Form 8-K - Current report

March 01 2024 - 4:53PM

Edgar (US Regulatory)

false000141389800014138982024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 29, 2024

DallasNews CORPORATION

(Exact name of registrant as specified in its charter)

Commission file number: 1-33741

| | |

| | |

Texas | | 38-3765318 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

P. O. Box 224866, Dallas, Texas 75222-4866 | | (214) 977-8869 |

(Address of principal executive offices, including zip code) | | (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Series A Common Stock, $0.01 par value | | DALN | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Discretionary Cash Bonus Policy

On February 29, 2024, the Board of Directors (the “Board”) of DallasNews Corporation (the “Company”) and the Compensation and Management Development Committee of the Board (the “Committee”) approved and adopted a discretionary cash bonus policy (the “Cash Bonus Policy”). Pursuant to the Cash Bonus Policy, the Company may award cash bonuses to certain of its employees upon the achievement of certain objective corporate, divisional, group, and/or individual performance measures, as determined by the Committee in its sole discretion. The Committee may establish for each eligible employee a target bonus amount, but it shall retain the authority to increase or decrease each employee’s bonus to reflect individual and/or corporate performance or to apply any other objective or subjective criteria the Committee deems appropriate in its sole and absolute discretion. All employees of the Company, including its executive officers, are eligible to participate in the bonus program described in the Cash Bonus Policy. The foregoing summary of the Cash Bonus Policy is qualified in its entirety by reference to the full text of the Cash Bonus Policy, which is attached as Exhibit 10.1 to this Current Report on Form 8-K.

Amended and Restated Incentive Compensation Plan

On February 29, 2024, the Board and the Committee approved and adopted an amended and restated version of the Company’s 2017 Incentive Compensation Plan (the “Plan,” and as amended and restated, the “A&R Plan”) to (i) incorporate three previously adopted amendments to the Plan, (ii) remove provisions previously required by Section 162(m) of the Internal Revenue Code of 1986 that no longer apply as a result of the enactment of the Tax Cuts and Jobs Act of 2017 and (iii) reflect the 2018 change in the Company’s state of incorporation from Delaware to Texas. The A&R Plan did not effect any material changes to the Plan. The foregoing summary of the A&R Plan is qualified in its entirety by reference to the full text of the A&R Plan, which is attached as Exhibit 10.2 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | |

| | | | | | |

Date: March 1, 2024 | | | | DALLASNEWS CORPORATION |

| | | |

| | | | By: | | /s/ Katy Murray |

| | | | | | Katy Murray |

| | | | | | President and Chief Financial Officer |

DALLASNEWS CORPORATION

DISCRETIONARY CASH BONUS POLICY

This DallasNews Corporation Discretionary Cash Bonus Policy (this “Policy”) provides an incentive to certain employees of DallasNews Corporation, a Texas corporation (the “Company”) and its subsidiaries, based upon the achievement of any combination of objective corporate, divisional, group, and/or individual performance measures, as determined by the Compensation and Management Development Committee (the “Committee”) of the Company’s Board of Directors (the “Board”) in its sole discretion.

1.For each fiscal year, the Committee may establish performance objectives and goals that if achieved would result in the potential payment of bonuses to eligible employees of the Company (these objectives and goals are referred to herein as the “Performance Goals”). The Performance Goals for each year shall be established, in writing, by the Committee during the first quarter of each fiscal year. The Performance Goals may be based on any combination of objective corporate, divisional, group, and/or individual performance measures, as determined by the Committee in its sole discretion.

2.The Committee may also establish for each eligible employee a target bonus amount payable upon achievement of the Performance Goals. At the end of each fiscal year to which the Performance Goals relate, the Committee, or its delegate, shall determine if, and to what extent, the Performance Goals have been met for each eligible employee. Notwithstanding the foregoing, the Committee, in its sole and absolute discretion, shall have the authority and discretion to increase or decrease each employee’s bonus to reflect individual and/or corporate performance or to apply any other objective or subjective criteria the Committee deems appropriate. The Committee may, but shall not be required to, consider the recommendations of the CEO or an employee’s supervisor or other members of management of the Company regarding an employee’s performance during a fiscal year when determining the amount of any bonus payable under this Policy. Bonuses, if any, shall be paid in the form of cash.

3.Awards may be made to eligible employees by the Committee for a fiscal year, but no eligible employee is assured of receiving any bonus and an eligible employee’s receipt of a bonus for one fiscal year does not assure receipt of a bonus in any future fiscal years. All employees are eligible to participate in the bonus program described in this Policy.

The Board, in its sole and absolute discretion, reserves the right to modify, amend, or terminate this Policy at any time and for any reason.

