0001880613

false

0001880613

2023-09-29

2023-09-29

0001880613

DRCT:ClassAcommonstockparvaluedollarpershareMember

2023-09-29

2023-09-29

0001880613

DRCT:WarrantstopurchaseClassAcommonstockMember

2023-09-29

2023-09-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 29, 2023

Direct Digital Holdings, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41261 |

|

87-2306185 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1177 West Loop South, Suite 1310

Houston, Texas |

|

77027 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (832) 402-1051

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A common stock, par value $0.001 per share |

|

DRCT |

|

The Nasdaq Stock Market LLC |

| Warrants to purchase Class A common stock |

|

DRCTW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (the “Exchange Act”) (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 8.01 Other Events.

On September 29, 2023, Direct Digital Holdings, Inc. (the “Company”)

issued a press release announcing the the expiration of its previously commenced offer to each holder

of its outstanding public warrants (the “Warrants”) to purchase shares of its Class A common stock, par value $0.001

per share, the opportunity to receive $1.20 in cash, without interest, for each outstanding Warrant tendered by the holder pursuant to

the offer (the “Tender Offer”), and (ii) the solicitation of consents (the “Consent Solicitation”)

from holders of the outstanding Warrants to amend that certain Warrant Agent Agreement, dated as of February 15, 2022, by and between

the Company and Equiniti Trust Company, LLC (formerly American Stock Transfer & Trust Company, LLC) which governs all of the Warrants

(the “Warrant Amendment”).

The Tender Offer and Consent Solicitation expired at one minute after

11:59 PM, Eastern Time on September 28, 2023, in accordance with its terms. Equiniti Trust Company, LLC, the Depositary for the Tender

Offer, has indicated that 2,229,263 Warrants, including 36,242 Warrants through guaranteed delivery, had been validly tendered and not

validly withdrawn prior to the expiration of the Tender Offer, representing approximately 69.3% of the outstanding Warrants. The

Company expects to accept all validly tendered Warrants for purchase and settlement on or before Wednesday, October 4, 2023 (the “Settlement”). Pursuant

to the terms of the Offer, the Company expects to pay an aggregate of approximately $2.7 million in cash to purchase the validly tendered

Warrants.

In addition, pursuant to the

Consent Solicitation, the Company received the approval of approximately 68.2% of the outstanding Warrants (not including the Warrants

through guaranteed delivery), which exceeds the 50.1% of the Warrants required to effect the Warrant Amendment with respect to the Warrants.

The Company expects to execute the Warrant Amendment concurrently with the Settlement.

The Tender Offer and Consent

Solicitation are made solely upon the terms and conditions in an Offer to Purchase and Consent Solicitation and other related offering

materials that have been distributed to holders of the Warrants. A copy of the press release is filed as Exhibit 99.1 hereto and is incorporated

herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

September 29, 2023

(Date) |

Direct Digital Holdings, Inc.

(Registrant) |

| |

|

| |

/s/ Diana Diaz |

| |

Diana Diaz |

| |

Interim Chief Financial Officer |

Exhibit 99.1

Direct Digital Holdings Announces Expiration

and Results of the Offer to Purchase and Consent Solicitation Relating to its Warrants

Houston, September 29, 2023 -- Direct Digital

Holdings, Inc. (Nasdaq: DRCT) ("Direct Digital Holdings" or the "Company"), a leading advertising and marketing technology

platform operating through its companies Colossus Media, LLC ("Colossus SSP"), Huddled Masses LLC ("Huddled Masses")

and Orange142, LLC ("Orange142"), today announced that the Company’s offer to purchase (the “Offer”) all of

its outstanding publicly traded warrants (the “Warrants”) to purchase shares of its Class A common stock, par value $0.001

per share, at a purchase price of $1.20 in cash, without interest, expired one minute after 11:59 p.m., Eastern Time, on September 28,

2023.

