Perry Ellis Pumps Up Share Buyback - Analyst Blog

December 01 2011 - 9:00AM

Zacks

Perry Ellis International

Inc. (PERY) recently approved a $20 million extension of

its stock repurchase program, thereby maintaining the trend of

returning wealth to its shareholders from time to time, depending

on market conditions. This program now authorizes the company to

repurchase up to $40 million of its common stock over a

twelve-month period.

Perry Ellis will fund this

repurchase program through the cash balances and its available

credit facility. At the end of third-quarter 2011, Perry Ellis had

cash and cash equivalents of $21.4 million. Long-term debt was

$220.0 million.

Although the board allocated a

maximum of $40 million to carry out the program, Perry Ellis is not

obligated to buyback any specific number of outstanding shares, and

can revaluate the program on an ongoing basis.

Earlier in November 2007, the

company’s board of directors authorized repurchase up to $20

million of its common stock over a 12-month period. Then, in

September 2008, 2009 and 2010, the board extended the stock

repurchase program for the next twelve months.

Since inception, total repurchases

under this plan, remain $17.4 million through the third quarter of

fiscal 2012. Perry Ellis has about 22.6 million common shares

remaining under its current repurchase authorization.

Perry repurchased 418,000 and

1,769,296 shares of its common stock during fiscal 2010 and 2009,

respectively, at a cost of approximately of $1.8 million and $11.6

million. No purchases were made during 2011 as well as in the first

nine months of fiscal 2012.

We believe this is a positive step

toward the return of shareholder wealth. The increase in share

buyback authorization also affirms the company’s confidence in its

fundamentals. At the same time, buying back shares will help the

company in reducing the share count, thereby increasing earnings

per share and return on equity. As of November 30, 2011, the shares

of the company were trading at $14.30. The stock had historically

traded between $12.22 and $32.84 in the last 12 months. Apart from

bolstering shareholder value, this strategic move will also lift

the relatively undervalued share price.

Perry Ellis currently retains a

Zacks #4 Rank, which translates into a short-term Sell rating. We

are also maintaining our long-term Neutral recommendation on the

stock. Perry Ellis' peers include Polo Ralph Lauren

Corp. (RL) and CROCS Inc. (CROX).

CROCS INC (CROX): Free Stock Analysis Report

PERRY ELLIS INT (PERY): Free Stock Analysis Report

RALPH LAUREN CP (RL): Free Stock Analysis Report

Zacks Investment Research

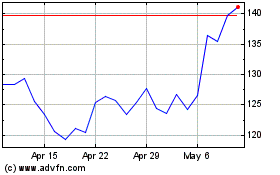

Crocs (NASDAQ:CROX)

Historical Stock Chart

From May 2024 to Jun 2024

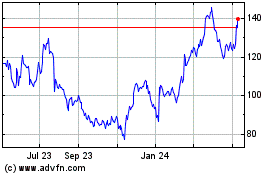

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2023 to Jun 2024