AMENDED AND RESTATED DALLASNEWS CORPORATION

INCENTIVE COMPENSATION PLAN

|

|

|

|

|

|

|

|

|

|

|

Section

|

|

Page

|

|

1.

|

Purpose

|

1

|

|

2.

|

Term

|

1

|

|

3.

|

Definitions

|

1

|

|

4.

|

Shares Available Under Plan

|

7

|

|

5.

|

Limitations on Awards

|

7

|

|

6.

|

Stock Options

|

7

|

|

7.

|

Appreciation Rights

|

10

|

|

8.

|

Restricted Shares

|

11

|

|

9.

|

Restricted Stock Units

|

12

|

|

10.

|

Performance Shares and Performance Units

|

13

|

|

11.

|

Incentive Compensation Plan Bonuses

|

15

|

|

12.

|

Awards for Directors

|

15

|

|

13.

|

Transferability

|

17

|

|

14.

|

Adjustments

|

17

|

|

15.

|

Fractional Shares

|

17

|

|

16.

|

Withholding Taxes

|

17

|

|

17.

|

Administration of the Plan

|

18

|

|

18.

|

Amendments and Other Matters

|

18

|

|

19.

|

Governing Law

|

20

|

AMENDED AND RESTATED DALLASNEWS CORPORATION

INCENTIVE COMPENSATION PLAN

This Amended and Restated DallasNews Corporation Incentive Compensation Plan (formerly known as, the A. H. Belo 2017 Incentive Compensation Plan) (the “Plan”) was originally adopted by DallasNews Corporation (formerly known as, A. H. Belo Corporation), a Texas corporation (the “Company”), effective as of March 2, 2017, and is hereby amended and restated effective February 29, 2024 (the “Effective Date”) to (i) incorporate that the previously adopted First Amendment to the Plan, Second Amendment to the Plan, and Third Amendment to the Plan; (ii) modify the Plan to provisions previously required by Section 162(m) of the Code (as defined below), which is no longer in effect; and (iii) reflect the Company’s change in state of incorporation from Delaware to Texas.

|

1.

Purpose. The purpose of the Plan is to attract and retain the best available talent and encourage the highest level of performance by directors, executive officers and selected employees, and to provide them incentives to put forth maximum efforts for the success of the Company’s business, in order to serve the best interests of the Company and its shareholders. |

|

2.

Term. The Plan will expire on the tenth anniversary of the Effective Date. |

|

3.

Definitions. The following terms, when used in the Plan with initial capital letters, will have the following meanings: |

|

(a)

Appreciation Right means a right granted pursuant to Section 7. |

|

(b)

Award means the award of an Incentive Compensation Plan Bonus; the grant of Appreciation Rights, Stock Options, Performance Shares or Performance Units; or the grant or sale of Restricted Shares or Restricted Stock Units. |

|

(c)

Board means the Board of Directors of the Company. |

|

(d)

Change in Control means the occurrence of any of the following: |

|

(i)

individuals who, as of the Effective Date of the Plan, were members of the Board (the “Incumbent Directors”) cease for any reason to constitute at least a majority of the Board; provided, however, that any individual becoming a director after the Effective Date of the Plan whose election, or nomination for election, by the Company’s shareholders was approved by a vote of at least a majority of the Incumbent Directors will be considered as though such individual were an Incumbent Director, other than any such individual whose assumption of office after the Effective Date of the Plan occurs as a result of an actual or threatened proxy contest with respect to election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a “person” (as such term is used in Section 13(d) of the Exchange Act) (each, a “Person”), other than the Board; |

|

(ii)

the consummation of (A) a merger, consolidation or similar form of corporate transaction involving the Company (each of the events referred to in this clause (A) being hereinafter referred to as a “Reorganization”) or (B) a sale or other disposition of all or substantially all the assets of the Company (a “Sale”), unless, immediately following such Reorganization or Sale, (I) all or substantially all the individuals and entities who were the “beneficial owners” (as such term is defined in Rule 13d-3 under the Exchange Act (or a successor rule thereto)) of shares of the Company’s common stock or other securities eligible to vote for the election of the Board outstanding immediately prior to the consummation of such Reorganization or Sale (such securities, the “Company Voting Securities”) beneficially own, directly or indirectly, more than 60% of the combined voting power of the then outstanding voting securities of the corporation or other entity resulting from such Reorganization or Sale (including a corporation or other entity that, as a result of such transaction, owns the Company or all or substantially all the Company’s assets either directly or through one or more subsidiaries) (the “Continuing Entity”) in substantially the same proportions as their ownership, immediately prior to the consummation of such Reorganization or Sale, of the outstanding Company Voting Securities (excluding any outstanding voting securities of the Continuing Entity that such beneficial owners hold immediately following the consummation of the Reorganization or Sale as a result of their ownership prior to such consummation of voting securities of any corporation or other entity involved in or forming part of such Reorganization or Sale other than the Company or a Subsidiary), (2) no Person (excluding any employee benefit plan (or related trust) sponsored or maintained by the Continuing Entity or any corporation or other entity controlled by the Continuing Entity) beneficially owns, directly or indirectly, 30% or more of the combined voting power of the then outstanding voting securities of the Continuing Entity and (3) at least a majority of the members of the board of directors or other governing body of the Continuing Entity were Incumbent Directors at the time of the execution of the definitive agreement providing for such Reorganization or Sale or, in the absence of such an agreement, at the time at which approval of the Board was obtained for such Reorganization or Sale; |

|

(iii)

the shareholders of the Company approve a plan of complete liquidation or dissolution of the Company; or |

|

(iv)

any Person, corporation or other entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange Act) becomes the beneficial owner, directly or indirectly, of securities of the Company representing 30% or more of the combined voting power of the Company Voting Securities; provided, however, that for purposes of this subparagraph (iv), the following acquisitions will not constitute a Change in Control: (A) any acquisition directly from the Company, (B) any acquisition by the Company or any Subsidiary, (C) any acquisition by any employee benefit plan (or

|

related trust) sponsored or maintained by the Company or any Subsidiary, (D) any acquisition by an underwriter temporarily holding such Company Voting Securities pursuant to an offering of such securities or (E) any acquisition pursuant to a Reorganization or Sale that does not constitute a Change in Control for purposes of Section 3(d)(ii). |

For purposes of applying the provisions of Section 3(d)(ii)(B)(2) and Section 3(d)(iv), neither Robert W. Decherd nor any Person holding voting securities of the Continuing Entity or Company Voting Securities, as applicable, over which Robert W. Decherd has sole or shared voting power will be considered to be the beneficial owner of 30% or more of such voting securities or Company Voting Securities.

