As filed

with the Securities and Exchange Commission on October 29, 2020

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES

ACT OF 1933

Hepion

Pharmaceuticals, Inc.

(Exact Name

of Registrant as Specified in its Charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

|

2834

(Primary Standard Industrial

Classification Code Number)

|

46-2783806

(I.R.S. Employer

Identification Number)

|

399 Thornall

Street, First Floor

Edison,

NJ 08837

(732) 902-4000

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Robert

Foster

Chief

Executive Officer

Hepion

Pharmaceuticals, Inc.

399 Thornall

Street, First Floor

Edison,

NJ 08837

(732) 902-4000

(Name, address,

including zip code, and telephone number, including area code, of agent for service)

|

Copies

to:

|

Jeffrey

J. Fessler, Esq.

Sheppard, Mullin, Richter & Hampton LLP

30 Rockefeller Plaza

New York, NY 10112

Tel.: (212) 634-3067

|

Brad

L. Schiffman, Esq.

Melissa

Palat Murawsky, Esq.

Blank

Rome LLP

1271

Avenue of the Americas

New

York, NY 10020

Tel:

(212) 885-5442

|

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box: ¨

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earliest effective registration statement for the same offering.

¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earliest effective registration statement for the same offering.

¨

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller

reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated

filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the

Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

Non-accelerated filer x

|

Smaller reporting company x

Emerging growth company x

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. x

CALCULATION

OF REGISTRATION FEE

Title

of Each Class of Securities

to Be Registered

|

|

Proposed

Maximum Aggregate

Offering Price(1)

|

|

|

Amount

of

Registration

Fee(2)

|

|

|

Common

Stock, $0.0001 par value per share (3)

|

|

$

|

34,500,000

|

|

|

$

|

3,764

|

|

(1)

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933,

as amended (the "Securities Act").

(2)

Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

(3)

Includes shares of common stock which may be issued on exercise of a 45-day option granted to the underwriters to cover over-allotments,

if any.

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter

become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the Registration Statement shall

become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The

information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until

the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not

an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale

is not permitted.

|

PRELIMINARY

PROSPECTUS

|

|

SUBJECT

TO COMPLETION

|

|

DATED

OCTOBER 29, 2020

|

Hepion

Pharmaceuticals, Inc.

We are offering

shares of our common stock, par value $0.0001 per share.

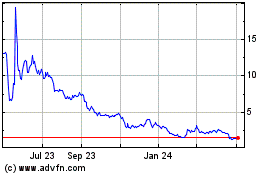

Our common

stock is listed on The Nasdaq Capital Market (“Nasdaq”), under the symbol “HEPA.” On October 28, 2020,

the last reported sale price of our common stock was $3.26 per share.

The final

public offering price of the shares of common stock in this offering will be determined through negotiation between us and the

underwriters in the offering and the recent market price used throughout this prospectus may not be indicative of the final offering

price.

We are an

“emerging growth company” under the federal securities laws and have elected to comply with certain reduced public

company reporting requirements.

Investing in our common stock

involves a high degree of risk. See “Risk Factors” beginning on page 6. Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions(1)

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds to us, before expenses

|

|

$

|

|

|

|

$

|

|

|

|

|

(1)

|

We

refer you to “Underwriting” beginning on page 14 for additional information regarding underwriters’

compensation.

|

We have

granted a 45-day option to the representative of the underwriters to purchase up to additional

shares of common stock solely to cover over-allotments, if any.

The underwriters

expect to deliver the shares of common stock to the purchasers on or about

, 2020.

ThinkEquity

a division of Fordham Financial Management, Inc.

The date

of this prospectus is , 2020

TABLE

OF CONTENTS

You

should rely only on the information contained or incorporated by reference in this prospectus

or in any free writing prospectus that we may authorize to be delivered or made available to you. We and the underwriters have

not authorized anyone to provide you with different information. We are offering to sell, and seeking offers to buy, our securities

only in jurisdictions where such offers and sales are permitted. The information in this prospectus is accurate only as of its

date, regardless of the time of its delivery or any sale of our securities.

Persons outside the United States

who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering

of our securities and the distribution of the prospectus outside the United States.

ABOUT

THIS PROSPECTUS

In this prospectus, “Hepion,”

“the Company,” “we,” “us,” and “our” refer to Hepion Pharmaceuticals, Inc.,

a Delaware corporation, and its subsidiaries, unless the context otherwise requires.

This

prospectus describes the specific information about the terms of this offering, the shares of common stock that we are selling

and the risks of investing in our common stock. You should read this prospectus, any free writing prospectus and the information

incorporated by reference in this prospectus before making your investment decision. See

“Where You Can Find More Information.” If any statement in one of these documents is inconsistent with a statement

in another document having a later date – for example, a document incorporated by reference in this prospectus – the

statement in the document having the later date modifies or supersedes the earlier statement.

Neither we, nor any of our officers,

directors, agents or representatives or underwriters, make any representation to you about the legality of an investment in our

common stock. You should not interpret the contents of this prospectus or any free writing prospectus to be legal, business, investment

or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business,

financial and other issues that you should consider before investing in our securities.

PROSPECTUS

SUMMARY

This summary highlights certain

information appearing elsewhere in this prospectus and the documents incorporated by reference. This summary does not contain

all of the information you should consider before investing in our common shares. You should read this entire prospectus and the

documents incorporated by reference into this prospectus carefully before making an investment decision. References in this prospectus

to “we,” “us,” “our” and “Company” refer to Hepion Pharmaceuticals, Inc.

and its consolidated subsidiaries.

Business Overview

We are a biopharmaceutical company

headquartered in Edison, New Jersey, focused on the development of pleiotropic drug therapy for treatment of chronic liver disease.

This therapeutic approach targets fibrosis and hepatocellular carcinoma (“HCC”) associated with non-alcoholic steatohepatitis

(“NASH”), viral hepatitis, and other liver diseases. Our cyclophilin inhibitor, CRV431, is being developed to offer

benefits to address these multiple complex pathologies. CRV431 is a cyclophilin inhibitor that targets multiple biochemical pathways

involved in the progression of liver disease. Preclinical studies with CRV431 in NASH models demonstrated consistent reductions

in liver inflammation, fibrosis, and cancerous tumors. CRV431 additionally shows antiviral activity towards hepatitis B, C, and

D viruses which also trigger liver disease.

We have completed a Phase 1 program

with CRV431 demonstrating safety, tolerability, and pharmacokinetics (PK). Our program consisted of three different clinical trials

with CRV431, administered orally once daily, that included: 1) a Single Ascending Dose (SAD) study; 2) a Multiple Ascending Dose

(MAD) study; and 3) a Drug-Drug Interaction (DDI) study. The SAD, MAD, and DDI studies were comprised of 32, 25, and 18 healthy

subjects, respectively. Additionally, in the SAD study, 8 of the 32 subjects received placebo (24 received CRV431).

