0001101680false00011016802024-02-162024-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 16, 2024

DZS INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 000-32743 | 22-3509099 |

(State or Other Jurisdiction of Incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

5700 Tennyson Parkway, Suite 400

Plano, TX 75024

(Address of Principal Executive Offices, Including Zip Code)

(469) 327-1531

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | DZSI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 16, 2024, the Board of Directors (the “Board”) of DZS Inc. (the “Company”), based on the recommendation of the Corporate Governance and Nominating Committee of the Board, appointed each of Todd Jackson and Paul Choi to the Board, filling vacancies created by (i) an expansion of the size of the Board and (ii) the resignation of Mr. Minwoo Nam on September 15, 2023. Neither Mr. Jackson nor Mr. Choi is expected to serve on a committee of the Board as of the time of this Current Report on Form 8-K.

Mr. Jackson and Mr. Choi have been appointed to the Board pursuant to nomination rights granted under the previously disclosed (i) Loan Agreement (the “Loan Agreement”), dated December 29, 2023, by and between the Company and EdgeCo, LLC, a Wyoming limited liability company (“EdgeCo”), and (ii) Securities Purchase Agreement (the “Securities Purchase Agreement”), dated December 29, 2023, by and between the Company and IV Global Fund No. 4, a Korean limited partnership (“Global Fund”), respectively. The information regarding the Loan Agreement and Securities Purchase Agreement, and the transactions contemplated thereby, set forth in Item 1.01 of the Company’s Form 8-K filed with the Securities and Exchange Commission on January 5, 2024 is incorporated by reference herein.

Mr. Jackson was nominated to the Board by EdgeCo pursuant to the Loan Agreement and was appointed as a Class I director, which class serves until the Company’s annual meeting of stockholders to be held in 2026. Mr. Jackson has worked in private practice as a business, tax and real estate attorney for over 30 years and brings to the Board deep expertise in M&A advisory and transaction experience, including deal-making and structuring. His total closed transaction volume among M&A deals, commercial real estate transactions and private equity raises exceeds $30 billion. Mr. Jackson holds Bachelor of Science degrees in Economics and Business Management from the University of North Carolina – Greensboro, and a JD and MBA from Wake Forest University.

Mr. Choi was nominated to the Board by Global Fund pursuant to the Securities Purchase Agreement and was appointed as a Class III director, which class serves until the Company’s annual meeting of stockholders to be held in 2025. Mr. Choi brings to the Board an extensive and valuable background in M&A and investment banking. He is currently Chief Executive Officer of Invites Ventures and a director at Newlake Alliance Management. Mr. Choi holds a Bachelor of Business Administration degree from Korea University.

Item 7.01 Regulation FD Disclosure.

On February 20, 2024, the Company issued a press release regarding the foregoing director appointments and other matters. A copy of that press release is attached as Exhibit 99.1 hereto and incorporated by reference herein.

The information set forth in this Item 7.01, including the attached exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filings under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: February 20, 2024 | DZS Inc. |

| | | |

| By: | /s/ Misty Kawecki |

| | Misty Kawecki |

| | Chief Financial Officer |

Exhibit 99.1

DZS Announces Two New Board of Director Members

DALLAS, Texas, USA, Feb. 20, 2024 – DZS (Nasdaq: DZSI), a global leader of access, optical and AI-driven cloud software solutions, today announced that Todd Jackson and Paul Choi have been appointed to the company’s Board of Directors. Jackson and Choi join the DZS Board following three strategic transactions: securing $25 million of working capital through two transactions, a private placement of DZS common stock and a term loan; the planned divestiture of the company’s lower margin Asia business, which, upon closing, will eliminate $43 million of debt; and an additional $5 million of working capital. The sale of the Asia business is expected to close in the first quarter of 2024.

Jackson is an accomplished attorney who brings to the DZS Board 30 years of M&A advisory and transaction experience with over $30 billion in transactions closed. Choi is the Chief Executive Officer of Invites Ventures, the purchaser in the company’s recent private placement, and brings to the Board a valuable background in M&A and investment banking.

“Todd and Paul join our Board of Directors at an important time as we focus on our strategic growth pillars spanning the Americas and Europe, Middle East, Africa (AEMEA) and Australia/New Zealand (ANZ) regions,” said Charlie Vogt, President and CEO, DZS. “There are many positive workstreams underway. Our Audit Committee is in the final phase of selecting a new independent registered public accounting firm and, together with our finance team, is laser focused on completing the restatement of the financial statements for the year-end 2022, each quarter of 2022 and the first quarter of 2023, as well as filing the outstanding reporting periods in 2023. DZS is focused on closing the divestiture of our Asia business unit and executing our growth playbook. We believe that recent investments provide validation and confidence in management’s vision and strategy to capitalize on the opportunity in front of us. We expect 2024 to be a pivotal year for DZS as we optimize our cost structure and inventory levels and successfully complete the numerous optical, fiber to the premises and cloud software trials we currently have underway.”