Notwithstanding the foregoing, however, in any circumstance or transaction in which compensation resulting from or in respect of an Award would result in the imposition of an additional tax under Section 409A of the Code if the foregoing definition of “Change in Control” were to apply, but would not result in the imposition of any additional tax if the term “Change in Control” were defined herein to mean a “change in control event” within the meaning of Treasury Regulation Section 1.409A-3(i)(5), then “Change in Control” shall mean a “change in control event” within the meaning of Treasury Regulation Section 1.409A-3(i)(5), but only to the extent necessary to prevent such compensation from becoming subject to an additional tax under Section 409A of the Code.

|

(e)

Code means the Internal Revenue Code of 1986, as in effect from time to time. |

|

(f)

Committee means the Compensation Committee of the Board and, to the extent the administration of the Plan has been assumed by the Board pursuant to Section 17, the Board. |

|

(g)

Common Stock means the Series A Common Stock, par value $.01 per share, and the Series B Common Stock, par value $.01 per share, of the Company or any security into which such Common Stock may be changed by reason of any transaction or event of the type described in Section 14. Shares of Common Stock issued or transferred pursuant to the Plan will be shares of Series A Common Stock or Series B Common Stock, as determined by the Committee in its discretion. Notwithstanding the foregoing, the Committee will not authorize the issuance or transfer of Series B Common Stock if the Committee determines that such issuance or transfer would cause the Series A Common Stock to be excluded from trading in the principal market in which the Common Stock is then traded. |

|

(h)

Date of Grant means (i) with respect to Participants, the date specified by the Committee on which an Award will become effective and (ii) with respect to Directors, the date specified in Section 12. |

|

(i)

Director means a member of the Board who is not a regular full-time employee of the Company or any Subsidiary. |

|

(j)

Evidence of Award means an agreement, certificate, resolution or other type or form of writing or other evidence approved by the Committee which sets forth the terms and conditions of an Award. An Evidence of Award may be in any electronic medium, may be limited to a notation on the books and records of the Company and need not be signed by a representative of the Company or a Participant or a Director. |

|

(k)

Exchange Act means the Securities Exchange Act of 1934, as amended. |

|

(l)

Grant Price means the price per share of Common Stock at which an Appreciation Right not granted in tandem with a Stock Option is granted. |

|

(m)

Incentive Compensation Plan Bonus means an award of annual incentive compensation made pursuant to and subject to the conditions set forth in Section 11. |

|

(n)

Management Objectives means the performance objectives, if any, established by the Committee in its sole discretion for a Performance Period that are to be achieved with respect to an Award. Depending on the Management Objectives, a performance goal may be: (i) expressed on a corporate-wide basis (i.e., the performance of the Company), with respect to one or more Subsidiaries, business units, divisions, or business segments, or based on the individual performance of a Participant, or any combination thereof as the Committee deems appropriate; (ii) expressed in either absolute terms or relative to the performance of one or more comparable companies or an index covering multiple companies; (iii) absolute or based on change in the designated performance criteria over a specified period of time and such change may be measured based on an arithmetic change over a specified period (e.g., cumulative change or average change), or percentage change over a specified period (e.g., cumulative percentage change, average percentage change or compounded percentage change); (iv) based on GAAP or non-GAAP calculations; or (v) based on any other performance criteria established by the Committee, in its sole discretion. |

The achievement of the Management Objectives established by the Committee for any Performance Period will be determined without regard to the effect on such Management Objectives of any acquisition or disposition by the Company of a trade or business, or of substantially all of the assets of a trade or business, during the Performance Period and without regard to any change in accounting standards by the Financial Accounting Standards Board or any successor entity and without regard to changes in applicable tax laws. The Committee shall, in its sole discretion, establish the Management Objectives for each Performance Period prior to, or as soon as practicable after, the commencement of such Performance Period.

If the Committee determines that, as a result of a change in the business, operations, corporate structure or capital structure of the Company (other than an acquisition or disposition described in the first paragraph of this Section 3(n) or the manner in which the Company conducts its business, or any other events or circumstances, the Management Objectives are no longer suitable, the Committee may in its discretion modify such Management Objectives or the related

minimum acceptable level of achievement, in whole or in part, with respect to a Performance Period as the Committee deems appropriate and equitable.

|

(o)

Market Value per Share means, at any date, the closing sale price of the Common Stock on that date (or, if there are no sales on that date, the last preceding date on which there was a sale) in the principal market in which the Common Stock is traded. |

|

(p)

Option Price means the purchase price per share payable on exercise of a Stock Option. |

|

(q)

Participant means a person who is selected by the Committee to receive benefits under the Plan and who is at that time (i) an executive officer or other key employee of the Company or any Subsidiary or (ii) a Director of the Company to whom an Award has been granted, provided that no Director is eligible to receive an Award of a Stock Option intended to qualify as an incentive stock option under Section 422 of the Code. |

|

(r)