CRV431 appeared to be well-tolerated

in the Phase 1 program, and there were no serious adverse effects (SAEs). The few adverse effects (AEs) observed were mild to

moderate and mostly unrelated to study drug. The PK profile of each subject was characterized and CRV431 blood exposures were

similar to those needed to elicit efficacy in the preclinical studies.

We are currently conducting a

Phase 2a study in NASH patients with fibrosis scores of F2 and F3. The first dosing cohort of 75 mg CRV431 once daily orally is

underway.

NASH is the form of liver disease

that is triggered by what has come to be known as the “Western diet”, characterized especially by high-fat, high-sugar,

and processed foods. Among the effects of a prolonged Western diet is fat accumulation in liver cells (steatosis) which is described

as non-alcoholic fatty liver disease (“NAFLD”) and can predispose cells to injury. NAFLD may evolve

into NASH when the fatty liver begins to progress through stages of cell injury, inflammation, fibrosis, and carcinogenesis. People

who develop NASH often have additional predisposing conditions such as diabetes and hypertension, but the exact biochemical events

that trigger and maintain the progression are not well known. Many people in the early stages of disease do not have significant

symptoms and therefore do not know that they have it. NASH becomes evident and a major concern when the liver becomes fibrotic

and puts the individual at increased risk of developing cirrhosis and other complications. Individuals with advanced liver fibrosis

have significantly higher risk of developing liver cancer, although cancer may also arise in some patients before significant

hepatitis or fibrosis. NASH is increasing worldwide at an alarming rate due to the spread of the Western diet, obesity, and other

related conditions. Approximately 4-5% of the global population is estimated to have NASH, and that proportion is higher in the

USA. It is predicted that NASH will become the leading reason for individuals requiring a liver transplant in the USA as early

as 2020. Considering the serious outcomes linked to advancing NASH, the economic and social burden of the disease is enormous.

There are no simple blood tests to diagnose or track the progression of NASH, and no drugs are approved to specifically treat

the disease.

HCC is the major type of liver

cancer, accounting for 85-90% of all cases. NASH, hepatitis virus infection, and alcohol consumption all are major causes of HCC.

Globally, over 700,000 people die each year from liver cancer which is second only to lung cancer among all cancer-related

deaths. The high mortality is due to the fact that only around half of all people who develop HCC (in developed countries) receive

the diagnosis early enough to have an opportunity for therapeutic intervention. Additionally, recurrence rates are high, and current

treatment options remain limited.

HCC is a type of cancer in which

the tissue microenvironment plays a major role in its development. In most cases HCC is preceded by significant, long-term damage

to liver cells, inflammation and fibrosis. One-third of people with cirrhosis, a very advanced stage of liver disease, will eventually

progress to HCC. The chronic injury to the liver leads to many genetic mutations that eventually lead to transformation of cells

and formation of tumors. The noxious tissue microenvironment also promotes cancer by altering the function of immune cells and

endothelial cells which form tumor-supporting blood vessels. These various events underscore the importance of halting liver injury

and scarring as early and effectively as possible to prevent cancer development.

Viral hepatitis may be linked

to one or more viruses including hepatitis A, B, C, D, or E. Hepatitis B virus (“HBV”) is one of many hepatitis viruses

that selectively infect human liver cells and can establish persistent infections under certain conditions. Chronic infections,

especially by HBV, HCV, and HDV, cause progressive liver inflammation, fibrosis, cirrhosis, and cancer. Collectively, these infections

represent one of the 3 major triggers of progressive liver disease (NAFLD/NASH and alcohol being the others).

An HBV vaccine is available that,

if administered prior to HBV infection, assists the body in neutralizing the virus and blocking infection. However,

vaccination is not efficacious for people who are already infected with HBV, and the vaccine has not been historically available

to everyone. As a result, an estimated 240 million people worldwide have chronic HBV infection. Anti-HBV medications are used

widely by chronically infected individuals but usually are only effective in decreasing viral replication and viremia (virus in

the blood), and NOT in eradicating HBV from the liver. This is because HBV, unlike HCV, has evolved clever ways of persisting

in liver cells and evading the immune system. Thus, despite vaccines and anti-viral medications, chronic HBV infection remains

a huge global health problem. Chronic HBV infection is the leading cause of hepatocellular carcinoma, which kills around 350,000

people per year. A similar number of people die each year from cirrhosis and other complications arising from HBV.

We are developing CRV431 as our

lead molecule. CRV431 is a cyclophilin inhibitor that targets specific isomerases that play an important role in protein folding

in health and in disease. To date, in vitro and/or in vivo studies have demonstrated reductions

in HBV DNA, HBsAg, HBeAg, inhibition of virus uptake (NTCP transport inhibition), and stimulation of innate immunity. Importantly, in

vivo studies in a NASH model of fibrosis and HCC have repeatedly demonstrated CRV431 reduces fibrosis scores and overall

liver tumor burden. Hence, CRV431 is a pleiotropic molecule that may not only treat liver disease but may also serve to reduce

important risk factors (e.g., HBV) for developing the disease.

CRV431

CRV431 is a novel drug candidate

designed to target a class of proteins called cyclophilins, of which there are many isoforms. Cyclophilins play a role in health

and in the pathogenesis of certain diseases and are known as peptidyl prolyl isomerases. The isomerase activity plays an important

role in several biological processes including, for example, folding of proteins to confer certain 3-dimensional configurations.

Additionally, specific host cyclophilins (e.g., cyclophilin A, B, C, D) play a role in the pathogenesis of many diseases,

including liver disease and viral hepatitis.

Cyclophilins are pleiotropic

enzymes that play a role in injury and steatosis through mechanisms including cell death occurring through mitochondrial pore

permeability (cyclophilin D). Inhibition of cyclophilin D, therefore, may play an important role in protection from cell death.

Cyclophilin A binding to CD147 is known to play a role in inflammation, cyclophilin B plays a role in fibrosis through collagen

production, and cyclophilins also play a role in cirrhosis and cancer (e.g., cell proliferation and metastasis). Cyclophilin inhibition

with CRV431, therefore, may play an important role in reducing liver disease.

To date, we have completed eight

separate preclinical animal efficacy studies of CRV431 to assess antifibrotic activity. Each of these eight studies were conducted

by independent laboratory collaborations at The Scripps Research Institute (San Diego, CA), SMC Corporation (Tokyo, Japan), and

Physiogenex S.A.S. (France), Each of these studies demonstrated consistent and significant reductions in fibrosis in mice and

rats. CRV431 was also tested in Precision Cut Liver Slices and in Precision Cut Lung Slices in ex plants from human donors.

