false

0001880613

0001880613

2023-11-27

2023-11-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 27, 2023

Direct Digital Holdings, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41261 |

|

87-2306185 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1177 West Loop South, Suite 1310

Houston, Texas |

|

77027 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (832) 402-1051

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A common stock, par value $0.001 per share |

|

DRCT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (the “Exchange Act”) (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On November 27, 2023, Direct Digital Holdings,

Inc. (the “Company”) entered into that certain Second Amendment (the “Amendment”) to the Credit

Agreement, dated July 7, 2023 (the “Existing Credit Agreement”), by and among East West Bank (“EWB”),

as lender, and Direct Digital Holdings, LLC, the Company, Huddled Masses LLC, Colossus Media, LLC and Orange142, LLC, as borrowers (collectively,

“Borrowers”). Under the terms of the Amendment, pursuant to Section 2.07 of the Existing Credit Agreement, Borrowers

have requested and EWB has agreed to increase the aggregate size of the revolving facility from $5,000,000 to $10,000,000. Accordingly,

the new commitment under the Existing Credit Agreement means that EWB is obligated to make available revolving credit advances in an aggregate

principal amount up to but not exceeding $10,000,000.

The

foregoing description of the Amendment is not complete and is qualified in its entirety by the full text of the Amendment, a copy of which

is filed herewith as Exhibit 10.1 and incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

EXHIBIT INDEX

| Exhibit No. | | |

Description |

| 10.1 | | |

Second Amendment to Credit Agreement, dated November 27, 2023, by and among Direct Digital Holdings, Inc., Direct Digital Holdings, LLC, Colossus Media, LLC, Huddled Masses LLC, and Orange142, LLC, as borrowers, and East West Bank, as lender. |

| 104 | | |

Cover Page Interactive Data File, formatted in Inline Extensible Business Reporting Language (iXBRL). |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

November 30, 2023

(Date) |

Direct Digital Holdings, Inc.

(Registrant) |

| |

|

| |

/s/ Mark Walker |

| |

Mark Walker

Chief Executive Officer |

Exhibit 10.1

Second

AMENDMENT TO CREDIT AGREEMENT

This

Second Amendment to Credit Agreement (“Amendment”), dated as of November 27, 2023 (the “Effective

Date”), is entered into by and among Direct Digital Holdings, Inc., a Delaware corporation (“DDH

Holdings”), Direct Digital Holdings, LLC, a Texas limited liability company (“Direct Digital”),

Colossus Media, LLC, a Delaware limited liability company (“Colossus”), Huddled Masses LLC, a Delaware limited

liability company (“HM”), Orange142, LLC, a Delaware limited liability company (“Orange”

and together with DDH Holdings, Direct Digital, Colossus and HM, “Borrowers” and each individually a “Borrower”),

and East West Bank, a California state bank (“Lender”).

RECITALS:

WHEREAS,

Borrowers and Lender entered into that certain Credit Agreement dated as of July 7, 2023 (as amended, supplemented, or otherwise

modified up to the date hereof, the “Existing Credit Agreement”; the Credit Agreement as may be further amended,

supplemented or otherwise modified from time to time, including by this Amendment, the “Credit Agreement”);

WHEREAS,

Pursuant to Section 2.07 of the Existing Credit Agreement, Borrowers have requested an increase to the aggregate Commitment

such that the aggregate Commitment after giving effect to such increase is $10,000,000; and

WHEREAS,

Lender is willing to increase the aggregate Commitment and amend the Credit Agreement under the terms and conditions set forth herein;

NOW,

THEREFORE, in consideration of the premises and for other good and valuable consideration, the receipt and sufficiency of

which are hereby acknowledged, Borrowers and Lender hereby agree as follows:

1. Same

Terms. The terms used in this Amendment shall have the same meanings as provided therefor in the Credit Agreement, unless the context

hereof otherwise requires or provides.

2. Amendments

to Existing Credit Agreement. On and after the Effective Date, the Credit Agreement shall be amended as follows:

(a) Section 1.01

of the Credit Agreement is hereby amended to delete the definition of “Commitment” in its entirety and replace

such definition with the following:

“Commitment”

means the obligation of Lender to make Revolving Credit Advances pursuant to Section 2.01 in an aggregate principal

amount up to but not exceeding Ten Million Dollars ($10,000,000), subject to termination pursuant to Section 10.02.