Performance Share means a bookkeeping entry that records the equivalent of one share of Common Stock awarded pursuant to Section 10. |

|

(s)

Performance Period means, with respect to an Award, a period of time within which the Management Objectives relating to such Award are to be measured. The Performance Period for an Incentive Compensation Plan Bonus will be a period of 12 months, and, unless otherwise expressly provided in the Plan, the Performance Period for all other Awards will be established by the Committee at the time of the Award. |

|

(t)

Performance Unit means a unit equivalent to $100 (or such other value as the Committee determines) granted pursuant to Section 10. |

|

(u)

Restricted Shares means shares of Common Stock granted or sold pursuant to Section 8 as to which neither the ownership restrictions nor the restrictions on transfer have expired. |

|

(v)

Restricted Stock Units means an award pursuant to Section 9 of the right to receive shares of Common Stock at the end of a specified deferral period, subject to the satisfaction of certain conditions. |

|

(w)

Rule 16b-3 means Rule 16b-3 under Section 16 of the Exchange Act (or any successor rule to the same effect), as in effect from time to time. |

|

(x)

Spread means the excess of the Market Value per Share on the date an Appreciation Right is exercised over (i) the Option Price provided for in the Stock Option granted in tandem with the Appreciation Right or (ii) if there is no tandem Stock Option, the Grant Price provided for in the Appreciation Right, in either case multiplied by the number of shares of Common Stock in respect of which the Appreciation Right is exercised. |

|

(y)

Stock Option means the right to purchase shares of Common Stock upon exercise of an option granted pursuant to Section 6. |

|

(z)

Subsidiary means (i) any corporation of which at least 50% of the total combined voting power of all outstanding shares of stock is owned directly or indirectly by the Company, (ii) any partnership of which at least 50% of the profits interest or capital interest is owned directly or indirectly by the Company and (iii) any other entity of which at least 50% of the total equity interest is owned directly or indirectly by the Company. |

|

4.

Shares Available Under Plan. The number of shares of Common Stock that may be issued or transferred (i) upon the exercise of Appreciation Rights or Stock Options, (ii) as Restricted Shares and released from all restrictions, (iii) as Restricted Stock Units, (iv) in payment of Performance Shares, Performance Units or Incentive Compensation Plan Bonuses will not exceed in the aggregate 1 million shares. Such shares may be shares of original issuance or treasury shares or a combination of the foregoing. The number of shares of Common Stock available under this Section 4 will be subject to adjustment as provided in Section 14 and will be further adjusted to include shares that (i) relate to Awards that expire or are forfeited or (ii) are transferred, surrendered or relinquished to or withheld by the Company in satisfaction of any Option Price or in satisfaction of any tax withholding amount. Upon payment in cash of the benefit provided by any Award, any shares that were covered by that Award will again be available for issue or transfer under the Plan. |

|

5.

Limitations on Awards. No more than 1 million shares of Common Stock, subject to adjustment only as provided in Section 14, will be issued pursuant to Stock Options that are intended to qualify as incentive stock options under Section 422 of the Code pursuant to the terms of this Plan. No Stock Option may be issued to a Director if such Stock Option is intended to qualify as an incentive stock option under Section 422 of the Code, instead the Director’s Stock Option shall be treated as a Stock Option issued under Section 12(c) of the Plan. |

|

6.

Stock Options. The Committee may from time to time authorize grants to any Participant and, subject to Section 12, to any Director of options to purchase shares of Common Stock upon such terms and conditions as it may determine in accordance with this Section 6. Each grant of Stock Options may utilize any or all of the authorizations, and will be subject to all of the requirements, contained in the following provisions: |

|

(a)

Each grant will specify the number of shares of Common Stock to which it relates. |

|

(b)

Each grant will specify the Option Price, which will not be less than 100% of the Market Value per Share on the Date of Grant. |

|

(c)

Each grant will specify whether the Option Price will be payable (i) in cash or by check acceptable to the Company, (ii) by the actual or constructive transfer to the Company of shares of Common Stock owned by the Participant or Director for at least six months (or, with the consent of the Committee, for less than six months) having an aggregate Market Value per Share at the date of exercise equal to the aggregate Option Price, (iii) with the consent of the Committee, by authorizing the Company to withhold a number of shares of Common Stock otherwise issuable to the Participant or Director having an aggregate Market Value per Share on the date of exercise equal to the aggregate Option Price or (iv) by a combination of such methods of payment; provided, however, that the payment methods described in clauses (ii) and (iii) will

|

not be available at any time that the Company is prohibited from purchasing or acquiring such shares of Common Stock. |

|

(d)

To the extent permitted by law, any grant may provide for deferred payment of the Option Price from the proceeds of sale through a bank or broker of some or all of the shares to which such exercise relates. |

|

(e)

Successive grants may be made to the same Participant or Director whether or not any Stock Options or other Awards previously granted to such Participant or Director remain unexercised or outstanding. |

|

(f)

Each grant will specify the required period or periods of continuous service by the Participant or Director with the Company or any Subsidiary that are necessary before the Stock Options or installments thereof will become exercisable. |

|

(g)

Any grant may specify the Management Objectives that must be achieved as a condition to the exercise of the Stock Options. |

|

(h)

Any grant may provide for the earlier exercise of the Stock Options in the event of a Change in Control or other similar transaction or event. |

|

(i)