Again, CRV431 demonstrated an antifibrotic effect that was consistent with the animal study findings. These studies provide support

of advancing CRV431 into clinical trials for NASH, and potentially additional indications where fibrosis plays a role.

Important risk factors for development

of liver disease include viral hepatitis (HBV, HCV, HDV), alcohol, and non-alcoholic fatty liver disease and the more aggressive

form called non-alcoholic steatohepatitis. The life cycle of certain viruses, including for example, HBV, HIV, and hepatitis C

virus (“HCV”) infections are dependent on host proteins (cyclophilins) for the role they play in the virus life cycle

and propagation of the virus. CRV431 has been developed to inhibit the role of host cyclophilins and therefore interfere in viral

propagation. CRV431 does not directly target the virus and, as such, should be less susceptible to drug resistance, borne from

viral mutations.

Data in various cell lines

of either transfected or infected HBV demonstrates nanomolar efficacy (EC50 values) and micromolar toxicity (CC50 values).

The selective index (“SI”), therefore, is wide and suggests that CRV431 presents a viable clinical drug candidate

for the treatment of viral infections, including HBV. Additional testing in a transgenic mouse model of HBV indicated that

CRV431 reduced HBV DNA in the liver and HBsAg in serum. CRV431 is orally active and appears to be well tolerated.

On May 10,

2018, we submitted an Investigational New Drug Application (“IND”) to the U.S. Food and Drug Administration

(“FDA”) to support initiation of our CRV431 HBV clinical development program in the United States and received

approval in June 2018. We completed the first segment of our Phase 1 clinical activities for CRV431 in October 2018

wherein we reached a major clinical milestone of positive data from a Phase I trial of CRV431 in humans. This achievement

triggered the first milestone payment, as stated in the Merger Agreement for the acquisition of Ciclofilin

Pharmaceuticals, Inc. (“Ciclofilin”) and we paid a related milestone payment of approximately $346,000 to

Aurinia Pharmaceuticals, Inc. ("Aurinia") and $654,000 to the former Ciclofilin shareholders along with the issuance of 1,439

shares of our common stock with a fair value of $55,398, representing 2.5% of our issued and outstanding common stock as of

June, 2016, to the former Ciclofilin shareholders. Our CEO is a former Ciclofilin shareholder and received approximately

$274,000 and 603 shares of common stock and Petrus Wijngaard, a director of our company, received $2,805 and 6 shares of

common stock.

Additional

milestone payments could potentially be payable to the former Ciclofilin shareholders pursuant to the Ciclofilin Merger

Agreement as follows: (i) upon receipt of Phase II positive data from a proof of concept clinical trial of CRV431 in humans -

4,317 shares of common stock and $3,000,000, (ii) upon initiation of a Phase III trial of CRV431 - $5,000,000, and (iii) upon

acceptance by the FDA of a new drug application for CRV431 - $8,000,000 . In addition, on February 14, 2014, Ciclofilin had

entered into a Purchase and Sale Agreement to acquire Aurinia’s entire interest in CRV431. This agreement contains

future milestone payments payable by us based on clinical and marketing milestones of up to CAD $2.45 million. The milestone

payments payable to the former Ciclofilin shareholders will be subject to offset by certain of the clinical and marketing

milestone payments payable to Aurinia as follows: (a) the payments to the former Ciclofilin shareholders pursuant to (ii)

above would be offset by payment to Aurinia of CAD $450,000, and (b) the payments to the former Ciclofilin shareholders

pursuant to (iii) above would be subject to offset by payment to Aurinia of up to CAD $2,000,000. In addition to the above

clinical and milestone payments, the Aurinia Agreement provides for the following additional contingent payment obligations:

(x) a royalty of 2.5% on net sales of CRV431 which is uncapped, (y) a royalty of 5% on license revenue from CRV431 and (z) a

payment equal to 30% of the proceeds from a Liquidity Event (as defined in the Purchase and Sale Agreement) with respect to

Ciclofilin, of which approximately $150,000 plus interest will be paid to Aurinia upon the closing of this offering. The

maximum obligation under both (y) and (z) is CAD $5,000,000.

On June 17, 2019, we submitted an IND to the FDA to support

initiation of our CRV431 NASH clinical development program in the United States and received approval in July 2019. We completed

dosing of CRV431 in our MAD clinical trial in September, 2020.

ARTIFICAL INTELLIGENCE (AI)

We have created a proprietary AI called, “AI-POWRTM

to optimize the outcomes of our current clinical programs and to potentially identify novel indications for CRV431 and possibly

identify new targets and new drug molecules to broaden our pipeline.

AI-POWR™ is our acronym for Artificial Intelligence

- Precision Medicine; Omics that include genomics, proteomics, metabolomics, transcriptomics, and lipidomics;

World database access; and Response and clinical outcomes. AI-POWR™ allows for the selection

of novel drug targets, biomarkers, and appropriate patient populations. AI-POWR™ is used to identify responders from big

data sources using our multi-omics approach, while modelling inputs and scenarios to increase response rates. The components of

AI-POWR™ include access to publicly available databases, and in-house genomic and multi-omic big data, processed via machine

learning algorithms. AI outputs allow for improved response outcomes through enhanced patient selection, biomarker selection and

drug target selection. We believe AI outputs will help identify responders a priori and reduce the need for large sample

sizes through study design enrichment.

We intend to use AI-POWR™ to help identify which patients

will best respond to CRV431 for treatment of NASH patients, currently in a Phase 2a clinical trial. It is anticipated that applying

this proprietary platform to our drug development program will ultimately save time, resources and money. In so doing, we believe

that AI-POWR™ is a risk-mitigation strategy that should reap benefits all the way through from clinical trials to commercialization.

We believe that NASH is a very heterogenous disease and we need

to have a better understanding of interactions between changes to proteins, genes, lipids, and metabolites, to name a few, induced

by both drugs and disease. All of this is further complicated by variable drug concentrations, patient traits and temporal factors.

AI-POWR™ is designed to address many of these typical challenges, as we believe we can use our proprietary platform to shorten

development timelines and increase the delta between placebo and treatment groups. AI-POWR™ will be used to drive our ongoing

Phase 2a NASH program and identify additional potential indications for CRV431 to expand our footprint in the cyclophilin inhibition

therapeutic space.

Recent Developments

On July 30, 2020, our stockholders approved an amendment to our 2013 Equity Incentive Plan (the "Plan"), increasing the number of shares

of common stock issuable under the Plan to 2,500,000 from 40,535. As of September 30, 2020, 2,499,473 shares of our common stock are issuable

upon exercise of outstanding options under the Plan and 527 shares of common stock are reserved for future issuance under the Plan.