According to information provided by Equiniti

Trust Company, LLC, the Depositary for the Offer, 2,229,263 Warrants, including 36,242 Warrants through guaranteed delivery, representing

approximately 69.3% of the outstanding Warrants, were validly tendered and not withdrawn prior to the expiration of the Offer. The tender

of 2,229,263 Warrants satisfies the Minimum Tender Condition (as defined in the Offer to Purchase) for the Offer. Pursuant to the terms

of the Offer and assuming the Warrants through guaranteed delivery are properly submitted before the end of the guaranteed delivery period

on October 2, 2023, the Company expects to pay an aggregate of $2.7 million in cash in exchange for such Warrants. Such payment will be

made promptly. Holders of Warrants that were validly tendered and not validly withdrawn prior to the expiration of the Offer and Consent

Solicitation, and upon the successful completion of any guaranteed delivery, will receive $1.20 per share for each Warrant tendered by

the holder and exchanged pursuant to the Offer. The Company expects to accept all validly tendered Warrants for exchange and settlement

on or before October 4, 2023 (the “Settlement”).

Direct Digital Holdings also solicited consents

(the “Consent Solicitation”) to amend the Warrant Agent Agreement, dated as of February 15, 2022 (the “Warrant Agreement”),

by and between Direct Digital Holdings and Equiniti Trust Company, LLC (formerly American Stock Transfer & Trust Company, LLC (the

“Transfer Agent”), which governs all of the Warrants, to permit Direct Digital Holdings to redeem each outstanding Warrant

for $0.35 in cash, without interest, which is approximately 71% less than the price applicable to the Offer (such amendment, the “Warrant

Amendment”). Pursuant to the terms of the Warrant Agreement, the adoption of the Warrant Amendment will require the consent of holders

of at least 50.1% of the outstanding Warrants. In order to tender the Warrants in the Offer and receive $1.20 in cash for each of their

Warrants, holders of the Warrants are required to consent to the Warrant Amendment. The 2,193,021 Warrants that were validly tendered

and not withdrawn prior to the expiration of the Offer (excluding those Warrants being delivered through guaranteed delivery) exceeds

the 50.1 % required to effect the Warrant Amendment. The Company expects to execute the Warrant Amendment concurrently with the Settlement.

The Offer and Consent Solicitation are being made

pursuant to a Second Amended and Restated Offer to Purchase dated September 21, 2023, and Schedule TO, originally filed on August 29,

2023, as amended and supplemented, each of which has been filed with the SEC and more fully set forth the terms and conditions of the

Offer and Consent Solicitation.

The Company’s Class A common stock and

Warrants are listed on The Nasdaq Stock Market LLC under the symbols “DRCT” and “DRCTW,” respectively.

Stifel, Nicolaus & Company, Incorporated has been appointed as the Dealer Manager for the Offer and Consent Solicitation, D.F.

King, Co., Inc. (“D.F. King”) has been appointed as the Information Agent for the Offer and Consent Solicitation, and

Equiniti Trust Company, LLC has been appointed as the Depositary for the Offer and Consent Solicitation. All questions concerning

tender procedures and requests for additional copies of the offer materials, including the letter of transmittal and consent should

be directed to D.F. King.

Disclaimer

This announcement is for informational purposes

only and shall not constitute an offer to purchase or a solicitation of an offer to sell the Warrants. The Offer and Consent Solicitation

are being made only through the Schedule TO and Offer to Purchase, and the complete terms and conditions of the Offer and Consent Solicitation

are set forth in the Schedule TO and Offer to Purchase.

About Direct Digital Holdings

Direct

Digital Holdings (Nasdaq: DRCT), owner of operating companies Colossus SSP, Huddled Masses, and Orange 142, brings state-of-the-art sell-

and buy-side advertising platforms together under one umbrella company. Direct Digital Holdings' sell-side platform, Colossus SSP, offers

advertisers of all sizes extensive reach within general market and multicultural media properties. The Company's subsidiaries Huddled

Masses and Orange142 deliver significant ROI for middle market advertisers by providing data-optimized programmatic solutions at scale

for businesses in sectors that range from energy to healthcare to travel to financial services. Direct Digital Holdings' sell- and buy-side

solutions manage on average over 136,000 clients monthly, generating approximately 250 billion impressions per month across display, CTV,

in-app and other media channels.

Forward Looking Statements

This

press release may contain forward-looking statements within the meaning of federal securities laws and which are subject to certain

risks, trends and uncertainties.