Stock Options may be (i) options which are intended to qualify under particular provisions of the Code, (ii) options which are not intended to so qualify or (iii) combinations of the foregoing. |

|

(j)

On or after the Date of Grant, the Committee may provide for the payment to the Participant or Director of dividend equivalents thereon in cash or Common Stock on a current, deferred or contingent basis. |

|

(k)

No Stock Option will be exercisable more than ten years from the Date of Grant. |

|

(l)

The Committee will have the right to substitute Appreciation Rights for outstanding Options granted to one or more Participants or Directors, provided the terms and the economic benefit of the substituted Appreciation Rights are at least equivalent to the terms and economic benefit of such Options, as determined by the Committee in its discretion. |

|

(m)

Any grant may provide for the effect on the Stock Options or any shares of Common Stock issued, or other payment made, with respect to the Stock Options of any conduct of the Participant determined by the Committee to be injurious, detrimental or prejudicial to any significant interest of the Company or any Subsidiary. |

|

(n)

Each grant will be evidenced by an Evidence of Award, which may contain such terms and provisions, consistent with the Plan, as the Committee may approve, including without limitation provisions relating to the Participant’s termination of employment or Director’s termination of service by reason of retirement, death, disability or otherwise. |

|

7.

Appreciation Rights. The Committee may also from time to time authorize grants to any Participant and, subject to Section 12, to any Director of Appreciation Rights upon such terms and conditions as it may determine in accordance with this Section 7. Appreciation Rights may be granted in tandem with Stock Options or separate and apart from a grant of Stock Options. An Appreciation Right will be a right of the Participant or Director to receive from the Company upon exercise an amount which will be determined by the Committee at the Date of Grant and will be expressed as a percentage of the Spread (not exceeding 100%) at the time of exercise. An Appreciation Right granted in tandem with a Stock Option may be exercised only by surrender of the related Stock Option. Each grant of an Appreciation Right may utilize any or all of the authorizations, and will be subject to all of the requirements, contained in the following provisions: |

|

(a)

Each grant will state whether it is made in tandem with Stock Options and, if not made in tandem with any Stock Options, will specify the number of shares of Common Stock in respect of which it is made. |

|

(b)

Each grant made in tandem with Stock Options will specify the Option Price and each grant not made in tandem with Stock Options will specify the Grant Price, which in either case will not be less than 100% of the Market Value per Share on the Date of Grant. |

|

(c)

Any grant may provide that the amount payable on exercise of an Appreciation Right may be paid (i) in cash, (ii) in shares of Common Stock having an aggregate Market Value per Share equal to the Spread or (iii) in a combination thereof, as determined by the Committee in its discretion. |

|

(d)

Any grant may specify that the amount payable to the Participant or Director on exercise of an Appreciation Right may not exceed a maximum amount specified by the Committee at the Date of Grant (valuing shares of Common Stock for this purpose at their Market Value per Share at the date of exercise). |

|

(e)

Successive grants may be made to the same Participant or Director whether or not any Appreciation Rights or other Awards previously granted to such Participant or Director remain unexercised or outstanding. |

|

(f)

Each grant will specify the required period or periods of continuous service by the Participant or Director with the Company or any Subsidiary that are necessary before the Appreciation Rights or installments thereof will become exercisable, and will provide that no Appreciation Rights may be exercised except at a time when the Spread is positive and, with respect to any grant made in tandem with Stock Options, when the related Stock Options are also exercisable. |

|

(g)

Any grant may specify the Management Objectives that must be achieved as a condition to the exercise of the Appreciation Rights. |

|

(h)

Any grant may provide for the earlier exercise of the Appreciation Rights in the event of a Change in Control or other similar transaction or event. |

|

(i)

On or after the Date of Grant, the Committee may provide for the payment to the Participant or Director of dividend equivalents thereon in cash or Common Stock on a current, deferred or contingent basis. |

|

(j)

No Appreciation Right will be exercisable more than ten years from the Date of Grant. |

|

(k)

Any grant may provide for the effect on the Appreciation Rights or any shares of Common Stock issued, or other payment made, with respect to the Appreciation Rights of any conduct of the Participant determined by the Committee to be injurious, detrimental or prejudicial to any significant interest of the Company or any Subsidiary. |

|

(l)

Each grant will be evidenced by an Evidence of Award, which may contain such terms and provisions, consistent with the Plan, as the Committee may approve, including without limitation provisions relating to the Participant’s termination of employment or Director’s termination of service by reason of retirement, death, disability or otherwise. |

|

8.

Restricted Shares. The Committee may also from time to time authorize grants or sales to any Participant and, subject to Section 12, to any Director of Restricted Shares upon such terms and conditions as it may determine in accordance with this Section 8. Each grant or sale will constitute an immediate transfer of the ownership of shares of Common Stock to the Participant or Director in consideration of the performance of services, entitling such Participant or Director to voting and other ownership rights, but subject to the restrictions set forth in this Section 8. Each such grant or sale may utilize any or all of the authorizations, and will be subject to all of the requirements, contained in the following provisions: |

|

(a)

Each grant or sale may be made without additional consideration or in consideration of a payment by the Participant or Director that is less than the Market Value per Share at the Date of Grant, except as may otherwise be required by applicable law. |

|

(b)

Each grant or sale may limit the Participant’s or Director’s dividend rights during the period in which the shares of Restricted Shares are subject to any such restrictions. |

|

(c)