3. Ratification.

Except as expressly provided herein, each Borrower hereby (a) ratifies the Obligations and each of the Loan Documents to which it

is a party, and agrees and acknowledges that the Credit Agreement and each of the other Loan Documents to which it is a party shall continue

in full force and effect after giving effect to this Amendment; (b) ratifies and confirms that the security instruments executed

by each Borrower, as amended hereby, are not released, diminished, impaired, reduced, or otherwise adversely affected by the Credit Agreement

and continue to secure the full payment and performance of the Obligations pursuant to their terms; (c) acknowledges the continuing

existence and priority of the Liens granted, conveyed, and assigned to Lender, under the security instruments; and (d) agrees that

the Obligations include, without limitation, the Obligations (as amended by this Amendment). Except as expressly provided herein, nothing

in this Amendment extinguishes, novates or releases any right, claim, Lien, security interest or entitlement of Lender created by or

contained in any of such documents nor is any Borrower released from any covenant, warranty or obligation created by or contained therein.

4. Representations

and Warranties. Each Borrower hereby represents and warrants to Lender that (a) this Amendment has been duly authorized, executed,

and delivered by each Borrower; (b) no action of, or filing with, any Governmental Authority is required to authorize, or is otherwise

required in connection with, the execution, delivery, and performance by each Borrower of this Amendment; (c) the Loan Documents,

as amended by this Amendment, are valid and binding upon each Borrower and are enforceable against each such Borrower, in accordance

with their respective terms, except as limited by bankruptcy, insolvency, or other laws of general application relating to the enforcement

of creditors’ rights; (d) the execution, delivery, and performance by each Borrower of this Amendment does not require the

consent of any other Person and do not and will not constitute a violation of any laws, agreements, or understandings to which each such

Borrower is a party or by which each such Borrower is bound; (e) all representations and warranties in the Loan Documents are true

and correct in all material respects except (i) to the extent that such representations and warranties specifically refer to an

earlier date, in which case they shall be true and correct in all material respects as of such earlier date or (ii) the facts on

which any of them were based have been changed by transactions contemplated or permitted by the Credit Agreement; and (f) no Event

of Default exists.

5. Other

Agreements. Each Borrower (a) agrees to perform such acts and duly authorize, execute, acknowledge, deliver, file, and record

such additional pledges, and other agreements, documents, instruments, and certificates as Lender may reasonably deem necessary or appropriate

in order to preserve and protect the Collateral granted by such Borrower pursuant to the security instruments executed by such Borrower;

and (b) represents and warrants to Lender that such liability and obligation may reasonably be expected to directly or indirectly

benefit each Borrower.

6. Conditions

to Effectiveness. The transactions contemplated by this Amendment shall be deemed to be effective as of the Effective Date, when

the following have been satisfied in a manner satisfactory to Lender:

(a) all

representations and warranties set forth in this Amendment are true and correct in all material respects as set forth in Section 4

above;

(b) Lender

receives a fully executed copy of this Amendment;

(c) Lender

receives a fully executed amended and restated Revolving Credit Note executed by Borrowers and payable to Lender in the amount of such

Commitment (as amended hereby);

(d) Lender

receives a Certificate certified by a Responsible Officer from Borrowers, in form and substance acceptable to Lender, attaching resolutions

from the appropriate governing body of Borrowers which authorize the execution, delivery and performance of this Amendment and the transactions

contemplated hereby, and such other items and documents as Lender shall reasonably request;

(e) Lender

receives (i) payment of the reasonable and documented out-of-pocket fees and expenses of Lender’s counsel incurred in connection

with this Amendment in immediately available funds to the extent invoiced on or prior to the date hereof and (ii) a non-refundable

Commitment Fee in the amount of $50,000;

(f) Lender

receives the Term Loan Lender’s written (including pursuant to electronic signature) consent to this Amendment and the modifications

contemplated herein, pursuant to the terms of the Intercreditor Agreement;

(g) the

representations and warranties set forth in the Loan Documents are true and correct in all material respects (without duplication of

any materiality standards set forth therein), except to the extent that such representations and warranties specifically refer to an

earlier date, in which case they shall be true and correct in all material respects as of such earlier date or the facts on which any

of them were based have been changed by transactions contemplated or permitted by the Credit Agreement; and

(h) after

giving effect to this Amendment, no Default or Event of Default exists under the Credit Agreement.

7. Counterparts.

For the convenience of the parties, this Amendment may be executed in multiple counterparts, each of which for all purposes shall be

deemed to be an original, and all such counterparts shall together constitute but one and the same agreement. Delivery of an executed

counterpart of a signature page of this Amendment by telecopy, e-mail, facsimile transmission, electronic mail in “portable

document format” (“.pdf”) form or other electronic means intended to preserve the original graphic

and pictorial appearance of the item being sent shall be effective as a delivery of a manually executed counterpart of this Amendment.