Risks Associated with our Business

Our business is subject to numerous risks and uncertainties,

including those highlighted and incorporated by reference in the section entitled “Risk Factors” immediately following

this prospectus summary. These risks include, but are not limited to, the following:

|

|

•

|

Our product candidate, CRV431, is in the early stages of clinical development and its commercial viability remains subject

to the successful outcome of current and future clinical trials, regulatory approvals and the risks generally inherent in the development

of pharmaceutical product candidates. If we are unable to successfully advance or develop or partner our product candidate, we

may be delayed or precluded further development or regulatory approval.

|

|

|

•

|

A pandemic, epidemic or outbreak of an infectious disease, such as COVID-19, may materially and adversely affect our business

and operations. The Company cannot estimate the length or gravity of the impact of the COVID-19 outbreak at this time, but if

the pandemic continues, it may have a material adverse effect on the Company’s results of future operations, financial position,

liquidity, and capital resources, and those of the third parties on which the Company relies in fiscal year 2020.

|

|

|

•

|

We have incurred losses since inception, anticipate that we will incur continued losses for the foreseeable future indicating

the possibility that we may not be able to operate in the future.

|

|

|

•

|

We will require substantial additional funding which may not be available to us on acceptable terms, or at all. If we fail

to raise the necessary additional capital, we may be unable to complete the development and commercialization of our product candidate,

or continue our development programs.

|

|

|

•

|

If we fail to comply with the continued listing requirements of The Nasdaq Capital Market, our common stock may be delisted

and the price of our common stock and our ability to access the capital markets could be negatively impacted.

|

|

|

•

|

Our product candidate and any future product candidates may exhibit undesirable side effects when used alone or in combination

with other approved pharmaceutical products or investigational new drugs, which may delay or preclude further development or regulatory

approval, or limit their use if approved.

|

|

|

•

|

If the results of preclinical studies or clinical trials for our product candidate, including those that are subject to existing

or future license or collaboration agreements, are unfavorable or delayed, we could be delayed or precluded from the further development

or commercialization of our product candidate, which could materially harm our business.

|

|

|

•

|

Clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials

may not be predictive of future trial results.

|

|

|

•

|

The regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time consuming and inherently

unpredictable, and if we are ultimately unable to obtain regulatory approval for our product candidate, our business will be substantially

harmed.

|

|

|

•

|

We currently have no sales and marketing organization. If we are unable to establish a direct sales force in the United States

to promote our products, the commercial opportunity for our products may be diminished.

|

|

|

•

|

We may not be able to manufacture our product candidate in commercial quantities, which would prevent us from commercializing

our product candidate.

|

|

|

•

|

Our product candidate, if approved for sale, may not gain acceptance among physicians, patients and the medical community,

thereby limiting our potential to generate revenues.

|

|

|

•

|

You will experience immediate and substantial dilution in the book value per share of the common stock you purchase.

|

|

|

•

|

Management will have broad discretion as to the use of proceeds from this offering and might not use them effectively.

|

Corporate History and Information

We were incorporated in Delaware on May 15, 2013 for the

purpose of holding certain FV-100 assets of Synergy Pharmaceuticals Inc., or Synergy. We were a majority-owned subsidiary

of Synergy Pharmaceuticals Inc. (Synergy) until February 18, 2014, the date Synergy completed the spinout of our shares

of common stock. On July 18, 2019, we filed a certificate of amendment to our certificate of incorporation to change the Company’s

name from “ContraVir Pharmaceuticals, Inc.” to “Hepion Pharmaceuticals, Inc.” The name change became effective

as of July 18, 2019.

Our principal executive offices are located at 399 Thornall

Street, First Floor, Edison, New Jersey 08837. Our telephone number is (732) 902-4000 and our website address is www.hepionpharma.com.

The information on our website is not a part of, and should not be construed as being incorporated by reference into, this registration

statement or the accompanying prospectus.

THE OFFERING

|

Common stock offered

|

|

shares.

|

|

|

|

|

|

Over-allotment option

|

|

We have granted a 45-day option to the representative of the underwriters to purchase up to additional shares of common stock solely to cover over-allotments, if any, at the public offering price less underwriting discounts and commissions.

|

|

|

|

|

|

Common stock to be outstanding after this

offering (1)

|

|

shares of common stock (or shares of common stock if the underwriters exercise in full their option to purchase additional shares of common stock).

|

|

|

|

|

|

Use of proceeds

|

|

We

estimate that the net proceeds to us from this offering from the sale of the shares of our common stock will be approximately $

million, or approximately $ million if the underwriters exercise their option

to purchase additional shares in full, at the assumed public offering price of $ , the closing price of our common stock as reported

on The Nasdaq Capital Market on , 2020, and after deducting underwriting discounts and commissions and offering expenses payable

by us.

We

intend to use the net proceeds of this offering to fund our research and development activities and general

corporate purposes, including approximately $150,000 plus interest for a milestone payment, working capital, operating

expenses and capital expenditures. We may use the net proceeds from this offering to fund possible acquisitions of other

companies, products or technologies, though no such acquisitions are currently contemplated. See “Use of

Proceeds.”

|

|

Risk factors

|

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus and the risk factors included in our Form 10-K for the year ended December 31, 2019, which are incorporated by reference into this prospectus, for a discussion of factors to consider carefully before deciding to invest in shares of our common stock in this offering.

|

|

|

|

|

|

Nasdaq symbol

|

|

Our common stock is listed on The Nasdaq Capital Market under the symbol “HEPA.”

|

|

(1)

|

Based on 9,025,061 shares of common stock outstanding as of June 30, 2020 and excludes:

|

|

|

•

|

1,402,771 shares of our common stock issuable upon exercise of outstanding options at a weighted average price of $7.76 per

share;

|

|

|

•

|

2,536,566 shares of our common stock issuable upon exercise of outstanding warrants with a weighted-average exercise price

of $19.35 per share;

|

|

|

•

|

3,184 shares of our common stock issuable upon conversion of outstanding shares of Series A Convertible Preferred Stock;

|

|

|

•

|

16,839 shares of our common stock issuable upon conversion of outstanding shares of Series C Convertible Preferred Stock;

and

|

|

|

•

|

shares of our common stock issuable upon exercise of the warrant to be issued to the representative in connection with this

offering.

|

RISK FACTORS

An investment in our securities involves a high degree of

risk. You should carefully consider the risk factors contained in our periodic reports filed with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2019 and all of our quarterly reports on Form 10-Q,

which are incorporated by reference into this prospectus. Before deciding to invest in our securities, you should carefully consider

these risks, as well as other information we include or incorporate by reference in this prospectus.

If any of the events described in these risk factors actually

occurs, or if additional risks and uncertainties that are not presently known to us or that we currently deem immaterial later

materialize, then our business, prospects, results of operations and financial condition could be materially adversely affected.

In that event, the trading price of our securities could decline, and you may lose all or part of your investment in our securities.