Each grant or sale will provide that the Restricted Shares will be subject, for a period to be determined by the Committee at the Date of Grant, to one or more restrictions, including without limitation a restriction that constitutes a “substantial risk of forfeiture” within the meaning of Section 83 of the Code and the regulations of the Internal Revenue Service under such section. |

|

(d)

Any grant or sale may specify the Management Objectives that, if determined to be achieved by the Committee, will result in the termination or early termination of the restrictions applicable to the shares. |

|

(e)

Any grant or sale may provide for the early termination of any such restrictions in the event of a Change in Control or other similar transaction or event. |

|

(f)

Each grant or sale will provide that during the period for which such restriction or restrictions are to continue, the transferability of the Restricted Shares will be prohibited or restricted in a manner and to the extent prescribed by the Committee at the Date of Grant (which restrictions may include without limitation rights of repurchase or first refusal in favor of the Company or provisions subjecting the Restricted Shares to continuing restrictions in the hands of any transferee). |

|

(g)

Any grant or sale may provide for the effect on the Restricted Shares or any shares of Common Stock issued free of restrictions, or other payment made, with respect to the Restricted Shares of any conduct of the Participant determined by the Committee to be injurious, detrimental or prejudicial to any significant interest of the Company or any Subsidiary. |

|

(h)

Each grant or sale will be evidenced by an Evidence of Award, which may contain such terms and provisions, consistent with the Plan, as the Committee may approve, including without limitation provisions relating to the Participant’s termination of employment or Director’s termination of service by reason of retirement, death, disability or otherwise. |

|

9.

Restricted Stock Units. The Committee may also from time to time authorize grants or sales to any Participant and, subject to Section 12, to any Director of Restricted Stock Units upon such terms and conditions as it may determine in accordance with this Section 9. Each grant or sale will constitute the agreement by the Company to issue or transfer shares of Common Stock to the Participant or Director in the future in consideration of the performance of services, subject to the fulfillment of such conditions as the Committee may specify. Each such grant or sale may utilize any or all of the authorizations, and will be subject to all of the requirements, contained in the following provisions: |

|

(a)

Each grant or sale may be made without additional consideration from the Participant or Director or in consideration of a payment by the Participant or Director that is less than the Market Value per Share on the Date of Grant, except as may otherwise be required by applicable law. |

|

(b)

Each grant or sale will provide that the Restricted Stock Units will be subject to a deferral period, which will be fixed by the Committee on the Date of Grant, and any grant or sale may provide for the earlier termination of such period in the event of a Change in Control or other similar transaction or event. |

|

(c)

During the deferral period, the Participant or Director will not have any right to transfer any rights under the Restricted Stock Units, will not have any rights of ownership in the Restricted Stock Units and will not have any right to vote the Restricted Stock Units, but the Committee may on or after the Date of Grant authorize the payment of dividend equivalents on such shares in cash or Common Stock on a current, deferred or contingent basis. |

|

(d)

Any grant or sale may provide for the effect on the Restricted Stock Units or any shares of Common Stock issued free of restrictions, or other payment made, with respect to

|

the Restricted Stock Units of any conduct of the Participant determined by the Committee to be injurious, detrimental or prejudicial to any significant interest of the Company or any Subsidiary. |

|

(e)

A payment may be delayed where the Company reasonably anticipates that the making of the payment will violate federal securities laws or other applicable law; provided, however, that the payment is made at the earliest date at which the Company reasonably anticipates that the making of the payment will not cause such violation. For this purpose, the making of a payment that would cause inclusion in gross income or the application of any penalty provision or other provision of the Code is not treated as a violation of applicable law. |

|

(f)

Each grant or sale will be evidenced by an Evidence of Award, which will contain such terms and provisions as the Committee may determine consistent with the Plan, including without limitation provisions relating to the Participant's termination of employment or Director’s termination of service by reason of retirement, death, disability or otherwise. |

|

10.

Performance Shares and Performance Units. The Committee may also from time to time authorize grants to any Participant and, subject to Section 12, to any Director of Performance Shares and Performance Units, which will become payable upon achievement of specified Management Objectives, as determined by the Committee, in its sole discretion, upon such terms and conditions as it may determine in accordance with this Section 10. Each such grant may utilize any or all of the authorizations, and will be subject to all of the requirements, contained in the following provisions: |

|

(a)

Each grant will specify the number of Performance Shares or Performance Units to which it relates. |

|

(b)

The Performance Period with respect to each Performance Share and Performance Unit will be determined by the Committee at the time of grant. |

|

(c)

Each grant will specify the Management Objectives that, if the Committee determines are achieved, will result in the payment of the Performance Shares or Performance Units. |

|

(d)

Each grant will specify the time and manner of payment of Performance Shares or Performance Units which have become payable, which payment may be made in (i) cash, (ii) shares of Common Stock having an aggregate Market Value per Share equal to the aggregate value of the Performance Shares or Performance Units which have become payable or (iii) any combination thereof, as determined by the Committee in its discretion at the time of payment. |

|

(e)

Any grant of Performance Shares may specify that the amount payable with respect thereto may not exceed a maximum specified by the Committee on the Date of Grant. Any grant of Performance Units may specify that the amount payable, or the number of shares of Common Stock issued, with respect to the Performance Units may not exceed maximums specified by the Committee on the Date of Grant. |

|

(f)

