Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

April 23 2015 - 9:28AM

Edgar (US Regulatory)

| Prospectus Supplement No. 1 |

|

Filed Pursuant to Rule 424(b)(3) |

| Dated April 23, 2015 |

|

Registration

No. 333-195783 |

| (to Prospectus dated April 6, 2015) |

|

|

Ekso

Bionics Holdings, INC.

67,134,768 Shares

Common Stock

This prospectus supplement no. 1 (the “Supplement”)

supplements information contained in the prospectus dated April 6, 2015 (the “Prospectus”), relating to the resale

by selling stockholders of Ekso Bionics Holdings, Inc., a Nevada corporation, of up to 67,134,768 shares of our common stock, par

value $0.001 per share. Of the shares being offered, 53,992,968 are presently issued and outstanding and 13,141,800

are issuable upon exercise of common stock purchase warrants. The shares offered by the Prospectus may be sold by the selling stockholders

from time to time in the open market, through privately negotiated transactions or a combination of these methods, at market prices

prevailing at the time of sale or at negotiated prices.

This Supplement modifies, supersedes and

supplements information contained in the Prospectus with respect to certain selling stockholders. This Supplement is incorporated

by reference into, and should be read in conjunction with, the Prospectus. This Supplement is not complete without, and may not

be delivered or utilized except in connection with, the Prospectus, including any amendments or supplements thereto.

Any statement contained in the Prospectus shall be deemed to be modified or superseded to the

extent that information in this Prospectus Supplement modifies or supersedes such statement. Any statement that is modified or

superseded shall not be deemed to constitute a part of the Prospectus except as modified or superseded by this Prospectus Supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this Supplement is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is

April 23, 2015

SELLING STOCKHOLDERS

The Company has been notified that the securities issued to

selling stockholder The Wiesenberg Family Revocable have been transferred to James H. Wiesenberg TTEE U/A Dtd. 12/27/2006 by Wiesenberg

Admin Trust. Accordingly, the “Selling Stockholders” table is being amended with respect to the shares previously registered

to The Wiesenberg Family Revocable Trust as follows:

| Selling Stockholder | |

Shares of

common stock

Beneficially

owned Prior to

the Offering | | |

Shares of

common

stock owned

Prior to this

Offering and

Registered

hereby | | |

Shares

Issuable Upon

Exercise of

Warrants

owned Prior to

this Offering

and Registered

hereby1 | | |

Shares of

common

stock

Beneficially

Owned Upon

Completion

of the

Offering2 | | |

Percentage of

Common

Stock

Beneficially

Owned Upon

Completion

of the

Offering3 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| James H. Wiesenberg TTEE U/A Dtd. 12/27/2006 by Wiesenberg Admin Trust116 | |

| 25,000 | | |

| 25,000 | | |

| 0 | | |

| 0 | | |

| 0 | |

| 1 | An aggregate of 13,141,800 of the shares of common stock being offered by the selling security holders are issuable upon exercise

of common stock purchase warrants. |

| 2 | Assumes all of the shares of common stock to be registered on the registration statement of which this prospectus is a part,

including all shares of common stock underlying common stock purchase warrants held by the selling stockholders, are sold in the

offering and that shares of common stock beneficially owned by such selling stockholder but not being registered by this prospectus

(if any) are not sold. |

| 3 | Percentages are based on 101,867,766 shares of common stock issued and outstanding as of the Determination

Date. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power

with respect to securities. Shares of common stock underlying shares of preferred stock, options or warrants currently exercisable

or convertible, or exercisable or convertible within 60 days after the Determination Date are deemed outstanding for computing

the percentage of the person holding such shares of preferred stock, options or warrants but are not deemed outstanding for computing

the percentage of any other person. |

| 116 | James H. Wiesenberg is the trustee of the Wiesenberg Admin Trust U/A Dtd. 12/27/2006 and has sole

voting and investment power over the shares held thereby. |

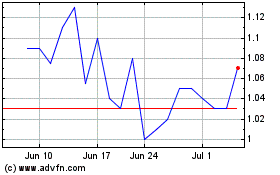

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Apr 2023 to Apr 2024