The risks discussed below include forward-looking statements, and our actual results may differ substantially from those discussed

in these forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to our Business

The following items supplement

the risks related to our business previously reported in Part 1, “Item 1A. Risk Factors – Risks Related to Our Business”

of our Annual Report on Form 10-K for the year ended December 31, 2019:

Our

approach to the discovery and development of product candidates based on AI-POWR™ is

novel and unproven, and we do not know whether we will be able to develop any products of commercial value.

We

intend to leverage AI-POWR™ to potentially identify

novel indications for CRV431 and possibly identify new targets and new drug molecules to broaden our pipeline for

patients whose diseases have not been adequately addressed to date by other approaches and to design and conduct efficient clinical

trials with a higher likelihood of success. While we believe that applying AI-POWR™ to

create medicines for defined patient populations may potentially enable drug research and clinical development that is more efficient

than conventional drug research and development, our approach is both novel and unproven. Because our approach is both novel and

unproven, the cost and time needed to develop our product candidates is difficult to predict, and our efforts may not result in

the discovery and development of commercially viable medicines. We may also be incorrect about the effects of our product candidates

on the diseases of our defined patient populations, which may limit the utility of our approach or the perception of the utility

of our approach. Furthermore, our estimates of our defined patient populations available for study and treatment may be lower than

expected, which could adversely affect our ability to conduct clinical trials and may also adversely affect the size of any market

for medicines we may successfully commercialize. Our approach may not result in time savings, higher success rates or reduced costs

as we expect it to, and if not, we may not attract collaborators or develop new drugs as quickly or cost effectively as expected

and therefore we may not be able to commercialize our approach as originally expected.

AI-POWR™

may fail to help us discover and develop additional potential product candidates.

Any

drug discovery that we are conducting using AI-POWR™ may

not be successful in identifying compounds that have commercial value or therapeutic utility. AI-POWR™ may

initially show promise in identifying potential product candidates, yet fail to yield viable product candidates for clinical development

or commercialization for a number of reasons, including:

|

|

·

|

research programs to identify new product candidates will require

substantial technical, financial and human resources, and we may be unsuccessful in our efforts to identify new product candidates.

If we are unable to identify suitable additional compounds for preclinical and clinical development, our ability to develop product

candidates and obtain product revenues in future periods could be compromised, which could result in significant harm to our financial

position and adversely impact our stock price;

|

|

|

·

|

compounds found through AI-POWR™ may

not demonstrate efficacy, safety or tolerability;

|

|

|

·

|

potential product candidates may, on further study, be shown to have

harmful side effects or other characteristics that indicate that they are unlikely to receive marketing approval and achieve market

acceptance;

|

|

|

|

|

|

|

·

|

competitors may develop alternative therapies that render our potential

product candidates non-competitive or less attractive; or

|

|

|

·

|

a potential product candidate may not be capable of being produced

at an acceptable cost.

|

Risks Related to this Offering

Management will have broad discretion as to the use of

proceeds from this offering and might not use them effectively.

Our management will have broad discretion as to the application

of the net proceeds from this offering and our stockholders will not have the opportunity as part of their investment decisions

to assess whether the net proceeds are being used appropriately. You might not agree with our decisions, and our use of the proceeds

might not yield any return on your investment. Because of the number and variability of factors that will determine our use of

the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. Our failure to

apply the net proceeds of this offering effectively could compromise our ability to pursue our growth strategy and we might not

be able to yield a significant return, if any, in our investment of these net proceeds. You will not have the opportunity to influence

our decisions on how to use our net proceeds from this offering.

Investors in this offering will experience immediate and

substantial dilution and may experience further dilution in the future.

The

offering price per share of our common stock being offered will be higher than the net tangible book value per share of our common

stock. Therefore, if you purchase shares of common stock in this offering, you will incur immediate and substantial dilution in

the as adjusted net tangible book value per share of common stock from the price you pay for the common stock. For a further description

of the dilution that investors in this offering will experience, see “Dilution”.

Furthermore,

we expect that we will seek to raise additional capital from time to time in the future. Such financings may involve the

issuance of equity and/or securities convertible into or exercisable or exchangeable for our equity securities. In

addition, investors in this offering will be subject to increased dilution upon the exercise of outstanding stock options or

warrants or conversion of outstanding preferred stock. We also expect to continue to utilize equity-based compensation which

would further dilute investors. We have in the past issued, and could in the future issue, securities with anti-dilution

features which if triggered could

result in further dilution to our stockholders.

If we fail to comply with the continued listing requirements

of The Nasdaq Capital Market, our common stock may be delisted and the price of our common stock and our ability to access the

capital markets could be negatively impacted.

A delisting of our common stock from The Nasdaq Capital Market

could materially reduce the liquidity of our common stock and result in a corresponding material reduction in the price of our

common stock. In addition, delisting could harm our ability to raise capital through alternative financing sources on terms acceptable

to us, or at all, and may result in the potential loss of confidence by investors, employees and fewer business development opportunities.

A large number of shares issued in this offering may be

sold in the market following this offering, which may depress the market price of our common stock.

A large number of shares issued in this offering may be sold

in the market following this offering, which may depress the market price of our common stock. Sales of a substantial number of

shares of our common stock in the public market following this offering could cause the market price of our common stock to decline.

If there are more shares of common stock offered for sale than buyers are willing to purchase, then the market price of our common

stock may decline to a market price at which buyers are willing to purchase the offered shares of common stock and sellers remain

willing to sell the shares. All of the shares of common stock issued in the offering will be freely tradable without restriction

or further registration under the Securities Act.

We have not paid dividends in the past and have no immediate

plans to pay dividends.

We plan to reinvest all of our earnings, to the extent we have

earnings, in order to further develop our product candidate and to cover operating costs. We do not plan to pay any cash dividends

with respect to our securities in the foreseeable future. We cannot assure you that we would, at any time, generate sufficient

surplus cash that would be available for distribution to the holders of our common stock as a dividend. Therefore, you should not

expect to receive cash dividends on the common stock we are offering.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus and the documents we incorporate by reference

in this prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act, and Section

21E of the Exchange Act, and may involve material risks, assumptions and uncertainties. Statements that are not purely historical

should be considered forward-looking statements. Often they can be identified by the use of forward-looking words and phrases,

such as “may,” “will,” “believe,” “anticipate,” “expect,” “should,”

“optimistic” or “continue,” “estimate,” “intend,” “plan,” “would,”

“could,” “guidance,” “potential,” “opportunity,” “project,” “forecast,”

“confident,” “projections,” “schedule,” “designed,” “future” and the

like. These forward-looking statements reflect our current expectations and projections about future events and financial trends

that we believe may affect our business, financial condition and results of operations. These forward-looking statements are

subject to a number of risks, uncertainties and assumptions described under the section entitled “Risk Factors.”

