the Sweet Baked Goods and Cookie Categories Continued POS Dollar Growth Source: Nielsen, Total Nielsen Universe for the Company within the U.S. SBG Category and Cookie Category. Point of Sale, 13 weeks ending 7/3/21, 7/2/22 and 7/1/23. Point-of-Sale Growth 7.2% growth 2.9% growth Cookies Sweet Baked Goods (in millions) 25.0% growth 15.6% growth 2 Year Stacked Hostess POS Growth 32.2% growth 18.5% growth Cookies SBG

2.2% 15.2% 3.7% 16.1% 9 Single-Serve and Multi-Pack Point-of-Sale Trends Multi-Pack Point-of-Sale Single-Serve Point-of-Sale Source: Nielsen, Total Nielsen Universe for the Company within the U.S. SBG Category. Point of Sale, 13 weeks ending 7/2/22 and 7/1/23. Q2 2022 Q2 2023 Single-serve 2-year Stacked Growth 19.8% Multi-pack 2-year Stacked Growth 17.4% Solid Growth in Immediate Consumption Occasion Q2 2022 Q2 2023 26.7%

10 Double Digit CAGR in the SBG Category Over the Last Five Years Consistent Track Record of Point-of-Sale Growth Dollar Market Share (52 weeks) 19.1% 19.5% 20.4% 21.7% 20.6% 2019 2020 2021 Point-of-Sale (52 weeks, in millions) $1,226 $1,318 $1,426 $1,703 $1,822 2019 2020 2021 20222022 Source: Nielsen, Total Nielsen Universe for the Company within the U.S. SBG Category. Point of Sale and Market Share, 52 weeks ending 7/6/19, 7/4/20, 7/3/21, 7/2/22, and 7/1/23. 2023 2023

11 Flexibility to Invest in Growth and Generate Shareholder Value Executing on Key Capital Allocation Priorities 4.0x** 3.3x Support Core Growth Targeted M&A Return Capital to Shareholders Manage Net Leverage $58.2 million capital expenditures in YTD 2023, including investment in new bakery to support continued growth Net leverage of 2.9x; Refinanced Term Loan extending maturity to 2030 and increased Revolver capacity to $200 million Continuing to look for growth-oriented branded targets, that expand our capabilities in the snacking universe $19.4 million share repurchases executed YTD 2023 1 2 3 4 Year to Date Progress Against Priorities

12 Raising Full-Year 2023 EBITDA and EPS Guidance Adjusted EBITDA and Adjusted EPS are non-GAAP financial measures. See “Use of Non-GAAP Financial Measures” and the Appendix for an explanation of all non-GAAP financial measures. The Company does not provide a reconciliation of forward-looking financial expectations to the most directly comparable GAAP financial measure because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation; including adjustments that could be made for deferred taxes; remeasurement of the tax receivable agreement, transformation expenses and other non-operating gains or losses reflected in the Company's reconciliation of historic non- GAAP financial measures, the amount of which could be material. Please refer to the Reconciliation of Non-GAAP Financial Measures included in the Appendix for further information about the use of these measures. Delivering Above Algorithm Profitability ($ in millions, except EPS) Updated Guidance Previous Guidance Net Revenue Growth 4% - 6% 4% - 6% Adjusted EBITDA Toward the higher end of $315 – $325 million $315 – $325 million Adjusted EPS Toward the higher end of $1.08 - $1.13 $1.08 - $1.13 Capital Expenditures $150 – $170 (Including Capacity Expansion) $150 - $170 million (Including Capacity Expansion) Income Tax Rate ~27% ~27% Weighted Average Shares Outstanding ~135 million ~135 million

5-7% EBITDA Growth Mid-Single Digit Organic Revenue Growth 7-9% EPS Growth Attractive Long-Term Growth Delivering Strong Growth While Maintaining our Industry-leading Margins Long-term Growth Algorithm See "Forward Looking Statements." EBITDA is a non-GAAP financial measure defined as earnings before interest, taxes, depreciation, amortization and stock compensation. See “Use of Non-GAAP Financial Measures.” Delivering Top-Tier Shareholder Returns 13

14 Our Focused Strategy is Driving Consistent Profitable Growth Disciplined Execution and Cash Deployment Investing in Data and Capabilities for Growth Unlocking Potential of Talented Team Targeted Focus on Growing Snacking Occasions

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 15 Premier Snacking Pure-Play Snacking ~100% of Total Retail Sales Source: NielsenIQ Total Snacking as percentage of All Departments Cal Yr 2022 W/E 12/31/22

Our Portfolio is Fully Aligned with Targeted Occasions $65B Market Opportunity $6.7B Market Size Morning Sweet Start Afternoon Reward Market Size $15.1B $9.8B Immediate Consumption Market Size $25.8B Evening Reward Market Size 16Source: McKinsey Analytics with Nielsen POS data through November 2022 Lunchbox Market Size $7.2B

17 Innovation Pipeline Driving Sustainable Growth Source: Nielsen, Total Nielsen Universe for the Company within the U.S. SBG Category, 52 weeks ending 1/1/22 and 12/31/22 New Products Launched in 2023

18 Innovation Pipeline Driving Sustainable Growth New Products Launched in 2023 Added easy open features “Zero Sugar” re-branding