On or after the Date of Grant, the Committee may provide for the payment to the Participant or Director of dividend equivalents on Performance Shares in cash or Common Stock on a current, deferred or contingent basis. |

|

(g)

Any grant may provide for the effect on the Performance Shares or Performance Units or any shares of Common Stock issued, or other payment made, with respect to the Performance Shares or Performance Units of any conduct of the Participant determined by the Committee to be injurious, detrimental or prejudicial to any significant interest of the Company or any Subsidiary. |

|

(h)

Each grant will be evidenced by an Evidence of Award, which will contain such terms and provisions as the Committee may determine consistent with the Plan, including without limitation provisions relating to the payment of the Performance Shares or Performance Units in the event of a Change in Control or other similar transaction or event and provisions relating to the Participant’s termination of employment or Director’s termination of service by reason of retirement, death, disability or otherwise. |

|

11.

Incentive Compensation Plan Bonuses. The Committee may from time to time authorize payment of annual incentive compensation in the form of an Incentive Compensation Plan Bonus to a Participant, which will become payable upon achievement of specified Management Objectives or upon such other criteria as determined by the Committee, in its sole discretion. Incentive Compensation Plan Bonuses will be payable upon such terms and conditions as the Committee may determine, subject to the following provisions: |

|

(a)

The Committee may specify the Management Objectives that, if the Committee determines are achieved, will result in the payment of the Incentive Compensation Plan Bonus. |

|

(b)

The amount of the Incentive Compensation Plan Bonus will be determined by the Committee based on the level of achievement of the specified Management Objectives and upon such other criteria as determined by the Committee in its sole discretion. The Incentive Compensation Plan Bonus will be paid to the Participant following the close of the calendar year in which the Performance Period relating to the Incentive Compensation Plan Bonus ends, but not later than the 15th day of the third month following the end of such calendar year, provided the Participant continues to be employed by the Company or a Subsidiary on the Incentive Compensation Plan Bonus payment date (unless such employment condition is waived by the Company). |

|

(c)

Payment of the Incentive Compensation Plan Bonus may be made in (i) cash, (ii) shares of Common Stock having an aggregate Market Value per Share equal to the aggregate value of the Incentive Compensation Plan Bonus which has become payable or (iii) any combination thereof, as determined by the Committee in its discretion at the time of payment. |

|

(d)

If a Change in Control occurs during a Performance Period, the Incentive Compensation Plan Bonus payable to each Participant for the Performance Period will be determined at the target level of achievement of the Management Objectives, without regard to actual performance, or, if greater, at the actual level of achievement at the time of the closing of

|

the Change in Control, in both instances without proration for less than a full Performance Period. The Incentive Compensation Bonus will be paid not later than 60 days after the closing of the Change in Control. |

|

(e)

Each grant may be evidenced by an Evidence of Award, which will contain such terms and provisions as the Committee may determine consistent with the Plan, including without limitation provisions relating to the Participant’s termination of employment by reason of retirement, death, disability or otherwise. |

|

13.

Transferability. Unless the Committee determines otherwise on or after the Date of Grant, (i) no Award will be transferable by a Participant or Director other than by will or the laws of descent and distribution, and (ii) no Stock Option or Appreciation Right granted to a Participant or Director will be exercisable during the Participant’s or Director’s lifetime by any person other than the Participant or Director, or such person’s guardian or legal representative. |

|

14.

Adjustments. The Committee will make or provide for such adjustments in (i) the maximum number of shares of Common Stock specified in Section 4 and Section 5, (ii) the number of shares of Common Stock covered by outstanding Stock Options, Appreciation Rights, Performance Shares and Restricted Stock Units granted under the Plan, (iii) the Option Price or Grant Price applicable to any Stock Options and Appreciation Rights, and (iv) the kind of shares covered by any such Awards (including shares of another issuer) as is equitably required to prevent dilution or enlargement of the rights of Participants and Directors that otherwise would result from (x) any stock dividend, stock split, combination of shares, recapitalization or other change in the capital structure of the Company, or (y) any merger, consolidation, spin-off, split off, spin-out, split-up, reorganization, partial or complete liquidation or other distribution of assets, issuance of rights or warrants to purchase securities, or (z) any other corporate transaction, equity restructuring or other event having an effect similar to any of the foregoing. In the event of any such transaction or event, the Committee, in its discretion, may provide in substitution for any or all outstanding Awards such alternative consideration as it, in good faith, may determine to be equitable in the circumstances and may require in connection with such substitution the surrender of all Awards so replaced. |

|

15.

Fractional Shares. The Company will not be required to issue any fractional share of Common Stock pursuant to the Plan. The Committee may provide for the elimination of fractions or for the settlement of fractions in cash. |

|

16.

Withholding Taxes. To the extent that the Company is required to withhold federal, state, local or foreign taxes in connection with any payment made or benefit realized by a Participant or other person under the Plan, and the amounts available to the Company for such withholding are insufficient, it will be a condition to the receipt of such payment or the realization of such benefit that the Participant or such other person make arrangements satisfactory to the Company for payment of the balance of such taxes required to be withheld. In addition, if permitted by the Committee, the Participant or such other person may elect to have any withholding obligation of the Company satisfied with shares of Common Stock that would otherwise be transferred to the Participant or such other person in payment of the Participant’s Award. However,

|

without the consent of the Committee, shares of Common Stock will not be withheld in excess of the minimum number of shares required to satisfy the Company’s withholding obligation. |

|

17.