These statements are not guarantees of future performance and

involve risks and uncertainties that are difficult to predict or are beyond our control. A number of important factors could cause

actual outcomes and results to differ materially from those expressed in these forward-looking statements. Consequently, readers

should not place undue reliance on such forward-looking statements. In addition, these forward-looking statements relate

to the date on which they are made.

The forward-looking statements reflect our current expectations

and are based on information currently available to us and on assumptions we believe to be reasonable. Forward-looking information

is subject to known and unknown risks, uncertainties and other factors that may cause our actual results, activities, performance

or achievements to be materially different from that expressed or implied by such forward-looking statements. Some of the risks, uncertainties, and other factors that could cause actual results to differ materially from estimates or projections

contained in the forward-looking

statements include, but are not limited to:

|

|

•

|

The impact of COVID-19 on our operations;

|

|

|

•

|

Our ability to compete with larger, better financed pharmaceutical companies;

|

|

|

•

|

Our uncertainty of developing marketable products;

|

|

|

•

|

Our ability to develop and commercialize our products;

|

|

|

•

|

Our ability to obtain regulatory approvals;

|

|

|

•

|

Our ability to maintain and protect intellectual property rights;

|

|

|

•

|

The inability to raise additional future financing and lack of financial and other resources;

|

|

|

•

|

Our ability to control product development costs;

|

|

|

•

|

We may not be able to attract and retain key employees;

|

|

|

•

|

We may not be able to compete effectively;

|

|

|

•

|

We may not be able enter into new strategic collaborations;

|

|

|

•

|

Changes in government regulation affecting product candidates could increase our development costs;

|

|

|

•

|

Our involvement in patent and other intellectual property litigation could be expensive and could divert management’s

attention;

|

|

|

•

|

The possibility that there will be no market acceptance for our products; and

|

|

|

•

|

Changes in third-party reimbursement policies could adversely affect potential future sales of any of our products that

are approved for marketing.

|

Although we have attempted to identify important factors that

could cause actual actions, events or results to differ materially from those described in forward-looking information, there

may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Other than

as required by law, we do not assume any obligation to update any forward-looking information, whether as a result of new information,

future events or results or otherwise.

You should also read the matters described in “Risk Factors”

and the other cautionary statements made in this prospectus and the documents incorporated by reference into this prospectus. The

forward-looking statements in this prospectus and the documents incorporated by reference into this prospectus may not prove

to be accurate and therefore you are encouraged not to place undue reliance on forward-looking statements. You should read

this prospectus and the documents incorporated by reference into this prospectus completely.

This prospectus and the documents incorporated by reference

into this prospectus also include estimates and other statistical data made by independent parties and by us relating to market

size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned

not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the

future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

USE OF PROCEEDS

We estimate that the net proceeds to us

from this offering from the sale of the shares of our common stock will be approximately $ million, or approximately $ million

if the underwriters exercise their option to purchase additional shares in full, at the assumed public offering price of $ , the

closing price of our common stock as reported on the Nasdaq Capital Market on , 2020, and after deducting underwriting discounts

and commissions and offering expenses payable by us.

We

intend to use the net proceeds from this offering to fund our research and development activities and general corporate

purposes, including approximately $150,000 plus interest for a milestone payment, working capital, operating expenses and

capital expenditures. We may use the net proceeds from this offering to fund possible acquisitions of other companies,

products or technologies, though no such acquisitions are currently contemplated.This expected use of our net proceeds from

this offering represents our intentions based upon our current plans and business conditions, which could change in the

future as our plans and business conditions evolve. The amounts and timing of our actual expenditures may vary significantly

depending on numerous factors, including the progress of our drug candidate development, the status of and results from

clinical trials, as well as any collaborations that we may enter into with third parties for our drug candidate, and

any unforeseen cash needs.

As a result, our management will retain broad discretion over

the allocation of the net proceeds from this offering, and investors will be relying on the judgment of our management regarding

the application of the net proceeds from this offering. The timing and amount of our actual expenditures will be based on many

factors, including cash flows from operations and the anticipated growth of our business.

DILUTION

If

you purchase securities in this offering, your interest will be diluted to the extent of the difference between the public offering

price and the net tangible book value per share of our common stock after this offering. Our net tangible book value as of June

30, 2020 was $13,231,154 million or $1.47 per share of common stock based on 9,025,061 shares of our common stock outstanding

as of that date. “Net tangible book value” is total assets minus the sum of liabilities and intangible assets. “Net

tangible book value per share” is net tangible book value divided by the total number of shares of common stock outstanding.

After giving effect to the sale by us in this offering of shares

of common stock at an assumed offering price of per share, which was the last reported sale price of our common stock on the Nasdaq

Capital Market on , 2020, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses

payable by us, our as adjusted net tangible book value as of June 30, 2020 would have been approximately $ million, or $

per share of common stock. This amount represents an immediate increase in net tangible book value of $ per share to existing stockholders

and an immediate dilution of $ per share to purchasers in this offering.

The following table illustrates the dilution:

|

Assumed public offering price per share

|

|

|

$

|

|

|

Net tangible book value per share as of June 30, 2020

|

$

|

1.47

|

|

|

|

Assumed increase in net tangible book value per share attributable to this offering

|

$

|

|

|

|

|

Assumed as adjusted net tangible book value per share as of June 30, 2020 after giving effect to this offering

|

|

|

$

|

|

|

Assumed dilution per share to new investors

|

|

|

$

|

|

The actual price at which shares are sold in this offering and

the actual amount of underwriting discounts and commissions and offering expenses payable by us may be lesser or greater than the

assumed amounts reflected in the table above.

The dilution information set forth in the table above is illustrative

only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

The above table is based on 9,025,061 shares of common stock

outstanding as of June 30, 2020, does not give effect to any exercise of the underwriters’ option to purchase additional

shares and excludes:

|

|

•

|

1,402,771 shares of our common stock issuable upon exercise of outstanding options at a weighted average price of $7.76 per

share;

|

|

|

•

|

2,536,566 shares of our common stock issuable upon exercise of outstanding warrants with a weighted-average exercise price

of $19.35 per share;

|

|

|

•

|

3,184 shares of our common stock issuable upon conversion of outstanding shares of Series A Convertible Preferred Stock;

|

|

|

•

|

16,839 shares of our common stock issuable upon conversion of outstanding shares of Series C Convertible Preferred Stock;

and

|

|

|

•

|

shares of our common stock issuable upon exercise of the warrant to be issued to the representative in connection with this

offering.

|

If we issue any additional shares in connection with outstanding

options or warrants or issue shares upon conversion of outstanding preferred stock there will be additional

dilution. In addition, we may choose to raise additional capital. To the extent that additional capital is raised through the sale

of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

CAPITALIZATION

The following table sets forth our cash and our capitalization

as of June 30, 2020 on:

|

|

•

|

an as adjusted basis to give effect to this offering (assuming no exercise of the underwriters’ option to purchase additional

shares) at an assumed offering price of $ per share, which was the last reported sale price of our common stock on the Nasdaq Capital