As used below,

“we,” “us,” and “our” refer to the Company. We use words such as “could,” “would,”

“may,” “might,” “will,” “expect,” “likely,” “believe,” “continue,”

“anticipate,” “estimate,” “intend,” “plan,” “project” and other similar expressions

to identify forward-looking statements, but not all forward-looking statements include these words. All statements contained in this press

release that do not relate to matters of historical fact should be considered forward-looking statements.

All of our

forward-looking statements involve estimates and uncertainties that could cause actual results to differ materially from those

expressed in or implied by the forward-looking statements. Our forward-looking statements are based on assumptions that we have made

in light of our industry experience and our perceptions of historical trends, current conditions, expected future developments and

other factors we believe are appropriate under the circumstances. Although we believe that these forward-looking statements are

based on reasonable assumptions, many factors could affect our actual operating and financial performance and cause our performance

to differ materially from the performance expressed in or implied by the forward-looking statements, including, but not limited to:

our dependence on the overall demand for advertising, which could be influenced by economic downturns; any slow-down or

unanticipated development in the market for programmatic advertising campaigns; the effects of health epidemics; operational and

performance issues with our platform, whether real or perceived, including a failure to respond to technological changes or to

upgrade our technology systems; any significant inadvertent disclosure or breach of confidential and/or personal information we

hold, or of the security of our or our customers', suppliers' or other partners' computer systems; any unavailability or non-performance

of the non-proprietary technology, software, products and services that we use; unfavorable publicity and negative public perception

about our industry, particularly concerns regarding data privacy and security relating to our industry's technology and practices,

and any perceived failure to comply with laws and industry self-regulation; restrictions on the use of third-party

"cookies," mobile device IDs or other tracking technologies, which could diminish our platform's effectiveness; any

inability to compete in our intensely competitive market; any significant fluctuations caused by our high customer concentration;

our limited operating history, which could result in our past results not being indicative of future operating performance; any

violation of legal and regulatory requirements or any misconduct by our employees, subcontractors, agents or business partners; any

strain on our resources, diversion of our management's attention or impact on our ability to attract and retain qualified board

members as a result of being a public company; our dependence, as a holding company, on receiving distributions from Direct Digital

Holdings, LLC to pay our taxes, expenses and dividends; the satisfaction of the conditions to the Offer, including the minimum

tender condition; and other factors and assumptions discussed in the "Risk Factors," "Management's Discussion and

Analysis of Financial Conditions and Results of Operations" and other sections of our filings with the Securities and Exchange

Commission that we make from time to time. Should one or more of these risks or uncertainties materialize or should any of these

assumptions prove to be incorrect, our actual operating and financial performance may vary in material respects from the performance

projected in these forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is

made, and except as required by law, we undertake no obligation to update any forward-looking statement contained in this press

release to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or

unanticipated events or circumstances, and we claim the protection of the safe harbor for forward-looking statements contained in

the Private Securities Litigation Reform Act of 1995.

Contacts:

Investors:

Brett Milotte, ICR

Brett.Milotte@icrinc.com

v3.23.3

Cover

|

Sep. 29, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 29, 2023

|

| Entity File Number |

001-41261

|

| Entity Registrant Name |

Direct Digital Holdings, Inc.

|

| Entity Central Index Key |

0001880613

|

| Entity Tax Identification Number |

87-2306185

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1177 West Loop South

|

| Entity Address, Address Line Two |

Suite 1310

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77027

|

| City Area Code |

832

|

| Local Phone Number |

402-1051

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A common stock, par value $0.001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.001 per share

|

| Trading Symbol |

DRCT

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase Class A common stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase Class A common stock

|

| Trading Symbol |

DRCTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=DRCT_ClassAcommonstockparvaluedollarpershareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=DRCT_WarrantstopurchaseClassAcommonstockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

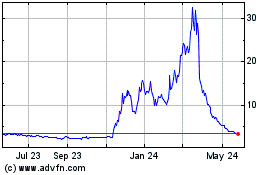

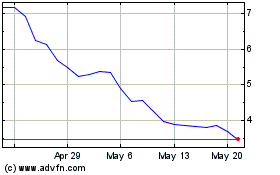

Direct Digital (NASDAQ:DRCT)

Historical Stock Chart

From Apr 2024 to May 2024

Direct Digital (NASDAQ:DRCT)

Historical Stock Chart

From May 2023 to May 2024