Administration of the Plan. |

|

(a)

Unless the administration of the Plan has been expressly assumed by the Board pursuant to a resolution of the Board, the Plan will be administered by the Committee, which at all times will consist of two or more Directors appointed by the Board, all of whom (i) will meet all applicable independence requirements of the New York Stock Exchange or the principal national securities exchange on which the Common Stock is traded and (ii) will qualify as “non-employee directors” as defined in Rule l6b-3, as such term may be amended from time to time. A majority of the Committee will constitute a quorum, and the action of the members of the Committee present at any meeting at which a quorum is present, or acts unanimously approved in writing, will be the acts of the Committee. |

|

(b)

The Committee has the full authority and discretion to administer the Plan and to take any action that is necessary or advisable in connection with the administration of the Plan, including without limitation the authority and discretion to interpret and construe any provision of the Plan or of any agreement, notification or document evidencing an Award. The interpretation and construction by the Committee of any such provision and any determination by the Committee pursuant to any provision of the Plan or of any such agreement, notification or document will be final and conclusive. No member of the Committee will be liable for any such action or determination made in good faith. |

|

18.

Amendments and Other Matters. |

|

(a)

The Plan may be amended from time to time by the Committee or the Board but may not be amended without further approval by the shareholders of the Company if such amendment would result in the Plan no longer satisfying any applicable requirements of the New York Stock Exchange (or the principal national securities exchange on which the Common Stock is traded) or Rule 16b-3. |

|

(b)

Neither the Committee nor the Board will authorize the amendment of any outstanding Stock Option to reduce the Option Price without the further approval of the shareholders of the Company. Furthermore, no Stock Option will be cancelled and replaced with Stock Options having a lower Option Price without further approval of the shareholders of the Company. This Section 18(b) is intended to prohibit the repricing of “underwater” Stock Options and will not be construed to prohibit the adjustments provided for in Section 14. |

|

(c)

The Committee may also permit Participants and Directors to elect to defer the issuance of Common Stock or the settlement of Awards in cash under the Plan pursuant to such rules, procedures or programs as it may establish for purposes of the Plan. The Committee also may provide that deferred issuances and settlements include the payment or crediting of dividend equivalents or interest on the deferral amounts. |

|

(d)

The Plan may be terminated at any time by action of the Board. The termination of the Plan will not adversely affect the terms of any outstanding Award. |

|

(e)

The Plan does not confer upon any Participant any right with respect to continuance of employment or other service with the Company or any Subsidiary, nor will it interfere in any way with any right the Company or any Subsidiary would otherwise have to terminate such Participant’s employment or other service at any time. |

|

(f)

All Awards granted under the Plan will be subject to recoupment in accordance with any clawback policy that the Company is specifically required to adopt pursuant to the listing standards of any national securities exchange or association on which the Company’s securities are listed or as is otherwise specifically required by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other applicable law. In addition, the Committee may impose such other clawback, recovery or recoupment provisions in an Award agreement as the Committee determines necessary or appropriate, including, but not limited to, a reacquisition right in respect of previously acquired shares of Common Stock or other cash or property upon the occurrence of cause (as such term may be defined by that agreement or any related plan or policy). |

|

(g)

It is the intention of the Company that no Award shall be “deferred compensation” subject to Section 409A of the Code unless and to the extent that the Committee specifically determines otherwise, and the Plan and the terms and conditions of all Awards shall be interpreted accordingly. The terms and conditions governing any Awards that the Committee determines will be subject to Section 409A of the Code, including any rules for elective or mandatory deferral of the delivery of cash or shares of Common Stock pursuant thereto, shall be set forth in the applicable Award Agreement, and shall comply in all respects with Section 409A of the Code. Notwithstanding any provision herein to the contrary, any Award issued under the Plan that constitutes a deferral of compensation under a “nonqualified deferred compensation plan” as defined under Section 409A(d)(1) of the Code and is not specifically designated as such by the Committee shall be modified or cancelled to comply with the requirements of Section 409A of the Code, including any rules for elective or mandatory deferral of the delivery of cash or shares of Common Stock pursuant thereto. |

|

(h)

Notwithstanding anything herein to the contrary, a Participant shall be solely responsible for the taxes relating to the grant or vesting of, or payment pursuant to, any Award, and none of the Company, the Board of Directors or the Committee (or any of their respective members, officers or employees) guarantees any particular tax treatment with respect to any Award. |

|

19.

Governing Law. The Plan, all Awards and all actions taken under the Plan and the Awards will be governed in all respects in accordance with the laws of the State of Texas, including

|

without limitation, the Texas statute of limitations, but without giving effect to the principles of conflicts of laws of such State. |

Adopted Effective February 29, 2024

/s/ Katy Murray

Katy Murray

President / Chief Financial Officer

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

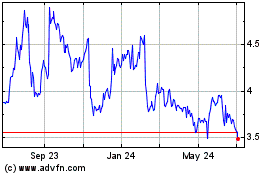

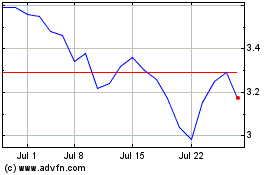

DallasNews (NASDAQ:DALN)

Historical Stock Chart

From Apr 2024 to May 2024

DallasNews (NASDAQ:DALN)

Historical Stock Chart

From May 2023 to May 2024