Market on , 2020, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable

by us.

|

The

following data is qualified in its entirety by, and should be read in conjunction with, our unaudited condensed consolidated financial

statements and notes thereto incorporated by reference in this prospectus. The as adjusted information set forth in the

table below is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering

determined at pricing.

|

|

|

As of June 30, 2020

|

|

|

|

|

Actual

|

|

|

As adjusted

|

|

|

Cash

|

|

$

|

17,561,813

|

|

|

|

|

|

|

Total long-term debt

|

|

$

|

176,585

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred Stock, stated value $10.00 per share; 85,581 shares of Series A Convertible Preferred Stock issued and outstanding

|

|

|

855,808

|

|

|

|

|

|

|

Preferred Stock, stated value $1,000; 1,827 shares of Series C Convertible Preferred Stock issued and outstanding

|

|

|

861,033

|

|

|

|

|

|

|

Common Stock, par value $0.0001; 120,000,000 shares authorized; 9,025,061 shares issued and outstanding, actual; shares issued and outstanding, as adjusted

|

|

|

901

|

|

|

|

|

|

|

Additional paid-in capital

|

|

|

108,923,663

|

|

|

|

|

|

|

Accumulated deficit

|

|

|

(92,349,327

|

)

|

|

|

|

|

|

Total stockholders’ equity

|

|

|

18,292,078

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

18,468,663

|

|

|

|

|

|

The

capitalization table above is based on the number of shares outstanding as of June 30, 2020, does not give effect to any exercise

of the underwriters’ option to purchase additional shares. The number of shares of our common stock that will

be outstanding after this offering is based on 9,025,061shares of common stock outstanding as of June 30, 2020 and excludes:

|

|

•

|

1,402,771 shares of our common stock issuable upon exercise of outstanding options at a weighted average price of $7.76 per

share;

|

|

|

•

|

2,536,566 shares of our common stock issuable upon exercise of outstanding warrants with a weighted-average exercise price

of $19.35 per share;

|

|

|

•

|

3,184 shares of our common stock issuable upon conversion of outstanding shares of Series A Convertible Preferred Stock;

|

|

|

•

|

16,839 shares of our common stock issuable upon conversion of outstanding shares of Series C Convertible Preferred Stock;

and

|

|

|

•

|

shares of our common stock issuable upon exercise of the warrant to be issued to the representative in connection with this

offering.

|

DESCRIPTION OF THE

SECURITIES WE ARE OFFERING

General

We are authorized to issue up to 120,000,000 shares of common

stock, $0.0001 par value per share, and 20,000,000 shares of preferred stock, $0.0001 par value per share.

As of June 30, 2020, there were 9,025,061 shares of our

common stock issued and outstanding, 85,581 shares of Series A convertible preferred stock outstanding, and 1,827 shares

of Series C convertible preferred stock outstanding. As of June 30, 2020, we had outstanding warrants to purchase an

aggregate of 2,536,566 shares of our common stock at an average weighted exercise price of $19.35 per share.

Common Stock

Holders of common stock are entitled to receive ratably dividends

out of funds legally available, if and when declared from time to time by our Board. We have never paid any cash dividends on our

common stock and our Board does not anticipate that we will pay cash dividends in the foreseeable future. The future payment of

dividends, if any, on our common stock is within the discretion of the Board and will depend upon earnings, capital requirements,

financial condition and other relevant factors. Holders of common stock are entitled to one vote for each share held on each matter

to be voted on by stockholders. There is no cumulative voting in the election of directors. In the event of liquidation, dissolution

or winding up of the affairs of us, holders of common stock are to share in all assets remaining after the payment of liabilities

and any preferential distributions payable to preferred stockholders, if any. The holders of common stock have no preemptive or

conversion rights and are not subject to further calls or assessments. There are no redemption or sinking fund provisions applicable

to the common stock. The rights of the holders of the common stock are subject to any rights that may be fixed for holders of preferred

stock, if any. All of the outstanding shares of common stock are fully paid and non-assessable. Our common stock is listed

on the Nasdaq Capital Market under the symbol “HEPA.”

Anti-Takeover

Effects of Certain Provisions of Hepion Certificate of Incorporation, Bylaws and the DGCL

Certain provisions

of our certificate of incorporation and bylaws, which are summarized in the following paragraphs, may have the effect of discouraging

potential acquisition proposals or making a tender offer or delaying or preventing a change in control, including changes a stockholder

might consider favorable. Such provisions may also prevent or frustrate attempts by our stockholders to replace or remove our management.

In particular, our certificate of incorporation and bylaws and Delaware law, as applicable, among other things:

• provide the Board

of Directors with the ability to alter the bylaws without stockholder approval; and

•

provide that vacancies on the Board of Directors may be filled by a majority of directors in office, although less than a quorum.

These provisions

are expected to discourage certain types of coercive takeover practices and inadequate takeover bids and to encourage persons seeking

to acquire control of Hepion to first negotiate with its board. These provisions may delay or prevent someone from acquiring or

merging with Hepion, which may cause the market price of Hepion common stock to decline.

Blank

Check Preferred. Our Board of Directors is authorized to create and issue from time to time,

without stockholder approval, up to an aggregate of 20,000,000 shares of preferred stock in one or more series and to establish

the number of shares of any series of preferred stock and to fix the designations, powers, preferences and rights of the shares

of each series and any qualifications, limitations or restrictions of the shares of each series.

The

authority to designate preferred stock may be used to issue series of preferred stock, or rights to acquire preferred stock, that

could dilute the interest of, or impair the voting power of, holders of the common stock or could also be used as a method of determining,

delaying or preventing a change of control.

Advance

Notice Bylaws. The Bylaws contain an advance notice procedure for stockholder proposals to

be brought before any meeting of stockholders, including proposed nominations of persons for election to our Board of

Directors. Stockholders at any meeting will only be able to consider proposals or nominations specified in the notice of

meeting or brought before the meeting by or at the direction of our Board of Directors or by a stockholder who was a

stockholder of record on the record date for the meeting, who is entitled to vote at the meeting and who has given Hepion's

corporate secretary timely written notice, in proper form, of the stockholder's intention to bring that business before the

meeting. Although the Bylaws do not give our Board of Directors the power to approve or disapprove stockholder nominations of

candidates or proposals regarding other business to be conducted at a special or annual meeting, the Bylaws may have the

effect of precluding the conduct of certain business at a meeting if the proper procedures are not followed or may discourage

or deter a potential acquirer from conducting a solicitation of proxies to elect its own slate of directors or otherwise

attempting to obtain control of us.