8. References

to the Credit Agreement. Upon the effectiveness of this Amendment, (a) each reference in the Credit Agreement to “this

Agreement”, “hereunder”, “hereof”, “herein”, or words of like import

shall mean and be a reference to the Existing Credit Agreement as amended hereby, and (b) each reference to the Credit Agreement

in any other document, instrument or agreement executed and/or delivered in connection with the Credit Agreement shall mean and be a

reference to the Existing Credit Agreement as amended hereby.

9. Effect.

This Amendment is one of the Loan Documents. The modifications set forth herein are limited precisely as written and shall not be deemed

(a) to be a consent under or a waiver of or an amendment to any other term or condition in the Credit Agreement, or (b) to

prejudice any right or rights which the Lender now has or may have in the future under or in connection with the Credit Agreement, as

amended hereby, or any of the other documents referred to herein or therein.

10. ENTIRE

AGREEMENT; GOVERNING LAW. THIS AMENDMENT CONSTITUTES THE ENTIRE AGREEMENT BETWEEN THE PARTIES HERETO WITH RESPECT TO THE SUBJECT

HEREOF. FURTHERMORE, IN THIS REGARD, THIS AMENDMENT AND THE OTHER WRITTEN LOAN DOCUMENTS REPRESENT, COLLECTIVELY, THE FINAL AGREEMENT

AMONG THE PARTIES THERETO AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF SUCH

PARTIES.

THERE ARE NO UNWRITTEN ORAL

AGREEMENTS AMONG SUCH PARTIES.

This

AMENDMENT AND ANY CONTROVERSY, DISPUTE, CLAIM OR CAUSE OF ACTION ARISING OUT OF OR RELATING TO THIS AMENDMENT, ANY BREACH HEREOF, OR

the transactions contemplated hereby, shall be governed by and construed in accordance with the laws of the State of Texas; provided

that Lender shall retain all rights under federal law.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN

WITNESS WHEREOF, this Amendment is deemed executed effective as of the date first above written.

| | BORROWERS: |

| | |

| | DIRECT DIGITAL HOLDINGS, INC. |

| | | |

| By: | /s/

Keith W. Smith

|

| | | Name: Keith W. Smith |

| | | Title: President |

| | DIRECT DIGITAL HOLDINGS, LLC |

| | |

| By: | /s/ Keith W. Smith |

| | | Name: Keith W. Smith |

| | | Title: President |

| | COLOSSUS MEDIA, LLC |

| | |

| By: | /s/ Keith W. Smith |

| | | Name: Keith W. Smith |

| | | Title: President |

| | HUDDLED MASSES LLC |

| | |

| By: | /s/ Keith W. Smith |

| | | Name: Keith W. Smith |

| | | Title: President |

| | ORANGE142, LLC |

| | |

| By: | /s/ Keith W. Smith |

| | | Name: Keith W. Smith |

| | | Title: President |

Signature Page to

Second Amendment to Credit Agreement

| | EAST

WEST BANK, |

| | a California state bank |

| | | |

| | | |

| By: | /s/ Hamilton LaRoe |

| | | Name: Hamilton LaRoe |

| | | Title: First Vice President |

Signature Page to

Second Amendment to Credit Agreement

v3.23.3

Cover

|

Nov. 27, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 27, 2023

|

| Entity File Number |

001-41261

|

| Entity Registrant Name |

Direct Digital Holdings, Inc.

|

| Entity Central Index Key |

0001880613

|

| Entity Tax Identification Number |

87-2306185

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1177 West Loop South

|

| Entity Address, Address Line Two |

Suite 1310

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77027

|

| City Area Code |

832

|

| Local Phone Number |

402-1051

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, par value $0.001 per share

|

| Trading Symbol |

DRCT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

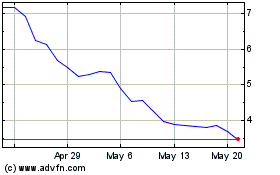

Direct Digital (NASDAQ:DRCT)

Historical Stock Chart

From Apr 2024 to May 2024

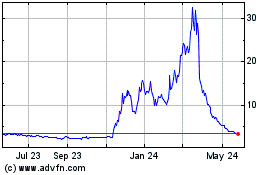

Direct Digital (NASDAQ:DRCT)

Historical Stock Chart

From May 2023 to May 2024