Appendix 19

20 Non-GAAP Reconciliations 1. Project consulting costs are included in general and administrative on the condensed consolidated statement of operations. 2. In 2023, costs related to certain corporate initiatives and are included in other expense on the condensed consolidated statement of operations. In 2022, costs related to certain corporate initiatives, including $0.1 million of accelerated depreciation. Gross Gross Operating Net Net Income Diluted Gross Gross Operating Net Net Income Diluted Profit Margin Income Income Margin EPS Profit Margin Income Income Margin EPS GAAP results $ 126.0 35.8% $ 61.7 $ 32.5 9.2% $ 0.24 $ 112.7 33.1% $ 51.0 $ 30.5 9.0% $ 0.22 Non-GAAP adjustments: Foreign currency remeasurement - - - (0.2) (0.1) - - - - (0.5) (0.2) - Project consulting costs (1) - - - - - - - - 0.6 0.6 0.2 - Accelerated depreciation related to network optimization 0.4 0.1 0.4 0.4 0.1 - - - - - - - Loss on debt modification - - - 7.5 2.1 0.07 - - - - - - Other (2) - - - 0.3 0.1 - 0.1 - 0.1 0.2 - - Discrete income tax expense - - - (0.7) (0.2) - - - - (0.1) - - Tax impact of adjustments - - - (2.1) (0.6) (0.03) - - - (0.1) - - Adjusted Non-GAAP results $ 126.4 35.9% $ 62.1 37.7 10.7 $ 0.28 $ 112.8 33.1% $ 51.7 30.5 9.0 $ 0.22 Income tax 14.2 4.0 11.4 3.3 Interest expense 10.3 2.9 9.7 2.9 Depreciation & amortization 14.3 4.1 14.6 4.2 Share-based compensation 3.5 1.0 2.6 0.8 Adjusted EBITDA $ 80.0 22.7% $ 68.9 20.2% Three Months Ended June 30, 2023 Three Months Ended June 30, 2022

21 Non-GAAP Reconciliations 1. Project consulting costs are included in general and administrative on the condensed consolidated statement of operations. 2. In 2023, costs related to certain corporate initiatives and are included in other expense on the condensed consolidated statement of operations. In 2022, costs related to certain corporate initiatives, including $0.1 million of accelerated depreciation. Gross Gross Operating Net Net Income Diluted Gross Gross Operating Net Net Income Diluted Profit Margin Income Income Margin EPS Profit Margin Income Income Margin EPS GAAP results $ 246.7 35.4% $ 123.8 $ 70.8 10.1% $ 0.53 $ 228.3 34.0% $ 109.3 $ 65.0 9.7% $ 0.47 Non-GAAP adjustments: Foreign currency remeasurement - - - (0.2) - - - - - (0.2) - - Project consulting costs (1) - - - - - - - - 3.9 3.9 0.6 0.03 Accelerated depreciation related to network optimization 0.8 0.1 0.8 0.8 0.1 0.01 - - (1.4) (1.4) (0.1) (0.01) Loss on debt modification - - - 7.5 1.1 0.06 - - - - - - Other (3) - - - 0.4 0.1 - 0.3 - 0.3 0.4 0.1 - Discrete income tax expense - - - (1.1) (0.2) (0.01) - - - 0.5 0.1 - Tax impact of adjustments - - - (2.2) (0.3) (0.02) - - - (1.1) (0.2) (0.01) Adjusted Non-GAAP results $ 247.6 35.5% $ 124.6 75.9 10.9 $ 0.57 $ 228.6 34.0% $ 113.5 68.5 10.3 $ 0.43 Income tax 28.2 4.0 25.5 3.8 Interest expense 20.5 2.9 19.4 2.9 Depreciation & amortization 29.3 4.2 27.9 4.1 Share-based compensation 6.5 0.9 5.0 0.7 Adjusted EBITDA $ 160.4 22.9% $ 146.3 21.8% Six Months Ended June 30, 2023 Six Months Ended June 30, 2022

v3.23.2

Cover Page

|

Aug. 08, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity Registrant Name |

Hostess Brands, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-37540

|

| Entity Tax Identification Number |

47-4168492

|

| Entity Address, Address Line One |

7905 Quivira Road

|

| Entity Address, City or Town |

Lenexa,

|

| Entity Address, State or Province |

KS

|

| Entity Address, Postal Zip Code |

66215

|

| City Area Code |

816

|

| Local Phone Number |

701-4600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

TWNK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001644406

|

| Former Address |

|

| Document Information [Line Items] |

|

| Entity Address, Address Line One |

7905 Quivira

|

| Entity Address, City or Town |

Lenexa

|

| Entity Address, State or Province |

KS

|

| Entity Address, Postal Zip Code |

66215

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

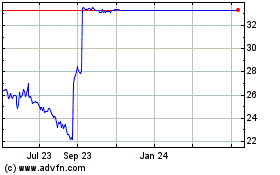

Hostess Brands (NASDAQ:TWNK)

Historical Stock Chart

From Apr 2024 to May 2024

Hostess Brands (NASDAQ:TWNK)

Historical Stock Chart

From May 2023 to May 2024