UNDERWRITING

We have entered into an underwriting agreement,

dated , 2020, with ThinkEquity, a division of Fordham Financial Management, Inc., acting as the sole book-running manager (sometimes

referred to as the “representative”). Subject to the terms and conditions of the underwriting agreement, we have agreed

to sell to each underwriter named below, and each underwriter named below has severally agreed to purchase, at the public offering

price less the underwriting discounts set forth on the cover page of this prospectus, the number of shares of common stock listed

next to its name in the following table:

|

Underwriters

|

|

Number of Shares

|

|

ThinkEquity, a division of Fordham Financial Management, Inc.

|

|

|

|

|

Total

|

|

|

|

The underwriting agreement provides that

the obligations of the underwriters to pay for and accept delivery of the shares of common stock offered by this prospectus are

subject to various conditions and representations and warranties, including the approval of certain legal matters by their counsel

and other conditions specified in the underwriting agreement. The shares of common stock are offered by the underwriters, subject

to prior sale, when, as and if issued to and accepted by them. The underwriters reserve the right to withdraw, cancel or modify

the offer to the public and to reject orders in whole or in part. The underwriters are obligated to take and pay for all of the

shares of common stock offered by this prospectus if any such shares of common stock are taken, other than those shares of common

stock covered by the over-allotment option described below.

We have agreed to indemnify the underwriters

and certain of their affiliates and controlling persons (within the meaning of Section 15 of the Securities Act or Section 20 of

the Exchange Act), among others, against specified liabilities, including liabilities under the Securities Act, and to contribute

to payments the underwriters may be required to make in respect thereof.

Discounts, Commissions and Reimbursement

The underwriters propose to offer the shares

of common stock directly to the public at the public offering price set forth on the cover page of this prospectus. After the offering

to the public, the offering price and other selling terms may be changed by the underwriters without changing the proceeds we will

receive from the underwriters.

The following table summarizes the public

offering price, underwriting discounts and commissions and proceeds before expenses to us. The underwriting commissions are 7.0%

of the public offering price. The information assumes either no exercise or full exercise of the over-allotment option we granted

to the representative of the underwriters.

|

|

|

Per Share

|

|

|

Total Without

Over-allotment

Option

|

|

|

Total With

Over-allotment

Option

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

Underwriting discounts and commissions (7.0%)

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

Proceeds,

before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

We have paid an expense deposit of $25,000

to the representative, which will be applied against out-of-pocket accountable expenses that will be paid by us to the underwriters

in connection with this offering, and will be reimbursed to us to the extent not actually incurred in compliance with FINRA Rule

5110(g)(4)(A).

We have also agreed to pay certain of

the representative’s expenses relating to the offering, including (a) all filing fees and communication expenses

relating to the registration of the shares of common stock to be sold in the offering (including the share’s subject to

the underwriters’ over-allotment option) with the Commission; (b) all public filing system filing fees associated with

the review of the offering by FINRA; (c) all fees and expenses relating to the listing of such shares of common stock on The

Nasdaq Capital Market and such other stock exchanges as we and the representative together determine; (d) all fees, expenses

and disbursements relating to background checks of our officers and directors in an amount not to exceed $15,000 in the

aggregate; (e) all fees, expenses and disbursements relating to the registration or qualification of the common stock under

the “blue sky” securities laws of such states and other jurisdictions as the representative may reasonably

designate; (f) all fees, expenses and disbursements relating to the registration, qualification or exemption of the common

stock under the securities laws of such foreign jurisdictions as the representative may reasonably designate; (g) the costs

of all mailing and printing of the underwriting documents (including, without limitation, the underwriting agreement, any

blue sky surveys and, if appropriate, any agreement among underwriters, selected dealers’ agreement,

underwriters’ questionnaire and power of attorney), registration statements, prospectuses and all amendments,

supplements and exhibits thereto and as many preliminary and final prospectuses as the representative may reasonably deem

necessary; (h) the costs and expenses of a public relations firm; (i) the costs of preparing, printing and delivering

certificates representing the common stock; (j) fees and expenses of the transfer agent for the shares of common stock; (k)

stock transfer and/or stamp taxes, if any, payable upon the transfer of securities from us to the underwriters; (l) the costs

associated with post-closing advertising the offering in the national editions of the Wall Street Journal and New York Times;

(m) the costs associated with bound volumes of the public offering materials as well as commemorative mementos and lucite

tombstones, each of which us or our designee shall provide within a reasonable time after the closing date in such quantities

as the representative may reasonably request, in an amount not to exceed $3,000; (n) the fees and expenses of our

accountants; (o) the fees and expenses of our legal counsel and other agents and representatives; (p) fees and expenses of

the representative’s legal counsel not to exceed $100,000; and (q) the $29,500 cost associated with the

underwriters’ use of Ipreo’s book-building, prospectus tracking and compliance software for the offering.

Our total estimated expenses of the offering,

including registration, filing and listing fees, printing fees and legal and accounting expenses, but excluding underwriting discounts

and commissions, are approximately $ .

Over-allotment Option

We have granted a 45-day option to the

representative of the underwriters to purchase up to additional

shares of common stock (equal to 15% of the common stock sold in this offering) from us solely to cover over-allotments, if any,

at the public offering price less underwriting discounts and commissions.

Representative’s Warrants

Upon closing of this offering, we have

agreed to issue to the representative as compensation warrants to purchase a number of shares of common stock equal to 3% of the

aggregate number of shares of common stock sold in this offering, or the Representative’s Warrants. The Representative’s

Warrants will be exercisable at a per share exercise price equal to 125% of the public offering price per share in this offering.

The Representative’s Warrants are exercisable at any time and from time to time, in whole or in part, during the four and

one half year period commencing 180 days from the effective date of the registration statement of which this prospectus is a part.

The Representative’s Warrants have

been deemed compensation by FINRA and are therefore subject to a 180-day lock-up pursuant to Rule 5110(e)(1) of FINRA. The representative

(or permitted assignees under Rule 5110(e)(2)) will not sell, transfer, assign, pledge, or hypothecate these warrants or the securities

underlying these warrants, nor will they engage in any hedging, short sale, derivative, put, or call transaction that would result

in the effective economic disposition of the warrants or the underlying securities for a period of 180 days from the effective

date of the registration statement. In addition, the warrants provide for registration rights upon request, in certain cases. The

one-time demand registration right provided will not be greater than five years from the effective date of the registration statement

in compliance with FINRA Rule 5110(g)(8)(A). The unlimited piggyback registration right provided will not be greater than seven

years from the effective date of the registration statement in compliance with FINRA Rule 5110(g)(8)(D). We will bear all fees

and expenses attendant to registering the securities issuable on exercise of the warrants other than underwriting commissions incurred

and payable by the holders. The exercise price and number of shares issuable upon exercise of the warrants may be adjusted in certain