DZS Network Edge innovation continues to position the company to expand its customer base and capture market share. The on-going fiber optic/5G upgrade cycle and a shift to AI-driven software defined networks, combined with broadband stimulus and security risk mitigation initiatives in the AEMEA and ANZ markets, have created substantial opportunities across DZS’s target markets. With differentiated platforms and solutions across the Access, Optical, Cloud and Subscriber Edge, DZS is well positioned to provide forward-looking service providers the solutions they need to win in an increasingly hyper-competitive marketplace.

Access Edge Innovation

The DZS Velocity portfolio of optical line terminals (OLTs) are architected to meet the characteristics, capacity, performance and agility required for today’s Access Edge while providing industry-leading performance. Led by the award-winning DZS Velocity V6, this broad portfolio is the industry’s leading environmentally hardened, multi-gigabit, fiber access platform with market-leading capacity and performance capabilities that support in-place upgrades to 50 Gigabit Passive Optical Networking (50G PON) and beyond. In addition, the DZS Velocity portfolio is ideally suited for government stimulus initiatives around the globe, including being Buy America, Build America (BABA) ready for the $40-plus billion U.S. funded Broadband Equity Access and Deployment (BEAD) program. Orange, Europe’s leading provider of Fiber-to-the-anywhere (FTTX) networks, recently selected the Velocity portfolio for deployment as have other major unannounced providers across Europe and North America.

Optical Edge Innovation

The DZS Saber 4400 platform is designed to close the bandwidth gap and change the economics for service providers at the emerging Optical Edge. The Saber platform provides a groundbreaking, cost-effective way to deploy coherent optics in remote and rural locations via environmentally hardened solutions that deliver long reach, low latency services and revenue-generating capabilities for both residential and enterprise networks, including applications such as data center interconnect, Dense Wave Division Multiplexing (DWDM) transport of N x 100 gigabit Ethernet clients, multi-degree Reconfigurable Optical Add-Drop Multiplexing (ROADM) rings and 5G mobile xHaul. Newly released ROADM modules have positioned the DZS Saber 4400 as a recognized industry leading platform for compact, modular, hardened deployment of next-generation, edge-to-edge optical transport up to 400 Gigabits-per-second (Gbps) per wavelength and beyond.

Cloud Edge Innovation

The AI-driven DZS Cloud Edge portfolio enables service providers to deliver the ultimate subscriber experience by leveraging the latest in AI and Machine Learning capabilities through network and data insights and the ability to offer network optimization in real-time. DZS CloudCheck and Expresse are award-winning platforms that power service providers to manage more than 50 million subscribers around the world with best-in-class, end-to-end visibility into their networks. DZS Xtreme is a disruptive solution for creating service provider agility by empowering them to dramatically launch new services faster and improve experience management, network and service assurance and orchestration/automation.

Subscriber Edge Innovation

DZS Subscriber Edge solutions include the DZS Helix portfolio of residential and business Optical Networking Terminals (ONTs), access points and WiFi-enabled gateways as well as support for more than 100 CloudCheck-integrated devices for comprehensive WiFi experience management. This extensive portfolio delivers world-class performance and WiFi experience management and proven interoperability with a wide range of third-party OLT equipment. The company’s Subscriber Edge and Access solutions have been recognized for their ability to significantly enhance and improve the end-user experience.

To learn more about DZS, visit https://www.dzsi.com.

About DZS

DZS Inc. (Nasdaq: DZSI) is a global leader of access, optical and AI-driven cloud software solutions.

DZS, the DZS logo, and all DZS product names are trademarks of DZS Inc. Other brand and product names are trademarks of their respective holders. Specifications, products, and/or product names are all subject to change.

This press release contains forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Private Securities Litigation Reform Act of 1995. These statements reflect the beliefs and assumptions of the Company’s management as of the date hereof. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “target,” “will,” “would,” variations of such words, and similar expressions are intended to identify forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict. The Company’s actual results could differ materially and adversely from those expressed in or contemplated by the forward-looking statements. Factors that could cause actual results to differ include, but are not limited to, those risk factors contained in the Company’s SEC filings available at www.sec.gov, including without limitation, the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q and subsequent filings. In addition, additional or unforeseen affects from the COVID-19 pandemic and the global economic climate may give rise to or amplify many of these risks. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date on which they are made. DZS undertakes no obligation to update or revise any forward-looking statements for any reason.

For further information see: www.DZSi.com.

DZS on Twitter: https://twitter.com/dzs_innovation

DZS on LinkedIn: https://www.linkedin.com/company/DZSi/

Press Inquiries:

Kenny Vesey, Thatcher+Co.

Phone: +1 973.518.3644

Email: kvesey@thatcherandco.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

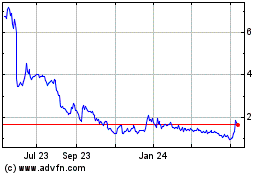

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

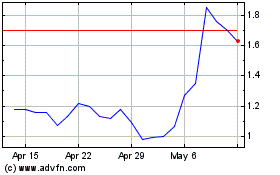

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Apr 2023 to Apr 2024