Current Report Filing (8-k)

June 26 2020 - 7:46AM

Edgar (US Regulatory)

0000034067FALSE00000340672020-06-252020-06-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): June 26, 2020 (June 25, 2020)

DMC Global Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

0-8328

|

|

84-0608431

|

(State or Other Jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021

(Address of Principal Executive Offices, Including Zip Code)

(303) 665-5700

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of exchange on which registered

|

|

Common Stock, $0.05 Par Value

|

|

BOOM

|

|

The Nasdaq Global Select Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement

On June 25, 2020, DMC Global Inc. (the “Company”) entered into an amendment ("Amendment") to its syndicated credit agreement (“credit facility”) with KeyBank, N.A., as administrative agent, and our lenders.

The Amendment waives the debt service coverage ratio covenant for the quarters ending September 30, 2020, December 31, 2020, and March 31, 2021. The debt service coverage ratio minimum of 1.35 to 1 will be applicable for the quarter ending June 30, 2020 and will resume beginning with the quarter ending June 30, 2021 and thereafter. The debt service coverage ratio is defined in the credit facility as the ratio of Consolidated Pro Forma EBITDA less the sum of capital distributions paid in cash, cash income taxes and Consolidated Unfunded Capital Expenditures (as defined in the credit facility) to Debt Service Charges (as defined in the credit facility).

Additionally, the Amendment adds a Minimum Liquidity covenant requiring the total of cash and cash equivalents held by U.S. subsidiaries and available borrowing capacity under the credit facility to exceed $10 million for the quarters ending September 30, 2020, December 31, 2020, and March 31, 2021. The Minimum Liquidity covenant is not required after the quarter ending March 31, 2021.

During the period from the Second Amendment Effective Date through August 31, 2020, borrowings outstanding under the credit facility will bear interest at a Fixed Rate (as defined in the credit facility) plus a margin of 1.75% or at a Base Rate (as defined in the credit facility) plus a margin of 0.75%. For the period from September 1, 2020 through the date of receipt of the covenant compliance certificate for the quarter ending March 31, 2021, borrowings outstanding under the credit facility will bear interest at a Fixed Rate plus a margin of 1.75% to 3.00% or at a Base Rate plus a margin of 0.75% to 2.00%. In each case, the margin is based on the Company's Leverage Ratio of Consolidated Funded Indebtedness (as defined in the credit facility) on the last day of such period to Consolidated Pro Forma EBITDA for such period. Additionally, the Amendment sets the minimum Fixed Rate at 0.75%.

The Amendment also made certain adjustments to the credit facility’s restricted payment provisions, including a restriction on the Company’s ability to make capital distributions through the reporting period for the quarter ending March 31, 2021, among other changes.

The foregoing description of the Amendment is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by reference to the Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On June 26, 2020, the Company issued a press release announcing the entry into the Credit Agreement Amendment further described in Item 1.01 above. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information provided in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference in any filings under the Securities Act of 1933, as amended, unless specifically stated so therein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

10.1

|

|

|

|

|

|

|

|

99.1

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

1 Certain confidential information contained in this agreement has been omitted because it (i) is not material and (ii) would be competitively harmful if publicly disclosed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DMC Global Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

June 26, 2020

|

By:

|

/s/ Michael Kuta

|

|

|

|

|

Michael Kuta

|

|

|

|

|

Chief Financial Officer

|

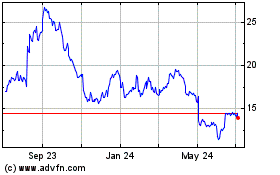

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Apr 2024 to May 2024

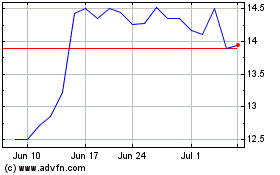

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From May 2023 to May 2024